Trump is going to open his own casino.

- 核心观点:特朗普家族正主导预测市场,引发利益冲突担忧。

- 关键要素:

- 小特朗普同时投资Polymarket并任职Kalshi顾问。

- 特朗普就职后司法部结束对Polymarket调查。

- 家族俱乐部汇聚监管者与市场参与者。

- 市场影响:预测市场可能沦为内幕交易工具。

- 时效性标注:中期影响

Original author: Sleepy.txt

Original editor: Kaori

On October 28, Trump Media & Technology Group announced the launch of a prediction market product, "Truth Predict," on its social platform, Truth Social. The company's CEO stated that the platform aims to empower more people to participate in information judgment and prediction, allowing them not only to voice their opinions but also to validate their judgments through betting.

This marks the Trump family's third major foray into the prediction market.

Back in January 2025, Donald Trump Jr. joined the regulated prediction platform Kalshi as a strategic advisor.

In August of the same year, his venture capital firm 1789 Capital led a new round of funding for Polymarket, Kalshi's main competitor in the crypto prediction market. Polymarket was a platform that had received investment from ICE, the parent company of the NYSE, and was valued at $9 billion. After the deal was completed, Donald Trump Jr. also joined Polymarket's advisory board.

It is unconventional for a single family to hold key positions in three core companies within the same industry, according to traditional venture capital logic.

Chris Perkins, Managing Partner of CoinFund, said, "From a venture capital perspective, we generally don't invest in projects that are competing with each other; we hope to bet on the ultimate winner."

The Trump family clearly doesn't care about these conventional logics; what they want is not victory, but certainty.

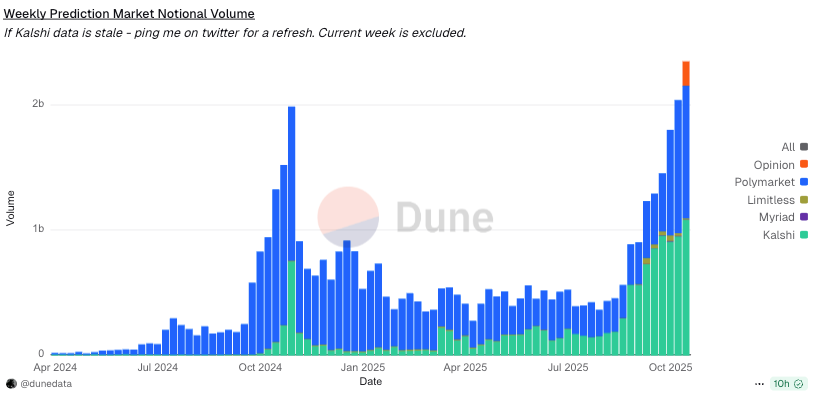

The market is poised for explosive growth. According to a research report by investment management firm Certuity, the industry will reach $95.5 billion by 2035, with a compound annual growth rate of 46.8%, while Polymarket and Kalshi currently control more than 96% of the market share.

Market share of mainstream prediction market platforms | Source: Dune

The allure of this new arena lies in the fact that, for the first time, "information" itself is openly priced and freely traded in the market. During the 2024 US presidential election, these platforms were even hailed by several media outlets as having the potential to be more sensitive and a "truth engine" than traditional polls.

Because in prediction markets, prices are not statistically derived figures, but rather the result of thousands of people betting real money, which reflects people's judgments about the course of events in real time better than questionnaires.

But when power and information begin to be controlled by the same group of people, this market, which claims to be "collective wisdom," may no longer aggregate the truth, but rather a carefully designed illusion.

Revelry in a Regulatory Vacuum

The story of Polymarket is key to understanding the entire prediction market industry. In 2022, this then-booming platform was identified by the U.S. Commodity Futures Trading Commission (CFTC) as an "unregistered derivatives trading market," fined $1.4 million, and ordered to cease providing services to U.S. users.

A few days later, Polymarket announced a geographic blockade, officially withdrawing from the US market.

In November 2024, on the eve of the US presidential election, in the early hours of the morning in Brooklyn, a team of federal agents knocked on the door of Polymarket CEO Shayne Coplan's apartment and confiscated his computer and cell phone.

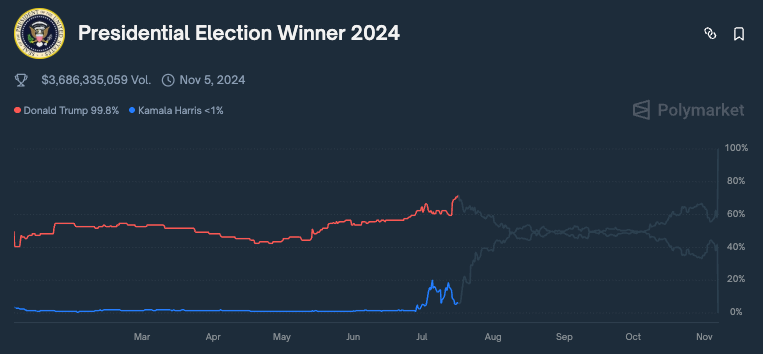

The investigation focuses on whether the company violated its settlement agreement by secretly accepting bets from American users. At that time, Polymarket's trading volume related to the "2024 presidential election" exceeded $3.6 billion—the largest betting event in the platform's history.

Over $3.6 billion has been wagered on the 2024 US presidential election by Polymarket | Image source: Polymarket

On January 20, 2025, Trump was sworn in and returned to the White House. Six months later, the U.S. Department of Justice announced the end of its investigation into Polymarket, without filing any charges or releasing any results.

Polymarket is now preparing to return to the U.S. market at the end of November, focusing on sports betting.

From the raids to the withdrawal of the investigation, only seven months passed, and the entire situation was completely reversed around the time of Trump's return to the White House. Cryptocurrency entrepreneur Zach Hamilton put it more bluntly: "If you want to explain why prediction markets have re-entered the United States, you only need one name—Donald Trump."

At almost the same time, Donald Trump Jr.'s personal trajectory also overlapped with this turning point.

On January 20, the same day his father returned to the White House, he announced his joining the regulated prediction platform Kalshi as a strategic advisor. In August, just as the Justice Department's investigation was coming to a close, his company 1789 Capital led a new round of funding for Polymarket, and he himself subsequently joined the advisory board.

Behind this frenzy lies the regulators' inability to effectively manage the situation.

The CFTC, a federal agency nearly fifty years old, initially regulated commodity futures such as corn and beef. Now, however, it faces the rapidly expanding crypto derivatives and prediction markets. This agency has an annual budget of less than $400 million and fewer than 700 employees. In contrast, the SEC, which oversees the securities markets, has a budget of $2 billion and over 4,000 employees.

In an anonymous interview, a former CFTC official admitted that they were almost powerless to deal with the situation. "We simply don't have the capacity to regulate cryptocurrencies or sports betting, let alone the combination of the two. The CFTC will be swallowed up, and you'll see more and more insider trading in the prediction market because we don't have the capacity to monitor it and can only rely on whistleblowing and confessions."

Regulation that relies on whistleblowing and self-surrender is essentially no regulation at all.

Does having inside information count as prediction?

The regulatory vacuum has turned prediction markets into a hunting ground where information advantages can be directly monetized.

On October 10, the day the Nobel Peace Prize was announced, an insider trading controversy suddenly broke out on Polymarket, drawing global attention.

Three months ago, the platform launched a prediction market for the "2025 Nobel Peace Prize laureate," attracting over $20 million in trading volume. Popular candidates included the widow of Russian opposition leader Alexei Navalny, US President Donald Trump, environmental activist Greta Thunberg, and WikiLeaks founder Julian Assange.

In contrast, the odds for Venezuelan Liberal Party leader Maria Corina Machado have consistently hovered between 3% and 5%, with almost no bets being placed.

However, just hours before the results were announced, Machado's odds suddenly surged from an unassailable low to over 70%. Data showed that at least three accounts placed large bets simultaneously, with some individual accounts wagering tens of thousands of dollars. The precision of these trades was astonishing.

The Nobel Committee's final decision is usually made only hours before the award announcement, with very few people knowing the details. However, these accounts can place large bets hours in advance, and their odds curves almost perfectly predict the final result.

Whether insider trading should be allowed in prediction markets has been a focal point of debate within the industry.

Robin Hanson, an economist at George Mason University and an early advocate of prediction markets, believes that insider trading can actually improve market accuracy because information is incorporated into prices more quickly. "If the goal of prediction markets is to obtain accurate information, then you certainly want to allow insider trading."

This viewpoint sounds self-consistent, but it overlooks a more fundamental premise: when information advantage is excessively concentrated in the hands of a few people and insider trading becomes the norm, ordinary traders will be quickly squeezed out of the market.

Without liquidity provided by retail investors, the market will eventually shrink, becoming an arena for a few insiders to gamble against each other. Such a market is neither accurate nor fair, because it has lost the foundation of "collective wisdom."

The regulatory vacuum makes this debate seem somewhat hollow.

Under the current system, the SEC's insider trading regulations do not apply to market prediction because the underlying assets of these transactions are "events" rather than "securities." Furthermore, the CFTC, the other regulatory body responsible for oversight, has yet to issue a clear ban on insider trading.

The original purpose of market forecasting was to use prices to measure the probability of the future. But now, it's more like an information game, where whoever has more insider information can turn the future into profit in advance.

$500,000 admission ticket

If information can be priced, then power has a more direct price tag in Donald Trump Jr.'s new business.

In April 2025, Donald Trump Jr. and his venture capital firm 1789 Capital founded an exclusive members-only club, Executive Branch, in Georgetown, Washington, D.C. The membership fee is $500,000, with an annual fee of $25,000. Even so, within two months of its founding, the waiting list was already very long.

This list of founding members of the club can almost be regarded as a condensed diagram of the power structure.

David Sacks, the White House's "crypto czar," the Winklevoss twins, founders of the crypto trading platform Gemini, and tech investor Chamath Palihapitiya are among those listed.

What is even more noteworthy is the collective appearance of high-ranking government officials.

At least six cabinet-level officials from the Trump administration were present at the Executive Branch launch party, including Secretary of State Marco Rubio, Attorney General Pam Bondi, Securities and Exchange Commission (SEC) Chairman Paul Atkins, Federal Trade Commission (FTC) Chairman Andrew Ferguson, Federal Communications Commission (FCC) Chairman Brendan Carr, and Director of National Intelligence Tulsi Gabbard.

In addition, FBI Deputy Director Dan Bongino also appeared at the event, raising a toast with several CEOs and founders of Silicon Valley companies.

Party scene | Image source: Axios

An insider at the club later revealed in an interview that they deliberately refused to allow the media and lobbyists to join, hoping to create an "absolutely private" environment where people could talk without any reservations.

The value of this so-called "privacy dialogue" lies precisely in its ability to systematically circumvent the existing framework of political oversight.

Under the U.S. Lobbying Disclosure Act, lobbying activities must be publicly documented, including the recipients, topics, and expenditures. However, the closed-door meetings of the Executive Branch Club are clearly outside the scope of disclosure. Similarly, they are not subject to the Federal Advisory Committee Act.

In other words, that $500,000 ticket was not an ordinary ticket, but a pass that allowed direct access to the core of power and bypassed institutional scrutiny.

This pattern inevitably evokes memories of the Trump International Hotel in Washington, D.C., during Trump's first presidential term.

That building with its golden facade became almost a transit point for power at the time.

Government officials, Republican lawmakers, foreign dignitaries, and business leaders frequented the hotel, where casual conversations over drinks often proved more effective than meetings. An investigation by The Washington Post revealed that at least 22 foreign government officials stayed at the hotel during Trump's presidency, leading to accusations that Trump violated the "Payment Clause" of the U.S. Constitution.

Unlike that hotel, the Executive Branch club is more private, more expensive, and more exclusive. The Trump Hotel, after all, is a semi-public business venue, where guests' comings and goings could still be captured by the media. At the Executive Branch, however, all meetings, conversations, and transactions take place under the protection of "privacy."

When 1789 Capital is an investor in Polymarket, and Donald Trump Jr. is both the founder of the club and an advisor to Polymarket, a closed-loop network of interests begins to take shape.

What's even more intriguing is that this club's membership includes regulators like the SEC chairman and the Attorney General, as well as investors and platform executives from prediction markets. When regulators and those being regulated, investors and those being invested in, are at the same table, the so-called "boundaries" become meaningless.

Jeff Hauser, executive director of the Revolving Door Project, an organization that oversees the appointment and conduct of U.S. government officials, has publicly questioned this.

He pointed out that Polymarket itself is already a politically controversial entity, and the Trump family's dual identity can both influence regulatory direction and potentially benefit from relaxed regulations, blurring the lines between power and capital. This overlapping relationship is a typical "conflict of interest" that should be strictly avoided.

In response to external questions, White House Press Secretary Karoline Leavitt stated that the president and his family "have never, and will never, be involved in any conflict of interest."

The future that is no longer unknown

The theoretical basis for predicting markets can be traced back to the "knowledge dispersion" theory proposed by Nobel laureate economist Friedrich Hayek.

Hayek believed that price is not only the result of transactions, but also a social signal that can bring together fragmented and localized knowledge scattered among countless individuals into a holistic information system.

Prediction markets are an extension of this idea. By having people bet real money on the future, they attempt to solidify the judgments and beliefs scattered among the population into a probability expressed by prices.

However, Hayek's theory has a premise that is often overlooked. The reason why markets can aggregate knowledge is that information is relatively dispersed among participants.

When a minority possesses an overwhelming informational advantage, prices no longer represent collective wisdom but merely reflect the flow of power and resources. At that point, the market degenerates from an aggregator of knowledge into a tool for transferring wealth.

That precise bet made before the Nobel Prize announcement did not prove the efficiency of the market, but rather reminded people that so-called market rationality is sometimes just an illusion of information controlled by a few.

The core promise of prediction markets is to turn the uncertain future into a tradable asset. This promise is based on a fundamental assumption: the future is unknown, and all participants are using their limited information to guess its future direction.

But for those who truly wield power, the future is not largely unknown. For them, so-called "prediction" is never about "guessing the unknown future."

When the Attorney General can decide whether to prosecute Polymarket, the SEC Chairman can redefine the regulatory boundaries of the entire industry, and the families of these decision-makers are deeply involved in and directly hold investment interests in this market, what they are trading is no longer an uncertain future, but "certainty" itself defined by their own power.

The launch of Truth Predict pushed this logic to its extreme. When the platform's operators, or their family members, have the power to influence the outcome of these events, the word "prediction" loses its meaning. It no longer points to the uncertainty of the future, but merely represents the pre-pricing of outcomes by those in power.

From left to right: Vivek Ramaswamy, Ohio Senator Bernie Moreno (Republican), Omid Malik, Vice President JD Vance, and Donald Trump Jr. | Image source: POLITICO

Blockchain technology allows all transactions to be recorded on a public ledger, seemingly enabling everyone to trace the origins of every bet. However, this transparency is limited to the visibility of wallet addresses, not the identity of the operators behind the transactions.

No one knows who placed precise bets on Polymarket in the hours leading up to the Nobel Prize announcement, and no one knows who placed precise orders on HyperLiquid before the policy announcement.

In the future, when the same logic is replicated on Truth Predict, when a platform directly or indirectly controlled by a presidential family allows people to bet on elections, interest rates, and wars, transparency in the transactions will no longer matter. What truly matters is who can know the outcome in advance, or even control the outcome to their advantage.

These answers probably only exist in the Executive Branch club, a corner protected by "privacy".