The Twilight of Giants: In the Trillion-Dollar Stablecoin Market, How Are Upstarts Eroding the Empires of Tether and Circle?

- 核心观点:稳定币收益正从发行方向分发渠道转移。

- 关键要素:

- 分发渠道重要性超越网络效应。

- 跨链基础设施实现稳定币互换。

- 监管明朗化降低发行门槛。

- 市场影响:重塑公链与应用收入结构。

- 时效性标注:中期影响

Author | @simononchain

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Tether and Circle's defensive moats are eroding: distribution channels are outweighing network effects. Tether and Circle's stablecoin market share may have peaked in relative terms, even as the overall stablecoin supply continues to grow. The total stablecoin market capitalization is projected to exceed $1 trillion by 2027, but the benefits of this expansion will not primarily accrue to established giants, as in the previous cycle. Instead, a growing share will flow to ecosystem-native stablecoins and white label issuance strategies, as blockchains and applications begin to internalize revenue and distribution channels.

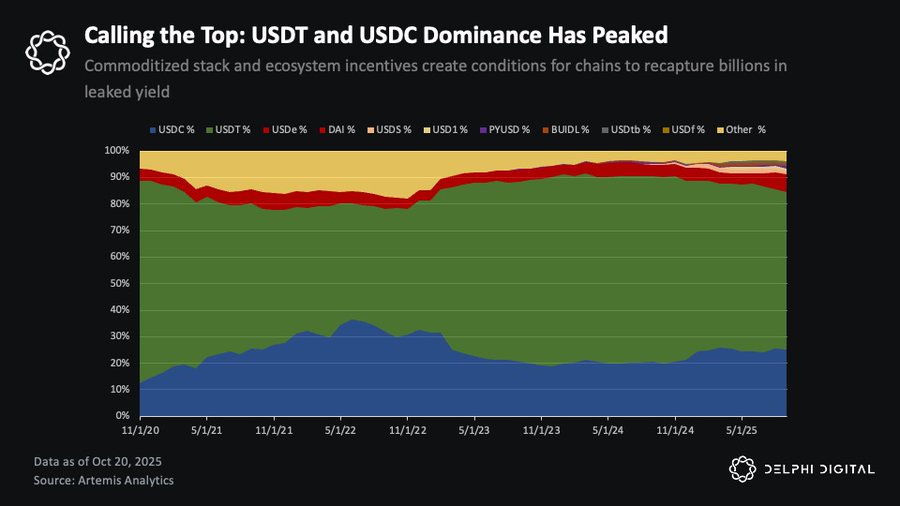

Currently, Tether and Circle hold approximately 85% of the circulating stablecoin supply, totaling approximately $265 billion.

The background data is as follows: Tether is reportedly raising $20 billion at a $500 billion valuation, with a circulating supply of approximately $185 billion; while Circle is valued at approximately $35 billion and has a circulating supply of approximately $80 billion.

The network effects that once supported their monopoly are weakening. Three forces are driving this change:

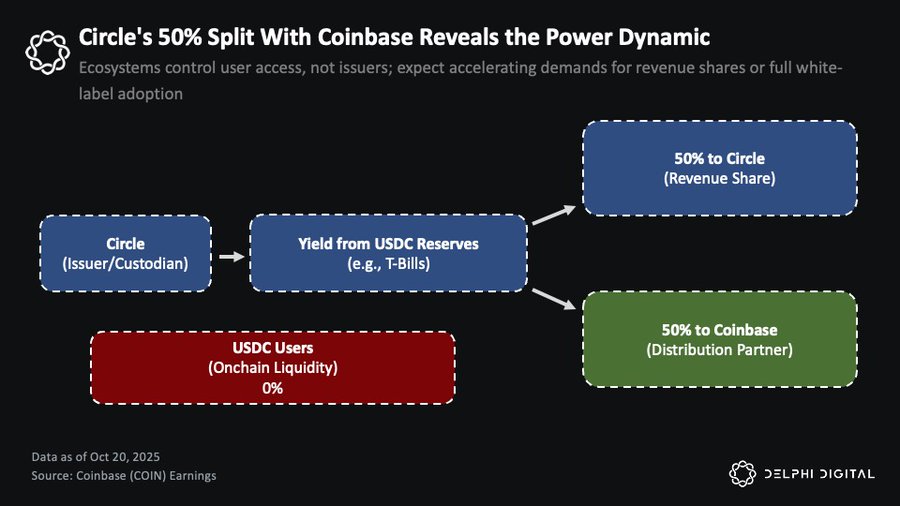

First, the importance of distribution channels has surpassed so-called network effects. Circle's relationship with Coinbase illustrates this point well. Coinbase receives 50% of the residual yield from Circle's USDC reserves and exclusively receives all USDC earnings on its platform. In 2024, Circle's reserve earnings were approximately $1.7 billion, of which approximately $908 million was paid to Coinbase. This demonstrates that stablecoin distribution partners can capture a significant portion of the economic benefits—which explains why players with significant distribution capabilities are now more inclined to issue their own stablecoins rather than continue to profit from them.

Coinbase receives 50% of Circle’s USDC reserve earnings and exclusively receives earnings from USDC held on the platform.

Secondly, cross-chain infrastructure has made stablecoins interchangeable. Official bridge upgrades for major Layer 2 protocols, the universal messaging protocol launched by LayerZero and Chainlink, and the maturity of smart routing aggregators have made stablecoin swaps within and across chains virtually cost-free and natively user-friendly. It no longer matters which stablecoin you use; you can quickly switch based on liquidity needs. Until recently, this was a cumbersome process.

Third, regulatory clarity is removing barriers to entry. Legislation such as the GENIUS Act establishes a unified framework for US-based stablecoins, reducing the risk for infrastructure providers holding the coins. Meanwhile, a growing number of white-label issuers are driving down fixed issuance costs, while Treasury yields provide strong incentives for monetizing float. The result: the stablecoin stack is becoming commoditized and increasingly homogenized.

This commoditization has eliminated the structural advantages of the giants. Now, any platform with effective distribution capabilities can choose to "internalize" the stablecoin economy—rather than paying the profits to others . Early adopters include fintech wallets, centralized exchanges, and a growing number of DeFi protocols.

DeFi is where this trend is most evident and has the most far-reaching impact.

From “Churn” to “Income”: DeFi’s New Stablecoin Playbook

This shift is already evident in the on-chain economy. Many public chains and applications with stronger network effects than Circle and Tether (as measured by metrics like product-market fit, user stickiness, and distribution efficiency) are beginning to adopt white-label stablecoin solutions to leverage their existing user base and capture the profits that previously accrued to established issuers. This shift is creating new opportunities for on-chain investors who have long ignored stablecoins.

Hyperliquid: The first “defection” within DeFi

This trend first emerged on Hyperliquid, where approximately $5.5 billion in USDC was held on the platform. This meant that approximately $220 million in additional revenue per year went to Circle and Coinbase rather than remaining with Hyperliquid itself.

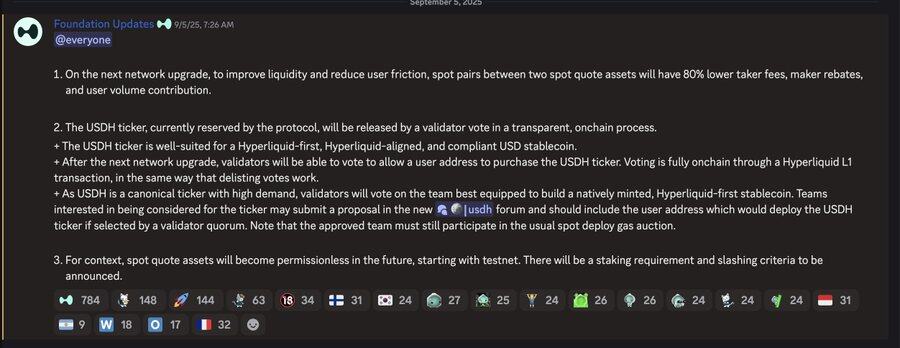

Before validators voted to decide on the ownership of the USDH code, Hyperliquid announced that it would launch a native issuance centered around itself.

For Circle, becoming a primary trading pair in Hyperliquid's core markets has generated significant revenue. While they directly benefited from the exchange's explosive growth, they provided little value back to the ecosystem. For Hyperliquid, this meant a significant loss of value to third parties who contributed little, a stark contradiction to its commitment to community-first, ecosystem-wide collaboration.

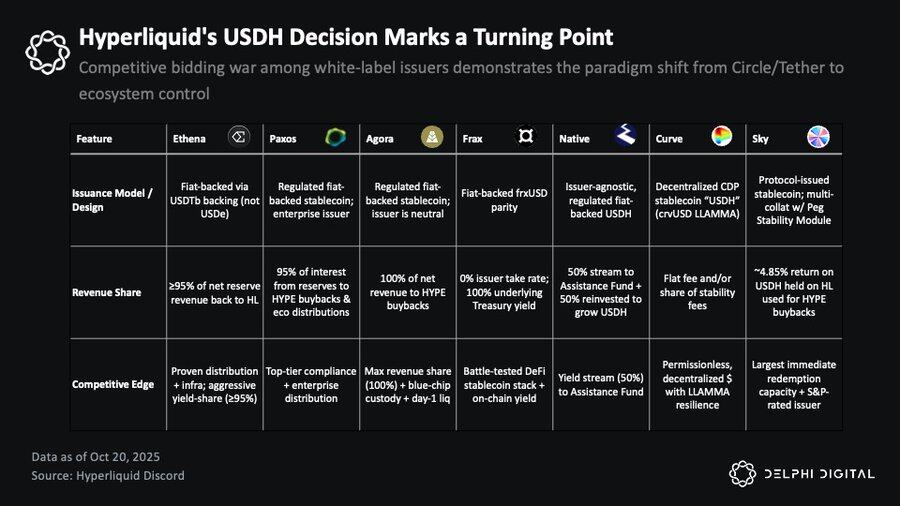

Nearly all major white-label stablecoin issuers participated in the USDH bidding process, including Native Markets, Paxos, Frax, Agora, MakerDAO (Sky), Curve Finance, and Ethena Labs. This was the first large-scale competition at the application layer of the stablecoin economy, signaling a redefinition of the value of "distribution rights."

Ultimately, Native won the right to issue USDH—its scheme better aligned with Hyperliquid's ecosystem incentives. This model offers issuer neutrality and regulatory compliance, with reserve assets managed offline by BlackRock and on-chain support provided by Superstate. Crucially, 50% of the reserve proceeds will be directly injected into Hyperliquid's assistance fund, with the remaining 50% used to expand USDH liquidity.

Although USDH will not replace USDC in the short term, this decision reflects a deeper power shift: in the DeFi field, moats and returns are gradually shifting to applications and ecosystems with a stable user base and strong distribution capabilities, rather than traditional issuers such as Circle and Tether.

The proliferation of white-label stablecoins: the rise of the SaaS model

Over the past few months, a growing number of ecosystems have adopted the "white-label stablecoin" model. Ethena Labs' " Stablecoin-as-a-Service " solution is at the center of this trend. On-chain projects such as Sui, MegaETH, and Jupiter are all using or planning to issue their own stablecoins through Ethena's infrastructure.

Ethena's appeal lies in its protocol's direct return of revenue to holders. USDe's revenue comes from basis trades. Although its yield has shrunk to approximately 5.5% as total supply exceeds $12.5 billion, it remains higher than US Treasury yields (approximately 4%) and far better than the zero-yield status of USDT and USDC.

However, as other issuers begin to pass on government bond returns directly to users, Ethena's relative advantage is declining. Government bond-backed stablecoins offer a more attractive risk-reward ratio. If the interest rate cut cycle continues, basis trading spreads will widen again, further strengthening the appeal of this type of "yield-based model."

You might ask, does this violate the GENIUS Act, which prohibits stablecoin issuers from paying returns directly to users? Actually, this restriction may not be as strict as one might imagine. The act does not explicitly prohibit third-party platforms or intermediaries from distributing rewards to stablecoin holders—as long as the funds are provided by the issuer. This gray area has not yet been fully clarified, but many believe this "loophole" still exists.

Regardless of how regulation evolves, DeFi has always operated in a permissionless, marginalized state and is likely to continue to do so in the future. More important than the letter of the law is the underlying economic reality.

Stablecoin Tax: Revenue Loss for Mainstream Public Chains

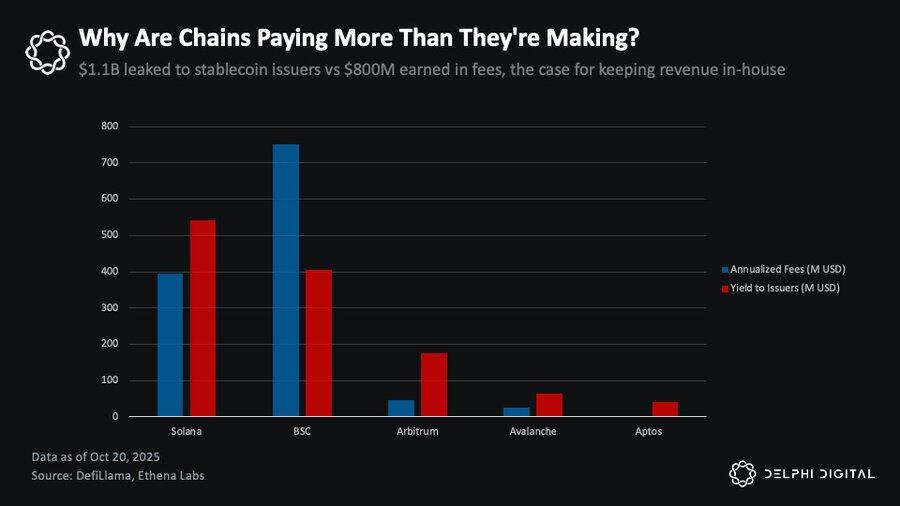

Currently, approximately $30 billion in USDC and USDT sits idle on Solana, BSC, Arbitrum, Avalanche, and Aptos. Based on a 4% reserve yield, this translates to approximately $1.1 billion in interest income annually for Circle and Tether. This figure is approximately 40% higher than the total transaction fee revenue of these public chains. This highlights a reality: stablecoins are becoming the largest yet under-monetized value proposition across Layer 1, Layer 2, and various applications.

Taking Solana, BSC, Arbitrum, Avalanche, and Aptos as examples, Circle and Tether earn approximately $1.1 billion in revenue each year, while these ecosystems only earn $800 million in transaction fees.

Simply put, these ecosystems are losing hundreds of millions of dollars in stablecoin revenue every year. Capturing even a small portion of this revenue on-chain would be enough to reshape their economic structure , providing a more robust and resistant revenue base for public chains than transaction fees.

What prevents them from reclaiming these gains? The answer is: nothing. There are actually a number of paths they could take . They could negotiate revenue sharing with Circle or Tether (as Coinbase has done); they could launch a competitive bidding process for white label issuers, as Hyperliquid has done; or they could launch their own stablecoins through a stablecoin-as-a-service platform like Ethena.

Of course, each approach has trade-offs . Partnering with traditional issuers maintains the familiarity, liquidity, and stability of USDC or USDT, assets that have weathered multiple market cycles and maintained trust in extreme stress tests. Issuing native stablecoins offers greater control and higher returns, but also faces the challenge of a cold start. Both approaches have corresponding infrastructure, and each chain can choose a path based on its priorities.

Redefining public chain economics: Stablecoins become a new revenue engine

Stablecoins have the potential to become the largest source of revenue for certain public chains and applications. Currently, when the blockchain economy relies solely on transaction fees, there is a structural ceiling on growth —network revenue can only increase when users "pay more fees," which in itself conflicts with the goal of "lowering the barrier to entry."

MegaETH's USDm project is a response to this. It partners with Ethena to issue a white-label stablecoin, USDm, using BlackRock's on-chain Treasury bond product, BUIDL, as a reserve asset. By internalizing USDm revenue, MegaETH can operate its sequencer at cost and reinvest the proceeds into community initiatives. This model fosters a sustainable, low-cost, and innovation-oriented economic structure for the ecosystem.

Jupiter, a leading Solana DEX aggregator, is pursuing a similar strategy with JupUSD . It plans to deeply integrate JupUSD into its product ecosystem, from the collateral of Jupiter Perps (where approximately $750 million in stablecoin reserves will be gradually replaced) to the liquidity pool of Jupiter Lend . Jupiter aims to funnel these stablecoin earnings back into its ecosystem, rather than to external issuers. Whether these earnings are used to reward users, repurchase tokens, or fund incentive programs , the value they generate is far greater than if all proceeds were ceded to external stablecoin issuers.

This is the core transformation at present: the profits that originally passively flowed to the old issuers are being actively recaptured by applications and public chains.

Valuation mismatch between applications and public chains

As all of this unfolds, I believe both public chains and applications are on a credible path to generating more sustainable revenue, gradually freeing themselves from the cyclical fluctuations of the "internet capital markets" and on-chain speculation. If so, they may finally justify those high valuations often criticized as "out of touch with reality."

The valuation framework that most people still use primarily views these two layers from the perspective of the total amount of economic activity occurring on them. In this model , on-chain fees represent the total costs borne by users, while chain revenue is the portion of these fees that flows to the protocol itself or to token holders (e.g., through burns, treasury inflows, etc.). However, this model is flawed from the outset—it assumes that as long as there is activity, the public chain will inevitably capture value, even if the true economic benefits have long since flowed elsewhere.

Now, this model is beginning to shift—and the application layer is leading the charge. The most striking examples are two of this cycle's star projects: Pump.fun and Hyperliquid. Both applications use nearly 100% of their revenue (note, not fees) to repurchase their own tokens, while achieving valuation multiples far below those of the primary infrastructure layer. In other words, these applications are generating real, transparent cash flows, rather than just implicit returns.

In contrast, the price-to-sales ratios of most mainstream public chains are still hundreds or even thousands of times higher, while leading applications generate higher returns at lower valuations.

Take Solana, for example. Over the past year, the chain generated approximately $632 million in fees, $1.3 billion in revenue, a market capitalization of approximately $105 billion, and a fully diluted valuation (FDV) of approximately $118.5 billion. This means Solana's market capitalization-to-fee ratio is approximately 166 times, and its market capitalization-to-revenue ratio is approximately 80 times—relatively conservative valuations for large L1 chains. Many other public chains have FDV valuation multiples reaching thousands of times.

In contrast, Hyperliquid generated $667 million in revenue and a $38 billion FDV, corresponding to a multiple of 57x; based on market capitalization, it trades at only 19x. Pump.fun generated $724 million in revenue, but its FDV multiple was only 5.6x, and its market capitalization multiple was a mere 2x. Both of these demonstrate that applications with strong product-market fit and strong distribution capabilities are generating significant revenue at multiples far lower than those of the base layer.

This is an ongoing power shift. The valuation of application layers is increasingly determined by the real revenue they generate and return to the ecosystem, while the public blockchain layer is still struggling to justify its own valuation. The eroding L1 premium is the clearest sign of this.

Unless public chains can find ways to internalize more of the value within their ecosystems, these inflated valuations will continue to be compressed. White-label stablecoins could be the first step for public chains to try to reclaim some of this value—transforming what was once a passive “currency channel” into an active revenue stream.

Coordination Problem: Why Some Public Chains Run Faster

The shift towards "stablecoins that are aligned with the interests of the ecosystem" is already happening; the speed of advancement varies significantly among different public chains, and the key lies in their coordination capabilities and execution urgency.

Sui, for example—although its ecosystem is far less mature than Solana's, it's moving incredibly quickly. In partnership with Ethena, Sui plans to simultaneously introduce two stablecoins, sUSDe and USDi (the latter similar to the BUIDL-backed stablecoin mechanism being explored by Jupiter and MegaETH). This isn't a spontaneous move at the application layer, but a strategic decision at the public chain level: to internalize the stablecoin economy as soon as possible, before path dependency forms. While these products aren't expected to officially launch until Q4, Sui is the first mainstream public chain to proactively implement this strategy.

In contrast, Solana faces a more complex and painful situation. Currently, approximately $15 billion in stablecoin assets are held on the Solana chain, with over $10 billion in USDC. This capital generates approximately $500 million in interest income for Circle annually, a significant portion of which flows back to Coinbase through its profit-sharing agreement.

So where does Coinbase use these profits? It subsidizes Base, one of Solana's direct competitors. Base's liquidity incentives, developer grants, and ecosystem investments are partially funded by the $10 billion in USDC on Solana. In other words, Solana is not only losing revenue, but is even providing financial support to its competitors.

This issue has long garnered significant attention within the Solana community. For example, Helius founder @0xMert_ called for Solana to launch a stablecoin tied to the ecosystem's interests, suggesting that 50% of proceeds be used for the repurchase and destruction of SOL tokens. Executives at some stablecoin issuers, such as Agora, have also proposed similar proposals. However, compared to Sui's aggressive push, Solana's official response has been relatively muted.

The reason is simple: With regulatory frameworks like the GENIUS Act becoming increasingly clear, stablecoins have become increasingly commoditized. Users don't care whether they hold USDC, JupUSD, or any other compliant stablecoin—as long as the price peg is stable and liquidity is sufficient. So, why default to a stablecoin that's profiting competitors?

Solana's hesitation on this issue stems in part from its desire to maintain "credible neutrality." This is particularly crucial as the foundation strives for institutional legitimacy—after all, only Bitcoin and Ethereum currently possess this kind of genuine recognition. To attract a major issuer like BlackRock—institutional backing that not only brings in real capital but also commoditizes the asset in the eyes of traditional finance—Solana must maintain a distance from eco-politics. Publicly endorsing a particular stablecoin, even one deemed "eco-friendly," could risk jeopardizing Solana's progress toward this level of legitimacy and even lead to the perception of favoritism towards certain ecosystem players.

Furthermore, the scale and diversity of the Solana ecosystem complicate matters. Hundreds of protocols, thousands of developers, and billions of dollars in TVL. At this scale, coordinating a migration away from USDC becomes exponentially more difficult. But this complexity is ultimately a characteristic, a reflection of the maturity of the network and the depth of its ecosystem. The real issue is this: inaction also carries a cost, and that cost is growing.

Path dependency accumulates daily. Every new user who defaults to USDC increases future switching costs. Every protocol that optimizes liquidity around USDC makes it harder for alternatives to launch. From a technical perspective, the existing infrastructure makes migration virtually overnight— the real challenge lies in coordination .

Within Solana, Jupiter has taken the lead, launching JupUSD and promising to recycle revenue back into the Solana ecosystem, deeply integrating it into its product offerings. The question now becomes: Will other leading applications follow suit? Will platforms like Pump.fun adopt a similar strategy, internalizing stablecoin revenue? At what point will Solana be forced to intervene top-down, or will it simply allow applications built on top of it to collect these revenues themselves? From a public chain perspective, if applications can retain the economic benefits of stablecoins, while not ideal, it is better than having these revenues flow off-chain or even to the enemy.

Ultimately, from the perspective of public chains and the broader ecosystem, this game requires collective action: protocols need to tilt their liquidity toward a consistent stablecoin, treasuries need to make thoughtful allocation decisions, developers need to change the default user experience, and users need to "vote" with their own funds. Solana's $500 million annual subsidy to Base won't disappear with a single announcement from the foundation; it will only truly disappear when ecosystem participants "refuse to continue funding competitors."

Conclusion: The Power Shift from Issuers to Ecosystems

The dominance of the next round of stablecoin economy will no longer depend on who issues the tokens, but on who controls the distribution channels and who can coordinate resources and seize the market faster.

Circle and Tether were able to build massive commercial empires thanks to their first-mover advantage and established liquidity. However, as the stablecoin stack becomes increasingly commoditized, their defensive moats are being eroded. Cross-chain infrastructure has made stablecoins virtually interchangeable; regulatory clarity has lowered barriers to entry; and white-label issuers have driven down issuance costs. Most importantly, platforms with the strongest distribution capabilities, highly engaged users, and mature monetization models have begun to internalize their revenue, eliminating interest and profit payments to third parties.

This shift is already underway. Hyperliquid is reclaiming $220 million in annual revenue that previously went to Circle and Coinbase by switching to USDH; Jupiter is deeply integrating JupUSD into its entire product ecosystem; MegaETH is leveraging stablecoin revenue to keep its sequencer operating near cost; and Sui is partnering with Ethena to launch an ecosystem-aligned stablecoin before path dependency sets in. These are just the first movers. Now, every public chain that bleeds hundreds of millions of dollars annually to Circle and Tether has a template to follow.

For investors, this trend offers a new perspective on ecosystem assessment. The key question is no longer, "How much activity is there on this chain?" but rather, "Can it overcome coordination challenges, monetize its capital pool, and capture stablecoin returns at scale?" As public chains and applications begin to "incorporate" hundreds of millions of dollars in annualized revenue into their ecosystems for token buybacks, ecosystem incentives, or protocol revenue, market participants can directly "undertake" this cash flow through the platforms' native tokens. Protocols and applications that can internalize this revenue will have more robust economic models, lower user costs, and more aligned interests with the community. Projects that fail will continue to pay the "stablecoin tax" and see their valuations compressed.

The most interesting opportunities ahead lie not in holding Circle equity or betting on high-FDV issuer tokens. The real value lies in identifying which chains and applications can make this transition, transforming "passive financial pipelines" into "active revenue engines." Distribution is the new moat. Those who control the "flow of funds," not just those who pave the "channels," will define the next phase of the stablecoin economy.