Multicoin: What other entrepreneurial opportunities are there in the prediction market?

- 核心观点:注意力资产有望成为新资产类别。

- 关键要素:

- 注意力资产可金融化为永续合约。

- 预测市场机制可构建抗操纵预言机。

- 模因价值在传统资产中日益凸显。

- 市场影响:为文化注意力提供双向交易工具。

- 时效性标注:中期影响

Original title: Building the Attention Economy

Originally Posted by Eli Qian, Multicoin Capital

Compiled by: Peggy, BlockBeats

Editor's Note: In an era of information explosion, attention itself is becoming a measurable and tradable asset. This article explores how "attention assets" can be financialized through prediction markets and oracle mechanisms, and proposes a methodology for constructing "attention perpetual contracts." As the value of memes gradually emerges in traditional assets like stocks, we may be on the cusp of the attention economy becoming a mainstream asset class.

The following is the original content:

The financial potential of attention assets

Although it may be overly concise, assets are broadly divided into two categories:

1. Cash flow assets – primarily stocks and bonds. These assets generate cash flow, which investors value based on that cash flow.

2. Supply and demand assets – mainly applicable to commodities and foreign exchange. Their prices fluctuate with supply and demand.

Recently, the crypto space has given rise to a new type of asset—one whose value is based on attention. Today, these "attention assets" primarily consist of user-generated assets (UGAs) such as NFTs, creator tokens, and meme coins. These assets serve as the "Schelling point" of cultural attention, their prices reflecting the ebb and flow of that attention.

While meme coins are interesting from a cultural perspective, they still have many shortcomings from a financial perspective. An efficient attention asset should allow market participants to directly gain financial exposure to the attention being paid to something. This would incentivize participants to trade assets they believe are mispriced, and the market would collectively shape prices that reflect the attention predictions.

We believe that attention assets, if properly constructed, have the potential to become a true asset class. To advance this concept, this paper proposes the concept of "Attention Oracles," a new oracle architecture that supports "Attention Perps"—a new type of financial instrument that allows traders to go long or short on cultural attention.

In short, the Attention Oracle constructs a weighted aggregate index designed to capture changes in attention by leveraging the price, liquidity, and time dimensions of binary prediction markets around a topic. To ensure its effectiveness, the underlying market must be carefully selected to represent relevant real-world attention inputs. Using prediction markets as inputs to the Attention Oracle also introduces an "embedded manipulation cost," theoretically mitigating malicious manipulation, as adversarial traders must risk capital to influence the index.

Why do we need perpetual attention contracts?

UGAs find product-market fit in purely speculative areas and are very good at tracking attention from the ground up, such as emerging web trends and memes.

UGAs solve a problem: creating assets for things the traditional financial system can't cover. Traditional asset issuance processes are slow, expensive, and subject to high regulatory barriers, limiting the range of assets that can be issued. Attention assets, on the other hand, must operate at internet speeds to keep pace with global cultural trends. Combining a permissionless token issuance mechanism, clever pricing methods like bonding curves, and the liquidity support of decentralized exchanges (DEXs), virtually anyone can create assets for free, generate liquidity, and bring them to market for others to trade.

One observation about UGAs is that their prices typically start at zero. This isn't a flaw, but a feature. If you create a new meme from scratch, its initial attention span is zero, making it reasonable to enter at a low price. This also allows those skilled at spotting trends early to monetize their skills by creating low-cost assets. However, this also means that UGAs aren't well-suited for providing financial exposure to things that already have a lot of attention.

For example, let's say you want to go long on LeBron James's attention. You could create a meme coin, but there are already many LeBron tokens on the market. Which one should you buy? Furthermore, the price of a new LeBron meme coin would be close to zero. However, LeBron is one of the most famous people in the world, and his attention is already very high. It's unlikely that his attention will increase 100x in a short period of time. Finally, if you want to go short on his attention, meme coins are difficult to achieve.

So, what should assets targeting existing high-attention topics look like?

Some requirements may include:

1. Two-way trading capability: Assets should support both long and short trading.

2. Connect to real-world attention data sources: There must be a reliable "source of truth" to measure attention.

3. Don’t start from scratch: The asset should have an initial value that reflects the existing attention.

If you examine these requirements, you quickly see that perpetual futures contracts (Perps) fit the bill perfectly: they are two-way, have an oracle (the source of truth), and as a derivative product, don't start from scratch. The real challenge lies in building an effective oracle for Attention Perps.

Several teams, such as Noise, are already working on this problem. On the Noise platform, traders can go long or short on the mindshare of certain crypto projects, such as MegaETH and Monad. Noise uses Kaito as an oracle, which aggregates social media and news data to generate a single number representing the level of attention a topic receives.

However, this design still has room for improvement. The goal of an attention oracle is to take attention-related data as input, apply some function to this data, and output a value that traders can use to make long or short moves.

One problem with using social media as input is that it's easily manipulated. This presents a variation of Goodhart's Law: in adversarial markets, traders attempt to manipulate input data to influence prices. Kaito has already had to redesign its leaderboards and anti-spam mechanisms to address this issue.

Furthermore, social media isn't a perfect way to capture attention. Take Shohei Ohtani, for example. He has a global fan base that uses a variety of social media apps, and those platforms might not all be indexed by Kaito. If he wins the World Series again, his star aura will be even stronger, but his follower count or social media mentions won't necessarily grow linearly.

Attention Oracles: A Market-Based Approach

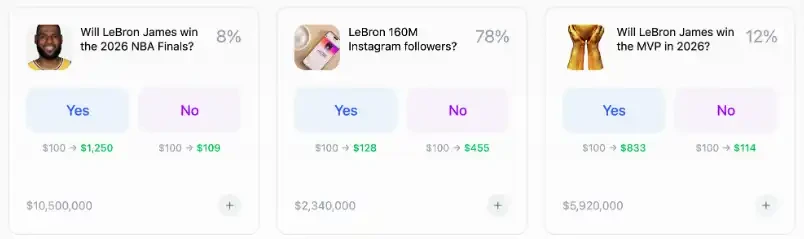

Going back to our earlier example of LeBron James, let’s say you want to trade LeBron’s attention. To build an attention oracle for him, the first step is to collect (or create, if one doesn’t already exist) multiple binary prediction markets on LeBron, such as:

“Will LeBron James have over X million followers by the end of this month?”; “Will LeBron James win a championship in 2026?”; “Will LeBron James win MVP in 2026?”

A complete LeBron Attention Oracle would use more underlying markets, but for the sake of example, we will use these three. The index price will be calculated by taking a weighted aggregation of each market’s price, liquidity, resolution time, and importance.

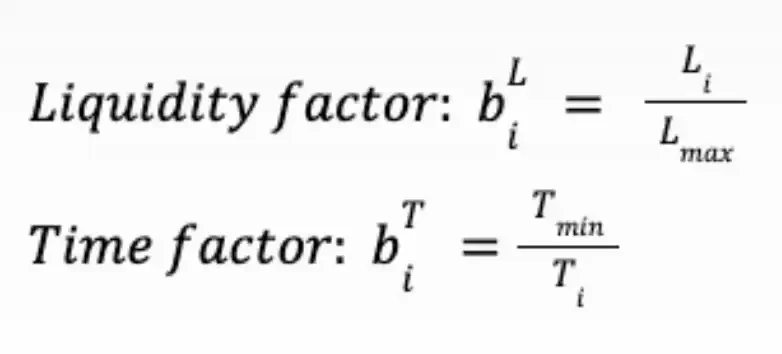

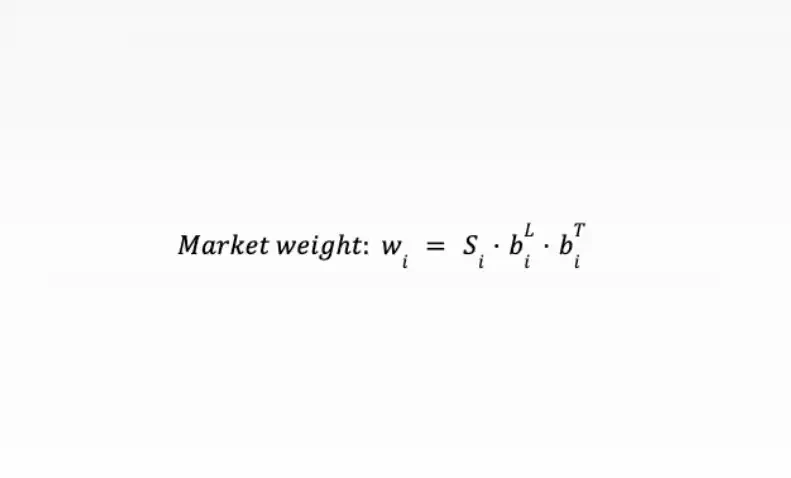

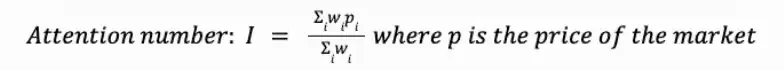

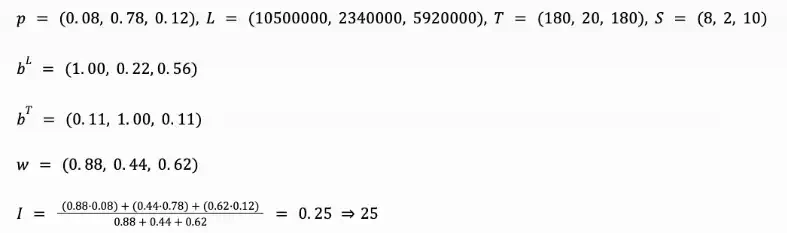

For each market, we have price, liquidity, resolution time, and an importance score. For ease of illustration, we use a very simple weighting formula. Each market is scored on a scale of 1 to 10, combining liquidity and time factors:

Assuming we decide to assign scores of 8, 2, and 10 to the three markets, the weight of each market would be:

The final attention value will be:

If we assume that the resolution times for these three markets are 180 days, 20 days, and 180 days respectively, and the importance scores are 8, 2, and 10 respectively, then combining the above factors yields:

Of course, there are more sophisticated ways to calculate the attention metric, such as using open interest instead of volume, accounting for correlated events, adjusting for market depth, non-linear relationships between variables, etc. We have also created an interactive website for readers to create their own indices using the live Kalshi market.

The key advantage of this prediction market-based oracle architecture is that manipulation has a real cost. If a trader is long LeBron James' attention and wants to manipulate the price upward, they must purchase a position in the underlying binary prediction market. Assuming the underlying market is liquid, this means they need to buy at a price that the market believes is overvalued.

We believe another very important advantage as these markets develop is that binary prediction markets provide market makers with a spot market for hedging. If a market maker is short on the attention index, they can hedge their exposure by taking a long position in the underlying prediction markets that make up the index.

Adjacent has used real-time, liquid markets on Kalshi to create indices to track political trends, such as the Democratic vs. Republican battle for control and the New York City mayoral election. We believe a similar approach can be used to track attention on any topic. As prediction markets develop, the set of topics for which attention indices can be constructed will continue to expand.

The design space of attention oracles

Our proposed oracle architecture is not without trade-offs. When thinking about attention oracles more broadly, we consider the following aspects to be key considerations:

1. How relevant is the input data?

2. How feasible is it to obtain this input data?

3. Is the input data easily manipulated or gamified?

4. What function do we apply to the input to calculate the attention value?

The most obvious trade-off with our proposed oracle is that the input data is difficult to obtain. If you want to build an attention oracle for LeBron James, you must first create multiple, liquid prediction markets for various topics related to LeBron. Furthermore, these markets must remain liquid over time and be replaced by new, liquid markets as the original markets resolve or become irrelevant. Therefore, we believe this design is best suited for a small number of high-attention topics (such as Donald Trump or Taylor Swift) that already have established prediction markets.

Another trade-off is that attention might increase regardless of the outcome of an event. For example, even if LeBron doesn't win another championship, attention might still rise as people begin to question his performance. There might be widespread discussion about whether he's really getting old or declining. Similarly, real-world attention tends to flow to unexpected events, while prediction markets measure expectations of those events. If the market expects LeBron to win the MVP, but he doesn't, attention might rise while the index falls. Fans and commentators might discuss whether he was "robbed" of the MVP or whether the selection process was unfair.

The best oracle design may ultimately be a combination of prediction markets, social media data, and other sources. Google Trends recently opened an alpha project, allowing developers to access search trend data through an API. The number of internet searches for a topic is clearly highly correlated with its attention, and because Google Trends filters out duplicate searches, it may be less susceptible to manipulation than social media data. Another source might be using large language models (LLMs) to analyze inputs that are more susceptible to manipulation and attempt to filter out spam. For example, an LLM could score attention based on headlines from major news outlets or popular posts on X (formerly Twitter).

We believe that established exchanges like Kalshi and Polymarket are best positioned to offer Attention Perps, as they already have many liquid underlying markets and users willing to trade on new markets. However, we do not believe the opportunity for attention assets is limited to these large platforms.

One configuration involves vaults trading prediction markets, targeting long/short positions on specific topics. For example, a vault long Taylor Swift could purchase "yes" contracts on events like whether she will have a top 10 single or perform at the Super Bowl. Vault managers determine which markets correlate with increased attention.

Another example is a builder-deployed perpetual contract using Hyperliquid. HIP-3 provides flexibility, allowing market deployers to customize their own oracles—a HIP-3 market could use a combination of Kalshi/Polymarket prices, social media metrics, Google Trends, news headlines, and more.

Attention as an asset class

Ironically, the first mature application scenario of the attention economy may appear in the stock market. Stock prices are composed of two components: DCF value (i.e., intrinsic value) and memetic value.

Historically, most stocks haven’t had significant meme value, but in recent years, thanks to 24/5 retail trading platforms like WallStreetBets and Robinhood, a growing number of stocks have begun to develop sustained meme value.

The goal of a stock research analyst is to determine a stock's price. While established methods exist for calculating the DCF component, how should the meme value component be modeled? As more and more assets are influenced by meme value, developing methods to model this value will become necessary. Sophisticated investors already use metrics like follower count, likes, and pageviews to gauge market sentiment. Prediction markets and other oracle constructs can be useful tools for measuring stock attention, thereby building better trading models.

But the opportunity in attention assets goes far beyond stock pricing. We believe that predicting attention is an economically valuable activity in its own right. Attention is a leading indicator of consumer preferences and spending. Companies allocate R&D, hiring, and marketing budgets based on where attention flows. The key lies in finding new heuristics to model these flows.

If you are building attention assets or related infrastructure, please contact us.