Mr. Beast’s Financial Gamble: Can it Subvert the Century-old Bank Trust Mechanism?

- 核心观点:MrBeast跨界金融,挑战传统信任机制。

- 关键要素:

- 申请金融商标,涵盖加密交易服务。

- 曾涉加密争议,被指获利千万美元。

- Z世代信任转移,青睐数字体验。

- 市场影响:或重塑网红经济与金融结合模式。

- 时效性标注:长期影响

In October 2025, MrBeast filed a trademark application with the U.S. Patent and Trademark Office for the name "MrBeast Financial."

This 27-year-old young man, who is willing to bury himself alive in the real world to create video content and has 450 million fans in the virtual world, plans to expand his business empire from fast food and snacks to banking, investment, and even cryptocurrency trading platforms.

According to the application, he envisions building a SaaS platform encompassing crypto payment processing, micro-loans, and investment management. Mr. Beast and his business empire, valued at $5 billion, are poised to enter a sector entrenched in the triple shackles of trust, risk, and regulation: finance.

This wasn't a sudden crossover. He already owned the snack brand Feastables and the virtual restaurant chain MrBeast Burger. But financial services were completely different, touching a nerve that was most sensitive.

What's more subtle is that just a year ago, he was at the center of controversy over his cryptocurrency investments. Blockchain researchers accused him of using his influence to profit from multiple projects, exceeding tens of millions of dollars.

Now, this controversial traffic giant is about to enter a strictly regulated financial world with his hundreds of millions of fans, mainly from Generation Z.

This is a huge gamble. His reputation is at stake, and the trust of a generation is at stake. The outcome of this gamble will redefine the relationship between traffic, finance, and trust.

Generation Z's Banking Exodus

Traditional banks are losing their future.

Young people are no longer entering temples of marble and bulletproof glass. They switch banks two to three times more frequently than their parents, not for higher interest rates but for a better digital experience. Only 16% of Generation Z say they have "a lot of trust" in traditional banks, a figure nearly double that of millennials and nearly three times that of baby boomers.

For those who grew up with algorithms and screens, a bank teller in a suit and tie is far less reliable than a smooth app interface.

Traditional banks have spent a century building trust. Offline branches symbolize accessibility, brand history signifies reliability, government endorsement signifies impeccability, and marble counters and well-dressed staff convey professionalism and stability. These visual symbols and institutional arrangements have proven effective in the past.

Bank of America | Source: BloomBeag

But for Generation Z, who live in a world of high-frequency interaction and instant feedback, they need dynamic, tangible trust experiences rather than static, institutional proof of trust. Whether a bank has a century of history is far less important to them than whether its app's interface is user-friendly, customer service is responsive, or its products can be customized to meet individual needs.

The deeper reason lies in Gen Z's deep-seated dissatisfaction with the traditional financial system. Growing up in the aftermath of the 2008 financial crisis, they witnessed how major banks were bailed out while ordinary people bore the brunt of the loss of jobs and wealth. They witnessed repeated data breach scandals at financial institutions and saw how Wall Street elites abandoned their moral compass for profit. These experiences have shaped their instinctive skepticism of traditional finance.

The vast majority of Generation Z are influenced by recommendations from financial influencers. They discover new financial products through social media, learn about investing on Xiaohongshu, and follow financial bloggers on Douyin. Behind these behavioral patterns lies the collapse and rebuilding of a foundation of trust.

Gen Z isn't looking for a "better bank"; they're looking for something entirely different: an ecosystem that seamlessly integrates financial services, social experiences, and personal values. They want finance to be more than just a cold, numbers-based game, but a partner who understands them, responds to them, and even represents their values.

This is exactly the opportunity Mr. Beast saw.

The relationship between him and his fans has long surpassed the traditional brand-consumer relationship to become a parasocial one. Social media researchers call this phenomenon "parasocial interaction," where viewers develop a one-way but intense emotional connection by continuously watching a media figure's content, as if that person were a friend in their real life.

Mr. Beast knows this well.

The videos he releases every week are meticulously choreographed displays of wealth redistribution. He lets 100 children challenge the world's strongest man, has strangers survive in a nuclear bunker for 100 days to win $500,000, and lets himself be buried alive for 50 hours—all these extreme challenges are backed by a constant stream of cash giveaways.

The cash, cars, and houses he gave away are worth tens of millions of dollars in total. These gifts are not accessories to a marketing strategy; they are content in themselves, the continuous fulfillment of the trust contract between him and his fans.

Mr. Beast challenges himself to be buried alive for 50 hours | Source: Instagram

Each gift proves to his fans that he keeps his word, that his promises are genuine, and that he's willing to share his earnings. This kind of "visible generosity" is more persuasive to Generation Z than any brand statement.

In 2024, Mr. Beast partnered with the fintech company MoneyLion to launch a $4.2 million giveaway. Young users willingly downloaded the MoneyLion app out of trust in Mr. Beast. They weren't choosing a financial product; they were following someone they trusted.

The success of this event allowed Mr. Beast to see a greater possibility. If he could directly convert traffic into financial services and eliminate middlemen, the monetization efficiency would reach an unprecedented level.

Traditional banks say, “We have a 100-year history, we’ve been through the Great Depression and the financial crisis, and we have government backing.”

Mr. Beast said, "I just gave $100,000 to 100 people each."

Trust in the former is based on past accumulation, while trust in the latter is based on current performance. The former requires institutional endorsement, while the latter requires algorithmic amplification. The former is static and abstract, while the latter is dynamic and visible.

The paradox is that Generation Z's distrust of traditional finance stems precisely from its transparency and ethical flaws. The financial services industry has long ranked low in global trust among all industries, and young people's dissatisfaction with financial institutions stems largely from their lack of ethics when it comes to profit.

So, how did Mr. Beast, an internet celebrity who left a "stain" in the world of cryptocurrency, become their financial savior?

The distance between the "sickle" and the "dealer"

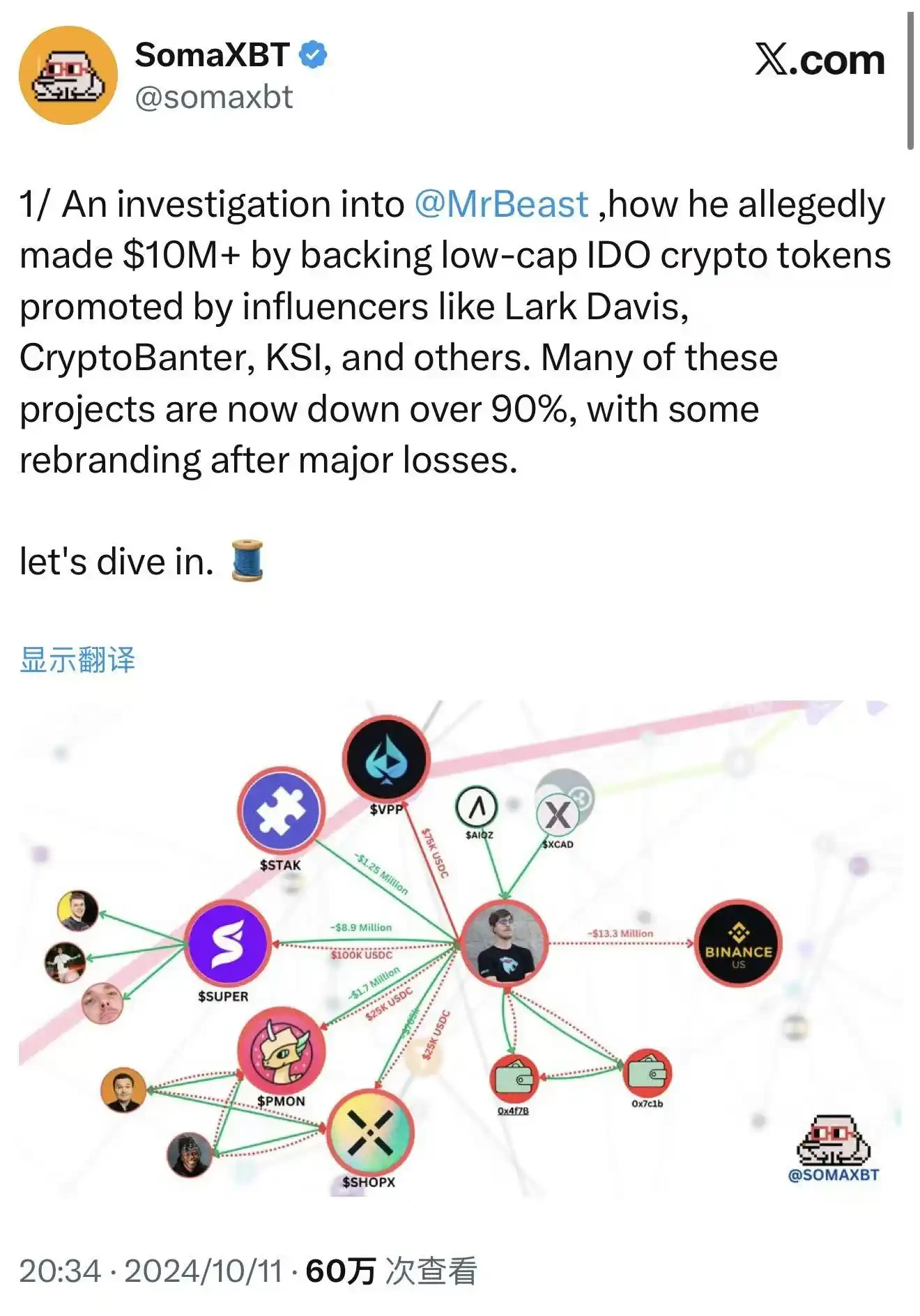

In October 2024, blockchain detective SomaXBT published a detailed report on the social platform X, which, like a scalpel, dissected Mr. Beast's other side in the crypto world.

The report traced wallet addresses associated with Mr. Beast and accused him of participating in multiple scams. These allegations are not groundless but based on the transparent transaction records on the blockchain. In a decentralized world, every transaction is permanently recorded, irrevocable, and irrefutable.

SomaXBT's revelation of Mr. Beast | Source: X

The most notable example is SuperFarmDAO. Mr. Beast invested $100,000 in the project's presale and received one million SUPER tokens. He then used his unparalleled influence to promote the project, sending the token price soaring and igniting market sentiment. Then, he began selling.

Ultimately, this $100,000 investment yielded millions in profits. Behind this staggering figure were the losses of countless retail investors. They saw Mr. Beast participating in the project, believing it was a solid investment opportunity, and jumped in. But when he began selling, the price of the coin quickly collapsed, leaving retail investors as the last ones to take advantage.

Similar operating patterns have been repeated in multiple projects, including Polychain Monsters, STAK, VPP, and SHOPX. SomaXBT estimates that Mr. Beast has made a total profit of over $10 million from these projects.

From a legal perspective, these actions likely did not violate any regulations. Mr. Beast made no explicit commitment to hold these tokens long-term, nor did he violate any explicit securities regulations. At the time, the cryptocurrency market remained in a regulatory gray area, and many of the rules of traditional financial markets did not fully apply. In traditional stock markets, such behavior would constitute market manipulation, which would be subject to severe legal sanctions. But in the crypto world, there are no such rules.

From an ethical perspective, however, these actions have sparked considerable controversy. Many in the cryptocurrency community believe that using influence to drive up token prices and then sell them off is essentially exploiting the trust of fans for profit. This not only destroys the long-term value of a project but also damages the credibility of the entire industry. When influential influencers exploit information asymmetry and their influence to exploit retail investors, the market becomes another version of Wall Street.

Mr. Beast's team responded by denying direct involvement, claiming the investments were managed by a third party and without his knowledge. But this defense seems weak. Even if investment decisions are made by others, his name and influence remain central to these projects' appeal to retail investors.

When he mentions a project on social media or features elements of it in a video, fans automatically interpret it as an endorsement. Regardless of who pulls the trigger, the bullet bears his name.

Now, it's October 2025. Less than a year after SomaXBT first publicly released its investigation results, Mr. Beast has filed a trademark application for "MrBeast Financial." Even more intriguing, his proposed services prominently include "cryptocurrency exchange" and "decentralized exchange operations," precisely the areas in which he's previously sparked controversy.

He seems to want to tell the world that the former "sickle" must now be transformed into a compliant "dealer".

There are two possible business logics behind this, which are not mutually exclusive.

The first is commercial "whitewashing." By establishing a compliant financial platform, he attempts to cover up his past history of speculation and rebrand himself as a responsible financial services provider. This strategy is not uncommon in business history. Many former speculators have transformed from "barbarians" to "establishment figures" by establishing formal institutions. The founder of JPMorgan Chase was also a radical speculator in his early years, but eventually became one of Wall Street's most respected bankers.

The second is a deeper business logic. He saw a more efficient path to directly monetize traffic into financial assets. Rather than investing and trading through third-party platforms and earning one-time speculative profits, it would be better to build his own platform and control the entire ecosystem. This way, he could not only profit from content creation but also collect commissions from every financial transaction made by his fans, earn interest from every loan, and share in the returns from every investment.

This is the ultimate form of creator economic monetization, from content monetization to financial monetization, from influence to capital, from fans to customers. If successful, Mr. Beast will create a brand new business model and become the first true "influencer banker."

Regardless of his logic, he must confront the same problem. The core of finance is trust, and once trust is broken, the cost of rebuilding is exponential. He needs to convince regulators that a company that once exploited retail investors in the crypto market now has the ability, willingness, and systematic approach to protecting consumer interests.

What's more, the sword of Damocles of supervision is hanging over his head.

Dancing on the blade of regulation

In 2025, cryptocurrency regulation in the United States is undergoing a subtle shift.

On July 31st, SEC Chairman Paul Atkins announced the launch of "Project Crypto," aimed at reforming securities laws and promoting crypto innovation. This was a significant signal. Over the past few years, the SEC has taken a harsh stance against the cryptocurrency industry, filing lawsuits against numerous exchanges like Coinbase and Binance in an effort to bring most crypto assets under the securities regulatory framework. But in 2025, the tide turned.

On September 29th, the SEC and CFTC held a historic joint roundtable to discuss the regulatory framework for crypto spot trading. This was the first time the two major regulatory agencies jointly discussed crypto regulation, marking a new phase in US cryptocurrency regulation, shifting from a "crackdown" approach to "clear rules."

SEC and CFTC Roundtable | Source: YouTube

This presents a rare regulatory window for companies looking to enter the crypto-finance sector. Regulators are sending friendly signals, attempting to strike a balance between protecting consumers and fostering innovation. According to the USPTO's timeline, the "MrBeast Financial" trademark application will undergo its first review in mid-2026, with final approval or rejection expected by the end of 2026. This means that even if all goes well, the platform won't officially begin operations until 2027.

But the window period does not guarantee a pass. MrBeast Financial will face multi-layered and comprehensive regulatory challenges.

At the federal level, the SEC will review whether the platform is involved in a securities offering. If the investment products offered by the platform are deemed securities, it must register as a broker-dealer or investment advisor and be subject to strict regulation. The CFTC will oversee its derivatives and commodity trading to ensure that the platform does not engage in market manipulation or fraud. FinCEN (Financial Crimes Enforcement Network) will require compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, which means that the platform must establish a comprehensive identity verification system, monitor suspicious transactions, and report unusual activity to regulators.

If a platform promotes cryptocurrency payments and transactions, it is likely to be classified as a money service business (MSB), which means stricter compliance requirements, including registration, regular reporting, and audits. Each requirement requires a significant investment of manpower, material, and financial resources.

At the state level, the challenges are even more complex. The United States employs a dual system of federal and state financial regulation. Operating a crypto exchange or mobile bank in various states requires obtaining a money transmitter license (MTL) from dozens of different states. Each state has different licensing requirements, making the application process time-consuming and costly.

Mr. Beast's direct targeting of young retail investors will put his business under the microscope of regulators. Regulators will ask a core question: Does a creator whose brand is based on extreme content possess the prudent nature to manage consumer deposits and investments?

This involves not only compliance but also reputational risk. When evaluating financial license applications, regulators look not only at technical capabilities and capital strength, but also at risk culture and governance. They review a company's track record, assess the integrity and professionalism of management, and determine whether the company is capable of protecting consumer interests in the long term.

Just weeks before the trademark application, Mr. Beast's video, "Would You Risk Your Life for $500,000?", sparked controversy. In the video, a professional stuntman escaped from a simulated building fire to win the prize. Mr. Beast defended the video, saying the safety measures were "more rigorous than anyone could imagine," with professional stunt and pyrotechnic teams on site, and that all risks were manageable.

Critics argue that this high-risk, high-drama content conveys a dangerous value system, tying human safety to financial rewards. Even if the actual risk is low, this presentation suggests that it's okay to risk one's life for money. This could have a negative impact on young viewers.

For companies seeking financial licenses, this controversy could serve as negative evidence. Regulators could view it as a manifestation of a "risk culture." Would a creator willing to risk lives for a prize also adopt a similarly adventurous approach in their financial product designs? Would they, for the sake of attention, create high-risk, high-reward products that are actually extremely disadvantageous to consumers?

This concern is not unfounded. Financial product design requires extreme caution; any elements that encourage risk-taking or speculation can lead to significant losses for consumers. The halo of celebrity is vulnerable to the compliance and ethics of financial products.

The design of financial products requires deep expertise and a genuine concern for consumer interests; it cannot rely solely on branding. Regulators and consumer protection organizations are more vigilant about celebrity-backed financial products, and any suspicious fee structures or risky designs will be scrutinized.

Mr. Beast faces a more complex challenge. Not only must he prove the compliance and fairness of his products, but he must also rebuild his moral image amidst the cryptocurrency controversy. He faces a delicate balancing act within the regulatory window, maintaining his "beast" persona to attract young users while demonstrating sufficient prudence to convince regulators.

This is a dance on a razor's edge. One wrong step could plunge the entire plan into the abyss. But if successful, he will create a brand new business model, directly converting the trust of 445 million fans into financial capital.

The ultimate experiment in trust

Mr. Beast's financial gamble is not so much a business adventure as it is an ultimate experiment on the nature of "trust" in our time.

It is the product of the confluence of three waves: the financialization of the influencer economy, the rebellion of Generation Z against traditional finance, and the regulatory compliance process of cryptocurrency.

The convergence of these three forces in 2025 creates a unique window of opportunity but also brings unprecedented risks.

If he succeeds, it will demonstrate a paradigm shift in the mechanisms by which trust is generated. It no longer necessarily stems from the accumulation of time and institutional backing, but can be rapidly generated through personal charisma and algorithmic amplification. Traditional financial institutions will be forced to acknowledge that their proud century-old foundations may be vulnerable in the eyes of Generation Z.

This will force traditional banks to re-examine their strategies for young users and rethink how to build trust in a world of algorithms and screens. They may need to lower their profile, learn the language of influencers, embrace the logic of social media, and even collaborate with influencers to leverage their influence to reach young users.

It will also open up a new monetization path for other influencers. The creator economy will enter a new phase, where content creators are no longer simply sellers of advertising and merchandise; they can become providers of financial services. We may see more "influencer banks," "influencer funds," and "influencer insurance." The boundaries of traffic and trust will be redefined.

But if he fails, it will once again prove an age-old lesson: traffic can create spectacle, but it can't create trust. Especially in the financial sector, ethical flaws and compliance risks can easily decimate any fan base. Influence can bring attention, but it can't directly translate into the most valuable asset in the financial world: responsibility.

This will serve as a reminder to regulators that influencer-driven financial innovation requires stricter scrutiny and clearer rules. When financial services are deeply integrated with content creation and the fan economy, traditional regulatory frameworks may no longer be applicable. Regulators need to consider whether the influence of an influencer with hundreds of millions of followers becomes a financial services provider. When fan relationships transform into financial relationships, how can consumer rights be protected?

Mr. Beast's brand is built on "spectacle" and "extreme". Burial alive, nuclear bunkers, extreme challenges, the core of these contents is to break the routine and create surprises.

But financial services require "stability" and "prudence", and require predictability, security and long-term nature.

Can he establish a credible financial brand while maintaining his entertainment credentials? This isn't just a business question; it's a dilemma about identity. When a creator known for his madness tries to convince you to entrust your hard-earned money to him, is he expanding the boundaries of his brand or diluting its core values?

There's no easy answer to this paradox. Perhaps Mr. Beast will create a new kind of financial brand, one that maintains both entertainment and professionalism. Or perhaps he'll discover that the two are fundamentally incompatible, ultimately forcing him to choose between them.

Whatever the outcome, the gamble has begun. It will force all of us to rethink: in an age where everyone has access to media, who should we trust? Should we trust those organizations in suits speaking in jargon we don't understand, or should we trust the influencers who create joy and dreams for us on screen?

When the first user completed their first trade on MrBeast Financial, whether they clicked "buy" or "sell," they cast a vote, offering their own answer to the trust dilemma of our time. Hundreds of millions of young people will, with their own hard-earned money, jointly determine the outcome of this experiment.