When a foreigner starts learning Chinese to trade in cryptocurrencies

- 核心观点:中文Meme币崛起代表加密文化迁移。

- 关键要素:

- BSC链交易量达60.5亿美元。

- 超10万新交易者参与,70%盈利。

- 币安人生引爆中西方平台博弈。

- 市场影响:推动跨文化投资与平台竞争。

- 时效性标注:中期影响

Binance Life has finally become the first Chinese currency to be listed on Binance perpetual contracts.

If you are a Chinese cryptocurrency practitioner, you cannot have not heard of this word in the past two weeks. Since the birth of this "ticker", it has been both a joke and a vision. CZ himself also said that he did not expect that it was just a simple reply, but it triggered a series of events later.

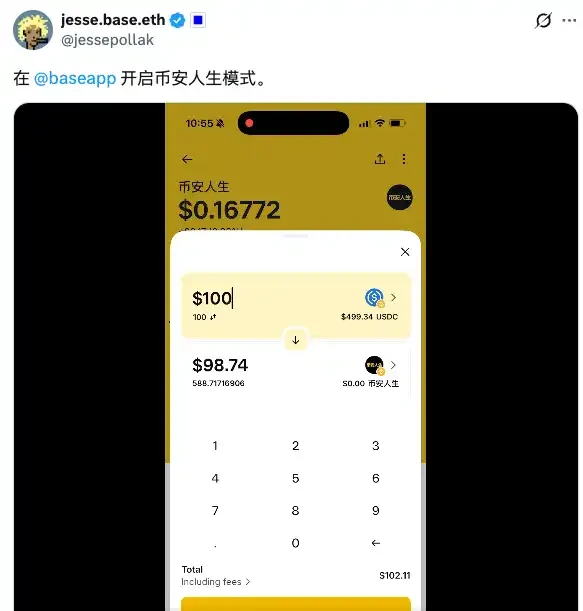

First, it sparked a discussion involving OKX CEO Star. Then, there was the craze for Chinese tickers on Tron and Solana. A few days ago, the founder of Limitless publicly disclosed the so-called "listing terms," triggering a confrontation between the two chains and trading platforms. Finally, Jesse ended the confrontation with the words "Start Binance Life Mode on Base."

What this represents may not just be a single ticker, but a deeper cultural shift. This may be the first time that a series of high-value memecoins are written in Chinese instead of English. What meme culture does this represent?

This time we found 0xBarrry , the co-founder of WOK Labs, a Polish trader who runs a community of hundreds of people. What are these foreigners thinking when they play Chinese memes?

The conspiracy community meets the Chinese conspiracy coin

This wave is both mysterious and exciting in the eyes of ordinary traders.

Barry, a Polish trader and founder of WOK Labs, recalled: "The first time I saw a Chinese-labeled coin's market capitalization exceed $20 million, I was shocked. On the one hand, I realized that this conspiracy coin still had great potential. When it reached $60 million or even $100 million, there was an uproar in the European group. Many people rushed to recharge the BSC chain just because the price had increased, but they couldn't understand why."

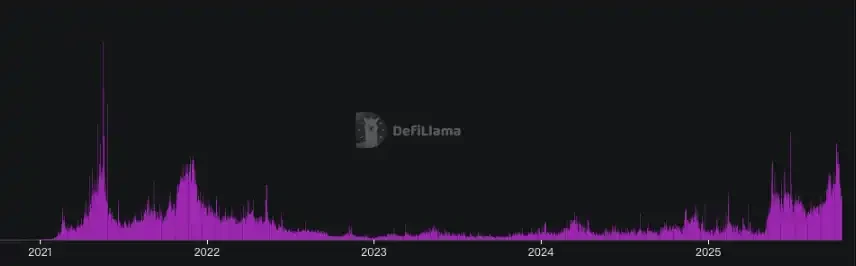

This market sentiment is not an isolated case. Defilama on-chain data shows that the transaction volume of the Bsc chain soared to US$6.05 billion on October 8, reaching the peak of the last round of BSC's machine-coin altcoin market in 2021, but this time it was led by Chinese Meme.

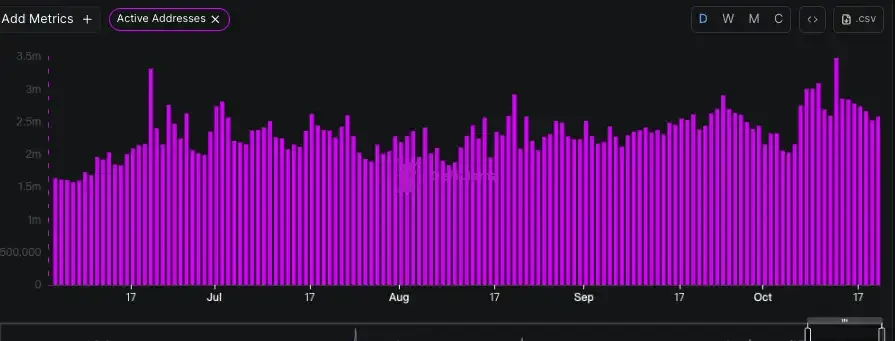

On that day, more than 100,000 new traders participated in this round of memecoins craze, and nearly 70% of them made profits. This indeed attracted many "foreigners" to participate in BSC's on-chain activities, and the number of active addresses also increased by nearly 1 million compared with the same period last month.

Western investors rushed in when prices soared, and many only realized the situation afterward by looking up the Chinese characters. Differences in culture and traditional trading habits also led to losses for European and American players the first time around.

"In the past, European meme investment often followed American internet culture, with its self-deprecating and rebellious humor. However, the sudden rise of Chinese memes has left many Westerners disoriented," said Barry.

However, due to his early collaboration with the Chinese team to create WOK Labs, Barry understood in advance how the Chinese community operates, including factors such as personal relationships and emotional resonance. He began to spread Chinese narratives in the European community to explain the differences to more Western traders.

Furthermore, the differences in the forms of community participation in Memecoins are also stark. European traders are more likely to participate in conspiracy-style meme projects, which rely heavily on the Ethereum ecosystem and are heavily manipulated by prominent influencers or teams. These communities tend to build more slowly, but while the right influencers or teams hold significant bottom-line shares, they also carry significant risk of selling pressure. This is why building long-term projects in Europe is so difficult.

Chinese communities are easier to establish. They focus more on emotions and storytelling (or leader coins). Project parties and Meme communities "tell stories" in WeChat groups to gather resonance and promote emotions. In theory, this form of emotional promotion under "fair" conditions can lead to a more lasting community form.

Especially in this cycle, it is quite easy for Chinese players. Just buy the IP you think is popular (or the speech of the opinion leader) and you can "print money at will". A retail investor who is only keen on buying Chinese coins rotated 65 Chinese meme coins on the BNB chain in 7 days, first casting a wide net with $100-300, and then increasing his position in the currency with outstanding momentum, making a net profit of about $87,000 in a week.

This high-frequency, "cast-a-net" approach reflects, to some extent, the rapid speculation of "most" retail investors in the Chinese community into new markets. Meanwhile, European and American players are gradually abandoning small-cap memecoins with a market cap of around $500,000 (approximately), and turning to more certain assets starting at $5 million.

This is also why agencies like Barry, which connect China and the West and bridge the Chinese, Korean, Japanese and European and American markets, are becoming increasingly active, helping Asian projects win the trust of the West and helping European teams enter Asia.

He believes that the cultural differences brought about by personal experience may be giving birth to new opportunities for cross-circle cooperation.

From Dogecoin to Chinese meme coin, from mocking meme to ideological meme

From a more macro perspective, the memecoin trend is rooted in the collision of different cultural genes. The originator of Western memecoins is Doge, which was created as a joke by two programmers in 2013.

Doge was originally a humorous mockery of Bitcoin's seriousness, but eventually due to the celebrity effect (such as Musk) and lasting community enthusiasm, it reached a peak market value of US$88.8 billion in May 2021.

Pepe coin experienced a similar fate. A meme born from the 4chan community, it quickly became a viral sensation after its launch in early 2023, reaching a market capitalization exceeding $1 billion. The Pepe project relied entirely on online hype, with no pre-sale, no team allocation, and no roadmap. The team also stated that the coin had "no intrinsic value and was for entertainment purposes only."

This value system also influenced the subsequent emergence of numerous Solana memecoins, such as Fartcoin and Uselesscoin, which embraced nihilism, Neet, which embodied Western internet culture's fondness for "subversion of real-world values" and dark humor, and memes like TikTok's "Hot 67." Solana memes captured investors' imaginations with their graphic memes and rebellious spirit, dominating the attention economy's memecoin era for a long time. This, in turn, led to a lack of cultural understanding of these tokens in Chinese-dominated regions, leading to biased views.

Chinese memecoins, however, exhibit different characteristics, often rooted in resonance and identity projection. For example, tokens like "Humble Xiao He" and "Customer Service Xiao He" employ self-deprecating humor from the working class to mock social realities. The "Xiu Xian" series reflects Chinese netizens' dreamlike desire to escape reality, while "Binance Life" directly embodies the dream of getting rich overnight in the crypto market. Of course, their common denominator is their connection to the government.

This is a cultural difference under the thinking system. For Chinese people, this is called "widening the road", while for most European and American players, this kind of name means that their upper limit is controlled by whether the "system" is willing to pull the market.

However, the explosion of Chinese memecoins represented by "Binance Life" actually directly benefited from this emotional resonance. Its slogan compares Binance Life to the previously popular "Apple Life". This innovative narrative is obviously different from the satire of Dogecoin, and it appeals more to loyalty and feelings.

When this impression is known by enough people, the Ticker is bound to the system. When it is pulled out and ridiculed, the official "has to pull the price up". This may be the thinking of many people who can still hold on to the coin after the wash.

This meme craze wasn't entirely driven by retail investors; it was also the result of meticulous nurturing within the Binance ecosystem. From He Yi's joke and CZ's response to a series of official Fourmeme interactions, and Binance's launch of the MemeRush platform, Binance has released favorable policies in a phased and step-by-step manner, promoting the release of high-market-cap memecoins, ensuring mid-term liquidity, and maintaining long-term sustainability. This has incorporated the previously chaotic issuance of memecoins into an official system, bringing the frenzy into a more organized state while keeping market attention focused on the BSC chain for a long time.

The enthusiasm spread from a single project to the entire BSC ecosystem, further fueling the public's DeFi mentality of "the next trade might make you a multi-millionaire." This "upward staircase" expectation is also why, at the beginning of this round of market, when multiple hot projects emerged, we didn't notice a significant liquidity siphoning effect between the various projects.

This is a significant step-by-step wealth creation effect, driven by the combined efforts of government and the community. This path validates the structured listing expectations behind Chinese meme coins, as well as the market consensus reaching a level unimaginable just a few months ago.

In contrast, Western meme coins are more of a whirlwind social frenzy, perhaps driven by conspiracy groups. However, the BSC ecosystem, through the combined influence of its founders, platform ecosystem, and community, has transformed this frenzy into a blatant "wealth-making movement."

The public opinion war among trading platforms, the dispute over listing fees, and the easing of Sino-US tensions

At the same time, this incident also triggered a fierce public relations showdown between trading platforms. On October 11, 2025, Jesse first tweeted, calling on everyone to boycott centralized trading platforms that charge 2% to 9% listing fees.

Three days later, on October 14, CJ Hetherington, founder of Limitless Labs, a prediction market project invested by Coinbase, revealed on X that during negotiations with the trading platform, he found that in order to be listed on Binance, the project party would need to pledge 2 million BNB and pay high fees, including 8% of the total tokens for airdrops and marketing allocations, and a deposit of US$250,000.

He compared Binance and Coinbase, arguing that Coinbase prioritizes the value of the project itself, while Binance charges a fee for listing. Binance quickly issued a denial, calling the accusation "completely untrue and defamatory," emphasizing that "Binance never charges listing fees," and threatened legal action against CJ for leaking the internal conversation.

Binance later issued a more restrained statement, acknowledging that its initial response was excessive but reiterating that it does not charge any listing fees.

As the debate escalated, Coinbase quickly responded. Jesse Pollak, head of the Base blockchain, publicly stated on social media that "listing a project on the exchange should be free."

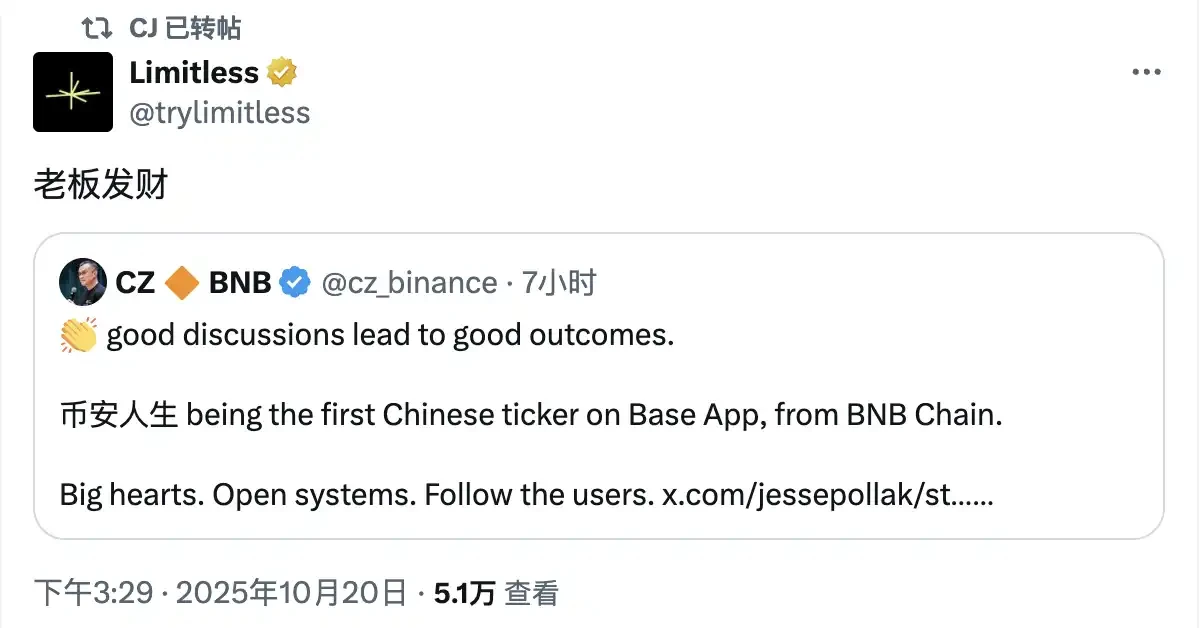

But that's when public opinion began to reverse. Coinbase, seemingly out of spite, officially announced the inclusion of BNB in its list of future supported tokens. This marked the first time in history that a token issued on a direct competitor's mainnet had been supported. Binance founder CZ welcomed this on social media and encouraged Coinbase to list more BSC projects.

CJ, who had "exposed" the terms, also began to actively show goodwill, and Jesse Pollak's attitude also changed 180 degrees. First, a demonstration video of the Base App was released on X. The Base App even used "Binance Life" as an example token in the demonstration. Pollak also joked in Chinese, "Start Binance Life mode in the Base App," and replied to CZ's tweet, "Binance Life + Base Life = the strongest combination." This series of actions was interpreted by the industry as a breakthrough in the Chinese and American crypto camps, and also brought a long-awaited little golden dog to the Base chain.

It can be said that when the trading volume and attention brought by the Asian market reach a certain scale, Western transactions have to take the initiative to approach the Chinese community, and the competition among trading platforms is also intertwined with cultural narratives.

Perceptions and reactions of Eastern and Western communities

Mainstream media in Europe and the United States paid close attention to this incident. At the same time, many Western retail investors also lamented in their groups that "we couldn't understand the price increase of the currency." Most people did not rush to buy in until the price took off. Even communities like Barry, which have deep exchanges with the Chinese language system, often encountered the problem of "knowing the meaning but not the significance" when foreseeing Memecoins with internal cultural significance. It can be seen that for overseas investors, Chinese elements once became a new barrier to entry.

Tugou tool for Chinese-English translation developed by some members of the European and American communities

This wave of investment also emphasizes the concept of "language is opportunity." For the cryptocurrency community, the cultural and emotional information behind different languages is itself a valuable resource. This is the first time that European and American investors need to understand Chinese culture to participate in this feast.

A video series about foreigners learning Chinese and buying memecoins that was very popular some time ago

However, Barry believes that "I think the Chinese meme market is nearing its end. The longer this cycle lasts, the more severe the PTSD it will cause traders. We can see that these memecoins have begun to evolve towards smaller market capitalizations and faster sector rotation."

However, he also said, "English and Chinese are already the most important components of the meme market, and this situation will not change soon. China has a larger market and is more easily driven by emotions. The European market tends to lag behind. I think English tickers may return, but they will become more integrated with Asian culture. Due to the inspiration brought by this round of Chinese memes, they will become more Chinese in humor, symbolism, and aesthetics."

Capturing the next wave of memecoin opportunities will require more than just opportunity; a deep understanding of the languages and cultures of diverse communities will also be required. AI can currently help with cross-lingual communication, for example by automatically generating Chinese memes and translating social media posts to accelerate information dissemination. However, AI cannot replace a deep understanding of cultural context.

We may see a more multipolar crypto world, with more and more "golden dogs" with Chinese tickers such as Base and Solana. There will be new trends of integration and mutual learning between Western and Eastern communities, but there may also be the emergence of independent and partitioned ecosystems. New opportunities may exist in the cracks between these cultural differences.