Lorenzo sUSD1+: Liquidity dividend in extremely volatile market

- 核心观点:极端行情暴露风控缺陷,Lorenzo策略稳健获利。

- 关键要素:

- 市场清算190亿美元,流动性瞬时枯竭。

- HLP金库单日利润4100万美元,收益不可持续。

- Lorenzo策略日化收益1.1%,七日APR超50%。

- 市场影响:凸显稳健策略价值,推动收益产品创新。

- 时效性标注:中期影响

Original author: Toi

On October 11th, the market experienced its most severe leveraged liquidation and ADL in this round. Over $19 billion was liquidated in 24 hours, making it the "largest forced liquidation event in crypto history." The trigger was Trump's sudden imposition of 100% tariffs and export restrictions on China, which instantly drained liquidity from risky assets, especially many altcoins, and forced deleveraging in the perpetual market.

In reality, this isn't simply a matter of "who made the wrong bet?" but rather a multi-faceted failure of microstructures under extreme conditions: instantaneous liquidity drain, matching congestion/order cancellation failures, rapid redrawing of oracle and internal risk control thresholds, and minute-by-minute reversals in borrowing availability and funding fees. Even platforms with nominally "delta neutral" positions can be passively downgraded to steering wheels and embroiled in forced liquidation in those few seconds when hedges are unable to materialize.

However, not everyone lost money. The vaults responsible for liquidation and market making reported a staggering "storm day" profit: the HLP vaults earned over $41 million in profits in the 24 hours of October 11th. On Pendle, Hyperwave and Looping Collective's packaged HLP products saw returns reaching a staggering 10,000%. This indirectly demonstrates the intensity and breadth of the sudden disruption in market liquidity.

This type of vault undertakes passive selling at extreme moments and earns abnormal price differences and funding fees from the liquidation of counterparties. The profits are very high, but not stable and sustainable. Once there is a lack of liquidation peaks or a reverse shock (such as liquidity depletion/price swing), there may also be a significant pullback.

Therefore, after the market trend, many media and community reviews have been asking: HLP's "Storm Day Excess" is more like an event dividend, earning bloody chips in extreme market conditions, rather than a steady-state return that can be replicated year after year.

At the same time, some platforms and strategies were unable to adjust their positions in time on extreme days: unified margin requirements coupled with execution congestion made delta neutral on the books unequal to neutral on execution. For example, on Backpack, many institutions and individuals hedged spot and perpetual contracts within the exchange, and extreme market conditions led to a series of position liquidations.

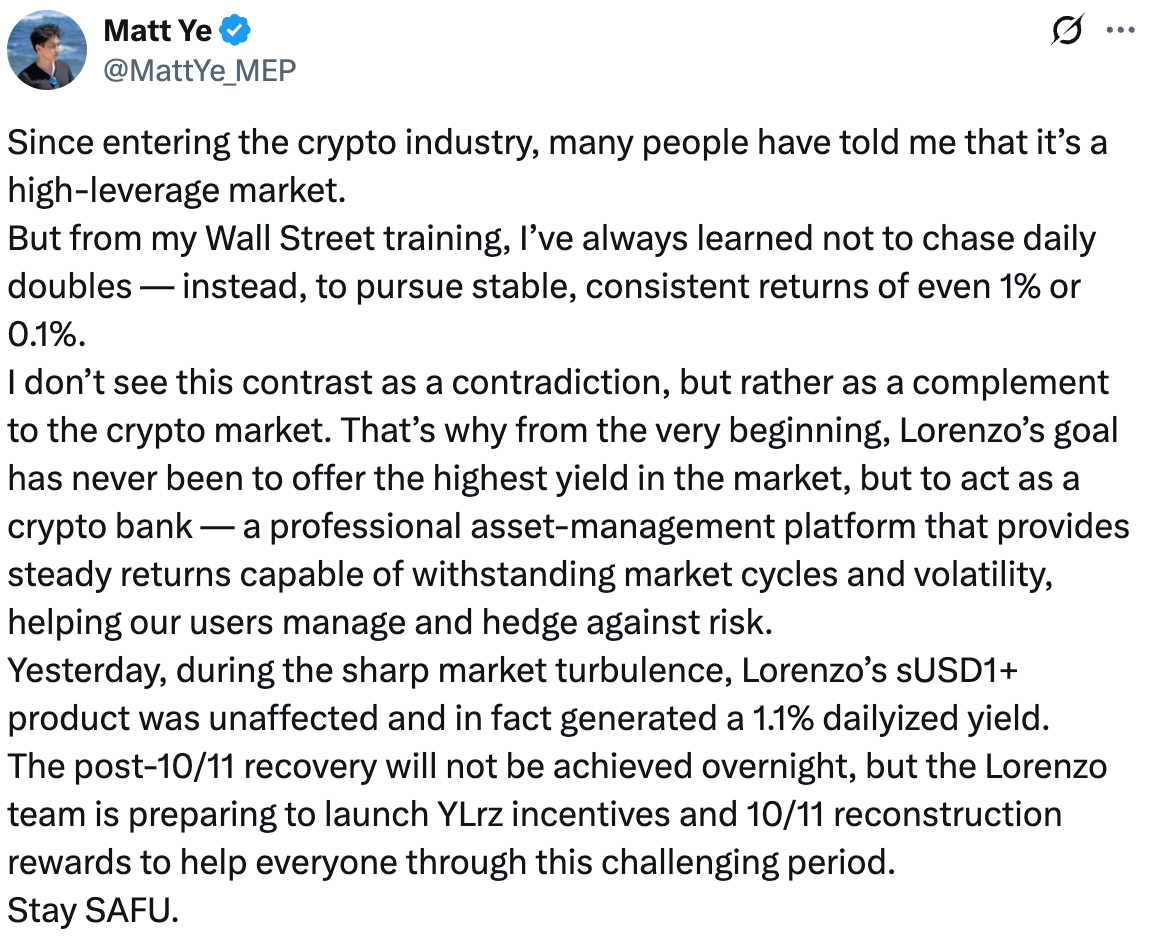

In this context, Lorenzo sUSD 1+ gave a different answer: turning "volatility" into "cash flow" to achieve stable returns in both extreme and normal situations.

- The principal is effectively protected, and the neutral basis trading strategy is not affected in any way by extreme market conditions. The price difference/funding fee in the abnormal range is deposited into sUSD 1+ NAV.

- The daily conversion rate on October 11th was approximately 1.1%, and the average APR in the past 7 days exceeded 50%.

This advantage stems from the fact that core members of the Lorenzo team have top-tier quantitative (Jump Trading/Two Sigma) backgrounds. Lorenzo's sUSD 1+ isn't a price-to-swing bet, but rather combines market-making dividends, basis/funding fees, and term structure management into a centrally managed OTF product. While users' sUSD 1+ OTF holdings remain unchanged, their net asset value (NAV) increases with the fund's returns. Redemptions are settled based on NAV, and the product has been integrated with various mainstream DeFi platforms, allowing users to explore a wider range of profit scenarios.

Lorenzo's price has also been recognized by the market. After the October 11th liquidation storm, $BANK not only did not experience a pullback, but actually reached a new high during the recovery period. This resilience isn't driven by sentiment, but rather by the market's recognition of sUSD 1+'s ability to convert market-making spreads and funding fees into actual cash flows amidst extreme volatility. The upward trend in net asset value drives valuations, and prices are driven by measurable cash flows rather than simple narratives.

In terms of stablecoin returns, sUSD 1+ has taken the lead in running the OTF model, providing a practical sample for the on-chain of more asset types. Recently, the official also announced that BNB+ will be launched soon. From the perspective of product layout, Lorenzo is building OTF into a scalable income asset factory. In the future, it may cover main chain assets, stablecoins, RWA and strategy combinations to build a diversified and reusable on-chain income asset matrix. This means that Lorenzo is gradually fulfilling his long-term vision of "on-chain investment bank".

In short, the lesson of October 11th is clear: in extreme moments of multi-point microstructural failure, book neutrality does not equate to safe execution. HLP's high returns on "storm days" are driven by event premiums from counterparty liquidations, which are difficult to replicate over the long term. However, sUSD 1+ utilizes engineered risk management to protect principal in extreme situations and steadily generate excess APY in normal times, turning volatility into measurable cash flow. This isn't a victory of "betting on the direction," but rather a victory of "capitalizing on volatility." Looking forward to Lorenzo's future performance.