Original author: Hersch & Dr. Larpist CEO CTO PHD LGBT

Original translation: TechFlow

I don't know if you've noticed, but there's $12 billion worth of assets sitting there casually on Morpho.

Is $12 billion enough for retirement?

Let me break down what's going on here, because at first glance, it makes absolutely no sense. It's an overcollateralized lending protocol—meaning for every $1 you deposit, it generously returns $0.75. So... who would actually use this machine? Who would be willing to lock up more capital than they can actually withdraw? It seems completely counterintuitive, right? Like the worst trading protocol ever. But wait, let's take a deeper look at the people who actually use it and what they're doing, and you'll find some really interesting insights.

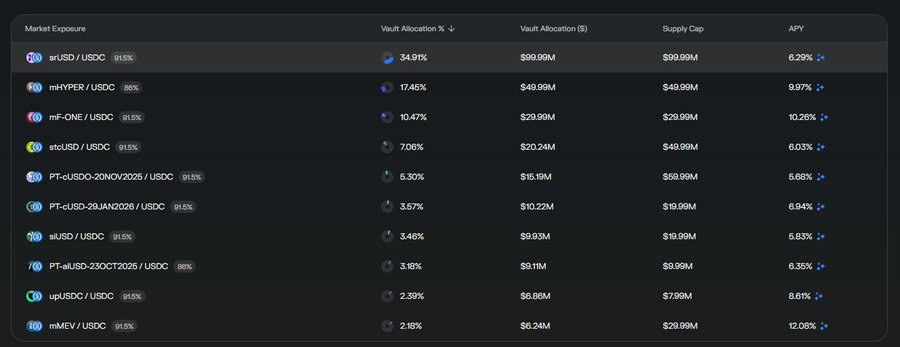

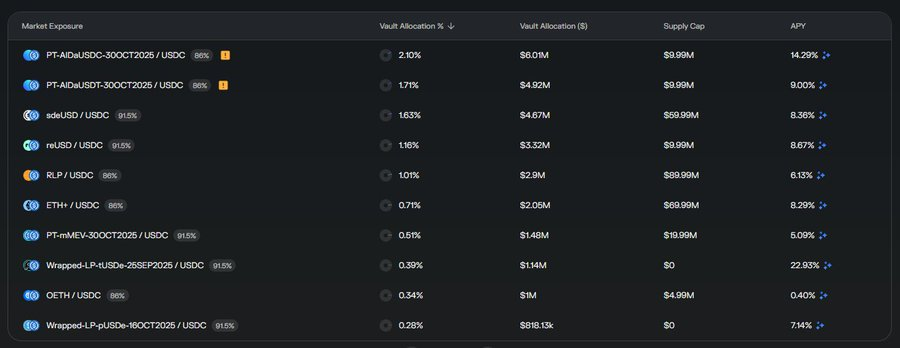

Take a look at the holdings of the second largest vault on Morpho.

What are these strange signs?

Seriously, look at this stuff. This isn't just some idiot betting their life savings on a bunch of shitcoins, or some whale arbitrage trading between exchanges. This is a carefully constructed portfolio of assets that, on the surface, looks... almost professional? Strategic? Like someone who actually knows the business?

Turns out there's some pretty cool stuff going on here...

DeFi is replicating the traditional asset management model.

The core game of traditional finance : Eight of the world's top 10 hedge funds—these truly powerful individuals, managing hundreds of billions of dollars in assets—all essentially do the same thing. They build diversified, near-market-neutral portfolios, extract excess returns (alpha) by systematically hedging market risk (beta), and then apply leverage to the entire portfolio to amplify returns. This is their playbook. This is how big money operates in traditional finance. To put it bluntly, it's not rocket science; it's simply a combination of sophisticated risk management and leverage to amplify otherwise mediocre returns.

But here’s the weird thing: DeFi doesn’t have portfolio leverage.

There isn't a single decentralized exchange (DEX) in the industry that offers this kind of functionality, which is widely used by almost every major asset manager. Think about it: we've built an entire parallel financial system with automated market makers (AMMs), yield aggregators, perpetual swaps, options protocols, lending markets—everything—but completely forgotten the core tools needed to implement institutional-grade portfolio management.

So what does this have to do with Morpho? Morpho doesn't even offer simple uncollateralized loans, let alone the sophisticated portfolio margin features that institutional traders find so appealing.

This is a true haute cuisine.

The truth is, those colorful logos in the screenshot above—things that look like DeFi protocols, but something's off—are actually market-neutral funds that trade almost entirely off-chain. These are real funds, managed by real people, running real strategies from traditional markets. But here's the clever part: they package these strategies into on-chain tokens, solely for distribution. This is essentially a wrapper that gives DeFi users access to off-chain strategies without the administrative nightmares, compliance requirements, know-your-customer (KYC) and accredited investor (accredited investor) vetting, or the inefficient operational speeds of traditional fund management.

Morpho's Vault Curators pool these tokens to construct a diversified portfolio of market-neutral off-chain funds. They essentially act as fund-of-funds (FoF) managers, selecting strategies to include, determining weights, and balancing risk across the portfolio. Users and investors can leverage these diversified, market-neutral portfolios through the Vaults—depositing collateral, borrowing funds, and then re-depositing the borrowed funds as new collateral, repeatedly, adding leverage to a portfolio of essentially market-neutral, institutional-grade strategies.

So, that “75-cent vending machine” suddenly made sense.

If you are running a market-neutral strategy that generates stable, low-volatility returns, the ability to amplify the strategy by 3-4x through revolving leverage can turn an 8% annual return into a more attractive 24-32%. And because the underlying portfolio is market-neutral and diversified across multiple uncorrelated strategies, even with significant leverage, liquidation risk remains relatively low.

DeFi has found a way to perfectly replicate the core mechanisms of traditional asset management—diversification, market neutrality, and portfolio leverage—through the least "dumb" overcollateralized lending protocol. It's not elegant, nor was it the original intention of anyone designing this system. But it works. The $12 billion sitting quietly on Morpho is proof of that. When you give people the tools, they always find ways to rebuild the financial system they truly need using temporary fixes and overcollateralized lending protocols.

My honest reaction to all of this.

- 核心观点:DeFi正复制传统资管模式。

- 关键要素:

- Morpho金库包装链下市场中性基金。

- 通过循环杠杆放大低波动策略收益。

- 构建多元化组合降低清算风险。

- 市场影响:推动DeFi向机构级资管演进。

- 时效性标注:中期影响