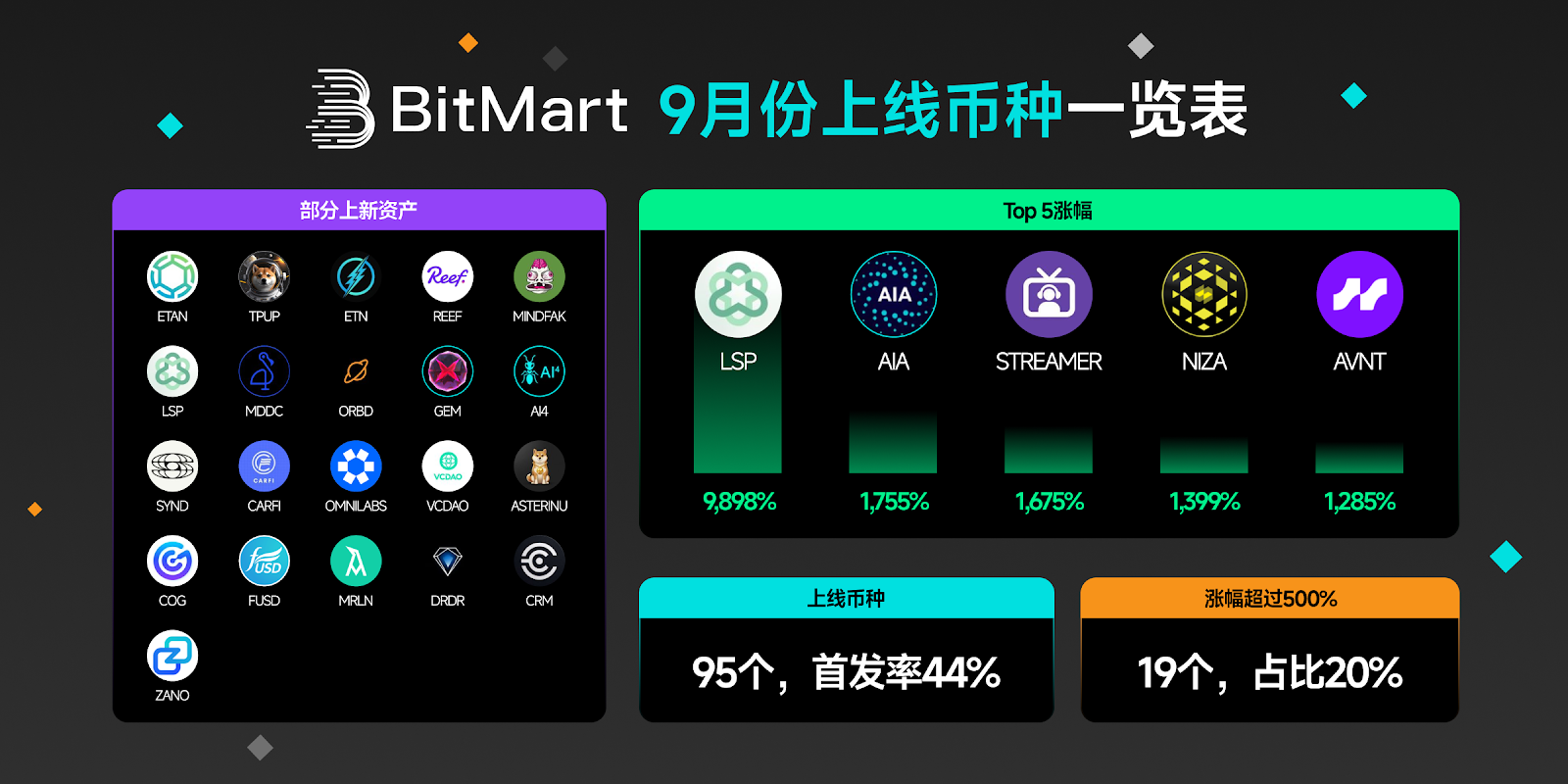

In the volatile crypto market, an exchange's speed of listing and asset quality are often the most intuitive indicators of the industry's performance. With the third quarter of 2025 just drawing to a close, BitMart's September listing data has once again become a focal point for the industry: the platform launched 95 new coins that month, representing a 44% initial public offering rate. Nineteen assets saw increases exceeding 500%, with several projects experiencing exponential growth in a short period of time.

On the surface, this is an impressive report card; however, if we combine the data and strategy changes from July and August, BitMart’s performance in September is more like a key step from “speed leadership” to “system formation”.

Robust output during turbulent cycles

September was a turbulent market. At the macro level, regulatory signals and the impact of the US Treasury cycle continued to unfold. Within the industry, sectors like AI, RWA, Decentralized Investment Platforms (DPI), and MEME (Metadata) saw a rapid shift in focus, exceeding expectations. Mainstream assets experienced volatile adjustments, and funds began to shift toward early-stage, small-cap projects and those at the edge of narratives.

In this context, maintaining a stable coin listing pace is inherently challenging. BitMart not only continued its high-frequency listing cadence in September, but also maintained a stable screening quality: 95 projects were listed that month, 44% of which were first-time tokens. This means that nearly half of all tokens debuting on CEX platforms chose BitMart.

The growth performance remains remarkable. Nineteen projects saw increases exceeding 500%, including LSP (9,898%), AIA (1,755%), STREAMER (1,675%), NIZA (1,399%), and AVNT (1,285%). The significance of these figures lies not only in the short-term earnings boost but also in the platform's ability to continuously identify high-potential projects and capture incremental opportunities during periods of cyclical uncertainty.

BitMart's stability lies in its controlled pace: it neither blindly chases hot spots nor slows down its layout, but rather seeks structural certainty amidst volatility. This "steady yet fast" pace is precisely what most exchanges struggle to achieve during periods of market weakness.

From a quarterly perspective: stable growth

If we expand our perspective to the entire third quarter, BitMart’s coin listing data shows a “rhythmic acceleration.”

In July, the platform launched 78 cryptocurrencies, 26 of which were first launched, representing a 34% first-launch rate. This was the first month of the platform's second half of the year, and the pace was stable but slightly slower, largely continuing the growth momentum of the first half of the year.

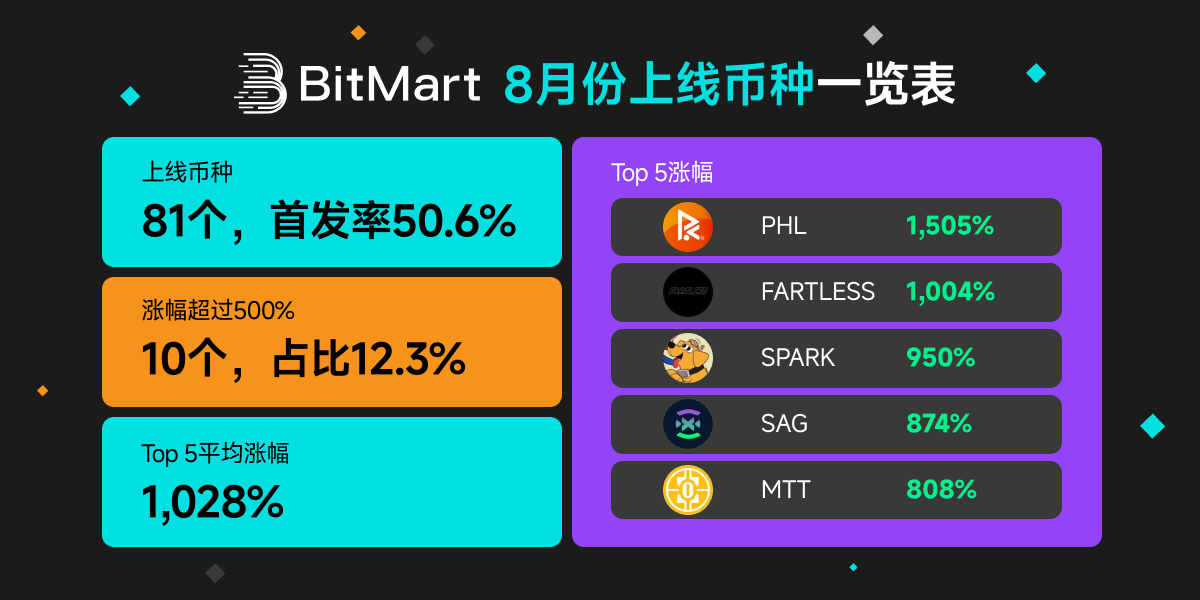

In August, BitMart's coin listings rose to 81, with the initial public offering rate exceeding 50% for the first time. This sparked heated discussion within the industry—some called it "extreme involution," while others saw it as a continuation of BitMart's consistent strategy of seizing early market opportunities and trading a higher initial public offering rate for greater future potential.

September's data shows this strategy is maturing. The number of listings increased to 95, a 17% month-over-month increase, while the initial launch rate remained at 44%. In other words, BitMart expanded its coverage while ensuring the quality of its initial launches, avoiding the trap of simply increasing the number of listings.

From a quarterly perspective, BitMart has formed a stable growth curve:

- In terms of quantity, the total number of listed coins has been steadily increasing, indicating that the platform's project access and review capabilities are continuously expanding;

- In terms of quality, the high first-time issuance ratio remains at the top level in the industry, indicating that its early-stage project screening mechanism is gradually maturing;

- In terms of returns, projects with growth rates exceeding a thousand times or a hundred times continue to emerge steadily, proving that "early and accurate coin listing" is not accidental, but the result of long-term strategic accumulation.

This means that BitMart's coin listing strategy has shifted from single-point breakthroughs to systematic growth. The platform's stability over the quarterly cycle is a rare trait in the fiercely competitive exchange landscape.

Proactive Innovation: From "Early Coin Listing" to "Deepening Asset Ecosystem Development"

However, BitMart did not stop at its traditional advantage of “first-release rate”.

Over the past two years, competition among exchanges has gradually evolved from "who lists a coin first" to "who can better manage the ecosystem after listing." BitMart clearly recognizes that speed alone cannot create a long-term competitive advantage, and therefore has been continuously upgrading its internal structure, transitioning from a single-point coin listing strategy to a diversified asset ecosystem.

During this process, BitMart has gradually formed a product matrix consisting of the BMD (BM Discovery) zone, DEX, LaunchPrime, etc., which jointly support the platform's layout in the entire chain of "asset discovery-circulation-incubation".

Among them, the BMD Discovery Zone focuses on early project screening and community connection, helping users access high-potential assets earlier through on-chain data analysis and project evaluation mechanisms; DEX allows users to directly participate in the decentralized liquidity market, getting closer to the early stages of asset circulation; LaunchPrime is positioned as a project incubation and early user participation platform, strengthening the value channel between CEX and high-quality projects.

Through the collaboration of these three sectors, BitMart is no longer just a "launch aggregation center", but is building a three-dimensional asset circulation ecosystem - from discovery, trading to incubation, forming a closed-loop value system, and also establishing deeper barriers in the face of homogeneous competition.

Beyond the data: the underlying tone of long-termism

While the data is impressive, BitMart seems to be more focused on dimensions that cannot be directly quantified by data - user revenue experience and platform security.

High-speed coin listings often come with high risks, but BitMart has chosen to balance speed and quality with a rigorous risk control system. The platform's full-lifecycle risk control mechanism encompasses project review, on-chain tracking, liquidity monitoring, contract security assessments, and other aspects. From project launch to subsequent trading, BitMart continuously monitors fund flows and market performance to prevent potential anomalies.

In addition, BitMart is also trying to transform the complex coin listing logic into a more user-friendly experience.

- At the product level, the trading interface, asset prompts, risk labels, and other designs are more intuitive, allowing ordinary users to more clearly understand the risk range when dealing with early-stage assets;

- At the community level, BitMart uses AMAs, project insight reports, B research briefs, and other forms to enable users to not only be "participants" but also "co-builders" with more transparent information.

Behind this strategy is a longer-term thinking:

BitMart doesn't pursue extreme monthly performance. Instead, it aims to ensure users continue to benefit from market fluctuations through stable screening, a controlled pace, and clear user education. As one industry observer noted, BitMart's "speed" isn't blind acceleration, but rather targeted and disciplined growth.

Conclusion: Building Determinism in Cycle Switching

In the crypto world, no platform can rely forever on "hit projects" to maintain growth. True competitiveness comes from understanding the rhythm, respecting users, and building long-term value for the ecosystem.

BitMart's performance in September was an extension of this philosophy. It neither stopped nor blindly accelerated, but instead found its own rhythm amidst the complex cycle transitions—a rhythm that was both fast and stable.

Looking ahead to the fourth quarter, as the industry returns to rationality and project quality diverges, the balance between "discovering early value" and "managing potential risks" will become a challenge that all exchanges must face. BitMart is clearly ahead of the curve in this test.

Amidst the noise and internal competition, BitMart used real data and strategy upgrades to answer a question: What is true long-termism in this volatile market?

- 核心观点:BitMart上币策略从速度转向体系化。

- 关键要素:

- 9月上线95币,44%首发率。

- 19个项目涨幅超500%。

- 构建资产生态闭环体系。

- 市场影响:推动交易所竞争转向生态建设。

- 时效性标注:中期影响。