ADL, the last line of defense

- 核心观点:中心化与去中心化交易平台风险管理哲学不同。

- 关键要素:

- Hyperliquid链上透明执行ADL。

- 币安中心化黑盒操作ADL。

- ADL触发机制与排名算法迥异。

- 市场影响:加剧行业对交易透明度的关注。

- 时效性标注:中期影响

This big crash and big margin call still led to a public debate.

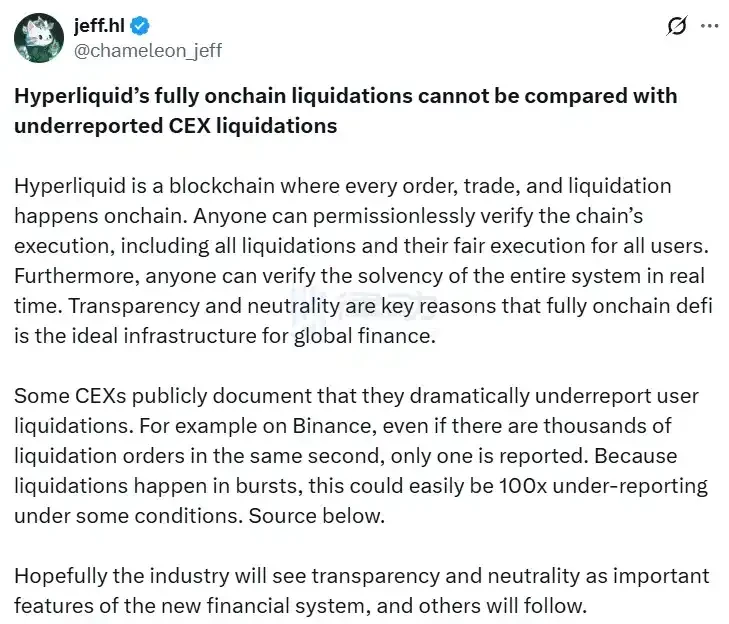

Hyperliquid founder Jeff Yan directly fired back on social media: "Some centralized exchanges have publicly stated that they severely underreport user liquidations. For example, on Binance, even if there are thousands of liquidation orders in the same second, only one is reported. Because liquidations are sudden events, in some cases, the underreporting can easily reach 100 times."

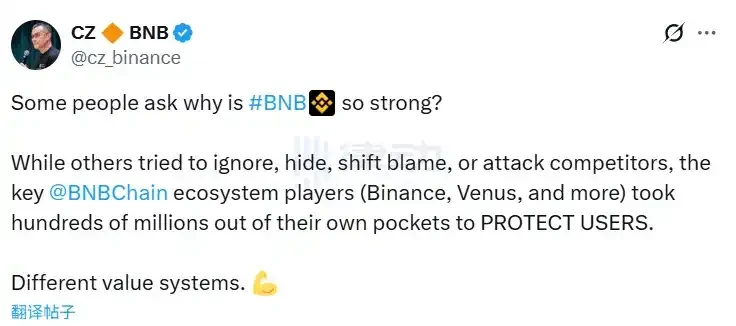

This statement undoubtedly slapped CZ in the face, and he quickly responded to Jeff: "While others tried to ignore, hide, shirk responsibility, or attack competitors, key players in the BSC ecosystem - Binance, Venus, etc. - spent hundreds of millions of dollars out of their own pockets to protect users. Different value system."

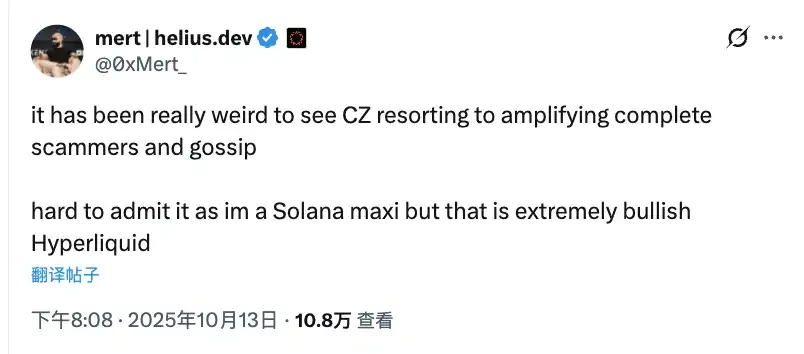

The debate quickly sparked a debate. DeFi veteran Andre Cronje supported Binance, while core Solana community member and Helius Labs CEO Mert backed Hyperliquid. The industry was thus divided into two camps.

Ultimately, the essence of this matter lies in the fundamental difference in stance between decentralized and centralized trading platforms. The ADL mechanism best embodies this difference.

If it weren't for this major crash and subsequent margin calls, most people might not have fully understood the difference between Hyperliquid and Binance's ADL. This difference, however, represents the starkly different philosophies of risk management between decentralized and centralized exchanges.

ADL: The last line of defense

ADL, short for Auto-Deleveraging, is the last line of defense for cryptocurrency exchanges. When losses from liquidation exceed the insurance fund's capacity, the exchange triggers this mechanism, forcibly closing profitable positions to maintain solvency.

It sounds cruel, but it is a necessary evil because if it is not done, the exchange will go bankrupt and all users' funds will be threatened.

Hyperliquid's ADL: Rare but Transparent

Let’s first look at Hyperliquid’s ADL mechanism.

Hyperliquid's ADL system is designed as a multi-layered safety net, activated only when all other mechanisms fail. When a trader's position falls below the maintenance margin requirement—typically 2% to 5% of the position's notional value—the system first attempts to match liquidation orders on the order book through standard liquidation procedures. What if the order book is insufficient to liquidate? The position and collateral are then transferred to the Hyperliquid liquidity provider pool, commonly known as the HLP vault.

ADL is only activated if the value of the HLP vault or a segregated position account becomes negative—meaning that unrealized losses exceed all available buffers. The specific triggering condition is: the sum of the insurance fund balance + position margin + unrealized profit and loss ≤ 0. This mechanism does not have a fixed percentage threshold; it is adjusted dynamically based on maintenance margin violations. For example, if you use 2x leverage, a decline of more than 50% may be required to trigger ADL.

Hyperliquid intentionally designed ADL to be an extremely rare event. The event on October 11, 2025, was the first ADL triggered in full-margin trading mode in the platform's more than two years of operation. Previously, it had only occurred sporadically in isolated trading mode.

Once ADL is triggered, the system prioritizes the largest whales first. The ranking formula is: Mark Price ÷ Entry Price × Notional Position ÷ Account Value. It sounds a bit complicated, but the logic is simple. The ratio of Mark Price to Entry Price measures your profit percentage. A higher ratio indicates greater profit, and thus a higher priority for forced liquidation. The ratio of Notional Position to Account Value represents effective leverage. The larger your position relative to your account size, the greater its contribution to systemic risk, and thus, will be prioritized.

The algorithm comprehensively considers three factors: unrealized profit and loss (most important), leverage (second), and position size (third). This queue is a dynamic, on-chain priority queue, with each asset or perpetual contract having its own independent queue. The queue is updated in real time based on the mark price and oracle data, approximately every three seconds. During execution, the system utilizes the sub-second finality of the HyperBFT consensus mechanism to batch processes. However, please note that because the platform supports cross-asset margining, unbalanced liquidations may occur, such as when only one side of a hedging strategy is liquidated.

Compared to centralized exchanges, Hyperliquid's ADL offers several distinct advantages. First, decentralized execution—all steps are automatically executed through smart contracts on the Hyperliquid L1 blockchain, without relying on any off-chain engines or human intervention. This ensures complete transparency, with all liquidation and ADL events auditable in real time via block explorers, eliminating any room for black box operations.

The deep integration between the platform and HLP is also very interesting. Revenue generated by ADL flows back into the community treasury, and the platform uses 97% of transaction fees to repurchase HLP and HYPE tokens. To encourage order book liquidity, the platform does not charge any fees for liquidations, and the HLP treasury does not cherry-pick only profitable trades, thus avoiding the so-called "toxic liquidity" problem.

Binance’s ADL: Regular but Transparent

Let’s take a look at how Binance does it.

Binance's ADL is the last resort for its USDT-margined futures platform, activated only after the insurance fund is depleted. This mechanism requires several prerequisites to be met: first, the trader's position must reach bankruptcy, meaning losses exceed the maintenance margin, resulting in a negative account balance; second, the liquidation order must be executed at a significantly poor price, resulting in losses exceeding the margin; and finally, the futures insurance fund must be depleted, unable to fully cover the loss.

Binance hasn't announced a specific trigger percentage; the entire mechanism is dynamic, depending on the specific contract and prevailing market conditions. Essentially, the insurance fund has bottomed out relative to the bankruptcy threshold. The platform maintains a separate insurance fund for each perpetual contract, funded by transaction fees and surpluses generated during liquidation.

Binance uses the ADL score to determine who will be liquidated first. For profitable positions, the ADL score = P/L percentage × effective leverage. P/L percentage is calculated by dividing unrealized P/L by initial margin × 100. Effective leverage is calculated by dividing the position's notional value by its wallet balance. For losing positions, the ranking is calculated by P/L percentage × effective leverage, giving these positions lower priority. Finally, the user's ADL score is divided by the total number of eligible users to determine the final ranking.

For example, if you have a 50% profit and 20x leverage, your ADL score is 1000. This score is much higher than another trader with a 20% profit and 10x leverage, who only has 200 points, so you will be forced to liquidate first.

Binance provides a five-level indicator light system within the trading interface, located below the position details, allowing you to visually assess your ADL risk level. Zero to one green light indicates low risk, placing you in the bottom 80% of the queue and generally not a cause for concern. Two lights indicate medium risk, ranking between 60% and 80%, and warrants attention. Three yellow lights indicate high risk, ranking between 40% and 60%, and warrant close monitoring.

Four orange lights indicate high risk, ranking between 20% and 40%, and you should consider reducing your leverage. When all five lights are red, it's the highest risk level, placing you in the top 20% and making you the first to be liquidated during extreme market conditions.

After ADL is activated, the system first monitors post-liquidation bankruptcies. If the insurance fund is insufficient, the queue is activated. All profitable positions are then sorted by ADL score, from highest to lowest. The highest-ranked position is then forcibly liquidated at the bankruptcy price or the mark price, with the liquidation amount just sufficient to offset the deficit. This process repeats until the deficit is filled or all positions in the queue are exhausted. In the most extreme case, if the queue is exhausted and the gap remains unfilled, a so-called socialized loss will occur.

After the liquidation, the profits and losses of affected users are realized, and the insurance fund may receive some of the surplus. This entire process is executed quickly through a centralized engine, but it doesn't take place on a public order book. Each contract has a separate queue that is dynamically updated. The system automatically excludes hedged positions or positions with too low leverage, preventing users from opting out.

Binance's notification system is quite comprehensive. When an ADL occurs, you'll receive an immediate notification via app push, email, and text message, detailing the amount of positions closed, the impact on your profit and loss, and the reason for the liquidation. Before an ADL is triggered, a five-level light bar will alert you, and you can also enable push notifications for high-risk rankings in settings.

All ADL events are subsequently recorded in your transaction history, marked as a special execution type, and the system automatically generates a customer service ticket to facilitate your dispute. These notifications are mandatory and cannot be turned off.

Comparison of key mechanism differences

In terms of execution, Hyperliquid uses on-chain smart contracts, ensuring complete decentralization; Binance relies on a centralized risk control engine and internal servers. However, the biggest difference lies in transparency. All steps in Hyperliquid's process are verifiable on-chain, allowing anyone to audit the entire process. While Binance has publicly released its ranking formula, the specific implementation details are completely invisible to outsiders, rendering it a semi-transparent black box.

For example, during the October 11th crash, Hyperliquid triggered its ADL mechanism. However, founder Jeff Yan emphasized that the platform maintained 100% operation, zero bad debts, and publicly disclosed all liquidation data. The community held this up as a model of transparency. Some users commented that while Hyperliquid's ADL mechanism might be indiscriminate, it was at least honest, unlike centralized exchanges that might conceal information.

In contrast, the "black box" operations of centralized exchanges have sparked widespread skepticism. During the October 11th crash, some users questioned Binance's "non-ADL" agreements with certain major clients, exposing ordinary users to increased ADL risk. This was seen as a sign of a loss of neutrality on the platform. Some traders even suggested that centralized exchanges' order books might be fake, exploiting their knowledge of liquidation prices to exploit users and then underreporting liquidation data through measures such as API restrictions.

Hyperliquid uses a ranking algorithm based on Mark Price ÷ Entry Price × Notional Position ÷ Account Value. Binance uses P/L Percentage × Effective Leverage for profitable traders and P/L Percentage ÷ Effective Leverage for losing traders.

The insurance fund structures are also different. Hyperliquid relies on the HLP community pool, which holds approximately $3.5 billion, along with an independent sub-treasury system. Binance has established independent insurance funds for each contract, funded by transaction fees. For large contracts like BTC USDT, the insurance fund can reach several million dollars.

Regarding trigger thresholds, Hyperliquid triggers when the account value reaches ≤ 0, which occurs after both standard liquidation and HLP takeover fail. Binance triggers when the insurance fund fails to cover bankruptcy losses, with no fixed percentage.

Hyperliquid offers no fees for clearing to encourage liquidity. Binance charges a 0.015% maker fee and a 0.04% taker fee, which are used to replenish the insurance fund. Regarding risk warnings, Hyperliquid's interface displays an ADL risk score, which is updated in real time based on on-chain data. Binance provides a five-level indicator bar that updates based on the real-time mark price.

The likelihood of manual intervention also varies. Hyperliquid has virtually no manual intervention, except for emergency validator governance votes, such as the JELLY token issue. While Binance hasn't publicly acknowledged this, there have been allegations that the platform provides VIP customers with special treatment for non-ADL protocols.

Data verifiability is the biggest difference. Hyperliquid is fully auditable, verifiable by anyone through block explorers and on-chain data. Binance's data is disclosed solely by the platform itself and cannot be independently verified. Regarding execution speed, Hyperliquid, based on HyperBFT consensus, achieves sub-second latency and a theoretical capacity of 100,000 transactions per second. Binance's centralized engine is generally near-instantaneous, but may experience delays under high load.

Hyperliquid designed ADL to be extremely rare. The first full-position ADL occurred after the platform had been operating for more than two years. ADL is minimized through position limits and a deep peg. Binance's ADL is a more conventional risk tool, with historical estimates suggesting that less than 0.1% of liquidations result in an ADL.

Ultimately, these are two completely different philosophies. Hyperliquid opts for structural transparency—enforced transparency through technical architecture, preventing fraud. Binance prioritizes efficiency—trading centralization for speed, but at the cost of trusting the platform won't do anything malicious.

Under normal circumstances, this difference may not be obvious, but under extreme market conditions like October 11, the difference is infinitely magnified.