Survival is everything.

Following "3.12" and "5.19", the crypto market has another historic crash day - 10.11.

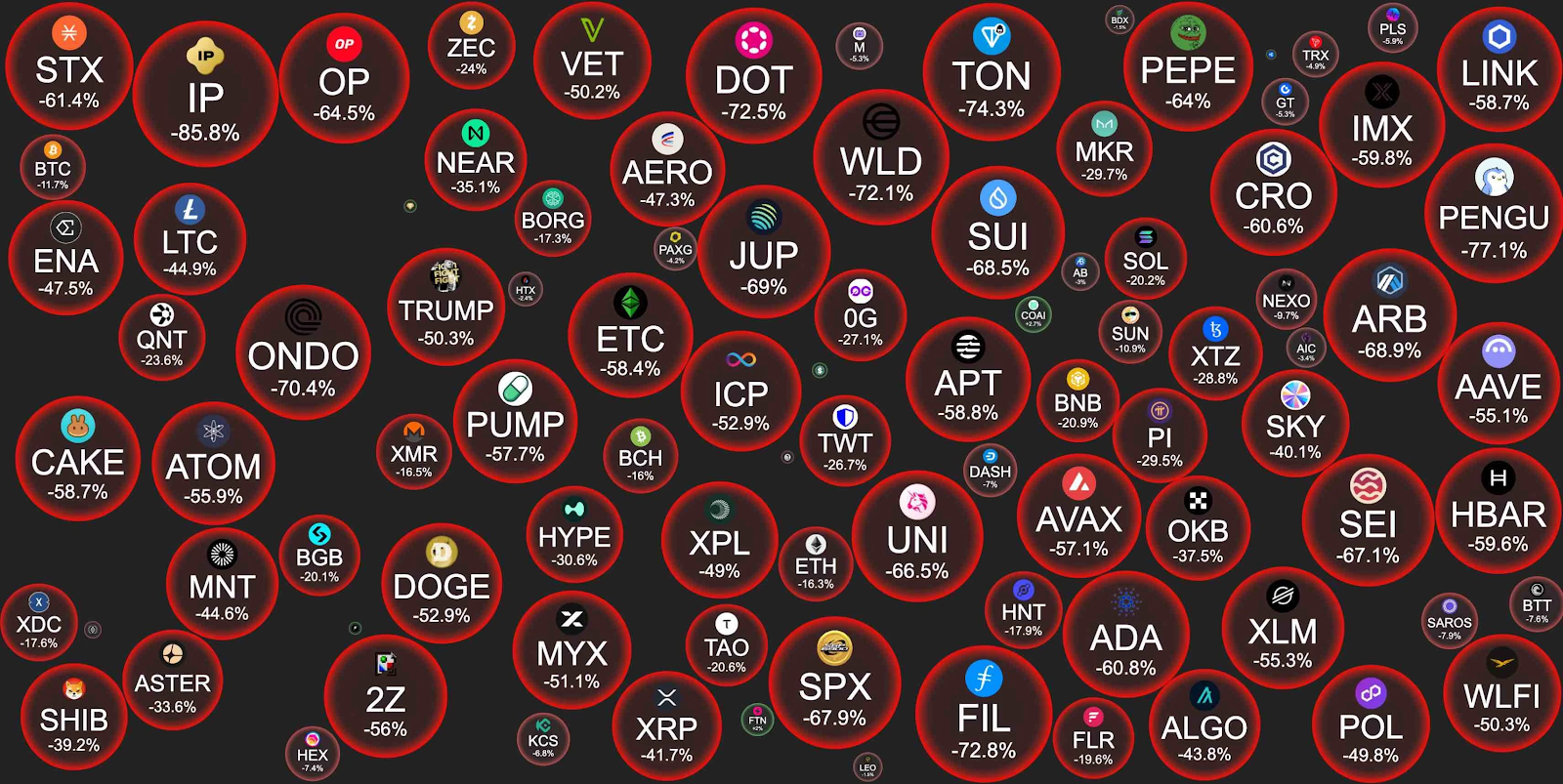

That night, the market spiraled out of control like an avalanche. BTC plummeted to 101,500 USDT, ETH to 3,373 USDT, and SOL to 145 USDT. Altcoins suffered even worse, with prices of many tokens plummeting to zero in a matter of minutes, a true annihilation.

According to Coinglass data, within 24 hours, the total amount of liquidations across the entire network reached $19.2 billion, with over 1.64 million people affected. The largest single liquidation occurred on the Hyperliquid platform, involving a long position in ETH, exceeding $200 million. Analysts generally believe this is just the tip of the iceberg—if undisclosed liquidations from platforms like Binance are included, the true scale could be as high as $30-40 billion.

We used to believe that the market, having weathered several bull and bear cycles, had already established a robust risk structure and would avoid another systemic crash like the one on March 12. But reality has once again ruthlessly slapped us in the face.

On the surface, this was a sudden macro black swan event, but the deeper reason was the structural fragility under the long-term leverage stacking and the failure of the liquidity protection system.

Triple strangulation: dissecting the underlying mechanism behind the plunge

The trigger of October 11th came from Trump.

His sudden announcement of a new round of tariffs on Chinese goods ignited risk aversion in global assets. Rising US Treasury yields and a stronger dollar led to a rapid flight of capital from high-risk assets, with cryptocurrencies bearing the brunt.

But tariffs alone clearly cannot explain the near-instant market collapse. The real killer is leverage.

Over the past few months, the market has continued to rally from a high point, but this incremental capital hasn't come from long-term users. Instead, it's the product of a combination of lending, contracts, revolving loans, and yield farming strategies. When negative macroeconomic conditions triggered a decline, highly leveraged positions became the first to break out. Once support levels were breached, forced liquidations were triggered one after another, snowballing selling pressure and ultimately leading to a chain reaction of liquidations.

What is even more fatal is that the market maker system completely collapsed during the crash.

When the tariff news triggered panic, market makers were forced to withdraw liquidity from altcoins to support mainstream coins. Tail-end projects instantly lost their counterparties, sending prices plummeting. Tokens like IOTX, JUP, and ENA saw short-term declines exceeding 90%, completely exposing the market's liquidity crisis.

Even more coincidental was the fact that the incident occurred on Friday night—with European and American traders away and liquidity thin in Asia, the market was directly hit by negative news during this vacuum. As one senior market maker put it, "Had this happened during the weekday, the market might have recovered long ago; but it happened to be a Friday. It was just too much of a coincidence."

Macroeconomic shock, leverage bubble, liquidity fault - the combination of these three forces made October 11 another "Black Friday" in the history of the cryptocurrency world.

And on the ruins, there are always people counting money with a smile.

Fishing chestnuts from the fire: the secret to profitability in extreme market conditions

A market crash is never a pure disaster; it is also an opportunity to transfer wealth.

In extreme market conditions, a few people have accumulated wealth through precise position management and calm judgment.

One is pre-positioned short positions. Hours before Trump's speech, a whale account on the Hyperliquid platform continuously increased its short positions in BTC and ETH, totaling over $1.1 billion. As the market crashed, these short positions generated profits exceeding $72 million overnight. This wasn't a blind bet, but rather a preemptive bet on macro risks.

The second is the extreme bottom-fishing "order miracle." At the moment when liquidity completely collapsed, mainstream assets also experienced rare price mispricing.

That night, some people bought WBETH for $430, BNSOL for $35, XRP for $1.25, and ARB for $0.1. Most of these orders were filled within minutes, and the market rebounded several times after stabilizing.

The "price hole" under extreme market conditions has become a moment for a few people to get rich quickly.

The third is stablecoin arbitrage. USDe briefly de-pegged to $0.626, prompting a surge in investors to buy at the bottom and profit by tens of pips after a short-term return to the peg. Ethena officials later confirmed that the system was overcollateralized and operating normally, and stated that they had "earned more insurance premiums" during the extreme volatility.

But such opportunities ultimately belong to only a select few. Those who get rich quick during a market crash are only stories, while the majority face liquidation. This game of wealth redistribution serves as another reminder that risk doesn't just fall from the sky; it lurks deep within leverage.

Unlike these short-term players who are trying to make a living by trading on the edge of a knife, other assets have chosen to "stand still" by relying on a stable ecosystem - this is what I will talk about next: the counter-trend example of platform coins.

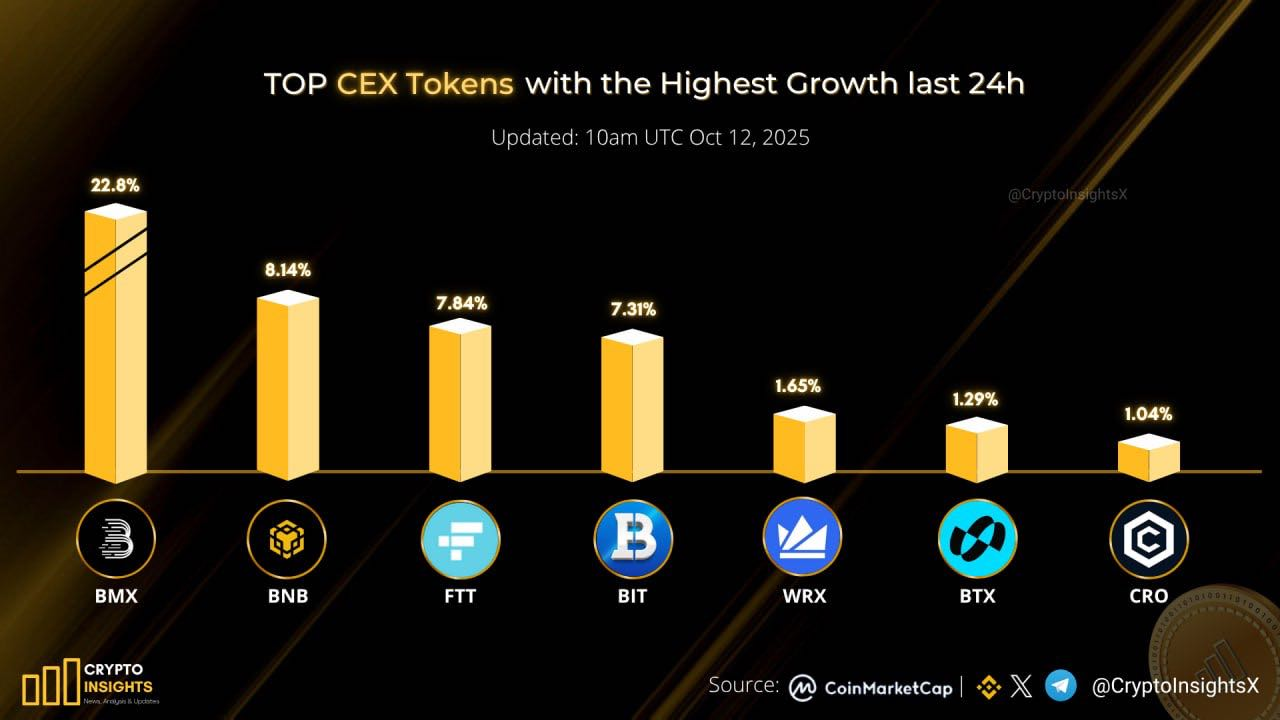

BMX Movements: The Anti-Fall Benchmark among Platform Coins

Amidst the turmoil sweeping the crypto market, exchanges' platform tokens were clearly not immune to the impact. However, the performance of BitMart's platform token, BMX, was remarkable. BMX demonstrated remarkable resilience amidst the market crash, maintaining price stability far superior to other mainstream cryptocurrencies.

More importantly, during the market bottoming out and rebounding phase, BMX's growth rate ranked first among major platform currencies, demonstrating strong recovery capabilities.

The fundamental reason why BMX can remain relatively stable in extreme market conditions is that it has solid ecological value support.

BMX introduces new features such as staking, small-value asset exchange, IEO subscription, staking returns, and liquidity management, establishing BMX as a key foundation for the BitMart ecosystem. BMX is not only a valuable asset but also a utility token, playing multiple roles within the BitMart ecosystem.

Secondly, community trust and capital retention are key factors. During the October 11th (October 11) trading period, BMX's stablecoin pairs maintained a normal order book depth, and the liquidity pool did not experience pump-and-dump fluctuations. Furthermore, the platform's tokens enjoyed high actual usage within the ecosystem, and their burn mechanism was stable, avoiding the price fragility associated with purely speculative trading.

Amidst the chaos, BMX's nearly "fluctuation-free" performance demonstrated the platform's ecosystem's resilience. Some have described it as a "black swan night shock absorber"—not because of its highs, but because of its stability. In the rebound after the plunge, BMX became one of the first to recover and the strongest performers, reaffirming the old saying: bull markets focus on growth, bear markets on resilience.

Conclusion: Only by surviving can there be the next cycle

October 11th was not an accident.

It is the inevitable liquidation of the highly leveraged system and the moment when the illusion of market prosperity is punctured.

The macro black swan is just the fuse. The real underlying logic is: too much leverage, too thin liquidity, and the system is too fragile.

This crash has forced the crypto world to face an old question again - are you speculating on price or investing in value?

Some people become rich overnight, while others lose everything, but the only thing that remains unchanged is: only those who remain at the table are qualified to talk about the next cycle.

The truth in the cryptocurrency world is cruel and simple: getting rich quickly is not the end, survival is victory.

- 核心观点:高杠杆导致加密市场系统性崩盘。

- 关键要素:

- 特朗普关税政策引发避险情绪。

- 高杠杆仓位触发链式爆仓。

- 做市商流动性抽离加剧暴跌。

- 市场影响:暴露杠杆风险,促进行业去泡沫。

- 时效性标注:中期影响