Multiple ETFs face final rulings in October. Could this trigger a new round of altcoins?

- 核心观点:SEC即将裁决多币种现货ETF,市场预期乐观。

- 关键要素:

- SEC加速审批,审查时间缩至75天。

- LTC、SOL等ETF获批概率超90%。

- 10月为关键裁决期,首案定市场预期。

- 市场影响:或引发山寨币行情,改变资金流入模式。

- 时效性标注:短期影响

Original author: 1912212.eth, Foresight News

The U.S. Securities and Exchange Commission (SEC) is expected to make final decisions on at least 16 spot cryptocurrency exchange-traded funds (ETFs) by October 2025. These applications involve a variety of tokens beyond Bitcoin and Ethereum, such as Sol, XRP, Litecoin, DOGE, ADA, and HBAR. In recent developments, the SEC has withdrawn several deferral notices and accelerated the approval process through new common listing rules, reducing the review time to under 75 days.

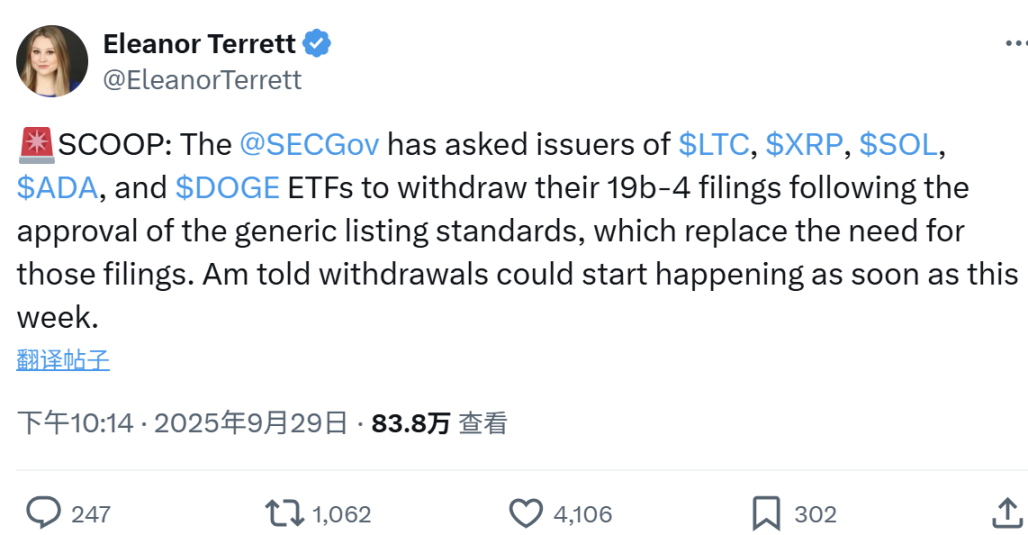

According to crypto journalist Eleanor Terrett, the US SEC has asked the issuers of LTC, XRP, SOL, ADA and DOGE ETFs to withdraw their 19 b-4 filings because these documents are no longer required after the approval of the universal listing standards.

Since their approval, Bitcoin and Ethereum spot ETFs have seen significant inflows and contributed significantly to price increases. So, will multiple ETFs be approved this time, and will this have a price-increasing effect?

Final deadline for rulings on multiple token ETFs is October

According to data compiled by Twitter blogger Jseyff, the final deadlines for multiple altcoin spot ETFs are spread throughout October. The first to be approved is Canary's LTC ETF, with a deadline of October 2nd.

Next is Grayscale’s Solana and LTC trust conversion, dated October 10, and finally WisdomTree’s XRP fund, dated October 24.

A decision could come at any time before the final deadline, according to a list of upcoming approvals created by Bloomberg ETF analyst James Seyffart.

These applications come from institutions such as Grayscale, 21 Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. Notably, BlackRock or Fidelity did not participate in this round, but this does not diminish their potential impact—if approved, they could pave the way for subsequent, larger-scale products.

Since the BTC and ETH spot ETFs, no other currency has been approved by the SEC. The SEC has continued to delay its application as usual. However, the upcoming final ruling must give the market a yes or no decision.

The market is eagerly waiting.

Litecoin, which was the first to be ruled on, and SOL's approval or rejection may determine subsequent market expectations.

Probability of approval

At the end of July this year, the SEC's new listing standards focused on the eligibility requirements and operating mechanisms of crypto ETPs. First, physical creation and redemption were officially allowed, meaning that authorized participants could exchange ETP shares for actual crypto assets instead of cash.

The SEC also announced listing standards for spot ETFs. The new standards, expected to take effect in October 2025, aim to simplify the ETF listing process. The "universal listing standards" require crypto assets to be listed on major exchanges such as Coinbase for at least six months. This regulation aims to ensure sufficient liquidity and market depth for assets to avoid manipulation.

Litecoin is renowned as a long-established altcoin. Its maturity and non-security nature make it a candidate for early approval. Litecoin founder Charlie Lee recently stated in an interview that he expects a spot LTC ETF to launch soon. This view is based on the US SEC's approval of the universal listing standards for cryptocurrency ETFs and LTC's inclusion as one of the 10 assets meeting these standards.

In an interview, Charlie Lee discussed the prospects of LTC within the evolving regulatory framework. He cited the SEC’s recent approval of universal crypto ETF listing standards as a key factor driving this, and emphasized that Litecoin meets the conditions for expedited approval.

As of now, the market on Polymarket is betting that the probability of Litecoin spot ETF being approved this year has risen to 93%.

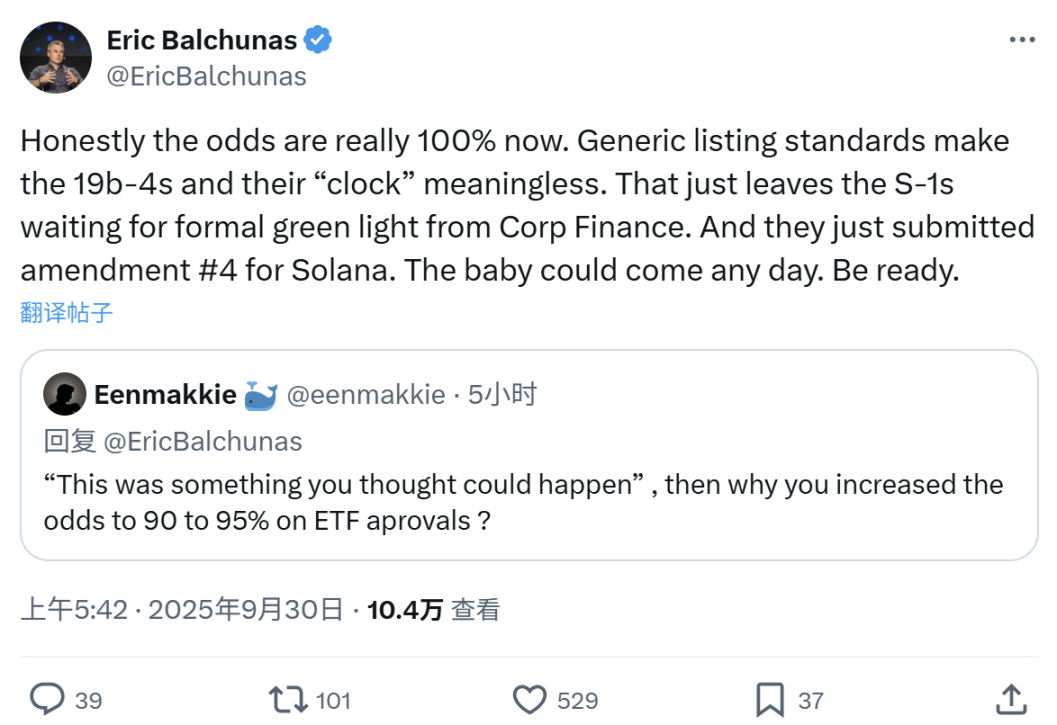

Regarding the SOL spot ETF, Bloomberg ETF analyst Eric Balchunas said, "Honestly, the success rate of approval for the SOL spot ETF is now close to 100%. Common listing standards have made the 19b-4 filing and its timeline meaningless, leaving only the S-1 Form to deal with. The baby could be born at any time, so be prepared."

It is worth mentioning that ADA was the last currency awaiting a ruling at the end of October, and the market on Polymarket bet that the probability of its ETF being approved has risen to 93%.

The SEC's decision in early October will clearly be a bellwether.

Previously, the SEC approved the Hashdex Crypto Index ETF. Recently, the Hashdex Nasdaq Crypto Index US ETF (NCIQ) added support for XRP, SOL, and XLM, allowing the product to provide US investors with investment exposure to five crypto assets: BTC, ETH, XRP, SOL, and XLM through a single investment vehicle.

Previously, the US SEC approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Is approval good for the currency price?

Bitfinex analysts previously predicted that crypto ETF approvals could trigger a new altcoin season or rally, and that these approvals would provide traditional investors with more crypto investment exposure.

However, some analysts do not agree with this view.

James Seyffart, an exchange-traded fund (ETF) analyst at Bloomberg, stated that the current altcoin market is driven by the rise in the price of digital asset finance companies (DATCOs) rather than traditional tokens. Seyffart noted that institutional investors are more inclined to choose multi-cryptocurrency portfolios rather than single-altcoin ETFs. He emphasized that institutional funds prefer to gain cryptocurrency exposure through regulated products rather than directly holding the tokens, and this structural shift could permanently alter the altcoin market's upward trajectory.