Berkshire Hathaway's Cryptocurrency Treasury

- 核心观点:数字资产财库有望成为加密经济长期引擎。

- 关键要素:

- DAT持有1050亿美元资产,规模扩张迅速。

- 可编程货币特性赋予DAT灵活资本配置优势。

- 头部DAT将向主动型资本配置者转型。

- 市场影响:推动加密资产机构化,重塑市场结构。

- 时效性标注:长期影响

Originally Posted by Ryan Watkins, Co-founder of Syncracy Capital

Original translation: Chopper, Foresight News

Digital Asset Treasuries (DATs) currently hold $105 billion in assets and control a significant portion of the token supply on major blockchains. While the rapid expansion of DATs has been astonishing, few have paused to consider the deeper implications of this latest Wall Street "gold rush."

So far, the market discussion on DAT is still limited to a short-term speculative perspective: how much financing amount will be raised, how long the premium can be maintained, and which asset will be the next to attract market attention.

This is not without reason, as most DATs lack tangible value beyond financial engineering and are likely to fade into obscurity once the market hype subsides. However, the excessive focus on short-term speculative factors has also caused the market to overlook the long-term economic potential of those DATs that ultimately stand out.

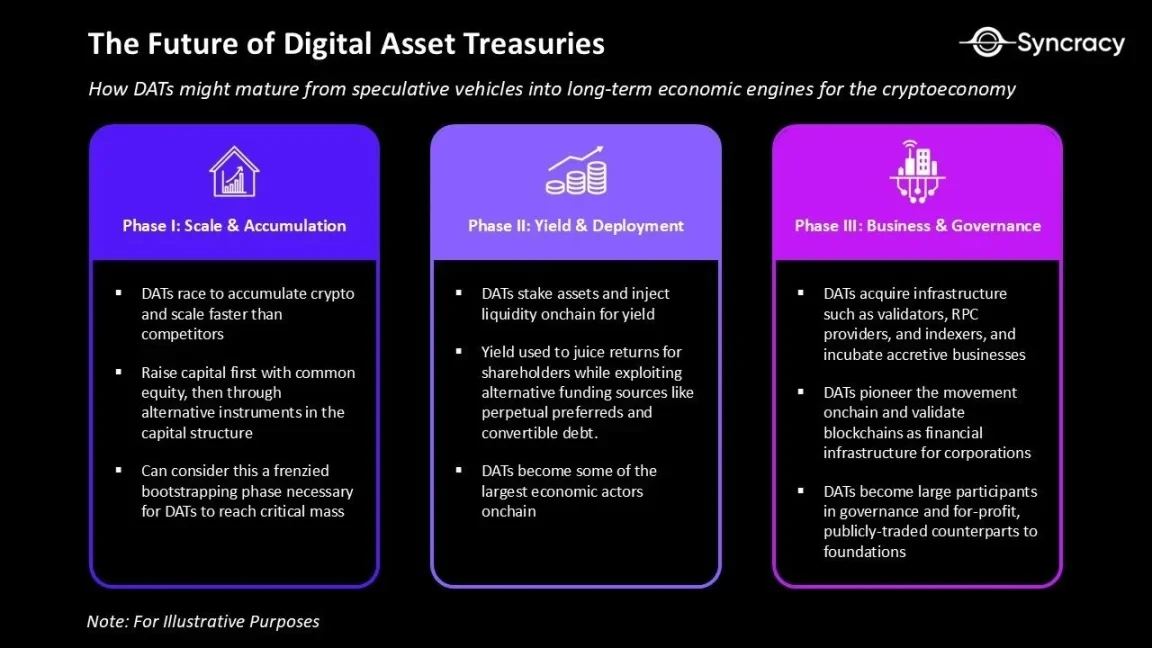

We believe the current period will ultimately be seen as the DAT "frenzy launch phase"—the necessary beginnings for DATs to achieve critical mass and surpass their peers. Over the coming quarters, leading DATs will optimize their capital structures, adopt more sophisticated asset management strategies, and expand into services beyond fund management.

In short, we believe some DATs have the potential to become the for-profit, publicly traded counterparts to cryptocurrency foundations . However, unlike foundations, they will have a broader mission: injecting capital into their ecosystems and leveraging their asset base to conduct business and participate in governance. A few DATs already hold assets exceeding those of the protocol foundations they support, and their ambitions for further expansion are accelerating.

However, to understand the future of DATs, we must first look back to the core attributes of cryptocurrency itself. Only then can we clearly see how DATs can grow from speculative tools to the long-term economic engine of the cryptoeconomy.

Programmable Money

Bitcoin's code embodies a series of principles, such as deterministic issuance and peer-to-peer transfers, that make it digital gold. Bitcoin's Proof-of-Work (PoW) consensus mechanism and small block size ensure sovereign-level censorship resistance and easy verifiability for end users, maximizing system trustworthiness through simplicity.

But this conservatism also comes with trade-offs: Bitcoin's security is unmatched, but its design limitations lead to insufficient scalability, ultimately enabling only simple transfer functions.

In contrast, Ethereum is positioned as a world computer. Its smart contracts allow developers to create new assets and set arbitrary custody logic, while its Proof-of-Stake (PoS) consensus mechanism ensures final settlement and greater scalability. These features together lay the foundation for a fully programmable financial system.

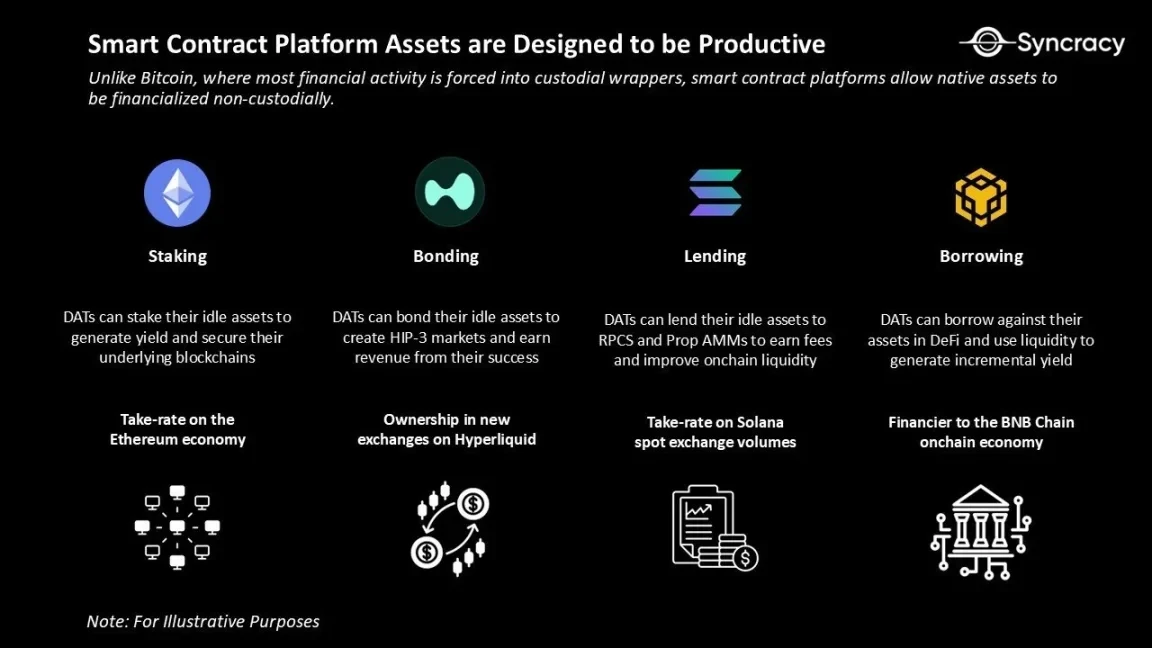

Today, the scalability of Ethereum and other smart contract platforms (such as Solana and Hyperliquid) is making money inherently programmable. Unlike Bitcoin, smart contract platforms allow native assets to be financialized in a non-custodial model. This not only reduces counterparty risk but also creates more possibilities for asset "value activation."

From a basic application perspective, this means "staking assets to secure the network and earn fees," or "borrowing and generating returns using native assets as collateral." But these are just the tip of the iceberg: programmability also enables asset re-staking and opens up entirely new forms of financial activity.

What’s unique about these on-chain applications is that they require a lot of native capital to start operations, improve product quality, and expand scale.

For example, on Solana, RPC service providers and market makers that stake more SOL tokens have an advantage in transaction confirmation stability and spread capture. On Hyperliquid, exchange front-ends that stake more HYPE tokens can offer lower fees or earn higher commissions without increasing user costs. These native capital requirements may limit the growth of smaller businesses, many of which would benefit greatly from direct access to a permanent pool of native assets.

Capital allocation game

Programmable money has completely changed the balance sheet management logic of DATs. For example, Strategy (MSTR) can only adjust its capital structure around "holding Bitcoin." However, DATs targeting assets like ETH and SOL can flexibly operate on both sides of the balance sheet.

These DATs combine core features of several traditional business models: they draw on the long-term capital structure of closed-end funds and real estate investment trusts, the balance sheet orientation of banks, and the long-term compounding philosophy of Berkshire Hathaway.

Their uniqueness lies in the fact that returns are calculated on a per-share basis, making them pure investment vehicles for underlying projects rather than fee-based asset managers. This structure offers capital allocation advantages that cannot be replicated by traditional funds or foundations.

- Long-Term Capital: Similar to closed-end funds or real estate investment trusts, the capital raised by DATs is long-term and cannot be redeemed at any time. This insulates them from liquidity pressures and prevents them from being forced to sell assets during market declines. Instead, they can opportunistically increase their holdings during market fluctuations, focusing on "compounding growth per share of cryptocurrency."

- Flexible Financing Tools: DATs can expand their balance sheets by issuing common stock, convertible bonds, or preferred stock. These financing channels are inaccessible to traditional funds and provide structural advantages for improving investor returns. For example, access to low-cost capital allows for arbitrage trading between traditional finance (TradFi) and decentralized finance (DeFi). The returns from assets like ETH and SOL also allow DATs to better manage financing costs than static asset pools like Strategy.

- High-yield balance sheets: As DATs begin staking tokens, injecting liquidity into DeFi, and acquiring core ecosystem assets (such as validators, RPC providers, and indexers), their asset pools gradually become "high-yield engines." This not only creates a sustainable revenue stream but also allows DATs to gain economic and governance influence within the ecosystem. For example, a leading DAT could leverage its asset pool to push for the passage of a controversial governance proposal.

- Ecosystem Compounding: The Foundation's mission is to maintain the ecosystem, but this is constrained by its non-profit nature. DATs, as for-profit counterparts, can reinvest profits into asset acquisition, product development, and ecosystem expansion. In the long run, the best-managed DATs could become the Berkshire Hathaways of the blockchain world, not only achieving capital compounding but also leading the direction of ecosystem development.

- Experimentation and Innovation: DATs are among the most motivated public companies to pursue on-chain transformation. Initially, this might involve tokenizing equity and executing on-chain market acquisitions. Longer-term, they could even migrate entire processes, including payroll and supplier payments, to the blockchain. If executed effectively, DATs could provide a roadmap for other public companies to transition to on-chain, validating the value of blockchain as enterprise financial infrastructure.

Understanding DATs from this perspective clarifies the key to their success: teams can't win simply by announcing acquisitions and repeatedly shouting about their investments on television. As competition intensifies, winners must rely on professional capital allocators and efficient operations to increase shareholder value.

The first generation of DATs is centered on financial engineering and uses Strategy as a model; the next generation of DATs will become active capital allocators, generating returns through on-chain asset libraries.

However, in the long run, surviving DATs will not simply be long token holders. In many ways, they will gradually become more like operating companies, leveraging the scale of their asset base to conduct business; otherwise, their net asset value premium will eventually collapse.

Hidden dangers

As the DAT frenzy ramps up, greed is building and speculators are jumping in. We expect this to lead to increased risk-taking and ultimately industry consolidation.

Currently, DAT activity is concentrated in the three major assets of BTC, ETH, and SOL. However, the model of "raising funds to increase holdings of their own tokens, then selling them to public equity investors at a premium" is extremely tempting for speculators. Once the path of mainstream assets is proven, capital will inevitably flow into higher-risk assets. This logic mirrors the 2017 ICO craze and the 2021 "Web 3.0" venture capital frenzy. Now, it's Wall Street's turn to take the reins.

As of this writing, DAT is primarily capitalized through common stock, which offers low leverage and minimal risk of forced sell-offs. Furthermore, the practice of liquidating underlying assets at a discount to support buybacks faces strong constraints: structurally, existing tools don't require this; and from a social perspective, selling core assets violates DAT's "social contract" of "long-term long position and alignment with token holders."

But this may simply be a matter of expectations. In a real crisis, shareholders might conclude, "Anything to increase net asset value per share is fine." As premiums turn into discounts, balance sheet experimentation increases, and new financing tools emerge, "prudent compounding" could be replaced by "aggressive financial engineering."

In fact, we believe this trend is inevitable: most DAT operators either lack experience or their vision for their companies remains limited to the current frenzy. Ultimately, we expect to see a surge in DAT mergers and acquisitions. Overtrading will also become more frequent, and struggling DATs may even divest unloved assets to pursue hot spots.

Bubble or boom?

The deeper I delve into DATs, the more I wonder: Is this discussion of long-term fundamentals merely a post-hoc justification for their existence? Can these instruments truly become the "Berkshire Hathaway of blockchain," or are they simply speculative packaging fueled by the "some lunatic leverages a buyout of a declining software company and buys Bitcoin" craze?

At least compared to previous crypto fundraising booms like ICOs, DATs are an improvement: they are subject to regulation, aligned with investor interests, and significantly reduce the risk of fraud. Furthermore, DATs bring positive changes to market structure, reducing supply without affecting prices. The meme coin craze and altcoin downturn of the past few years have eroded retail investor confidence, leading to widespread short-termism and pessimism in the market. Therefore, the emergence of any form of "long-term, committed buyers" is a positive sign.

But perhaps the question of whether this is a post hoc justification isn't important. The world is path-dependent, and whether we agree or not, publicly traded companies now hold vast amounts of cryptocurrency on their balance sheets. The real question is: What happens next?

Wall Street is gradually catching up to the crypto industry's achievements over the past few years, and the blockchain sector is experiencing a period of regulatory clarity and the emergence of killer applications. If even a small portion of this value can be integrated into the operating models of public companies and financial institutions, DATs will be a major victory for the crypto asset class. Even if they can only attract a new group of buyers to crypto assets, it will be extremely meaningful.

There's no shortage of concerns about DAT on Twitter and in mainstream media. Short-term markets are inherently noisy, but zooming out might reveal reasons for optimism. History shows that in the long run, markets tend to favor optimists.

Not all DATs can reach their ideal destination, but the few that succeed will surely leave a profound impact on the crypto economy.