BNB hits new highs, still undervalued: It is at the starting point of its second growth curve

- 核心观点:BNB价值被低估,潜力巨大。

- 关键要素:

- 监管不确定性逐步消除。

- RWA与机构采用带来新增长。

- 生态活跃,资金持续注入。

- 市场影响:推动BNB及生态代币持续上涨。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

BNB is on the verge of breaking the $1,000 mark. Early this morning, Federal Reserve Chairman Powell announced a 25 basis point interest rate cut, as expected. Upon the announcement, BNB surged, reaching a new all-time high of $995 before easing slightly to $988. What exactly is behind this sharp rise?

The answer may be the gradual elimination of regulatory uncertainty . Media reports indicate that federal prosecutors are discussing with Binance the removal of its external compliance monitor. It's worth noting that the Department of Justice has previously lifted similar measures against several companies, a sign that regulatory attitudes are quietly shifting.

At the same time, Binance founder Changpeng Zhao updated his Twitter account, prompting market speculation about a potential return, despite CZ publicly stating at multiple events that he would not return even if he could.

The market may have noticed the new highs in price, but it's overlooking a deeper issue: even as BNB continues to break records, it may still be undervalued. The reason is that the strength and potential of BNB Chain go far beyond short-term price fluctuations. Instead, it is ushering in a wave of restructuring of financial narratives and real-world assets (RWAs) .

Capital Narrative: The Transformation from Platform Coins and Public Chain Coins to Capital Hubs

As US-listed companies increasingly incorporate cryptocurrencies into their balance sheets, global capital markets are rapidly gaining acceptance of digital assets. Within this trend, large institutional funds tend to flow into assets with high certainty and robust ecosystems. BNB Chain, one of the most robust ecosystems in the cryptocurrency market, naturally deserves attention.

More importantly, unlike other assets that passively await capital selection, BNB Chain's funding narrative is being proactively written by YZi Labs (formerly Binance Labs) . As the incubation and investment engine for the BNB Chain ecosystem, YZi Labs not only drives innovation with financial support but also leads the ecosystem towards deeper capital integration through concrete actions, directly facilitating the implementation of the BNB Treasury Company plan .

In July, CEA Industries partnered with 10x Capital to launch the first BNB Treasury Company, The BNB Treasury Company, successfully raising $500 million and attracting over 140 subscribers, including renowned institutions such as Pantera Capital and GSR. Subsequently, on August 25th, B Strategy, with the strategic support of YZi Labs, announced the completion of a $1 billion fundraising round. On August 22nd, Huaxing Capital and YZi Labs signed a memorandum of understanding (MOU) to establish a strategic cooperation framework. This capital injection is not only a statement of confidence in the long-term ecosystem but also represents BNB Chain's entry into the global capital market.

But this is just the beginning. In a recent interview, Changpeng Zhao revealed that he has been in contact with approximately 50 potential DAT companies . This means that the strategic value of BNB Chain must be re-evaluated: it is no longer just a public chain in the strictest sense, but is transforming into a core infrastructure for global capital allocation, carrying the dual mission of capital and technology.

BNB Chain's second growth curve is accelerating, with capital treasury at its core.

RWA: Leveraging the Second Growth Curve

If the funding narrative is the first step, then the real catalyst is real world assets (RWA) .

RWA is becoming a new consensus in the crypto industry. Its value lies in leveraging on-chain real-time liquidity, transparent settlement, and borderless nature to manage the massive volume of traditional assets. This not only expands the boundaries of asset size but also represents a restructuring of the financial order. BNB Chain holds a unique advantage in this restructuring.

The accumulation of time: five years of stable operation of the public chain

Since its launch in 2019, BNB Chain has been operating stably for over five years. During this time, it has weathered both the peak trading volume of bull markets and the quiet and regulatory pressures of bear markets. Regardless of market volatility, it has consistently maintained high availability and stability, earning the trust and confidence of users. For traditional institutions, the primary criterion for selecting infrastructure is not short-term traffic, but long-term stability. BNB Chain has proven this over time.

Large user and address base

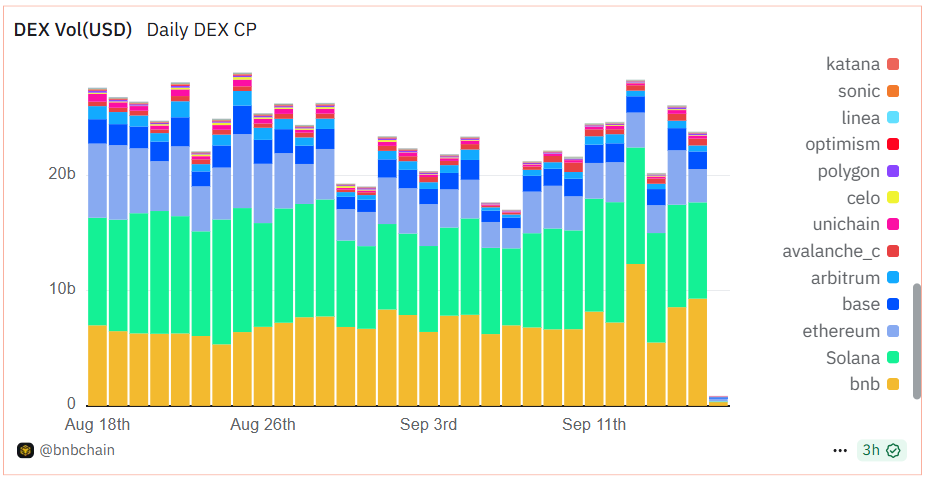

BNB Chain's activity also constitutes its core competitiveness. According to Dune.com data, in the past month, BNB Chain's daily active users (DAU) exceeded 2 million, DEX daily trading volume remained stable at $6 billion to $9 billion, and the total number of unique addresses on the chain exceeded 625 million. These are not just impressive numbers; they also provide the project's most direct market foundation. For RWA projects, user scale means liquidity, which means tokenized assets can quickly find buyers and sellers, rather than becoming isolated "financial islands."

Global Liquidity and DeFi Depth

BNB Chain is also a liquidity hub in the crypto market. According to data from defillama.com , its total value locked (TVL) has reached $14.6 billion, and its stablecoin market capitalization has exceeded $10 billion. Only with sufficient liquidity can the efficiency advantages of on-chain assets be truly realized. Compared to the "9 to 5" work schedule of traditional finance, on-chain liquidity is available 24/7, making it particularly critical for RWAs. This means that BNB Chain can provide instant funding for new assets at any time.

Cost and efficiency advantages brought by technological optimization

Currently, BNB Chain has further reduced block times from 3 seconds to 0.75 seconds, and transaction fees have also been reduced. Its transaction per second (TPS) has been repeatedly verified in long-term high-frequency trading and is sufficient to support the daily settlement of large-scale RWAs. This is crucial for financial assets. Whether it is the distribution of US Treasury bonds or the over-the-counter circulation of equity tokens, low latency, low cost, and high reliability are required. BNB Chain's technological iterations precisely align with these requirements.

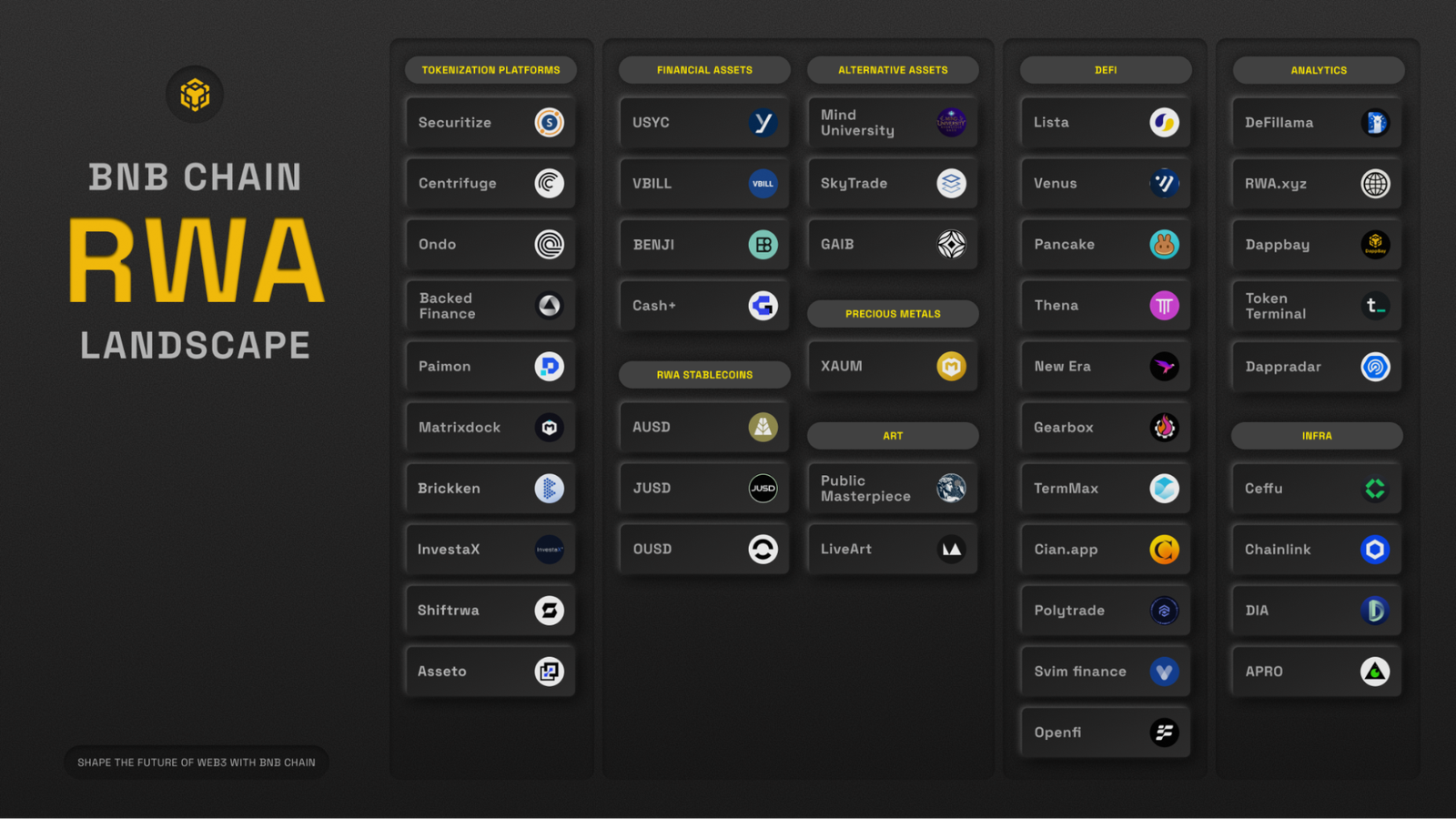

Complete ecological support and incubation mechanism

Beyond technology and users, BNB Chain has quietly built a complete supporting system. Just like preparing a full set of engines, tires, and fuel for a car about to hit the track, it not only provides the runway but also the accelerator.

The MVB Incubation Program provides funding, resources, and community support to early-stage projects. The RWA Exclusive Incentive Program uses dedicated funding and support mechanisms to truly integrate projects into the RWA ecosystem. The one-click deployment tool lowers the barrier to entry, enabling traditional asset owners to quickly launch tokenized products through the most comprehensive large-scale tokenization stack without having to deeply understand the complexities of blockchain. Furthermore, BNB Chain has established a collaborative network with securities firms, investment banks, funds, and other institutions, ensuring that assets on the blockchain not only have technical implementation but also provide direct market access.

Together, these elements form a closed loop: BNB Chain can not only host RWA projects but also help them truly land and scale. In particular, multiple use cases have already been implemented on BNB Chain, providing direct evidence of this model.

For example, Circle’s tokenized money market fund, USYC, is issued on BNB Chain. According to rwa.xyz , USYC’s on-chain assets have reached $579 million, primarily invested in U.S. government securities through reverse repurchase agreements.

Securitize partnered with VanEck to bring a government bond fund to BNB Chain, launching VBILL. This type of product requires regulatory-grade infrastructure, but through on-chain issuance, VanEck gained compliance, programmability, and instant access to secondary market liquidity within the BNB ecosystem. The issuance has already reached $76 million. Similarly, Asseto and China Merchants Securities Asset Management brought their Asia Asset Management USD Money Market Fund to BNB.

Regarding commodities, Matrixdock's gold token has also been launched. Gold, traditionally a safe-haven asset, has now been tokenized on-chain, maintaining its stable value while also offering the efficiency of real-time transfers and circulation. Even more ambitiously, energy assets like crude oil and natural gas could be integrated into the BNB Chain in the future, making it a primary platform for commodity tokenization.

Meanwhile, Ondo and xStock are planning to introduce government bonds, stocks, and structured products onto the BNB chain, further strengthening its position in institutional asset allocation. Collaboration with Japanese companies opens another window for the tokenization of IP and artwork.

Taken together, these examples paint a clear picture of BNB Chain: it is becoming a centralized platform for diverse RWA assets . From bonds to gold, from equities to art, BNB Chain has already run through a complete range of experimental scenarios. This not only opens up new application scenarios for BNB but also establishes a longer-term growth strategy for the market.

Conclusion

Today's market may only see new highs in price, loosening regulations, and the return of Changpeng Zhao. However, the deeper underestimation lies in the market's inability to fully understand that the dividends brought by RWA and institutional adoption have not yet been factored into BNB's long-term valuation model.

Ethereum plays a central role in the RWA narrative, but this doesn't mean BNB has fewer opportunities. On the contrary, leveraging its capital treasury, user base, deep liquidity, and ecosystem incubation system, BNB is already quietly building a secondary growth curve. Furthermore, within the crypto community, the BNB Chain ecosystem token has recently seen a general surge, with Alpha IPOs generating 20x returns. Following yesterday's TGE, Aster, the leading public chain derivatives company, saw its stock price rise over 400% on the same day. These ecological flywheels will also feed back into BNB.

The story of BNB doesn’t stop at $1,000. Its true starting point has just arrived.