Aave's State of the Union Address: What's the future strategy of the lending king?

- 核心观点:Aave需优化战略巩固市场主导地位。

- 关键要素:

- 终止低效L2部署,聚焦核心网络。

- 改革友好分叉模式,避免价值稀释。

- 推动GHO稳定币增长,提升利润率。

- 市场影响:强化Aave竞争优势,挤压对手空间。

- 时效性标注:中期影响。

Originally Posted by Marc Zeller, Founder of the Aave Chan Initiative

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Editor's Note: Aave has long become the only giant in the DeFi lending market.

On September 15, Marc Zeller, founder of Aave Chan Initiative (ACI), the Aave ecosystem contribution team, delivered a speech titled "Aave State of the Union Address," summarizing the lessons learned from Aave's past development, analyzing Aave's current market position in the lending and even DeFi industries, and proposing strategic plans for Aave's future development from multiple dimensions.

ACI has always been committed to promoting the development of Aave through technological innovation and community governance optimization, and Marc Zeller himself has always been regarded as the most active opinion leader of Aave DAO. In the development cycle of Aave in the past few years, which has left all competitors behind, both ACI and Marc Zeller have played a vital role, and their attitudes are of extremely critical directional significance for the future development of Aave.

The following is the original text by Marc Zeller, translated by Odaily Planet Daily.

Rebirth from the ruins

The Aave Chan Initiative (ACI) launched three years ago in November 2022, as the entire DeFi industry was facing disintegration. Fraudulent activities by CeDeFi entities led to the collapse of FTX, Celsius, and Three Arrows Capital (3AC), followed by the collapse of the Anchor protocol, which triggered $6 billion in liquidations—equivalent to a quarter of Aave's all-time high TVL. Amid this chaos, stETH even experienced a decoupling. Regulators seized the opportunity to encircle the industry, attempting to stifle it completely.

Aave's internal situation was equally dire. Its DAO was controlled by extractive entities, while teams like Gauntlet and Llama plundered the treasury. Its TVL plummeted to $5 billion, and its balance sheet showed an annualized loss of $35 million. The founding team also suffered from talent loss and divisions within its core team, while intense pressure from hostile regulators also constrained its operational capabilities.

External challenges are equally formidable. Aave's open-source nature has been exploited by exploitative teams. Opportunists have forked the Aave codebase and issued separate tokens to raise funds, and some ecosystems even condone such behavior. These forked projects often receive more generous incentives and airdrops than Aave, creating a false sense of prosperity. When these forked projects are hacked due to incompetence or recklessness, the entire Aave ecosystem bears the brunt of their reputational losses.

To differentiate itself in an increasingly competitive landscape, Aave V3 launched on Layer 2, but with limited success. The protocol's codebase was in dire need of improvement—it contained many promising ideas but lacked a coherent implementation path and vision. For example, features like Portals and credit delegation vaults remained at the proof-of-concept stage.

"DeFi is dead" once became an industry consensus, and giving up the struggle and gradually depleting treasury funds seemed to be the most rational choice.

But we refused to surrender.

We left the comfort of our founding team positions and plunged into the DAO arena, launching the "Make Aave Great Again" initiative. It was an act of faith with no guarantees—no investment, no resources, and a slim chance of success. But it was necessary, so we didn't look back.

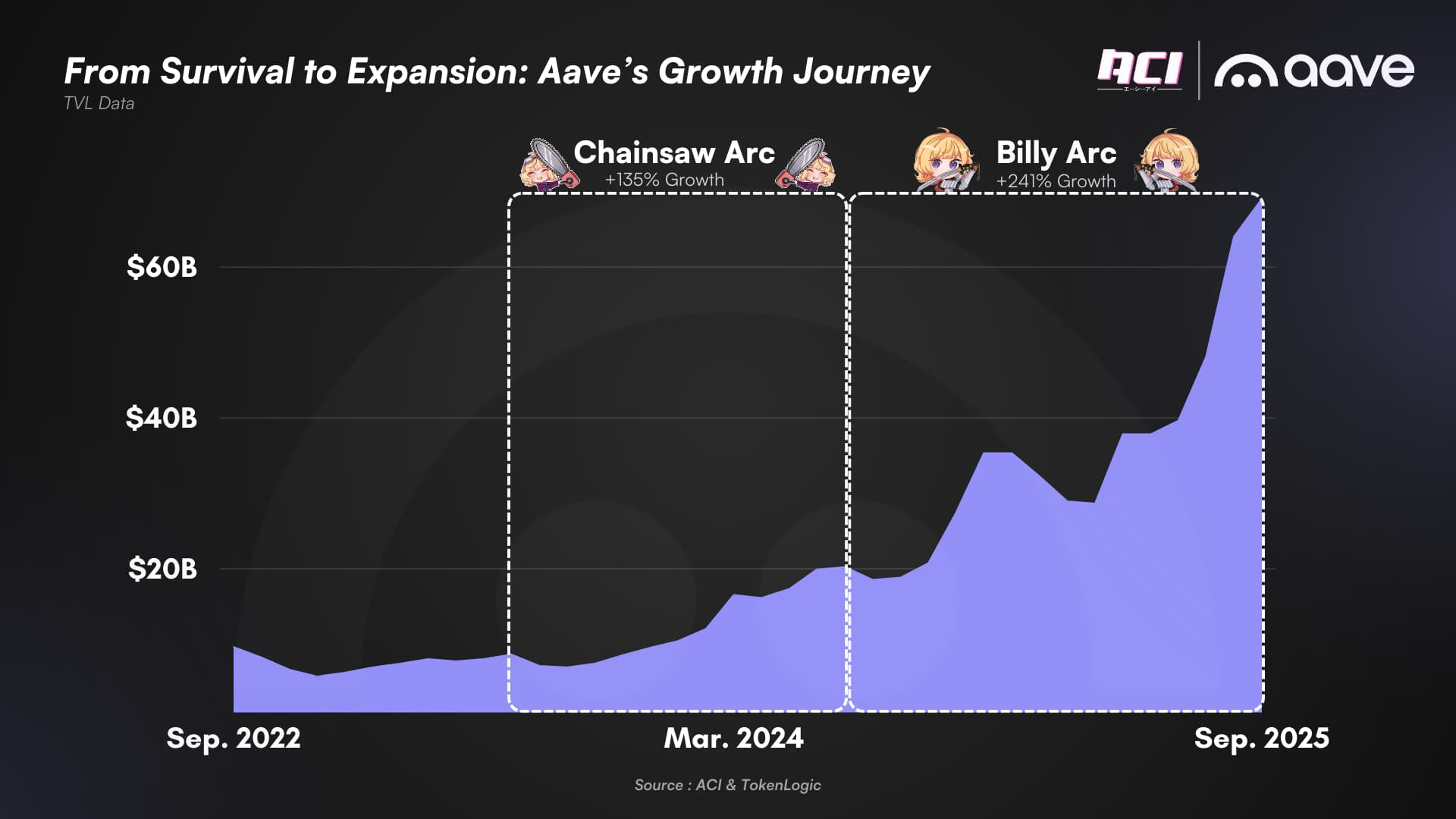

Chainsaw Arc

Eighteen months after the launch of ACI, extractive entities have been eliminated, resource-wasting verticals have been reduced, and DAOs have established a clear and efficient professional framework, with a group of high-level service providers operating collaboratively within clear boundaries.

For the first time, the community truly had a voice, directly influencing Aave's future. Initiatives like Skywards, Dolce Vita, and Orbit, launched by ACI, laid the foundation for efficient DAO processes. With key technical support from former founding team members (now at BGD Labs), the codebase continued to improve, the protocol achieved positive returns, and recaptured market share in the most competitive environment ever.

The DAO faced well-funded competitors at the time, with multiple protocols raising tens of millions of dollars in an attempt to "swallow Aave," but they were unable to shake our market dominance . This was all thanks to the focus and hard work of DAO service providers, who spared no effort to ensure our success.

The period we call the "Chainsaw Arc" was filled with challenges. ACI faced limited funding, few supporters, internal and external hostility, and a barrage of criticism and smear campaigns. Despite the immense challenges, in hindsight, David triumphed over Goliath thanks to the hundreds of individual voting delegates who decided to join the initiative and turn the tide. Their contributions made everything possible, and while Aave's primary audience may never know their names, we are deeply grateful for each and every one of their support.

All achievements are hard-earned, not gifted. We are incredibly proud of Aave’s remarkable achievements, our impressive portfolio of DAO service providers, and the delegation ecosystem that has made Aave what it is today.

Comfortable status quo

Aave DAO is in a relatively comfortable position today.

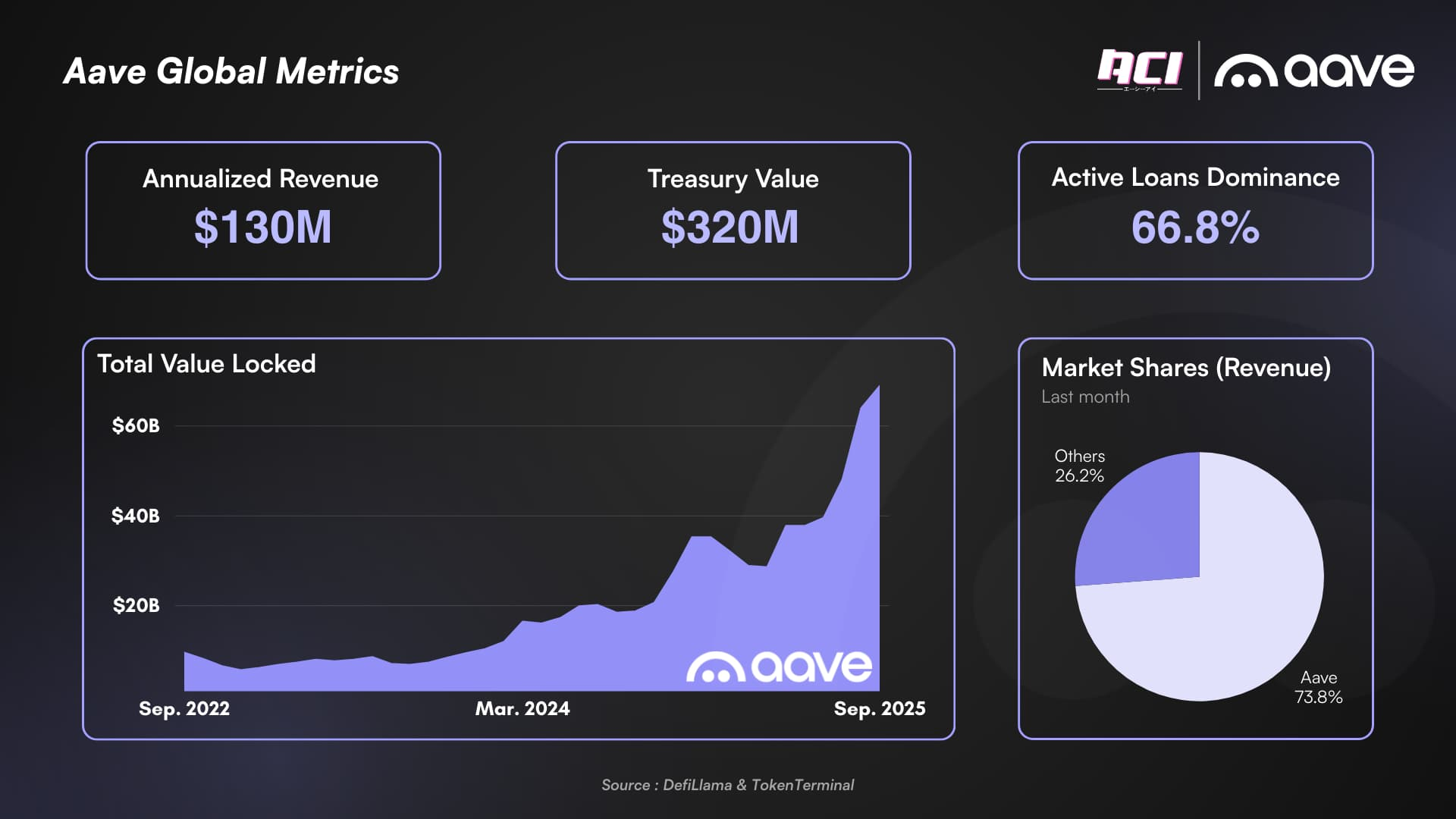

TVL (total value locked), revenue, market share, lending volume—every metric attests to the DAO's success. Aave has not only improved upon it, but surpassed it. We believe Aave's dominance is no longer threatened by its competitors. Aave now firmly dominates the core profitable use cases for on-chain lending: leveraged (re)staking, stablecoin lending with BTC and ETH as collateral, and yield-generating collateral arbitrage trading.

Our competitors often fall into three traps: TVL leasing—using exorbitant native token incentives to temporarily attract liquidity and create the illusion of a booming TVL; the long-tail asset collateral trap—relying on high-risk, low-liquidity fringe assets to offset TVL; and loss-making distribution agreements—signing partnerships that increase TVL but yield virtually no returns while simultaneously consuming the value of the native token at the expense of user returns. These tactics, while inflating TVL, generate little actual revenue and require high native token incentives to dilute user returns.

Aave's current annual net revenue exceeds the combined cash reserves of all our competitors. They desperately need new funding rounds to stay afloat, struggling to deplete their reserves; we, on the other hand, have ample resources to fund further growth. If the market reverses, the value of their token incentives will be severely impacted, while our cash remains cash—cash is king.

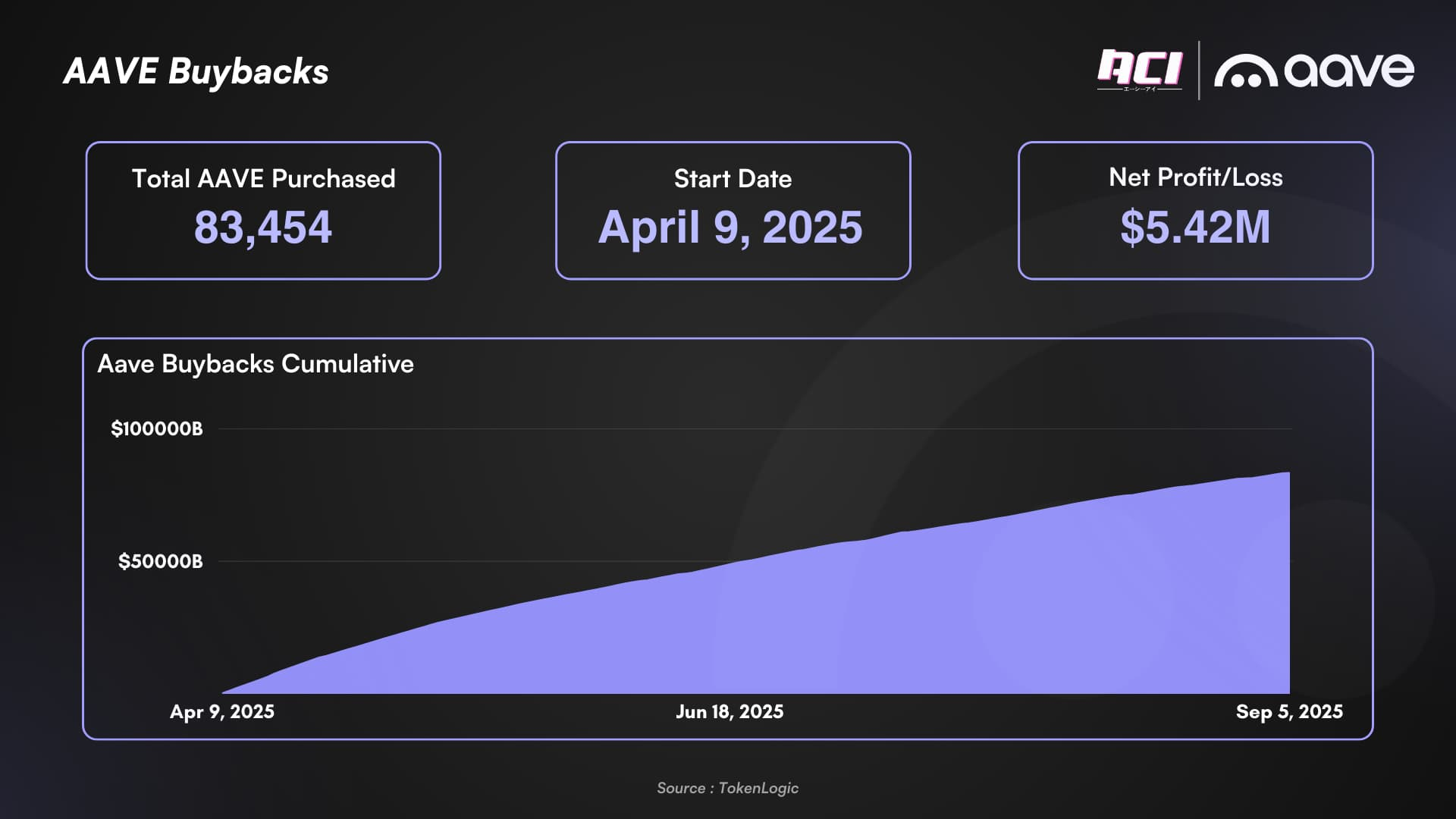

Furthermore, one of ACI’s core promises at launch—improving the Aave token economics and empowering its native asset—is already beginning to materialize. Aave’s buyback program has already absorbed over 0.5% of the total token supply , and Aave’s current revenues have enabled the DAO to institutionalize this program, reinforcing market confidence in the enduring value of our ecosystem.

But being content with the status quo has never been in Aave’s genes.

Optimize, focus, and accelerate

Now is the time to shift our focus from external threats to internal restructuring to propel Aave further growth and strengthen its market dominance. The first step is to conduct a self-examination to assess the strengths and weaknesses of our existing strategy so we can focus our resources moving forward.

Analysis of the Current Layer 2 Landscape

The Layer 2 strategy we developed in the early days of Aave V2 was a key factor in Aave's success. We deployed to the Polygon and Avalanche ecosystems as early as 2021, gaining strong support and achieving growth in uncharted territory, ultimately creating a mutually beneficial partnership. However, the situation in 2025 is different.

While past cycles have focused on ecosystem development, the recent influence of VCs, opportunistic investors, controlled DAOs, and foundations has eroded the winning formula, leading to L2 fatigue—a phenomenon whereby efforts are dispersed through a “cast a wide net” strategy, prioritizing the pursuit of short-term gains for farming users over the long-term value of building a sustainable on-chain economy, ultimately diluting the likelihood of success.

In past market cycles, ecosystems tended to focus on developing their own niches. However, in recent years, the influence of venture capital, opportunistic investors, and captive DAOs and foundations has gradually eroded this successful model, leading to the following phenomena: Layer 2 ecosystem fatigue—projects adopt a "cast a wide net" strategy, distributing resources across multiple networks; value dilution—prioritizing farmers' pursuit of short-term returns over long-term value creation through building a sustainable on-chain economy; and distorted mechanisms—spray-and-pray (speculation) approaches prevail, ultimately trapping all participants in an inefficient cycle.

The Layer 2 lifecycle, from token generation (TGE) to TVL decline, is rapidly shrinking. Aave was mistakenly lured in by seemingly attractive but fleeting incentives—incentives that paled in value when the native token depreciated by an order of magnitude in a short period of time.

Currently, over half of Aave's deployments on Layer 2 and other alternative Layer 1 platforms lack economic viability. Year-to-date data shows that 86.6% of Aave's revenue comes from the mainnet, making deployments on other chains a side project.

With this in mind, ACI has updated its principles for new network deployments and welcomes the fact that competitors are expending resources on what we believe to be future dead links. Our service providers have limited bandwidth, and every additional workload inevitably leads to higher compensation costs.

DAOs should focus on investing in networks with key differentiating advantages: for example, CeDeFi collaborations that support large-scale distribution protocols (such as Kraken/Ink and other projects in the pipeline), or networks with core native elements (such as the Plasma/USDT case).

Therefore, we will soon submit a proposal to terminate Aave operations on underperforming networks.

The failure of friendly forks

The so-called “friendly fork” framework, which was supposed to be Aave’s response to competitors commoditizing lending and converting itself into neutral infrastructure, has proven to be of little benefit in hindsight.

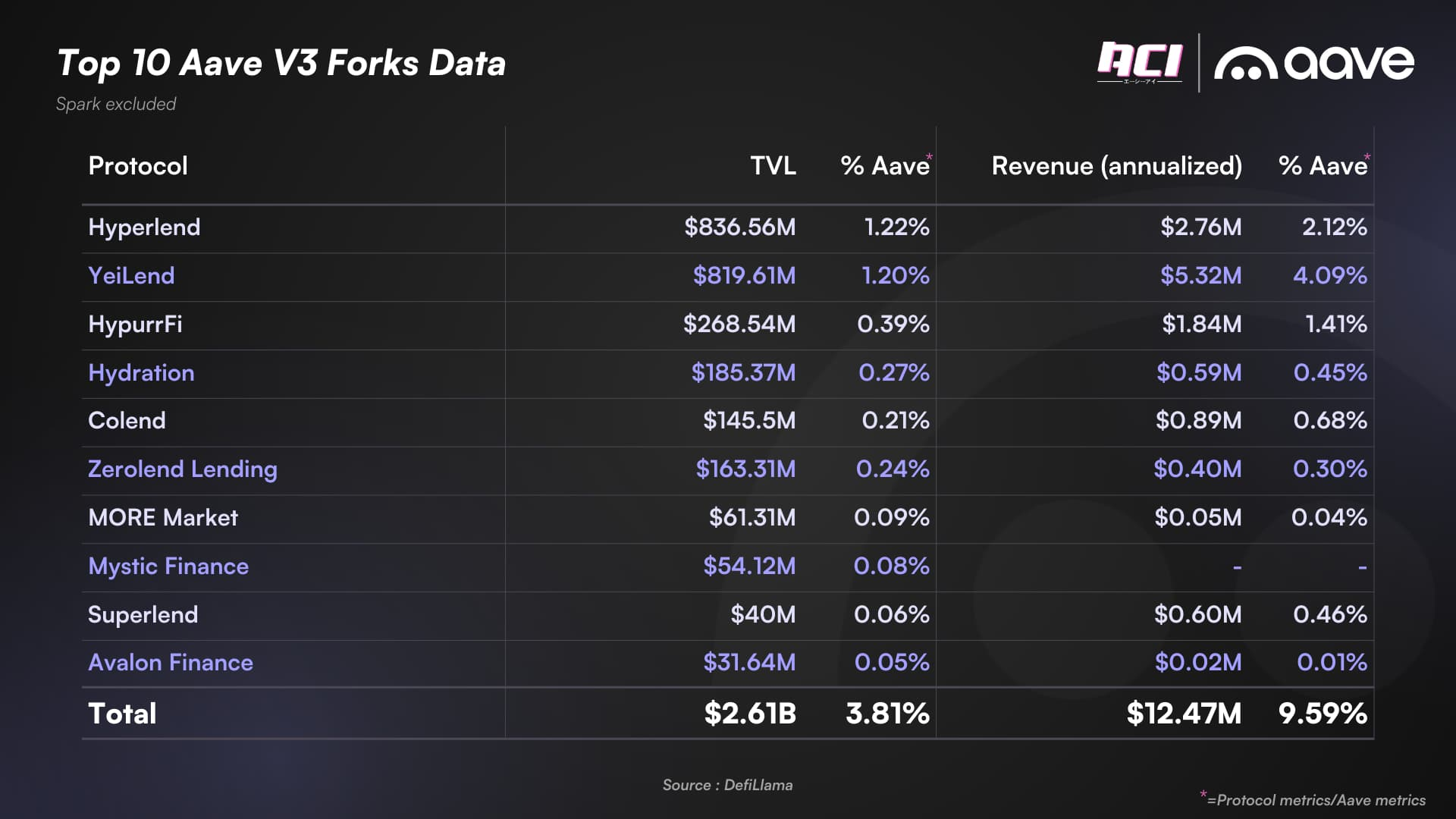

Most of Aave’s “friendly forks” have performed mediocrely in terms of TVL and revenue, and have sometimes even been exploited by non-cooperative participants — who have profited from extremely liberal interpretations of the terms at Aave’s expense.

The most notable example is Spark, which proved to be a significant detriment to Aave. Despite employing “creative accounting” practices that resulted in far less revenue flowing into the Aave DAO than anticipated, the platform remained a key ally and liquidity provider to our competitors.

Spark is currently helping our competitor secure its Coinbase distribution agreement by providing approximately $600 million in USDC liquidity. Furthermore, last year, they also provided tens of millions of dollars in liquidity as a counterparty to Ethena, saving the same competitor from being eliminated by our Merrit initiative. To mitigate the damage caused by Spark, DAOs still incur millions of dollars in annual incentive costs.

Other so-called "friendly forks" have either contributed negligible revenue (less than 1% of our total revenue) or increased friction for Aave to deploy on promising networks. We must reflect on past mistakes, learn from our failure modes, and adjust our strategy to achieve evolutionary improvement.

According to DefiLlama data, the top 10 Aave V3 forks represent only 3.81% of Aave's total TVL, generating 9.59% of Aave's total revenue. Crucially, this revenue accrues entirely to the forkers, with no share going to the Aave DAO.

For this reason, ACI officially opposes any "friendly forks" operated by third parties, unless the service provider chooses to fork under two specific scenarios : 1) adapting to a non-DAO mainstream ecosystem (non-EVM or custom-developed EVM-equivalent chains); 2) exploring asset types outside the current risk boundary (such as Horizon's RWA market). Such "side quests" must offer a higher revenue share and must not issue new protocol tokens to avoid diluting Aave's value.

Aave DAO should accept a reality - the Aave codebase will adhere to the quality and simplicity route, which is part of the brand value itself, and some low-potential markets may be left to competitors to distract their attention.

Therefore, ACI will promote a comprehensive reform of the "friendly fork" framework in the near future.

The failure of the “Instances” pattern

“Instances” were a clever innovation in the early codebase of Aave V3. They circumvented eMode restrictions while also enabling risk isolation. By providing dedicated instances of a curated portfolio of assets, they also became an effective narrative selling point against competitors.

However, this innovation came at a significant cost – liquidity fragmentation leading to reduced overall efficiency. Despite the success of Prime instances, Liquid eModes now offer all the benefits of isolated instances without the drawbacks.

We must acknowledge that in the new Aave V 3 codebase, the “Instance” model is outdated and no future development or growth resources should be invested in it.

Prime Instances will continue to exist and thrive, but their model should not be replicated.

Service provider interest collaboration

The "tug of war" is the necessary pain for Aave DAO to regain financial health after experiencing resource extraction and dominance by non-allied forces.

This led to a cultural trait that ACI strongly promoted: an overly conservative approach to resource management and compensation.

We acknowledge that we pushed most service providers to their limits with limited resources and kept them working at a high intensity for three consecutive years. While this was necessary, ACI always stood by them through thick and thin, leading by example.

Now that the landscape has stabilized as described in this article, we believe now is the time to reward the undisputed top service providers in these verticals and ensure long-term synergy.

The industry model has changed. The current standard compensation structure includes a combination of native tokens and cash payments, in addition to profit sharing. Meanwhile, industry growth is heavily dependent on partnerships and institutional agreements—initiatives whose success and impact are easily tracked.

Our current internal mechanism still uses fixed, pure cash compensation (decoupled from KPIs), which is strictly monitored by a highly dedicated group of representatives and sets extremely high standards for service providers. If performance does not meet expectations, they will not hesitate to terminate the contract.

We believe that there is a need to introduce a performance-based compensation mechanism for some service providers that is linked to quantifiable success indicators.

More importantly, the service providers who shape what Aave is today and are crucial to the future success of The DAO must have a stake in the success of the AAVE token.

Therefore, we recommend that service providers who have made AAVE a core business explore token vesting schemes tied to their KPIs.

The ideal implementation approach is to allow service providers related to business growth (TokenLogic, ACI, Aave Labs) to directly lead transactions and partner docking within the authorization framework and directly share in the quantifiable benefits generated by these initiatives.

Of course, sustainable growth requires thorough risk and technical analysis. Therefore, we also support allowing risk analysis service providers (Chaos Labs, Llamarisk, and BGD Labs) to participate in a revenue sharing mechanism that prioritizes growth.

Introducing this new model on the basis of existing fixed compensation will increase the enthusiasm of service providers, enable them to explore new growth areas, and retain top talent for the ecosystem.

ACI is about to propose a new framework for reforming service provider compensation.

Transformation from low-profit business to high-profit business

Aave is the undisputed leader in on-chain lending. As mentioned above, we have almost complete dominance over this cash cow of a niche market.

Despite its success, on-chain lending remains a very low-profit business: 80%-95% of the revenue generated by the Aave protocol through lending volume is returned to liquidity providers (LPs). Even with a 70% market share and lending volume reaching three times its historical peak, the DAO's annual net income is still only US$130 million.

It is clear that a pure lending business will not allow us to achieve billions of dollars in revenue in the short term - especially in an environment where yields are compressed and the arbitrage space for borrowing costs is shrinking.

Previously, stablecoin lending rates typically ranged from 8-12%, though they could reach 16-20% during market fervor. Long-term interest rates are likely to be locked in the 6-8% range. As the market matures, interest rates will gradually converge toward traditional finance levels, as the market will no longer be willing to pay the risk premium for on-chain lending—a long-term erosion of our profits.

GHO represents a paradigm shift because the protocol itself can become the primary liquidity provider for GHO. Instead of paying returns to limited partners, the protocol can focus on incentivizing liquidity deposits, maintaining secondary market liquidity, and maintaining peg strength. Even if 50%-60% of GHO revenue were invested in this goal over the long term, the DAO's profit margin would still be four times higher than that of USDC lending.

Aave's absolute advantage lies in: we first successfully built a lending business, and then developed a stablecoin CDP business, which enabled DAO to use the income from the lending business to feed back the growth of GHO.

While the initial version of GHO struggled in terms of growth and stability, we must acknowledge the tireless efforts of service providers, led by TokenLogic, in reconstructing the product and driving growth. GHO has now achieved a significant scale breakthrough and completed its first CeFi integration. Going forward, GHO will continue to strategically bundle key CeDeFi distribution protocols to expand adoption. Its scale advantage also provides a buffer for profitable credit line strategies (following the principles of Spark's USDS strategy).

GHO is now two years old, and after spending the first year getting it up to speed, we believe that given its potential, regardless of its current profitability, we should continue investing in the product for at least another year.

ACI will continue to fully support GHO's growth and work hand in hand with Tokenlogic, which has led GHO's success.

Growth, growth, and more growth

The current market cycle is not driven by retail investors; we are experiencing unprecedented regulatory tailwinds and mass institutional adoption of the industry. This is new and uncharted territory, requiring new rules, new approaches, and new strategies to win.

Over the past 18 months, our growth has been driven significantly by key exclusive partnerships, the adoption of high-quality collateral, and strategic investments in our core network.

As mentioned above, Aave is already in its comfort zone, so ACI's current strategy is to leverage its healthy financial position to maximize investment in growth and consolidate its short-term dominance. If we act aggressively enough, existing competitors will be wiped out, and our first-mover advantage will ensure our dominance in the medium to long term.

ACI has always been extremely conservative with its cash reserves, committed to building a massive war chest for The DAO. As a result, The DAO currently holds $130 million in cash and cash equivalents, and even with the buyback program, the treasury continues to grow.

We recommend that the DAO maintain buybacks at current levels ($500,000-1,000,000 USD per week) to demonstrate confidence in the native token, while using reserves to aggressively invest in distribution and protocol growth over the next 18 months.

Furthermore, the AAVE token reserve accumulated from buybacks, combined with our substantial BTC and ETH reserves, will generate a GHO credit line with a health factor (HF) of at least 2/2.5, which can be used for investment in growing the protocol. Returns from these transactions can be used to repay the credit line over the medium term. Continued buybacks and revenue will naturally increase the collateralization ratio of positions, mitigating adverse consequences. Combined with our existing cash reserves, this will provide the DAO with over $100 million in firepower, accelerating our growth and consolidating our dominant position.

Such an ambitious plan requires rigorous safeguards and close oversight. The DAO should carefully debate this strategic vision and vote on an appropriate framework to define, limit, allocate, and track investments.

No service provider should have free reign over such a large budget. A better solution would be to establish a special committee composed of relevant service providers (similar to the current AFC), operating under the supervision of independent core representatives and service providers.

ACI is about to submit a principled framework proposal for growth investment to the DAO.

Summarize

At ACI, we’re incredibly proud of what we’ve accomplished at Aave over the past three years. The industry is at a critical crossroads, and our previous successes have given us all the cards to expand our reach and take the protocol to new heights.

If we play our cards right, focusing on the best solutions and discarding ineffective ones, this period will be the foundation for Aave's enduring dominance in DeFi. Through strategic growth investments, synergistic service providers, and focused product development, we will solidify Aave's position as the undisputed leader in DeFi for years to come.

Use Aave, that’s the right choice.