5 Common Arbitrage Strategies in Prediction Markets (A Quick Guide)

- 核心观点:预测市场存在多种套利机会。

- 关键要素:

- 跨市场价差可获无风险利润。

- 时间套利利用价格均值回归。

- 事件处理速度差异创造机会。

- 市场影响:提升市场效率与流动性。

- 时效性标注:中期影响。

Original author: Eniola

Original translation: CryptoLeo ( @LeoAndCrypto )

Last week, I wrote an article about new prediction market projects, titled "A Comprehensive Review of New Prediction Markets in 2025 (Part 1) (Part 2) ." The starting point was that "potential new projects may provide potential profits for early users." However, since many prediction market projects are in their early stages, their trading volume and liquidity haven't yet taken off, making them less attractive to users who need to make money in a short period of time.

Today, we're sharing prediction market arbitrage strategies for short-term traders . This article, written by Eniola and translated by Odaily Planet Daily, is as follows:

Wherever there are markets, there are arbitrage opportunities. Depending on the market type, arbitrage may manifest as narrower or wider spreads, but it always exists. Prediction markets are no exception. At first glance, the spreads may appear small, but with the right strategy, they can accumulate into substantial profits.

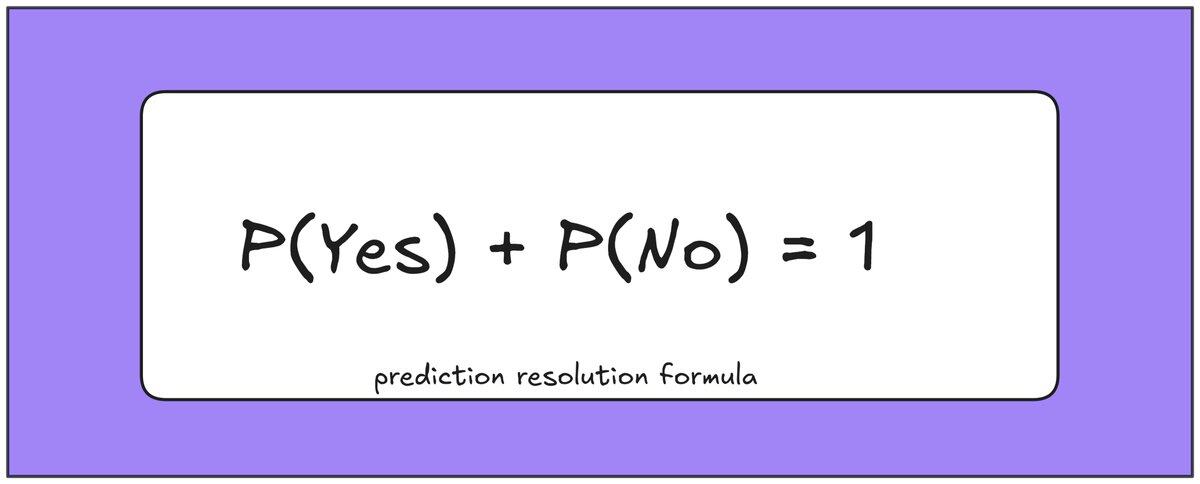

Prediction markets are platforms for trading the outcomes of future events, where prices represent probabilities. If the market price for a "yes" prediction is 0.65, it means there is a 65% chance of the event occurring; the price for a "no" prediction is 0.35.

When the event is finalized, the market price of the corresponding outcome may rise to $1 or return to zero. [0.65 + 0.35 = 1]

If you are new to prediction markets, I recommend you take a look at what prediction markets are and how they work : “ Technical Types of Prediction Markets: Mechanisms and Trade-offs ”

I also wrote about semantic traps (unclear wording in prediction questions about how to define whether a certain event occurred). The wording in these prediction events is tricky and can still affect your trading if you don’t read it carefully.

What is needed is a solid new niche market and decentralized platform, not a copy of the existing prediction market model. In addition, every new market that emerges will have inefficiencies, and inefficiency = arbitrage.

We need more high-quality markets, not more noise. One of the projects I personally like is Opinion , and I shared the reasons in another article.

My arbitrage strategy

In this article, I will break down the main arbitrage strategies in the prediction market that I am familiar with into two levels:

Easy to understand: So you can “get it intuitively” without too much math.

Technical Proof: This way you know the numbers actually match up.

1. Cross-market arbitrage

This arbitrage model works when two platforms price the same event differently. You buy "Yes" on the platform where "Yes" is priced lower, and hedge by buying "No" on the platform where "Yes" is priced higher. This way, you profit from the price difference regardless of the outcome.

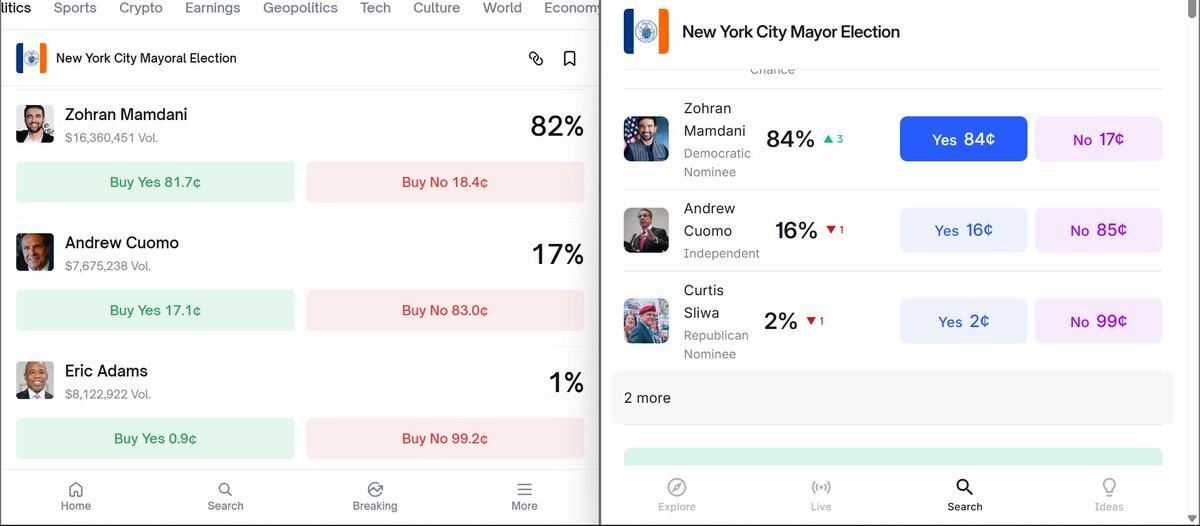

Take the New York City mayoral election market as an example:

On Polymarket, Andrew Cuomo's "Yes" is trading at 17.1 cents and "No" is trading at 83 cents.

On Kalshi, the price of "Yes" in the same market is 16 cents and "No" is 85 cents.

If you buy "Yes" on Kalshi and hedge it with "No" on Polymarket:

Yes (B) + No (A) = 0.16 + 0.83 = $0.99

This means you can spend $99 to secure $100, a 1% risk-free profit.

Note: You may think that a 1% profit is too low, but don't be fooled by appearances. In arbitrage trading, even small price differences can accumulate into substantial profits through repetition or expansion.

Sometimes, mispricing is more severe. Markets with low liquidity, attention-driven markets, or multiple-outcome markets can easily produce spreads of 5% to 10% or more, and these are the ones you need to pay attention to.

2. Time Arbitrage (Buy Early vs. Buy Late)

Some markets get hyped too early, especially political predictions, such as overpricing a candidate before a debate. Over time and with real-world events, prices are bound to fall, even if only slightly. If you buy or hedge at the right time, you can profit from this repricing.

This is very common in election markets: for example, if hype pushes Candidate A's chances of winning to 70% in June, by September they might drop to between 50% and 60%.

So if you bought the "No" at the peak of the hype, you would have made money. The secret is to understand that early prices tend to inflate reality, and if prices are overvalued prematurely, this will be very obvious.

Technical Strategy:

Suppose you buy "No" at 0.3. Later, the price of "Yes" drops to 0.5.

Hedge: Sell at 0.5 and lock in $50.

If your trade size is large enough, you can lock in a risk-free spread of between 0.30 and 0.50. This is essentially trading mean reversion in the prediction market. It's like buying an overhyped stock, knowing it will definitely reprice.

3. Event Processing Arbitrage

Sometimes certain platforms process transactions faster (or differently) than others. If you know how one market will settle before other markets do, you can trade ahead of time.

Example:

The "Will SpaceX launch before September?" prediction on Polymarket was processed quickly after the rocket launch, but Kalshi's order book was still lagging. Before Kalshi updated, you could buy the "yes" option at a lower price.

This is latency arbitrage, you’re betting on information gaps, so if you’re constantly following real-time information feeds (e.g., election results, court decisions, sporting events), you can easily stay ahead of slower platforms.

4. Liquidity Arbitrage

A thin order book or a sudden surge in speculation can distort prices. If a few large trades come in, they can shift the odds, at least temporarily, away from reality.

For example, if an event deviates from the actual situation due to a sudden increase in large transactions, you can buy No, close the position and make a profit after correcting to the actual situation.

5. Semantic/Oracle Arbitrage

This one's a bit tricky, and if you've read my article on semantic traps, you'll understand what I mean and how to spot them. It's about the oracle's interpretation and the trader's perception. If you can predict or fully understand how the oracle interprets it, you can exploit mispriced odds. Less math, more rules/text arbitrage.

The fact is that the current prediction market mechanism is not perfect and efficient. There are always small gaps in the market. Your task is to discover them, exploit them, and then let compound interest work.

A 5% difference compounded 20 times will grow 2.65 times.

A 10% difference compounded 20 times will grow 6.7 times.

Arbitrage Tools

If you are sharp and patient enough, most of the above strategies can be done manually. However, this field is developing rapidly, and new tools are emerging all the time. I recommend two more suitable arbitrage tools:

1. DK launched a proxy that can research the market, scan volatility, and even identify arbitrage opportunities. Powered by Kalshi, it is currently open to private beta testers. Users can join the waiting list via email and register an account after being accepted.

2. ArbX : A paid tool that can find the price difference of the same event on platforms such as Kalshi and Polymarket.