Pokémon card prices surge 40-fold, leveraging RWA to unlock global business opportunities

- 核心观点:Web3技术正重塑收藏卡牌市场。

- 关键要素:

- 宝可梦卡牌年化收益率超20%。

- 传统交易流程繁琐且成本高昂。

- NFT实现实体卡牌数字化流通。

- 市场影响:推动RWA资产数字化进程。

- 时效性标注:中期影响。

Original author: Wen Paopao, EeeVee

Original editor: Sleepy.txt

Original source: Beating

In 1999, a 10-year-old boy traded his lunch sandwich for a shiny Charizard Pokémon card. At the time, it seemed like just another kid's exchange, like exchanging marbles for gum.

Twenty years later, the card sold at auction for over $400,000.

It sounds like an urban legend, but it actually happened. That original Charizard card, issued in 1998 and certified a perfect 10 by PSA, has become a collector's holy grail.

From a child's lunch exchange to a sky-high price at an auction house, this small piece of paper witnessed the rise of a phenomenal market.

And now, Web 3 seems to be rewriting the rules of the game in this market.

A Reddit user shared that he accidentally found his first-generation Charizard card in his childhood card book.

1. A huge and underestimated market

To understand why Pokémon cards have become so popular, you need to understand the true scale of this market. Many people think it is just a children's toy, but in fact it has long been a mature investment market.

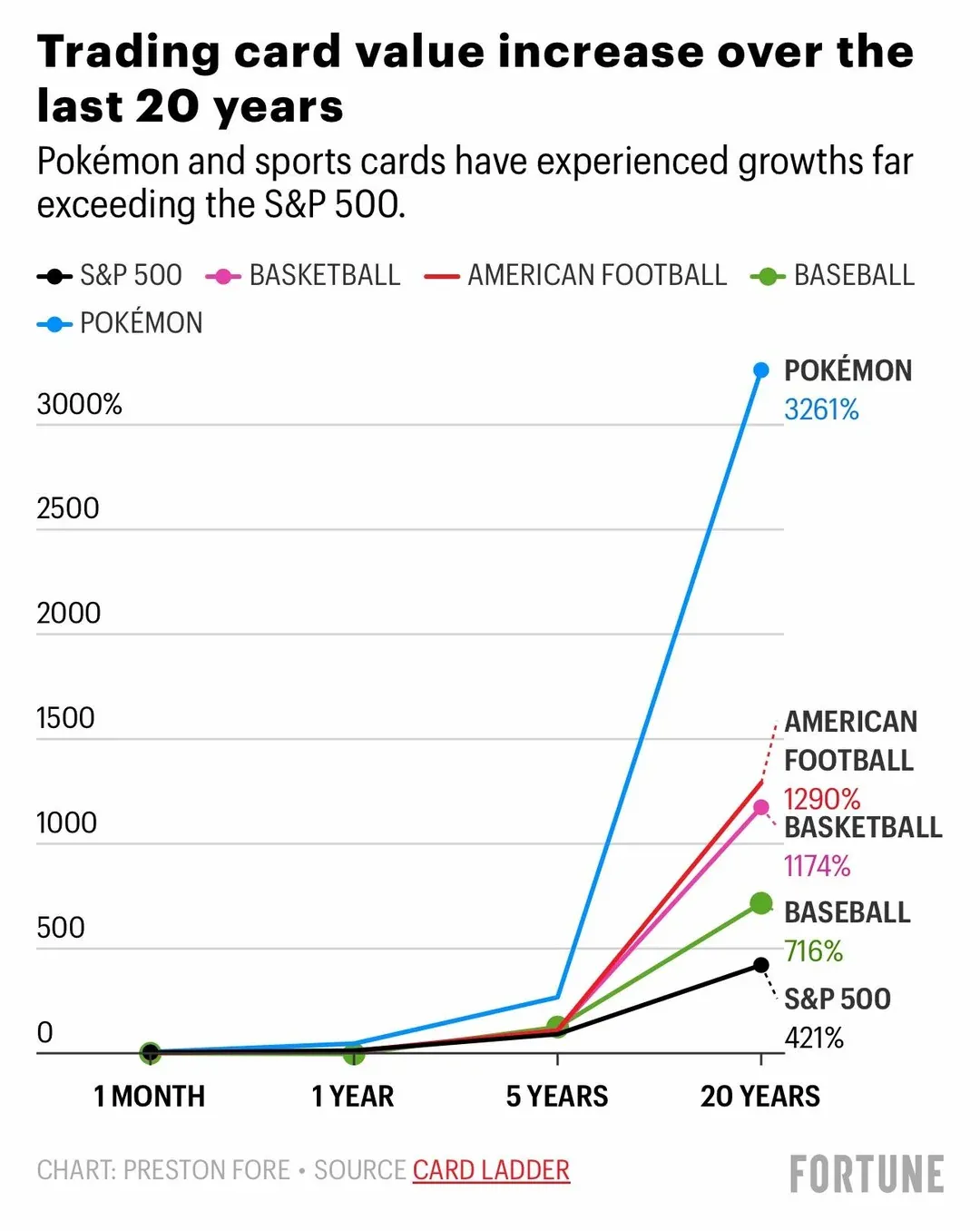

According to data from analytics firm Card Ladder, Pokémon cards have generated a staggering 3,821% monthly return since 2004, a figure that has shocked even Wall Street fund managers.

By comparison, the S&P 500 index rose 483% during the same period, and even the tech star Meta has only risen 1,844% since its IPO in 2012.

Several key factors are behind this growth, the first being timing. The Pokémon game launched in Japan in 1996, followed two years later by the official Pokémon card game. Those original cards are now 26 years old, corresponding to the growth trajectory of a generation. The children who bought those cards back then have now become adults with purchasing power.

Harris is a trader working at a New York investment bank. He and his friends founded a Pokémon card trading community, NY Crazy's Lab. In an interview, he shared that after founding this platform, he came into contact with different groups from all walks of life that he had never encountered before in investment banking.

From police officers to plumbers, from high schoolers making millions trading Pokémon cards to elderly people nearing death, the popularity of the Pokémon IP has made the promotion of its peripherals virtually unlimited.

Harris shows off his "Screaming Pikachu" at a card show. The card is priced between $17,000 and $18,000.

Millennials and Generation Z, who are between 20 and 40 years old, are now the main consumer groups of Pokémon cards.

According to BBC reports, the global consumption power of Generation Z has reached 450 billion US dollars, while the annual disposable income of millennials is between 8 and 10 trillion US dollars. Their consumption power together accounts for more than 50% of the world's current consumer expenditure (35% for millennials and 17% for Gen Z), of which emotional value consumption accounts for the majority.

This value is further amplified by scarcity. Early Pokémon cards were minted in relatively small quantities, and most were played with by children. After more than two decades, only a few cards remain in good condition. A first-edition Charizard with a PSA score of 10 might only have a few hundred copies in the world.

In addition to the card rarity levels (Common, Uncommon, Rare), there are also many sub-levels within each level. Different Pokémon appear in different packs each season. Add to that special limited-edition cards and cards specific to different language regions. The Pokémon Company has taken rarity to a new level through a multi-dimensional approach.

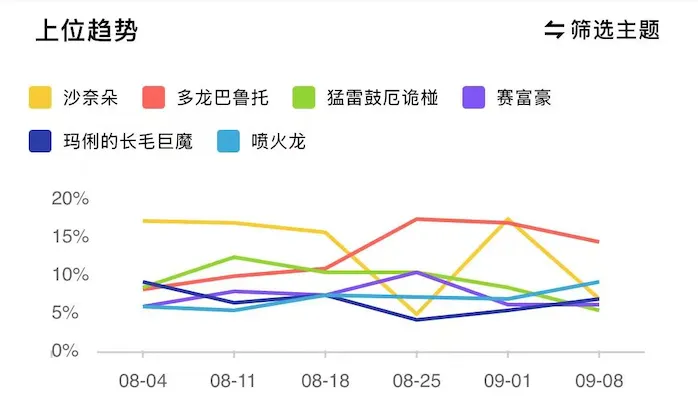

All cards for certain Pokémon are more popular in the market, and their prices are higher than other Pokémon of the same rarity level. Image source: Trading Club

The celebrity effect has played a catalytic role in this. During the 2020 epidemic, the well-known YouTuber Logan Paul spent $6 million to buy a box of 1998 Pokémon card packs and opened the pack during a live broadcast.

This event attracted global attention, turning Pokémon cards from niche collectibles into mainstream investment targets. Traditional auction houses such as Sotheby's and Christie's also gradually began to recognize the value of the TCG industry and successively launched Pokémon-specific auctions.

In July 2021, Logan Paul bought a "Pikachu Illustrator" card from collector Marwan Dubsy for $5.3 million, setting a Guinness World Record. This event completely ignited the Pokémon card trading market.

The investment logic behind Pokémon cards has also matured as trading volume has increased. Professional rating agencies like PSA and BGS have established a standardized condition evaluation system, with scores ranging from 1 to 10. A difference of 0.5 points can lead to significant price fluctuations.

Platforms like eBay and PWCC provide transparent price discovery mechanisms, allowing investors to analyze the price trends of cards just like they would stocks.

This even brings huge profit margins to the card authentication industry. According to research data, the scale of this field will be approximately US$360 million to US$400 million in 2024-2025, and it is growing at a CAGR of 7-8%. By 2030, the overall market may reach more than US$560 million.

Data shows that sales in the US toy sector grew 6% in the first four months of 2025, mainly due to new Pokémon releases and the growing popularity of collectible trading cards.

Walmart Marketplace reports that trading card sales increased by 200% between February 2024 and June 2025, with Pokémon card sales increasing more than tenfold year-on-year.

2. Pokémon in Trouble

While the Pokémon card market has matured, it still faces some fundamental issues that not only affect market efficiency but also limit participation by ordinary investors.

The traditional Pokémon card trading process is quite cumbersome. You need to send the cards to a grading agency and wait for weeks or even months for the grading results. If you do not participate in the grading, the price of the card will be greatly discounted.

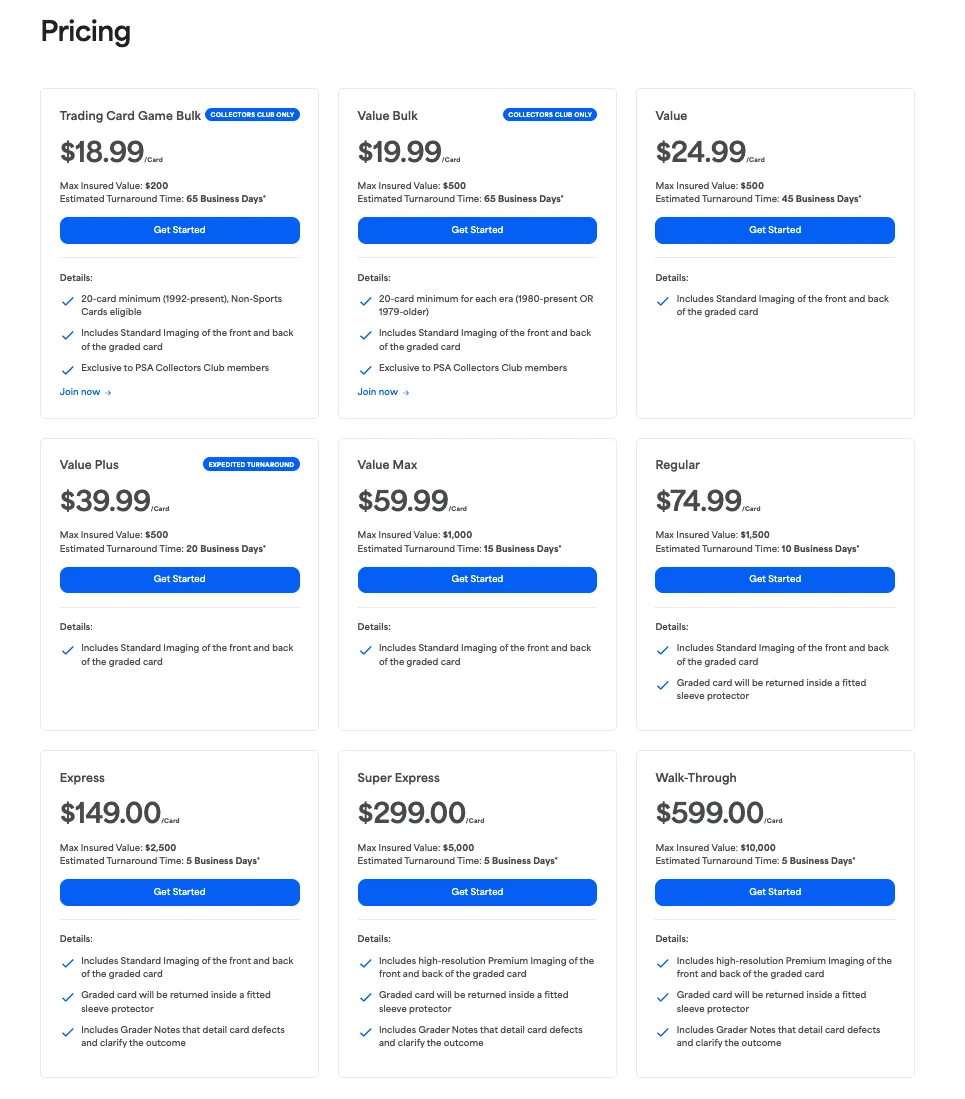

The minimum authentication cost for most institutions is around $20 per card, but depending on the length of the review and the base value of the cards under review (including the provision of insurance and other services), this fee can be as high as $600.

PSA official gives different prices based on different services

This may be relatively convenient for North American players who are closer to the institution's location, but the cost will become quite high for participants in other regions.

Taking East Asia as an example, even through collective ordering or professional review intermediaries, the lowest cost is usually around RMB 200 to 300 per card, which is about 1.5 times the review fee for players in North America.

After going through all the difficulties, auctioning on traditional trading platforms (mostly eBay's TCGplayer and Cardmarket abroad, and more scattered in China such as swap clubs, Card Home or Xianyu) also incurs high handling fees (mostly 5% to 10%, and some offline card stores even charge 10% to 15% for consignment), not to mention the risk of damage during the mailing process and the information cocoon of price differences between different platforms.

More importantly, there's the issue of trust. Without a third-party guarantee, it's difficult for buyers and sellers to build trust. Problems like counterfeit cards, package swaps, and refusal to ship are common.

After going through such a complicated process, the money earned from trading a Pokémon card may be far lower than its original price, and the high volatility of its secondary market also adds a lot of risks to Pokémon card trading.

Harris encountered an interesting phenomenon in his Pokémon trading community. Whenever the trading enthusiasm for NFTs or Bitcoin is high, everyone's enthusiasm for trading Pokémon cards also increases. When the crypto market is active, some players will even directly use Bitcoin to purchase Pokémon cards.

However, various restrictions prevent Pokémon card players from applying this market law in a timely manner, and sometimes even the core traders themselves are not aware of the bubble's fault line.

Pokémon card bubbles have occurred numerous times. For example, during the second half of 2020, when Logan Paul purchased a $5.3 million Pikachu, market FOMO drove the prices of many Pokémon cards up tenfold, with some specialty cards seeing increases of 30-50 times.

After that, the price plummeted, and the overall market corrected by more than 60%, leaving many new players stuck.

In 2023, some Japanese market makers collectively raised the prices of some female "character cards". Within a week, the prices of some cards were raised by thousands of dollars, and within the next three months they were dropped to only 200 to 300 US dollars.

The lengthy card review process, coupled with the complexity of the transaction process and space limitations, often prevents Pokémon card participants from taking action in a falling market, and they cannot escape the fate of being "reduced to zero."

Tuam, founder of the blockchain TCG trading platform Collector's Crypt, has personal experience with these issues.

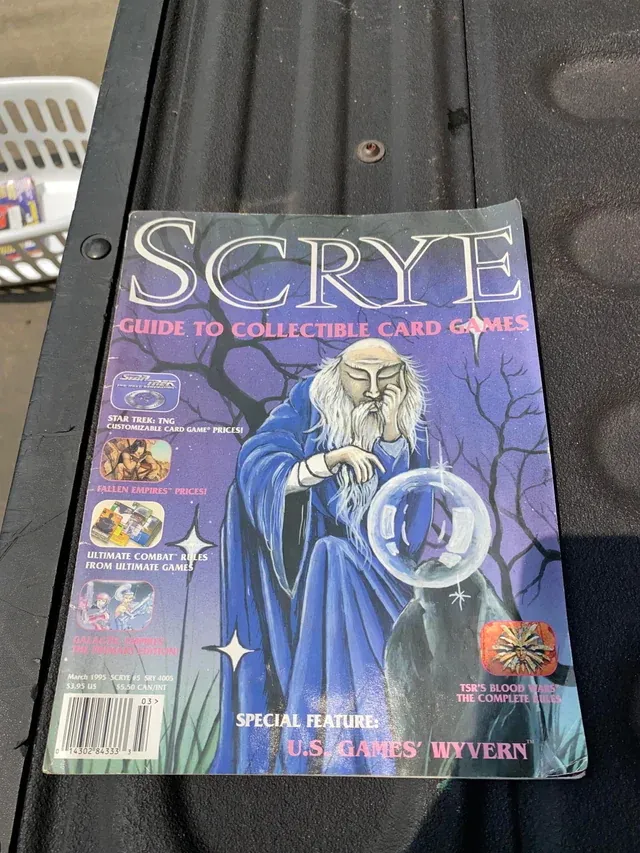

A longtime Magic: The Gathering collector who has been playing since 1993, he was a semi-professional player and even wrote for Scrye, the longest-running TCG magazine.

He sold most of his card collection before going to college to pay for his undergraduate education, and his remaining Magic: The Gathering collection was later worth more than his estate.

Collector's Scrye Magazine

But over the past few decades, Tuam has traded a large number of cards through eBay and has experienced firsthand the challenges of trust, security, customs, damage and fraud.

He once sold a $10,000 copy of Magic: The Gathering to a buyer in Croatia, but the card was held in customs for two months and then returned. He lost the shipping and insurance costs, and eBay refused to refund the seller's fees, which cost him 40 hours of time dealing with these unnecessary troubles.

He discovered even more serious abuses in trade settlement. During the Super Bowl, speculators would bid on cards of rookie players from both teams simultaneously. If their favorite team lost, they would cancel their orders or withhold payment, while the winning team would purchase the cards at the pre-game price, effectively obtaining a "free futures contract."

Safekeeping is also a headache for many collectors. In 2018, Tuam's parents' home burned down in the Thomas Fire in California, destroying everything, including a 1969 Camaro.

In 2021, his own home in San Francisco was evacuated due to the threat of wildfires, and he had to put his large Magic: The Gathering collection on the passenger side of a pickup truck in 105°F temperatures for 8 hours, which made him realize that traditional storage methods posed huge risks.

The Pokémon Company also tried to use digitalization to solve its complex structural problems, but the results were not satisfactory.

The Pokémon Company launched Pokémon TCG Live in 2021. Players who purchased physical card packs received redemption codes that could be exchanged for corresponding digital cards in the game. However, this system only enabled a one-way flow of "physical to digital" transactions; digital cards could not be exchanged for physical items or traded between players.

Daniel Paez, executive producer of Gods Unchained, previously worked at Blizzard and was involved in the development of famous card games like Hearthstone. He pointed out a fundamental problem with traditional digital card games:

Players cannot truly own their assets in the game.

3. When RWA meets Pikachu

It was based on these pain points that Tuam decided to create the Collector's Crypt project. Although some people discussed using NFTs to represent real-world assets as early as 2017, there was a lack of stable infrastructure such as stablecoins and NFT trading platforms at the time.

It wasn’t until the DeFi summer and the NFT craze that the infrastructure around NFTs was gradually built up, providing a viable infrastructure for projects like Collector’s Crypt.

The Collector's Crypt's operating model is relatively simple yet extremely innovative.

First, they partner with specialized vaults to provide secure storage for physical Pokémon cards graded by PSA or BGS. These vaults feature temperature and humidity controls, as well as advanced fire prevention measures like a "halon system," which, upon detecting a spark, floods the vault with foam, sucking away all oxygen and extinguishing the fire.

Then, a unique NFT is generated for each stored card. This NFT contains all the card's important information, including card name, rarity, rating score, serial number, etc. More importantly, an unalterable correspondence is established between the NFT and the physical card.

Players can acquire these NFT cards in a variety of ways. They can directly purchase minted NFTs or participate in "pack opening" events. However, unlike traditional pack opening, the Collector's Crypt pack opening experience is designed as a gamified shopping experience with positive expected value.

Collector's Crypt "pack opening" machine

Traditional physical card packs typically have an expected value of negative 60% to 70%. However, in the $50 vending machine at Collector's Crypt, the average $50 investment yields a $55 worth of cards, providing positive expected value (10% positive EV) from the initial draw.

After acquiring an NFT card, players have a variety of options. They can trade these NFTs on the secondary market, or they can choose to redeem the NFT for the corresponding physical card. Collector's Crypt promises to safely deliver the physical card within a certain period of time after receiving the redemption request.

This model addresses several core pain points in the traditional market. Through NFT technology, player ownership of cards is recorded on the blockchain, making this record immutable and inalienable. In the Web 3 world, players can trade directly peer-to-peer, without the need for centralized platforms.

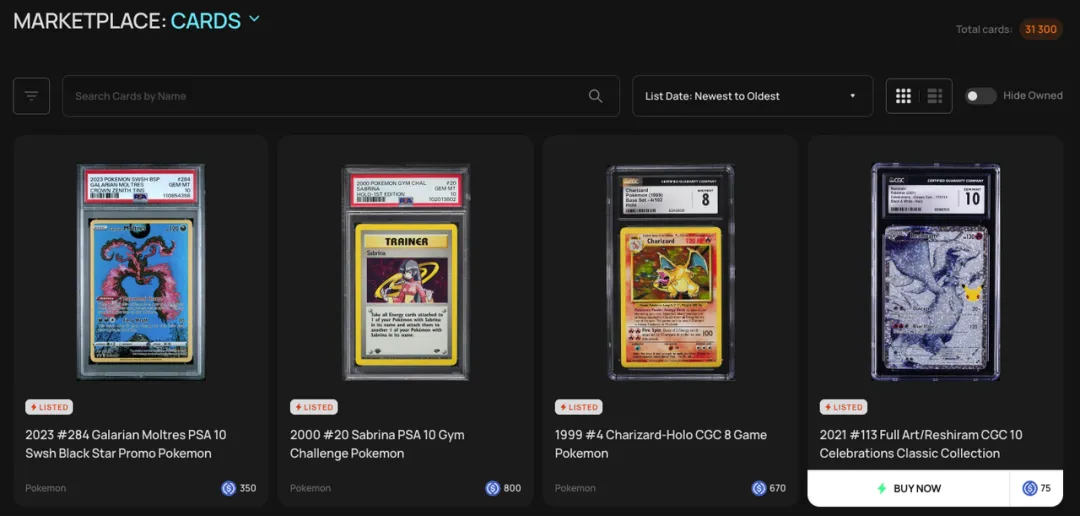

CARDS secondary market trading platform

Blockchain technology breaks down geographical restrictions, allowing collectors around the world to trade in a frictionless market. A player in Tokyo can instantly sell cards to a buyer in New York without having to worry about exchange rates, payment, and logistics.

RWA's one-to-one mapping technology enables a free, two-way flow between physical cards and NFTs. After players exchange physical cards for NFTs, they can redeem them back to physical cards as needed. On the traditional Pokémon TCG Live platform, users can only convert physical cards to digital cards in a one-way manner.

Collector's Crypt also innovatively introduces a buyback mechanism, promising to repurchase NFT cards held by players at 85-90% of the market price. This provides a price floor for cards, addressing concerns about unsaleable items. Furthermore, transactions on the blockchain are nearly instantaneous, and fees are significantly lower than on traditional platforms.

The Collector's Crypt project has implications far beyond card collecting itself. It represents the beginning of a larger trend: the digitization of real-world assets.

In the real world, investing in high-value collectibles has always been the preserve of the wealthy. Assets like a Picasso painting, a bottle of 1947 Château Lafite Rothschild, or a 1952 Mickey Mantle baseball card can be worth millions of dollars, putting them out of reach for the average investor. Even if one has sufficient funds, the purchase, safekeeping, insurance, and authentication processes are fraught with complexity and risk.

Pokémon cards have several unique advantages as RWA:

First, they are standardized collectibles, with each card having a clear version, rarity, and condition rating, which makes tokenization relatively simple.

Secondly, Pokémon cards have an active secondary market and a transparent price discovery mechanism, which provides a reliable reference for NFT pricing.

Furthermore, Pokémon cards are small and valuable, making them ideal for both physical storage and digital management. A card worth tens of thousands of dollars is the size of a credit card and can be easily stored in a professional vault, while the corresponding NFT can circulate freely around the world.

Collector's Crypt founder Tuam envisions that their token could be seen as a "Pokémon card ETF" in the future.

Pokémon cards are one of the best-performing asset classes of this century, with a compound annual growth rate of approximately 20% to 25% since the early 2000s, significantly outperforming the S&P 500 and remaining uncorrelated with traditional assets. The only ones to surpass them are a handful of cryptocurrencies like Bitcoin, Ethereum, and Solana.

20-year ROI of the card market | Source: FORTUNE

However, high-net-worth individuals (such as billion-dollar family offices) have traditionally struggled to invest in trading cards. The process involves numerous cumbersome steps, such as sourcing the cards, preventing counterfeits, and the significant time and effort required to store and transport them.

Collector's Crypt tokens are backed by a vault of real-world assets, and their market capitalization reflects, to some extent, the value of the Pokémon cards in the vault.

This means that investors can easily gain exposure to Pokémon card assets by purchasing their token $Cards through decentralized exchanges without having to deal with the complexities of physical trading.

Users can also purchase NFTs on the platform by holding $Cards tokens, participate in project governance voting, and influence the platform's future development. To incentivize token holders, Collector's Crypt provides rewards through a buyback mechanism, allowing them to benefit from the project's revenue growth.

The success of this model provides valuable insights for other RWA projects. High-value collectibles such as art, luxury goods, and rare metals can all be tokenized using a similar approach. The key lies in establishing a trusted custody mechanism, a transparent price discovery mechanism, and a convenient redemption process.

4. The beginning of a new era, or new wine in old bottles?

The success of the Collector's Crypt project is more than just a business case; it's a milestone in the digital transformation of the entire collectibles industry. It demonstrates the potential of Web 3 technology in traditional industries and provides a reference model for the digitization of other collectibles categories.

Tuam is optimistic about the future of the crypto industry. He believes that during the last cycle, many major Web 2 brands entered the crypto space, driven primarily by marketing teams, attracted by the hype surrounding NFTs. When the marketing hype faded, these projects disappeared.

He observes a shift in the current trend, which is more driven by practicality.

For example, internet payment giant Stripe acquired a payment processing company to improve the deposit and withdrawal experience and smart wallets for blockchain users, allowing users to use them safely without three years of encryption experience.

But Tuam believes that true mass adoption of cryptocurrency won't come from people downloading wallets and speculating on it. Instead, it will be a "silent" technological revolution hidden in the background.

For example, Walmart may use smart wallets and NFT technology to reserve Pokémon boxes for specific users, without the user even knowing that the underlying technology is blockchain. He believes that this "revolution" will completely change the rules of the game in the next five years.

That $400,000 Charizard card witnessed the transformation of Pokémon cards from children's toys to investment products. From the sandwich exchange in 1999 to the Web 3 revolution in 2024, this story spans 25 years and bears witness to profound changes in technology, culture, and the economy.

The emergence of Web 3 technology has injected new vitality into this age-old collectibles market. It solves many pain points of the traditional market and also brings new possibilities to the collectibles market.

From a Charizard bought in exchange for a sandwich, to a $400,000 auction item, to a freely tradable digital asset, this story continues. And we are standing at the starting point of a new era.