CoinEx Research August 2025 Monthly Report: Double All-Time High

- 核心观点:比特币以太坊创历史新高后进入整固。

- 关键要素:

- 机构需求与ETF流入推动新高。

- 稳定币流入超百亿美元支撑牛市。

- 美联储降息预期或成新催化剂。

- 市场影响:短期整固后或迎新一轮增长。

- 时效性标注:短期影响。

August 2025 was a historic month for digital assets, with both Bitcoin and Ethereum reaching new all-time highs. Bitcoin surged to $124,000, and Ethereum surpassed $4,900, driven by strong institutional demand, ETF inflows, and mass enterprise adoption. Despite a month-end pullback—Bitcoin closed at $108,000 and Ethereum at $4,300—the overall market bull market structure remained solid, supported by over $10 billion in stablecoin inflows. Meanwhile, the rapid rise of Digital Asset Treasury (DAT) companies, and their shifting asset allocation beyond Bitcoin and Ethereum, highlighted the deepening integration between traditional finance and the crypto industry. However, the decline in market-to-net-asset value (mNAV) multiples for some DATs suggests a potential period of market consolidation. With the expected Federal Reserve rate cut looming, crypto assets are expected to maintain momentum as risk-on assets.

BTC and ETH reach new highs

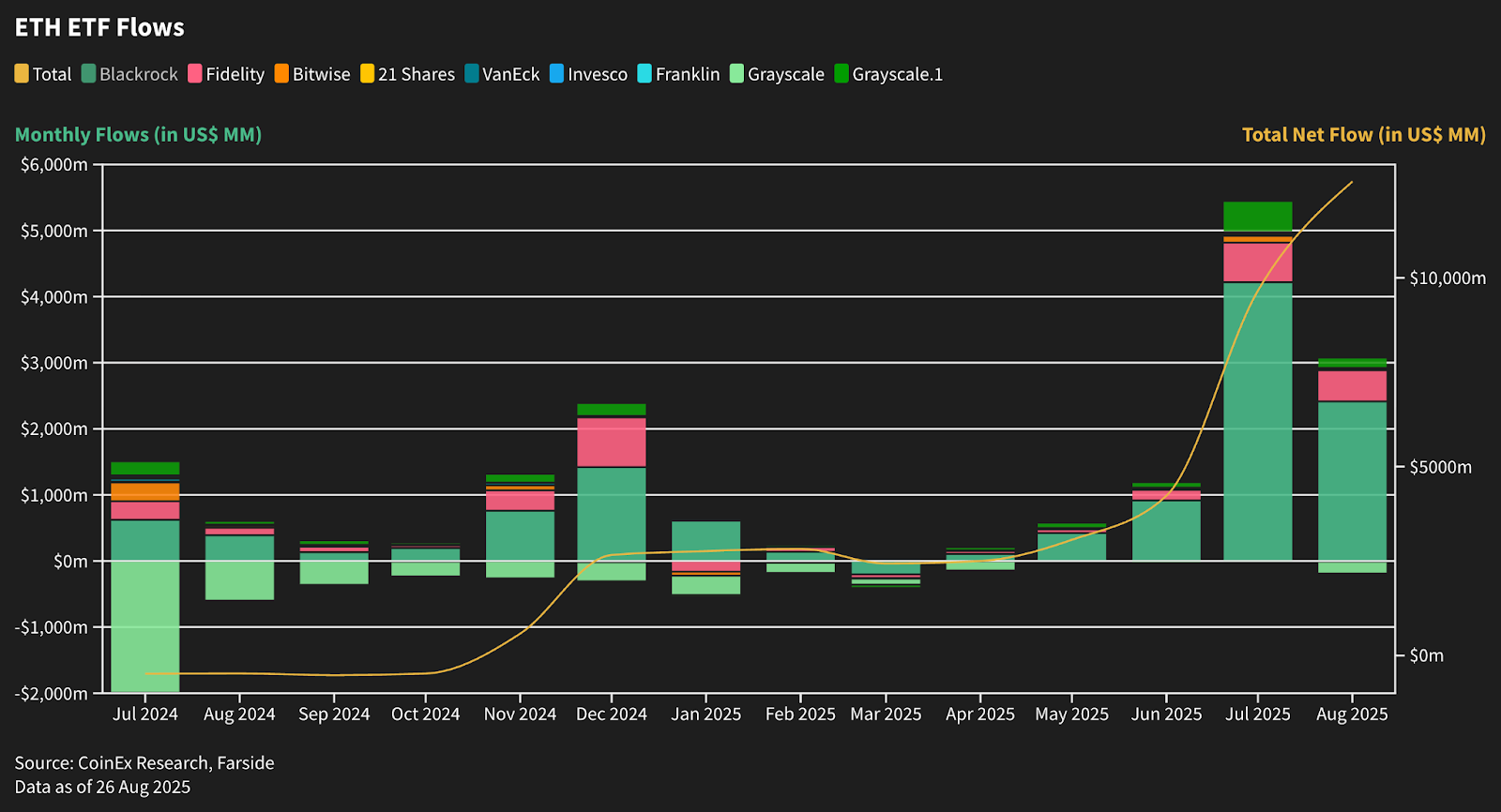

Bitcoin opened August at $115,000, continuing its upward momentum from July and reaching a new high of $124,000 on August 14. Ethereum performed even more strongly, starting at $3,700 and breaking its 2021 record high of $4,900 on August 24. Institutional funds continued to flow in, with Ethereum ETFs attracting $3.8 billion in August, a significant increase following the $5.4 billion in July.

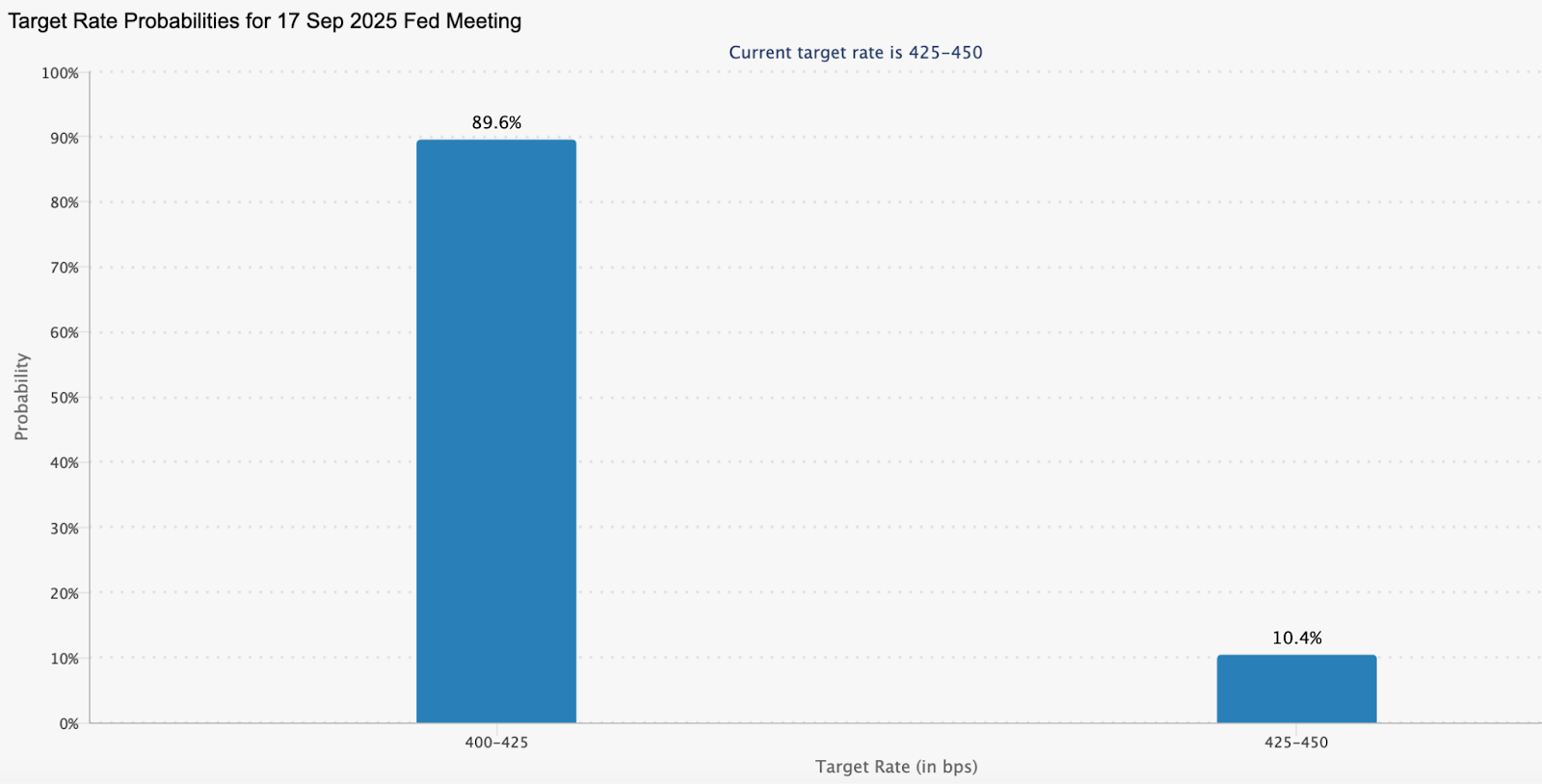

Bitcoin ultimately closed at $108,000, and Ethereum at $4,300. Despite the pullback, the overall bull market structure remains intact. Market attention is now shifting to macroeconomic policy. The CME FedWatch tool indicates an 89.6% probability of a September Fed rate cut, potentially serving as a catalyst for renewed strength in risk assets.

Source: CME FedWatch; data as of September 1, 2025

Technical Outlook: BTC Consolidation, ETH Profits May Flow to Solana

Bitcoin's upward momentum is weakening and is expected to enter a consolidation phase in the short term. It may repeatedly test the support level near $108,000, but the overall bull market pattern remains unchanged.

At the same time, some ETH profits may flow into SOL, and the related narrative is also heating up. The SOL/ETH ratio has seen a strong rebound recently and is expected to retest the resistance level of 0.05716.

Ethereum hits new all-time high

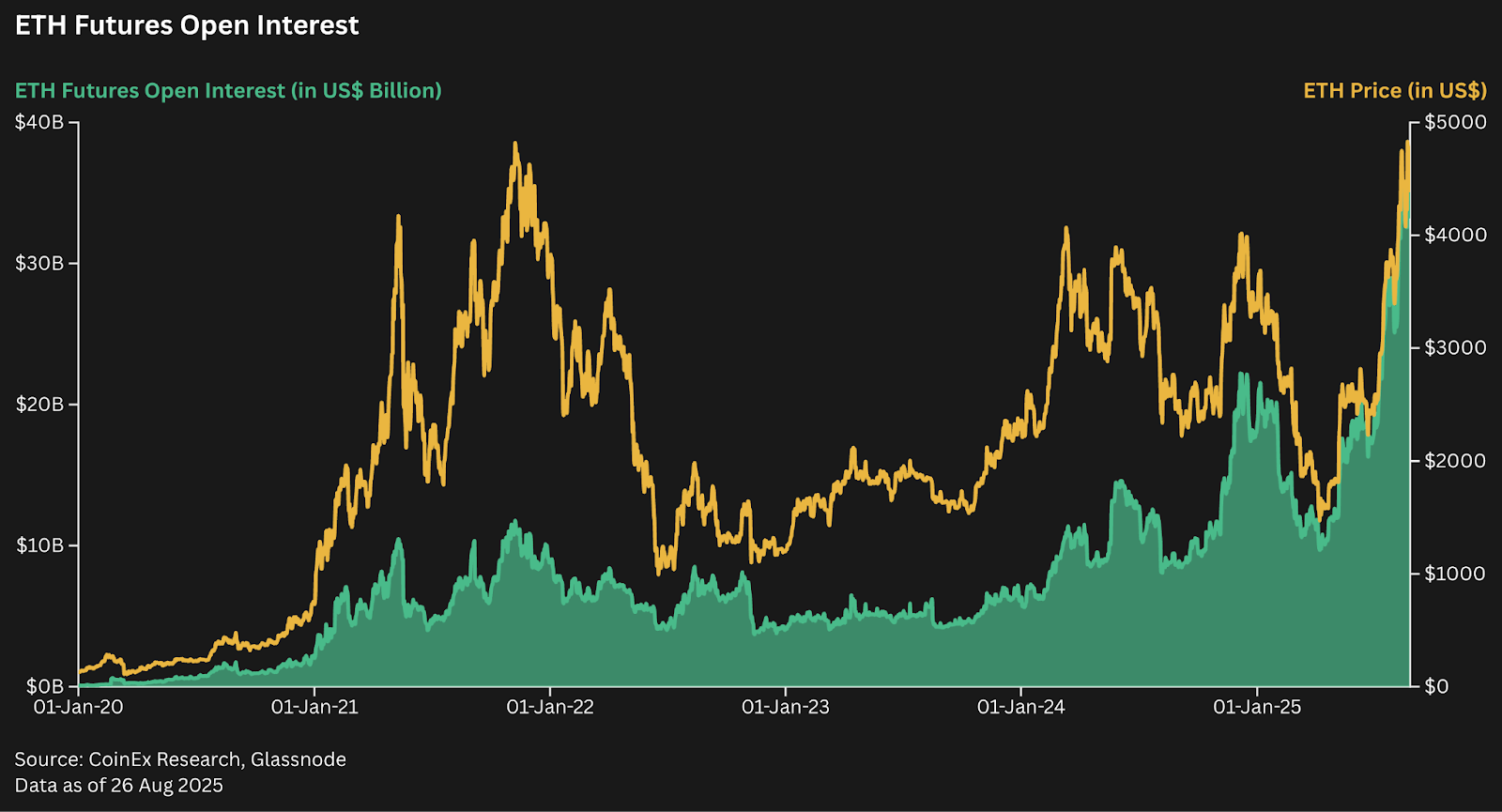

This month, Ethereum surpassed $4,900, reaching a new high, driven by inflows from ETH treasuries and ETFs. However, it's important to note that ETF inflows have slowed, and ETH derivatives leverage remains high, suggesting a period of consolidation before the next leg of gains.

For a deeper understanding of the core drivers of this round of Ethereum's rise, please refer to our recent article "Ethereum Price Hits Record High in 2025: Key Drivers and Future Outlook" .

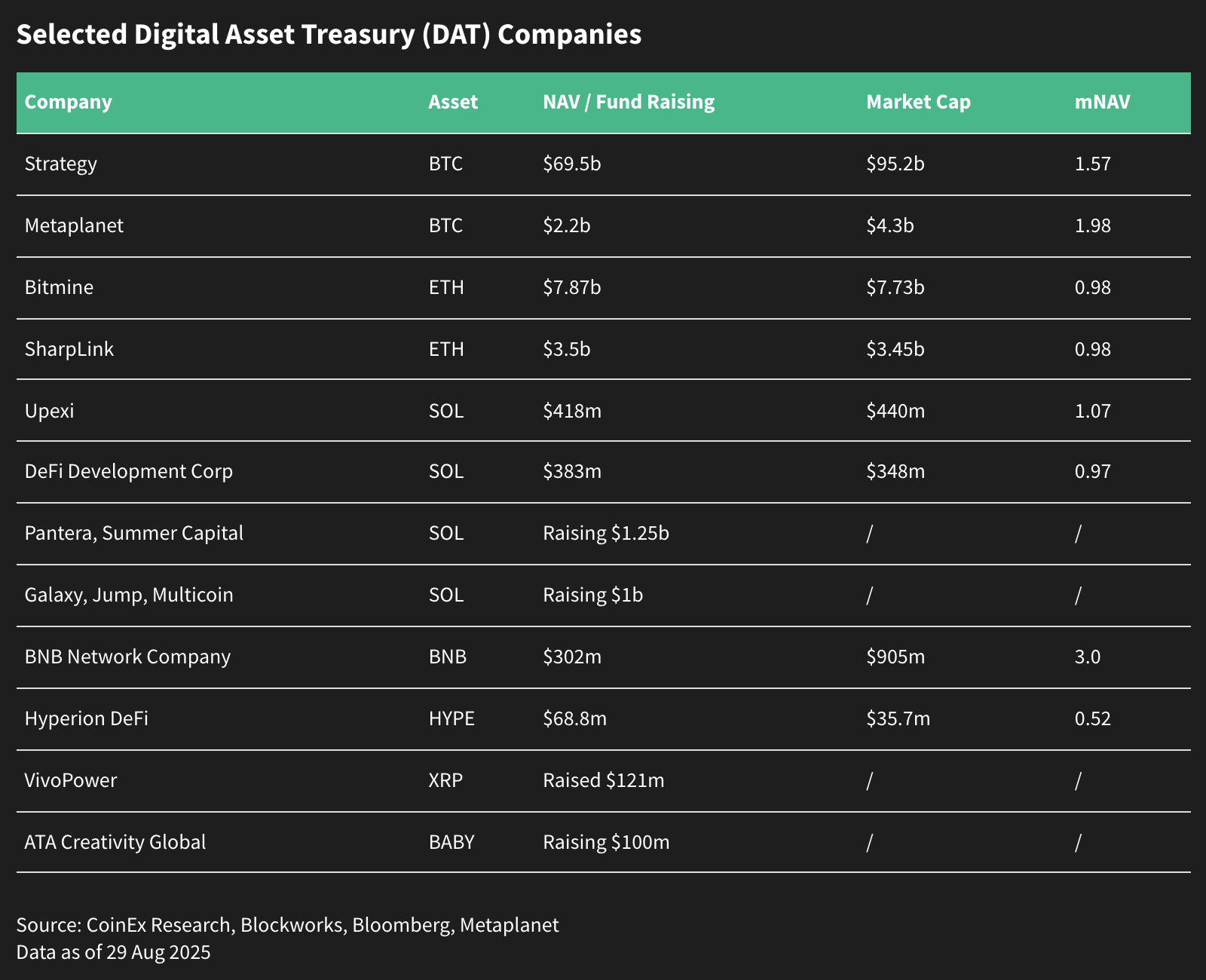

Digital Asset Treasury (DAT) Company Expansion

In July, CoinEx Research noted the rise of Ethereum-based digital asset treasury (DAT) companies. By August, the sector had expanded rapidly, with firms like Pantera Capital and Galaxy Digital raising funds for Solana treasuries, while others invested in assets like BNB, XRP, HYPE, and BABY. This diversification reflects the robust market demand for altcoins, while the number of companies operating is expected to vary regionally due to varying market and regulatory conditions.

However, the market net asset value (mNAV) multiples of some DATs have declined from high premiums to close to 1.0x, indicating that valuations may face pressure as competition intensifies and sentiment returns to rationality.

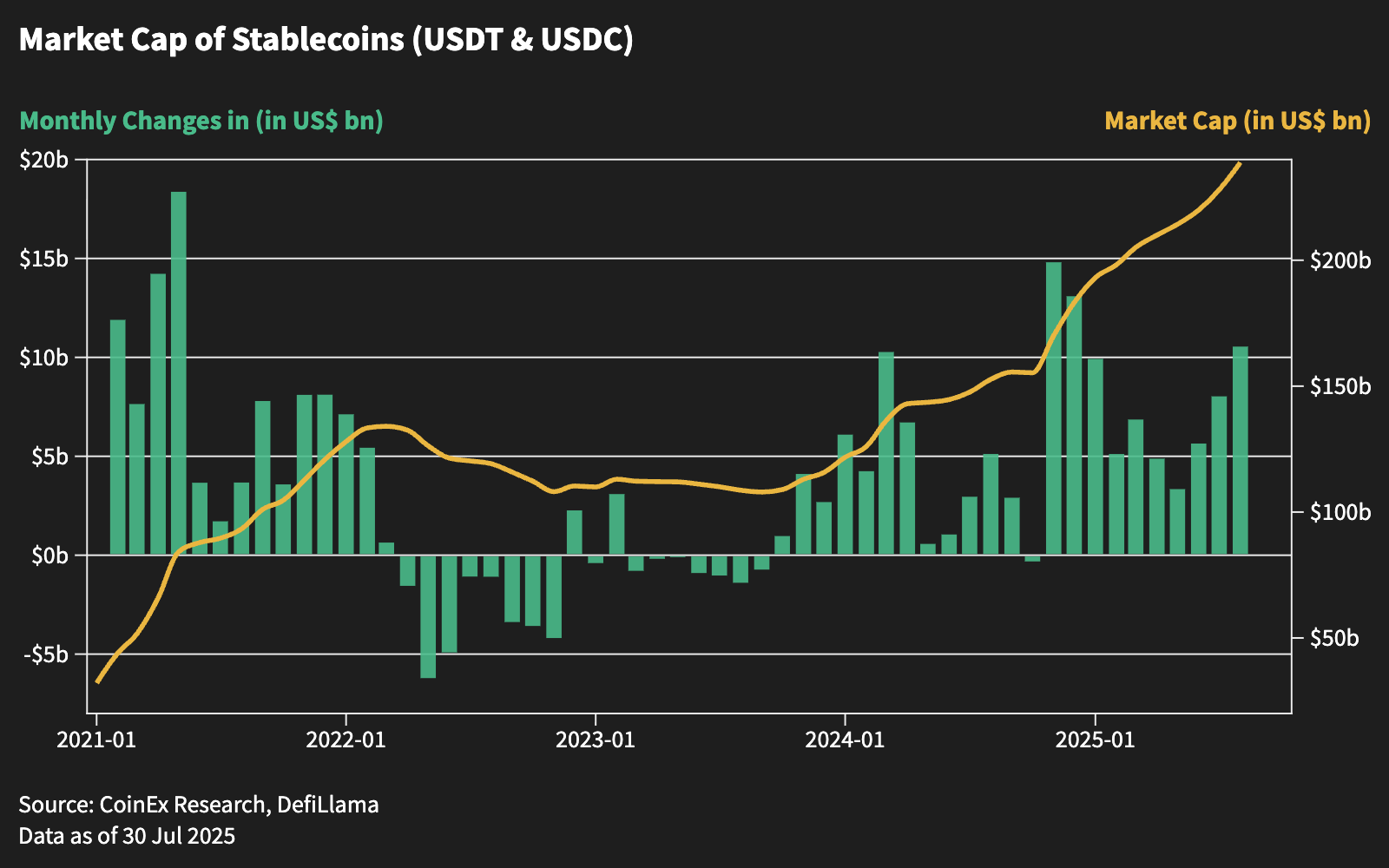

Stablecoin inflows exceed $10 billion

Stablecoin inflows exceeded $10 billion in August, marking the fastest growth rate in the past eight months. This trend reflects increased market liquidity, accelerated capital deployment, and continued growth in investor activity. CoinEx Research sees this as strong evidence of a robust bull market structure.

Outlook: Expansion after consolidation

CoinEx Research believes that August's double all-time highs demonstrate both market strength and the complexity and maturity of the current crypto market. Bitcoin and Ethereum remain core anchors for institutional strategies, but the month-end pullback suggests the market will need some consolidation before the next leg of gains.

Meanwhile, the rise and diversification of DATs highlight the further integration of crypto and traditional finance. However, the compression of mNAV multiples also suggests that the market is distinguishing between hype and sustainable models. Stablecoin inflows exceeded $10 billion, confirming the solid structural foundations of the bull market. With the September macroeconomic policy shift approaching, the market may usher in a new wave of growth, but investors should be cautious about leverage and valuation risks.

About CoinEx

Founded in 2017, CoinEx is a user-centric global cryptocurrency exchange. Since the founding of ViaBTC, the industry's leading free Bitcoin mining pool, CoinEx has been one of the first exchanges to implement Proof of Reserve (PoR) to guarantee 100% security for user assets. Currently, CoinEx offers over 1,400 cryptocurrencies, boasts a user base of over 10 million in over 200 countries and regions, and offers specialized features and services. CoinEx also issues its native token, CET, to incentivize user activity and continuously empower the platform ecosystem.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube