CoinEx 2025 Annual Report: The Four-Year Cycle is Over – Where is the Institutionally-Driven Crypto Era Heading?

- 核心观点:加密市场正从散户投机转向机构主导。

- 关键要素:

- 比特币ETF使其成为机构标准化资产。

- 流动性将集中于有真实采用的项目。

- 散户需采用“双轨策略”寻求机会。

- 市场影响:市场结构重塑,投资逻辑转向价值与现金流。

- 时效性标注:中期影响。

Core Summary (In Brief)

CoinEx 's 2025 Annual Report points out that the cryptocurrency market is undergoing a profound structural transformation . The traditional "four-year halving cycle" is gradually disintegrating due to the continued involvement of institutional capital .

The spot Bitcoin ETF has transformed BTC into part of a standardized asset allocation**, evolving it from a highly volatile speculative asset into an asset with macro reserve attributes.

This report systematically analyzes the market's transformation from a "retail speculative-driven" to an "institutionally dominated ecosystem" and answers six key questions regarding asset allocation in 2026 .

CoinEx's baseline forecast is that Bitcoin could reach $180,000 by 2026. However, it also clearly points out that the era of altcoins is over —future liquidity will only flow to "blue-chip survivors" with real adoption and clear business models.

Retail investors must adopt a **"Double-Track Strategy):**

On the one hand, it focuses on BTC, ETH and compliant yield products, taking advantage of institutional funds; on the other hand, it seeks Alpha in smaller on-chain sub-sectors that are not yet fully covered by institutions.

DeFi has entered a new phase centered on profit , with a focus shifting to protocols like the Fee Switch, which employ equity-based profit-sharing mechanisms.

In the AI × Crypto field, the real sustainable advantage lies not in "buying AI coins," but in using AI tools —through AI Agents and "Vibe Coding"—to upgrade retail investors into "super individuals" with productivity leverage.

The market in 2026 will reward certain cash flows, structured adoption, and technological leverage , rather than simply betting on volatility.

I. Market Assessment: Where is the overall crypto market headed?

The four-year cycle is undergoing structural collapse.

The widely validated "four-year halving cycle" is failing.

Historically, halvings have often been driven by retail investor sentiment, resulting in parabolic rallies followed by deep pullbacks. However, in 2025, Bitcoin fell back to below $90,000 after approaching $125,000 in October, without experiencing excessive speculation or frenzy.

Profit-taking and emotional restraint indicate that the supply shock from the halving is having a diminishing impact in the face of continued demand growth.

The fundamental reason lies in the significant increase in institutional absorption capacity . As of the end of 2025, the assets under management (AUM) of spot Bitcoin ETFs exceeded US$150 billion , with funding sources including corporations, governments, endowments, pension funds, and sovereign wealth funds.

Bitcoin's behavior is shifting towards becoming a "new type of reserve asset" rather than a bubble asset.

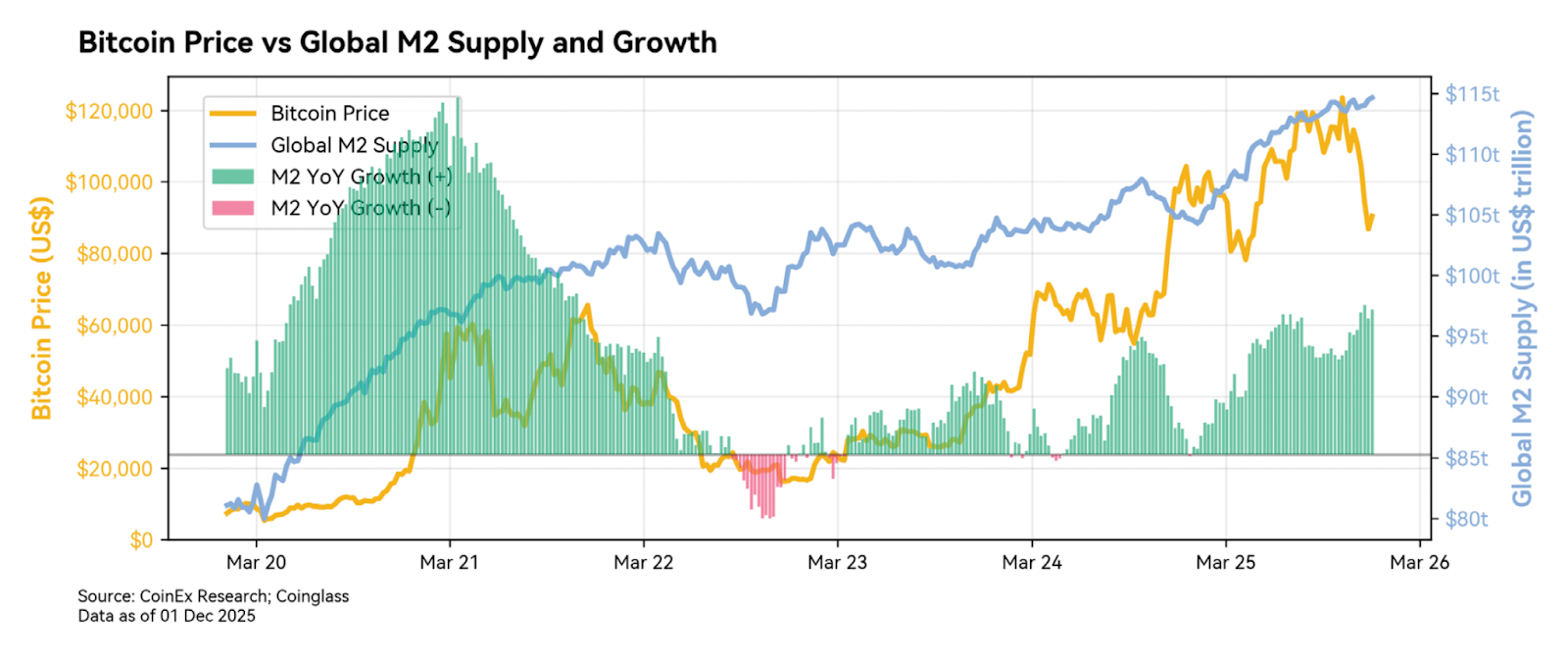

Global liquidity remains the underlying variable, but its marginal impact is diminishing.

Global liquidity will provide limited support in 2026.

The market expects the Federal Reserve to cut interest rates by 50-75 basis points , while the European Central Bank and the People's Bank of China remain cautious, and the Bank of Japan is gradually normalizing.

Since the launch of ETFs in 2024, the correlation between Bitcoin and M2 has weakened significantly.

Liquidity provides a "floor," but what will truly drive the rise will be institutional inflows and regulatory progress .

2026 may see a record high, but the "copycat season" will not return.

CoinEx holds a cautiously optimistic view of the market, predicting that Bitcoin could reach $180,000 in 2026, driven by policy support and institutional demand.

A 20-30% pullback is still possible due to macroeconomic or geopolitical factors, but the probability of a traditionally significant 70-80% crash is extremely low . A roughly 2x increase from current levels is the baseline scenario.

However, a widespread surge in altcoin prices will no longer occur.

Retail investor fatigue, fragmented liquidity, and shortened project lifecycles mean that funds will only selectively flow into projects with real adoption, continuous revenue, and profitability .

II. Institutional Investors vs. Retail Investors: Where are the Opportunities for Retail Investors?

Retail investors remain important, but the potential for excess returns is narrowing .

The "simple alpha" that relies on narrative and emotion is disappearing; success now depends more on structural understanding and in-depth research .

Beta Strategy: Anchoring to Inflation-Helping Assets and Compliance Returns

Bitcoin and Ethereum are gradually becoming tools for storing value against inflation .

Retail investors should use it as the core of their portfolio, rather than chasing extreme multiples.

"Riding the wave of institutional funds" through compliant yield products (such as pledged ETFs and insurance-encapsulated products) is a more stable approach.

An improved regulatory environment will drive the development of low-volatility, compliant on-chain yield products .

RWA (Real World Assets) is building a "programmable risk-free rate" by tokenizing government bonds .

Selection criteria should prioritize compliance, ecosystem maturity, developer retention, and real revenue, rather than price speculation.

Alpha Strategy: Shifting from Emotion-Driven Tracking to On-Chain Precision

The $19 billion liquidation event in October 2025 marked the end of the peak in retail investor sentiment.

High FDV projects and VC unlocking pressure create valuation traps; in the absence of retail investors to take over, the cost of pumping prices rises sharply.

Alpha in 2026 needs a "dual-track strategy":

- Avoid high FDV and re-unlocked assets

- Projects with a preference for fair distribution and natural demand-driven development.

- Focus on Product-Market Fit (PMF), Audited Revenue, and Execution Capability

Analysis tools should shift from CEX sentiment analysis to on-chain tools such as Nansen, Glassnode, Santiment, and Dune.

Retail investors have the advantage of flexibility , allowing them to rotate faster and track smart money.

True Alpha exists in areas not yet covered by institutions:

Web3 payments, vertical AppChain (games, creators), and the early liquidity gap in new chains.

III. Public Blockchain: A User Manual for Retail Investors on Public Blockchains

With regulatory oversight and institutional funding inflows, the top Layer 1 has become an "institutional battleground."

However, retail investors still have an advantage in highly volatile niche sectors: Meme, AI, privacy, staking, and mining .

The current competitive landscape is stabilizing.

Solana, BSC, and Base lead in liquidity, developer density, and execution efficiency, making them core platforms for retail investors.

Retail investor participation path

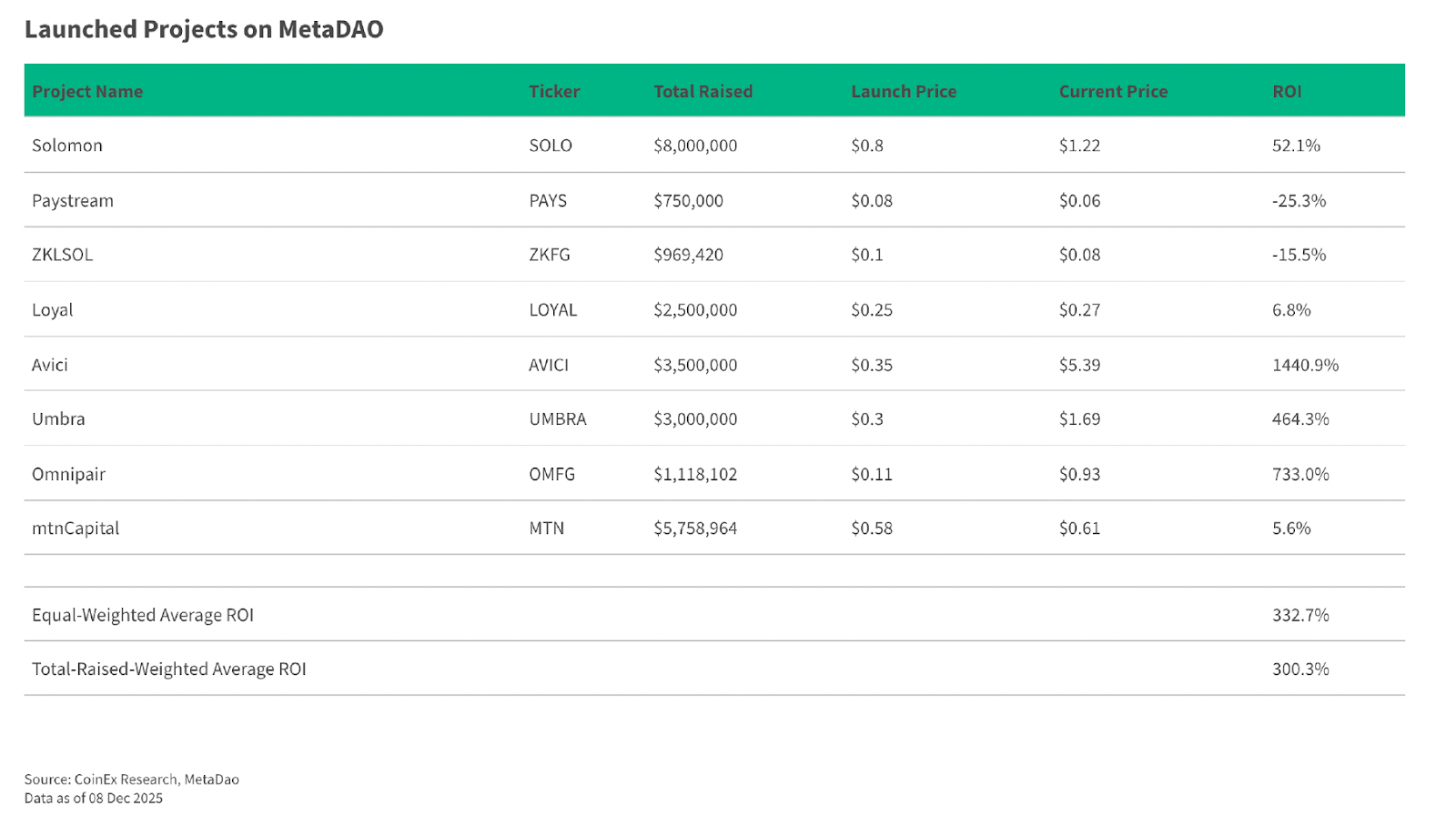

Early opportunities: ICO / IDO / Launchpad

Retail investors can gain access to screened early exposure through a high-quality Launchpad.

Meme Coin

Community-driven, high-risk, high-return, suitable for retail investors with a high tolerance for volatility.

On-chain staking yield

Staking and liquidity mining are expected to continue to outperform traditional financial interest rates in 2026, making them an important complement to beta strategies.

IV. TradeFi × Crypto: The Next Stage of Integration

Nonlinear evolution path: Issuance → Tokenization → Persistence

Tokenization is the core driving force, with a current scale exceeding $18 billion (mainly in government bonds), and stock tokenization at approximately $670 million .

The next step will be to expand into private lending, equity, and alternative assets, with funds such as BlackRock's BUIDL leading the way.

Then it enters the "sustainability phase" :

Build perpetual contracts on top of tokenized assets and achieve automatic deleveraging through AI risk control.

A deeper level of integration will involve issuing stocks and bonds on the native blockchain .

The logic of profit is changing

Institutional returns are becoming "democratized".

Protocols such as Plume provide 4–10% real yield to DeFi through off-chain assets.

Centralized exchanges will compete fiercely around AUM, launching subsidized wealth management products and TradFi-like structured products.

V. DeFi: Which sectors are worth paying attention to?

DeFi has moved from the experimental stage to a profit-driven stage , with capital concentrating on real product-market fit (PMF) and cash flow.

Emerging high-growth sectors

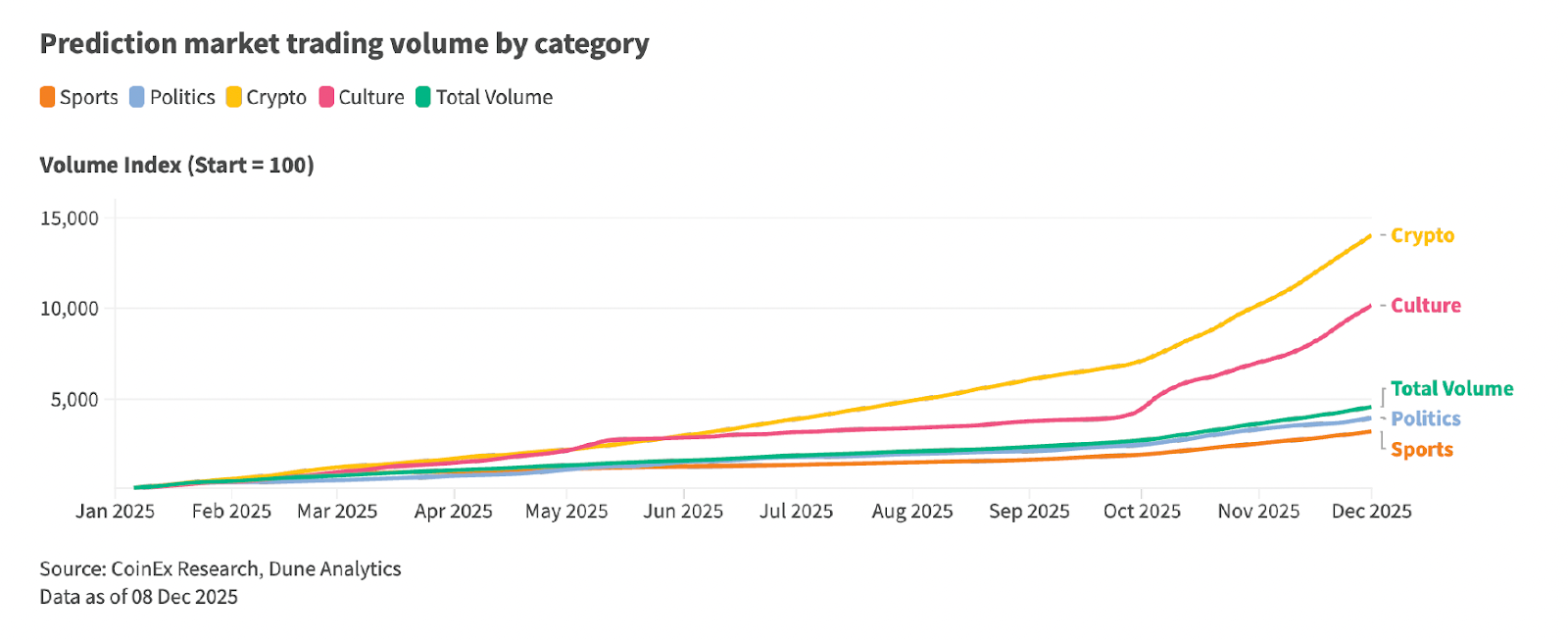

Prediction Markets and Real-Time Data Infrastructure

Weekly trading volume is expected to exceed $3 billion in 2025. Hybrid products combining prediction markets and traditional derivatives will emerge in 2026.

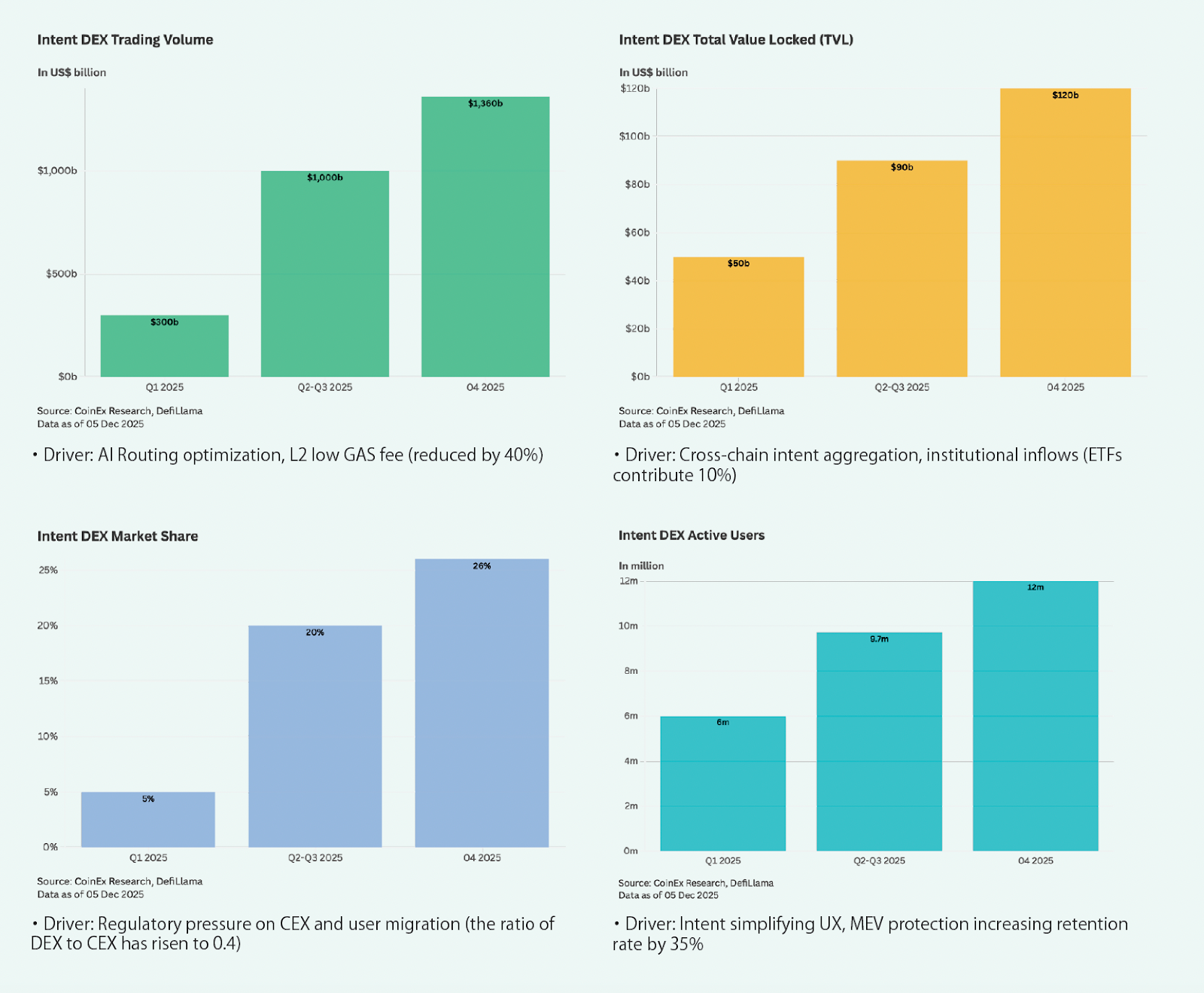

Intent Architecture: Solver Revolution

The Intent DEX market is worth $1.2 trillion , and it optimizes execution and eliminates MEVs through AI Solver.

The focus of competition has shifted to algorithm efficiency.

Core Investment Pool: Protocols with Real Value Capture Capture

Prioritize the Fee Switch protocol (revenue > emissions):

- Perpetual Contracts: Hyperliquid

- Aggregator: Jupiter

- DEX: Raydium, Aerodrome, PancakeSwap

- Others: Pump.fun, SKY, Aave, Lido

Avoid governance tokens that have no cash flow.

VI. AI × Crypto: Buying Cryptocurrency or Using Tools?

AI × Crypto is heading towards a fork:

One approach is "concept token speculation," while the other is the tool-based and productivity-oriented approach .

Infrastructure of the machine economy

Protocols such as x402 support Agent payments of less than $0.0001 with a processing time of 200ms .

Web3 is becoming a key infrastructure for physical AI and decentralized computing power.

Strategic Shift: From Conceptual Speculation to Productivity Alpha

Distinguish between genuine PMF (verifiable reasoning, agent payment, decentralized GPU) and marketing narratives.

Building AI-enhanced systems:

- Research: Agent aggregation chain and sentiment data

- Decision: LLM noise filtering

- Execution: Automated Arbitrage, DCA and Risk Control

The ultimate advantage lies in "Vibe Coding" —building trading agents using natural language, enabling retail investors to become "super individuals".

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please conduct your own research. The author is not responsible for any losses incurred.

About CoinEx

Founded in 2017, CoinEx is an award-winning, user-centric cryptocurrency exchange. Established by ViaBTC, a leading global mining pool, the platform was one of the first exchanges to release Proof of Reserves , guaranteeing 100% security of user assets.

CoinEx covers 200+ countries and regions, 10 million+ users, supports 1400+ crypto assets , and has issued its ecosystem token CET.

Learn more: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube