TechnoRevenant Raised $300 Million in 7 Days: Is It an Insider or the New King of the Blockchain?

- 核心观点:神秘交易员TechnoRevenant巨额收益引市场操控争议。

- 关键要素:

- Hyperliquid上意外操作获利3800万美元。

- 早期投资WLFI获利超2亿美元。

- 与Jump Trading等机构有资金往来。

- 市场影响:暴露低流动性市场易被操控风险。

- 时效性标注:中期影响。

The two most discussed topics on the blockchain lately are the XPL "arbitrage incident" on the leading perp DEX Hyperliquid and the launch of the WLFI project, led by the Trump family. The name "TechnoRevenant" has repeatedly appeared in both topics. There's no photo of him online, no real name, and no clear background, but this mysterious figure, who uses a bionic figure and enjoys techno music, raked in nearly $300 million from the on-chain market in just one week.

Who is TechnoRevenant, the man who earned $38 million in 20 minutes while Hyperliquid users lost hundreds of millions, and who invested $15 million earlier this year to become a major investor in WLFI? How did he do it?

WLFI Big Investors’ “Fat Fingers”

On the evening of September 1st, as many pre-sale addresses rushed to claim WLFI tokens in an effort to sell at the opening high, causing Ethereum gas fees to exceed 100 Gwei for the first time in a long time. However, moonmanifest.eth, an address holding 1 billion WLFI tokens, calmly claimed its tokens. Community verification later revealed that this address was TechnoRevenant, known for its $38 million profit on Hyperliquid last week.

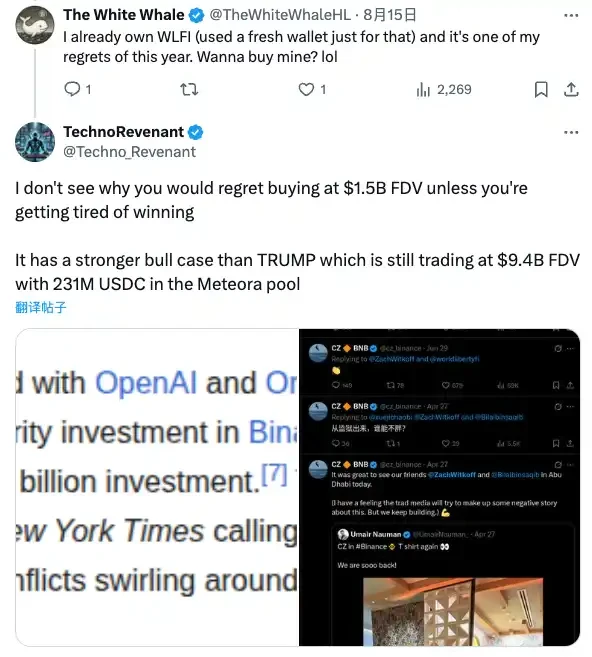

TechnoRevenant began planning its World Liberty Financial project as early as January 2025 , before Trump officially took office as President of the United States. The official website's "Gold Paper" also stated that WLFI was non-transferable. However, TechnoRevenant invested 13 million USDC and 2.01 million USDT through the moonmanifest.eth wallet, totaling approximately $15 million, in WLFI's first public offering, purchasing approximately 1.5% of the total supply.

On September 1, 2025, when WLFI officially began trading, TechnoRevenant received 200 million WLFI as a 20% unlocked share, valued at approximately $49 million. The remaining 800 million WLFI remain locked. Based on the current price of $0.245, the total value of its 1 billion WLFI reaches $245 million, achieving a paper return of 8-16 times.

In addition to being a major investor in the Trump family project WLFI (worldlibertyfi), what really surprised the market was the generous returns he "accidentally" obtained by going long on XPL on Hyperliuquid as a "contract novice."

What happened in the early morning of August 27, 2025, was a bitter lesson for those who hedged or shorted the Plasma project token XPL on Hyperliquid.

Starting at 5:36 AM on August 27th and continuing for over two hours, approximately $159 million in holdings on Hyperliquid were liquidated, affecting over 1,000 traders. Several addresses were found to be buying large amounts of tokens in an attempt to manipulate the already illiquid XPL pre-market on Hyperliquid. However, TechnoRevenant, a "newbie" who was only operating the contract for the fifth time, later admitted that the incident was caused by an accidental "fat finger."

TechnoRevenant said that because he was optimistic about XPL but did not participate in the pre-sale, he began to build exposure when Hyperliquid launched its pre-market perpetual contract trading. Before that, he used three wallets to purchase XPL at a scale of US$44,000 each. In two days, he accumulated 54.4 million XPL, which was worth between US$31 million and US$33 million based on the market value at the time.

However, in just 15 seconds, between 05:36:05 and 05:36:20, he accidentally typed an extra "4" in his purchase amount 10 times, claiming he was "drowsy." This caused his single purchase amount to increase from $44,000 to $444,000, resulting in a massive investment of approximately $4.44 million for 7,288,505 XPL tokens, representing 77.37% of the total long position at the time. This move also pushed the XPL price up from $0.587 to $0.65 within a minute, a 10.8% increase.

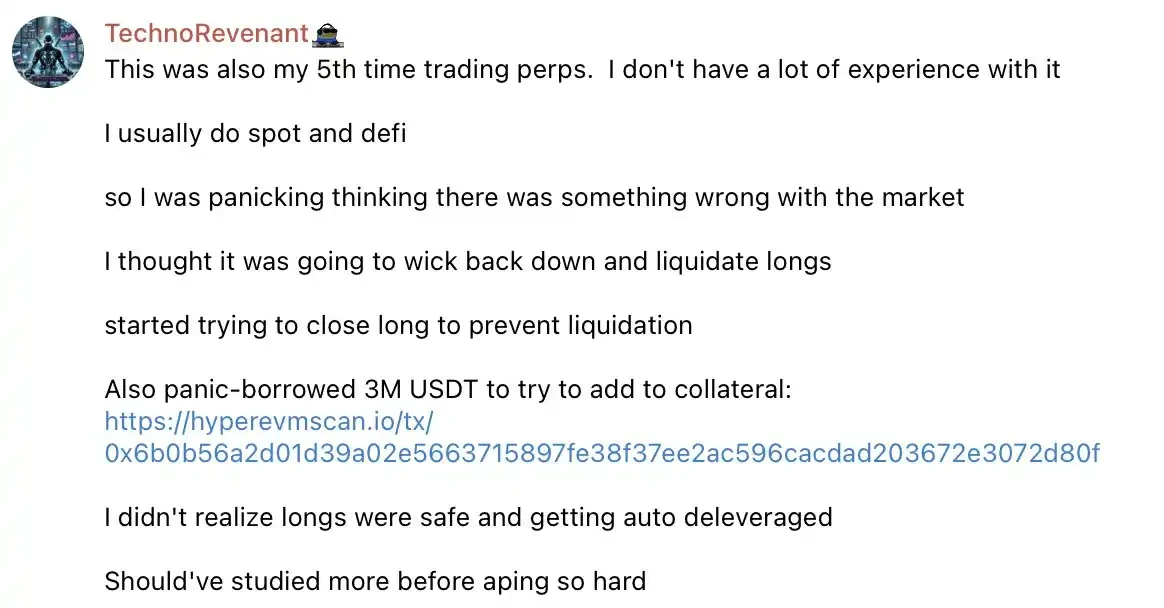

By the time he realized the problem, the market had begun to decline slightly. He even nervously borrowed $3 million as a precaution. He tried to close his long position, but he didn't realize that the large amount of his position made it safe. Hyperliquid activated the automatic position reduction mechanism during this period. For the next 15 minutes, he continued to buy in large amounts of $45,000 each, and then began to gradually close his long position.

He ultimately profited $38 million from this trade, and to this day, he still holds over $30 million in long XPL positions, representing 87% of the total open interest on Hyperliquid, with an additional $26 million in his account to continue buying. This has also kept the price of XPL on Hyperliquid at a 20-30% premium compared to other trading platforms.

Radical opportunist or market manipulator?

TechnoRevenant's actions sparked heated discussion in the crypto community. Supporters hailed him as a "god-level market interpreter," citing his consistent winning streak as commendable. The community even memed the "fat finger" incident, calling it "the best typo ever." Despite causing significant losses for many traders, the community debated his manipulation of the market using large sums of money.

However, some opinion leaders, including Zhu Su, stated that this was not an exploitation of a contract loophole, but rather a normal trading behavior. Furthermore, unlike other recent DEGEN contract traders, his trading was more rational and less extreme, leading many traders to follow his lead and go long on WLFI (FDV has now jumped to $24.6 billion).

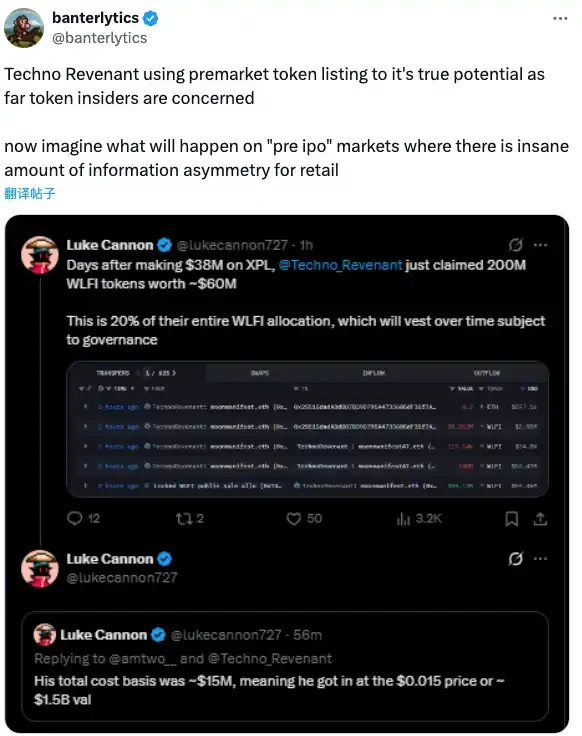

On-chain data shows eight USDC transfers between moonmanifest.eth and Jump Trading, totaling $27 million. The platform also frequently interacts with top market makers like Wintermute and Amber. Furthermore, the platform invested $15 million in WLFI during its early stages, when token unlocking and transferability were uncertain. These signs suggest that TechnoRevenant may not be an ordinary retail investor, but rather a professional trader with institutional background.

This has further fueled concerns within the community about the recently popular on-chain equity (pre-IPO) model. KOL banterlytics stated on X, "Having seen how TechnoRevenant has already had such a significant impact on the token pre-market, imagine what would happen if this happened to a pre-IPO with even more insider information."

TechnoRevenant's frenzied on-chain "printing money" continues, and this mysterious trader once again demonstrates how easily whales can manipulate illiquid markets. With the advent of the blockchain era, the impact of on-chain transactions may extend beyond the physical chain itself, potentially affecting housing prices in a region or the valuation of a startup. Before we usher in this "new era," we must confront the question of whether blockchain's liquidity and mechanisms can support this transformation.