A quick look at Google's blockchain GCUL, a Layer 1 public chain or a consortium chain?

- 核心观点:谷歌云推出私有许可链GCUL。

- 关键要素:

- 面向金融机构私有测试。

- 支持Python智能合约。

- 与CME合作试点结算。

- 市场影响:推动机构采用区块链技术。

- 时效性标注:中期影响。

Original author: Nicky, Foresight News

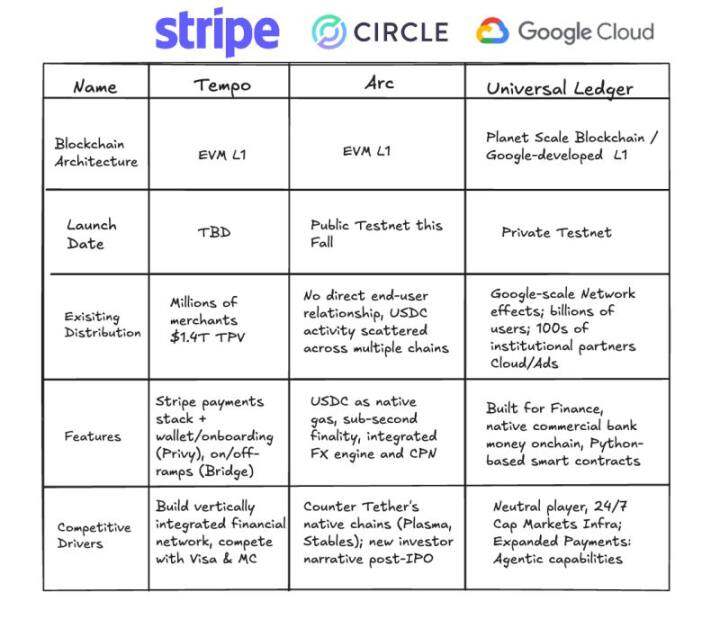

Recently, Rich Widmann, Head of Web 3 Strategy at Google, announced via social media the official launch of its blockchain network, Google Cloud Universal Ledger (GCUL), defining it as a "Layer 1 blockchain." This has sparked debate over its technical positioning: Is GCUL a true Layer 1 public blockchain, or is it more akin to a traditional consortium blockchain?

Official positioning and core features

According to an official description, GCUL is designed as a "high-performance, trustworthy, neutral, and Python smart contract-enabled distributed ledger platform." Currently in a private testnet phase, it primarily serves financial institutions. Google Cloud emphasizes that GCUL aims to simplify the management of commercial bank currency accounts and enable multi-currency and multi-asset transfers and settlements through distributed ledger technology, while also supporting programmable payments and digital asset management.

In its official release, "Beyond Stablecoins: The Evolution of Digital Currency," Google further elaborated on the positioning of GCUL: It aims not to "reinvent money" but rather to address the fragmentation, high costs, and inefficiencies of the traditional financial system by upgrading infrastructure. GCUL is packaged as a service and provided through an API, emphasizing its ease of use, flexibility, and security, particularly in terms of compliance (such as Know Your Customer verification) and private deployment.

Notably, GCUL's early testing has already begun in collaboration with the Chicago Mercantile Exchange (CME Group). In March 2025, the two parties announced the launch of a distributed ledger pilot to explore solutions for wholesale payments and asset tokenization.

CME CEO Terry Duffy said GCUL is expected to improve the efficiency of collateral management, margin settlement and other aspects under the "24/7 trading trend"; Google Cloud Financial Services General Manager Rohit Bhat emphasized that this cooperation is "a typical case of traditional financial institutions achieving business transformation through modern infrastructure."

Layer 1 and Consortium Chains: Definitions and Differences

In the blockchain world, Layer 1 typically refers to the underlying public blockchain, such as Ethereum and Solana. Its core characteristics include decentralization, permissionlessness, and transparency. Any user can freely participate in network verification, transactions, and smart contract deployment, and on-chain data is visible to everyone.

In contrast, a consortium blockchain is a permissioned distributed ledger jointly maintained by specific organizations or institutions, with controlled node access and customizable data access permissions. Typical applications include Hyperledger Fabric and Ant Chain. While consortium blockchains offer advantages in compliance, controllability, and high performance, they sacrifice openness and censorship resistance.

Which model does GCUL better fit?

Judging from the information currently disclosed, GCUL exhibits obvious characteristics of a consortium chain:

- Private and permissionless: GCUL explicitly runs on a "private and permissioned network", and node access and account permissions are controlled by the management agency.

- Target users: Focused on financial institutions (such as CME Group), rather than the public's free participation.

- Compliance first: The original design intention includes traditional financial compliance requirements such as KYC verification and transaction fees complying with outsourcing regulations.

- Technical Architecture: Although it supports smart contracts (based on Python), its underlying infrastructure is maintained in a centralized manner by Google Cloud, which differs from the "decentralized" Layer 1 concept.

However, Google Cloud officials still insist on calling it "Layer 1," emphasizing its "trust neutrality" and "infrastructure neutrality"—meaning it can be used by any financial institution, not just by specific interest groups. This narrative attempts to blur the lines between public and consortium blockchains.

Third-party perspective: doubt and wait-and-see

Industry practitioners have expressed different views on GCUL's positioning:

- Liu Feng, partner of BODL Ventures, believes that GCUL is more in line with the characteristics of a "consortium chain" and is essentially different from decentralized, permissionless public chains.

- Dragonfly partner Omar said that Google's previous description of GCUL was rather vague, and now the team clearly tends to package it as "Layer 1", but the actual technical details have not yet been fully disclosed.

- Helius CEO Mert pointed out that GCUL is currently still a "private and permissioned" system, which is different from the open model of the public chain.

Despite skepticism, some believe GCUL could represent a form of "incremental innovation." For example, the pilot program between Google and CME Group demonstrates institutional demand for the application of distributed ledger technology in scenarios like settlement and collateral management. If GCUL can integrate Google's technical capabilities and financial compliance experience, it may be able to forge a practical path between traditional finance and blockchain.

Disclaimer: This article is based on public information analysis. The specific technical architecture and operating model of GCUL are still subject to subsequent official disclosure by Google.