Losing in social, gaining in crypto: The Winklevoss twins and Gemini’s road to IPO

- 核心观点:Gemini冲刺上市,加密CEX合规化加速。

- 关键要素:

- Gemini提交SEC注册声明,拟纳斯达克上市。

- 2025年上半年净亏2.8亿,收入依赖交易费。

- 创始人兄弟曾押注比特币,现财富达150亿。

- 市场影响:推动加密交易平台合规化进程。

- 时效性标注:中期影响。

After Bullish rang the bell on the New York Stock Exchange last week, becoming the second publicly listed cryptocurrency trading platform in the United States, Gemini finally couldn't hold back. This old American domestic trading platform, which has always focused on "compliance", began to compete for the third listing position.

This time, the spotlight is on twin brothers Tyler and Cameron Winklevoss, a pair already etched in the pages of American entrepreneurship textbooks. Over a decade ago, their legal battle with Mark Zuckerberg made global headlines; a decade later, they became among the first investors to make a significant bet on Bitcoin amidst the crypto boom.

Today, Gemini's listing isn't just a symbol of further regulatory compliance for crypto CEXs; it's also a sign that the two brothers have regained their footing in the new wave of US capital markets. They lost in social networks, but gained in the crypto wave.

Image source: Bloomberg

IPO season, Gemini sprints to go public

According to the latest news, Gemini publicly filed a registration statement (Form S‑1) with the U.S. Securities and Exchange Commission (SEC) on August 15, 2025, intending to list on the Nasdaq Global Select Market under the ticker symbol GEMI. Prior to this public filing, Gemini also filed a confidential IPO application in February 2025.

According to documents filed by Gemini, Gemini is choosing a traditional IPO, with Goldman Sachs and Citigroup serving as lead underwriters, with Morgan Stanley, Cantor Fitzgerald, and other institutions participating in the underwriting team. However, the prospectus does not yet disclose the offering price range or the specific share size. SEC approval is still required, and the listing date has not yet been determined.

Renaissance Capital estimates that Gemini's IPO could raise approximately $400 million. Additionally, the company has secured a $75 million credit line from Ripple to enhance liquidity through its RLUSD stablecoin, but has yet to draw down on it.

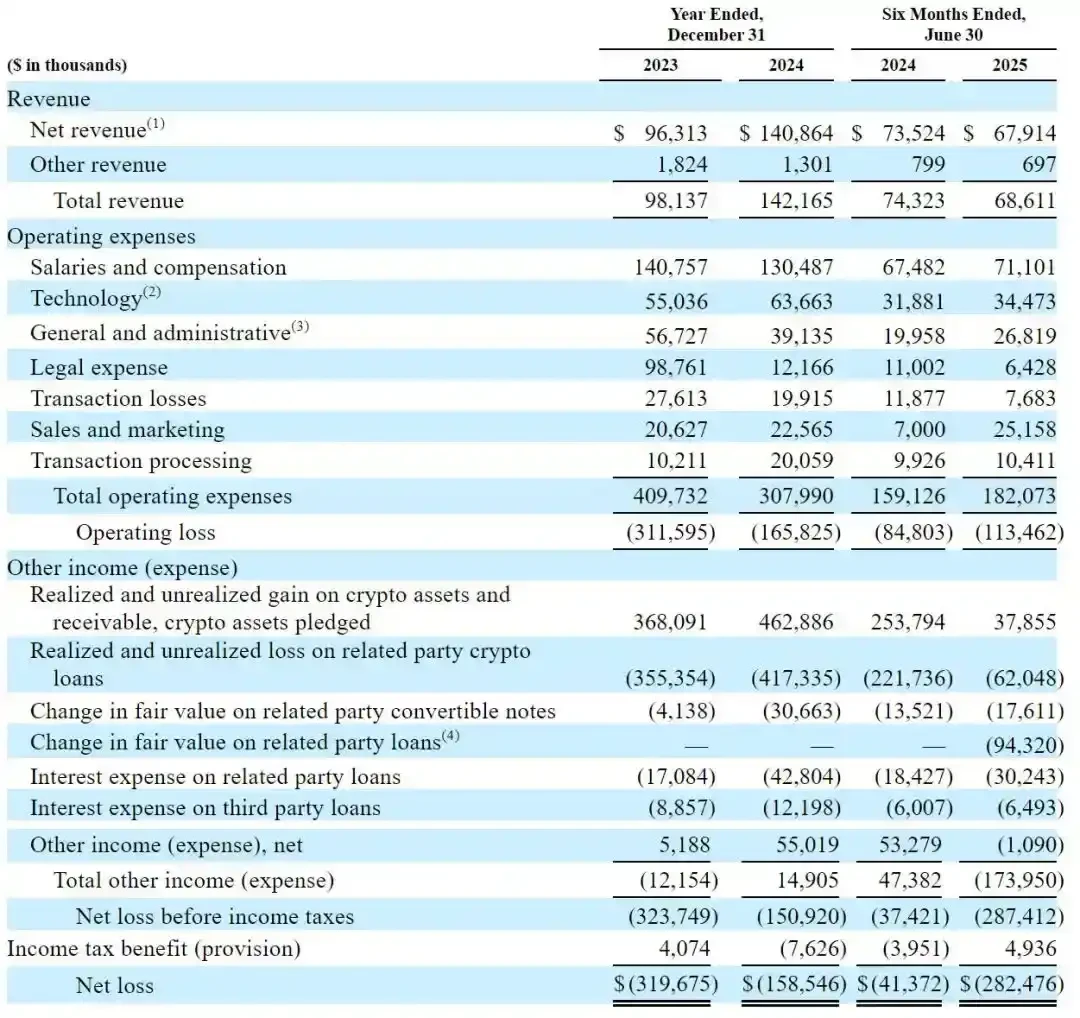

It's worth noting that Gemini is currently experiencing financial pain. According to its S-1 filing, for the six months ending June 2025, the company reported revenue of $68.6 million, but a net loss of $282.5 million, significantly higher than the $41.4 million reported in the same period last year. Trading fees remain the primary source of revenue, accounting for approximately 66% of total revenue in the first half of 2025. Gemini also provides services such as custody, staking, and the issuance of its stablecoin, Gemini Dollar (GUSD).

This round of IPOs also occurred amidst a generally recovering US IPO market, with a particularly strong showing for digital asset companies. Circle (a stablecoin issuer) and Bullish (a crypto trading platform) completed their IPOs a few months ago and last week, respectively. Coinbase was also included in the S&P 500 index, significantly boosting market recognition of compliant trading platforms.

The most compatible twins on Wall Street

Compared to Gemini itself, the story of the two founders may be more interesting.

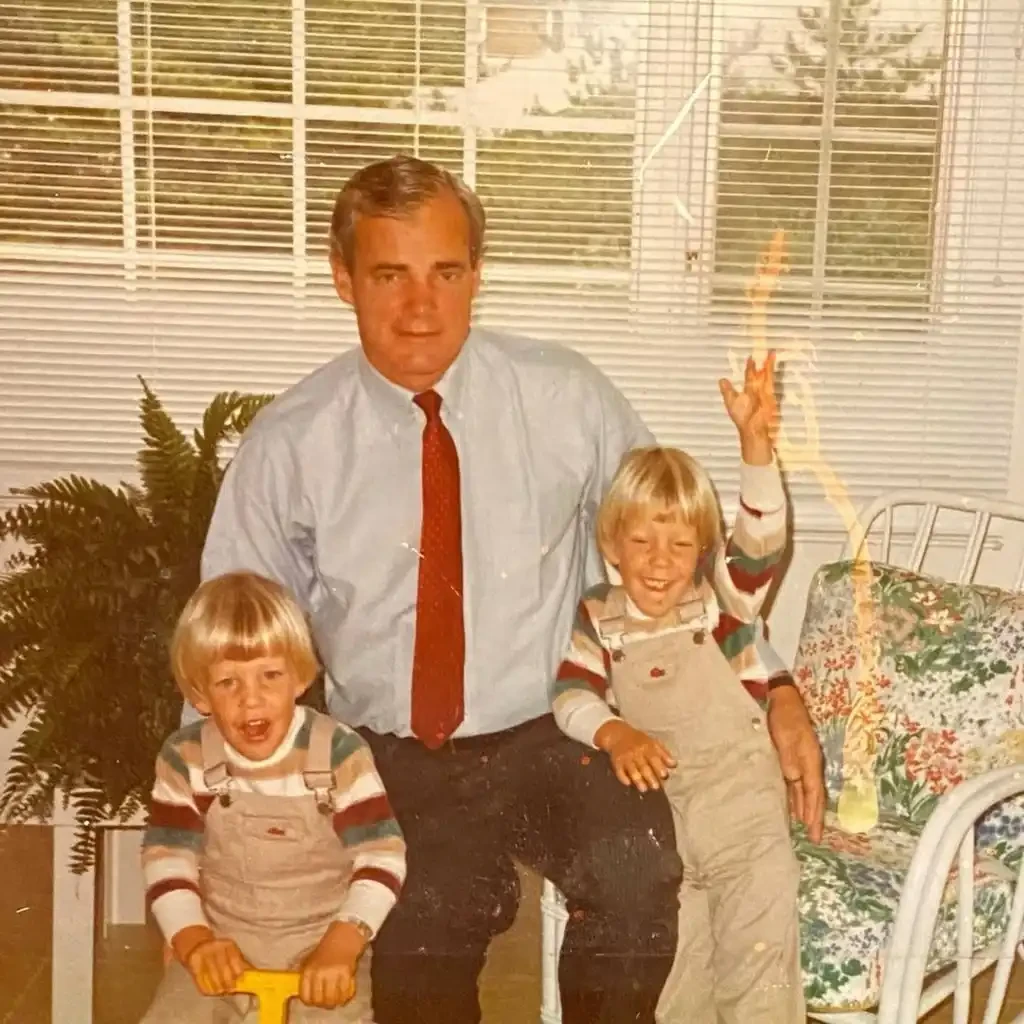

In the summer of 1981, Tyler and Cameron Winklevoss were born into a family of both academics and wealth. Their father, Howard, was a professor of actuarial science at the Wharton School of the University of Pennsylvania and an investor. The brothers grew up in Greenwich, Connecticut, a quiet town known for its wealthy, where manicured lawns and yacht marinas were common sights.

The Winklevoss brothers and their father

As teenagers, the Winklevoss twins were practically perfect: high achievers, handsome, and boundless energy. They taught themselves programming and were tinkering with websites by the age of thirteen or fourteen. They also took turns playing guitar and drums in their band. Their mother always said they were mirror images from birth: the same blue eyes, the same high cheekbones, even their cries had a certain synchronized rhythm.

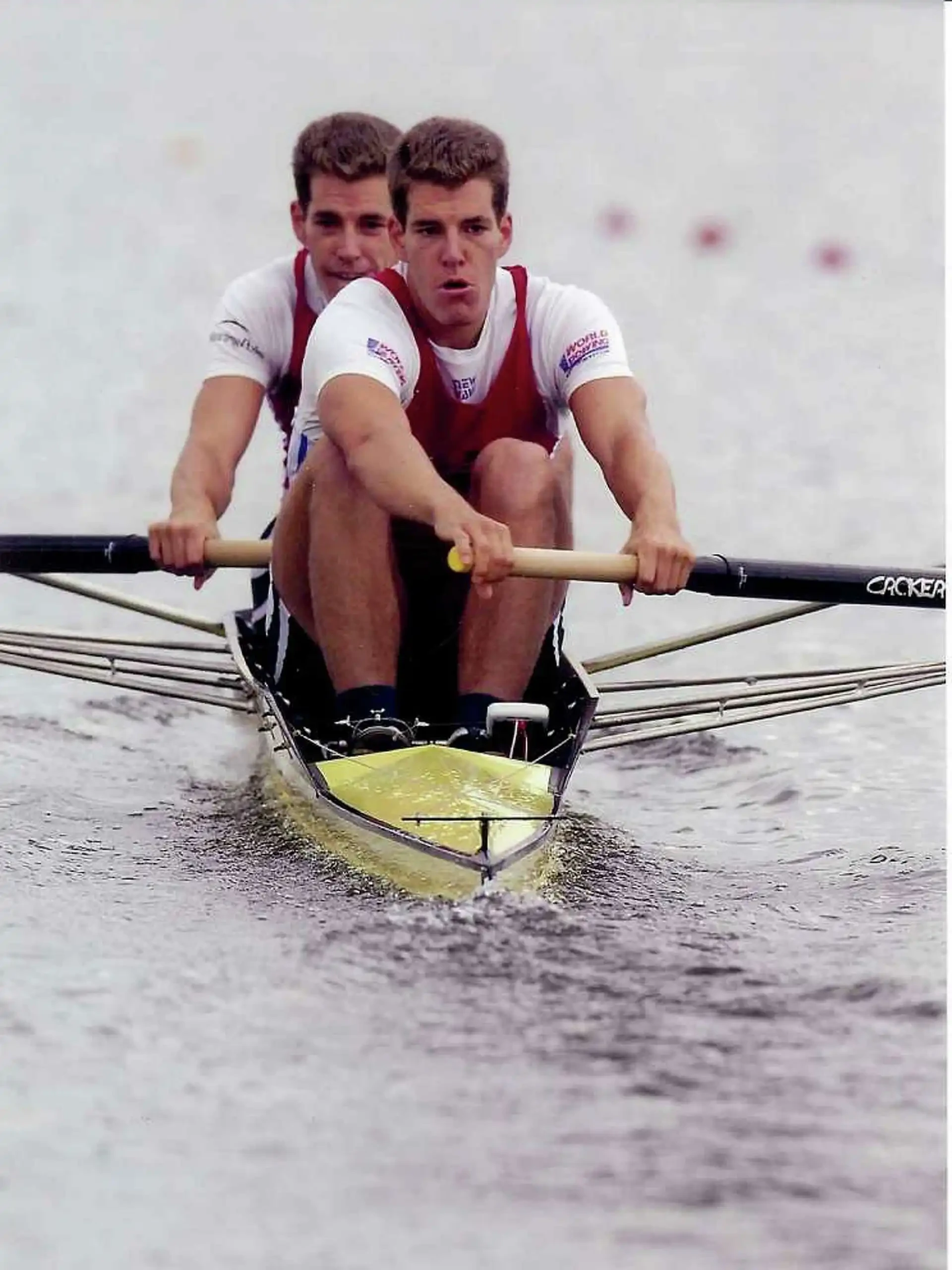

Their subsequent youthful paths overlapped almost perfectly: undergraduate economics studies at Harvard University, further studies at Oxford University, and a rowing career that went down in sports history. At Harvard, they were the backbone of the varsity rowing team, nicknamed the "God Squad" by their teammates for their coordinated strokes.

Winklevoss brothers rowing

In 2008, they represented the United States in the coxless doubles event at the Beijing Olympics, finishing sixth. While they missed out on a medal, the long-term training they put into synchronized breathing, and the intense unity of muscles and will on the water, laid the foundation for their future partnership in starting a business.

The dispute with Zuckerberg

In their junior year at Harvard, they launched a campus social networking site, HarvardConnection, which was a new idea they had been thinking about for a long time: if Harvard students' profiles, photos, and relationships could be put on the same site, it might become a new way to socialize.

This idea later evolved into a dispute between them and Zuckerberg.

The brothers were star rowers, skilled at getting their oars into the water, but they were also deeply interested in technology. However, they weren't top programmers, so they teamed up with classmate Divya Narendra to develop a website. During this process, they found a sophomore to help with the coding—his name was Mark Zuckerberg.

The story unfolds with even greater drama than fiction. Initially, the brothers had high hopes for Zuckerberg, believing he could help complete the core functionality of the website. But after a few weeks, Zuckerberg's messages became less and less frequent, and progress remained elusive. He offered various excuses: heavy workload, system bugs, needing more time. Then, one day, the brothers discovered that Zuckerberg had quietly launched a website called TheFacebook. Its interface and style were strikingly similar to their vision for HarvardConnection, with only a different name and domain name.

The anger quickly turned to legal action. In 2004, the brothers and Narendra sued Zuckerberg, accusing him of stealing ideas and source code. The lawsuit dragged on, and Zuckerberg's Facebook expanded rapidly, becoming one of Silicon Valley's hottest companies.

This tangled story was also brought to the screen by Hollywood in the movie "The Social Network".

In 2008, they settled for $65 million, including a significant amount of Facebook stock. At that moment, they became the "Facebook losers." But fate often reverses: a few years later, that money was their ticket to the world of cryptocurrency.

They first heard about Bitcoin in 2012. At the time, few truly understood the technology, but the brothers keenly sensed its potential. They used part of the proceeds from the settlement to purchase Bitcoin, ultimately holding 70,000, or about 1% of the total supply. What was then a small bet has now become a multi-billion dollar legend.

Some people joked that if it weren't for the dispute with Facebook, there might not be Gemini today.

In 2014, Gemini was born. The brothers decided not to be the ones who "missed out on Facebook," but to firmly navigate this wave of technological change. Unlike the trading platforms that were growing wildly and operating in a murky area at the time, Gemini embraced regulation from the outset, applying for a trust license from the New York State Department of Financial Services (NYDFS) and strictly adhering to Wall Street compliance standards. The brothers even introduced a daily Bitcoin auction mechanism, mimicking Nasdaq-style trading rules, hoping to reassure institutional investors.

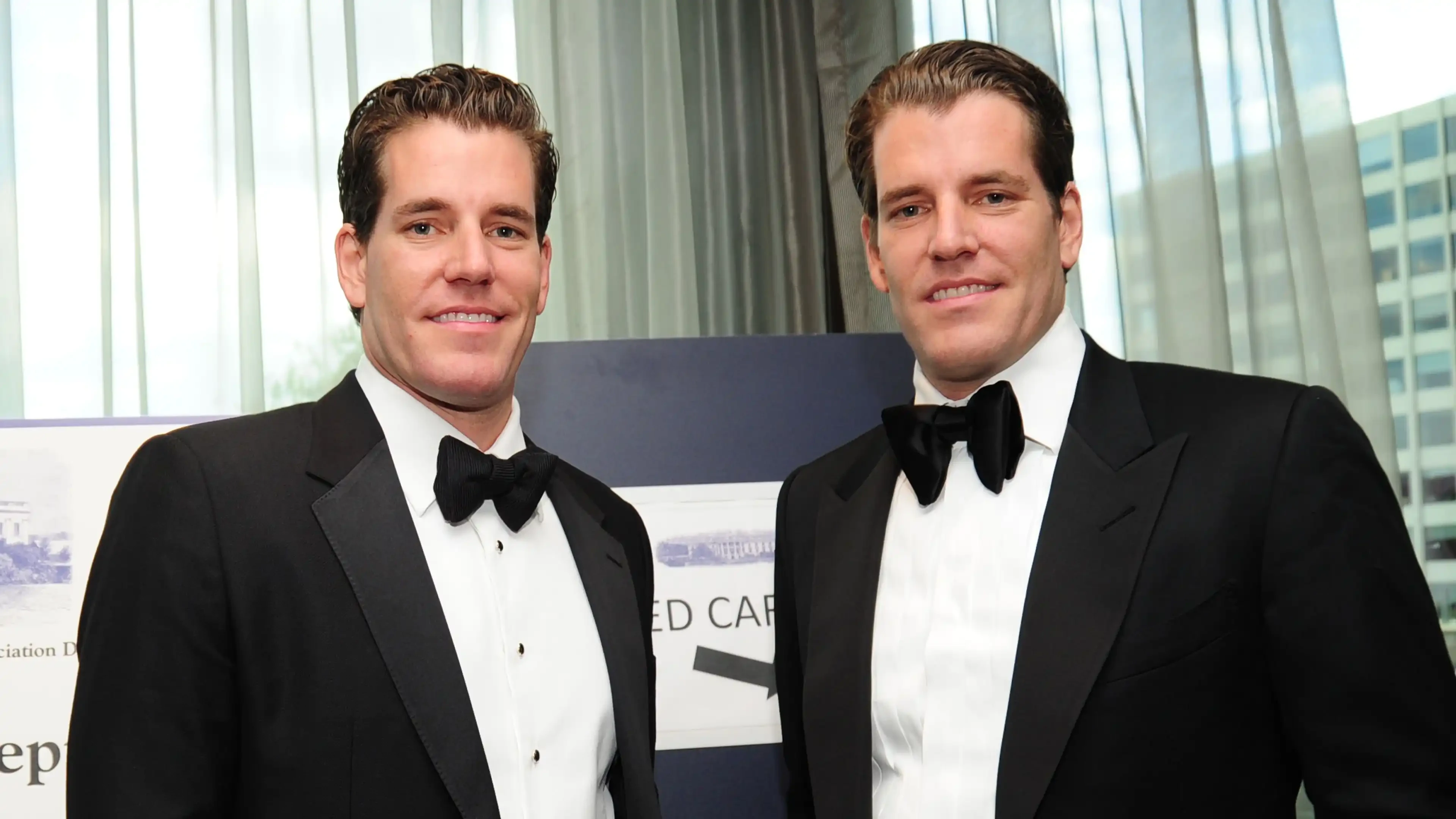

The division of labor between the brothers gradually became clear. Tyler focused more on internal affairs and strategy, excelling at management and meticulous execution; Cameron, on the other hand, was the spokesperson, preferring to appear in public and tell Gemini's story. Their roles, one insider and one outsider, were clearly defined, and their rapport became almost instinctive.

Compared to Binance and OKX, Gemini hasn't experienced rapid expansion; compared to Coinbase, Gemini lacks the Silicon Valley engineering romance. They're often labeled "compliance advocates," appearing in suits at congressional hearings and before media cameras, emphasizing the need for institutionalization and legal protection for cryptocurrencies.

Today, according to Bloomberg estimates, the brothers each hold over 5% of Gemini's shares, with a personal net worth of $7.5 billion and a combined wealth of $15 billion. Their names are no longer just about their feud with Zuckerberg; they are now deeply intertwined with the rise of Bitcoin and the development of regulated trading platforms.

The previous defeat was reversed by another technological wave.