With over 97% support, who will be the biggest beneficiary of LayerZero's acquisition of Stargate?

- 核心观点:LayerZero收购Stargate将强化ZRO生态。

- 关键要素:

- ZRO持有者受益于STG收入回购代币。

- STG持有者获16%溢价但补偿有限。

- Stargate依赖LayerZero技术实现扩张。

- 市场影响:跨链协议整合加速生态集中化。

- 时效性标注:中期影响。

Original article from matt

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Editor's Note: On the morning of August 18th, voting began on the LayerZero Foundation's proposal to acquire Stargate , with support currently at 97.09%. Voting will close on August 24th. Judging by the current vote count, LayerZero's successful acquisition of Stargate is a foregone conclusion. So, who will be the biggest beneficiary of this acquisition?

Proposal Summary

LayerZero intends to acquire the Stargate token and its treasury (specifically, the treasury backing each STG token at a value of $0.1444 USD), thereby dissolving the Stargate DAO and merging it with the ZRO-powered economy. The acquisition price is $0.1675 USD per STG, or 1 ZRO = 0.08634 STG.

This proposal follows the same standard process as other proposals posted on the Stargate DAO, requiring at least 1.2 million votes and a 70% quorum for approval. If the acquisition is approved, any future excess revenue generated by Stargate will be used to reduce the circulating supply of ZRO through buybacks.

Who is the biggest beneficiary of the acquisition?

Under the current circumstances, it seems that LayerZero and ZRO token holders will benefit the most from this acquisition, as it is a liquidity acquisition for them via their own tokens , meaning:

- Acquisition at a 16% premium to the STG price backed by the Stargate vault, while also increasing the number of ZRO holders;

- Revenue comes from fees generated by the protocol. According to DefiLlama data, the Stargate protocol generates $1.74 million in annual revenue. These fees will be used to repurchase ZRO on the open market.

- Vertically integrate ZRO token economics with LayerZero's cross-chain business expertise and enhance its utility through buybacks.

But what do STG and veSTG (locked STG) holders get? Not much, actually.

Due to the recent price increase of the ZRO token, the discount has become smaller, while STG's premium is smaller due to market volatility and has a clear price floor. After some discussion, LayerZero decided to pay six months of Stargate revenue to veSTG holders, as they were unable to unlock their tokens before the end of the lock-up period.

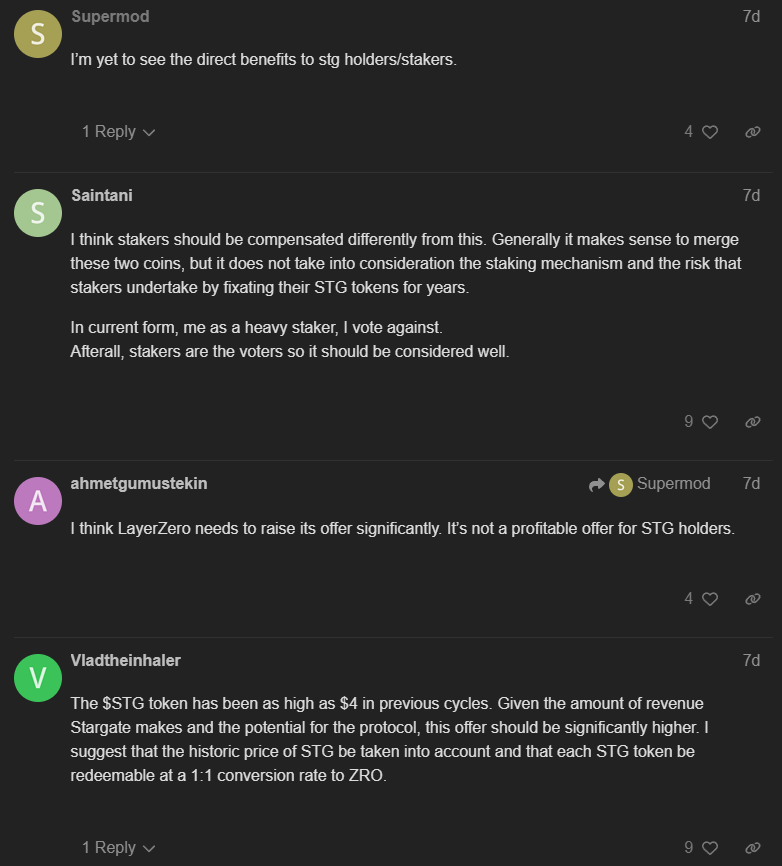

Complaints from STG Holders

There’s a lot to discuss here, but I think it all boils down to one word: compromise. Under the current circumstances, LayerZero stands to gain more, while Stargate token holders are likely to be dissatisfied, to say the least.

Dissatisfaction among STG holders

Here are three main questions and uncertainties:

- At what premium should LayerZero acquire STG tokens?

- Which is the lesser of two evils for STG holders? Selling the tokens permanently, or choosing a safer option with less of a yield?

- What are the incentives for veSTG holders now, given that the average lockup period is around a year and they would only receive six months of compensation if the proposal passes?

STG’s FDV is only slightly lower than ZRO’s by 10%, and $8.1 million worth of STG is locked up in veSTG. Many STG holders are demanding a 1:1 swap between ZRO and STG, but this isn’t very reasonable, as it would mean they would immediately receive a 12x return, while LayerZero would have to invest its entire FDV to acquire a well-funded company with low current revenue.

The acquisition is expected to achieve a win-win situation

While the LayerZero team should consider re-evaluating the premium paid to STG holders and offering a better revenue-sharing plan for stakers, the acquisition is not catastrophic for the Stargate project itself.

Because DAOs rely primarily on revenue and token issuance for funding, and tokens like STG have fallen over 95% from their all-time highs, Stargate has little room for further expansion with only $2 million in annual revenue. Furthermore, Stargate already relies on LayerZero's infrastructure, making it easier for Stargate to deliver and expand its capabilities with LayerZero's technology stack and financial support.

This acquisition makes sense for Stargate. However, the retention and loyalty of STG holders to LayerZero will largely depend on how the team handles this matter. Otherwise, LayerZero risks losing a significant number of new, potentially loyal ZRO holders and Stargate stakeholders, who have often supported the project since its inception.

But this is not a predatory acquisition, as LayerZero's current earnings are certainly far greater than those of STG and veSTG token holders.