Is the protocol fee cut-off imminent? Uniswap introduces DUNA architecture to strengthen DAO compliance

- 核心观点:Uniswap提案设立DUNI实体以增强DAO合规性。

- 关键要素:

- DUNI提供法律外壳,解决DAO合规痛点。

- 1650万美元UNI拨款用于税费及法律防御。

- DUNA框架或为协议费开关扫清障碍。

- 市场影响:提升DAO法律认可度,推动治理创新。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

On the evening of August 11, the decentralized exchange Uniswap Foundation released a proposal in the community governance forum , planning to establish a new legal entity for its governance organization - DUNI , and to land it under the DUNA framework in Wyoming.

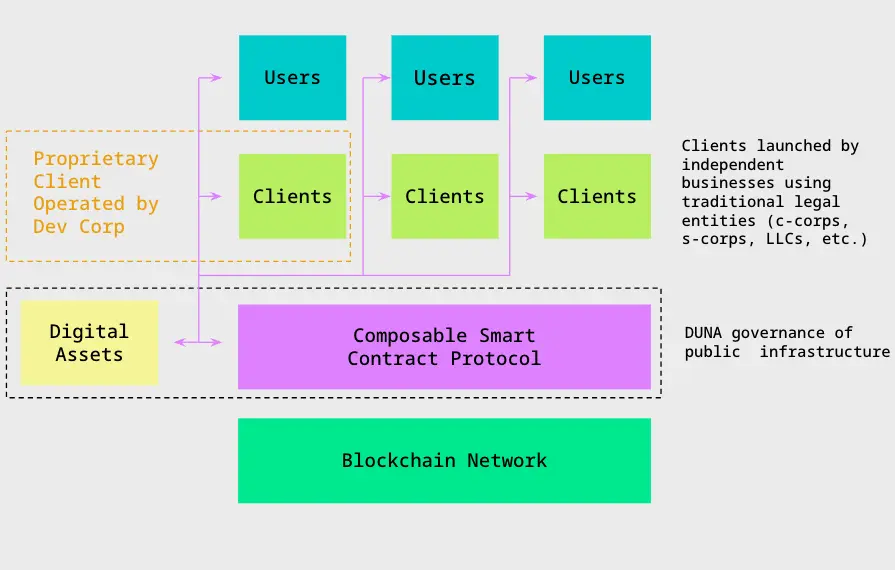

According to the proposal, DUNI will maintain the existing DAO governance mechanism and Uniswap protocol, while providing a compliant and limited-liability "legal shell" for the entire governing organization, enabling it to legally hire service providers, sign contracts, and handle tax matters. To this end, the Foundation intends to allocate $16.5 million worth of UNI to the new entity, of which approximately $10 million will be used to settle historical taxes and potential fines, and the remaining funds will be used as a future legal defense budget. In addition, DUNI will hire Cowrie, a firm whose co-founder was directly involved in the drafting of the DUNA Act, as its administrator.

It is worth noting that the General Counsel of the Uniswap Foundation clearly stated in the proposal that the adoption of the DUNA framework will not only enhance the legal protection and enforcement of the DAO, but is also expected to clear institutional obstacles for the launch of the "protocol fee switch" - once implemented, the DAO can transfer part of the LP transaction fees to the treasury under the compliance framework for community decision-making and ecological development.

What is DUNA and when was it enacted?

DUNA, the full name of which is Decentralized Unincorporated Nonprofit Association, is a new legal framework signed by the State of Wyoming in March 2024 and officially came into effect in July of the same year. It aims to provide DAOs with legal entity status and limited liability protection, and is regarded as one of the most "friendly" DAO compliance paths in the United States.

Unlike traditional companies or foundations, DUNA is defined as a nonprofit organization. While it can engage in profit-making activities, it must use its revenue for public, nonprofit purposes and is prohibited from distributing dividends to members (except for reasonable compensation and expense reimbursement) . Specifically, DUNA allows DAOs to sign contracts, hold assets, open bank accounts, and participate in litigation and arbitration as independent legal entities, while also providing members with limited personal liability protection . This means that DAO participants can fulfill their governance responsibilities without worrying about their personal assets being reclaimed due to collective decisions. Furthermore, DUNA's governance mechanism runs directly on the blockchain, executed through smart contracts and consensus algorithms.

In my opinion, DUNA addresses a key pain point that DAOs have long faced: maintaining decentralization while securing real-world legal recognition and protection. However, this "legal shell" is not without controversy. The US SEC and CFTC have consistently emphasized that DAOs cannot evade securities or commodities law obligations simply because they appear decentralized. If DUNA assumes an excessively heavy role and focuses too heavily on network operations, it could be viewed by regulators as a "centralized management entity," triggering stricter compliance requirements.

Comparison of DAO Governance Paths

The Uniswap Foundation's choice to use the DUNA framework to strengthen decentralized governance is just one of three main paths in the current DAO ecosystem. On the other end of the spectrum, two other cases—LayerZero and Yuga Labs—represent varying degrees of the trend toward "power retraction."

On August 10th, the LayerZero Foundation, a cross-chain protocol, released a draft proposal on the governance forum of Stargate, its incubated cross-chain bridge. The proposal proposes acquiring Stargate for approximately $110 million and dissolving the Stargate DAO. The proposal calls for the conversion of existing STG tokens to LayerZero's native token, ZRO, at a ratio of 1 STG to 0.08634 ZRO, with governance and assets fully vested in the foundation. Co-founder and CEO Bryan Pellegrino stated that this proposal aims to "bring the cross-chain bridge home," unifying governance and value media, and reducing the divergence and value dilution associated with multiple tokens and governance structures. (For details, see: "LayerZero Proposed Stargate Acquisition: Both Tokens Surge Over 20%, But This Group Strongly Opposes" ).

In June of this year, Yuga Labs, the company behind Bored Ape, went even further. CEO Greg Solano proposed dissolving the ApeCoin DAO and having a new entity, ApeCo, take over all governance and resources, effectively ending the existing DAO system. Solano argued that the ApeCoin DAO had become a "slow, inefficient, and noisy governance theater." The new entity would focus on three core projects: ApeChain, Bored Ape Yacht Club, and Otherside, empowering "real builders" through milestone funding and stronger accountability mechanisms.

Both cases point to a common trend: some leading projects are proactively reclaiming governance rights in an effort to improve execution efficiency. However, the three also offer stark contrasts: Uniswap is pursuing a path of "preserving decentralization while strengthening compliance capabilities"; LayerZero is achieving "centralized integration" through acquisitions; and Yuga Labs is opting for a complete rebuild from the ground up.

What this reflects is the trade-off between efficiency, compliance and decentralization of DAO - in the context of stricter regulation and intensified market competition, this differentiation trend may further deepen.

The significance of protocol fees

For Uniswap, the decision to advance the DUNA architecture at this time is largely a preparation for the "protocol fee switch." The protocol fee has been debated within the Uniswap community for years. The core of the issue is to take a small portion of LP transaction fees and inject it directly into the DAO treasury to fund public expenditures such as R&D and ecosystem development.

In theory, this is a way to return the value of the protocol to the governance organization, but in practice, protocol fees have long been subject to two obstacles: one is compliance - how does the DAO legally receive and manage this money? The other is tax and legal risks - when there is no legal entity, the flow of funds may trigger regulatory accountability and even make individuals involved in governance bear joint liability.

The introduction of DUNA provides an institutional solution to these problems. As a legally registered nonprofit entity, DUNA can open bank accounts, sign custodial agreements, and retain accounting and legal advisors in compliance with regulatory requirements, ensuring that protocol fee income is transparent, auditable, and compliant with regulatory requirements. Furthermore, limited liability protection protects DAO participants from personal financial risk in collective decision-making, which has a direct impact on lowering the barrier to participation in governance, increasing voter turnout, and fostering community activity.

According to OKX market data, boosted by the news, the price of UNI rose from a low of US$10.91 to US$11.99, a short-term increase of nearly 10% , and market sentiment has significantly improved.

What to watch next

In the short term, we need to pay attention to two key points: first, the outcome of the governance vote on the DUNA proposal , which will directly determine whether Uniswap has the institutional conditions to initiate protocol fees; second, the pace of progress on the protocol fee-related proposal. Once the legal framework is finalized, the community may usher in a new round of discussion and voting in the near future. The outcome remains uncertain.

In the longer term, if DUNA achieves positive results in legal protection, tax compliance, and operational efficiency, the Wyoming model is expected to be adopted by more DAOs; conversely, it may also be seen as another governance experiment in comparison with centralized paths such as LayerZero and Yuga Labs.