When Technology Meets Foreign Exchange Barriers: Why Is Stablecoin Growth Difficult to Break Through the "Traditional Dilemma"?

- 核心观点:稳定币交易量激增但面临外汇成本挑战。

- 关键要素:

- 2025年稳定币交易量达5万亿美元。

- 外汇成本与常规兑换类似。

- 新兴市场支付推动增长。

- 市场影响:支付巨头加速布局稳定币领域。

- 时效性标注:中期影响。

Original article by Sidhartha Shukla, Bloomberg

Original translation: Saoirse, Foresight News

Key Points

- According to data from Visa and Allium, stablecoin transaction volume has reached $5 trillion so far in 2025, involving 1 billion payments.

- When using stablecoins to exchange different fiat currencies, costs similar to regular exchanges will be incurred, including bid-ask spreads, exchange fees, intermediary fees, and slippage.

- Mike Robertson, CEO of foreign exchange infrastructure company AbbeyCross, commented on the limitations of stablecoins as an emerging payment tool: “In the cryptocurrency world, some people believe that code and technology can solve all problems. But in the foreign exchange world, this idea is naive.”

While stablecoins have reached a peak of anticipation, veterans in the fintech space still believe that these tokens have limitations as an emerging payment tool.

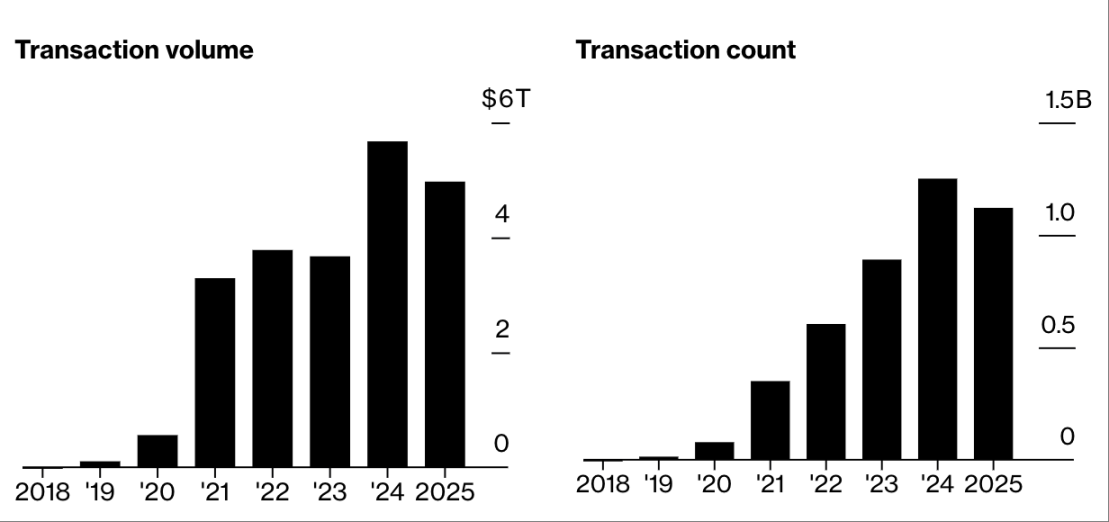

According to data from Visa and Allium, stablecoin transactions have reached $5 trillion so far in 2025, involving 1 billion payments, not far off the $5.7 trillion total for all of 2024. Since the election of Donald Trump as US president in November 2024, the total market capitalization of these cryptocurrencies, which are designed to closely track the price of established currencies such as the US dollar, has increased 47% to $255 billion.

The promise of stablecoins is a faster, cheaper, and more efficient future for payments, particularly cross-border ones. While data suggests this potential is gradually being realized, skepticism remains about whether the technology can solve the problems that have plagued foreign exchange for decades.

When exchanging a stablecoin for a different fiat currency (e.g., Euro to Hong Kong Dollar), many of the same costs as a regular exchange are incurred.

“In the cryptocurrency world, there’s a perception that code and technology can solve all problems. But in the foreign exchange world, that’s completely naive,” said Mike Robertson, CEO of AbbeyCross, a foreign exchange infrastructure company. “Each currency has its own unique dynamics. And most banks and payment institutions make their profits from foreign exchange transactions, not from fees.”

Stablecoin trading volume is expected to double compared to last year

Source: Visa, Allium

Note: Data for 2025 is as of July

Foreign exchange costs typically include bid-ask spreads, exchange fees, intermediary fees, and slippage. These costs also exist in cross-border cryptocurrency transactions and can be particularly pronounced during inflows and outflows , challenging the "low-cost" claims of stablecoin advocates.

The growth in stablecoin payments is mainly due to two application scenarios: one is to simplify cross-border transactions that are not covered by traditional financial institutions, and the other is payment services in emerging markets.

BVNK, a startup specializing in stablecoin payment infrastructure, is less focused on payment corridors between the British pound and the US dollar. Instead, it is focusing on “alternative” payment corridors, such as the Sri Lanka to Cambodia route, according to Sagar Sarbhai, BVNK’s managing director for Asia Pacific.

"This type of process typically requires multiple intermediaries, which is not only costly but also slow. Stablecoins simplify this process. While not necessarily cheaper at the moment, they are faster and more efficient in using funds," he said. BVNK currently has an annual trading volume of approximately $15 billion.

BVNK is not the only startup focused on helping businesses conduct stablecoin business.

After the cryptocurrency industry experienced a downturn in 2022, Conduit transitioned into the stablecoin payments space. The startup began using stablecoins to enable users to send remittances through local systems like Brazil's Pix and receive payments through SEPA (Europe's Single Euro Payments Area, a standardized payment system covering the European Union and several other European countries) . According to CEO Kirill Gertman, the company currently processes $10 billion annually.

Singapore-based Thunes and Canada-based Aquanow are also trying to work with stablecoin issuers and businesses to streamline payments.

“The rise of stablecoins is a business opportunity,” said Floris de Kort, CEO of Thunes, which raised $150 million in April. “The infrastructure may change, but people will always need to use local currencies and wallets to complete the ‘last mile’ of payment delivery.”

Venture capitalists rekindle interest in stablecoins

Source: CB Insights

Note: Data for 2025 is as of July 23

These figures may seem insignificant compared to the scale of established payment operators. According to Visa’s latest annual report, Visa alone will process $13.2 trillion in payments in 2024, more than double the total volume of stablecoin transactions during the same period.

But the rapid growth of the market has made payment giants highly alert. They are exploring the so-called "stablecoin mezzanine" model : introducing a stablecoin between two fiat currencies, bypassing traditional banking networks such as the Society for Worldwide Interbank Financial Telecommunication (Swift), and achieving transaction settlement within minutes. They are focusing on markets where US dollar liquidity is scarce and traditional systems are inefficient.

In October 2024, Visa launched a platform that allows banks to mint, destroy, and transfer tokens backed by fiat currencies, including tokenized deposits and stablecoins.

The recently passed GENIUS Act in the United States provides a clear regulatory framework for the world's largest stablecoin market, allowing banks and payment institutions to enter the sector with greater confidence. This has triggered a global race among regulators to develop similar regulations for stablecoin issuers.

“We’re just beginning to see the beginnings of exponential growth,” said BVNK’s Sarbhai. “The foundations laid over the past five years are likely to explode in the next 12 months.”