In February 2025, Zora, a social platform within the Base ecosystem, launched the "COIN" feature. Within a few months, Base officials actively promoted the concept of "content currency." From "Base for everyone" to many tokens released later, they disappeared after a period of popularity, and few people discussed them in the market.

Until the recent surge in the price of $ZORA, more and more people were paying attention to and discussing it. Sterlingcrispin, a researcher at DelComplex , retweeted a post by a community member praising ZORA and sarcastically said, "Any token with low liquidity and an exponential price curve is garbage, whether you call it a creator coin, a cultural token, an internet capital market, or a music token."

This prompted a discussion among the founders of Base. Jesse Pollak tried to explain the differences between "creator coins," "content coins," and "meme coins" in the subsequent discussion. Solana co-founder Anatoly Yakovenko also joined the discussion. He scoffed at Jesse's view on "content fundamentals." Their debate sparked a discussion in the community about the "basic value of content and the speculative craze."

Source: BOLD

Source: BOLD

In fact, this discussion has continued from the NFT boom to the present day but there is still no conclusion. The only difference is that the carrier has changed from "blue chip NFT" and "local dog NFT" to the current "content currency" and "Meme currency". This article will combine the perspectives of multiple markets with available data and research materials to analyze the truth behind it.

Does content currency have fundamental value?

From an economic perspective, fundamental value often refers to an asset's ability to generate cash flow, usage rights, or long-term utility. This metric is quite common in the stock market, as the company's revenue is often more closely related to its share price. However, before the cryptocurrency industry's "regulatory" craze this year, this metric was rarely discussed, as most cryptocurrencies lack actual business lines.

When Jesse initiated the discussion, he repeatedly mentioned the term "fundamentals matter," referring to content as inherently valuable. After hearing Jesse's response, Toly commented that his argument "sounds like there's zero fundamentals." He argued that creators rely solely on their personal reputation and social media following to prop up prices, making these coins akin to a one-time "pump-and-dump" marketing campaign. If a token truly possessed fundamental value, then even if the creator sold it, its value wouldn't be affected, as fundamental value should be independent of buying and selling. This popularity-dependent model differs from assets with real output or cash flow, and therefore hardly qualifies as "fundamental investing."

Most content coins are no different from memecoins. They lack sustained income or equity, their value is completely dependent on the creators or the community to maintain popularity, and they are easily affected by emotions and traffic, causing them to fluctuate wildly or even return to zero. Toly even bluntly stated that Coinbase should use transaction fees to buy those zero-value coins on Zora because they are lower than their "content base."

But Jesse's point might not be entirely unfounded. The fundamentals he's discussing aren't the effects of individual tokens (at least not in their current state), but rather the model that emerges from establishing a mature distribution system and copyright economy. Most content tokens are essentially short-term collectibles or gamified products, while true "creator fundamentals" require a large user base, sustained attention, and reasonable revenue distribution, which requires time and infrastructure development.

Regarding this point, Base's ecosystem manager expressed his views several months ago. To a large extent, this is similar to Base's values. He believes that whether it is the consensus prediction market for quantitative "rumors/news" such as Polymarket, which has been widely discussed in the market some time ago, or the quantitative "attention/content" market such as Kaito (quantified attention/attention), or the "content field", they can all be carried by the blockchain and should be supported rather than attacked.

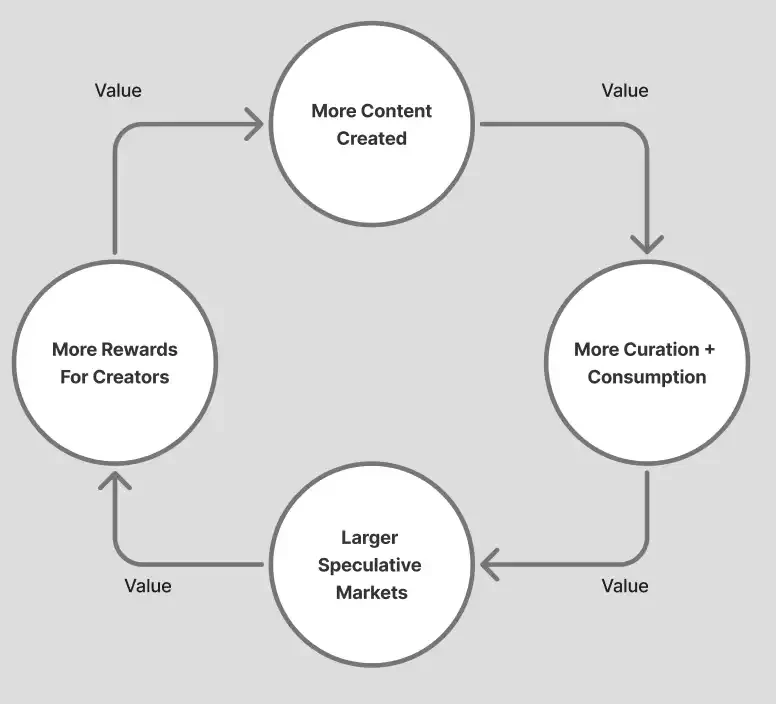

KOL @WagmiAlexander wrote an article titled " Why I Find Zora So Interesting? " He argues that the core of the attention market lies in creators and curators attracting users by producing and distributing content for free. Users, through free participation, contribute their attention, which is ultimately sold to advertisers for monetization. Facebook (3 billion monthly active users, market capitalization over $1 trillion, annual revenue of $164 billion), YouTube (2.7 billion monthly active users, valuation of $500 billion, annual revenue of $50 billion), and TikTok (1.6 billion monthly active users, valuation of $300 billion, annual revenue of $23 billion) are built almost entirely on the exploitation of user and creator value. Their valuations and revenue scales far exceed those of the crypto industry. Capturing even a small portion of their market share would significantly expand the on-chain economy, representing a trillion-dollar opportunity for decentralized social media to disrupt and capture.

Zora flywheel architecture, source: @WagmiAlexander

Zora flywheel architecture, source: @WagmiAlexander

However, similar products have appeared in the market more than once before. After the token skyrocketed, the concept could not be sustained and disappeared from the market. As of July 2025, Zora has processed more than 100 million transactions in total, and its market value has recently reached 1 billion, but its number of active addresses is only 250,000, of which daily active addresses are about 37,000.

Zora chain data, source: DUNE

Zora chain data, source: DUNE

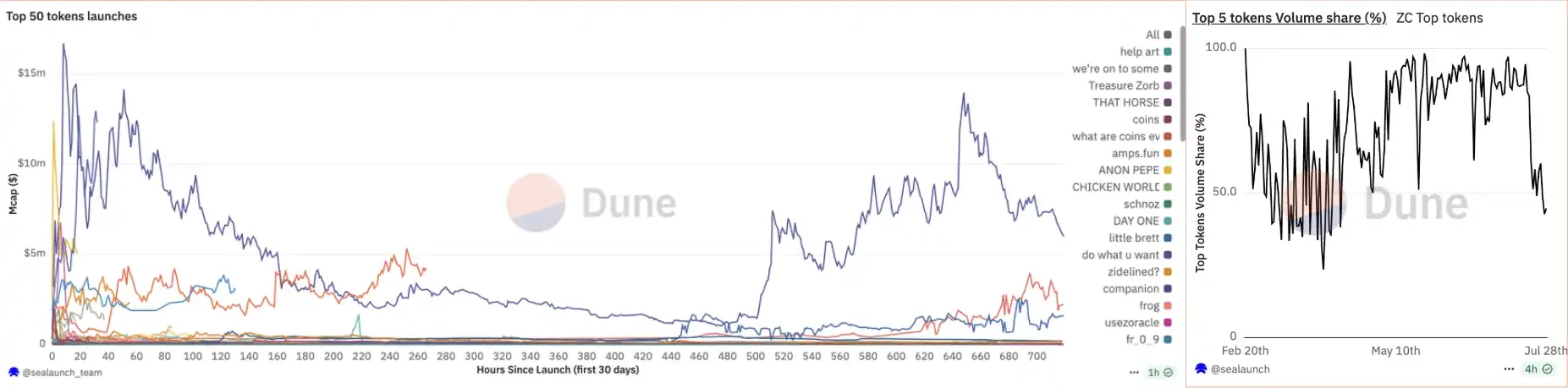

A total of 3.5 million contracts have been deployed on the Zora chain, of which 1.5 million are "content currency" contracts for the Zora App. However, for a long time, the market share of the top five tokens in terms of trading volume has always exceeded 60%. When the $ZORA token reached a new high on July 27, this data reached a new low (under the condition of exceeding 500,000 trading volumes). The ecosystem finally has other content tokens that have generated a "breakthrough effect", but in a sense, Zora's "graduation rate" is even lower than Pumpfun.

Left: Top 50 token market capitalization, Right: The proportion of the top five tokens in the total market capitalization, Source: DUNE

Left: Top 50 token market capitalization, Right: The proportion of the top five tokens in the total market capitalization, Source: DUNE

Despite recent significant growth, Zora remains significantly smaller than mainstream social media platforms. The majority of Zora's tens of thousands of daily active users are crypto-savvy, lacking mass distribution channels. Comparative data shows that Zora's user base and stickiness are far from those of influential social platforms. Establishing a strong "creator base" requires a large user base and sustained attention, which is precisely the bottleneck facing Zora and the content coin ecosystem. Currently, its "fundamentals" are not yet solid.

Source: BlockBeats

Source: BlockBeats

Despite ongoing criticism, the on-chain content economy still presents unique opportunities. First, the on-chain transparent ledger mechanism can automatically distribute revenue to creators, partners, and community members through smart contracts, reducing platform commissions and thereby increasing creator income. For example, data from Zora shows that 54% of the platform's revenue goes directly to creators. In Web 2, monetizing IP has always required complex channels. The issuance of personal tokens or limited-edition content coins not only fosters closer economic ties with fans but also allows for direct funding of creative projects.

However, this also requires clearer governance and rights design, otherwise it is easy to encounter legal risks related to unregistered securities. In the long run, building a decentralized social platform with a social relationship graph and content discovery algorithm is the key to forming a true on-chain content ecosystem. Regarding the current shortcomings of platforms like Zora in distribution capabilities, Mable Jiang, founder of the social protocol Trend, expressed understanding of Jesse's original intention and agreed with Toly's criticism. She just recently launched a product "similar" to Zora on Solana, Trend, and pointed out several key points:

Most content has no value. In today's world where generative AI can create content at almost zero cost, the vast majority of content lacks scarcity and lasting value. Many trending posts, even by well-known IPs, go untraded.

The lack of distribution and social graph makes it difficult for content on Zora to be discovered and generate value.

Some content does have commemorative value, such as recording historical events or artistic moments, and such content tokens may have long-term "weight". But this is a minority, and most content coins will not generate transactions, which is also an important reason why most content coins lack value.

The wool comes from the sheep, does blockchain have a creator economy?

The original poster, sterlingcrispin, raised the issue of incentives for content creation and content distribution in a further discussion with Jesse. He stated, "Through binary buy/sell decisions and market interactions, buyers and sellers can express their beliefs about the value of an asset at any time, but this may not be the best way to express their beliefs about the value of content creators."

He further stated that "the second-order effects and human behavior of the past decade have shown that this mechanism often evolves into a highly destructive zero-sum PvP game. Especially AMMs (Bonding Curve) with low liquidity and exponential price curves are suitable for large-scale mature markets with tens of millions or hundreds of millions of liquidity, rather than small creator scenarios. Most tokens on the market are almost "altcoins." Simply focusing on theoretical returns on paper is an idealized thinking standing in an ivory tower. The real problem is that we must face real human behavior."

A chart showing the volatility of the top 1,000 ERC20 tokens traded in AMMs. The chart shows the most volatile tokens (darker in the chart means more volatility) with declining market capitalizations. (This chart is, in my opinion, a work of art for crypto traders.) Source: Sterlingcrispin

A chart showing the volatility of the top 1,000 ERC20 tokens traded in AMMs. The chart shows the most volatile tokens (darker in the chart means more volatility) with declining market capitalizations. (This chart is, in my opinion, a work of art for crypto traders.) Source: Sterlingcrispin

Zagabond, the founder of the well-known NFT project Azuki, said about this incident, “We shouldn’t be angry when someone points out that certain tokens lack fundamental value. That’s okay, because in many industries, cultural/perceived value is already more valuable than fundamental value, such as luxury brands, intellectual property/collectibles, meme coins, artworks, etc. Tokenization is just the financial infrastructure to capture this value.”

It seems that no one has more say than Azuki on this matter. In fact, although the community criticized the release of multiple "Azuki sub-series" that caused its price to collapse (before the NFT bull market subsided), in fact, Azuki has never stopped looking for the IP path of NFT. Unlike the entity of Little Penguin and the game of BAYC, Azuki chose the most difficult path - making animation.

Azuki animation, source: Azuki official Youtube

Azuki animation, source: Azuki official Youtube

The quality of Azuki's animation production in Japan is actually quite high, and it once reached the level of breaking the circle. In addition, it has cooperated with many IP derivative brands that are still working hard. After going around in circles of IP construction, these "fundamentals" did not save Azuki's floor price. Without the support of business logic, sometimes value may be a more illusory thing, but the price is something that users can actually touch.

Azuki Mahjong, source: FrameBeans

Azuki Mahjong, source: FrameBeans

In a sense, this is actually a "destruction" of creators' creations. Some people in the community bluntly stated that this model will make creators more inclined to "please" token buyers rather than the creation itself. Brookejlacey, who has 300,000 TikTok followers, mentioned the confusion he encountered when playing BaseApp. The fact that BaseApp can make money has often appeared in Twitter streams recently, and they actually achieve it through "rewards" and "tokenization like Zora."

Brooke, a TikTok creator, said she earned $65 by posting the video "Women in Web 3" on BaseApp. "But that wasn't paid income like a creator would receive. I earned it by selling tokens. My wallet balance peaked at around $185, but as people started selling, I could only withdraw $65 before the pool was depleted. Is that considered supporting me? They weren't rewarding me, but hyping up a token with my name on it. And to get the money, I had to personally "dump the market."

In reality, products with these incentive mechanisms are like a Pandora's box for creators. On the one hand, they're rewarding their creative credit, while on the other, they face "returns" that can fluctuate by dozens of percentage points or even dozens of times. Traditional centralized social media platforms have already developed a comprehensive ecosystem for creators. For example, X, a platform most familiar to crypto users, will begin sharing 25% of the platform's Premium membership revenue starting in November 2024. Some mid-level influencers can earn hundreds of dollars per month, while a few top users can earn thousands. In comparison, X's incentives are more sustainable and stable, potentially making them more attractive to long-term creators. So, how will creators and the ecosystem behind it choose?

Source: BlockBeats

Source: BlockBeats

Content Value and the Luxury Effect — Solana’s Revisionism

Just as Toly broke the news, "Memecoin and NFTs are digital junk with no intrinsic value, just like loot boxes in mobile games. People spend $150 billion on mobile games every year." He emphasized that the value of these assets is not determined by the so-called "content itself," but rather by in-game random boxes—players pay to receive random rewards, a gameplay mechanic criticized for encouraging addictive spending. However, "random rewards" in crypto are determined by market transactions and market maker liquidity.

Well-known influencer @thecryptoskanda succinctly explained Toly's thinking, stating, "On the surface, he criticizes memes and NFTs as digital garbage, but in reality, he's acknowledging Solana's reliance on speculation and on-chain liquidity, with value determined by the AMM market. Its core logic remains gambling, not so-called content fundamentals. Toly no longer offers Silicon Valley-style 'content value stories,' but instead focuses on finding a more stable holding logic for SOL than simply operating in the meme market—maintaining demand through on-chain manipulation. Solana has entered a revisionist phase."

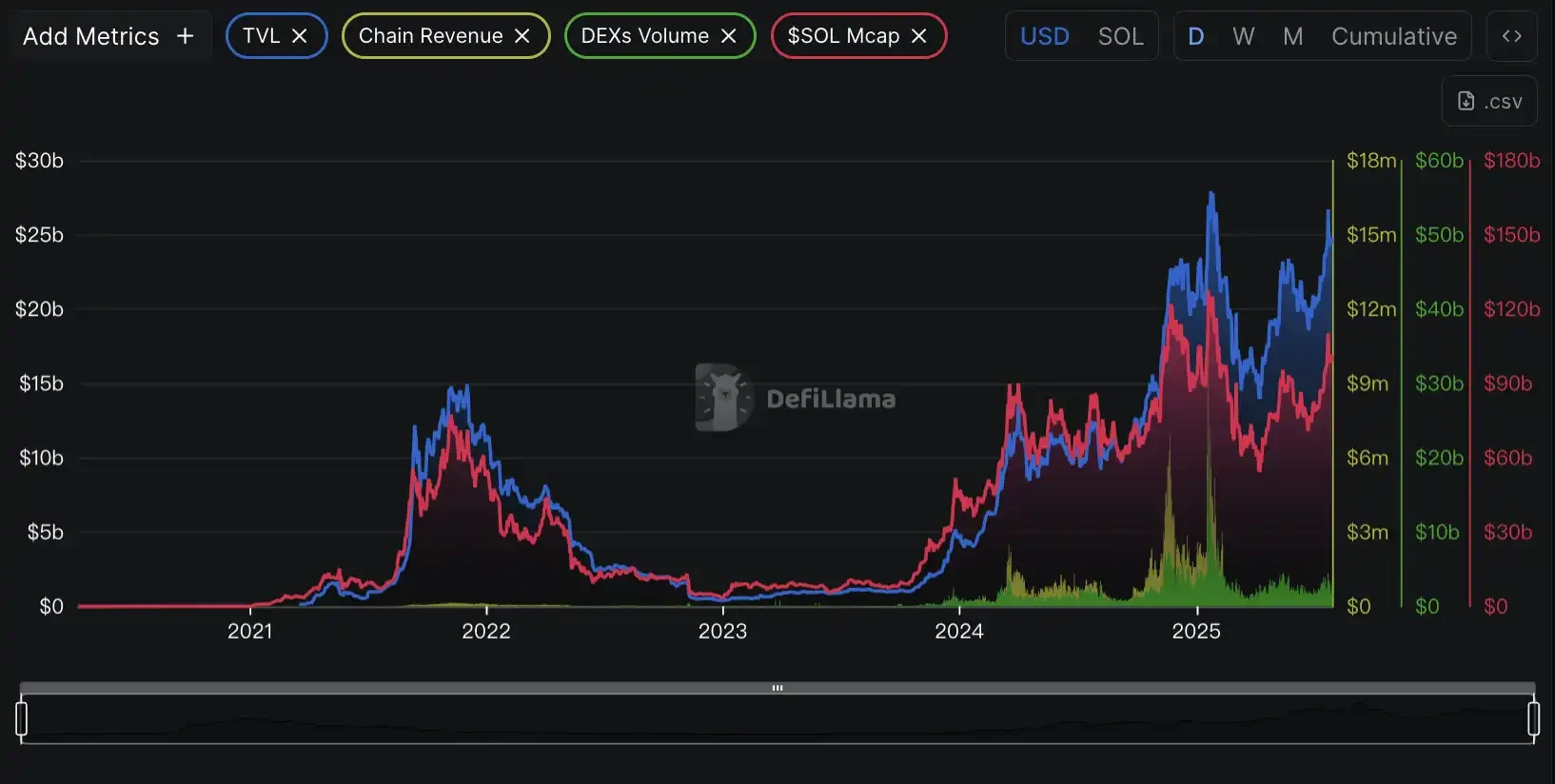

More than 80% of Solana’s transaction volume is due to the activity of Memecoins. Source: DUNE

More than 80% of Solana’s transaction volume is due to the activity of Memecoins. Source: DUNE

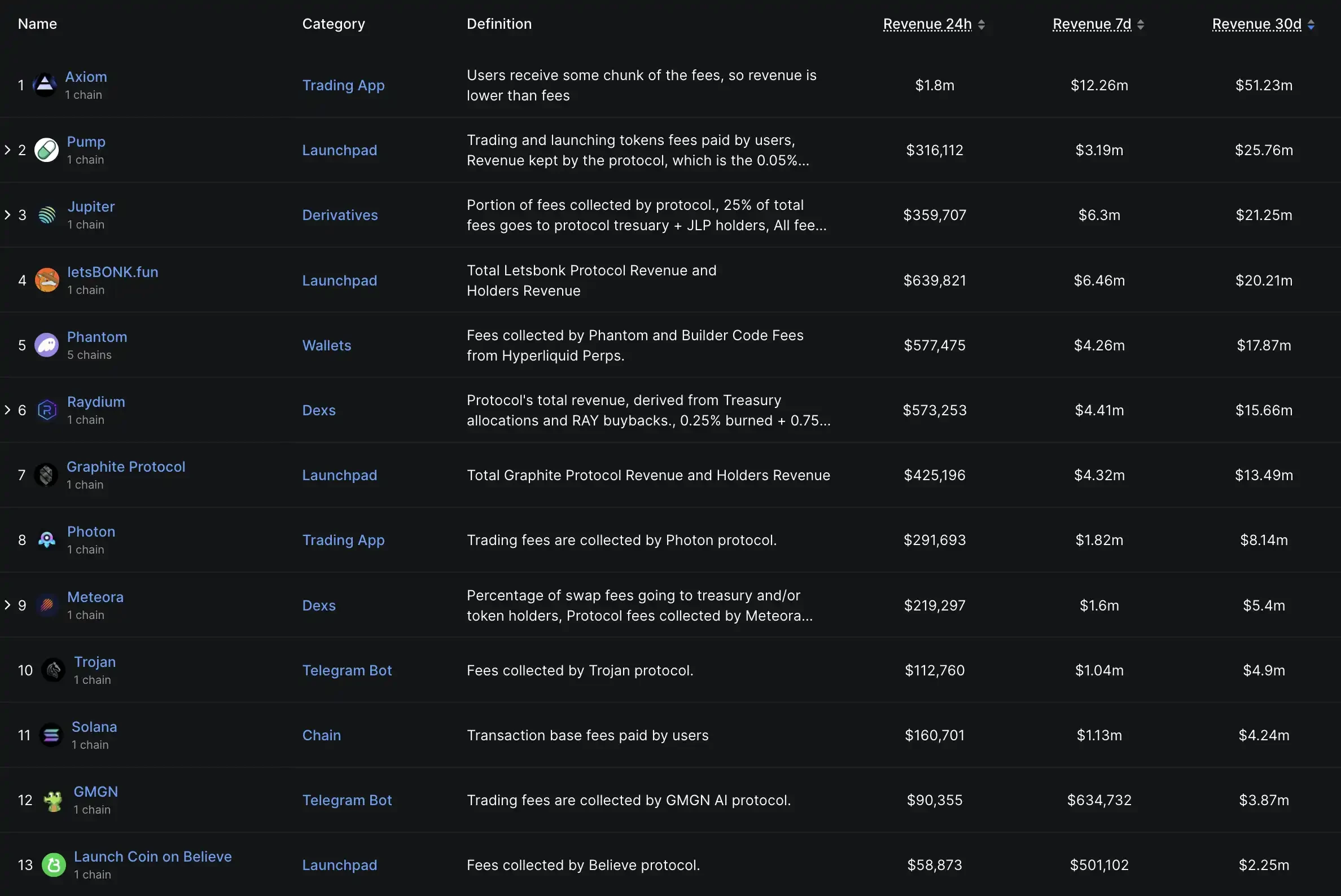

The top 10 (or even 20) Solana ecosystem revenue rankings are almost entirely dominated by the Memecoin ecosystem. Source: Defillma

The top 10 (or even 20) Solana ecosystem revenue rankings are almost entirely dominated by the Memecoin ecosystem. Source: Defillma

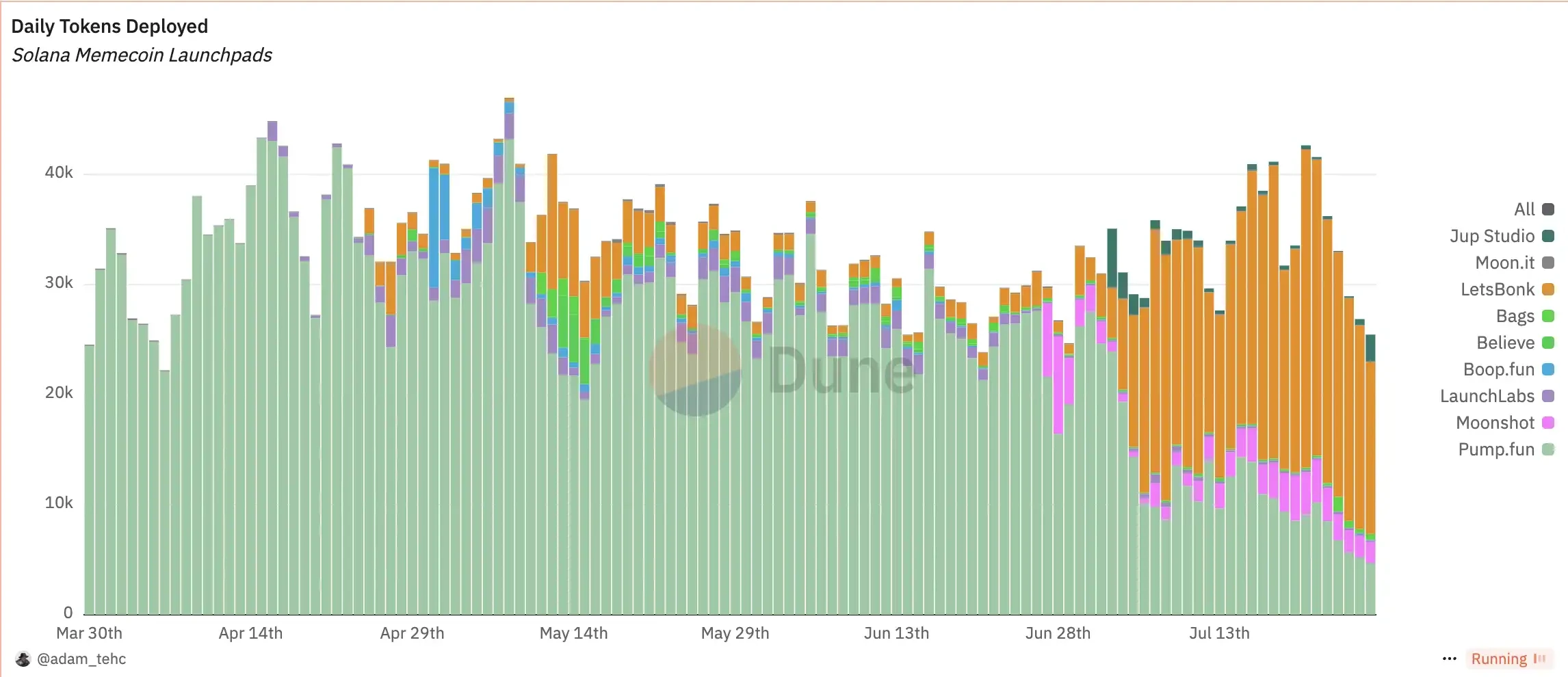

While Solana's "casino concept" has gained widespread popularity, they've also faced challenges. With an average of 20,000 to 30,000 new tokens added to the market daily, attracting attention has become increasingly difficult. As these memecoins fluctuate, their market capitalization continues to decline. @thecryptoskanda further analyzed the situation, arguing that Solana has adopted a mitigation strategy. First, they rallied with the OG community and institutional forces to crack down on Pump.fun, which is "continuously selling SOL." They also sought to establish a more controllable, long-term, and stable market maker system (LetsBonk) to avoid uncontrollable "high seas gambling" driven by market sentiment. Furthermore, their partnership with Kraken on coin-shares aims to migrate speculative investors from the old platform to the new sub-platform, continuing to provide a small number of individuals with "get-rich-quick" opportunities while stabilizing the majority of users and maintaining the financial stability of the SOL system.

Solana daily token deployment ratio for each launch platform, source: Dune

Solana daily token deployment ratio for each launch platform, source: Dune

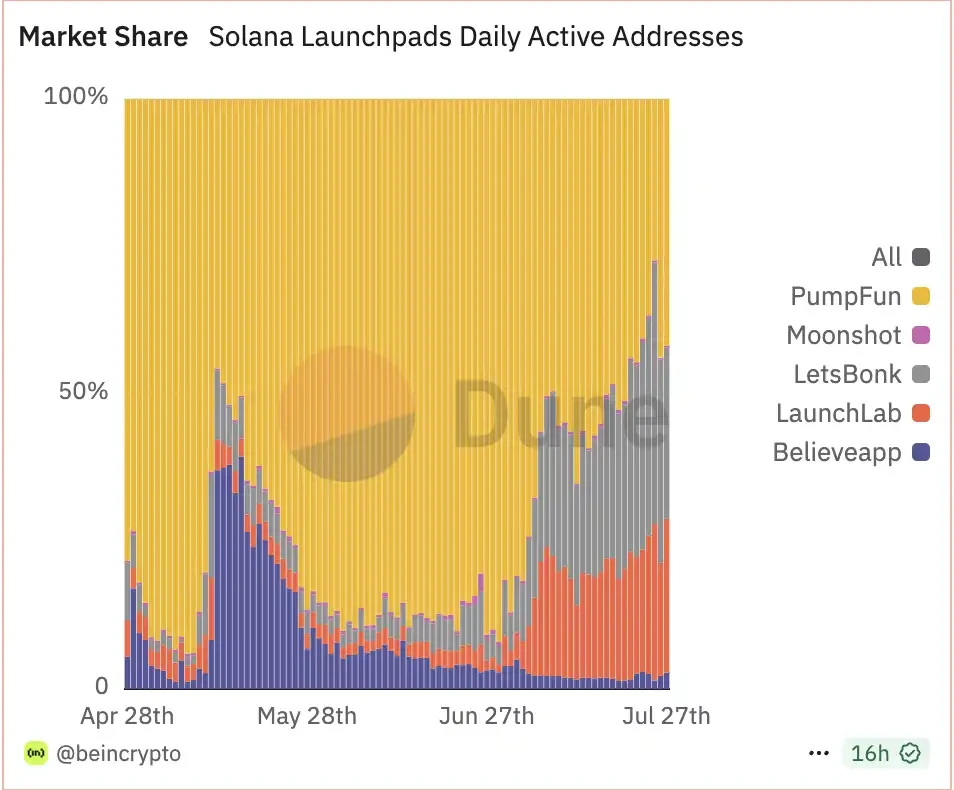

The migration strategy was not entirely smooth sailing, encountering considerable bottlenecks both internally and externally. Although BONK, a team that would continue to contribute within the ecosystem, was successfully used to push its market share beyond Pumpfun, this was merely a cost-saving measure. Its positioning was still Memecoins, and its true meaning of launching a sub-platform should be the "ICM" and "coin-stock concept" they mentioned some time ago, but neither was satisfactory. The market share of ICM's leading platform, Believe, continued to decline, and with the emergence of multiple "SCAM startups," the market merely considered it a variant of Memecoins.

Launch platform market share, source: Dune

Launch platform market share, source: Dune

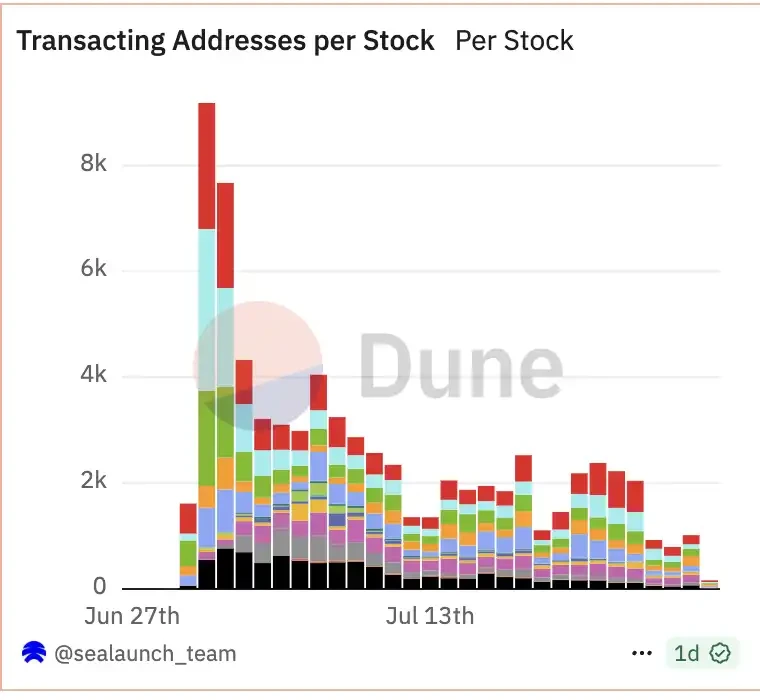

The concept of on-chain US stocks only caused heated discussions in the first few days of issuance, but the number of people who actually participated was very small. In the past week, the total number of people participating in all the on-chain US stocks was only more than 1,000 addresses. The total transaction volume in the past month has only accumulated more than 75 million US dollars.

xStock transaction address count, source: Dune

xStock transaction address count, source: Dune

In addition, @thecryptoskanda also mentioned that the biggest competitor to Solana is not Base but Binance. He believes that Binance is a USDT-based casino, while Solana is a SOL-based casino, and the two parties are in direct competition. Binance has absorbed the liquidity of SOL through mechanisms such as Alpha, and also refused to list Solana Meme coin on spot/contract, forcing Solana to speed up the construction of its own closed loop.

Source: Defillma

Source: Defillma

On the one hand, there are internal worries, and on the other hand, there are external threats. As more and more cryptocurrency companies and ETFs choose to reserve Solana through deep on-chain binding, one is the interest income as a yield-type financial product, and the other is to maintain the "basic plate" of the currency price. No matter which one, Solana has reached a fork in the road where it needs to speed up the search for a way out.

They are not arguing about the content and the basic market of Memecoins, but the basic market of Crypto at this stage.

The debate between the co-founders of Base and Solana over "content coins" reflects the collision of two ideas in the crypto field. One side hopes to capture the value of the attention economy through tokenization and provide creators with new sources of income; the other side is wary of speculation and marketing gimmicks, and believes that tokens that lack cash flow and use value can hardly be called "fundamental investments."

Existing data and academic research indicate that most content and meme coins exhibit strong Veblen commodity characteristics, their value driven by social recognition and emotional outflow rather than intrinsic returns. Platforms like Zora have evolved on-chain content trading methods, but their user base is hundreds of times smaller than that of mainstream social platforms, and their ecosystem remains confined to the cryptosphere. Therefore, the fundamentals of content remain largely aspirational, requiring resolution to numerous issues, including attracting and retaining users at scale, securing IP rights and recognition from ecosystem merchants, and defining a regulatory framework.

In the absence of these conditions, content coins and meme coins are still mainly speculative or collectibles, and their sentiment overflows similar to luxury goods or trendy brands. For creators, it is understandable to explore on-chain tools to build a community economy, but they still need to grasp scarcity, value commitment and long-term credibility to avoid becoming a short-term traffic game.

In this era, content supply is unlimited, but attention is scarce.

- 核心观点:内容币与Meme币的价值争议持续发酵。

- 关键要素:

- Base创始人认为内容币有基本面价值。

- Solana创始人认为内容币依赖投机无价值。

- Zora生态数据增长但用户规模仍小。

- 市场影响:引发对链上内容经济可行性的质疑。

- 时效性标注:中期影响。