ENA's "confidence game": $260 million repurchase to stabilize prices, $360 million transfusion to help StablecoinX sprint to listing

- 核心观点:Ethena 高调回购与链上抛售并存引质疑。

- 关键要素:

- 2.6 亿美元 ENA 回购计划提振市场信心。

- 链上数据显示关联地址疑似抛售 1.5 亿 ENA。

- USDe 规模达 73 亿美元,位列稳定币第三。

- 市场影响:短期或加剧 ENA 价格波动。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

On July 21st, Ethena Labs announced a $360 million PIPE (Private Investment in Equity) transaction with stablecoin issuer StablecoinX. StablecoinX plans to list on the Nasdaq under the ticker symbol "USDE" (the same as Ethena's stablecoin, USDe). Simultaneously, the Ethena Foundation launched a high-profile $260 million ENA token buyback program, attempting to leverage capital to stabilize the price and boost market confidence.

However, on-chain data quietly tells a different story: addresses associated with the project are suspected of being "pull and sell." Odaily Planet Daily attempts to delve into Ethena from a data perspective, deeply analyzing both its opportunities and challenges.

ENA buyback: boosting confidence or calling for long and short?

The Ethena Foundation’s $260 million ENA token buyback plan is the core highlight of this transaction.

StablecoinX will use the $260 million in net cash proceeds from the financing (after deducting relevant expenses) to purchase locked ENA tokens from subsidiaries of the Ethena Foundation to establish an ENA reserve, with the Ethena Foundation contributing $60 million worth of ENA tokens. The repurchase program is expected to invest approximately $5 million per day over the next six weeks, representing approximately 8% of the circulating market value of ENA (at the time of this announcement).

Crucially, the Ethena Foundation retains a veto over StablecoinX's sale of ENA, ensuring that these tokens are used solely for accumulation, not disposal. If StablecoinX subsequently raises funds to purchase more locked ENA, the proceeds will be used primarily to repurchase ENA on the spot market.

On the surface, this move demonstrates Ethena's unwavering confidence in the token's value and sends a strong, positive signal to the market: the project is committed to stabilizing the ENA price and strengthening investor confidence through capital operations. According to the latest data , Ethena has repurchased 83 million ENA tokens on the open market, valued at approximately $60 million, initially fulfilling its commitment.

However, on-chain data complicates this narrative of confidence. According to on-chain analyst Yu Jin (EmberCN ), after Ethena announced on July 21st that StablecoinX would be holding ENA reserves, an address associated with the Ethena project began transferring ENA out. A total of 150 million ENA (worth $77.35 million USD) entered Binance and Bybit within five days of the announcement, with the most recent transfer occurring on July 26th. So, while the project was publicly repurchasing ENA, it was also suspected that ENA was being sold off. Perhaps influenced by this news, ENA briefly weakened, dropping from $0.62 to around $0.56.

To further investigate the truth, I conducted a detailed analysis of Ethena's on-chain addresses. A cross-comparison of Nansen and Arkham data reveals that the top 20 addresses hold 81.7% of the total tokens. Addresses with significant movement over the past month and clearly associated with the Ethena project account for a whopping 56.7% of the total tokens. Furthermore, the fourth-largest newly created address received 1.23 billion tokens from the second-ranked address, Ethena:Coinbase Prime Custody, on July 23rd, and is currently also considered an address associated with the project.

Looking at the overall inflow and outflow of Ethena from the top 20 addresses over the past month, Ethena-related addresses saw a net outflow of approximately 230 million tokens. Exchange addresses saw a net inflow of 71.65 million tokens, worth approximately $50 million at the current price of $0.70 . However, individual addresses (ranked 19th and 20th) saw a net inflow of 80 million tokens, worth approximately $56 million. The 20th-ranked address began receiving tokens two days ago. Judging solely by this data, the market sell-off may have been fully absorbed, indicating that there is additional capital willing to take ENA.

Although the inflow into personal addresses seems to have absorbed the selling pressure, most of these tokens come from non-exchange addresses, so the attributes of the address are not very clear. The above analysis is for reference only.

Deconstructing the Flywheel Model: Is Ethena’s Growth Engine Running?

Ethena's core appeal lies in its unique "flywheel model," considered key to its success in the stablecoin market. In an article titled " Up Nearly 50% in a Week, Will ENA Be ETH's Biggest Beta? ", Odaily Planet Daily simplifies this as a self-reinforcing cycle: market recovery (especially ETH price increases) → rising bullish sentiment → higher derivatives contract fees → increased USDe yields → attracting more capital inflows → expanded stablecoin issuance → strengthened protocol fundamentals → support for ENA's price.

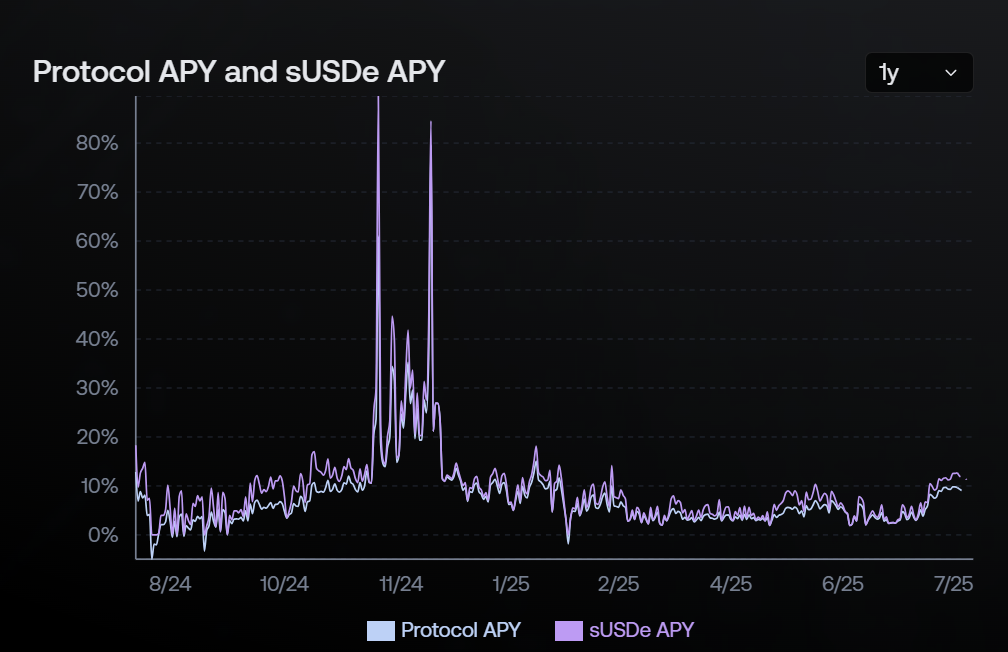

As Ethena's primary arbitrage target, the recent price recovery of ETH has driven a continued rise in contract fees. According to the latest data, the average yield in the fee market has reached 11.95%, providing momentum for USDe's revenue growth.

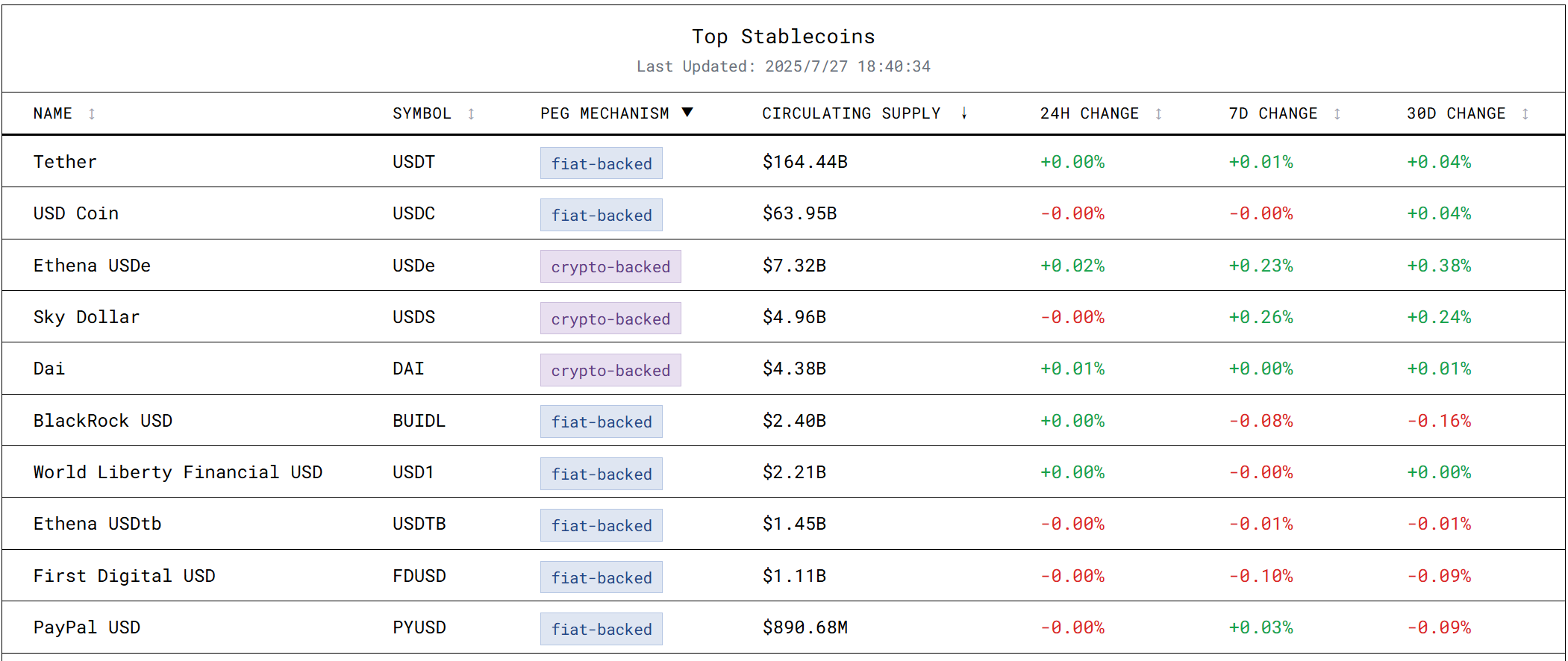

As of July 27th, the total value of Ethena's stablecoins reached approximately $8.7 billion, of which USDe reached nearly $7.3 billion, a record high. According to data from stablecoins.asxn.xyz , the current stablecoin market size has reached $265 billion, making USDe the third-largest stablecoin after the two major centralized stablecoins, USDT and USDC. Odaily Note: Due to Dai's rebranding, some tokens have been migrated to USDS, so USDe should actually be the fourth-largest stablecoin.

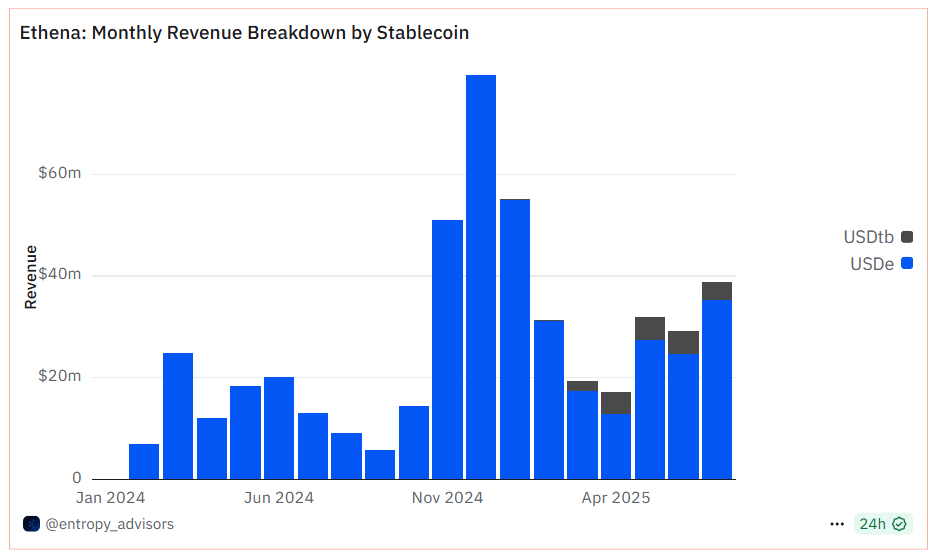

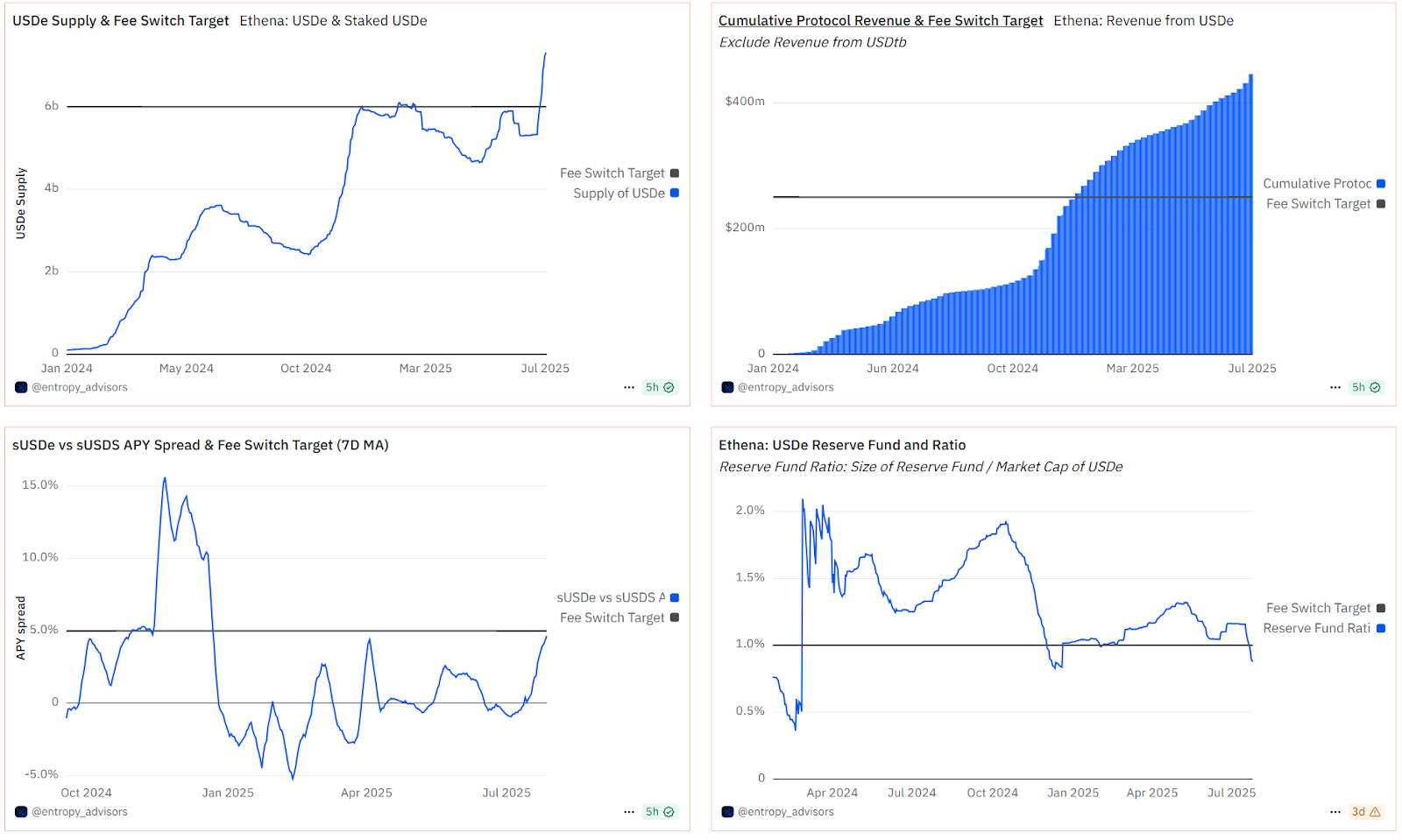

In terms of revenue, Ethena protocol generated approximately $310 million in revenue over the past year. While this still lags behind giants like Tether and Circle, it's already on par with Sky. Since April 2025, USDe's monthly revenue has continued to increase, demonstrating the initial success of the flywheel.

Image source: Dune: Entropy Advisors

To enhance transparency, Ethena Labs, in collaboration with Harris & Trotter, Chaos Labs, LlamaRisk, and Chainlink, has launched USDe Reserve Proofs, which are published weekly and independently audited. As of the April 26th snapshot, the USDe supply stood at 4.765 billion, with $44.695 million available for redemption in mint/redemption contracts, $60.95 million in reserve funds, and approximately $663 million in Copper custody, indicating overall robust financial health. However, the continued operation of the flywheel model relies on the stability of ETH prices and market sentiment. Fluctuations in the external environment could put the sustainability of revenue growth at risk.

USDtb and the GENIUS Act: New chips in the compliance race

In 2025, the GENIUS Act signed by Trump marked the beginning of a new regulatory era for the stablecoin industry. The Act requires stablecoins to be backed 1:1 by the US dollar or other highly liquid assets, and USDe's collateral structure may find it difficult to fully meet this standard.

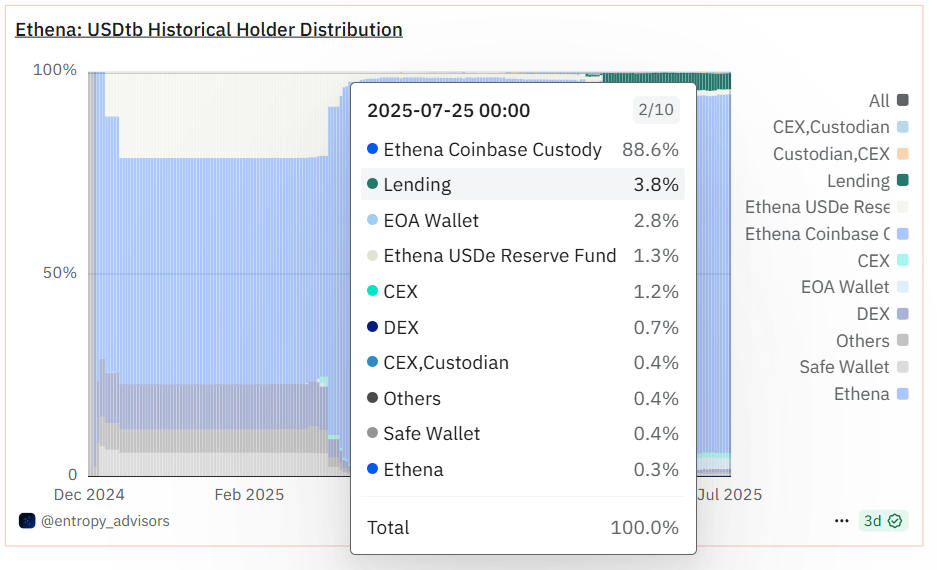

To this end, Ethena partnered with Securitize in December 2024 to launch USDtb, a stablecoin primarily backed by short-term U.S. Treasury bonds (76% of which are invested in BlackRock's BUIDL fund). To date, USDtb has reached $1.45 billion in issuance. It not only serves as a standalone stablecoin but has also been approved as a reserve asset for the USDe, providing a risk buffer during periods of market volatility or negative funding rates.

On July 24th, Anchorage Digital announced a partnership with Ethena to launch USDtb, the first GENIUS Act-compliant cryptocurrency exchange in the United States. As the only federally chartered crypto bank in the United States, Anchorage Digital's involvement further strengthens USDtb's market credibility. This partnership also represents Ethena's proactive response to regulatory pressure, aiming to maintain long-term competitiveness in an increasingly regulated industry.

More notably, approximately 95% of all USDtb was previously held by the Ethena team. With the integration of lending protocols like Aave, approximately $160 million in USDtb has been held by external protocols since June of this year. While still relatively small, this data demonstrates that Ethena's economic model is expanding from an internal closed-loop to externally. The adoption of external protocols has created new revenue streams and increased the project's diversification.

Fee switch: a potential positive for fundamentals?

In 2024, crypto market maker Wintermute proposed a "fee switch" proposal, suggesting clarification of Ethena protocol revenue distribution, specifically allowing users holding sENA (Ethena's staking token) to directly benefit from protocol revenue. After multiple rounds of discussions and blind pitches, the Ethena Risk Committee ultimately determined the following success metrics for activating the fee switch:

- USDe circulation : The requirement is to exceed 6 billion US dollars, and the current level is 7.2 billion US dollars, which has been met.

- Cumulative agreement revenue : The requirement is to exceed US$250 million, currently at US$450 million, which has been met.

- Exchange adoption : USDe is required to be listed on 4 of the top 5 exchanges in terms of derivatives trading volume. Currently, there are 3 exchanges, which does not meet the standard.

- Reserve Fund : Requires more than 1% of the USDe supply, which was not met.

- sUSDe yield spread : The spread with the benchmark interest rate is required to be between 5.0% and 7.5%, which was not met.

While three metrics are currently below target, the above charts show that the reserve fund and yield spread are approaching the threshold, suggesting a strong likelihood of a fee switch being activated. If successfully activated, sENA holders will directly benefit from protocol revenue, further strengthening Ethena's economic incentives and generating potential dividends for long-term holders.

Converge and Securitize: Potential bets on the RWA track

Real world assets (RWA), as a bridge connecting traditional finance and the crypto economy, are becoming the focus of this cycle.

According to rwa.xyz , the total market capitalization of the RWA market has exceeded $25 billion, with BlackRock's BUIDL fund leading the industry with $2.4 billion in tokenized assets. This success is largely due to the support of Securitize's underlying protocol. Through its technical infrastructure and compliance framework, Securitize has provided critical support to projects such as BUIDL, Exodus Movement (EXOD), and Blockchain Capital (BCAP), establishing its core position in the RWA space.

Ethena Labs has keenly recognized this trend and, in partnership with Securitize, plans to launch Converge, an EVM-compatible blockchain, in the second quarter of 2025. This blockchain aims to host Securitize's new products and expand the application of RWAs. USDe and USDtb are explicitly designed as Converge's native gas tokens, used to pay network transaction fees and support on-chain and off-chain transactions and cross-chain interoperability for RWAs.

Ethena is demonstrating its ambition to become a rising star in the stablecoin sector through ENA token repurchases, the flywheel model's growth engine, USDtb's compliance strategy, the potential benefits of the fee switch, and Converge's layout in the RWA track. It may become the next high-quality target that combines innovation and stability in this cycle.