The SUI treasury of US$450 million was established, and MCVT's stock price tripled in 3 days

- 核心观点:Mill City转型投资SUI代币。

- 关键要素:

- 募资4.5亿美元购买SUI代币。

- SUI生态TVL创新高达21.3亿美元。

- SUI现货ETF申请提升机构吸引力。

- 市场影响:推动SUI代币市场热度上升。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

On July 28, Nasdaq-listed Mill City Ventures III announced that it had signed a securities purchase agreement to raise $450 million through a rights offering to launch the SUI Treasury Strategy. The transaction is expected to be completed around July 31, 2025, subject to the satisfaction of normal closing conditions. Driven by this news, MCVT's stock price soared in just three days, with the largest increase exceeding 300%.

Transforming from Specialty Finance to Blockchain

Mill City Ventures III, headquartered in Minnesota, USA, has been focusing on providing high-interest short-term loans to private enterprises, micro-companies and high-net-worth individuals. Its loan business usually relies on collateral or personal guarantees, with a term of no more than nine months, aiming to reduce the risk of default.

The company was originally named Poker Magic, Inc. and was involved in the gaming and entertainment sectors. It transitioned to a business development company (BDC) in 2013 and withdrew from BDC election in 2019 to focus on specialty finance businesses.

However, the recently announced $450 million private placement marks a significant shift in the company's business model. The announcement indicates that approximately 98% of the proceeds will be used to purchase SUI, the native token of the Sui blockchain, while the remaining 2% will support traditional short-term lending. This strategy means that the SUI token will become the company's core reserve asset going forward, fundamentally transforming its asset structure. The transaction was led by London-based digital asset hedge fund Karatage Opportunities and the Sui Foundation, with participation from prominent crypto institutions including Galaxy Digital and Pantera Capital. Following the transaction, Karatage co-founder Marius Barnett will become Chairman of the Board, and Stephen Mackintosh will serve as Chief Investment Officer, further strengthening the company's strategic presence in the blockchain sector.

Sui is a leader in the reserve wave

With this move, Mill City Ventures III has become the largest publicly listed company to announce its SUI reserves. According to Odaily, other publicly listed companies that hold or plan to hold SUI include Lion Group (holding approximately 1.0157 million SUI, valued at approximately $4 million), OFA Group, LGHL, and Aurora. However, these companies are relatively small, with most holding only a variety of cryptocurrencies, including SUI. In contrast, Mill City Ventures III's substantial investment occupies a unique position within the Sui ecosystem.

Sui Ecological Recovery and Potential

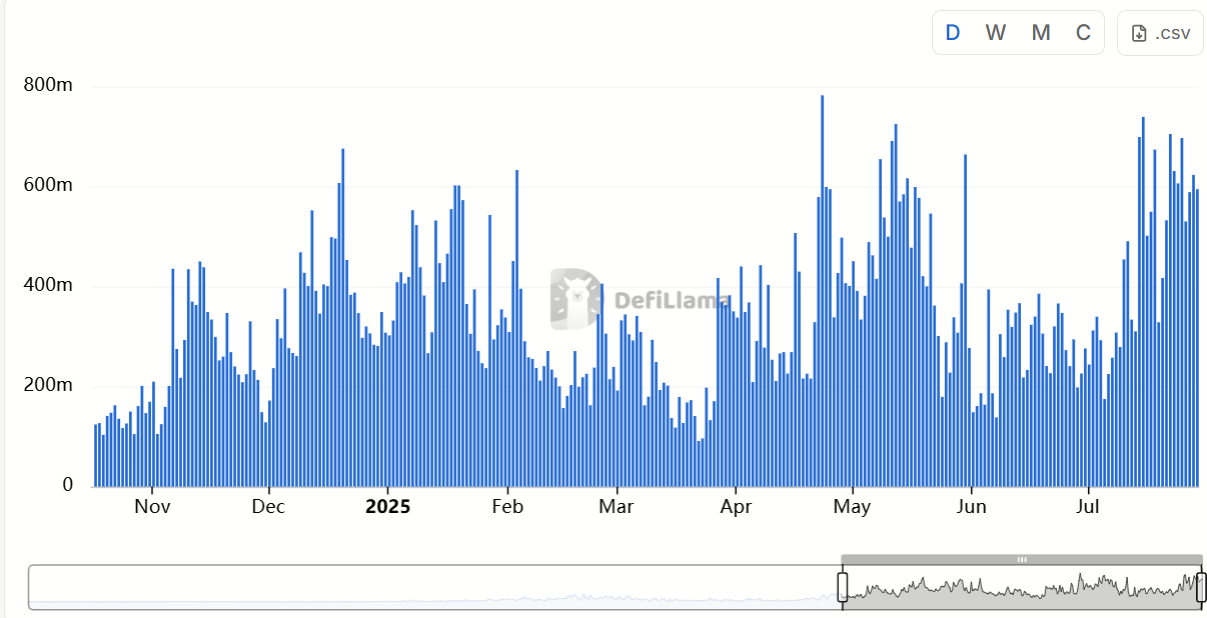

The Sui ecosystem has recently shown strong signs of recovery. On May 22, 2025, Cetus, a decentralized exchange (DEX) within the Sui ecosystem, suffered a $223 million hack, triggering a massive outflow of funds on the chain and severely damaging confidence in the ecosystem. However, after months of repairs, the Sui ecosystem has fully recovered. According to data from defillama.com , as of July 2025, the total value locked (TVL) on the chain reached a record high of $2.13 billion.

DEX trading volume has also been steadily climbing since June, and the price of SUI tokens has risen simultaneously, reflecting the market's renewed confidence in the Sui ecosystem.

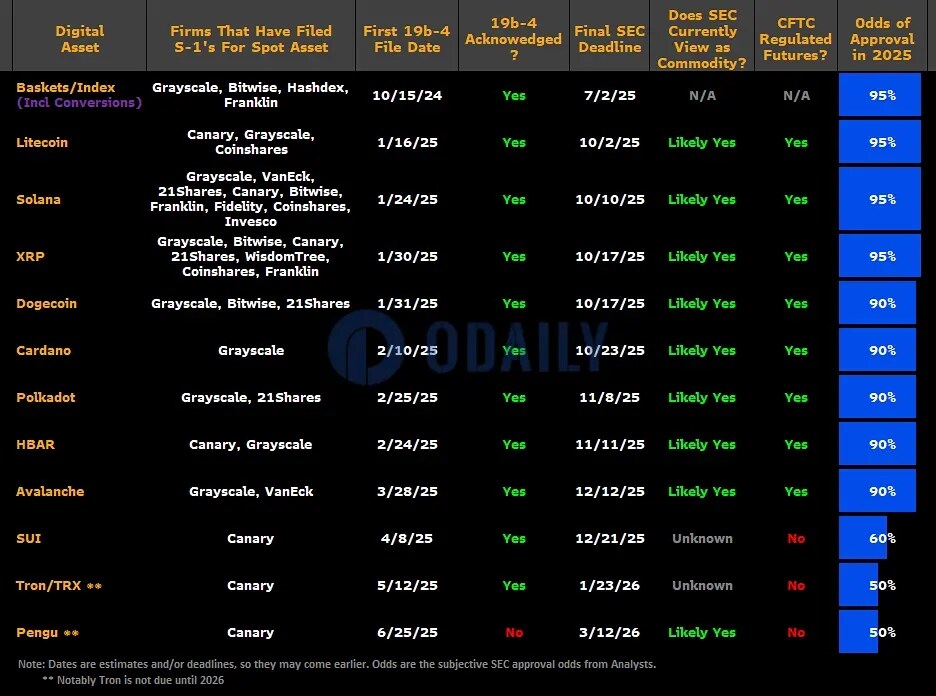

The Crypto ETF Boom and the Market Prospects of SUI

In the current crypto market cycle, exchange-traded funds (ETFs) have become a major channel for institutional capital to enter the market, providing altcoins with new narrative opportunities. Canary has reportedly submitted an application for the SUI spot ETF, further enhancing SUI's appeal to institutional investors. According to Bloomberg ETF analyst James Seyffart, a wave of crypto spot ETF approvals is expected in the second half of 2025. Litecoin (LTC), Solver, and XRP have a 95% probability of approval, while DOGE, HBAR, Cardano, Polkadot, and Avalanche have a 90% probability of approval, and SUI has a 60% probability of approval. While SUI's ETF has a relatively low probability of approval, as an emerging blockchain project in the eyes of traditional finance, its potential should not be underestimated.

Market sentiment and trading opportunities

As interest in the SUI continues to grow, market sentiment is also becoming increasingly active. Well-known trader Eugene stated in a July 26th post that despite altcoins generally underperforming Bitcoin, he has established long positions in both ETH and SUI. He noted that ETH has shown strong support around $3,500, while the SUI offers short-term trading potential, suitable for fast trading on low time frames (LTF scalping). However, Eugene also emphasized that he would consider exiting the market if ETH falls below $3,500.

More interestingly, in his post last night, Eugene suggested that SUI's recent price strength may be related to insider trading based on the SUI treasury news, although the extent of this influence is difficult to quantify. Based on this assessment, Eugene stated that while he doesn't believe this will constitute a significant negative, he has already taken profits and exited his long position because the market has already preemptively reflected this news.