Original author: Mario Chow

Original source: IOSG Ventures

introduction

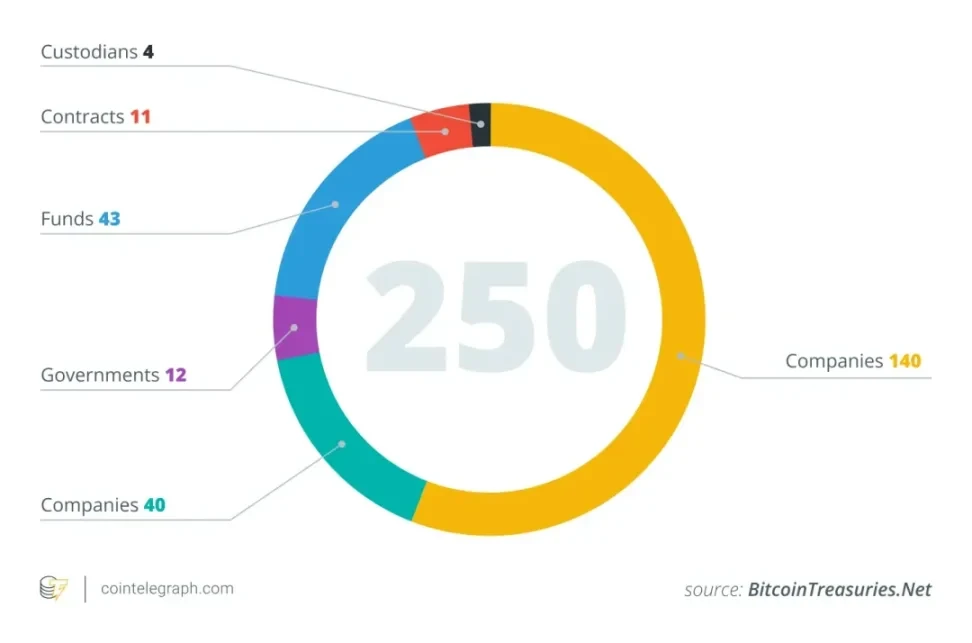

As of mid-2025, more and more public companies have begun to include cryptocurrencies, especially Bitcoin, in their treasury asset allocations, inspired by the success of Strategy ($MSTR). For example, according to blockchain analysis data, in June 2025 alone, 26 new companies included Bitcoin in their balance sheets, bringing the total number of companies holding BTC worldwide to about 250.

These companies span a wide range of industries (tech, energy, finance, education, etc.) and countries. Many view Bitcoin's limited supply of 21 million as a hedge against inflation, emphasizing its low correlation with traditional financial assets. This strategy is quietly becoming mainstream: as of May 2025, 64 SEC-registered companies collectively held approximately 688,000 BTC, representing approximately 3–4% of the total Bitcoin supply. Analysts estimate that over 100–200 companies worldwide already include crypto assets in their financial statements.

Models for Crypto Asset Reserves

When a public company allocates a portion of its balance sheet to cryptocurrencies, a core question arises: how do they finance the purchase of these assets? Unlike traditional financial institutions, most companies employing crypto treasury strategies do not rely on a core business with strong cash flow. The following analysis will focus on $MSTR (MicroStrategy) as a prime example, as most other companies are effectively copying its model.

Operating Cash Flow

Although the most "healthy" and least dilutive way in theory is to purchase crypto assets through the free cash flow generated by the company's core business, this approach is almost impossible in reality. Most companies themselves lack sufficiently stable and large-scale cash flow to accumulate large amounts of BTC, ETH or SOL reserves without external financing.

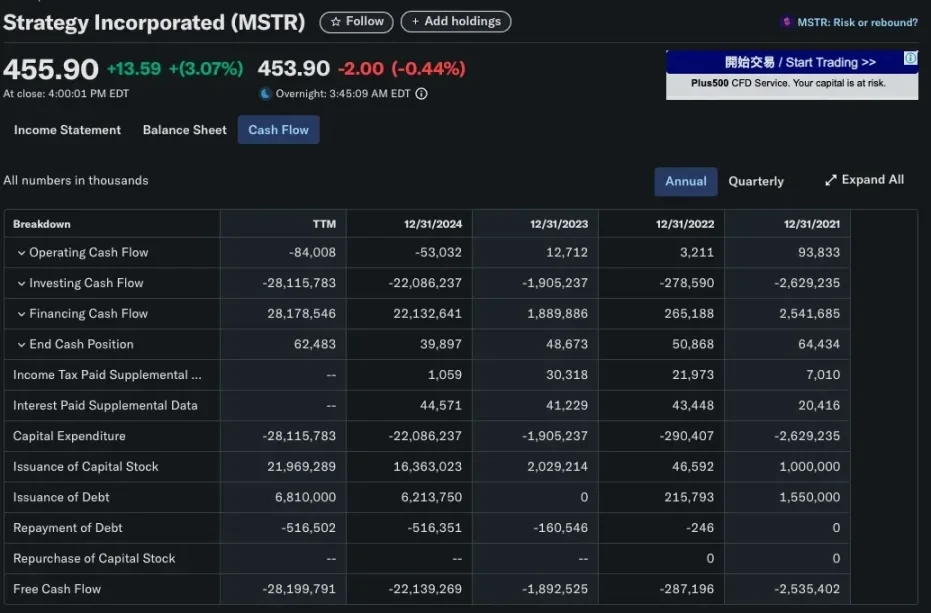

Take MicroStrategy (MSTR) as a prime example: Founded in 1989, the company originally focused on business intelligence software. Its core products include HyperIntelligence and AI analytics dashboards, but these products still generate limited revenue. In fact, MSTR's annual operating cash flow is negative, far from the tens of billions of dollars invested in Bitcoin. This shows that MicroStrategy's crypto vault strategy was not based on internal profitability from the outset, but relied on external capital operations.

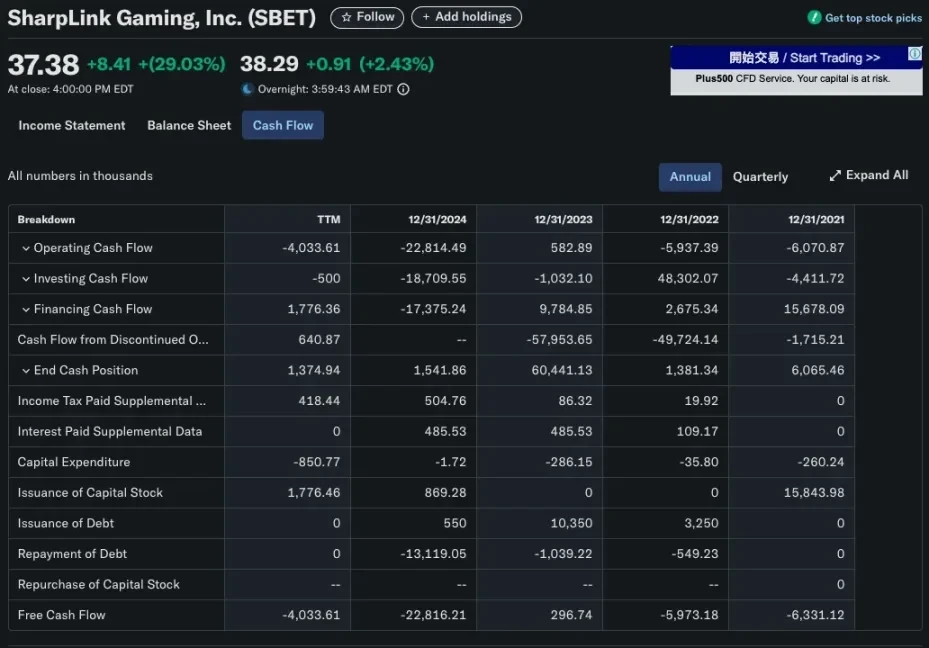

A similar situation occurred with SharpLink Gaming (SBET). The company transformed into an Ethereum treasury carrier in 2025, purchasing more than 280,706 ETH (about $840 million). Obviously, it could not have done this operation relying on the revenue from its B2B gaming business. SBET's capital formation strategy mainly relies on PIPE financing (private investment in public equity) and direct stock issuance, rather than operating income.

Capital Market Financing

Among listed companies that adopt crypto treasury strategies, the most common and scalable way is to raise funds through public offerings by issuing stocks or bonds and use the proceeds to purchase crypto assets such as Bitcoin. This model enables companies to build large-scale crypto treasuries without using retained earnings, and fully draws on the financial engineering methods of traditional capital markets.

Issuing Equity: A Traditional Dilutive Financing Example

In most cases, issuing new stock comes with costs. When a company raises capital by issuing additional stock, two things typically happen:

- Ownership dilution: Existing shareholders' ownership of the company decreases.

- Earnings per share (EPS) decreases: When net profit remains unchanged, an increase in total share capital leads to a decrease in EPS.

These effects typically cause stock prices to fall for two main reasons:

Valuation logic: If the price-to-earnings ratio (P/E) remains unchanged and EPS declines, the stock price will also fall.

Market psychology: Investors often interpret financing as a sign that the company is short of funds or in trouble, especially when the funds raised are used for unproven growth plans. In addition, the supply pressure of a large number of new shares entering the market will also pull down market prices.

An exception: MicroStrategy’s anti-dilution equity model

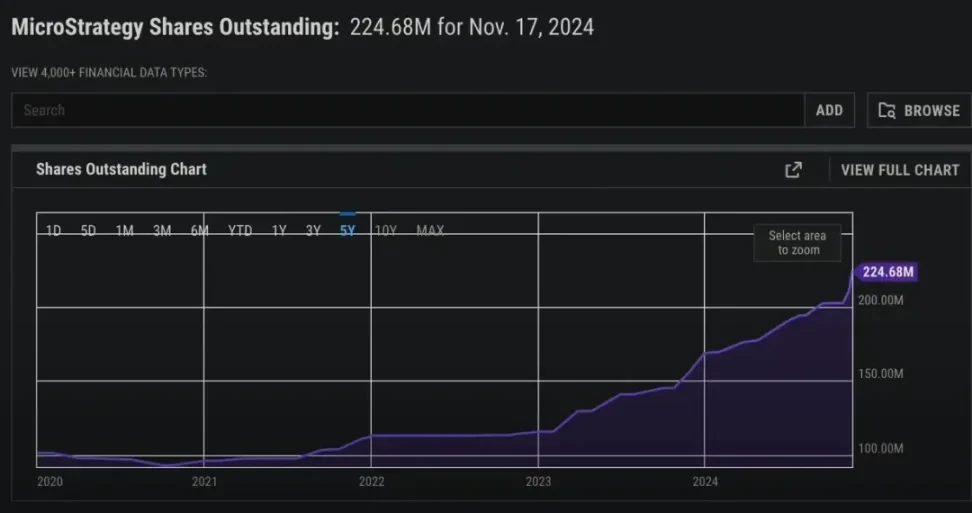

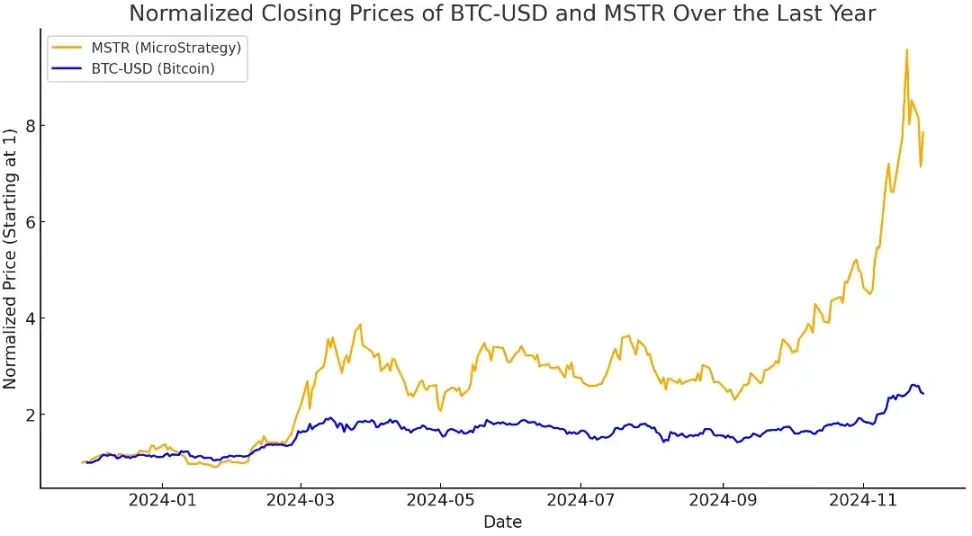

MicroStrategy (MSTR) is a typical counterexample that deviates from the traditional "equity dilution = shareholder loss" narrative. Since 2020, MSTR has been actively purchasing Bitcoin through equity financing, and its total outstanding shares have increased from less than 100 million shares to more than 224 million shares by the end of 2024.

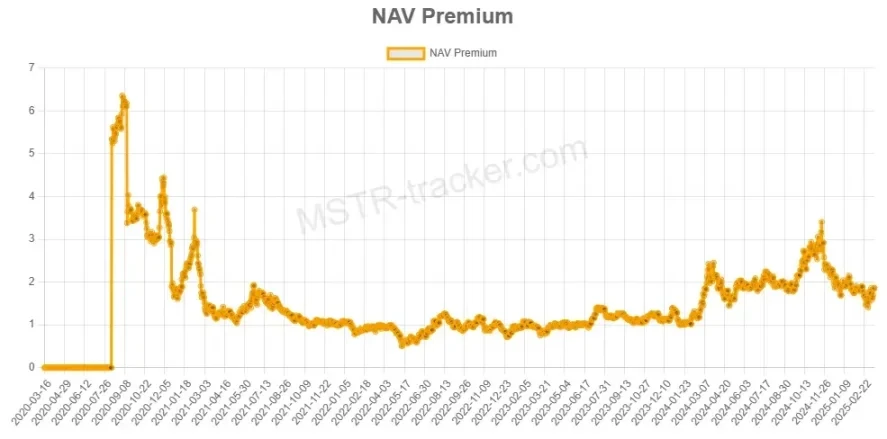

Despite the dilution, MSTR has often outperformed Bitcoin itself. Why? Because MicroStrategy has long been in a state of "market value greater than the net value of its Bitcoin holdings", which we call mNAV > 1.

Understanding the Premium: What is mNAV?

When mNAV > 1, the market values MSTR at a higher value than the fair market value of the bitcoins it holds.

In other words, when investors gain exposure to Bitcoin through MSTR, they pay a higher price per unit than the cost of purchasing BTC directly. This premium reflects the market's confidence in Michael Saylor's capital strategy, and may also represent the market's belief that MSTR provides leveraged, actively managed BTC exposure.

Support of traditional financial logic

Although mNAV is a crypto-native valuation metric, the concept of "trading price higher than the underlying asset value" has long been prevalent in traditional finance.

There are several reasons why companies often trade at a premium to their book value or net assets:

Discounted Cash Flow (DCF) Valuation Method

Investors focus on the present value of a company's future cash flows, not just its current assets.

This valuation approach often results in companies trading at prices far above their book value, especially in the following situations:

- Revenue and profit margin growth expectations

- The company has pricing power or technology/business moat

Example: Microsoft's valuation is not based on its cash or hardware assets, but rather on its future stable subscription software cash flows.

Earnings and Revenue Multiple Valuation Method (EBITDA)

In many high-growth industries, companies are often valued using a P/E (price-to-earnings) or revenue multiple:

- High-growth software companies may trade at multiples of 20–30x EBITDA;

- Early-stage companies may trade at multiples of 50 times revenue or more even without profits.

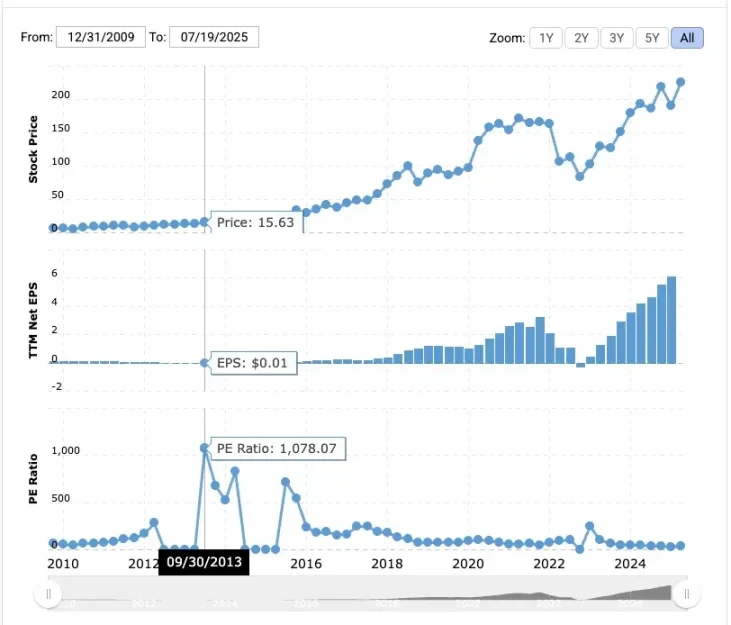

Example: Amazon's P/E ratio in 2013 was 1,078.

Despite slim profits, investors are betting on its future dominance in e-commerce and AWS.

MicroStrategy has an advantage that Bitcoin itself does not: a corporate shell that can access traditional financing channels. As a US public company, it can issue stocks, bonds, and even preferred equity to raise cash, and it does so with amazing results.

Michael Saylor has cleverly exploited the system: he has raised billions of dollars through the issuance of zero-percent convertible bonds and, more recently, innovative preferred stock products, and has invested all of that money in Bitcoin.

Investors recognize that MicroStrategy is able to use "other people's money" to buy Bitcoin on a large scale, and this opportunity is not easily replicated by individual investors. MicroStrategy's premium "has nothing to do with short-term NAV arbitrage" but comes from the market's high confidence in its capital acquisition and allocation capabilities.

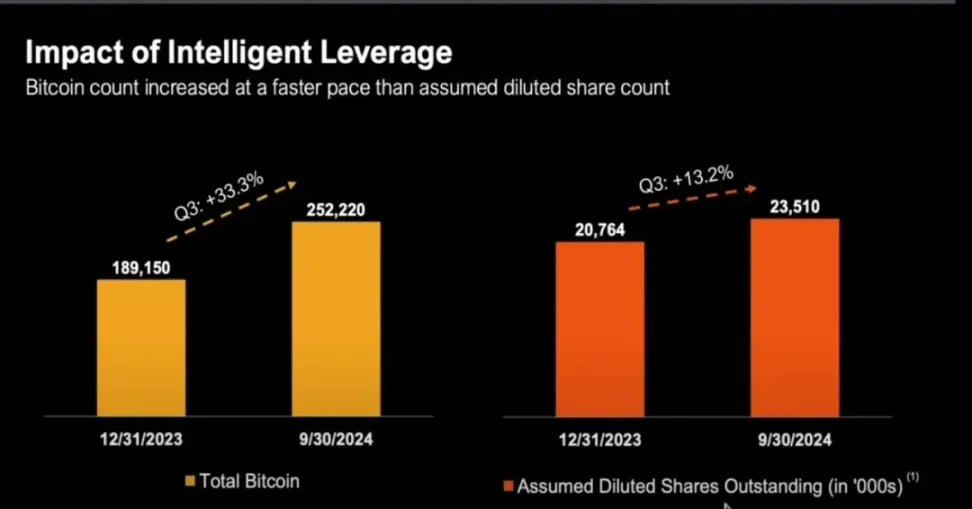

mNAV > 1 How to achieve anti-dilution

When MicroStrategy is trading above the net asset value of its Bitcoin holdings (i.e. mNAV > 1), the company can:

- Issue new shares at a premium price

- Use the raised funds to buy more Bitcoin (BTC)

- Increase total BTC holdings

- Drive NAV and Enterprise Value to Rise Simultaneously

Even as the number of outstanding shares increases, BTC/share holdings may remain stable or even increase, making the issuance of new shares an anti-dilution operation.

What happens if mNAV < 1?

When mNAV < 1, it means that every dollar of MSTR stock represents a BTC market value of more than $1 (at least on paper).

From a traditional financial perspective, MSTR is trading at a discount, below its net asset value (NAV). This creates challenges in capital allocation. If the company uses equity financing to buy BTC in this situation, from a shareholder perspective, it is actually buying BTC at a high price, thereby:

- Dilution BTC/share (BTC holdings per share)

- and reduce existing shareholder value

When MicroStrategy faces a situation where mNAV < 1, it will no longer be able to maintain the flywheel effect of "issuing new shares → purchasing BTC → increasing BTC/share".

So what options are there at this point?

Buy back stocks instead of continuing to buy BTC

When mNAV < 1, repurchasing MSTR stock is a value-accretive behavior for the following reasons:

- You are buying back shares at a discount to their intrinsic BTC value

- BTC/share will rise as the number of outstanding shares decreases

Saylor once made it clear: If mNAV is lower than 1, the best strategy is to buy back stocks rather than continue to buy BTC.

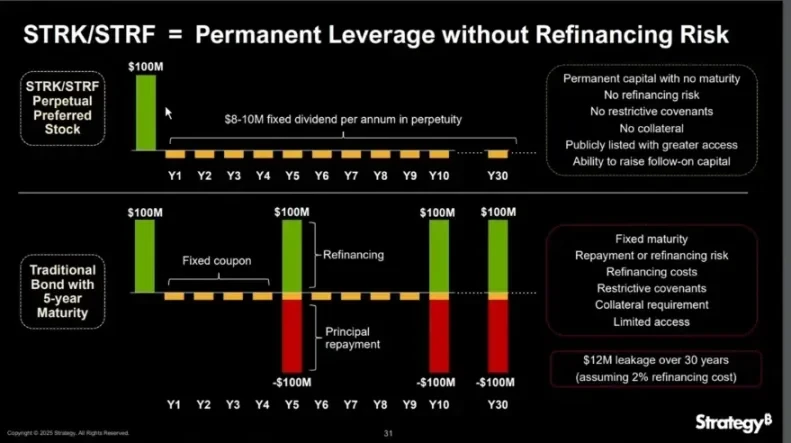

Method 1: Issuing Preferred Stock

Preferred stock is a hybrid security that sits between debt and common stock in a company's capital structure. It typically provides a fixed dividend, has no voting rights, and takes precedence over common stock in profit distributions and liquidations. Unlike debt, preferred stock does not require repayment of principal, and unlike common stock, it provides more predictable income.

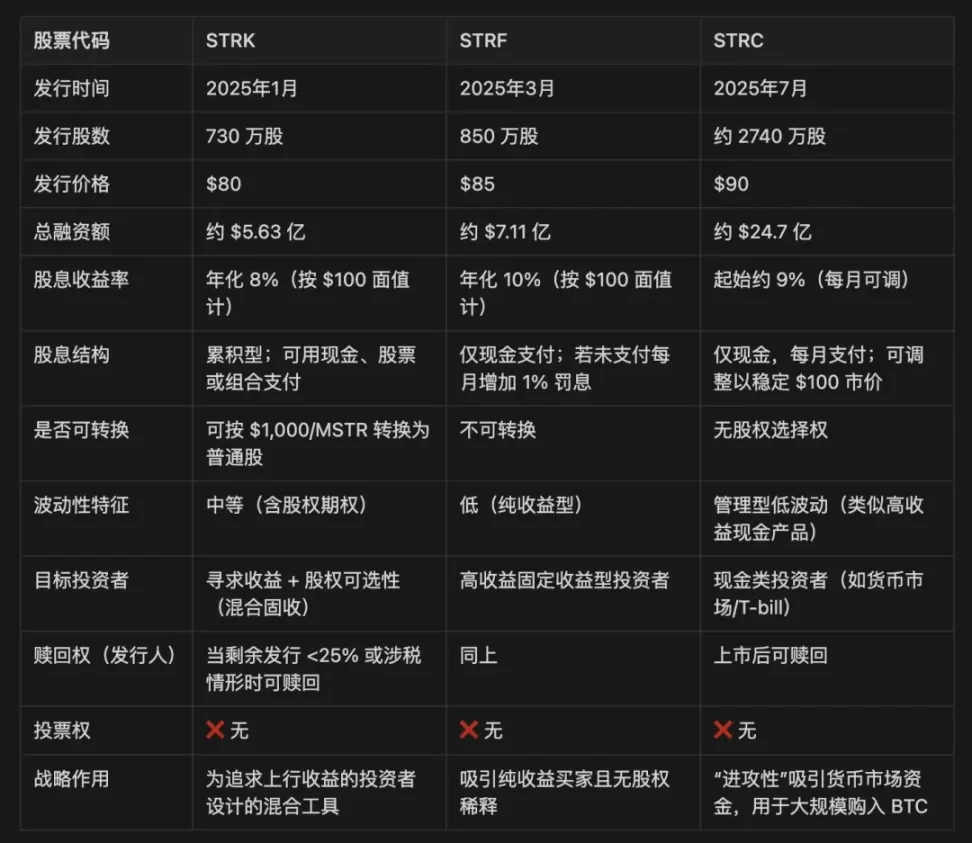

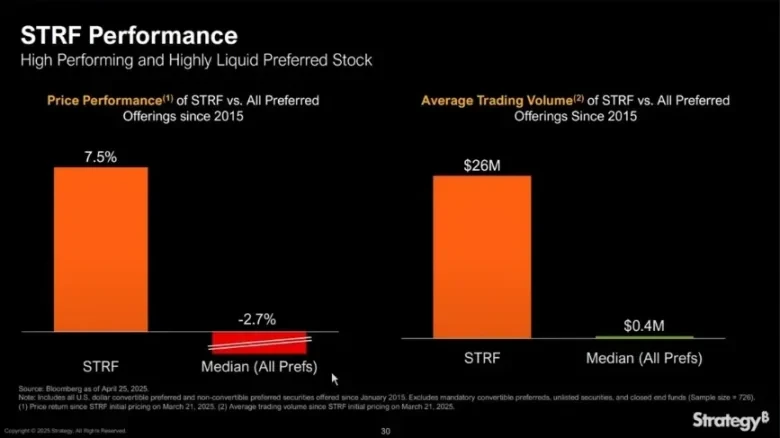

MicroStrategy has issued three classes of preferred stock: STRK, STRF and STRC.

STRF is the most straightforward instrument: it is a non-convertible perpetual preferred stock that pays a fixed cash dividend of 10% per annum on a $100 par value. It has no conversion option and does not participate in MSTR's stock appreciation, only provides income.

The market price of STRF will fluctuate around the following logic:

- If MicroStrategy needs to raise funds, it will issue more STRF, thereby increasing supply and lowering the price;

- If the market demand for yield surges (such as during a period of low interest rates), the STRF price will increase, thereby reducing the effective yield;

This creates a self-regulating price mechanism, with prices typically ranging in a narrow range (e.g. $80–$100), driven by yield demands and supply and demand.

Example: If the market demands a 15% yield, the STRF price may drop to $66.67; if the market accepts 5%, it may rise to $200.

Because STRF is a non-convertible, largely non-redeemable instrument (unless tax or capital triggers are met), it behaves like a perpetual bond, and MicroStrategy can use it repeatedly to "bottom-fish" BTC without having to refinance.

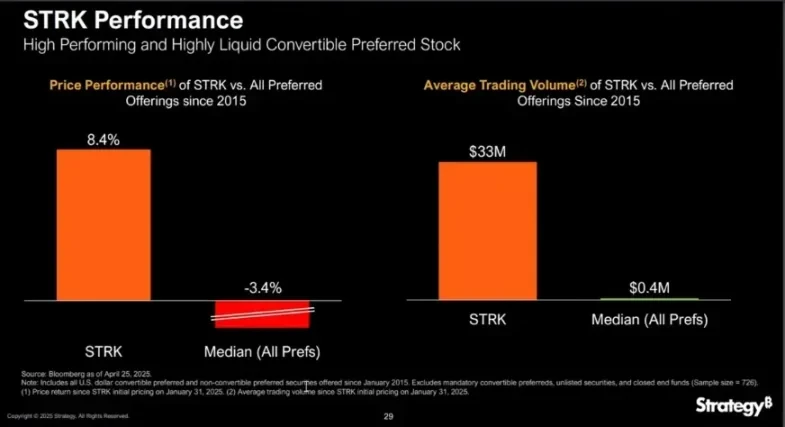

STRK is similar to STRF, with an annualized dividend of 8%, but with an added key feature: when the MSTR stock price exceeds $1,000, it can be converted into common stock at a ratio of 10:1, which is equivalent to embedding a deeply out-of-the-money call option, providing holders with long-term growth opportunities.

STRK is very attractive to both companies and investors for the following reasons:

Asymmetric upside opportunities for MSTR shareholders:

- Each STRK share is priced at approximately $85, and 10 shares can raise $850;

- If converted into 1 share of MSTR in the future, it means that the company currently buys BTC at a cost of $850, but dilution will only occur if the MSTR share price rises above $1,000;

- Therefore, it is non-dilutive during the period when MSTR < $1,000, even after conversion it reflects the appreciation from prior BTC accumulation.

Income self-stabilizing structure:

- STRK pays a dividend of $2 per quarter, which is $8 per year;

- If the price falls to $50, the yield will rise to 16%, attracting buying to support the price;

- This structure makes STRK behave like a "bond with options": defense on the downside and participation on the upside.

Investor Motivations and Switching Incentives:

- When MSTR stock price exceeds $1,000, holders will have an incentive to convert to common stock;

- As MSTR rises further (e.g. to $5,000 or $10,000), STRK's dividend becomes negligible (yield is only about 0.8%), accelerating the conversion;

- Ultimately, a natural exit channel will be formed, transforming temporary financing into a long-term shareholder structure.

MicroStrategy also reserves the right to redeem STRK if, for example, the number of shares remaining unconverted falls below 25% or special triggering circumstances, such as tax, occur.

In the order of liquidation, STRF and STRK rank above common stock but below debt.

These tools are particularly important when the company is in a situation where mNAV < 1. This is because issuing common stock at a discount will dilute BTC/share, thereby reducing value. Preferred stocks like STRF and STRK allow the company to continue to raise funds without diluting common stock, whether it is used to continue buying Bitcoin or repurchasing stocks, it can maintain the stability of BTC/share while expanding assets.

How do they pay interest (dividends)?

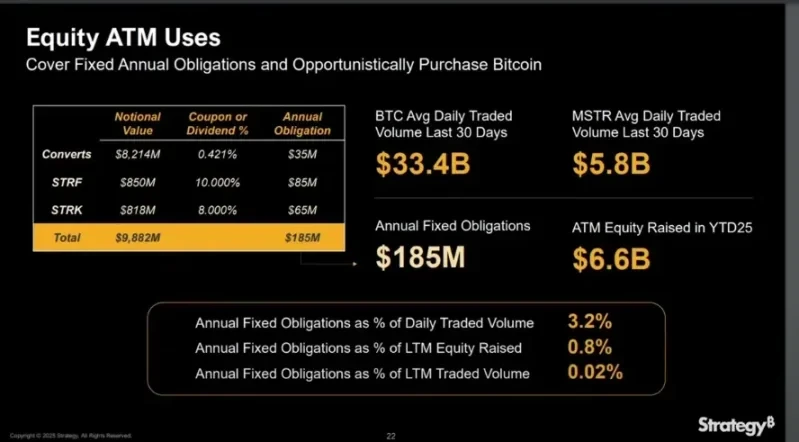

As of YTD 2025, MicroStrategy has raised $6.6 billion through ATM (At-The-Market) stock issuance, far covering its annual fixed interest and dividend costs of $185 million.

When mNAV > 1, paying preferred stock dividends through equity issuance does not dilute BTC per share because the incremental BTC brought by the raised funds exceeds the unit dilution.

In addition, preferred shares are not counted as debt, allowing MicroStrategy to continue to expand its balance sheet without worsening its net debt ratio, which is critical to maintaining market confidence in its capital structure.

When mNAV > 1

Convertible Bond

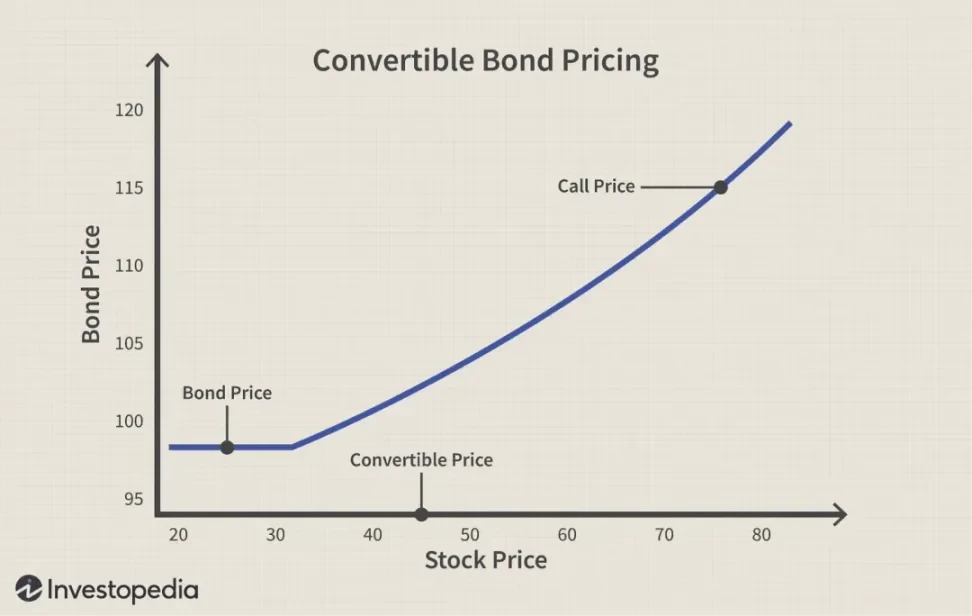

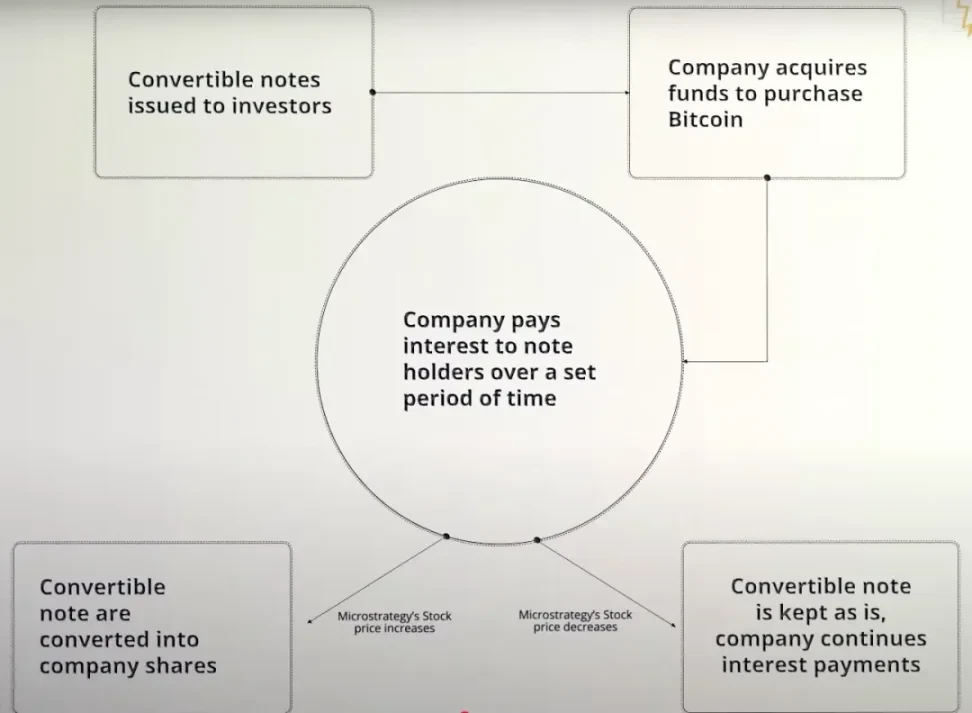

Convertible bonds are corporate debt instruments that give creditors the right (but not the obligation) to convert bonds into shares of the issuing company at a predetermined price (called the conversion price) in the future, so it is essentially a bond + call option structure. This tool is often used in situations where mNAV > 1 because it is particularly suitable for accumulating Bitcoin.

Take MicroStrategy's 0% convertible bonds as an example:

- No interest is paid during the life of the bond;

- Only the principal is repaid at maturity (unless the investor chooses to convert to shares);

- For MSTR, this is an extremely capital-efficient financing method: it can raise billions of dollars to purchase Bitcoin without any immediate dilution or interest burden. The only risk is that the principal will have to be repaid in the future if the stock price performs poorly.

Case 1: Stock price rises beyond expectations

- MicroStrategy issues convertible bonds to investors;

- The company immediately received $3 billion in funding to purchase Bitcoin;

- Since the bonds carry a 0% interest rate, MicroStrategy does not have to pay interest during the life of the bonds;

- If the MSTR stock price rises above the conversion price threshold;

- Investors choose to convert bonds into stocks, or to recover their principal;

- Instead of paying cash principal, MicroStrategy will deliver it through the issuance of new shares.

Case 2: The stock price falls but does not reach the conversion price

- MicroStrategy issues convertible bonds to raise funds to purchase Bitcoin;

- The bonds have a 0% interest rate, and the company does not need to pay interest during the term;

- MSTR stock price continues to trade below the conversion price;

- Investors will not exercise the conversion option because the conversion will result in a loss;

- When the bonds mature, the company needs to repay the entire principal in cash;

- If cash reserves are insufficient, MicroStrategy may need to raise funds again to repay debt.

It is worth emphasizing that convertible bonds are essentially a combination of "ordinary bonds + call options", which is especially typical in the case of MicroStrategy (MSTR). The company continues to issue convertible bonds with an annual interest rate of 0%, which means that investors have no interest income at all during the bond period.

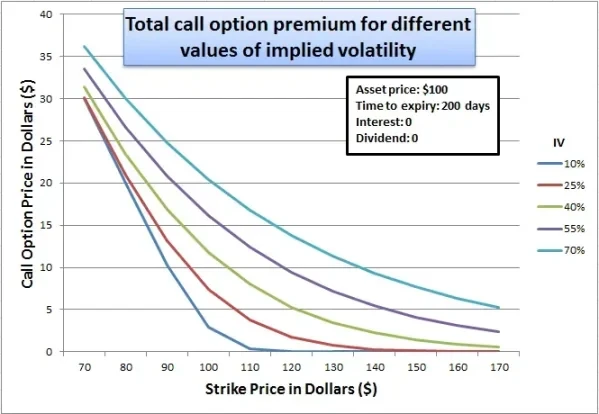

Why are savvy institutional investors willing to accept such a "low attractiveness" structure? The answer lies in the embedded call option value: this embedded call option is particularly valuable when the market expects higher implied volatility for MSTR, because the greater the expected price volatility, the higher the option value to capture upside opportunities.

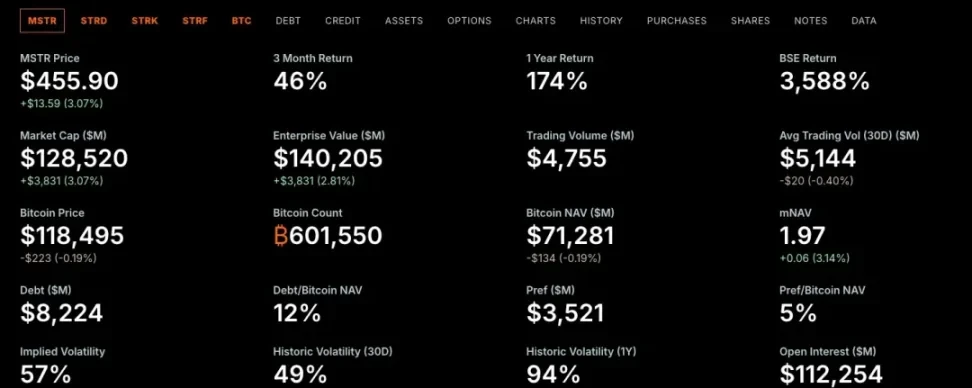

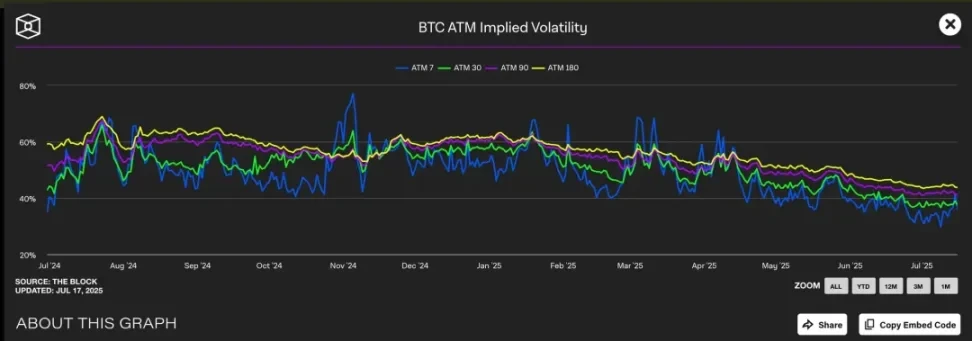

We observe that Bitcoin’s implied volatility (IV) is usually between 40% and 60% at different maturities. As MicroStrategy’s stock price is highly correlated with Bitcoin, this higher BTC IV indirectly raises the valuation of MSTR stock options.

Currently, at-the-money call options (strike price of about $455) are trading at an IV level of 45%, while the corresponding put option IV is higher, indicating that the market has strong expectations for future volatility. Such a high volatility environment significantly increases the value of the embedded call option in the MSTR convertible bond.

In essence, MicroStrategy is actually "selling" this call option to investors at a high premium. Because the greater the price volatility of the underlying asset, the higher the probability that the option will be "in the money" when it expires, which makes the call option more expensive during periods of high volatility.

From the investor’s perspective, this is acceptable because they are effectively buying a leveraged volatility bet: if MSTR’s stock price rises sharply, they can convert it into equity and realize a huge gain; if the stock price does not rise, the bondholders can still recover their principal at maturity.

For MSTR, this is a win-win situation: on the one hand, it can raise funds without paying interest and diluting equity immediately; on the other hand, if the Bitcoin strategy is successful, it can service or refinance this debt simply through stock price appreciation. In this framework, MSTR is not just raising debt, but "monetizing volatility" and exchanging future expectations of appreciation for current cheap funds.

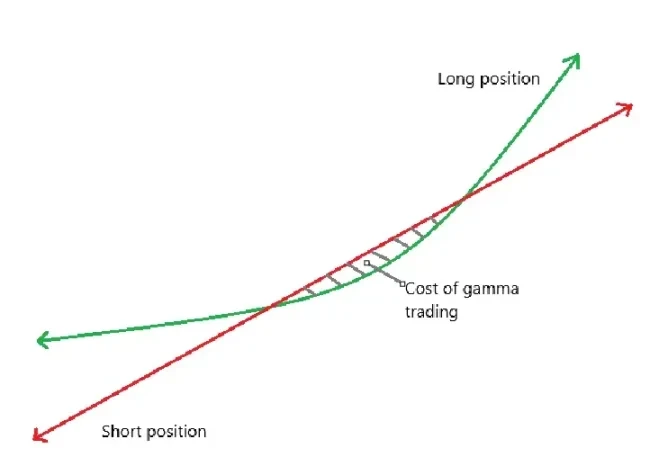

Gamma Trading

Gamma Trading is a core mechanism for the sustainability of MicroStrategy's capital structure, particularly in the context of its recurring convertible bond issuances. The company has issued billions of dollars in zero-coupon convertible bonds, whose primary appeal lies not in traditional fixed income but in the value of the call options embedded within them. In other words, investors value the tradability and volatility arbitrage opportunities offered by the option component rather than the interest income inherent in the bonds.

The buyers of these bonds are not traditional long-term creditors, but hedge funds that adopt a market-neutral strategy. Such institutions are widely engaged in so-called Gamma Trading, whose investment logic is not "buy and hold", but relies on constant hedging and rebalancing to capture profits in fluctuations.

Gamma Trading Mechanism in MSTR:

Basic transaction structure:

- Hedge funds buy MicroStrategy’s convertible bonds (essentially bonds + call options);

- At the same time, short a corresponding amount of MSTR stock to maintain delta-neutral.

Why was it established?

- If MSTR's stock price rises, the call option on the bond will increase in value faster than the loss from the short stock;

- If the stock price falls, the short position gains faster than the bond loses;

- This symmetrical payoff structure allows hedge funds to profit from volatility rather than directional changes.

Gamma and rebalancing mechanism:

- As stock prices fluctuate, hedge funds need to dynamically adjust their short positions to maintain delta neutrality;

- The initial hedge is set according to the bond’s Delta value. For example, if a convertible bond has a Delta of 0.5, the fund will short MSTR stock worth $50 to hedge the $100 bond;

- However, when the stock price continues to fluctuate, the Delta of the convertible bond itself will also change (i.e. the manifestation of Gamma), and the fund needs to continue to dynamically rebalance:

- Stock price rises, Delta increases (bonds behave more like stocks) → add to short position;

- Stock price falls, Delta decreases (bond behaves more like a bond) → Cover short position;

- This type of hedging transaction of constantly "selling high and buying low" is called Gamma Trading.

In reality, bond Delta changes nonlinearly with stock prices, and you need to constantly adjust your short position to maintain neutrality.

- Green curve: Returns from holding convertible bonds;

- Red straight line: returns on short stocks;

- The difference between the two is the net income P&L;

- When the stock is sideways and near the conversion range, frequent hedging operations may lead to losses. This is called the "cost zone" of Gamma Trading (the shaded area in the figure).

Impact on MSTR premium:

- These Gamma Hedgers Are Not Long-Term Holders

- When MSTR stock reaches the convertible bond conversion price, Delta → 1 and Gamma drops to an extremely low level;

- If volatility declines or spreads narrow, causing gamma trades to lose money, these funds will exit the market, weakening demand for convertible bonds.

Second-Order Effects:

- MicroStrategy's convertible bonds usually have zero coupons but long duration → low Theta (time value decay);

- When volatility is too low, Gamma trading is no longer profitable, Gamma PnL ≪ Theta loss (time loss);

- The sale of convertible bonds will become difficult, affecting its financing capabilities.

The comparison of Short Float illustrates the dominance of this strategy:

Short float refers to the proportion of a company's total outstanding shares that are shorted. We observed that MicroStrategy's short float was high due to its large convertible bond issuance, because funds that perform gamma trading often need to short MSTR stocks for delta neutral hedging.

In contrast, SBET does not issue convertible bonds, relying instead on PIPE private placements and ATM mark-to-market issuances. This lacks the arbitrage opportunities offered by a convertible bond + option structure, resulting in a significantly lower short float. SBET's financing structure is also closer to traditional financing, making it less attractive for large-scale arbitrage-focused institutions.

Performance

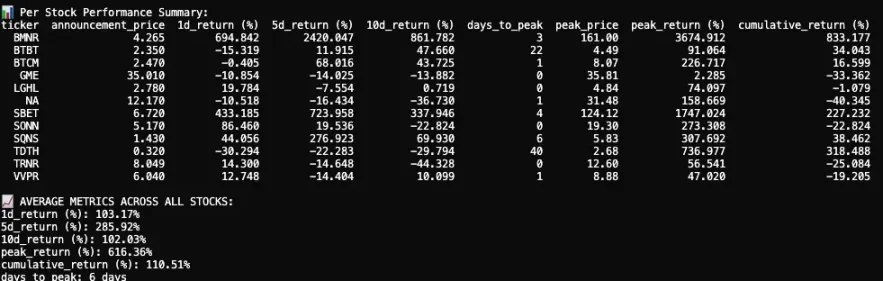

I tracked and analyzed the stock price reactions of 12 public companies after they announced cryptocurrency asset allocations in 2025. Our dataset contains stock price data around the announcement date, candlestick chart visualizations, and key performance indicators.

The stock price reaction following the first crypto vault announcements in 2025 was, on average, explosive, short-term, but still resulted in positive cumulative returns.

Across the 12 listed companies, the average one-day return was +103.17%, demonstrating a strong and immediate investor reaction. The five-day return surged further, reaching +285.92%, before retreating on the 10th day and ultimately stabilizing at +102.03%. While some companies experienced flat or even negative performance, several experienced extreme share price surges.

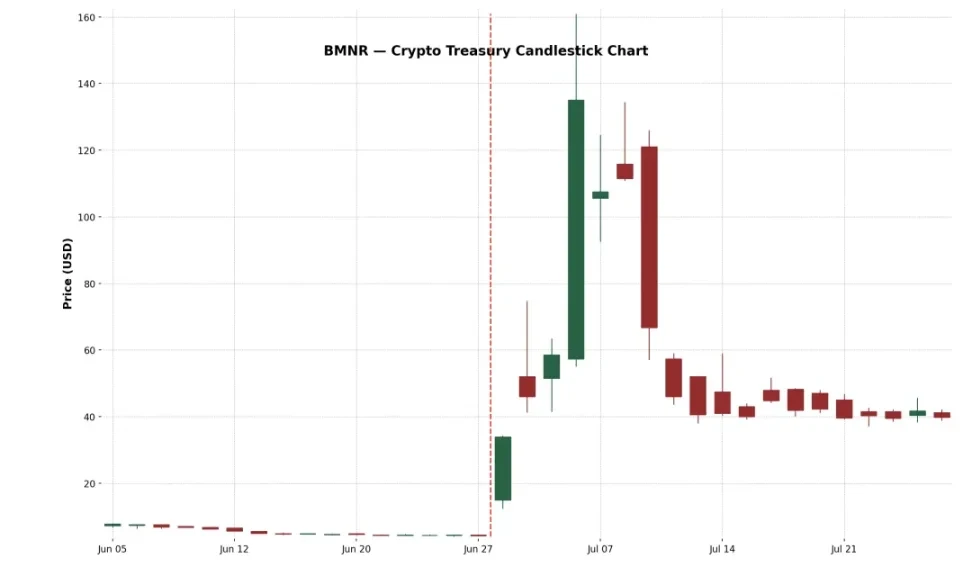

Example 1: BitMine Immersion Technologies Inc. (NYSE-American: BMNR)

This Las Vegas-based blockchain infrastructure company operates industrial-scale Bitcoin mining farms, sells immersion cooling hardware, and provides hosting services for third-party equipment in areas with low electricity prices, such as Texas and Trinidad. On June 30, 2025, the company issued 55.6 million shares in a private placement at a price of $4.50 per share, raising approximately $250 million to expand its Ethereum vault.

Following the announcement, BMNR's stock price soared from $4.27 to a high of $161, a 3,674.9% gain in three days. This epic surge was likely driven by thin float, retail investor enthusiasm, and FOMO. Despite the subsequent sharp correction, the cumulative two-week gain still stands at 882.4%. This event underscores the market's positive response to MicroStrategy-style high-conviction crypto vault strategies.

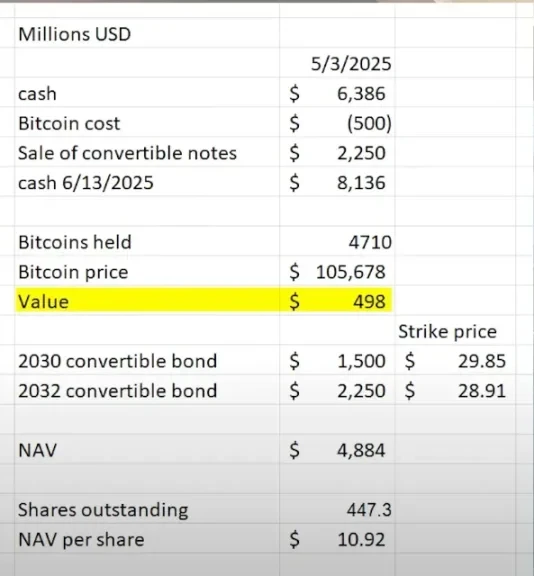

Example 2: SharkLink Gaming Ltd. (Nasdaq: SBET)

Founded in 2019, SharpLink is an online technology company focused on converting sports fans into bettors. Its platform pushes sports betting and interactive gaming offers to users based on timeliness. The company began accumulating ETH on its balance sheet in 2025, raising funds through PIPE (private placement financing) and ATM (at-market additional issuance).

The stock's initial reaction was strong: SBET surged +433.2% on its first day, reaching a high of +1,747% on its fourth trading day. This surge was driven by both the scale of crypto asset allocation and the support of the major investors behind the deal. Retail investors, crypto funds, and speculative traders piled in, pushing the stock price above $120.

However, the rally was short-lived. On June 17, SharpLink filed an S-3 registration statement with the SEC, making it possible for PIPE investors to resell their shares, sparking widespread confusion. Many people mistakenly believed that major shareholders were selling. Although Consensys co-founder and SBET chairman Joseph Lubin later clarified that "no shares have been sold yet," it was too late: SBET's stock price plummeted by nearly 70%, almost wiping out most of the gains after the announcement.

Despite the sharp pullback, SBET still has a cumulative gain of +227.2%, indicating that the market still places significant long-term value on its ETH treasury strategy. Despite retreating from its highs, the stock has regained financial support in the following weeks, indicating that market confidence in the "ETH as a reserve asset" model is recovering.

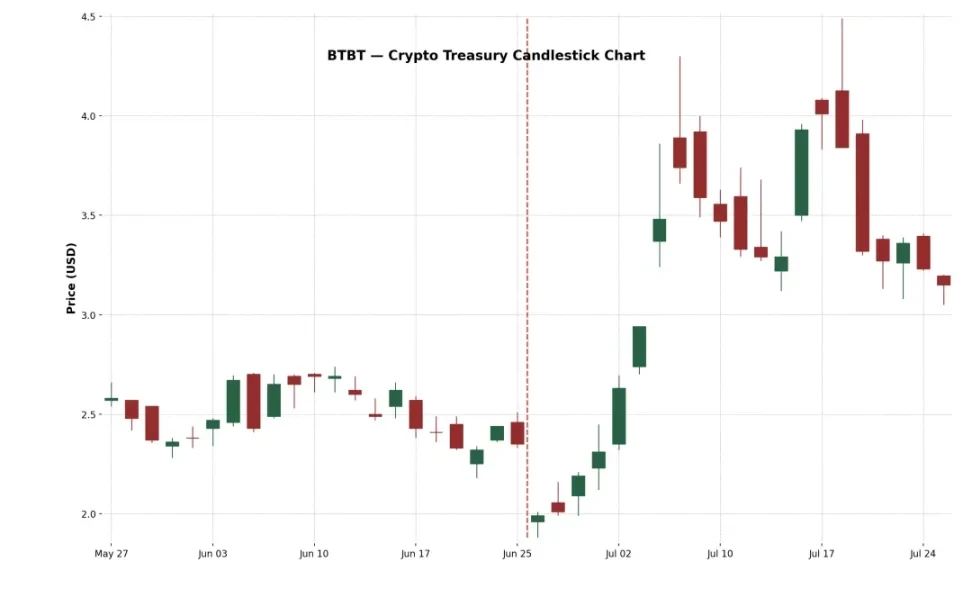

Example 3: Bit Digital Inc. (Nasdaq: BTBT)

BTBT is a digital asset platform headquartered in New York. It was founded in 2015 and initially operated Bitcoin mining farms in the United States, Canada, and Iceland.

In June 2025, the company completed an underwritten additional offering, raising approximately US$172 million. It reallocated capital to ETH through the additional proceeds from the sale of 280 BTC, purchasing a total of approximately 100,603 ETH, officially completing the transition to the Ethereum staking and vault model, with crypto veteran Sam Tabar serving as CEO.

While the initial market reaction was muted (a -15% drop on the first day), the stock price gradually rose over the following two weeks, ultimately reaching a +91% gain. This modest reaction likely reflects the market's familiarity with BTBT's background in crypto mining. However, the cumulative return of +34% demonstrates that even established crypto companies can gain positive market recognition by further expanding their crypto asset allocation.

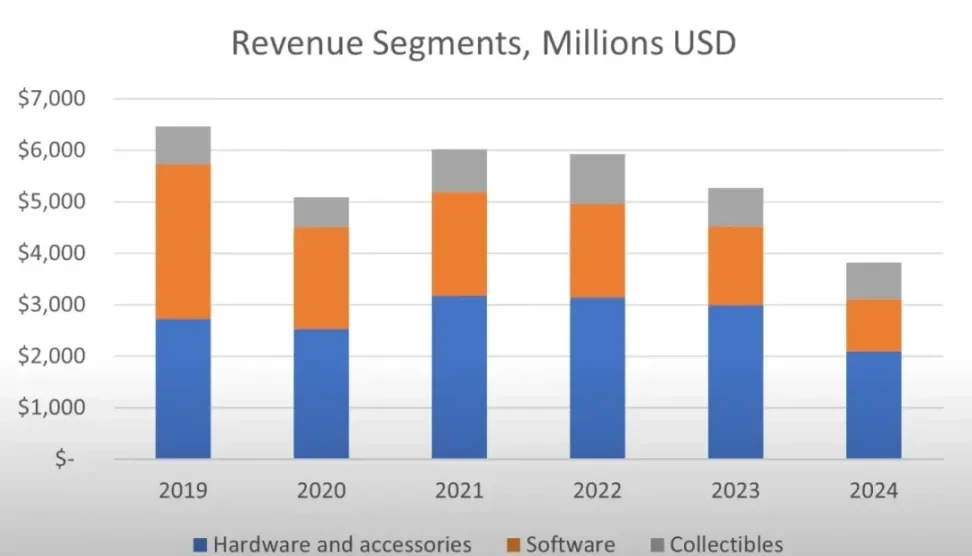

Example 4: GameStop Corp. (Nasdaq: GME)

However, in May 2025, GameStop (GME) announced its first Bitcoin purchase and plans to further transform into a cryptocurrency-related consumer gaming infrastructure company. Despite intense retail investor interest and the symbolic significance of this meme stock's foray into crypto, GME's returns were negative on both the fifth and tenth days following the announcement. This performance discrepancy reveals a core insight: positive crypto news alone is not enough to sustainably drive stock prices higher.

GameStop's Bitcoin layout has been questioned by the market because its retail business continues to shrink. This transformation comes after the company's multiple strategic shifts (such as stores, NFTs, metaverse, etc.).

Its failure to maintain its upward trend reflects market skepticism about its fundamentals and strategic uncertainty. The company's core revenue continues to decline, and management has offered no concrete reforms beyond "buying Bitcoin." The company's messaging is also mixed, with its strategic vacillation from stores, NFTs, the metaverse, and now cryptocurrencies has severely undermined market confidence.

Cryptocurrency asset allocation trends

In addition to Bitcoin, a growing number of companies are turning to Ethereum (ETH) as the primary asset for their cryptocurrency reserves. The reasons are multifaceted. First, Ethereum is widely recognized as the underlying infrastructure for real-world asset (RWA) tokenization platforms. Protocols like Ondo, Backed Finance, and Centrifuge are all building institutional-grade financial products on the Ethereum settlement layer. This makes ETH a strategic reserve asset for companies betting on the trend of bringing traditional finance to blockchain.

Second, unlike Bitcoin, Ethereum is a staking- and interest-earning asset that is composable with DeFi. Holders can earn an annualized return of approximately 3–4% by participating in network security. This makes ETH a programmable, interest-earning asset, making it highly attractive to CFOs seeking to optimize returns on idle cash.

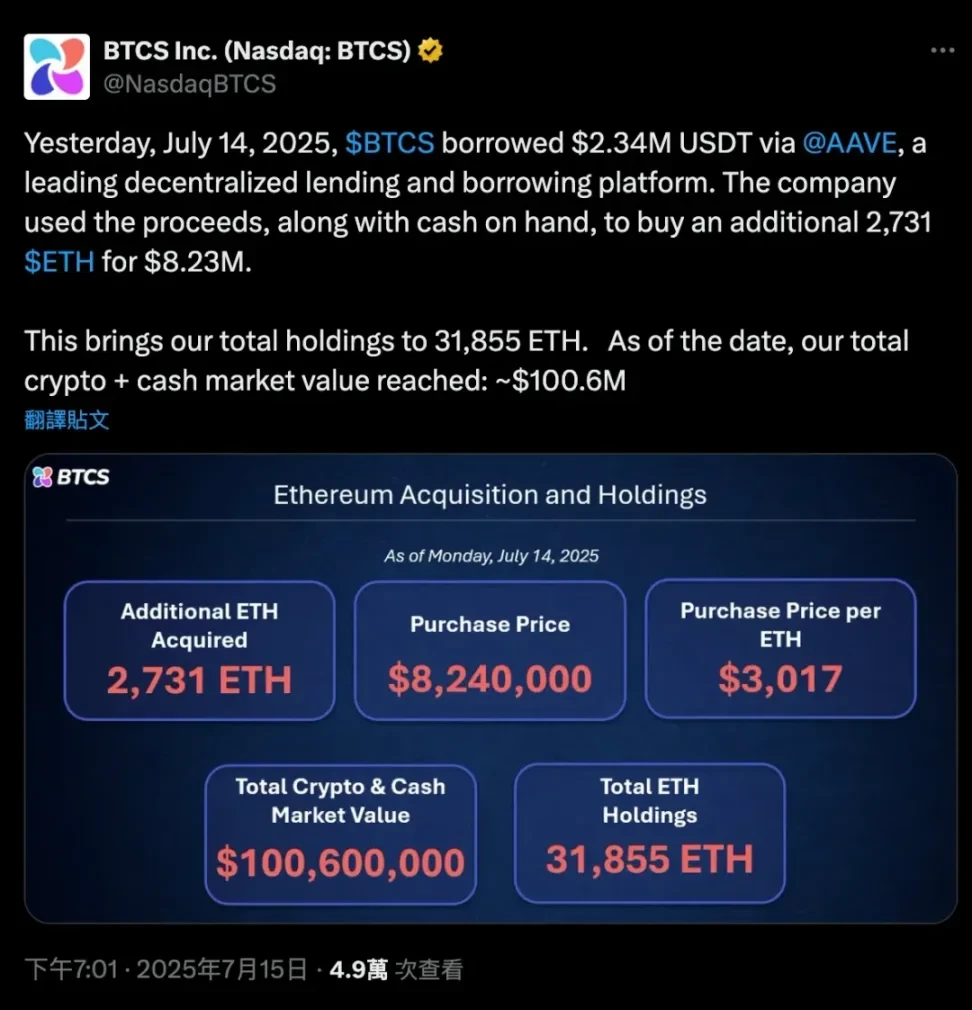

On July 14, 2025, BTCS borrowed 2.34 million USDT from Aave, a decentralized lending protocol. Combined with some of its own cash, it purchased 2,731 ETH, valued at approximately $8.24 million, further expanding its Ethereum holdings. This leveraged transaction brought BTCS's total ETH holdings to 31,855, increasing the company's overall crypto-cash market capitalization to $100.6 million.

This case study clearly demonstrates Ethereum's unique dual role in DeFi, serving as both collateral and capital. While Bitcoin is more of a passive asset held in cold wallets, requiring wrapping to participate in DeFi, ETH is a native composable asset that businesses can use for lending, staking, or participating in yield farming protocols without having to sell it.

The launch of an Ethereum spot ETF has further bolstered institutional confidence and liquidity in ETH. Net subscription inflows indicate the gradual acceptance of ETH in mainstream financial markets. Consequently, companies like SharpLink (SBET), Bit Digital (BTBT), and even some private companies are adjusting their balance sheets and increasing their ETH holdings. This isn't just a speculative bet; it's a manifestation of a long-term belief in Ethereum as the underlying infrastructure of decentralized capital markets.

This trend marks a major shift in the asset allocation strategy of crypto companies: from "Bitcoin = digital gold" to "Ethereum = digital financial infrastructure."

Here are a few examples of this diverse configuration:

XRP as a reserve asset: VivoPower International (NASDAQ: VVPR) raised $121 million in May 2025, led by a Saudi prince, becoming the first publicly listed company to adopt an XRP reserve strategy. Shortly thereafter, Singapore's Trident Digital Holdings (TDTH) announced plans to issue up to $500 million in shares to establish an XRP reserve. China's Webus International (WETO) also filed an application to invest $300 million in XRP holdings and plans to integrate Ripple's cross-border payments network into its business. These moves, influenced by Ripple's legal compliance status in the United States, generated mixed market reactions. While XRP rallied in mid-2025, the performance of related stocks diverged. However, these actions demonstrate that crypto asset allocation is moving beyond the traditional dual-track approach of BTC and ETH.

Litecoin (LTC) Reserve: MEI Pharma (MEIP), a small biopharmaceutical company, unexpectedly announced a pivot in July 2025. With participation from Litecoin founder Charlie Lee and the Litecoin Foundation, the company raised $100 million to establish the first institutional-grade Litecoin reserve program. This initiative, accompanied by a management change (Lee joined the board of directors), was viewed by the market as an attempt to inject new momentum into the struggling biopharmaceutical industry using crypto capital. The stock surged following the announcement of the "biopharmaceutical + Litecoin" partnership, but has fluctuated significantly due to investor skepticism about the company's ultimate business model.

HYPE Token Reserve: A more "unusual" case comes from Sonnet BioTherapeutics (SONN), which announced an $888 million reverse merger in July 2025 to establish Hyperliquid Strategies Inc., with plans to include $583 million in HYPE tokens on the company's balance sheet. The transaction is backed by mainstream crypto venture capital firms such as Paradigm and Pantera, and aims to create the world's largest listed entity holding HYPE tokens. SONN's stock price soared after the announcement (because HYPE is a popular token), but analysts pointed out that its structure is complex and the token itself is still in its early stages. Similarly, Lion Group (LGHL) also obtained a $600 million credit line to reserve tokens such as HYPE, Solana, and Sui to create a multi-asset crypto treasury.

When will Saylor sell coins?

Michael Saylor has publicly declared that MicroStrategy will "HODL" its Bitcoin assets forever, that is, the company has no intention of selling its BTC reserves. In fact, MicroStrategy has even revised its corporate policy to officially establish Bitcoin as its main treasury reserve asset, which means that this is an extremely long-term holding plan. However, in the real world of corporate finance, "never sell" is not absolute. In certain situations, MicroStrategy may be forced to sell some Bitcoin. Understanding these potential scenarios is critical because they constitute risk factors in the entire "MicroStrategy as a Bitcoin proxy asset" investment logic.

Here are some scenarios that could challenge MicroStrategy’s resolve and “force” it to sell BTC:

Significant debt maturities in tight credit markets: MicroStrategy currently has multiple debts outstanding, including convertible bonds due in 2028 and 2030 (it has previously redeemed the 2025 and 2027 bonds with equity), and possibly other loans. Typically, companies pay off old debt by refinancing - issuing new debt or new equity. In early 2025, MicroStrategy successfully redeemed its 2027 convertible bonds with equity, avoiding cash outlays. But imagine a scenario: In 2028, Bitcoin is in a deep bear market, MicroStrategy's stock price has plummeted, and interest rates are high (new financing is too expensive). At this time, if $500 million to $1 billion of debt matures, the company may face a cash flow crisis.

In this case, the traditional capital market may "close" its doors, especially when the implied volatility (IV) is too low, resulting in no investors willing to buy convertible bonds with embedded option value, and MicroStrategy's best financing tool will become ineffective.

Faced with such a credit crunch, the company would likely be forced to sell some of its BTC to repay debt, akin to a forced liquidation. While MicroStrategy holds a substantial BTC holding (valued at over $70 billion by 2025), tapping it would inevitably shake market confidence. Such a sale would likely be a last resort, undertaken only after all other financing avenues have failed.

High interest burden or preferred stock dividend pressure: While MicroStrategy's financing structure is flexible, it does come at a cost. Fixed expenses facing the company in 2025 include:

- STRK Annual interest rate 8% (payable in cash or stock)

- STRF annual interest rate is 10% (must be paid in cash, there is a penalty for default)

- STRC monthly interest rate 9–10% (payable in cash, adjustable by the Board of Directors)

- Convertible bond interest (e.g. coupon rate in 2030 is 0.625%)

The total annual fixed liability exceeds US$180 million and may continue to rise with subsequent financing.

- If MSTR's stock price is depressed, a direct share issuance financing would cause severe dilution.

- If a crypto winter sets in, MicroStrategy could continue to burn cash to maintain cash dividends from STRF and STRC. If BTC remains depressed for a prolonged period, the company's leverage structure could become precarious. The board of directors might decide to sell some Bitcoin to "buy time," providing cash flow for interest or dividends over the next one to two years. While this defeats the purpose, it's better than defaulting on the contract or triggering the STRF's cumulative default mechanism.

- What if interest rates keep rising? Then all future financing will become more expensive:

- Newly issued preferred shares must offer higher yields (e.g. >10%) to attract investors;

- Convertible bonds must have higher implied volatility to be accepted by the market (which is often difficult to achieve in a bear market);

- If MSTR's stock price is depressed, direct equity financing will cause severe dilution.

- In other words, capital costs are rising, but revenues are not, and BTC is low.

Summary: MicroStrategy may only sell coins under extreme pressure or strategic shifts. These scenarios are mostly related to financial pressure: debt is difficult to roll over, capital costs are too high, or the market discounts the company's valuation. Under normal circumstances, Saylor's strategy is to continue buying or holding, not selling. In fact, the company has already shown this firmness: when the crypto market plummeted in 2022-2023, MicroStrategy did not sell BTC like Tesla. Instead, it quietly repurchased some convertible bonds in the secondary market and realized "discounted debt repayment". At any time, it would give priority to other means and was unwilling to sell Bitcoin, because once the currency was sold, the entire "Bitcoin Treasury" story would collapse, and market beliefs would be shaken.

Summarize

MicroStrategy (MSTR) pioneered a new corporate finance model, transforming a publicly traded operating company directly into a leveraged Bitcoin holding. Through aggressive use of capital market instruments, particularly zero-coupon convertible bonds, MSTR financialized its stock volatility, accumulating over 600,000 Bitcoins without relying on cash flow from its core business.

Its core mechanism is simple yet powerful: when the company's stock price is trading at a premium to its Bitcoin net asset value (mNAV) (i.e., mNAV > 1), it raises funds through the issuance of stock or convertible bonds (such as the "21/21" or "42/42" plans), then converts all proceeds into Bitcoin. Because MicroStrategy's stock price has long been higher than its Bitcoin market capitalization, this cycle continues, allowing it to simultaneously raise funds and increase its "coin holdings per share."

At the heart of this model, convertible bonds play a key role: they combine the downside protection of bonds (the bond floor) with the upside potential of stocks (the embedded call option). In a highly volatile environment (such as 2025), investors are even willing to accept 0% interest simply because the option value is high enough. In essence, MSTR isn't just raising debt; it's "selling volatility," and doing so at a premium. The market is willing to pay upfront for this future growth potential, enabling the company to continuously raise funds to buy tokens without paying interest or immediately diluting shareholders.

However, this model has limitations: once implied volatility contracts (whether due to market maturity or a lack of BTC momentum), the embedded option value will decline, significantly reducing the attractiveness of future convertible bond issuances. The company will then be forced to rely on traditional financing methods or repay the debt with cash when it matures. Furthermore, the "gamma traders" and volatility arbitrageurs who support the MSTR financing ecosystem are opportunistic. Once volatility decreases or market sentiment shifts, demand for their securities could quickly dry up. This isn't "delta risk" (as everyone knows, MSTR is a BTC proxy), but rather "low gamma risk," where even a small change in volatility expectations can render the entire financing mechanism ineffective.

Despite this, investing in MicroStrategy has become a new trend among institutional funds and retail investors, who view it as a trading alternative to Bitcoin's rise. This speculative mentality is also reflected on-chain: users continue to buy meme tokens related to "crypto treasury companies" or trade stocks like MSTR and SBET to bet on this narrative. Whether in traditional markets or DeFi, the underlying logic is consistent: crypto treasuries represent a high-volatility, highly leveraged alternative to BTC, and if timed well, returns can even exceed the original asset itself.

In short, MicroStrategy isn't just using Bitcoin as a reserve; it's building a fundamentally new financial structure around it. It's the first successful "crypto treasury company" and could define a new paradigm for how companies allocate treasury assets, monetize volatility, and create shareholder value, setting a new benchmark in a Bitcoin-dominated financial world.

- 核心观点:上市公司加速配置加密资产作为抗通胀工具。

- 关键要素:

- 2025年6月新增26家公司持有BTC,总数达250家。

- 64家SEC注册公司持有68.8万枚BTC,占比3-4%。

- MicroStrategy通过优先股/可转债融资扩表BTC持仓。

- 市场影响:推动加密资产主流化与机构化进程。

- 时效性标注:中期影响。