Technology Accelerators Are Excited: A Summary of the Latest Developments in Stablecoins, There Are Many Things (and Projects) You Don’t Know

Original author: Poopman , DeFi researcher

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Recently, DeFi researcher Poopman published an article on the current situation and vision of stablecoins. Odaily Planet Daily compiled it as follows:

Stablecoins are having a breakthrough moment, with recent headlines including:

The Genius Act passed;

Stripe acquires crypto wallet provider Privy and stablecoin infrastructure company Bridge;

Circle (CRCL) rose 7 times after IP 0;

Plasma deposits are capped at $1 billion;

Tether is now the 19th largest entity invested in Treasury bonds;

Mastercard partners with Chainlink to allow users to buy stablecoins on DEX;

Banks, big tech companies and Asian regions are racing to launch their own stablecoins.

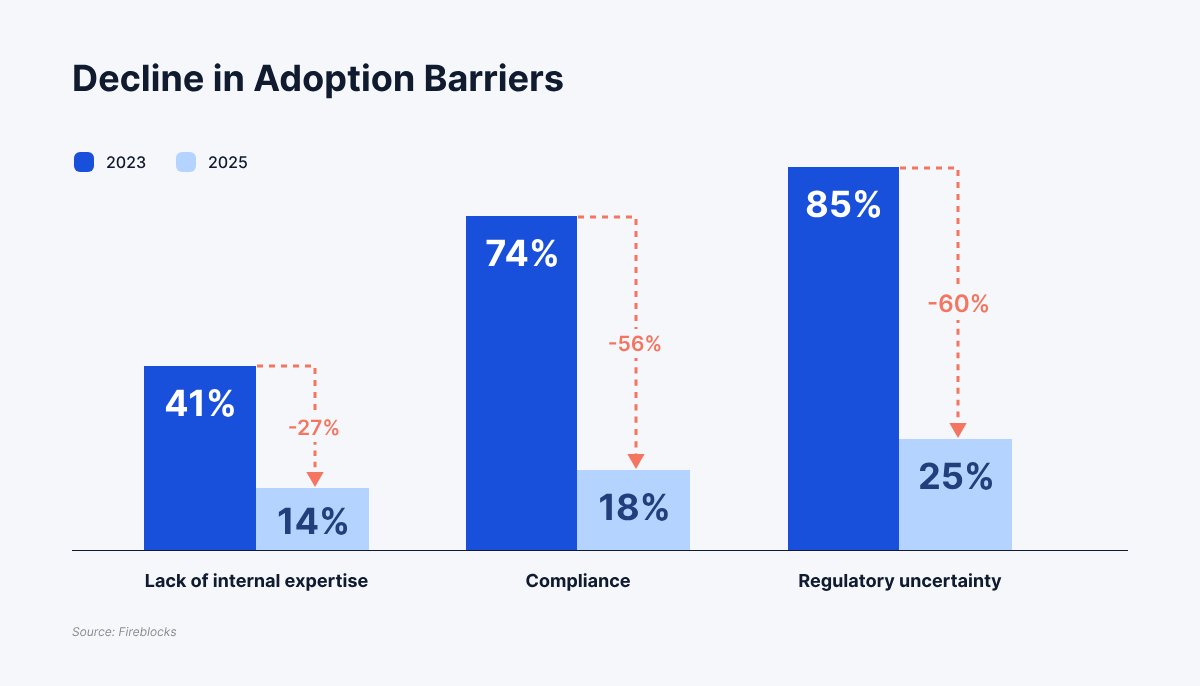

Regulation was once seen as an obstacle to the development of stablecoins, and traditional financial institutions were hesitant to enter the field due to a lack of understanding, consensus, and appropriate compliance tools. However, with a deeper understanding of stablecoin regulation, this factor, once seen as an obstacle, has become a catalyst.

Fireblocks said that the regulatory framework has increased corporate confidence in stablecoins by 80%. At the same time, 86% of companies have established stablecoin infrastructure, indicating that banks and institutions have been preparing for this transition.

So why are stablecoins suddenly in the spotlight?

Because they solve real problems. Some of the significant advantages of stablecoins include:

1. Instant and lower-cost cross-border transactions, enabling emerging markets to access US dollars without permission, potentially enabling more efficient on-chain transactions in the foreign exchange market, etc.

2. Stablecoins can create more demand for U.S. Treasuries, and the United States is only too happy to take advantage of this to sell its debt.

Thanks to the Genius Act for bringing this to the public’s attention. I believe we are entering a new era where the next wave of adoption of stablecoins as core payments will be driven by the non-crypto native community, also known as “mass adoption”.

What’s next?

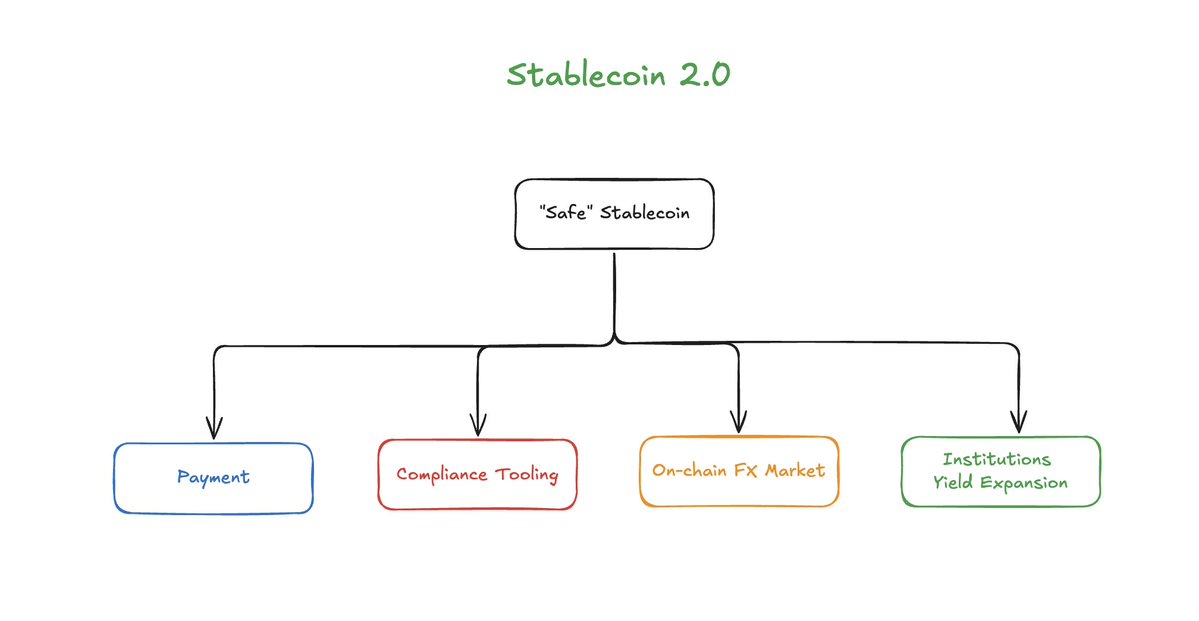

In my opinion, the expected growth of stablecoins, especially in payments, cross-border and personal banking, will create a lot of opportunities for stablecoin-related businesses. Let’s explore four paths for the future of stablecoins:

More than just trading: Stablecoins are going mainstream. From this moment on, stablecoins will no longer only serve trading pairs, but also serve payments, savings, and even new businesses that were previously limited by T+1 settlement delays.

Compliance Tools: Issuers need more sophisticated, regulation-friendly solutions (e.g., tax/fraud reporting, etc.) to comply with AML laws and policies.

24/7 on-chain foreign exchange market: A more efficient, 24/7 foreign exchange market that supports instant settlement.

Increased demand for yield: As the market landscape becomes increasingly fragmented, there is a need for more RWA strategies, fixed-rate yield products and aggregate products (e.g., indices).

More than just trading

The original intention of stablecoins was simple: to provide volatility hedging and a safe haven for crypto assets for cryptocurrency traders. USDT, a fully asset-backed stablecoin, became the dominant trading pair on major exchanges due to its first-mover advantage. USDC followed as the second most popular stablecoin. Fundamentally, stablecoins were created to meet the trading and hedging needs of cryptocurrencies in their early stages.

New trends:

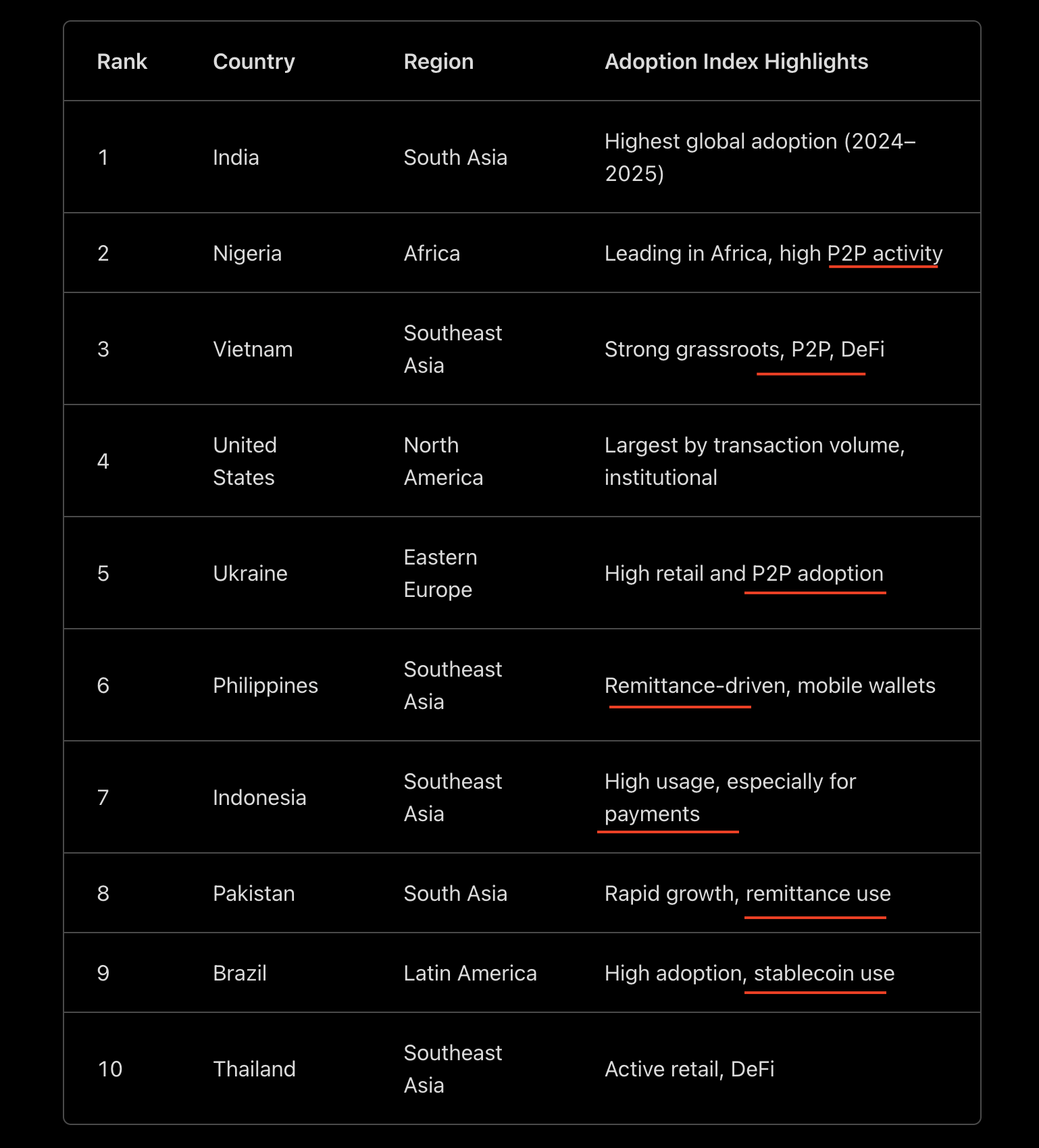

In addition to transactions, payment has become another core function of stablecoins. This trend has become increasingly evident over the past year. The 2025 Cryptocurrency Adoption Index report shows that 8 of the 10 countries with the fastest growing cryptocurrency adoption rates are actually driven by P2P and remittance demand.

Growth is concentrated in emerging markets, where the purpose of stablecoins is to provide permissionless access to dollars, which is not easy to achieve in low-income countries. For business activities in these regions, stablecoins backed by US dollars provide them with protection against the risk of fluctuations in local currencies. As confidence grows, I expect the adoption of stablecoins to increase further.

Cross-border payments and e-commerce

Another important use case is cross-border payments. The advantages are clear: instant settlement, lower costs, greater transparency, and permissionless access to dollars free up capital for businesses that were previously trapped in slow and opaque cross-border transfer systems.

A good example is Conduit , a cross-border payment solution powered by Dragonfly. According to reports, there has been a surge in demand from importers and exporters in Latin America and Africa, with the region driving a 16-fold increase in transaction volume on the Conduit platform to $10 billion in annual payment volume, reflecting the growing demand for stablecoin solutions in cross-border payments.

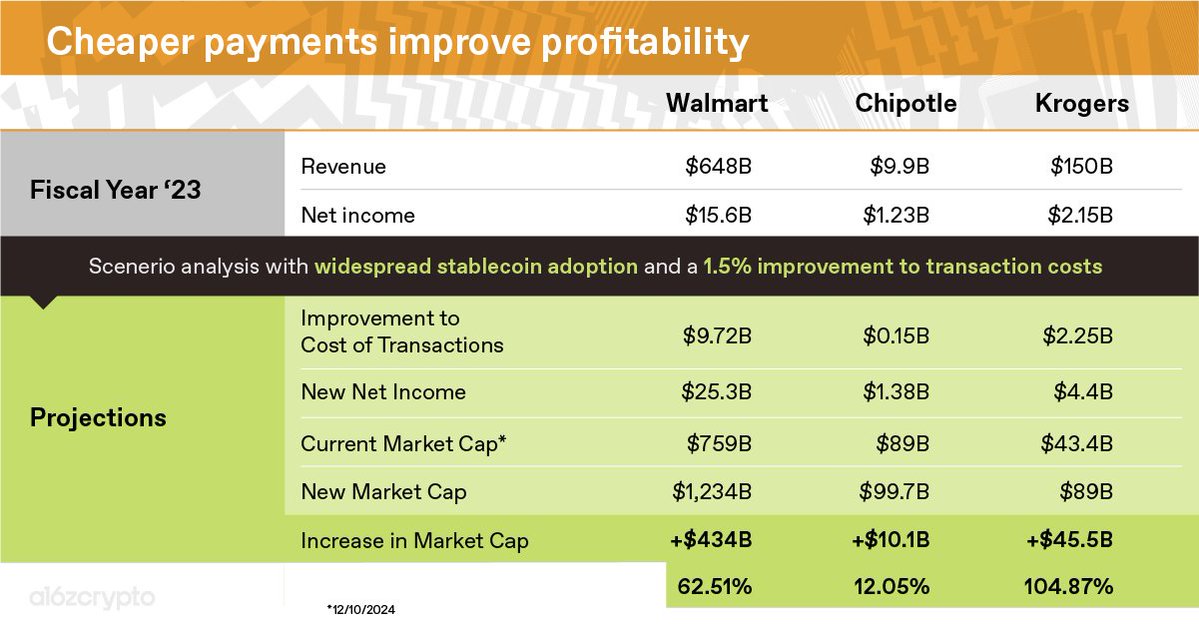

At the same time, e-commerce has also opened up new horizons for stablecoins, mainly because stablecoins can bring profit growth to merchants and payment processors. According to a16z crypto report, large retailers like Walmart can reduce network intermediary fees through stablecoin payments, increasing revenue by up to 62%. Payment processors like Stripe can also benefit from profit margins and may be incentivized to integrate stablecoins.

Web2 payment giants are not just watching, they are already taking action, and stablecoins will soon be everywhere. Here are some examples:

Shopify accepts USDC payments via Stripe;

Paypal launched pyUSD, a $1 billion market cap token that can be used as a payment rail;

Walmart and Amazon plan to develop their own stablecoins…

As regulatory barriers are removed, stablecoins are poised for explosive growth. We will see an increase in cross-border stablecoin transfers in emerging markets, more payments in USDC on the SOL/Base network via CEXs, Phantoms, neo-banks, fintech applications, more stablecoin sales in e-commerce, etc. The story has just begun.

Compliance Tools

Trust is critical to enterprise adoption of stablecoins, and the Genius Act now establishes a regulatory framework for the issuance of stablecoins in the U.S. I expect the need for compliance tools to grow as new issuers enter the market. To understand the role of compliance tools in the stablecoin stack, let’s look at some basic concepts and background.

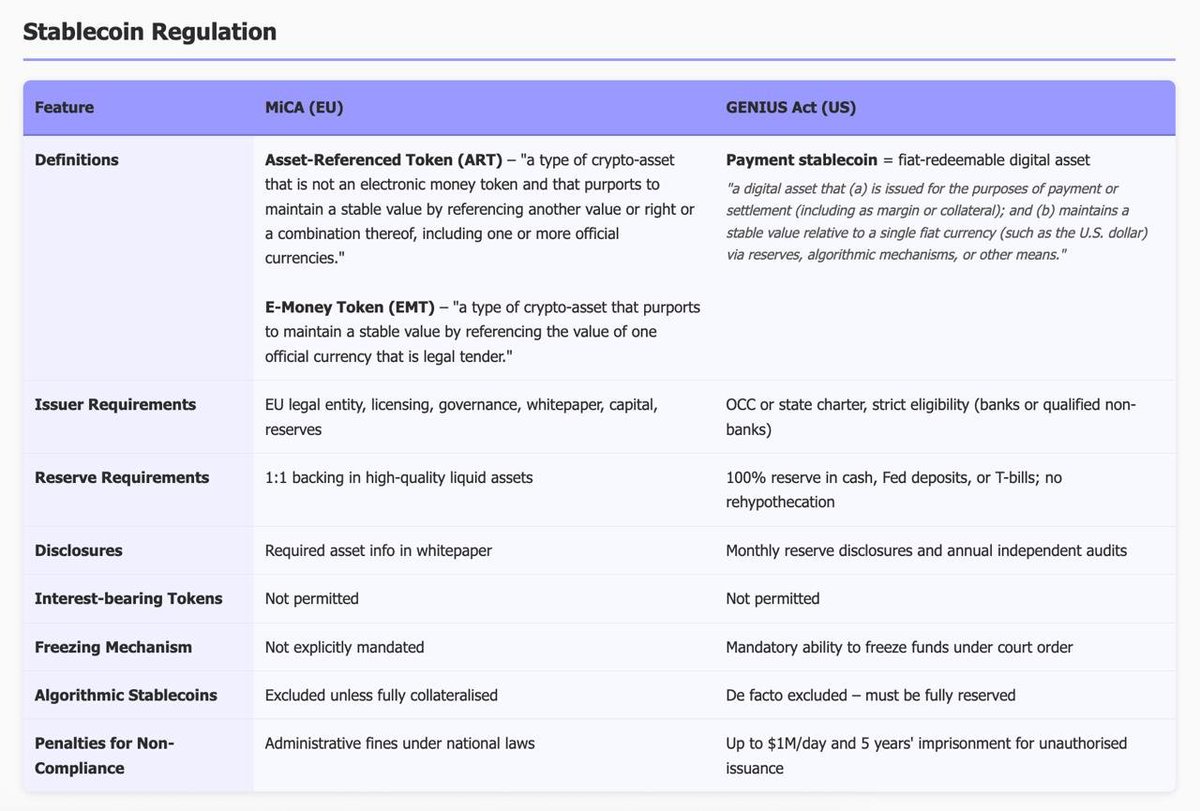

While regulations may vary from state to state, there are two major regulatory frameworks that are shaping the stablecoin landscape: MICA and the Genius Act.

The following table summarizes the main differences between these frameworks:

In short, the new Genius Act has two main purposes: consumer protection and national security. Chainalysis summarizes it well, but the basics are as follows:

1. Consumer Protection:

Reserves: must be fully secured by liquid assets (such as Treasury bonds or cash with a maturity of 93 days or less);

Transparency: Publicly disclose the structure of the reserve, redemption policy, and any associated fees on the website on a monthly basis;

Restrictions: The use of "USG" and any other "legal" currency in marketing or promotional materials is prohibited;

Bankruptcy protection: Stablecoin holders have priority in bankruptcy liquidation;

No yield: Issuers are not allowed to offer yield or interest on 1:1 collateralized stablecoins.

2. National Security Clauses:

Bank Secrecy Act compliance: AML, KYC, transaction monitoring and record keeping, reporting of any suspicious activities, etc.;

Technical execution capabilities: Ability to freeze and destroy tokens as an issuer, and have the right to prohibit non-compliant foreign issuers from entering the U.S. market, etc.;

Sanctions enforcement coordination: Before blocking a foreign entity from trading, the Treasury Secretary must attempt to coordinate with the stablecoin issuer, whenever possible.

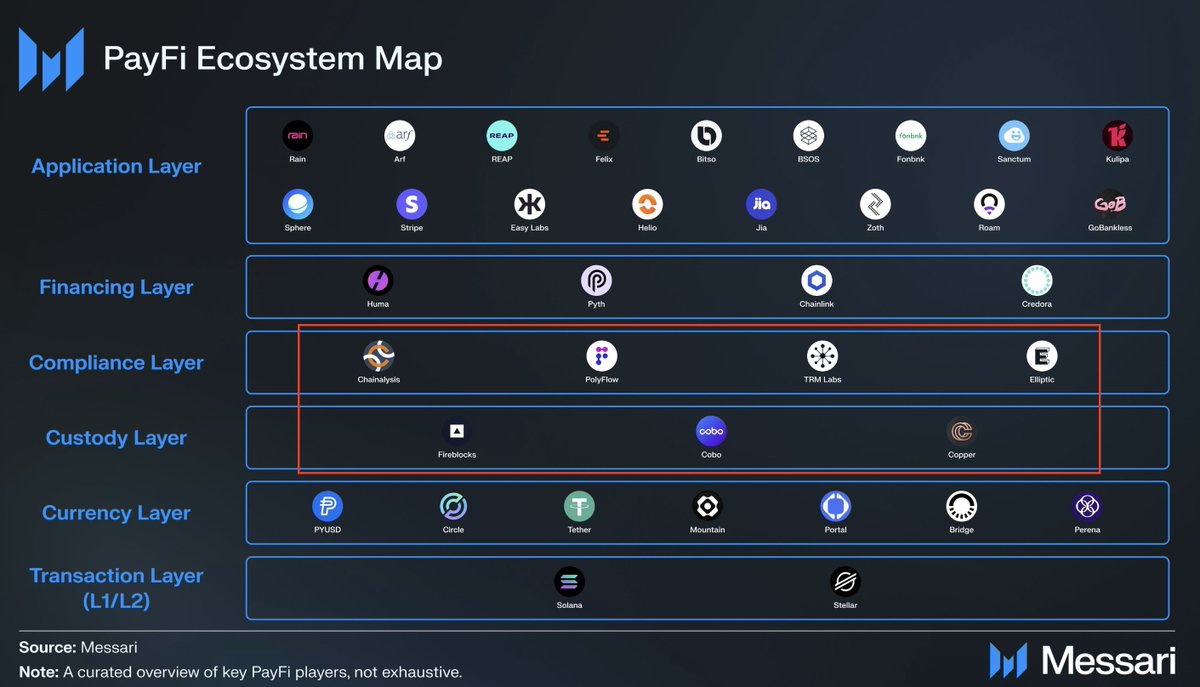

To become a "certified" stablecoin issuer, companies need a way to identify, freeze, track, and disclose their reserves to the public, while properly communicating with affected parties. This is where compliance tool providers come into play. For example, Chainalysis Sential can monitor transactions for 35 risk behavior categories in real time, and the API provided by the platform enables card issuers to freeze and blacklist addresses, stop, mint, or destroy tokens when suspicious activity is detected.

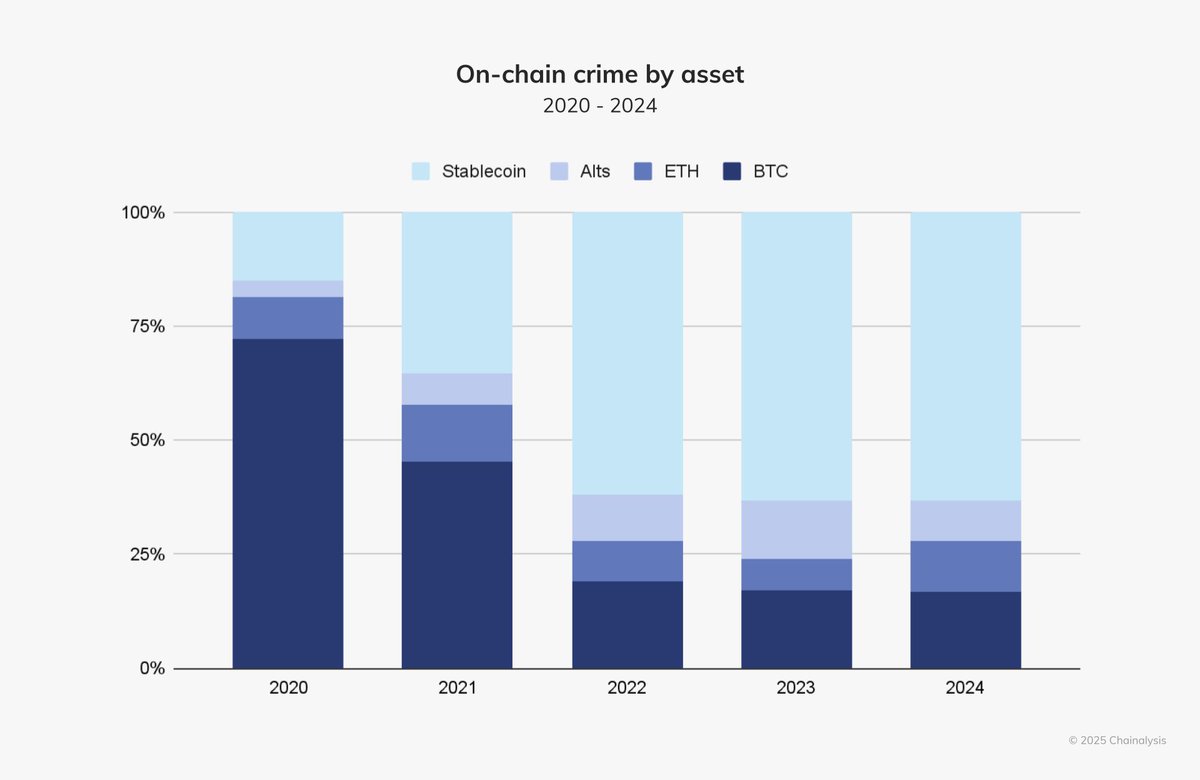

This layer has become increasingly important recently, as some sanctioned entities turn to stablecoins as a transfer medium when they are unable to obtain US dollars through traditional banks;

Furthermore, due to the price stability provided by the US dollar, funds from fraud and money laundering are now partially held in stablecoins, in fact, the percentage of stolen funds held in stablecoins has increased from 20% to nearly 50% over the past few years. This is why compliance tools are important, which will help identify, filter and report suspicious transactions, giving businesses and all new users confidence in the system.

This functionality is not limited to existing infrastructure, and all platforms handling stablecoins will need to become more compliance-friendly over time.

For example, Coinbase recently acquired Liquifi , a platform that handles token locks, airdrops, and even payroll in stablecoins, and they are starting to offer tax filing tools and ensure their tools meet compliance requirements in different countries.

Fireblocks has developed a toolkit similar to Chainalysis, but they offer more services, including configurable compliance policies and integrated KYT, AML, and travel rule compliance capabilities. Other players in the space include TRM Labs, Elliptic, and Polyflow, all of which are building stablecoin compliance layers.

While this may not be the sexiest direction for the industry, it is a necessary step to gain trust and adoption from traditional businesses.

On-chain foreign exchange market

As US regulators approve stablecoins, more and more countries will inevitably adopt stablecoins and asset tokenization. This shift is likely to give rise to an on-chain foreign exchange market, which, in my opinion, has two major advantages: 24/7 and increased retail participation due to accessibility. In my opinion, the on-chain foreign exchange market can be divided into two major layers: issuers and trading venues. We will not discuss the issue of deposits and withdrawals for the time being, because considering that this issue needs to be discussed on a case-by-case and country-by-country basis, it will require a separate analysis in the future.

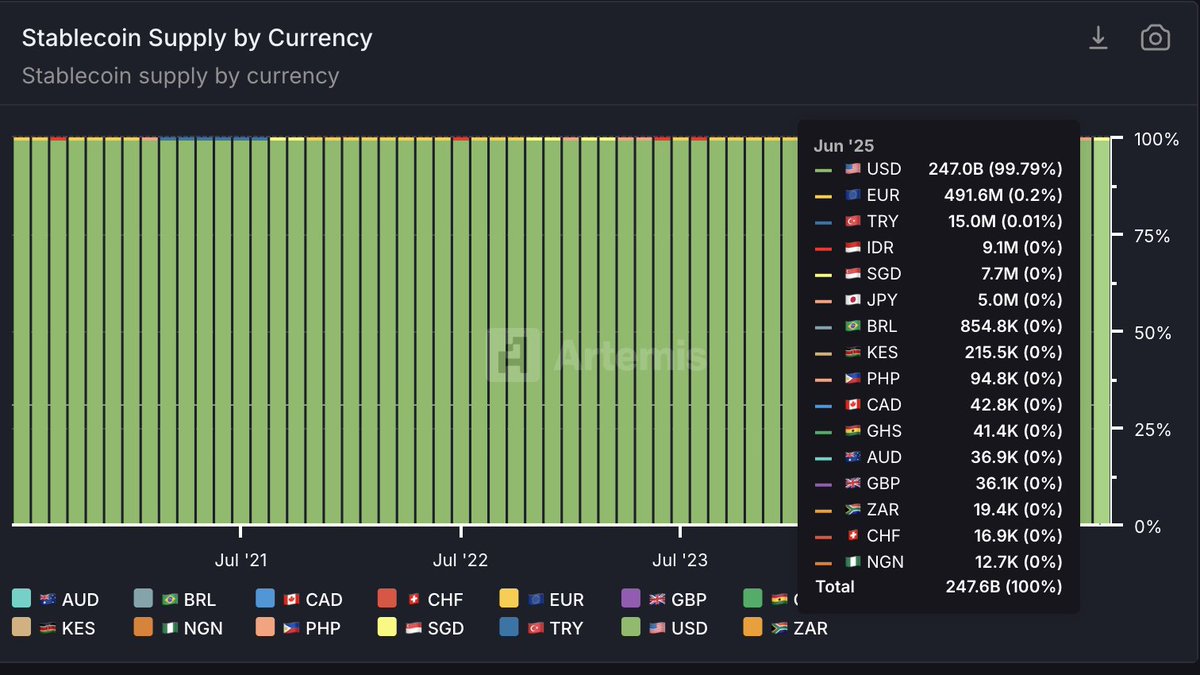

Currently, the US dollar stablecoin accounts for 99.79% of the market share, while the euro stablecoin accounts for only 0.2%. The main issuers of non-US dollar assets currently include Circle, Paxos and Tether. But in the future, banks and institutions that follow compliance requirements can also issue their own stablecoins.

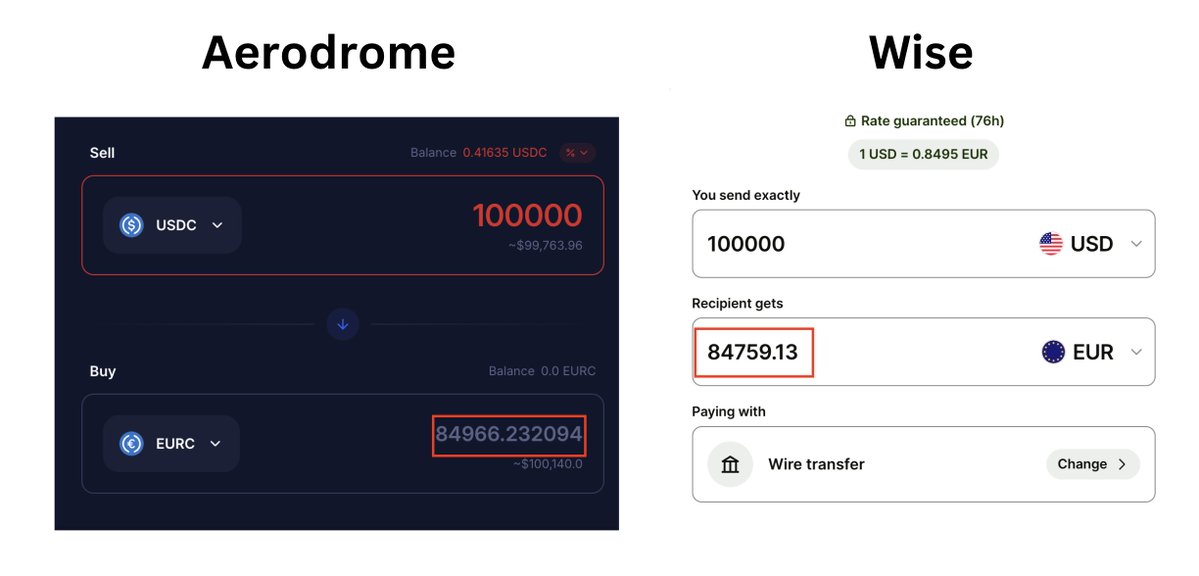

The demand for non-USD stablecoin trading is gradually growing. Most USD/non-USD trading is conducted on AMMs, especially Aerodrome and Pancakeswap. Among them, the USDC to EURC swap transaction on Aerodrome is actually 30 points cheaper than trading on currency transfer platforms such as Wise, even after considering slippage and fees (excluding deposit and withdrawal fees).

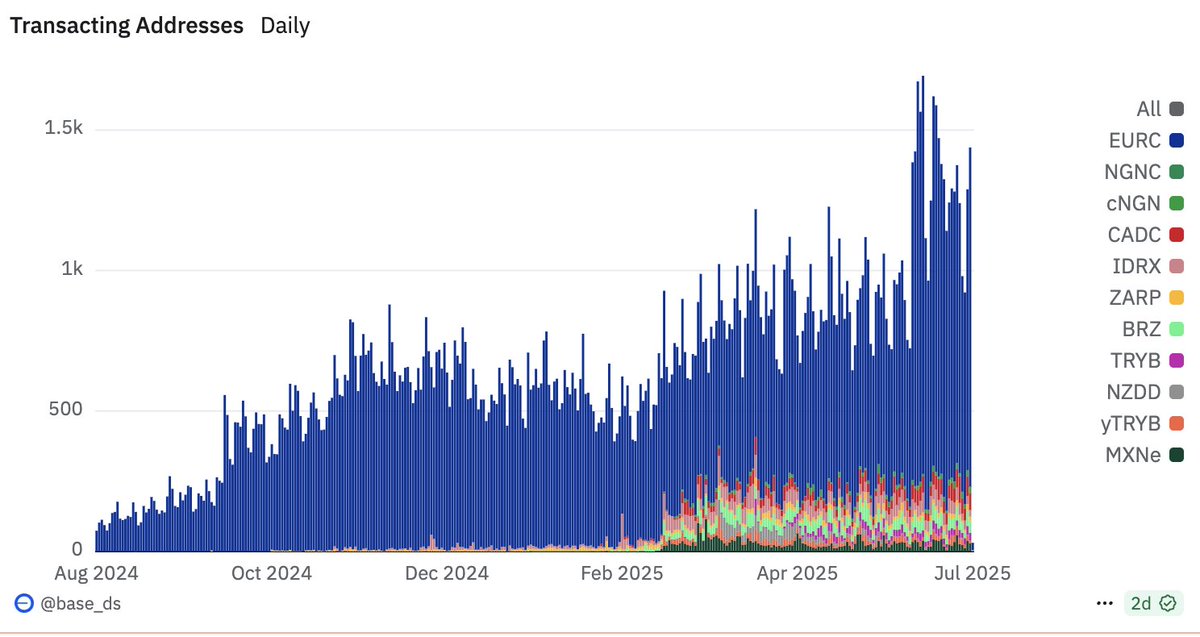

Given the intense exchange rate competition and increased economic uncertainty during the Trump administration, we are starting to see growth in Euro stablecoins, with daily active addresses doubling from 600 to 1300 since February, while new stablecoins like the Canadian Dollar (CAD) and Brazilian Real (BRZ) are also starting to enter the market, albeit with small initial market share.

Not only that, governments and regulators in the European Union, Hong Kong, Singapore, Japan and the Middle East are actively developing regulatory frameworks to promote the on-chain of assets, including stablecoins backed by local fiat currencies, which once again shows that the widespread acceptance of stablecoins provides an excellent opportunity for the emergence of on-chain foreign exchange markets.

DeFi Forex Market:

While issuers like Tether, Circle, and Paxos, banks, and fintech companies are driving adoption of stablecoins, some on-chain projects are trying to innovate in the foreign exchange space by adding “DeFi” elements.

For example, Injective offers a 24/7 market that allows trading EUR and GBP pairs with up to 100x leverage, while Mento Labs leverages CDPs to enable multi-currency exposure while directly holding the underlying asset, etc. This is an exciting area that could provide users with more mining/trading opportunities.

But there are two major obstacles in the current on-chain foreign exchange field.

1. Insufficient on-chain liquidity. The largest single pool contains only $1.3 million of EURC, which is unhealthy for large-scale transactions.

2. The friction between fiat currency (within the bank) and stablecoins in deposits and withdrawals remains the main obstacle to its efficiency competition with the traditional foreign exchange system.

High yield, more benefits

We all love DeFi, or what we call personal finance. In the near future, anyone who touches USDC will eventually think about how to generate income with idle funds.

While regulation has largely favored payment stablecoins, the growth of the stablecoin-driven yield market cannot be ignored. Over the past year, the market capitalization of yield-based stablecoin projects like Ethena and Sky has grown 6x to around $6 billion, while the demand for leverage or mining has become the main catalyst driving new highs in TVL in lending protocols such as Aave, Euler, and Syrup.

But the situation we are facing now is very different from the past. In the previous DeFi summer, we enjoyed the high returns brought by the flywheel of the token economy, but the sustainability of this often depends on the token price itself. When the token price falls, the protocol will stop running or become extremely difficult.

Since the success of Ethena, the Ce-DeFi model has become more popular, where depositors lend their stablecoins to teams that execute off-chain strategies in exchange for real trading returns. This has opened up a wave of yield-based stablecoins, and many projects have begun to accept deposits to execute on-chain/off-chain strategies. This trend makes token price no longer the only consideration for using the protocol, but it often also reduces the value of the token.

There are three main types of yield-generating strategies that are most common in the market: Treasury bonds, Delta neutral strategies, and money market strategies. Although there are more strategies in the market, these strategies are considered to be the “tested” yield strategies in the market. These yield-generating stablecoin strategies can generate a total of about $1.5 million in income per day, and the trend is positive.

RWA/Money Market Strategies

Yield-generating stablecoins are just the tip of the iceberg. The next stage should be a new asset class that combines traditional financial RWA strategies with DeFi elements (such as circular compounding), which will attract the participation of more institutions and funds.

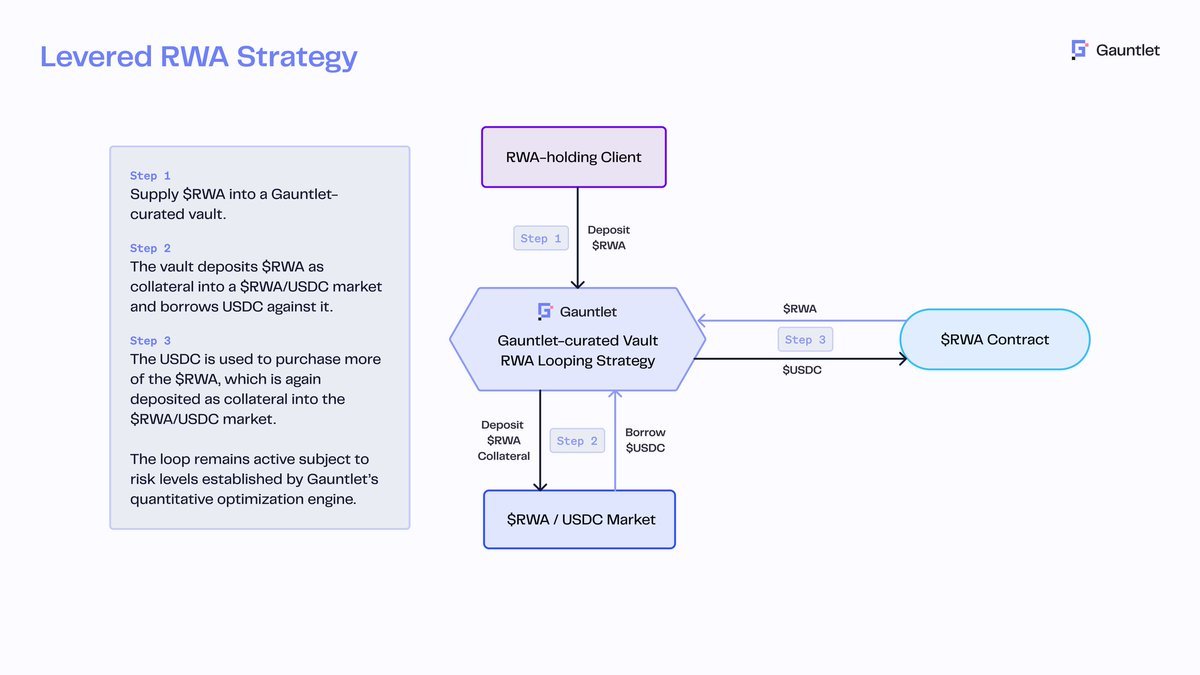

Recent example: ACRED (Apollo Diversified Credit Bond Fund) investors can deposit ACRED into the Morpho Blue market and use it as collateral to borrow USDC. Borrowers can then use the borrowed USDC to reinvest in ACRED, forming a leveraged loop. Under this setting, ACRED investors enjoy leveraged returns, while USDC providers (retail investors/funds) earn interest paid by ACRED.

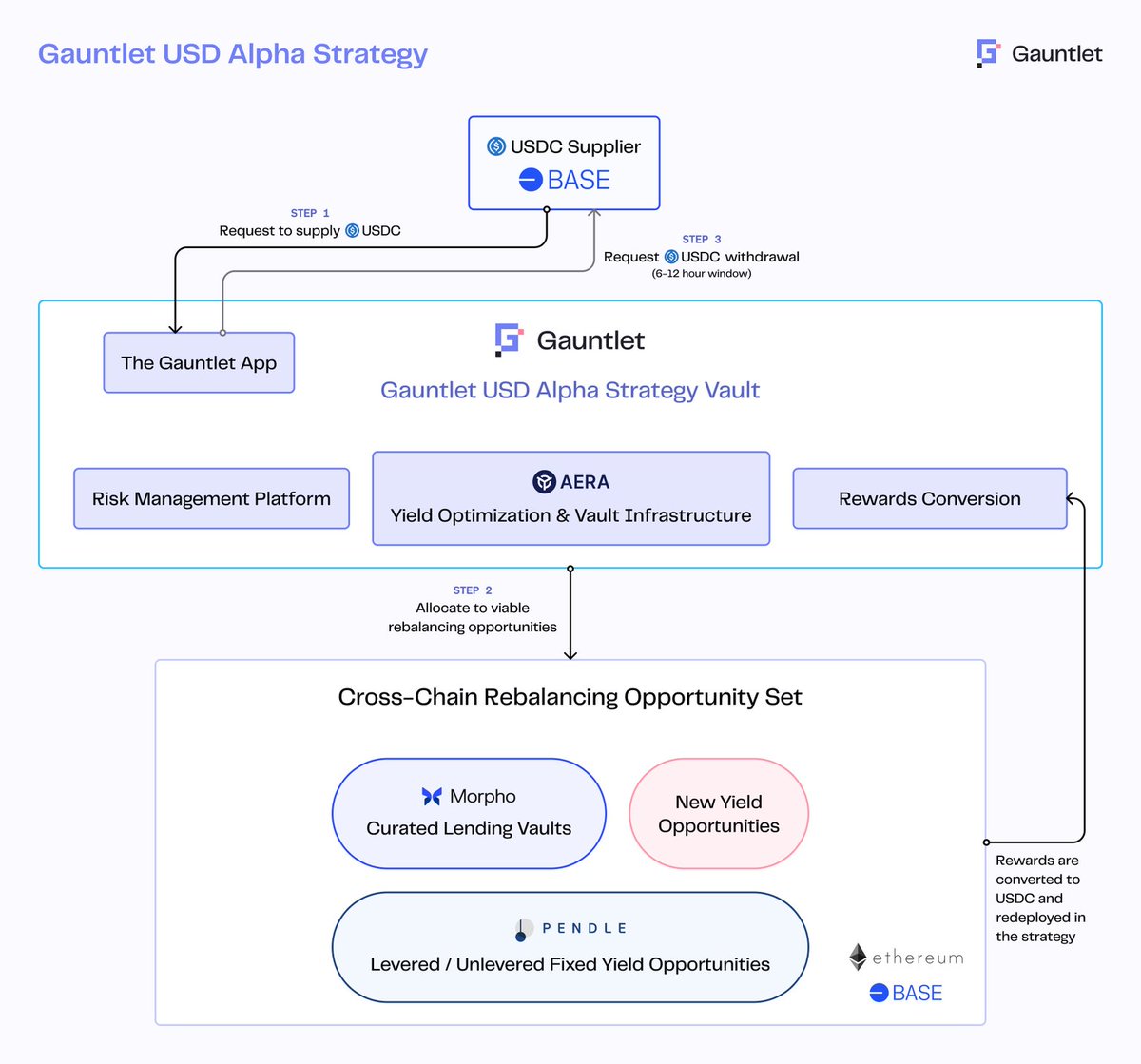

Below is a diagram of what Gauntlet and Redstone did.

This is just one example. Sooner or later, traditional financial players and funds will realize that they can use DeFi's huge stablecoin liquidity to bring their complex yield strategies and tokenized products on-chain and use them as collateral to borrow stablecoins. As long as the underlying assets (such as USCC, which provides a 7.7% return) can provide sustainable and attractive returns to qualified investors, the market can expand infinitely. This is a new source of income generated by leveraged RWA assets.

However, directly providing liquidity for different strategies can be confusing for newcomers. In my opinion, the ideal projects to build these strategies in the form of vaults are:

Upshift , Morpho , Euler Labs , Veda , Maple , Nest

The above platforms are striving to be compliant while also trying to meet institutional needs. However, there are currently no clear legal guidelines for these products, and legal and compliance risks remain one of the main obstacles currently faced.

Market fragmentation

As projects update their strategies and progress (50+ projects and growing every day), the market is becoming more complex and fragmented. New users don’t know where to deploy their stablecoins for the best returns, nor how to allocate their portfolio based on risk-adjusted metrics. More importantly, there are many excellent strategies that lack exposure. In this case, an aggregation platform or a unified “yield” page (preferably with a risk dashboard) can connect farmers and strategies. We need an on-chain product similar to Binance Earn, but with higher transparency and more detailed risk disclosure.

Stablecoin projects such as Cap and Perena , as well as Gauntlet , have been committed to building aggregation platforms that simplify the complexity of finding, managing, and deploying capital for yield strategies. They have built a comprehensive infrastructure where users can get the best yield (whether on-chain or off-chain) with just "one click" and only pay a small management fee.

cap:

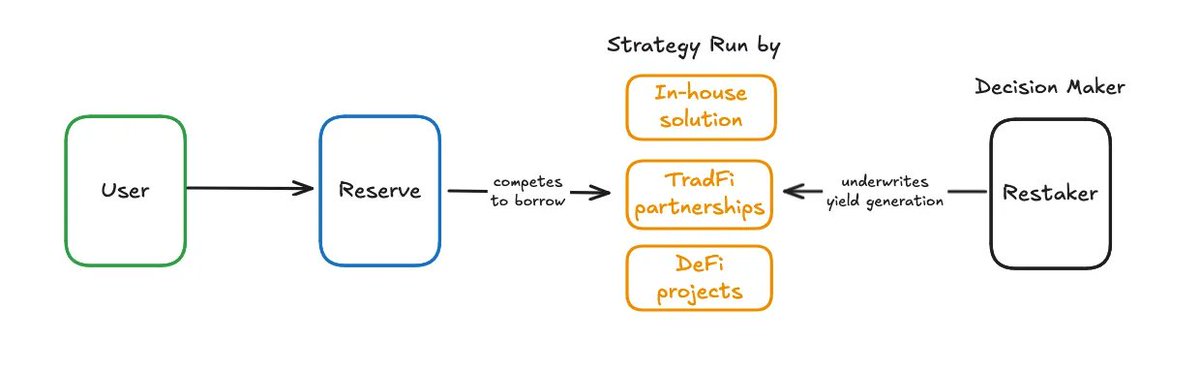

CAP brings together all the top on-chain/off-chain yield strategies and unifies their exposure into a stablecoin/anchored asset that can also interact with any DeFi product. Capital allocation depends on strategy performance and forms a self-reinforcing market with the most sustainable competitive returns.

But this is only part of their product. Stablecoins still need trust to gain widespread adoption. Cap creates a new market in which re-pledge users can entrust their assets to strategy providers on Eigenlayer to provide the "trust" required by stablecoin holders. In return, these re-pledge users will receive a certain percentage of the returns as compensation for their trust.

A very interesting idea is to aggregate returns “safely”.

Perena:

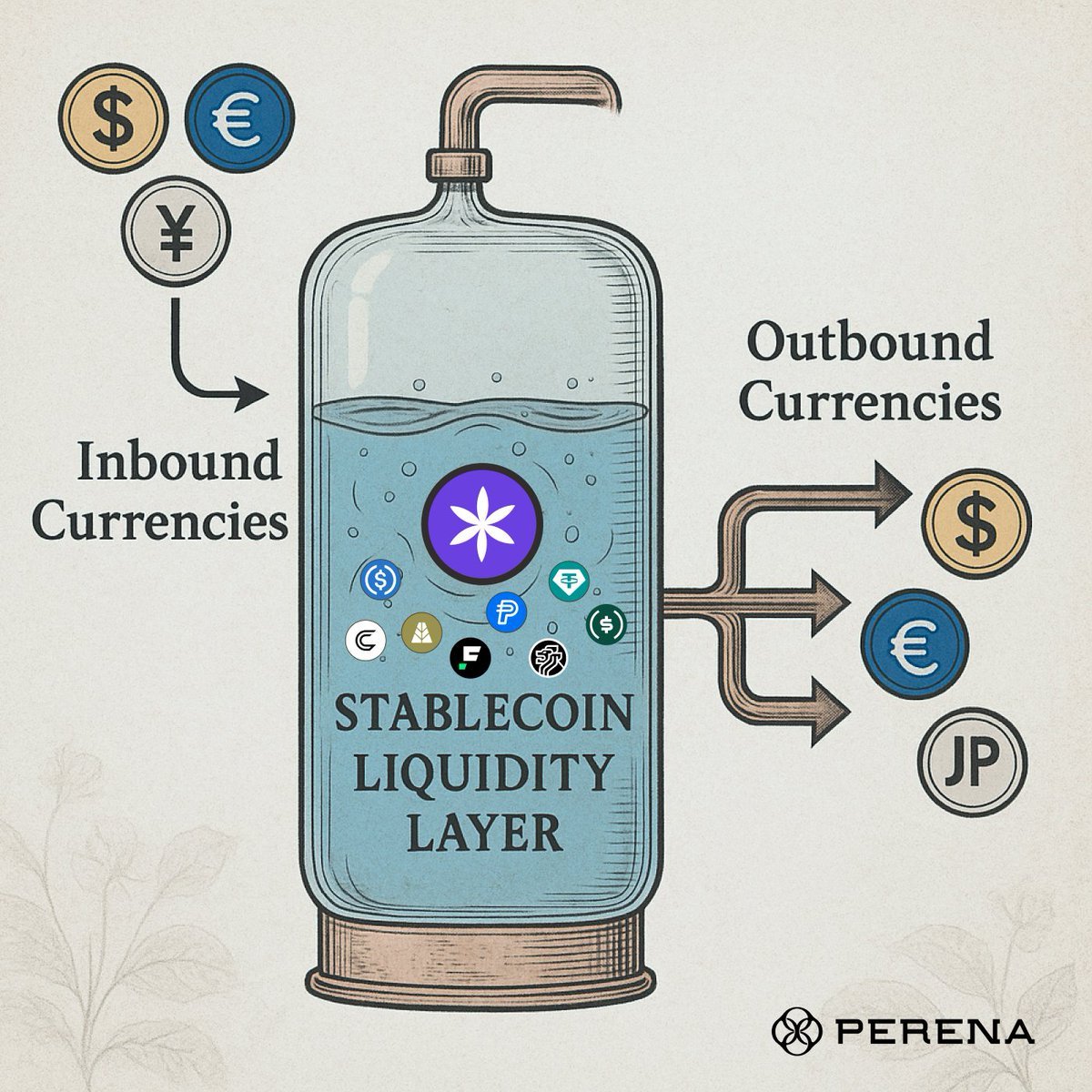

SOL has the advantages of transaction speed and low gas, making it the perfect chain for daily stable payments and on-chain foreign exchange markets. Perena's vision for the stablecoin bank is to build a unified stablecoin liquidity layer that integrates the on-chain liquidity of USDC, USDT, PYUSD, BENJI, AUSD, and other stablecoins into one AMM represented by USD*. This design can create a deeper stablecoin liquidity pool and provide Swap traders with the best stable exchange rate on SOL.

Perena v2 will add smart routing capabilities to scan all pools and OTC venues to ensure the best on-site swap rates (even outside of SOL). The tool will also support multiple currencies (such as EURC, GBP, etc.) and cross-chain swap functions to prepare for the mass adoption of stablecoins.

The unification doesn’t stop there — USD* is more than just an exchange engine. It’s an all-in-one savings and yield platform. Perena, the stablecoin banking network, is working with over 20 projects to find the best yields and strategies for USD* holders, which will connect strategies that need exposure with stablecoin investors seeking yield, all on a single interface.

Gauntlet USD Alpha:

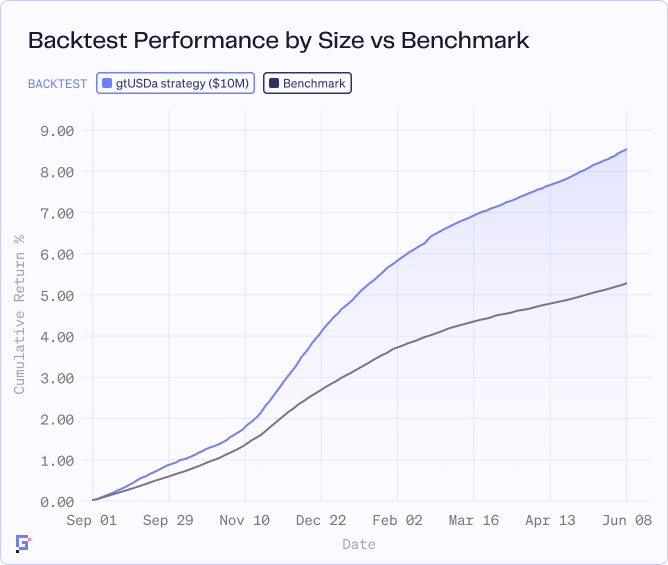

Gauntlet released their new product, Gauntlet USD Alpha (gtUSDa), a vault that can dynamically deploy stablecoins to different lending markets to obtain the best risk-adjusted returns.

The strategy is managed by the Gauntlet team through Aera Finance, a vault infrastructure they developed to implement off-chain strategies on-chain. The strategy is executed and overseen by a "Guardian", a role designed to help clients achieve their on-chain goals. The goal of the Gauntlet USD Alpha vault is to allocate depositors' stablecoins to the lending market with the highest current actual yield, while automatically adjusting positions based on its risk guidelines.

During the backtest period, Gauntlet’s risk-adjusted strategy on Morpho (Base+Ethereum) outperformed the benchmark yield of Vaults.fyi (7.76% Alpha yield vs. 4.46% benchmark yield). The vault is now live and has a yield of 7.2%, with most of the allocation allocated to midasUSD and gtusdcf.

Gauntlet stable alpha provides passive “farmers” seeking risk-adjusted returns with a platform that simplifies the complexity of discovering real yield and managing risk.

in conclusion

The future of stablecoins is bright.

On the one hand, regulatory progress is accelerating the mainstream adoption of stablecoins. The Genius Act provides confidence to traditional finance, fintech or payment channels through a clear compliance framework to enable them to integrate with stablecoins.

Meanwhile, emerging nations will continue to adopt stablecoins for cross-border transactions and USD exposure, while nations that tokenize their national fiat currencies will create a 24/7 FX market that is compatible with DeFi.

More ambitious companies can now execute RWA strategies on-chain by leveraging the vast on-chain stablecoin liquidity, and retail investors can earn yield by providing liquidity. The mass adoption of stablecoins will also stimulate the demand for on-chain personal finance, thereby driving the growing demand for yield products. Projects such as Cap, Perena, and Gauntlet will also solve the fragmentation problem.

Today, stablecoins are no longer “just another internet currency”, but a real asset that proves the relevance of blockchain in the real world. It settles instantly, 24/7.

Everything about stablecoins is starting to accelerate.