Michael Saylor: BTC mortgage bonds have an annualized rate of 10%, and the $9 trillion retirement fund battlefield is ready

Original video: Michael Saylor

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

The trend of companies planning to reserve Bitcoin continues to grow. Recently, many companies have accelerated their Bitcoin reserve strategies. Typical cases include:

Nasdaq-listed company Profusa: Announced that it has signed an equity credit agreement with Ascent Partners Fund LLC, planning to raise up to US$100 million through the issuance of common stock, and use all net proceeds to purchase Bitcoin.

H100 Group: Raised an additional approximately US$54 million, which will be used to seek investment opportunities within the framework of its Bitcoin reserve strategy.

In addition to the above cases, many traditional companies are also actively raising funds to build strategic Bitcoin reserves. At the same time, the potential "battlefield" of the pension market is also emerging.

On July 18, the Financial Times reported that the Trump administration is considering opening up cryptocurrency, gold and private equity investment channels to the US retirement market, which manages $9 trillion in assets. It is reported that Trump plans to sign an executive order to allow 401(k) retirement plans to invest in alternative assets other than traditional stocks and bonds. If this policy is implemented, the equity of listed companies that focus on Bitcoin reserves or hold a large amount of Bitcoin is expected to become a popular investment target in the retirement market, and its attractiveness may even surpass existing methods such as spot ETFs.

Under this trend, Strategy (formerly MicroStrategy)'s business model is moving towards a broader stage. Previously, Strategy announced the "BTC Credits Model" for evaluating the value of Bitcoin-denominated equity. Founder Michael Saylor also elaborated on the application and significance of the model in a recent interview. Odaily Planet Daily specially compiled the key content of the full text as follows:

What is Bitcoin Reserve's next business model? Why is it so simple yet powerful? How can you maximize results by focusing on execution?

The first paragraph of Saylor’s answer is the same old story (he always says this at the beginning of every interview) - the story of a dentist buying Bitcoin to build a company and Metaplanet. The author deleted this part of the content. For details, please refer to the previously compiled Saylor interview articles: " BTC Conference | Michael Saylor Speech: 21 Keys to Unlock BTC Billions of Wealth " and " Exclusive Interview with Michael Saylor: $62 Billion is Just the Beginning, Strategy's Bitcoin Reserves Will Increase Exponentially ";

I said in Las Vegas that the business is the most efficient wealth creation machine we have ever devised. If we think of the spread of Bitcoin as a currency virus or super idea, when Bitcoin touches individuals, the spreader of the virus is a business. When a business is recapitalized through Bitcoin, the real opportunity is for any public company to sell equity or sell issued credit.

All equity capital in the world is valued based on future expectations of statutory cash flows. For example, every company in Nigeria is valued based on expectations of Nigerian cash flows. Brazilian companies are valued based on Brazilian cash flows. American companies are valued based on cash flows. But we know that the value of cash is going down.

You have multi-term, idiosyncratic, uncertain risk, like credit risk or equity risk, and then on the credit side, all creditors base their value on future expectations of cash flows. I don’t have the money to lend you, I promise to pay you back, and I intend to get the money in 10 years. So the existing market is based on future expectations of business operations. We are valuing real world assets, we are valuing future cash flows, we are valuing equity or opportunities.

Bitcoin Treasury has the most elegant business model. I have some Bitcoin (worth $10 million). I start issuing equity based on my ability to get more Bitcoin, then credit, fixed credit, convertible credit, other credit, and then I use it to buy Bitcoin. For example, Metaplanet has been increasing its market value exponentially by frequently issuing equity to reserve Bitcoin, and Strategy announced a $21 billion ATM plan to buy Bitcoin last year. If we do this in three years, it will be the most successful equity plan in the history of capital markets.

I would just say that a company is a person who understands finance, a person who understands law and a leader come together - a CEO, a CFO and a chief legal officer come together to become a Bitcoin treasury company. If you put Bitcoin in it, then your company can grow as fast as issuing securities and buying Bitcoin.

That is, it is also an investment cycle, 1,000 times faster and more even than the physical, real estate cycle or the business cycle. The main point of conflict is the issuance of securities, which requires compliance and is also a difficult regulatory issue. If you are Japanese, the situation is different from that of the French. In the UK, you need a Bitcoin treasury company that understands British law, and you also need one in France, Norway, Sweden, and Germany.

And these companies all have local advantages. If you are a Japanese company, it is much easier to issue securities in Japan than an American company to issue securities in Japan. I knew this, and I called Simon (Metaplanet CEO). I said, you may issue preferred shares in the Japanese market earlier than I did, go ahead and do it.

So I think that's the simplicity of the business model, I'm just going to issue billions of dollars of securities and then buy billions of dollars of Bitcoin. I'm going to transform the equity and credit capital markets from the 20th century analog physical cash (cash-based) to the 21st century Bitcoin (cryptocurrency-based).

About BTC Credit Model

We developed a set of metrics to assess the value of equity denominated in Bitcoin. Since we use the Bitcoin standard, simple US dollar accounting methods do not apply, as US dollar accounting is designed for companies that generate earnings through operations. Therefore, we created BTC yield, which is basically the appreciation and percentage of each Bitcoin.

The idea is that if you can get a 20% yield on BTC, you can multiply that by a factor, like 10, so that you get a 200% premium to NAV. To calculate what the premium to NAV is, it's a very simple way to calculate whether the company is generating a 220% yield, a 10% yield, or a 200% yield, like a bond that pays 200% interest after tax is worth a lot more than a bond that pays 5% interest after tax, so BTC yields or USD yields are an equity indicator.

Bitcoin's dollar earnings are basically equivalent earnings. A Bitcoin company is based on Bitcoin, and if you generate $100 million in Bitcoin dollar earnings, that's equivalent to $100 million in after-tax earnings, which goes directly to shareholders' equity and bypasses the PnL, but a company that generates billions of dollars in BTC earnings is the same as a company that generates a billion dollars in earnings, and you can use PDEs on this (Odaily Note: PDE is a partial differential equation, a model that can model the price dynamics of financial derivatives, and is widely used in the field of option pricing) and say, I should set the value of the PDE to 10, 20, 30 or any other number times that earnings.

This gives me an understanding of the enterprise value of this business and the ability of the enterprise to execute this business. Now the question is, how to generate BTC currency-based income or BTC U-based income? There are several ways to do it:

The first way is to manipulate cash flow and invest all operating profits in Bitcoin, which will generate corresponding returns, involving $100 million in operating cash flow. I use this money to buy Bitcoin. In this way, I get $100 million in Bitcoin income without diluting any shareholder's equity, but I need an operating company that can generate a lot of cash flow to do this ;

The second way is that if you sell equity at a price higher than the net asset value (M times NAV), such as selling $100 million of equity at 2 times NAV, you will get $50 million in BTC. Of course, if you sell equity at an amount lower than NAV, you are actually diluting shareholders and will get a negative rate of return;

I believe that the reason BTC yield and earnings are important is because they provide investors with a simple, transparent, and immediate way to understand whether a management team has made accretive or dilutive transactions on any given day. Public companies can raise almost any amount of money as long as they are willing to dilute shareholders. The real trick is to do it in an accretive manner. So these two metrics are important, but now we have solved this problem.

For example, my cash flow is exhausted, and if the price of BTC goes up, what do you do? If M is 10 or 5 or 8, it's not a complicated problem. When M is 10, you get about 90% of the difference, so every $1 billion of equity sold generates $900 million in proceeds, which is risk-free and immediate. In essence, it's not complicated.

The question is, what happens if M drops to 1 or below? If you don't have any cash flow and M drops to 1, but you have a billion dollars of Bitcoin on your balance sheet, what do you do? If you're a closed-end trust like Grayscale, or if you're an ETF (especially a closed-end trust), there's nothing you can do. So you're trading below M times NAV.

And that's exactly what people want to avoid. However, the special power that operating companies have is to issue credit instruments. So if it's trading at a discount or the trading price drops to the normal market price, then the way you can really get out of the predicament is to start selling credit instruments, which are collateralized by the company's assets, which leads to the concept of the BTC credit model.

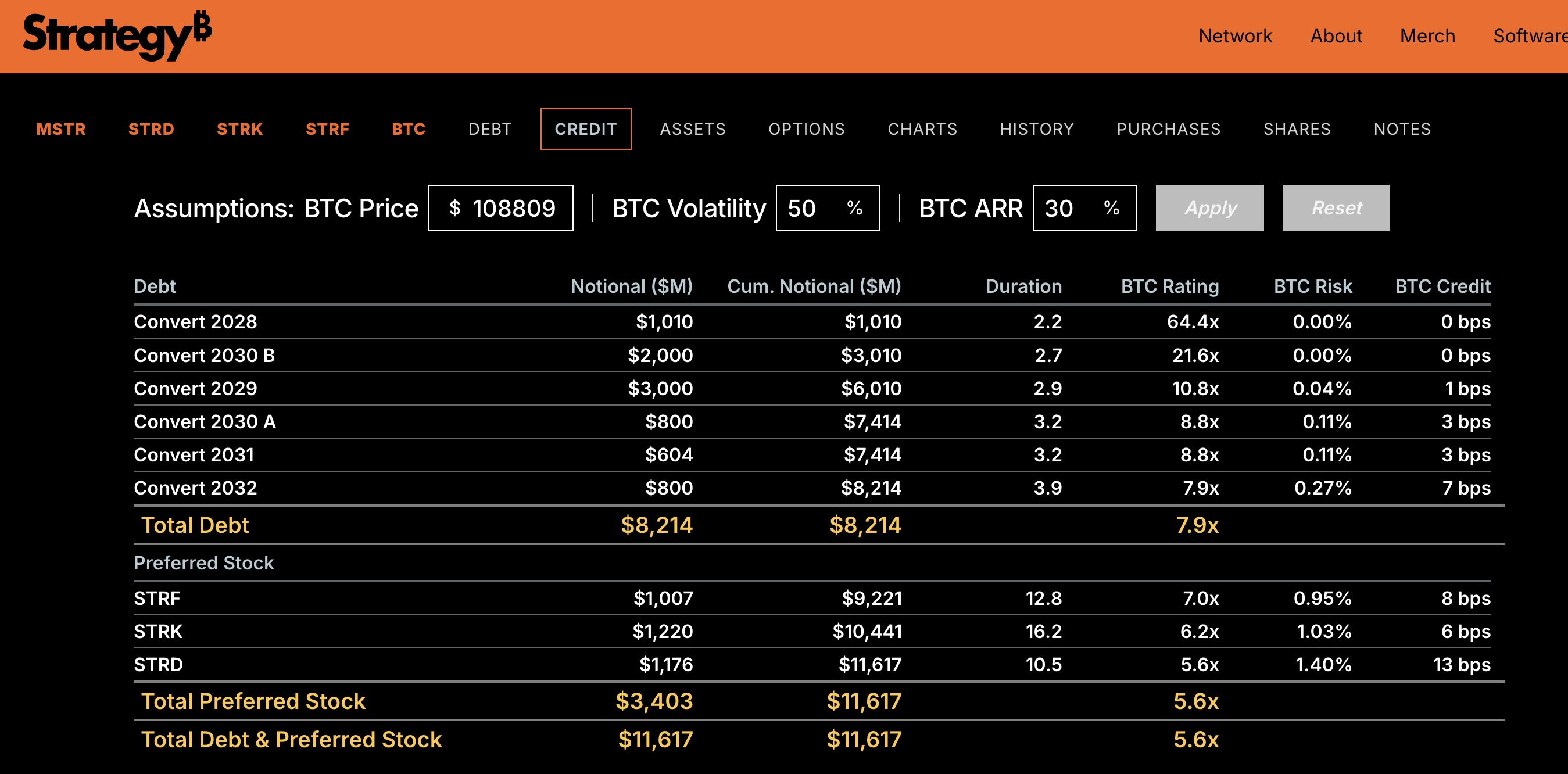

If I have $1 billion in Bitcoin, I can sell $100 million in bonds, or $100 million in preferred stock with a 10% dividend yield. This is equivalent to 10 times collateralization. Therefore, Bitcoin is rated 10, and now you can calculate the risk, which is that your $1 billion Bitcoin transaction may shrink to less than $100 million when the instrument expires. You can calculate it statistically like the Black-Scholes Model (Odaily Note: The Black-Scholes model is a mathematical model in the financial field, widely used to price derivative financial instruments such as options ) , input volatility, BTC rating, get the risk, and then calculate the credit spread, which is what we call BTC credit.

BTC credit represents the theoretical credit spread you need to offset risk (relative to the risk-free rate), and of course, the credit spread itself. If BTC is rated 2, the credit spread will be higher than if it is rated 10; if Bitcoin's volatility is predicted to be 50, the credit spread must be higher than if Bitcoin's volatility is 30.

So if you plug your rate of return or annualized rate of return on Bitcoin into the BTC credit model and plug in your expectations of Bitcoin volatility and then plug in the price of Bitcoin, you get the BTC rating and the risk pops up and the BTC credit model pops up. What we do is we use it to start issuing credit instruments for Bitcoin, and the idea is that we want to sell securities to a market that is orthogonal to the stock market and the Bitcoin market, or an unrelated market.

In the dollar yield market for retirees in the U.S. There are a lot of people who don't know what Bitcoin is, don't know what Strategy is, they don't know anything about our business model, but if we offer them a 10% dividend par value preferred stock, we offer them a 10% dividend yield and qualified income distributions, a qualified type of vehicle that you can buy in the U.S. and get a 10% tax-free return if you make less than $48,000 a year.

A lot of people want 10%. Now the question is risk, if it's 5x or 10x collateralized, then it doesn't look that risky. If you're bullish on Bitcoin, my idea is simple, give someone a high fixed income with very low risk, I think collateral is a killer application for Bitcoin, and what we did strategically is create a convertible preferred stock called "Strike" ( ticker: STRK ), which gives you 40% upside in the stock and an 8% par dividend.

Then we created a convertible preferred stock called "Strife" (STRF) that offered a 10% yield. These two stocks are two of the most successful preferred stocks of this century. These are the most liquid, the highest performing, and when other preferred stocks were trading down 5%, they were all up 25%.

They are the most successful because any security that is purely bound by Bitcoin is always better. These equity are more valuable, the convertible bonds are more valuable, these preferred stocks are more valuable because you are connecting to an asset that is going up 55% a year, and we put it into those instruments, they will be very successful, go public and achieve a stock price increase, and now the idea is that we can market to people.

We can sell people a 40% upside in stocks, maybe an 80% upside in Bitcoin, with downside protection and guaranteed dividends. So we call it a "Strike." It's like a Bitcoin bonus, it's like you get a living stipend, you have enough capital protection that you can put it in a car and hold it forever.

This is for those who are curious about Bitcoin but are afraid of the "roller coaster", such as the "turbocharged" version of Bitcoin Stock MSTR. But there are also many people who don't want to touch Bitcoin, they only want the return of US dollars, euros or yen, but how many people in the world have such ideas, the fact is that for all retirees, no one does not want to get 8% or 10% dividend income with very low risk.

That's why the credit market and the fixed income market are larger than the stock market, and what we do is use Bitcoin to generate that yield. If Bitcoin is going up, and it's already up 55%, then you can pretty much cut any percentage of the yield from the 50% that's less than 55% and give it to investors. And, I think the long-term high forecast for Bitcoin is 30%, but I think Bitcoin will always have an annual yield of between 20% and 60%.

You can always sell these instruments that are providing 6%-10% returns and trade them for 20%-40% returns whenever Bitcoin returns 20% or more. Capture the difference for equity investors, and equity will outperform Bitcoin. As for convertible bonds, this is our financial engineering.

We are transforming the company with the goal of actually outperforming Bitcoin by 50% to 100%. If you want to invest in Bitcoin directly, you can buy BTC in IBIT and hold it. But through our stock, you will get all the gains and losses of Bitcoin, and all the volatility. The STRK convertible bond is designed to give you 80% to 100% of the gains of Bitcoin, but only 10% downside risk. So we want you to get 80% of the upside, take 10% downside risk, and get guaranteed dividends. This is for people who want to enjoy the income but also want to avoid risk. They don't want the roller coaster volatility. This is almost to compete with IBIT. If I give you 80% to 100% upside, 100% downside risk, and no dividends, what will happen in the end (IBIT)?

I don't know if it's going to be 100%, but the more we leverage the equity, the more likely it is that the convertible equity will perform as well as Bitcoin. So the goal is to have a convertible equity that performs as well as Bitcoin over the long term, while providing principal protection, liquidation preference, and a guaranteed dividend stream. That's it. It seems like there's a demand in the market for people to just enjoy the upside without taking the risk of the downside, right? That's financial engineering, I give you the upside, you have nothing to lose, and I'll give you dividends while you wait to get rich. In my opinion, smart financial engineers would agree with me, but many people don't fully understand it yet. They don't fully understand it yet because of the last 10 preferred stocks issued in the last four years, there has not been a perpetual convertible preferred stock issued.

The first three of the 10 preferreds are ours and they are all perpetual, the other seven are not. People don't usually sell perpetual dividends or perpetual calls because they don't have perpetual income rights, they can't invest for 100 years, if you have confidence in Bitcoin and think that Bitcoin will always outperform the S&P 500, then you can sell a dividend that will always be lower than the S&P index. Then you can also sell convertible preferreds that outperform the market, which is a good thing. So we designed this product, and then the idea of fixed income is, we want to give someone an indefinite and permanent dividend income? And traditional thinking says that it makes sense to design a call option.

If interest rates go down, you can redeem it. This is the way that traditional bankers like to do it, you set up a call option, and if interest rates go down 200 basis points, you exercise the option and refinance it.

But that's what you think, if you sell 144 A (Odaily note: it's SEC's Rule 144 A, a regulation that allows qualified institutional buyers to trade private securities that are not registered in the public market in the over-the-counter market, such securities are usually less liquid, but trading is flexible and suitable for institutional investors ) on the trading market for three years in exchange for trading on the over-the-counter market, but these are incomplete tools from the 20th century, then the way of thinking at this stage is: I inject STRF into the market, I don't care how much I see in the first week, I created this tool to maximize capital raising in the next 20 years.

So we want to design a tool that if Powell cuts rates by 200 basis points, then when STRF trades at 150, the yield will drop to 6%. When the yield drops to 6%, we can sell it instead of buying it back.

The whole idea was that when interest rates went down, I would sell billions or even tens of billions of dollars of this instrument through the ATM at 150 or 200, and the “smart people” would think, I’ve got to buy it back, refinance it, and then go back and do a 144 A deal with the investment bank and pay a huge amount of money to refinance it, so that the STRF would become both liquid and defective, so I didn’t want to issue a series of defective and illiquid securities.

By the way, what I'm describing is the entire preferred stock market, all preferred stocks are garbage in my opinion, and you buy these junk instruments that only have $400,000 of daily volume, yield 6%, have a credit rating equivalent to a mid-sized regional bank, and a mortgage portfolio from a place you have never touched and don't understand, and you take this illiquid over-the-counter product that has little trading and yields 6% instead of something that has a higher yield, is liquid, and is available to everyone.

The problem, of course, is that all corporate credit, all preferred equity, is based on 20th century ideas of the credit model. We concluded that the killer app for Bitcoin Treasury is issuing Bitcoin credit, which is Bitcoin-backed equity, and that’s the first step.

But the long-term sustainable business is issuing BTC-backed credit instruments, in the billions, tens, hundreds of billions of dollars at first. You’re not competing with other Bitcoin treasury companies, you’re competing with all the junk bonds issued by all the companies that don’t have money and all the corporate bonds issued by all the investment-grade companies. And we have more collateral than the best investment companies that issue corporate bonds, our collateral is better.

So we compete in this market with corporate bonds, investment grade bonds, junk bonds, private credit, and preferred stocks. The idea is that we want to sell something with better credit, lower risk, better collateral, higher yield, and more liquidity.

Our ultimate goal is that instead of having a thousand preferred stocks with $500 million in circulation each, all of which are illiquid, worthless junk stocks, it would be better to have only one preferred stock with $50 billion in circulation and $2 billion in trading every day, which would be higher than any return you have ever heard of, and it is backed by Bitcoin. To do this, all you need to do is use the metrics I just described, which every Bitcoin Treasury company can replicate, and I sincerely invite all companies to try it.

I encourage companies to do this because just as 20 Bitcoin treasury companies issuing stocks legitimized Bitcoin and Bitcoin stocks, 20 companies issuing Bitcoin-backed credit instruments will legitimize Bitcoin credit, which will accelerate the digital transformation of all credit markets and trigger capital to transform flawed, crippled credit instruments of the 20th century into digital credit instruments of the 21st century, and S&P, Moody's, and Fitch will all start rating them.

Everyone's understanding of credit risk will evolve. A retiree gets 200 pips of return with an order of magnitude less risk. If Bitcoin goes to $1/2 million, the collateral value will increase and the market as a whole will evolve.

What I am saying is that the digital transformation of capital markets driven by these blockchain technology companies will quickly put an end to the current popular capital markets approach.

Answering questions from reporters

This is Saylor's response to the reporter's question.

Journalists concerned about centralization of Bitcoin mining pools

The network is decentralizing, I'm not worried about mining pool centralization, I think Bitcoin mining is decentralizing globally. It's more decentralized now than it was during the China ban, when China banned Bitcoin mining. China used to be half of the mining, it was a little centralized, then it moved to the U.S., and then in the last year or two, it moved from the U.S. to all over the world. At the end of the day, I don't think mining has that big of an impact.

The hashing power is in the hands of economic actors, political actors, Bitcoin miners, and technology providers, and there is more consensus today than there was five years ago. And I think that policy-driven mining will eventually be replaced by economic and technology actors. In my opinion, Bitcoin is actually stronger than ever. I am not worried about the current situation and it will continue to be good in the future.

Reporter asked questions about the exchange's KYC review

Let's be clear, you're not working with exchanges, you're working with companies, you're in a world of Bitcoin, exchanges are just a medium, you can completely bypass it, the way people deal with cryptocurrency exchanges today is dynamic. As the digital asset environment becomes more flexible, we're going to see an explosion of innovation, innovation is happening at the national level and at the individual level, and whatever the status quo is today, it may not be the same in five years. There will be more freedom and privacy, and they will develop very good technology that may spread to the rest of the world. There will be other countries that make mistakes on KYC and censorship, but not on privacy.

KYC is not a Bitcoin issue, it’s a nation-state, citizenship issue , and if you find yourself in a particularly unfriendly country where they take away your privacy or economic freedom, then of course the answer is that you either use technology from another place, like VPNs and firewalls and so on, or you get an identity from some other country.

Bitcoin is global, it allows every country, every participant to participate, and Layer 2, 3, 4 technology will probably be developed as quickly as possible around the world. Some things you do in a country you don't live in are illegal or culturally unacceptable in your country. As a Bitcoin holder, you may benefit from someone in another place, if you have Bitcoin in Cuba or North Korea, although it is profitable, it is illegal somewhere.

Likewise, a lot of technology will flow from the United States to countries that don't allow it. And there will be technology flowing from other countries to Europe that may not allow it. I think there is no standard answer to this dynamic balance, and the best answer will be a protocol like the Bitcoin Lightning Network that can provide the most anti-sovereign and robust way to obtain and circulate monetary assets that you can get.

So these are all gradual, everything is developing, don't be too idealistic, the fact is that Bitcoin has reached a market value of 2.3 trillion US dollars so far, and we are now in a good position, the best and smartest technicians around the world are starting to spend more money on programming and innovation and BTC Layer 2 and 3 to solve all the existing problems. Bitcoin is a movement, a technology, and a protocol that provides us with a promising solution path, better than any other protocol I know of so far.