XRP breaks new highs, the encrypted parallel world behind the fierce old currency

Original author: TechFlow

Between the ups and downs of each round of crypto market, there are always some familiar names that appear repeatedly on the list of gains.

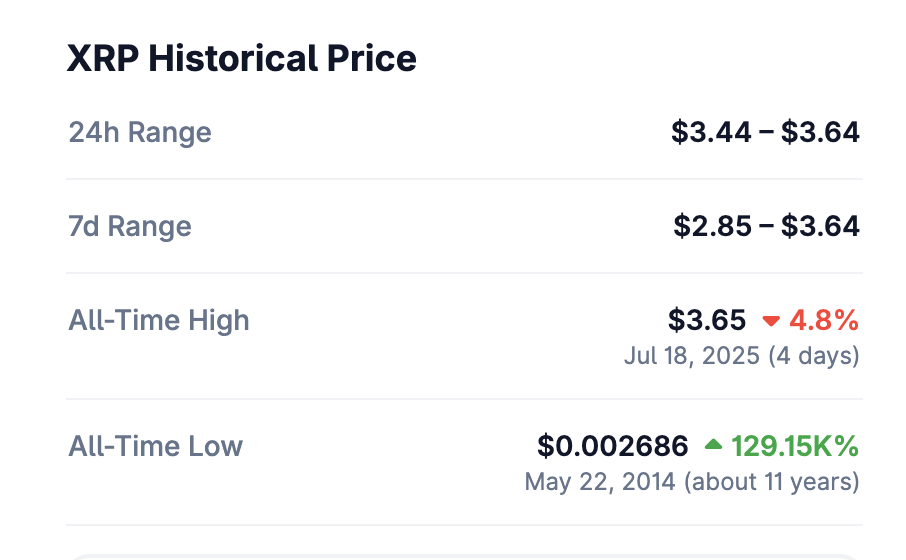

XRP, XLM, ADA... These projects, which are regarded as "without future" in the mainstream crypto circle, are still regaining their presence today in the wave of a new bull market.

They are not new innovative public chains, nor are they the hottest newcomers with hot narratives, let alone any strong ecosystem or technological breakthroughs. But at a certain stage in the bull market cycle,

In some inexplicable way, they always rise against the trend, return to the center of traffic, and even break new highs like XRP.

This is not just "hype inertia" in the financial market, it's more like there is a hidden parallel world in the crypto industry.

In this parallel world, XRP is the future of cross-border payments, XLM is the hope for global micropayments, and ADA is the new order of smart contract governance.

As long as old coins are alive, they will become extraordinary.

Encrypted parallel world

If the crypto market is a stage full of hot spots and technological innovations, then the survival of old coins often exists behind this stage - a world that is almost parallel to the mainstream crypto community.

We are used to discussing new narratives and new projects on Twitter, Discord, Telegram, and WeChat communities, and are used to switching hot topics between Ethereum, Solana ecosystem, or meme coins.

However, few people realize that these assets, known as “old coins”, also have large and stable communities behind them, but their active spaces are not in the circles we are accustomed to.

XRP, XLM, ADA, HBAR... Users of these old coins have never been active members of Crypto Twitter, nor are they speculators in the community who buy coins based on the propaganda of KOLs.

They have their own information channels, social networks and judgment logic - or, to put it more bluntly, they don't care what's popular in the industry.

The XRP community is active in WhatsApp groups, Line groups and Facebook groups in Japan, the United States and even Latin America.

Most of these users do not care about the technical logic of encryption, nor do they chase industry hot spots, but they are familiar with XRP's cross-border payment story, agree with Ripple's cooperation model with banks, and even regard XRP as a "long-term asset for financial innovation."

Whether XRP is sued by the SEC or there are various negative voices in the market, the beliefs of these users are basically unaffected.

The same is true for the Stellar (XLM) community.

In some developing countries, Stellar’s cooperation with local financial service providers has given it a real user base. They may not know Staking, DeFi, or even the innovative ecosystem on the chain, but Stellar is already a cutting-edge brand and asset in their cognition.

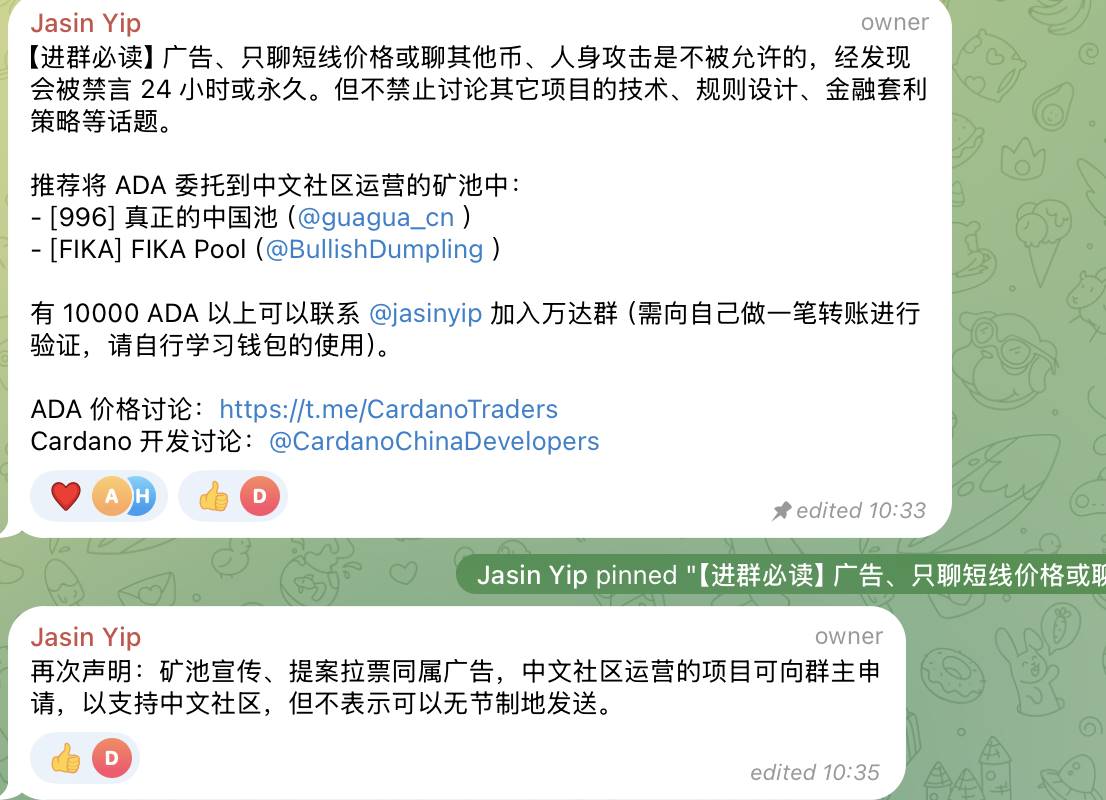

Cardano (ADA) has a more typical "die-hard fan" phenomenon.

In Japan, Africa, Eastern Europe, and some English-speaking countries, Cardano's education, governance, and community projects have accumulated a large number of loyal users. Even in China, there is an ADA community dominated by programmers from major Internet companies.

These people are active in Reddit, Telegram and local forums all year round. They are familiar with Cardano’s technical route and the speeches of founder Charles Hoskinson. Even though the ecosystem is developing slowly and there are constant doubts in the industry, they still hold on firmly.

To outsiders, these perceptions may have long been out of touch with reality, but they constitute a deep-rooted reason for holding currency.

All of this constitutes an ecosystem that runs parallel to the mainstream crypto world.

Messari analyst Sam said in x that crypto Twitter always looks down on those "old coins" because these coins are outdated compared to the new technologies used on their chains. Their judgment is correct, but ordinary retail investors do not actually understand what modern chain technology is and only buy coins they are familiar with (such as XRP, ADA, XLM, DOGE).

It does not survive on popularity, nor does it rise and fall with market narratives. Instead, the community operation logic of these old coins is closer to the user culture of the Web2 era: brand, habits, emotional identification, and even the psychological inertia of "having long been accustomed to it."

The survival of old coins has never relied on the mainstream stage of the industry. Their vitality is hidden in those "hidden corners" that are ignored by the mainstream crypto world.

For this reason, no exchange will easily delist XRP, XLM or ADA.

The trading volume, active users, market depth and hedging demand they bring are all important components of the trading platform.

Even if the project team does not make any technical breakthroughs, the old currency still has an important position in the trading list of spot, leverage, and perpetual contracts.

They have become a part of the market, the allocation habits of passive funds, and even "old friends" in the minds of speculators - as long as the market starts, there will always be a round of capital inflows.

Not just capital, but also politics

In addition to users and communities, the economic and political strength of these project parties far exceeds the imagination of the outside world.

The reason why these crypto projects, which are considered "outdated", still shine is not only because of the presence of old users, but also because they have already firmly established a place in traditional finance and political capital.

Taking XRP as an example, Ripple is not an isolated technology and business organization, but an "old player" that has long been involved in traditional finance and policy making.

Ripple's founding team and executives frequently appear at international payment forums, U.S. congressional hearings and fintech summits, and have close ties with the Trump administration.

In January 2025, Ripple CEO Brad Garlinghouse was invited to attend the Trump dinner at the Florida resort Mar‑a‑Lago, and posted a photo of the dinner on Twitter with the words “Strong start to 2025!”

On July 19, Trump officially signed the Genius Act at the White House. Ripple Chief Legal Officer Stuart Alderoty was invited to the scene and was one of the few witnesses in the cryptocurrency industry.

In the SEC’s long-running lawsuit against Ripple, Ripple not only did not get defeated, but instead obtained a favorable result, further consolidating its political position in the discussion of “compliant crypto assets”.

Not only that, Ripple has cooperated with hundreds of financial institutions around the world for many years, including traditional financial giants such as Santander, PNC, Standard Chartered Bank, SBI Holdings, etc. This extensive business network has become an important support for XRP market confidence.

Cardano promotes blockchain education and digital identity projects in governments of Ethiopia, Rwanda and other countries to connect with local national policies and governance.

Hedera's governance committee is composed of world-renowned companies such as Boeing, Google, IBM, and Deloitte, and has participated in many discussions on digital assets and distributed ledger policies in the United States. Hedera board member Brian Brooks is the former acting director of the U.S. Office of the Comptroller of the Currency and a close partner of current U.S. SEC Chairman Paul Atkins.

These projects do not only operate within the cryptosphere, but also build a solid foundation in the multi-dimensional space of political system, compliance consulting and business cooperation. They have the ability to influence policies, strive for regulatory compromises, and obtain the status of "selected" through political and capital networks.

Therefore, when people question these old coins from a technical and narrative perspective, they often overlook the moats they have already established at the policy and capital levels.

Under such a framework, these old coins do not reflect technological backwardness, but rather another strategy of "living longer and more steadily" - the real trump card lies in capital, commercial resources and political protection.

So, next time you see XRP, XLM, ADA, HBAR, etc. on the market list again, don’t be surprised, and don’t rush to explain it with technology and narrative.

They don't need to be recognized, they just need to be alive.

Sometimes, just “living long enough” is an underestimated competitive advantage.