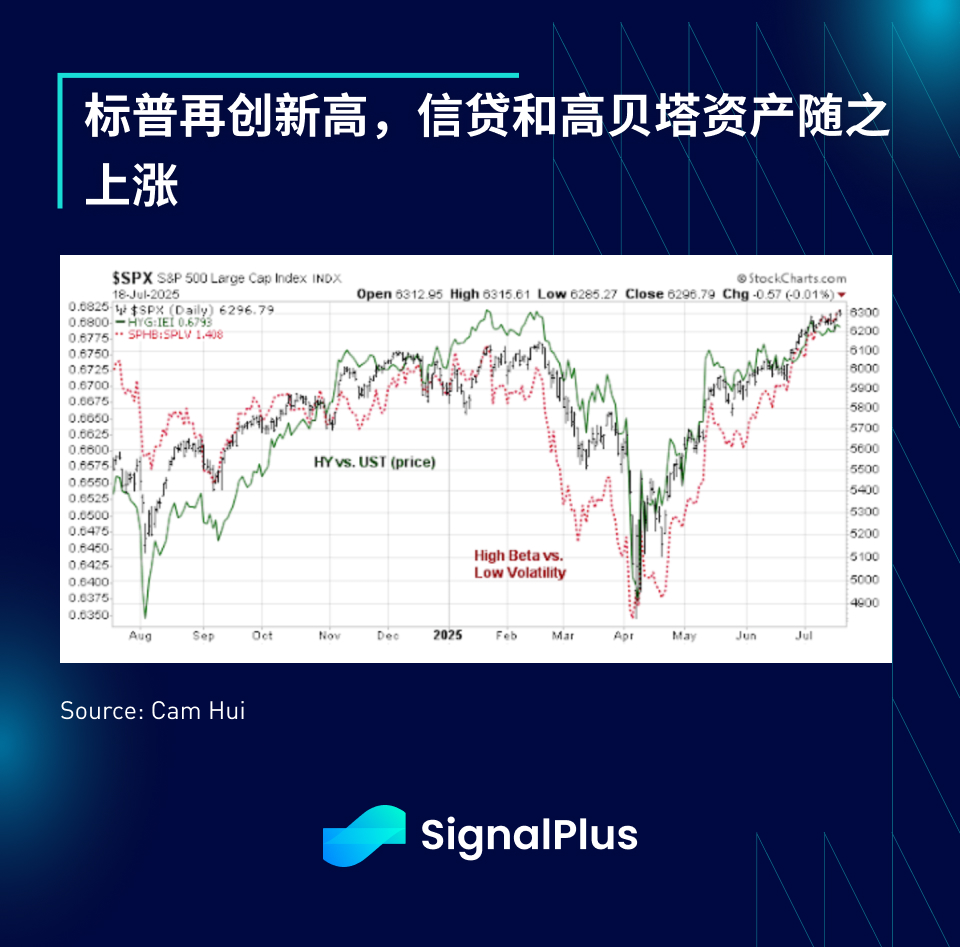

Another week, another all-time high. The S&P 500 hit another all-time high on Friday, the third time this week and the sixth time in July. Markets continue to ignore the ongoing tariff escalation (30% tariffs on Mexico and the EU), the incipient pass-through of price pressures in the latest CPI data, and the latest drama of removing Fed Chairman Powell for “just cause.”

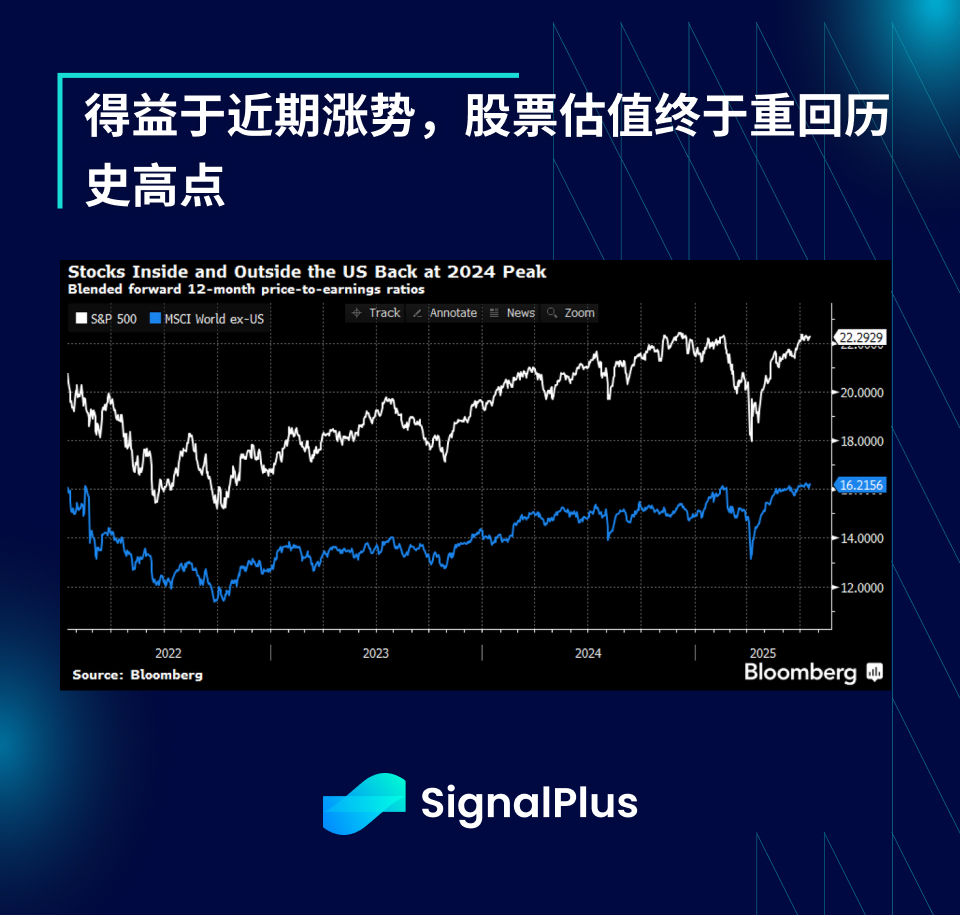

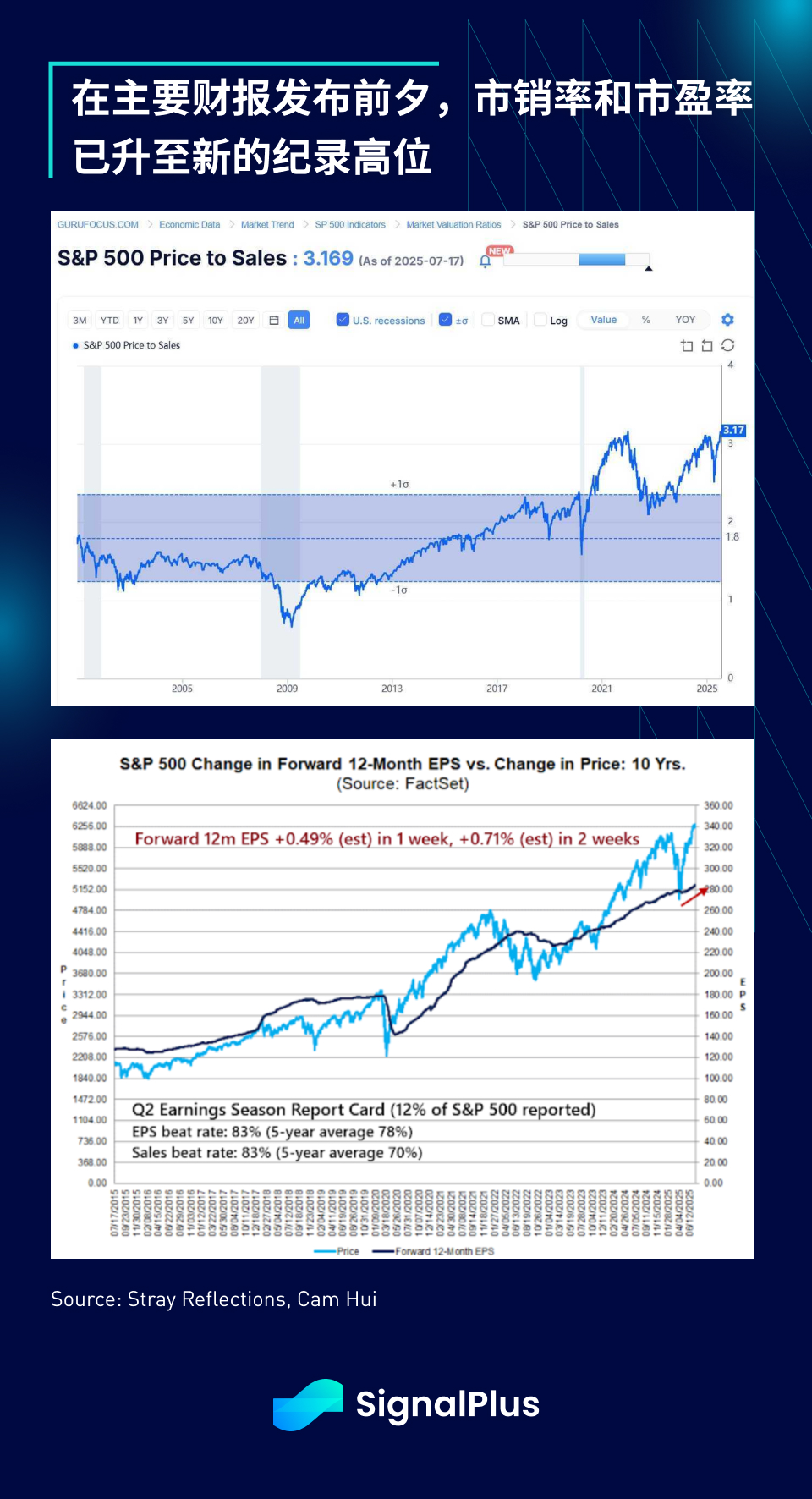

The recent rally has pushed the S&P 500's price-to-earnings ratio close to its own all-time high, just as the second-quarter earnings season is about to kick off and investors are paying a premium for any kind of stock exposure.

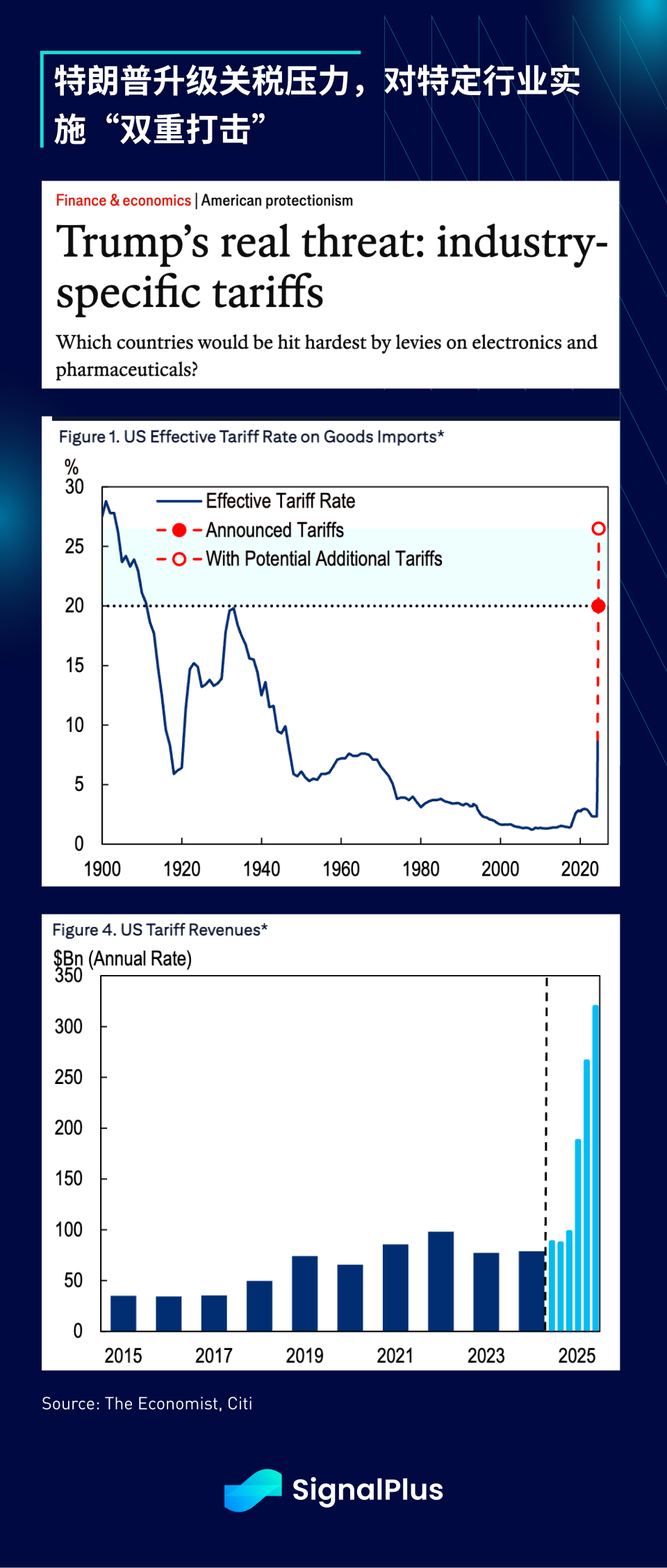

Meanwhile, encouraged by the stock market's performance, President Trump has reignited his tariff escalation war and is making plans to add industry-specific tariffs on top of existing country-specific tariffs, which will reportedly be implemented within two weeks. The initial target industries will be pharmaceuticals and semiconductors, aiming to fully cover US imports.

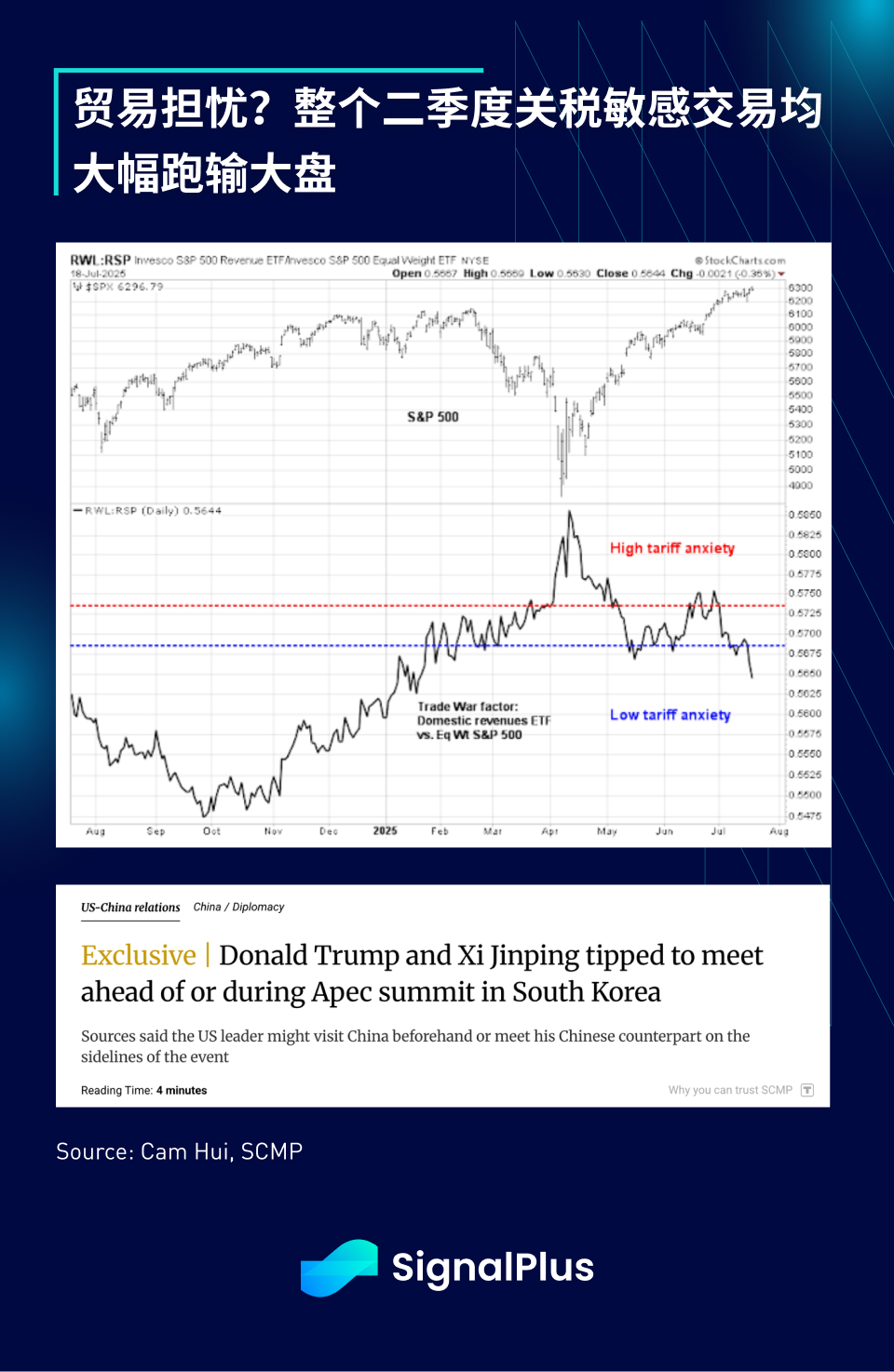

Despite the new threats, markets have almost completely ignored this round of tariff escalation, with “tariff-sensitive” thematic sectors continuing to underperform the benchmark index. Whether due to expectations of an eventual “TACO” moment (referring to the easing of trade tensions), less targeted attacks on key trading partners (the expected Trump-Xi summit in South Korea), or confidence that the private sector can handle the shock, markets are likely to remain deaf to the trade conflict until further notice.

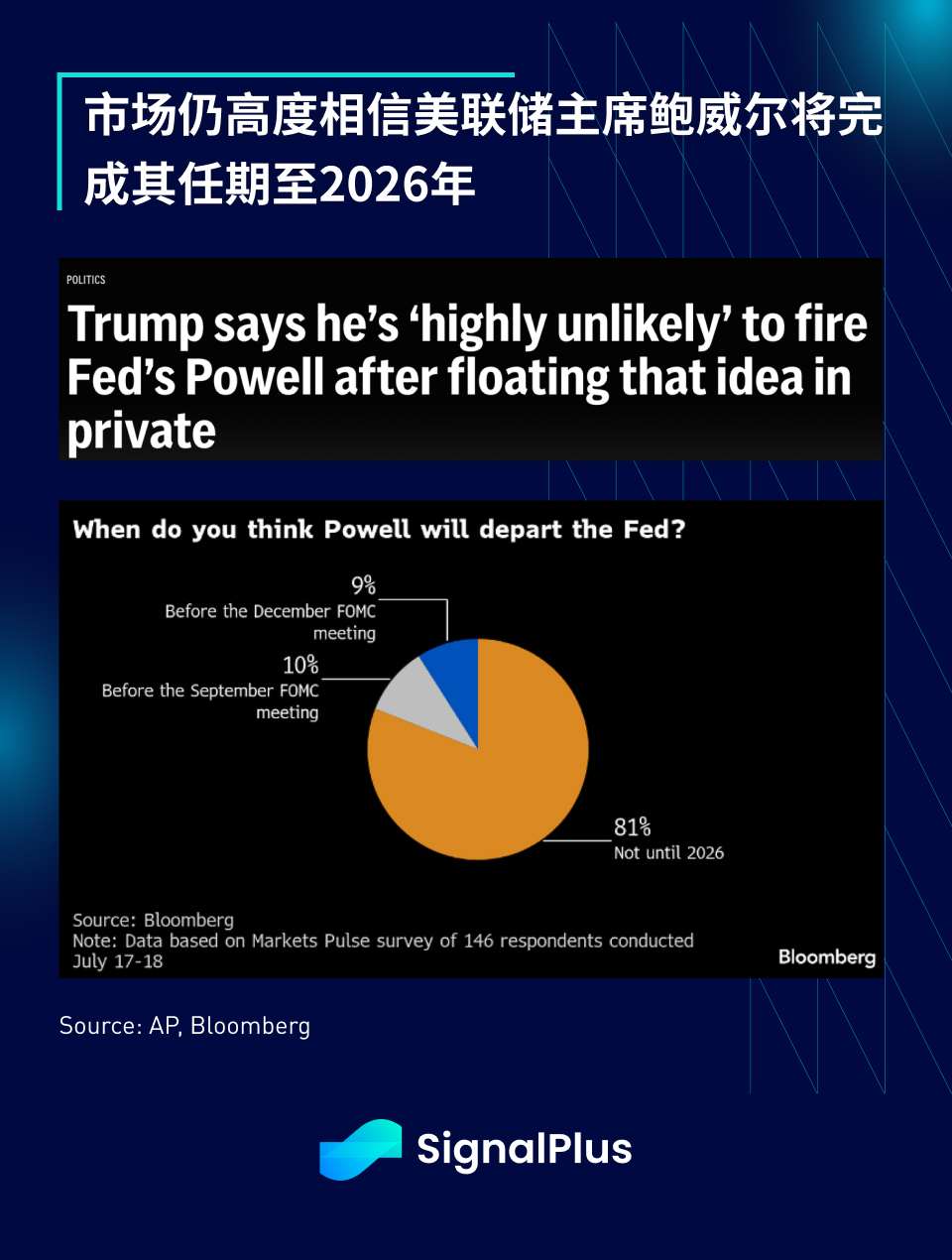

Speaking of policies, the Trump administration has set off a new round of Fed turmoil, with media reports saying that Fed Chairman Powell may be removed due to serious budget overruns for building renovations. Yes, you read that right!

Powell has been mired in project management issues over some of the roughly $2.5 billion in renovations to the Fed's Washington headquarters that have cost about $600 million more than initially expected. Asked Tuesday whether the expensive renovations constituted a fireable offense, Trump said, "I think to some extent, yes." -- The Hill

After leaking the ridiculous claim, Trump quickly walked back his threat, and the market consensus is overwhelmingly that Powell will complete his term until 2026.

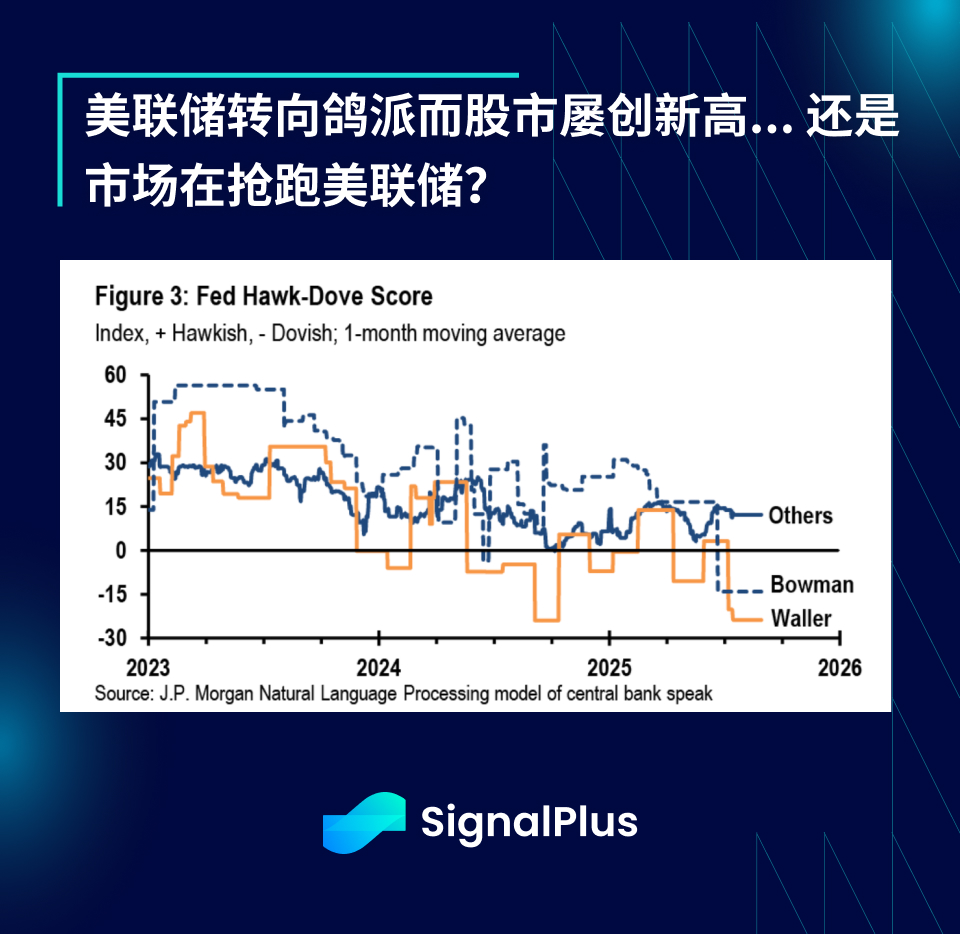

Meanwhile, Fed Governor Waller took a slightly unconventional move by expressing his "dissent" in advance, publicly stating that he was inclined to cut interest rates at the July meeting, arguing that "the private sector is not performing as well as everyone thought" and that the U.S. labor market is also "on the edge" because most employment is concentrated in the public sector.

Is it any wonder that the market is currently in the same risk-on mode as it has been for the past two months as the Fed rhetoric turns dovish and stocks continue to hit new highs? Or is the market pricing in a dovish Fed, front-running the upcoming rate cuts and contributing to the “Goldilocks economics” narrative?

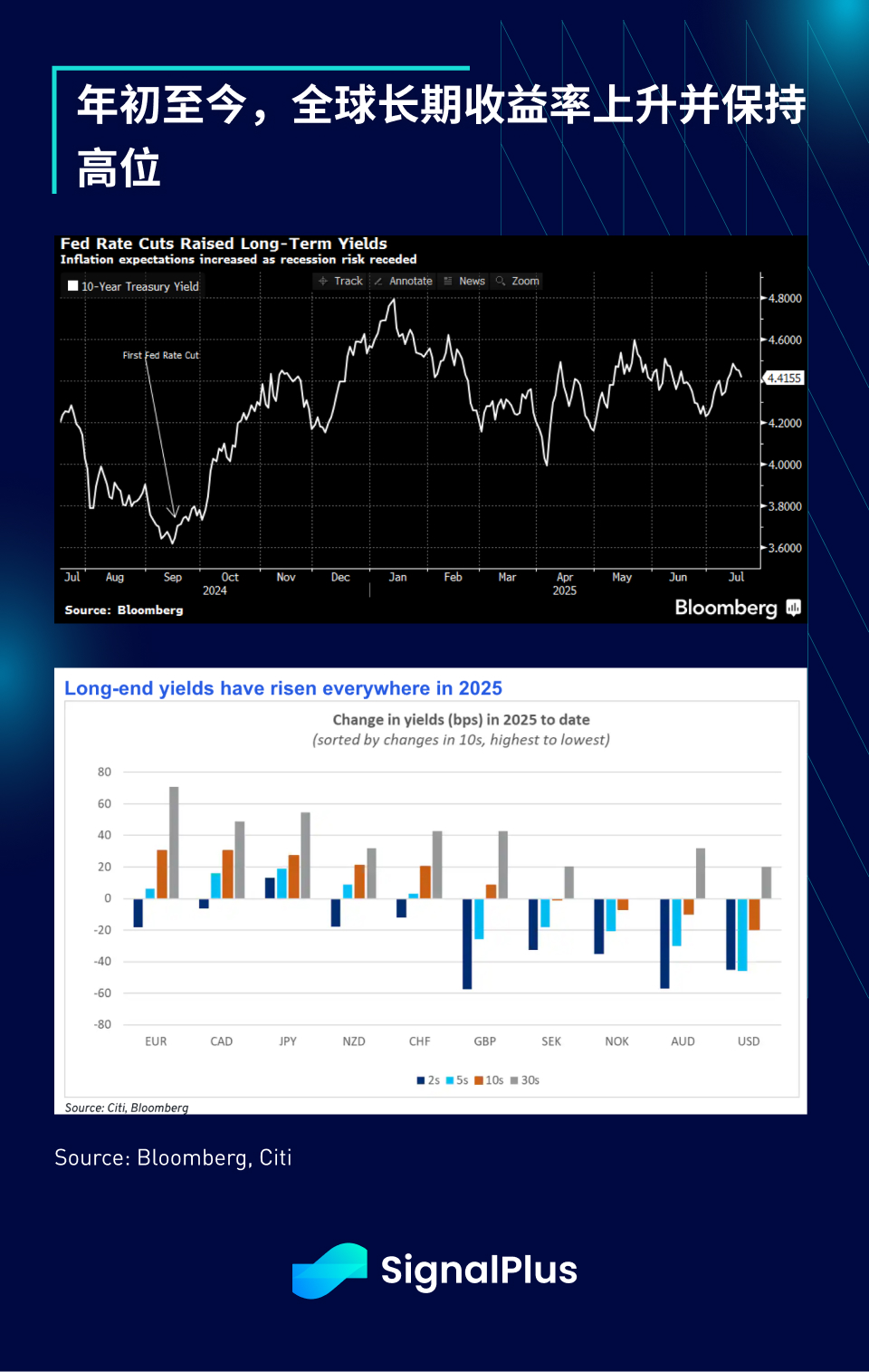

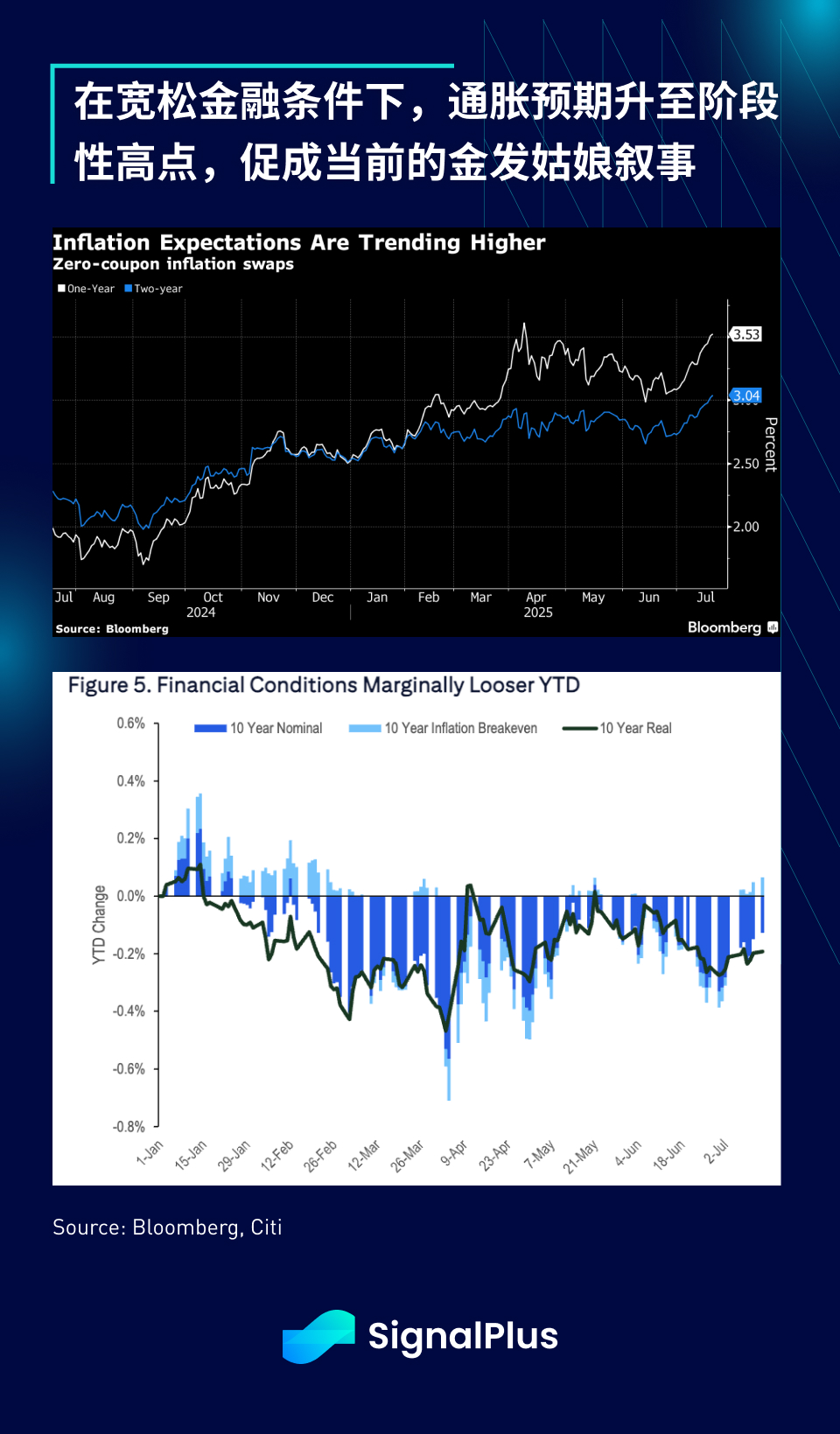

In any case, inflation expectations have quietly returned, global long-term yields remain high, while inflation break-even points have climbed to their highest levels in many years, while financial conditions remain loose.

Data from the past week also aligned well, with the University of Michigan reporting a slight improvement in consumer confidence both about current conditions and future expectations, while one-year inflation expectations have fallen to pre-tariff levels (4.4% vs. 5.0% prior).

The earnings season will enter its climax this week, with Tesla and Google's parent company Alphabet set to release their earnings reports on Wednesday. According to Bloomberg, 58 of the 498 S&P 500 companies have released their earnings reports, with earnings exceeding expectations by 7.8%. Even with earnings growth, the price-to-sales (P/S) and price-to-earnings (P/E) ratios of US and global stocks have risen to or above historical highs, and investors are paying "full price" for increasing risk exposure at this moment.

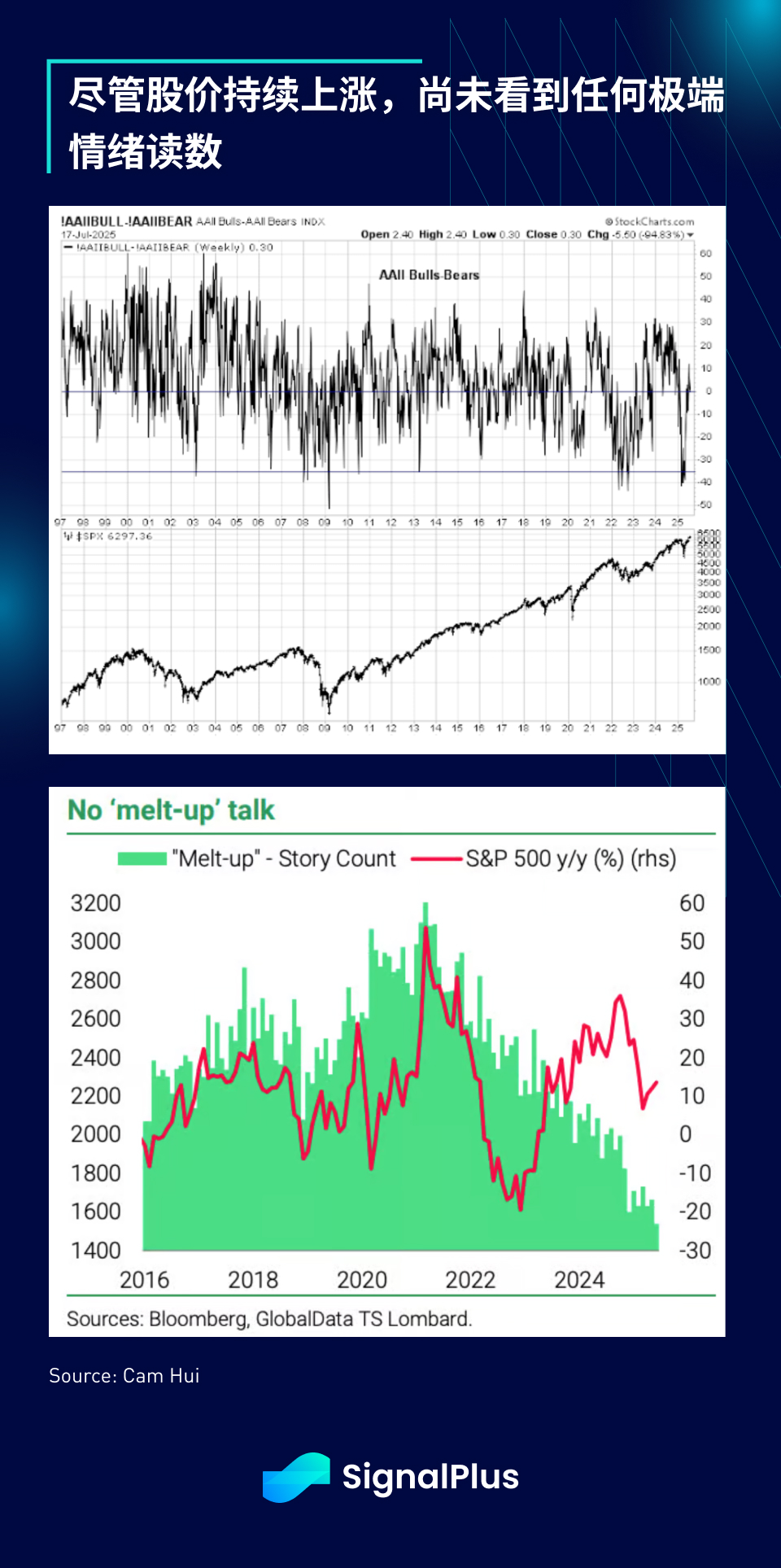

Surprisingly, despite the market’s continued rally, we haven’t seen extreme sentiment readings in traditional momentum indicators: the National Association of Individual Investors bull-bear ratio remains around the mid-range, and search engine queries for “boom” stories remain at historically low levels.

Are the macro doomsayers finally extinct? Have we all accepted the belief that the stock market can only go up and not down? Don't short the market against the trend...

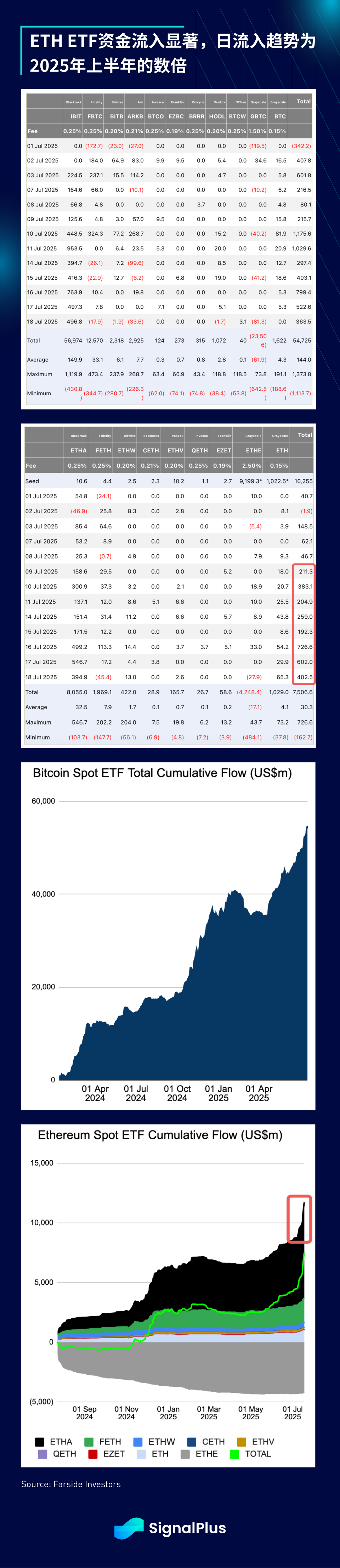

The crypto space certainly hasn’t missed out on our own FOMO moment. Ethereum is having a blast, approaching the $4,000 region (up 22% in 5 sessions), with some major altcoins also posting double-digit gains this week. Bitcoin also hit its own all-time high, topping $118,000, though the excitement was a little restrained. Until further notice, it feels like the good times are back.

The ETH/BTC ratio has temporarily risen from the grave and has improved to its best level since Q1. Some attribute this to the focus on stablecoins/real world assets being good for proof-of-stake networks, while others see Ethereum's new treasury strategy as a catalyst for the rise. We personally believe this is just a classic risk-on spillover as most of the money in mainstream traditional finance has been fully deployed in Bitcoin over the past 7 months.

As a positive milestone, Congress did finally pass landmark stablecoin legislation last week, exchanging tighter federal and state regulation for more stablecoin payment channels. This may have brought some structural tailwinds, as evidenced by the record inflows into Ethereum ETFs over the past two weeks, with total inflows exceeding $3 billion in July, and daily inflows ($300 million to $500 million) trending 5 to 10 times the daily inflows in the first half of this year.

At the risk of repeating what I have said for most of the past 8 weeks... Never short a dull market, and enjoy the good times rolling in. Good luck and happy trading to all of you as we head into the heat of summer!

You can use the SignalPlus trading indicator function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com