US macro data is in line with expectations, the market continues before the rate cut, and long-term investors officially start selling (07.14~07.20)

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this article are for reference only and do not constitute any investment advice.

BTC Price Trends

BTC opened at $119,130.81 this week and closed at $117,312.70, down 1.53%. The highest price was $123,231.07 and the lowest price was $115,697. The amplitude was 6.32%, and the trading volume was significantly increased.

The US macroeconomic data maintained the expectation of a rate cut in September. Driven by the enthusiasm for long positions, both OTC funds and on-site funds actively went long, forming an upward force and pushing BTC to a new high. It is expected that the forward-looking trading trend before the rate cut will continue in the short term.

As BTC broke through its all-time high, funds began to rotate and Altseason started again. BTC's market share dropped by 4.83% in a single week to 61.5%.

At the same time, after BTC hit a new high of $120,000, long-term investors continued their cyclical reduction of holdings, providing selling pressure on the market and suppressing upward prices.

Another factor worth being vigilant about is "reciprocal tariffs". The market currently prices tariffs to end at a lower rate, which will not have a significant impact on US inflation. However, the repetitive nature of Trump's decisions makes it difficult to confirm the conclusion now. However, this uncertainty is likely to be roughly resolved by the August 1 deadline.

Policy, macro-finance and economic data

Last week we pointed out that the CPI data that we focused on did not exceed expectations this week.

On July 15, the United States announced that the seasonally adjusted CPI annual rate at the end of June was 2.7%, in line with expectations. The seasonally adjusted core CPI annual rate at the end of June was 2.9%, lower than the expected 3.0%.

The data was in line with expectations, so the market did not react extra. But CPI did start to rebound. In addition to the short-term rise in oil prices caused by the "Iran-Israel conflict", tariffs also played a role. The second wave of mild inflation has occurred, but it is not enough to force the Fed to turn hawkish. Whether the impact of subsequent tariffs will continue to be significantly amplified requires careful attention.

On July 16, the PPI data released by the United States showed that the annual PPI rate in June was 2.3%, lower than the expected 2.5% and the previous value of 2.7%, showing some signs of cooling of the economy.

Subtle changes in the data pushed FedWatch's probability of a September rate cut down to just over 50%.

Uncertainties at the political and trade levels remain high. On July 11, the Trump administration raised Canada's unified tariff to 35%, and in the following days sent "circulars" to the European Union, Mexico and 23 countries with tariffs as high as 20-50%. All measures are set to take effect on August 1. At the same time, the $3.4 trillion "Big and Beautiful Act" is entering the Senate for deliberation. If it is finally implemented, the ten-year deficit rate may be pushed up to 9%, which, together with tariff inflation, will increase the risk of stagflation of the "fiscal-monetary" dual expansion.

As the economic data was in line with expectations, U.S. stocks continued to rise, with the Nasdaq and S&P 500 rising 1.51% and 0.59% respectively, and the Dow Jones falling slightly by 0.07%.

After a continuous decline, the US dollar index rebounded by 0.64% to 98.46, achieving a rebound for two consecutive weeks. Both long-term and short-term US Treasury yields remained relatively stable. Gold fell slightly.

With the data basically in line with expectations and expectations for a slight rate cut falling, BTC adjusted slightly after hitting a record high, falling 1.53%.

Crypto Market

The Crypto market achieved another historic breakthrough this week.

On July 17, the U.S. House of Representatives approved three major Crypto bills at once - the GENIS Act, the CLARITY Act, and the Anti-CBDC Act. The CLARITY Act and the Anti-CBDC Act have been transferred to the Senate for review, and the GENIS Act was quickly signed by Trump the next day, marking the official entry of the U.S. stablecoin into the compliance era, and also marking that stablecoins are becoming the second largest use case in the crypto world in addition to value storage.

Under the impact of this positive news, ETH reversed its downward trend and surged by more than 20% in a single week, leading to the restart of Altseason.

From a technical perspective, BTC is currently above the "Trump bottom", between the first and second rising trend lines of the bull market.

Due to the preemptive passage of the three major bills last week, BTC surged 9.08%. This week, BTC chose to adjust at a high level, and the long-term selling volume increased. However, with corporate procurement and retail investors flowing in through the Spot ETF channel, BTC is likely to continue to rise after the adjustment.

Inflow and outflow of funds and selling

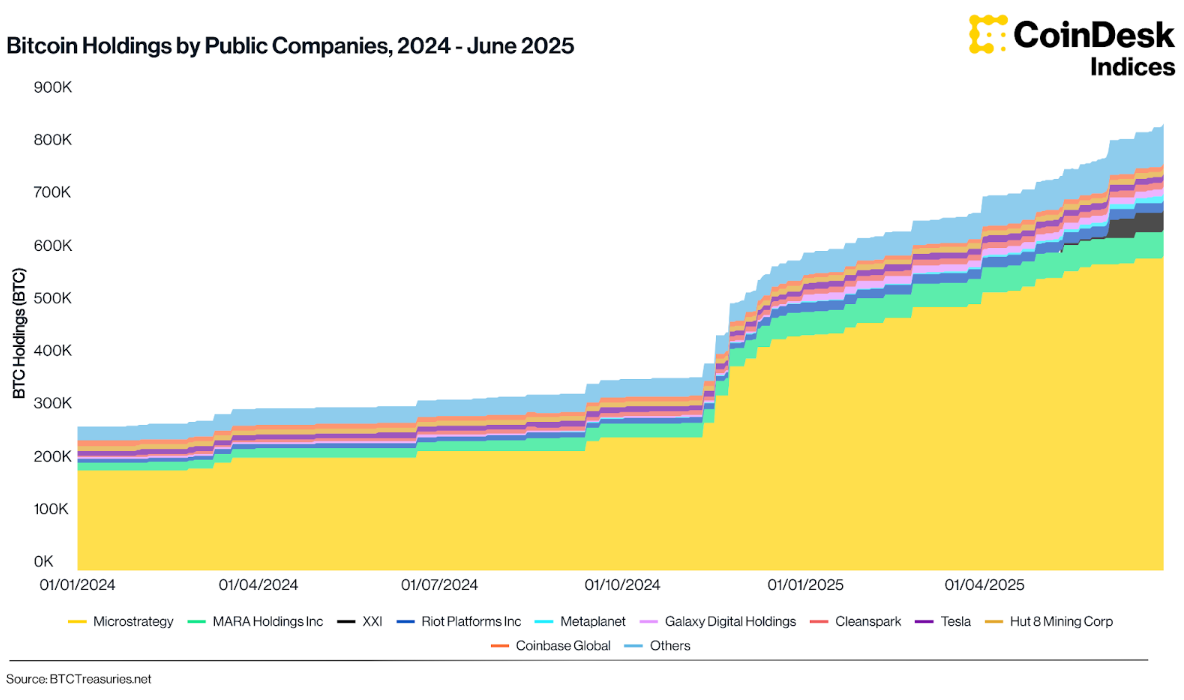

As BTC and stablecoins gain support at the U.S. legislative level, public companies have become important buyers in the crypto market.

According to Coindesk, public companies have surpassed the BTC Spot ETF channel to become the largest buyer of BTC in the second quarter. The purchase speed has increased significantly since December last year, which coincides with the election of pro-Crypto Trump as US president.

Statistics on the scale of BTC held by listed companies

Currently, the range of Crypto reserves of listed companies has expanded from BTC to Altcoin and even MEMECoin, which has cleared the logical obstacles for the opening of Altseason and provided financial and emotional support.

This week, the funds flowing into the market through the BTC Spot ETF were $2.359 billion, while the ETH Spot ETF channel reached $2.258 billion. On July 17 and 18, the funds flowing into the ETH Spot ETF channel exceeded those of the BTC Spot ETF, which was a historic milestone.

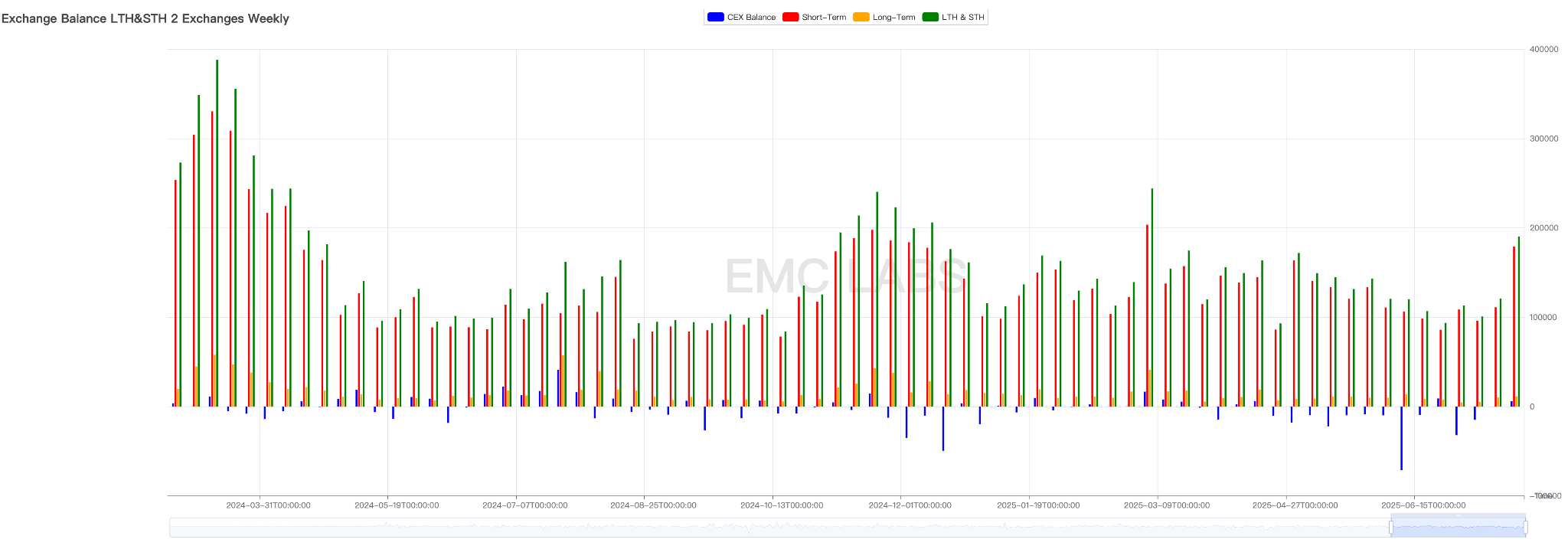

As BTC started its fourth wave of rise and as public companies and US retail investors showed great enthusiasm, BTC long holders started to sell off sharply.

Data from the eMerge Engine chain shows that more than 150,000 BTC were moved in long positions last week. On exchanges, long and short positions sold a total of 190,000 BTC, and the scale of the sell-off was significantly enlarged.

Long and short selling statistics (weekly)

In the course of a bull market, long-term investors will continue to sell, which is consistent with historical rules. Its impact on prices and trends depends on the extent to which buying power absorbs selling pressure. This needs to be closely watched in the future market.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.5 and is in an upward period.

EMC Labs

EMC Labs was founded by crypto asset investors and data scientists in April 2023. It focuses on blockchain industry research and Crypto secondary market investment, takes industry foresight, insight and data mining as its core competitiveness, and is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets to bring benefits to mankind.

For more information, please visit: https://www.emc.fund