7% token allocation remains a mystery: WLFI and Aave’s cooperation proposal is mired in a “Rashomon”

- 核心观点:DeFi合作提案争议暴露治理透明度问题。

- 关键要素:

- WLFI否认7%代币分配提案真实性。

- AAVE代币价格短期下跌超8%。

- 创始人Stani坚称提案已通过有效。

- 市场影响:引发对DAO治理可信度的质疑。

- 时效性标注:短期影响。

Original author: 1912212.eth, Foresight News

While collaboration is commonplace in the crypto space, conflict is no exception. The recent dispute between World Liberty Financial (WLFI) and Aave has garnered significant market attention. This dispute stemmed from a seemingly mutually beneficial DeFi collaboration proposal, but information asymmetry and denials sparked a furor, leading to a short-term drop of over 8% in the AAVE token price.

WLFI, an open finance project endorsed by the Trump family, was originally intended to expand its influence through Aave's DeFi infrastructure, but the dispute exposed the pain points of governance transparency in the crypto ecosystem.

Is the token distribution proposal a bubble?

The WLFI project, launched in 2024 and driven by members of the Trump family, has a total token supply of 100 billion. As an emerging project, WLFI has previously sought to collaborate with established DeFi protocols to enhance liquidity.

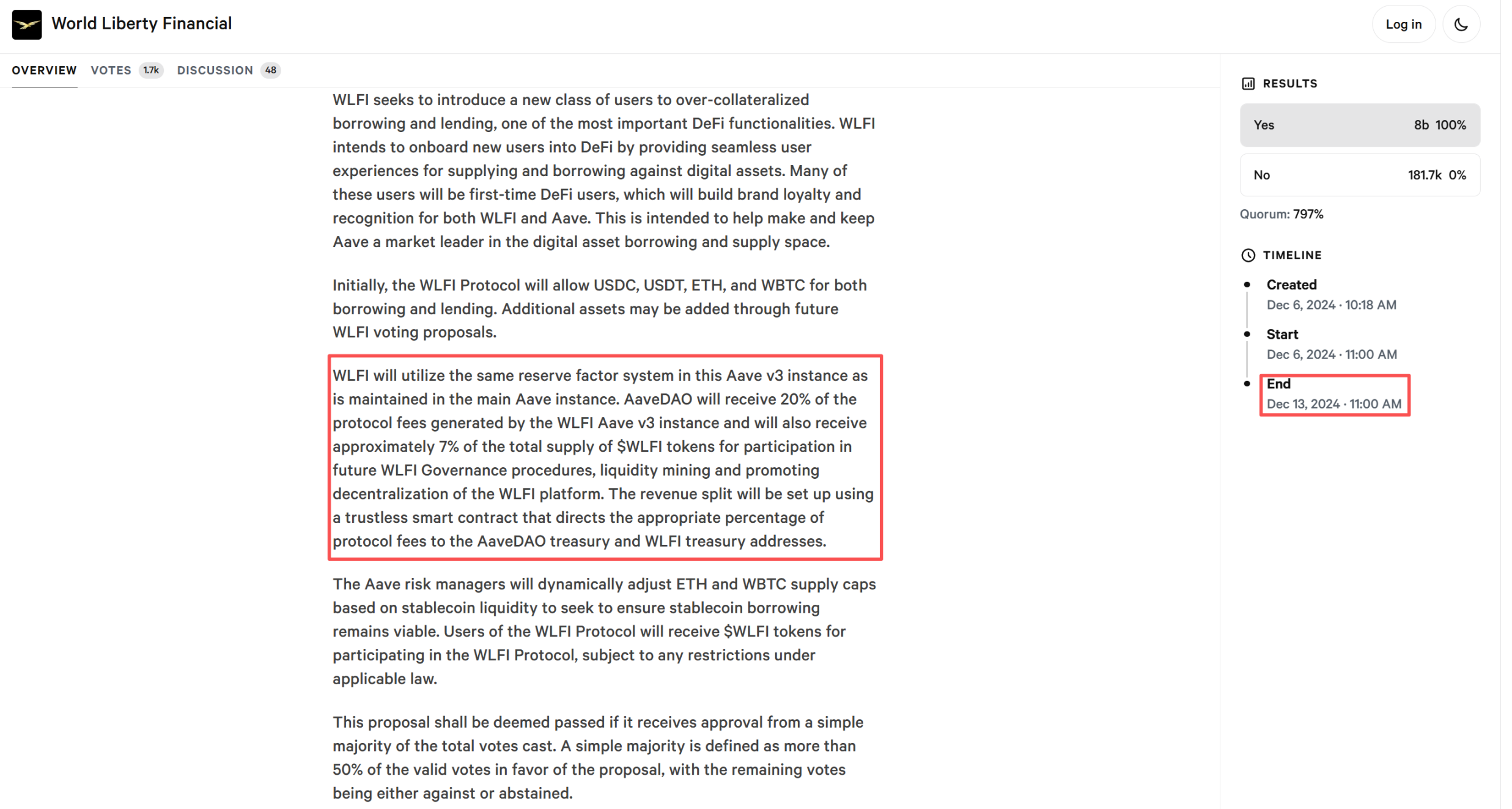

Previously, Aave DAO (Decentralized Autonomous Organization) passed a proposal: WLFI will deploy its platform on Aave V 3. In return, Aave DAO will receive 20% of the fees generated by the WLFI protocol and allocate approximately 7% of the total supply of WLFI (i.e. 7 billion tokens).

This clause was initially seen as a positive - Aave, as a leading lending protocol, can use this to inject new assets to increase TVL, while WLFI can accelerate adoption by leveraging Aave's user base.

On August 23, Aave founder Stani.eth responded to questions about "Are the WLFI and AAVE protocols still valid? Are they really built on Aave? There are many different rumors outside." He said that the protocol is still valid, and publicly forwarded the view that "Based on the current price, the Aave treasury will receive $2.5 billion worth of WLFI, making it one of the biggest winners in this cycle." He called this the art of trading, and then AAVE rose to $385.

However, soon after, Dylan_0x (@0xDylan_), a member of the WLFI Wallet team, denied the proposal that "Aave will obtain 7% of the total WLFI tokens", and AAVE fell 5% in a short period of time.

On August 24th, the WLFI team denied the authenticity of the "7% token allocation" to Wu Blockchain, calling it "fake news." WLFI officials stated that while the proposal existed, the allocation clause was not true, and emphasized that the project's focus is on tokenized innovation rather than external profit sharing.

Aave founder Stani.eth responded below his tweet, saying that the proposal created by the WLFI team has been voted and passed on Aave DAO and approved by WLFI, and attached a link to the proposal.

As of now, the official WLFI account has not made an official response to this matter, which has also led to different opinions in the market.

WLFI will be launched on Ethereum on September 1st and will be available for redemption and trading. Early adopters (in the $0.015 and $0.05 rounds) will have 20% of their tokens unlocked, with the remaining 80% determined by community voting. Tokens for the founding team, advisors, and partners will not be unlocked.

On September 25, according to Bitget, its pre-market price was $0.45, bringing its FDV (fully diluted valuation) to tens of billions of dollars. It has now fallen back to $0.25. AAVE has fallen back below $350.

Does governance count?

The DAO governance problem continues from the last cycle to the present.

Aave founder Stani.eth responded that the proposal is still valid and may just be unilateral wishful thinking.

dForce founder Mindao commented on the matter, saying the proposal "looks like it was written by a WLFI intern and doesn't resemble a deal the Trump family would sign. Aave's partnership with Spark only offers a 10% revenue share. WLFI has the Trump brand, so it's reasonable for Aave to pay a premium to justify it. Even if WLFI was aiming for a public offering, it wouldn't have come up with such poor terms. Later, as crypto took off, WLFI issued USD 1, and the narrative jumped directly from "crypto bank" to "Aave + Circle," with a valuation 10x. After all, Trump wrote the Art of the Deal, and this deal is absolutely shameful."

In addition, Mindao speculates that the subsequent scenario is "WLFI will completely abandon Aave, so that the previous contract will naturally become invalid. The token distribution share will be greatly reduced. The allocation will be used to incentivize USD 1 lending and minting. There will be no loss in the left hand and the right hand. It can be regarded as a subsidy for the directional stablecoin minting operation."

Laolu, a Twitter KOL, said that it wouldn’t be surprising if WLFI didn’t plan to give AAVE 7% of its tokens. “SPK defaulted by over 10% and only gave 1% of the profit in the end, and it ended up in nothing. WLFI said during the public offering that all tokens would be unlocked, but now it has changed to partial unlocking.”

Polygon and Aave have had similar experiences

In December 2024, Polygon and Aave clashed over a Polygon community proposal to use bridge funds (approximately US$110 million) for income strategies such as staking income.

Aave contributor Marc Zeller objected, calling this a "risky strategy" and proposing that Aave drop its Polygon support to prevent misuse of funds. Aave even adjusted the parameters of the Polygon lending platform, setting the LTV to 0, meaning that no matter how much a deposit is, no one can borrow money.

Polygon founder Sandeep Nailwal accused Aave of "monopolistic behavior" and "sour grapes mentality," believing that Aave was trying to suppress competition and maintain its hegemony in the lending market.

The conflict escalated into private threats and public accusations, with Polygon CEO Marc Boiron and Zeller even making a bet: if Aave withdrew from Polygon, the latter would prove its independence.

Ultimately, the proposal was adjusted, and Aave didn't completely withdraw, but the relationship remained strained. Polygon turned to developing a dual-token system (POL and MATIC) to enhance its autonomy.

It is worth mentioning that in April 2021, Polygon (with a market value of approximately 4 billion) took out 1% MATIC worth 40 million US dollars to incentivize Aave (with a market value of approximately 6.5 billion at the time).