Pantera Capital In-Depth Analysis: The Value Creation Logic of Digital Asset Treasurys (DATs)

- 核心观点:DATs通过收益策略超越单纯持币回报。

- 关键要素:

- Pantera投资3亿美元布局DATs赛道。

- BitMine持115万枚ETH成最大储备方。

- DATs通过质押、发股等多途径增值。

- 市场影响:推动机构采用收益型数字资产策略。

- 时效性标注:中期影响。

Source: Pantera Capital

Compiled and edited by Janna and ChainCatcher

This article is written by Cosmo Jiang, General Partner and Portfolio Manager at Pantera Capital. Digital asset investing has long passed the stage of simply hoarding coins and waiting for appreciation. Digital asset treasuries (DATs), with their unique strategy of increasing net asset value per share and earning more in underlying tokens, have become a hot commodity for institutions. Pantera has invested $300 million in DATs, while BitMine has become a star performer thanks to its ETH reserves. This article will decipher the value of DATs, explore the underlying reasons why leading industry institutions are choosing this sector, and understand the new trends in digital asset investment.

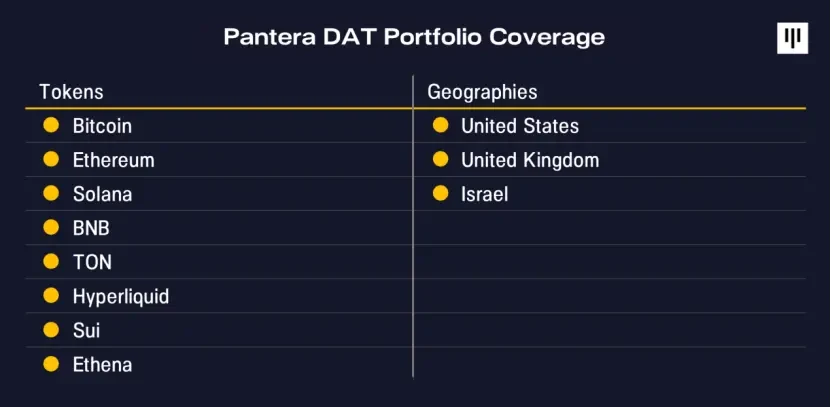

(1) Digital Asset Treasury (DATs) Investment Logic

Our investment rationale for DATs is based on a simple premise: DATs can increase net asset value per share by generating income, ultimately resulting in a higher underlying token holding than simply holding spot assets. Therefore, holding DATs may offer higher return potential than directly holding the tokens or through ETFs. Pantera has deployed over $300 million in DATs globally, covering a wide range of tokens. These DATs are leveraging their unique advantages to achieve per-share value growth by strategically increasing their holdings of digital assets. Below is an overview of our DAT portfolio.

BitMine Immersion, listed on the NYSE under the ticker symbol BMNR, is an innovative company focused on blockchain technology and digital asset financialization. As the first investment of the Pantera DAT Fund, BitMine has demonstrated a clear strategic path and exceptional execution. BitMine Chairman Tom Lee outlined BitMine's long-term vision: to acquire 5% of the global ETH supply—the "5% Alchemy Plan." We believe that an in-depth analysis of BitMine's value creation process can provide a case study for understanding the operating models of high-performing DATs.

Since launching its reserve strategy, BitMine has become the world's largest ETH reserve holder and the third-largest DAT (after Strategy and XXI), holding 1,150,263 ETH, valued at $4.9 billion, as of August 10, 2025. Furthermore, BitMine is the 25th most liquid stock in the United States, with a five-day average daily trading volume of $2.2 billion as of August 8, 2025.

2. The Strategic Value of Ethereum

The core of DATs' success lies in the long-term investment value of their underlying tokens. BitMine's DAT strategy is based on the assumption that Ethereum will become one of the most significant macro trends of the next decade, as Wall Street fully migrates to blockchain. As we discussed last month, the "Great On-Chain Migration" is underway—with tokenized innovation and stablecoins growing in importance. $25 billion in real assets already on-chain, coupled with $260 billion in stablecoins (equivalent to the 17th-largest holder of US Treasury bonds globally), are driving this progress. As BitMine Chairman Tom Lee stated in early July 2025, "Stablecoins have become a ChatGPT-level phenomenon in crypto."

This activity primarily occurs on the Ethereum network, allowing ETH to directly benefit from the increased demand for block space. As financial institutions increasingly rely on the security of Ethereum to support their businesses, they will be more motivated to participate in the Proof-of-Stake network, further driving up demand for ETH.

(3) Actual Evidence of DAT Value Creation

After establishing the investment value of the underlying token, the DATs’ business model focuses on maximizing the number of tokens held per share. The main approaches include:

1. Premium Stock Issuance: Issuing stock at a price higher than the net asset value (NAV) per token

2. Issuing Convertible Bonds: Monetizing the Fluctuating Value of Stocks and Tokens through Equity-Linked Securities

3. Reinvestment: Increase token holdings through operating income such as staking rewards and DeFi income (this is a unique advantage of smart contract token DATs such as ETH, which traditional Bitcoin DATs such as Strategy do not have)

4. M&A of undervalued assets: Acquiring DATs trading at or below NAV

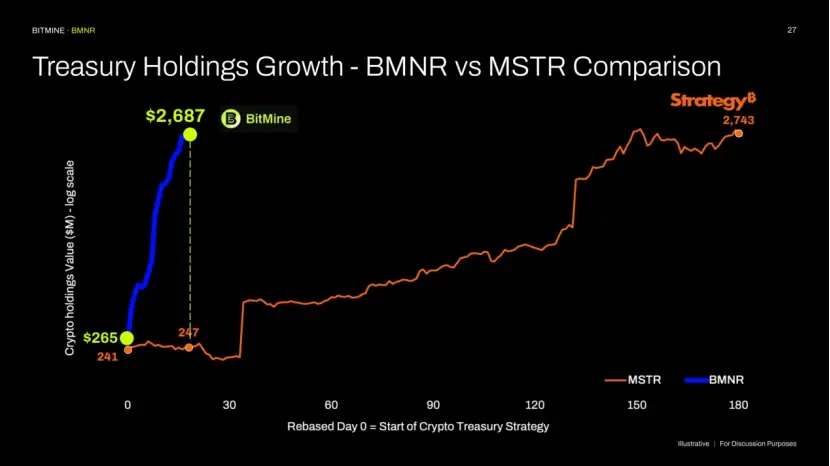

BitMine achieved astonishing growth in ETH per share in the first month of its ETH reserve strategy, significantly outpacing its peers. Its first-month ETH increase exceeded the Strategy's total for the previous six months. BitMine primarily achieved growth through equity issuance and staking income, and plans to soon expand into financing instruments such as convertible bonds.

Source: BitMine, July 27, 2025

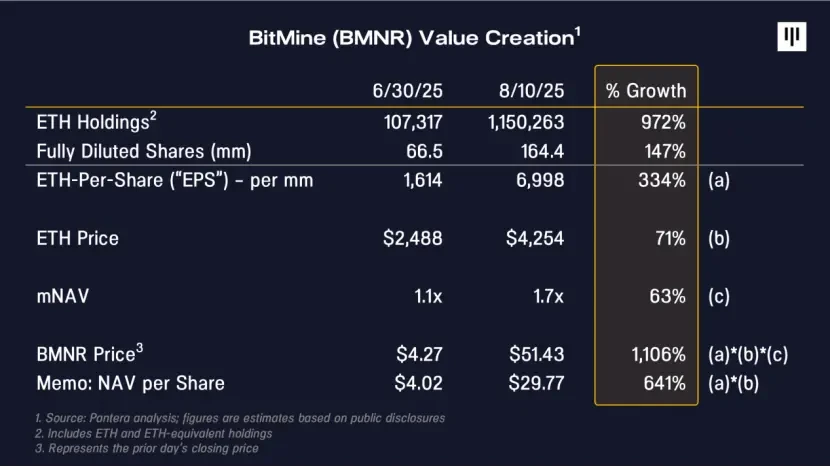

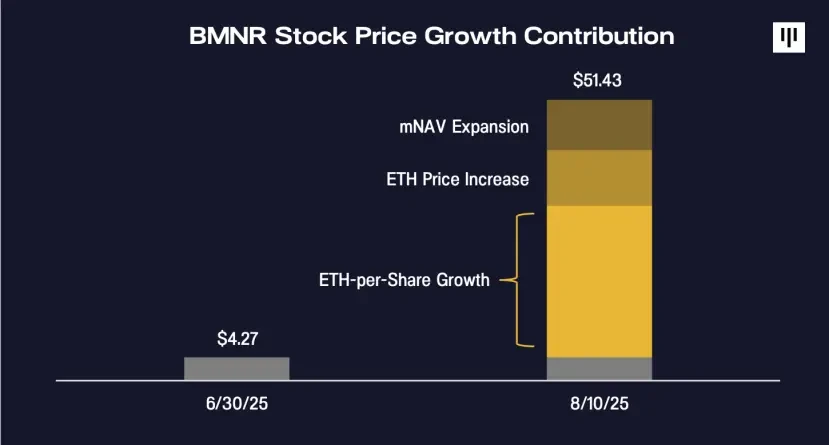

The price of a DAT can be broken down into the product of three factors: (a) token volume per share, (b) token price, and (c) NAV multiplier (mNAV). At the end of June, BitMine's stock price was $4.27 per share, approximately 1.1 times its NAV of $4 per share after the initial DAT financing. A little over a month later, the stock price soared to $51 per share, approximately 1.7 times its estimated NAV of $30 per share. Of this 1,100% increase in one month, approximately 60% came from EPS growth (330%), 20% from the increase in ETH price (from $2,500 to $4,300), and 20% from mNAV expansion (1.7 times). This indicates that the core driver of BitMine's stock price growth is the growth in ETH per share (EPS), a core engine under management's control and the key difference between DATs and simply holding spot assets.

A third factor we haven't explored yet is the NAV multiple (mNAV). A natural question is: why would anyone be willing to pay a premium for DATs' shares above their net asset value (NAV)? This can be understood by analogy to balance sheet-based financial institutions like banks: Banks generate income through their assets, and investors place a valuation premium on banks perceived to consistently generate returns above their cost of capital. High-quality banks often trade above their net asset value (or book value); for example, JPMorgan Chase (JPM) trades at a price-to-book ratio exceeding 2x. Similarly, if investors believe a DAT can consistently increase its per-share net asset value, they may be willing to value it above its NAV. We believe BitMine's approximately 640% monthly per-share NAV growth is sufficient to justify its NAV multiple premium. Whether BitMine can consistently execute its strategy remains to be seen, and challenges are inevitable. However, its management team and track record have attracted support from traditional financial giants such as Stan Druckenmiller, Bill Miller, and ARK Investors. We expect that, as Strategy’s development history demonstrates, the growth potential of high-quality DATs will be recognized by more institutional investors.