The former NYSE president’s “on-chain experiment”, Bullish is quietly joining the ranks of crypto US stocks

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

According to the Financial Times, the crypto trading platform Bullish has recently secretly submitted an initial public offering (IPO) application to the U.S. Securities and Exchange Commission (SEC). For users outside the circle, the name of this exchange may not be familiar enough, but within the crypto industry, it has a great background: Bullish is the parent company of the well-known crypto media CoinDesk, and behind it stands Block.one, the development company that once led the EOS project. Therefore, after the IPO application was announced, the price of EOS (now called A) once rose by more than 17%.

However, this is not Bullish's first attempt to enter the capital market. As early as 2021, it tried to go public through a SPAC (special purpose acquisition company) model, but ultimately failed due to multiple factors. This time, Bullish no longer takes shortcuts, but chooses a more lengthy but more secure traditional registration process. It no longer bets on short-term windows of opportunity, but tries to become the player who can survive in the market for a long time.

So, how did this exchange, which had close ties with EOS and has always been low-key in the industry, step by step reach the door of IPO?

From SPAC failure to strategic restart: Bullish presses the "pause button"

Back in 2021, Bullish announced that it would merge with Far Peak Acquisition Corp. and planned to go public through the SPAC model with a valuation of up to US$9 billion. The person driving this plan is Bullish's current CEO Tom Farley.

Farley is not an outsider, but his own work experience also laid the tone for Bullish to eventually move closer to regulation. He was the president of the New York Stock Exchange (NYSE), during which he promoted a number of changes including the Bitcoin Index and Coinbase's early investment. He then worked for the Intercontinental Exchange (ICE) for many years and was deeply involved in the integration of the NYSE. He is one of the few people in the traditional financial field who understands the "logic of digital assets."

After leaving the New York Stock Exchange, Farley joined the SPAC track and founded two shell companies, Far Point and Far Peak. Far Point successfully facilitated the listing of Global Blue in 2020, and the latter became the springboard for Bullish's listing.

However, plans cannot keep up with changes. In 2022, the overall crypto market cooled down, the SEC tightened its review of SPACs, and the market tightened due to the Fed's interest rate hike. Finally, Bullish announced the termination of its merger with Far Peak at the end of that year. Although the transaction failed, Farley and some of the Far Peak management team chose to stay, and Bullish did not quit, but looked for other new ways out.

No longer chasing the trend, Bullish chooses to "slow down"

Bullish was launched in May 2021, just as crypto trading platforms were flourishing. At that time, whether it was NFT, GameFi or platform coin incentives, major exchanges were competing for users and popularity. But Bullish took a different path.

It has no platform currency, no incentive activities, and supports no more than a hundred cryptocurrency trading pairs, most of which are settled in USDC. It is obvious that Bullish has been more concerned about the stability and regulatory friendliness of the platform rather than the popularity in the market from the beginning.

When many platforms competed to attract users and transaction volume, it never emphasized that it was a new entrance for the public, and rarely made a voice on social media. Now it seems that it is not that it does not understand, but that it is doing a slow and structured self-shaping: an "atypical" encryption platform is trying to become a "typical" financial institution.

Born with a "golden key", but caused controversy in the community

Unlike many crypto startups that started from scratch, Bullish started from a very high point. Its parent company Block.one was generous, investing $100 million in cash, 164,000 bitcoins (worth about $9.7 billion at the time), and 20 million EOS as start-up capital. It then received $300 million in external financing from investors including PayPal co-founder Peter Thiel, hedge fund tycoon Alan Howard, and crypto veteran Mike Novogratz.

Therefore, although Bullish is far behind the established exchanges such as Coinbase and Kraken in terms of brand reputation, its financial strength is not inferior, and it does not need to rely on user growth or high-frequency trading to maintain basic operations. Therefore, it has enough "time" to wait for the door of compliance to open.

But problems also arise: Although Bullish’s funding, technology and brand have deep roots in EOS, it has "drawn a clear line" with EOS in terms of products, direction and positioning, as if the two have never had any intersection.

But the EOS community is of course aware that the start-up capital, resources, and influence used by this new exchange almost all came from their initial investment and trust.

From "Blockchain 3.0" to community split: EOS's old dream has not been fulfilled

EOS was once one of the hottest projects in the crypto world. In 2017, it was born with the halo of "Blockchain 3.0" and "Ethereum Killer", led by the genius developer BM (Daniel Larimer) in technology, and Block.one in charge of financing and commercialization. In a whole year, EOS completed an ICO of up to US$4.2 billion, becoming one of the most sensational cases in the history of crypto financing.

It was an era when idealists and early investors flocked to EOS. The community provided technical support, public opinion resources and belief endorsement for EOS. As the parent of the project, Block.one promised to use the financing funds for ecological construction, support developers, improve the governance structure, and attract application landing.

However, these promises were rarely fulfilled. Although the EOS mainnet was successfully launched, it frequently stalled in ecological development: node operation was inefficient, development threshold was high, interactive experience was poor, and Block.one provided almost zero incentives to developers. In addition, problems such as BM’s resignation and the “familyization” of internal management broke out one after another, and community trust gradually collapsed.

Finally, at the end of 2021, the EOS Network Foundation (ENF) and multiple nodes launched a "governance uprising" to try to negotiate with Block.one to return funds, return domain names, and transfer governance authority. After the negotiations failed, they turned to propose a governance proposal and finally achieved an on-chain vote to clear Block.one's governance authority.

Although governance liquidation has become a reality, the right to use the funds is still in the hands of Block.one, and the legal dispute between the two parties has not been resolved. This has also become an unfinished pain for the EOS community.

Zooming out, it’s not just EOS, the former “Ethereum killers” and even Ethereum itself are all suffering from the rampant “inflation” of the underlying public chain.

Returning to the mainstream capital market, Bullish’s “compliance narrative”

Today, Bullish has resubmitted its IPO application to the SEC. This time, it avoided the "fast track" of SPAC and returned to the traditional review process, trying to "restore" itself to the familiar appearance of traditional financial institutions: clear logic, clear path, stable structure, and narrating its role in the crypto world in compliant language.

This reflects a clear signal: they no longer want to rely on "market trends" to rise to the top, but are more willing to take root through "structured operations". Its story is not only Bullish's attempt, but also represents the crypto industry's new understanding of "sustainability".

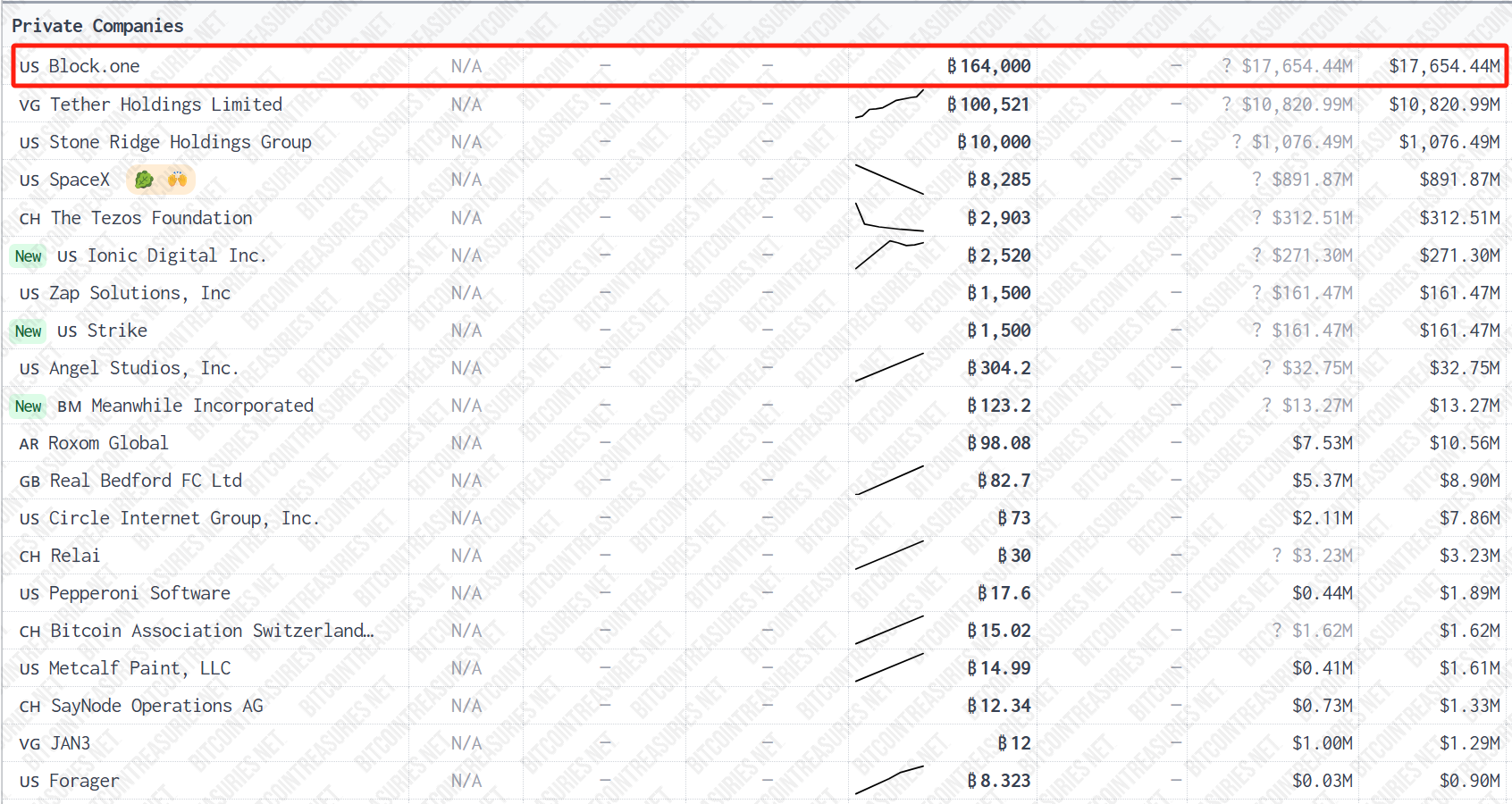

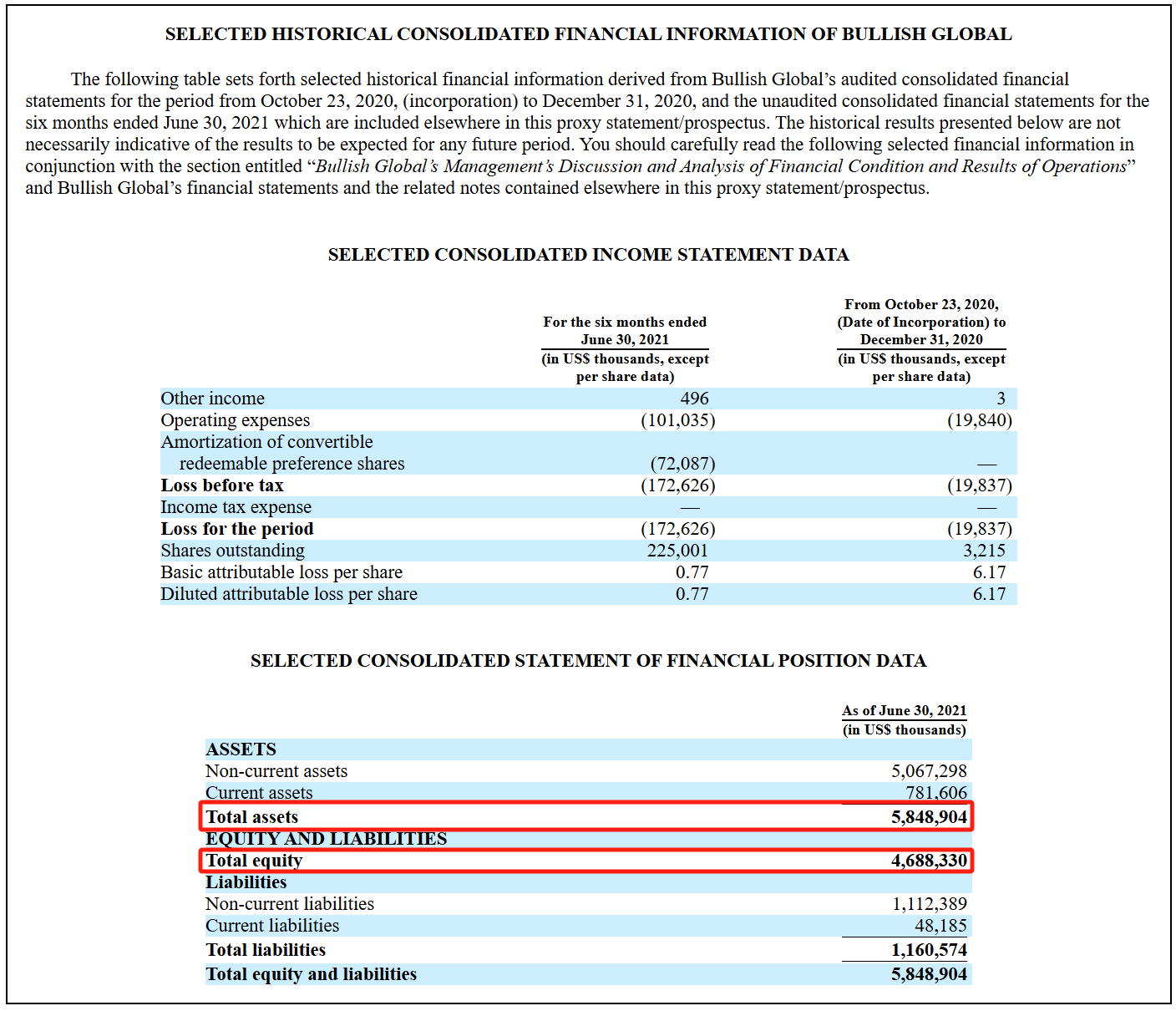

According to data from bitcointreasuries , as of now, Block.one still holds 164,000 bitcoins (market value of more than $17.6 billion), making it the private company with the largest number of bitcoins. According to a SEC financial report published on its official website, as of 2021, Bullish has total assets of approximately $5.85 billion , of which net assets are as high as $4.69 billion , and its financial situation is sound.

Crypto is heading towards IPO, is Wall Street the next stop?

Since the successful listing of Circle in 2025, it has become a trend for crypto companies to line up for listing: Gemini plans to go public within the next year , and the stablecoin issuer Paxos is also rumored to be in contact with investment banks.

The logic behind this is a shift in the collective narrative: from " breaking finance " to " entering finance ."

In the past, crypto projects always talked about "decentralized utopia"; now, they talk about "compliant, controllable, and sustainable" digital financial systems. They no longer rely on quick money brought by volatility, but on revenue, user stickiness, and infrastructure construction to win trust.

In this trend, Bullish's role is quite symbolic:

It is Block.one’s experiment to “launder” the old capital path;

It is a new start for institutions after the EOS community “cut ties”;

It is an exercise in the crypto industry's proactive move toward the mainstream, and an attempt to become a role that can be accepted by the mainstream.

In a sense, it may not be the end point of the crypto world, but it may very well be a "relay station" connecting the two worlds.