Report interpretation: What does the U.S. Treasury think tank think about stablecoins?

Original author: TechFlow

Stablecoins are undoubtedly a hot topic in the crypto market in the past week.

First, the US GENIUS Stablecoin Act passed the Senate voting procedure , and then the Hong Kong Legislative Council passed the "Stablecoin Bill" in the third reading. Stablecoins have now become an important variable in the global financial system.

In the United States, the future development of stablecoins is not only related to the prosperity of the digital asset market, but is also likely to have a profound impact on government bond demand, bank deposit liquidity, and U.S. dollar hegemony.

A month before the GENIUS Act was passed, the U.S. Treasury’s “think tank”, the Treasury Borrowing Advisory Committee (TBAC), used a report to explore in depth the potential impact of the expansion of stablecoins on U.S. fiscal and financial stability.

As an important part of the Treasury Department's debt financing plan, TBAC's recommendations not only directly affect the issuance strategy of U.S. Treasury bonds, but may also indirectly shape the regulatory path of stablecoins.

So, what does TBAC think about the growth of stablecoins? Will the think tank’s views influence the Treasury’s debt management decisions?

We will use TBAC’s latest report as a starting point to interpret how stablecoins have evolved from “on-chain cash” to an important variable that influences U.S. fiscal policy.

TBAC, a fiscal think tank

First, let me introduce TBAC.

TBAC is an advisory committee that provides economic observations and debt management advice to the Treasury Department. Its members are composed of senior representatives from buy-side and sell-side financial institutions, including banks, broker-dealers, asset management companies, hedge funds and insurance companies. It is also an important part of the U.S. Treasury Department's debt financing plan.

TBAC Meeting

The TBAC meeting is mainly to provide financing advice to the U.S. Treasury Department and is an important part of the U.S. Treasury Department's debt financing plan. From the perspective of the financing plan process, the U.S. Treasury Department's quarterly financing process includes three steps:

1) Treasury debt managers seek advice from primary dealers;

2) After the meeting with the principal dealers, the Treasury debt manager seeks advice from the TBAC; the TBAC issues a formal report to the Secretary of the Treasury based on the questions raised and the discussion materials;

3) Treasury debt managers make decisions on changes in debt management policies based on research analysis and suggestions received from the private sector.

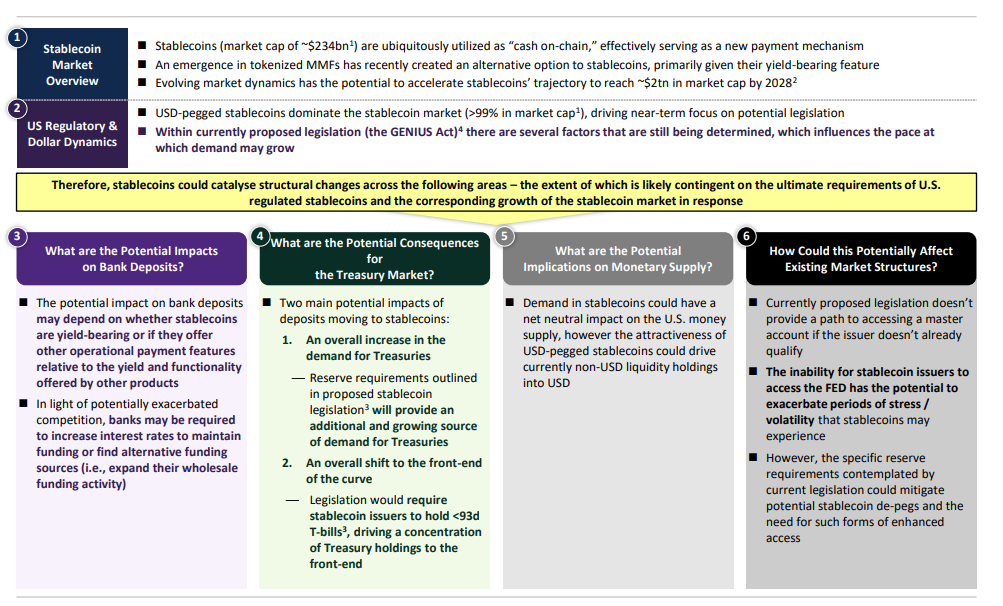

Report Summary: Impact on U.S. Banks, Treasury Markets, and Money Supply

Bank deposits: The impact of stablecoins on bank deposits depends on whether they have a yield function and their operational payment characteristics compared to other financial products. In the context of increased competition, banks may need to raise interest rates to maintain funds or seek alternative sources of financing.

Treasury bond market: The overall increase in demand for treasury bonds. The reserve requirements in stablecoin legislation will provide an additional and growing source of demand for treasury bonds. The overall shift forward in the holding period of treasury bonds. Legislation requires stablecoin issuers to hold treasury bills with a term of less than 93 days, resulting in the concentration of treasury bond holdings in the short term.

Money supply: Stablecoin demand could have a net neutral impact on U.S. money supply. However, the appeal of stablecoins pegged to the U.S. dollar could shift current non-USD liquidity holdings toward the U.S. dollar.

Impact on existing market structure: Current legislative proposals fail to provide non-qualified issuers with access to master accounts. Stablecoin issuers’ lack of access to the Federal Reserve could exacerbate the risks of stablecoins during periods of stress or volatility.

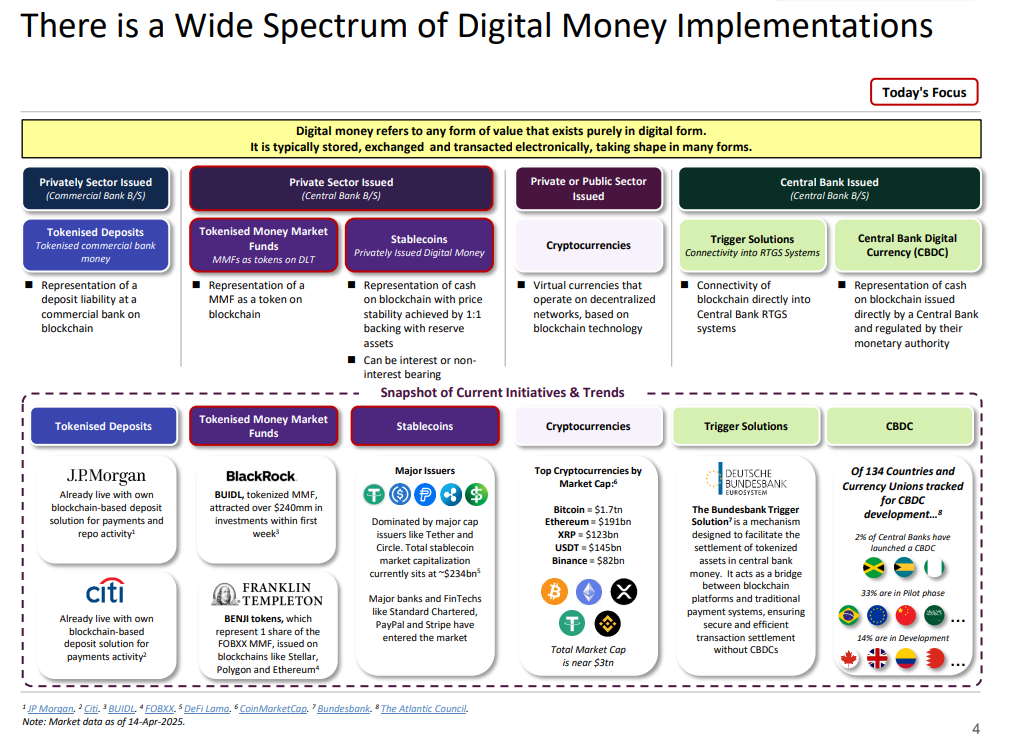

The current diversified implementation of digital currency: a panoramic view from private to central banks

This picture provides us with a panoramic view of digital currency, showing its diverse implementation paths and its practical applications in various fields.

1. Classification of digital currencies

Private sector issuance (commercial bank balance sheets)

Tokenised Deposits: Blockchain representation of commercial bank deposit liabilities.

Tokenised Money Market Funds: Tokenised money market funds based on blockchain.

Private sector issuance (central bank balance sheet)

Stablecoin: A blockchain cash representation backed 1:1 by reserve assets, which can be interest-bearing or non-interest-bearing.

Private or public sector issuance

Cryptocurrency: A virtual currency based on a decentralized network.

Central bank issuance

Trigger Solutions: Connecting blockchain to the central bank’s real-time gross settlement system (RTGS).

CBDC (Central Bank Digital Currency): A blockchain cash representation directly issued and supervised by the central bank.

2. Current market trends

Tokenized deposits

JP Morgan and Citi have already launched blockchain-based solutions for payments and repo activities.

Tokenized Money Market Funds

BUIDL launched by BlackRock attracted more than $240 million in investment.

Franklin Templeton launches BENJI token, supporting Stellar, Polygon and Ethereum blockchains.

Stablecoins

The market is dominated by major issuers such as Tether and Circle, with a total market capitalization of approximately $234 billion.

Cryptocurrency

The total market capitalization is close to $3 trillion, with mainstream currencies including Bitcoin ($1.7 trillion) and Ethereum ($191 billion).

Trigger Solution

The mechanism introduced by the German central bank facilitates the settlement of blockchain assets with traditional payment systems.

CBDC

Of the 134 countries and monetary unions tracked, 25% have launched, 33% are in the pilot phase, and 48% are still under development.

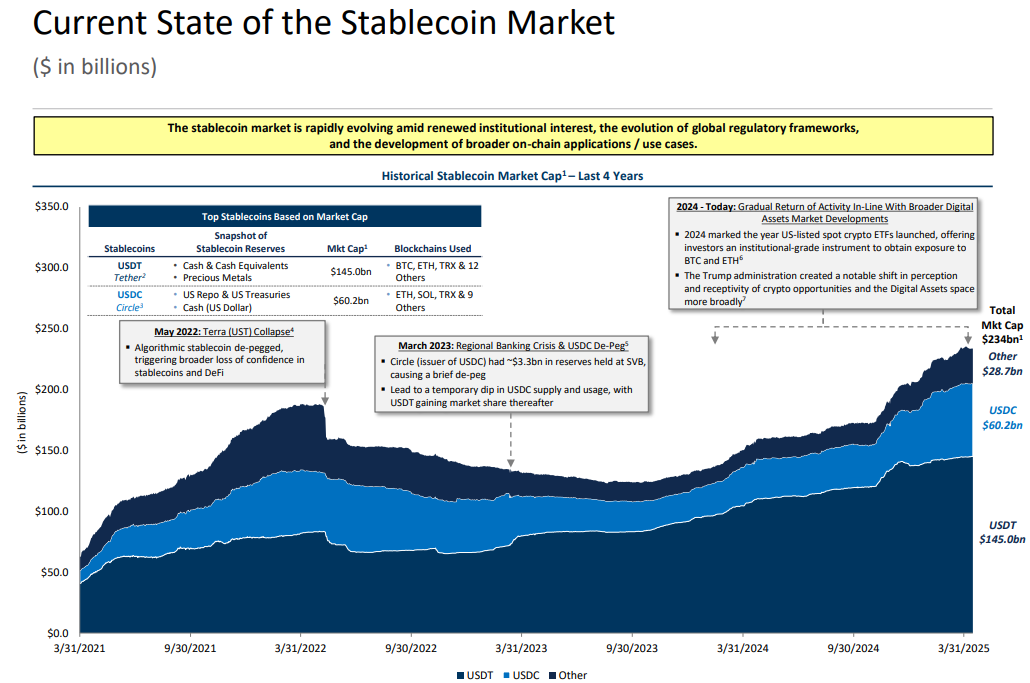

The current state of the stablecoin market: market capitalization and key events at a glance

The stablecoin market has experienced significant fluctuations and developments in recent years. As of April 14, 2025, the total market value of the entire market has reached $234 billion, of which USDT (Tether) dominates with a scale of $145 billion, followed by USDC (Circle) with $60.2 billion, and the total market value of other stablecoins is $28.7 billion.

Looking back over the past four years, two major events in the stablecoin market have become watersheds in the development of the industry.

In May 2022, the collapse of the algorithmic stablecoin UST triggered a crisis of trust in the entire DeFi field. The decoupling of UST not only made the market question the feasibility of algorithmic stablecoins, but also affected the market confidence of other stablecoins.

Then, the regional banking crisis in March 2023 plunged the market into turmoil again. At that time, USDC issuer Circle had about $3.3 billion in reserves frozen at Silicon Valley Bank (SVB), causing USDC to temporarily de-anchor. This incident caused the market to re-evaluate the transparency and security of stablecoin reserves, and USDT further consolidated its market share during this period.

Despite multiple crises, the stablecoin market gradually recovered in 2024 and kept pace with the development of the broader digital asset market. In 2024, the first spot crypto ETFs were launched in the United States, providing institutional investors with tools to gain exposure to BTC and ETH.

Currently, the growth of the stablecoin market is mainly due to three aspects: increased institutional investment interest, the gradual improvement of the global regulatory framework, and the continuous expansion of on-chain application scenarios.

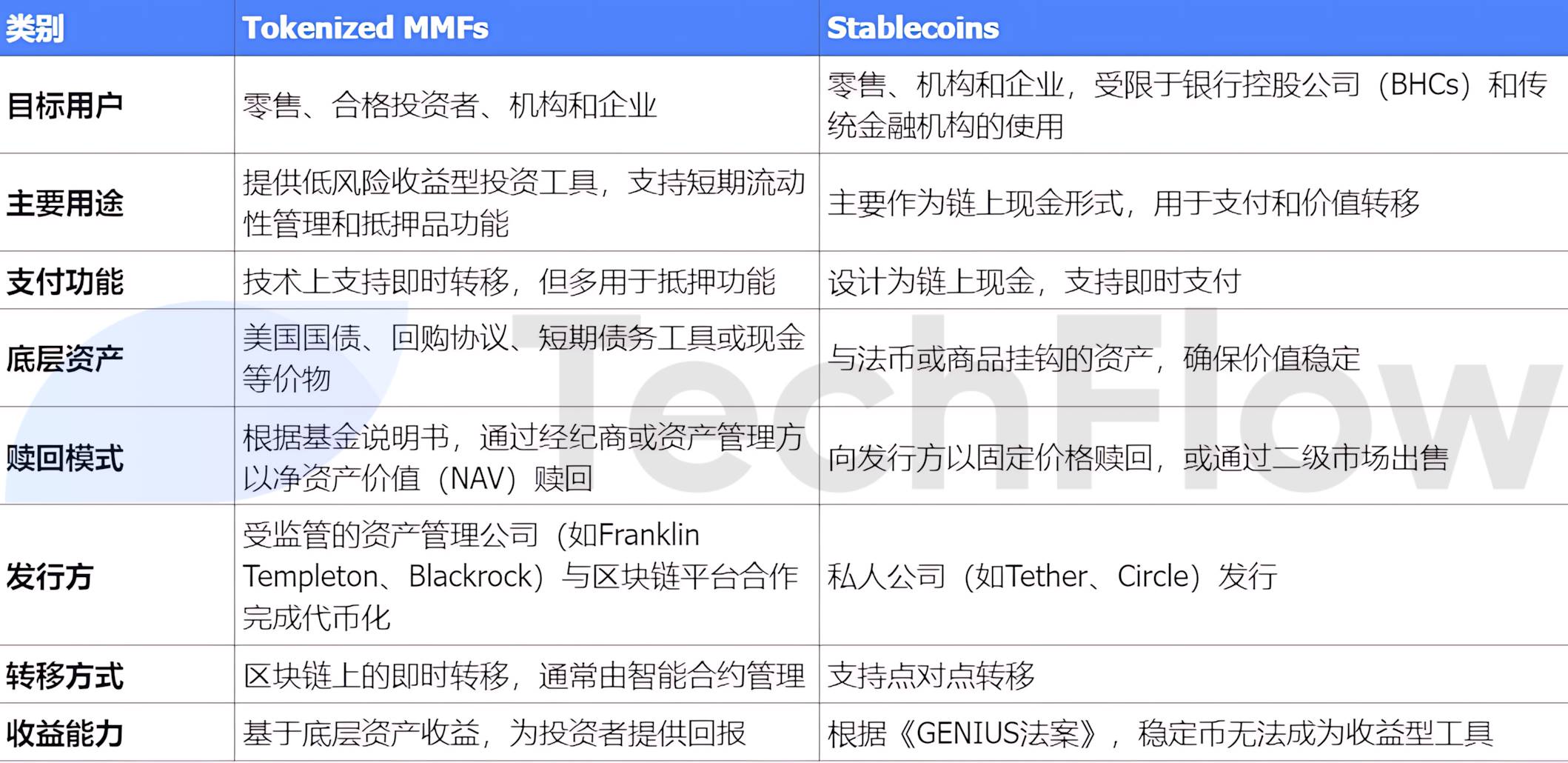

Cryptocurrency Market Funds and Stablecoins: A Comparison of Two On-Chain Assets

With the rapid growth of Tokenized Money Market Funds (MMFs), a narrative of alternative stablecoins has gradually taken shape. Although there are similarities in the use cases of the two, a significant difference is that stablecoins cannot become income-generating tools under the current GENIUS Act, while MMFs can generate returns for investors through underlying assets.

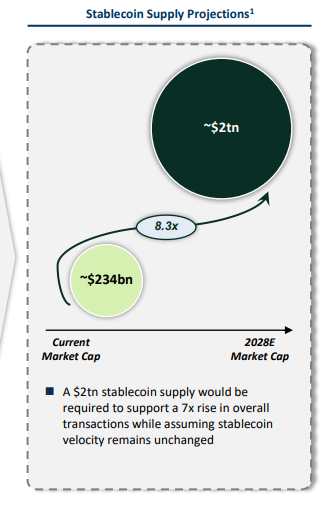

Market potential: from 230 billion to 2 trillion US dollars

The report believes that the market value of stablecoins is expected to reach approximately US$2 trillion in 2028. This growth trajectory not only relies on the natural expansion of market demand, but is also driven by a variety of key drivers, which can be summarized into three categories: adoption, economy, and regulation.

Adoption: The participation of financial institutions, the on-chain migration of wholesale market transactions, and merchant support for stablecoin payments are gradually driving it to become a mainstream payment and transaction tool.

Economy: The value storage function of stablecoins is being redefined, especially the rise of interest-bearing stablecoins, which provide holders with the possibility of generating income.

Regulation: If stablecoins can be included in the capital and liquidity management framework and obtain permission from banks to provide services on the public chain, their legitimacy and credibility will be further enhanced.

(Note: The Stablecoin Act had not been passed when the report was issued, and it has entered the voting process at this time)

The stablecoin market is expected to grow from the current $234 billion to $2 trillion by 2028. This growth requires a significant increase in transaction volume and assumes that the circulation velocity of stablecoins remains constant.

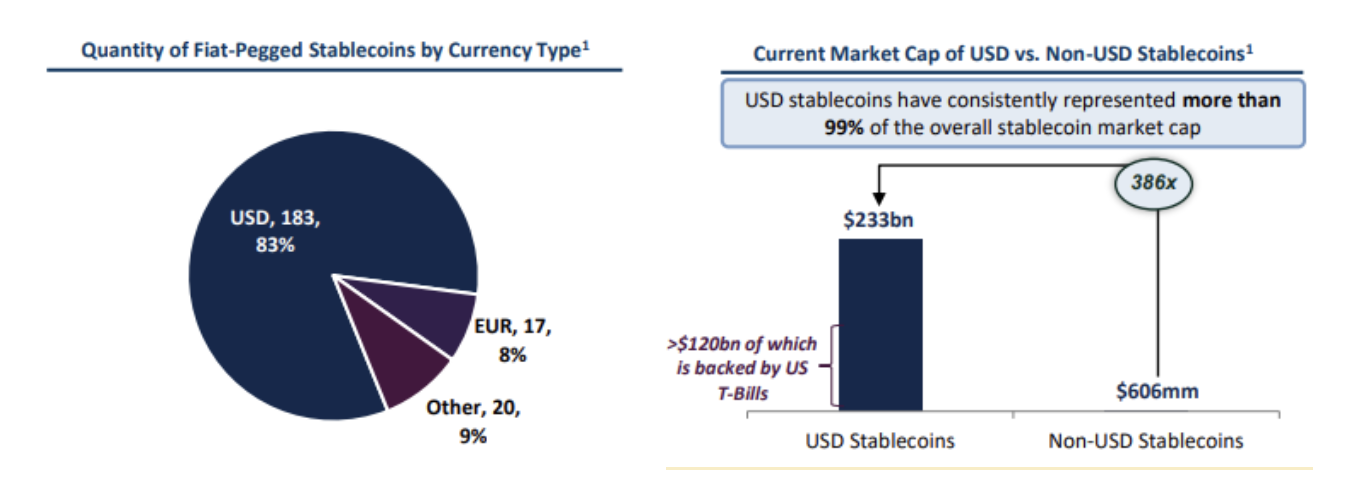

Market dominance of USD stablecoins

USD stablecoins account for 83% of the total fiat-pegged stablecoins, far higher than other currencies (EUR accounts for 8% and others account for 9%).

USD stablecoins account for more than 99% of the total stablecoin market value, with a market value of $233 billion, of which about $120 billion is backed by U.S. Treasury bonds. Non-USD stablecoins have a market value of only $606 million.

The market size of USD stablecoins is 386 times that of non-USD stablecoins, indicating its absolute dominance in the global stablecoin market.

Potential impact of stablecoin growth on bank deposits

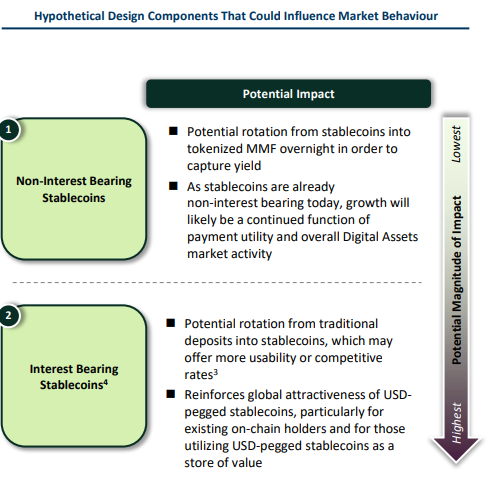

The growth of stablecoins could have a significant impact on bank deposits, particularly as whether they are designed to pay interest will be a key factor.

As of the fourth quarter of 2024, the total deposit size in the United States reached 17.8 trillion US dollars, of which non-transaction deposits (including savings accounts and time deposits) accounted for the majority, at 8.3 trillion US dollars and 2.9 trillion US dollars respectively. Transaction deposits include demand deposits (5.7 trillion US dollars) and other non-demand transaction deposits (0.9 trillion US dollars).

Among these deposits, transaction deposits are considered the most "vulnerable", that is, more vulnerable to the impact of stablecoins. The reason is that such deposits usually do not pay interest, are mainly used for daily activities, and are easy to transfer. During periods of market uncertainty, uninsured deposits are often transferred by holders to instruments with higher returns or lower risks, such as money market funds (MMFs).

If stablecoins do not pay interest, their growth will mainly rely on payment functions and the overall activity of the digital asset market, so the impact on bank deposits will be limited. However, if stablecoins start to pay interest, especially if they offer higher yields or ease of use, traditional deposits may be transferred to such stablecoins on a large scale. In this case, USD-pegged interest-bearing stablecoins will not only attract on-chain users, but also become an important tool for value storage, further strengthening their global appeal.

In summary, the interest-bearing properties of stablecoins will directly affect their potential impact on bank deposits:

The impact of non-interest-bearing stablecoins is relatively small, while interest-bearing stablecoins may significantly change the deposit landscape.

The potential impact of stablecoin growth on U.S. national debt

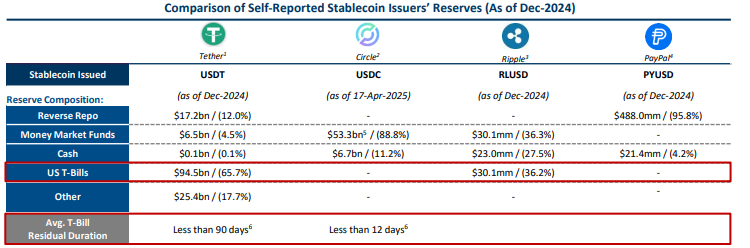

According to public reserve data, major stablecoin issuers currently hold more than $120 billion in short-term Treasury bonds (T-Bills), of which Tether (USDT) accounts for the largest proportion, with about 65.7% of its reserves allocated in T-Bills. This trend shows that stablecoin issuers have become important participants in the short-term Treasury bond market.

It is expected that in the future, the demand for T-Bills by stablecoin issuers will be closely related to the expansion of overall market instruments.

This demand could push up demand for short-term Treasury bills by an additional $900 billion over the next few years.

There is a trade-off between the growth of stablecoins and bank deposits. Large amounts of funds may flow from bank deposits to stablecoin-backed assets, especially during market volatility or a crisis of confidence (such as a stablecoin depegging), and this transfer may be further amplified.

The U.S. GENIUS Act’s requirements for short-term Treasury bonds may further drive stablecoin issuers’ allocation to T-Bills.

In terms of market size, the size of T-Bills held by stablecoin issuers in 2024 is about $120 billion, and by 2028, this figure may grow to $1 trillion, an increase of 8.3 times. In contrast, the current market size of tokenized government securities is only $2.9 billion, showing huge growth potential.

In summary, the demand for T-Bills by stablecoin issuers is reshaping the ecology of the short-term Treasury market, but this growth may also intensify competition between bank deposits and market liquidity.

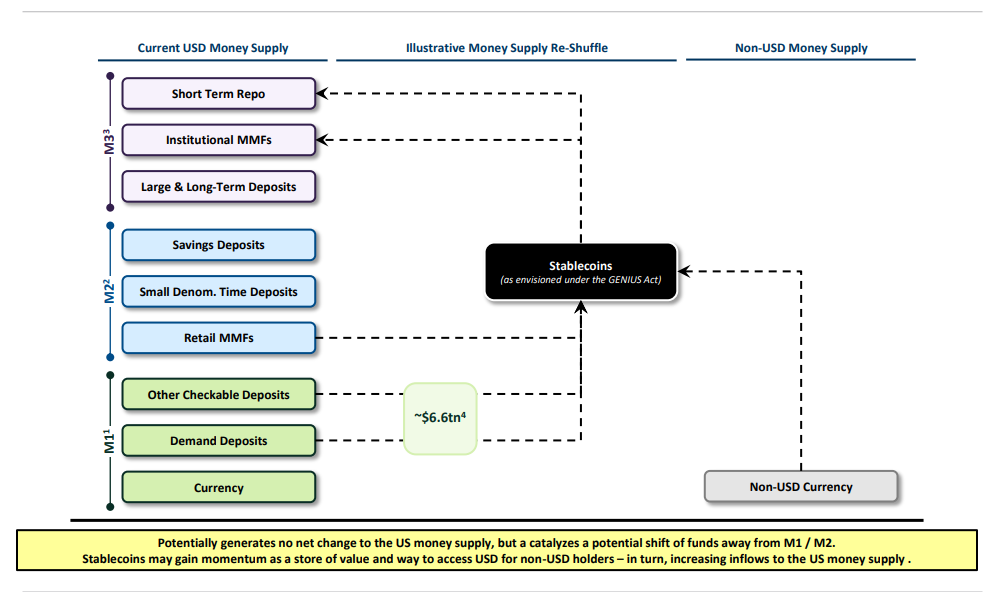

Potential Impact of Stablecoin Growth on U.S. Money Supply Growth

The impact of the growth of stablecoins on the U.S. money supply (M1, M2, and M3) is primarily reflected in potential shifts in fund flows rather than direct changes in total volume.

Current money supply structure:

M 1 includes currency in circulation, demand deposits, and other checkable deposits, totaling about $6.6 trillion.

M2 includes savings deposits, small time deposits and retail money market funds (MMFs).

M3 includes short-term repurchase agreements, agency MMFs, and large long-term deposits.

The role of stablecoins:

Stablecoins are seen as a new means of storing value, especially in the context of the GENIUS Act.

Stablecoins may attract some funds to flow out of M1 and M2 and flow to stablecoin holders, especially non-US dollar holders.

Potential impact

Transfer of Funds:

The growth of stablecoins may not directly change the total amount of U.S. money supply, but it will cause funds to be transferred from M1 and M2. This transfer may affect bank liquidity and the attractiveness of traditional deposits.

International impact:

Stablecoins, as a way to obtain U.S. dollars, could increase demand for dollars among non-dollar holders, thereby increasing inflows into the U.S. money supply. This trend could boost the use and acceptance of stablecoins around the world.

Although the growth of stablecoins will not immediately change the total money supply in the United States, their potential as a store of value and a way to obtain money may have a profound impact on the flow of funds and international demand for the US dollar. This phenomenon needs to be paid attention to in policy making and financial supervision to ensure the stability of the financial system.

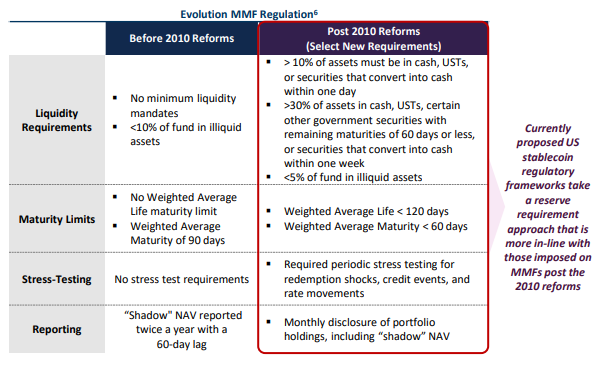

Possible directions for future stablecoin regulation

The current stablecoin regulatory framework proposed by the United States is similar to the reform requirements of MMF after 2010, with the following highlights:

Reserve requirements: Ensure high liquidity and security of stablecoin reserves.

Market Access: Explore whether stablecoin issuers can gain access to Federal Reserve (FED) backing, deposit insurance, or 24/7 repo markets.

These measures are intended to reduce the risk of stablecoin depegging and enhance market stability.

Summarize

Market size potential

The stablecoin market is expected to grow to approximately $2 trillion by 2030 with continued market and regulatory breakthroughs.

Dominance of the US dollar peg

The stablecoin market is primarily comprised of USD-pegged stablecoins, which has focused recent attention on the potential U.S. regulatory framework and its legislation’s accelerating impact on stablecoin growth.

Impact and opportunities on traditional banks

Stablecoins may have an impact on traditional banks by attracting deposits, but they also create opportunities for banks and financial institutions to develop innovative services and benefit from the use of blockchain technology.

The far-reaching impact of stablecoin design and adoption

The ultimate design and adoption of stablecoins will determine the extent of their impact on the traditional banking system and their potential boost to demand for U.S. Treasuries.