According to incomplete statistics from Odaily, a total of 40 domestic and overseas blockchain financing events were announced from March 11 to March 17, an increase from last weeks data (35 cases). The total amount of financing disclosed was approximately US$266 million, an increase from last weeks figure (US$260 million).

Last week, the project that received the largest amount of investment was financial service provider Figure Markets (USD 60 million); zero-knowledge proof infrastructure company Succinct also followed closely (USD 55 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

On March 18, US financial technology company Figure Technologies announced today that it will establish an independent company called Figure Markets, which is the first step in developing a single platform for investors that can allow investors to trade various A variety of blockchain-native assets, including cryptocurrencies, stocks and alternative investments. Figure Markets completed a Series A financing of over US$60 million led by Jump Crypto, Pantera Capital and Lightspeed Faction, with other investors including Distributed Global, Ribbit Capital and CMT Digital.

On March 22, according to official news, zero-knowledge proof infrastructure company Succinct completed a total of US$55 million in financing (including seed round and Series A), with Paradigm leading the investment. Robot Ventures, Bankless Ventures, Geometry, ZK Validator and multiple angel investors participated in the investment.

Web3 privacy infrastructure Espresso completes $28 million in Series B financing, led by a16z crypto

On March 22, Web3 privacy infrastructure Espresso announced the completion of a $28 million Series B financing, led by a16z crypto. The new funding will be used to continue product development, expand investment in the rollup ecosystem, and expand the size of the Espresso Systems team. This latest funding will be used to continue product development, increase investment in the rollup ecosystem, and expand the size of the Espresso Systems team. .

Morph completes US$20 million in seed and angel round financing, led by Dragonfly Capital

On March 21, Ethereum L2 Morph announced the completion of a $19 million seed round of financing, led by Dragonfly Capital, with participation from Pantera Capital, Foresight Ventures, The Spartan Group, MEXC Ventures, Symbolic Capital, Public Works, MH Ventures and Everyrealm. In addition, Morph also received US$1 million in angel round financing. Investors include founders from projects such as Polygon, Manta, Galxe, Sei, Nansen, Story Protocol, and KOLs such as Icebergy, MoonOverlord, NaniXBT, and Dingaling. Morph plans to use this round of financing to accelerate team building, increase developer incentives, expand marketing, etc.

On March 21, Mystiko.Network announced the completion of a US$18 million seed round of financing, led by Sequoia Capital India/SEA (now known as Peak XV Partners), Samsung Next, HashKey, Mirana, Signum, Coinlist, Naval Ravikant, Sandeep Nailwal, Gokul Rajaram, Tribe Capital, Morningstar Ventures and others participated in the investment. Mystiko.Network is a Web3 base layer built on the Mystiko SDK, a universal ZK SDK that simultaneously provides scalability, interoperability, privacy, and artificial intelligence for every blockchain/dApp.

On March 19, Singapore-based crypto trading platform Tokenize Xchange announced the completion of US$11.5 million in financing, with participation from Trive and others. This brings its Series A funding round to $23 million. The platform plans to raise $33 million by the end of 2024.

MANTRA completes new round of financing of US$11 million, led by Shorooq Partners

On March 19, according to official news, L1 blockchain MANTRA announced the completion of a new round of financing of US$11 million, led by Shorooq Partners, Three Point Capital, Forte Securities, Caladan, Virtuzone, Hex Trust, Token Bay Capital, GameFi Ventures, Mapleblock, Fuse Capital, 280 Capital, etc. participated in the investment, and the new funds are intended to be used to build compliant infrastructure, provide support for developers, and expand RWA tokenization.

On March 18, blockchain payment company Zone announced the completion of a US$8.5 million seed round of financing, led by Flourish Ventures and TLcom Capital, with participation from Digital Currency Group (DCG), VKAV (Verod-Kepple Africa Ventures) and Alter Global.

Crypto exchange Rails completes $6.2 million in seed round led by Slow Ventures

On March 22, self-hosted cryptocurrency exchange Rails announced the completion of a $6.2 million seed round of financing, led by Slow Ventures, with participation from CMCC Global, Round 13 Capital and Quantstamp.

On March 19, London-based encryption compliance platform Keyring announced on Tuesday the completion of a $6 million seed round of financing, led by Gumi Cryptos Capital and Greenfield Capital, with participation from Motier Ventures, Kima Ventures and others. The new financing will be used to expand its on-chain compliance platform.

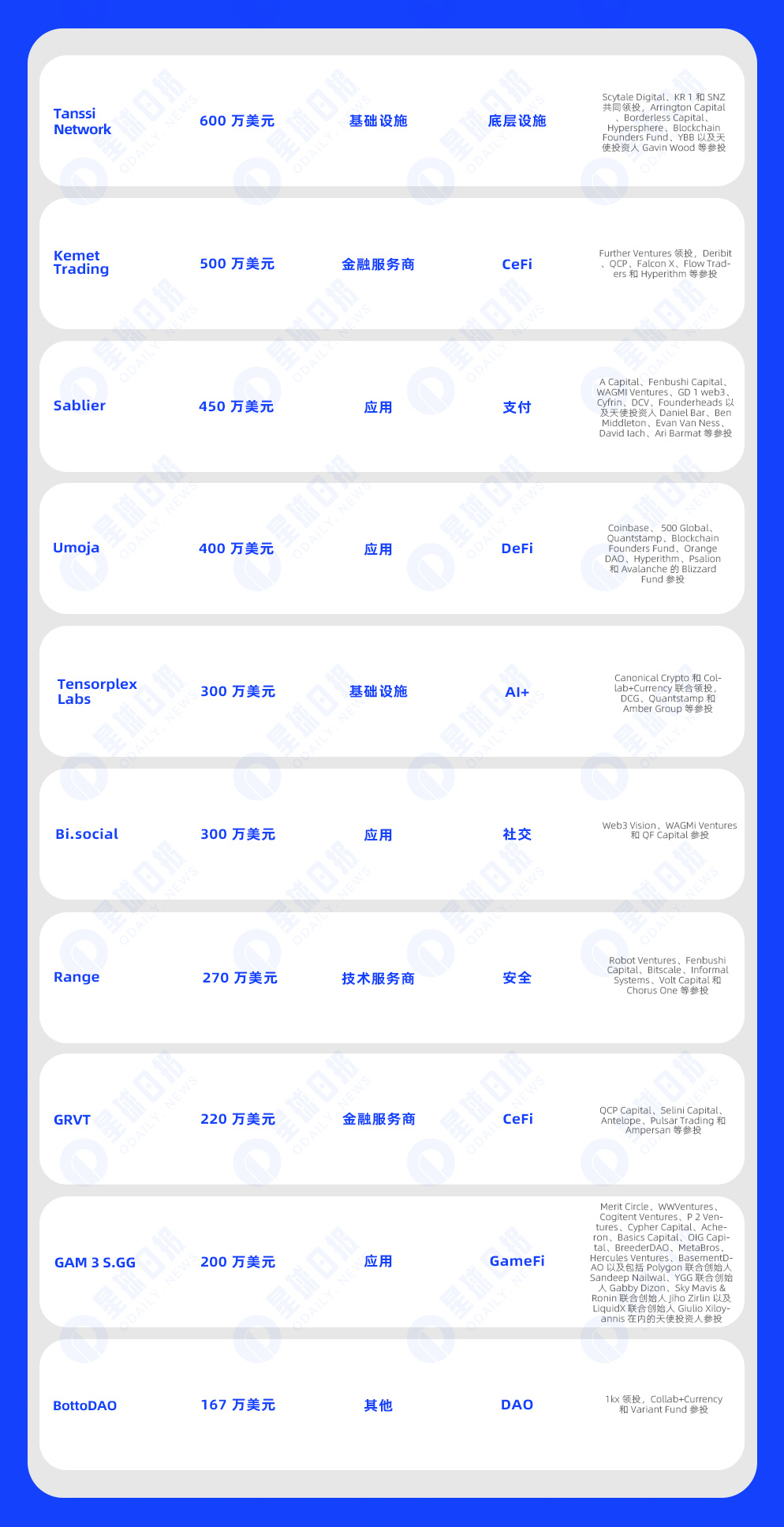

Moondance Labs closes $6 million in strategic financing led by Scytale Digital, KR 1 and SNZ

On March 21, according to official news, application chain infrastructure protocol Tanssi Network development company Moondance Labs announced the completion of strategic financing of US$6 million, co-led by Scytale Digital, KR 1 and SNZ, Arrington Capital, Borderless Capital, Hypersphere, Blockchain Founders Fund , YBB and angel investor Gavin Wood participated in the investment.

On March 22, digital asset derivatives trading platform Kemet Trading announced the completion of US$5 million in financing, led by Further Ventures, with participation from Deribit, QCP, Falcon X, Flow Traders and Hyperithm.

On March 23, according to official news, the real-time payment protocol Sablier announced the completion of a US$4.5 million seed round of financing from A Capital, Fenbushi Capital, WAGMI Ventures, GD 1 web3, Cyfrin, DCV, Founderheads and angel investors Daniel Bar, Ben Middleton, Evan Van Ness, David Iach, Ari Barmat and others participated in the investment.

On March 19, asset hedging protocol Umoja announced that it had raised $2 million in its second seed round of financing, with participation from Coinbase, 500 Global, Quantstamp, Blockchain Founders Fund, Orange DAO, Hyperithm, Psalion and Avalanche’s Blizzard Fund. As of The total amount of seed round financing it has completed so far reaches US$4 million.

Web3 AI startup Tensorplex Labs completes $3 million in seed round financing

On March 21, Web3 AI startup Tensorplex Labs announced the completion of a US$3 million seed round of financing. Canonical Crypto and Collab+Currency jointly led the investment, with participation from DCG, Quantstamp and Amber Group. The company will use the funds to develop decentralized ized artificial intelligence infrastructure.

On March 21, decentralized social trading protocol Bi.social completed US$3 million in financing, with participation from Web3 Vision, WAGMi Ventures and QF Capital. The funding will be used to support the continued development of the social protocol and its upcoming features.

On March 23, Cosmos ecological security platform Range announced the completion of a US$2.7 million seed round of financing, with participation from Robot Ventures, Fenbushi Capital, Bitscale, Informal Systems, Volt Capital and Chorus One.

On March 19, hybrid cryptocurrency exchange GRVT announced the completion of a strategic round of financing of US$2.2 million, with participation from QCP Capital, Selini Capital, Antelope, Pulsar Trading and Ampersan. Its total financing amount so far has reached US$9.3 million. GRVT said that upon completion of this funding round, it will launch a central limit order book for perpetual contracts and options trading, as well as request for quote (RFQ) and spot trading later this year.

On March 23, according to official news, Web3 game information platform GAM 3 S.GG announced the completion of a US$2 million strategic round of financing from Merit Circle, WWVentures, Cogient Ventures, P 2 Ventures, Cypher Capital, Acheron, Basics Capital, OIG Capital, BreederDAO, MetaBros, Hercules Ventures, BasementDAO and angel investors including Polygon co-founder Sandeep Nailwal, YGG co-founder Gabby Dizon, Sky Mavis Ronin co-founder Jiho Zirlin and LiquidX co-founder Giulio Xiloyannis participated.

Digital art NFT decentralized autonomous organization BottoDAO raised US$1.67 million, led by 1kx

On March 24, according to official news, BottoDAO, a decentralized autonomous organization focusing on digital art NFTs, announced the completion of US$1.67 million in financing through treasury OTC transactions, with 1kx leading the investment, Collab+Currency and Variant Fund participating.

On March 19, OrangeDX, a DeFi development company on the Bitcoin chain, announced the completion of US$1.5 million in financing, with participation from GBV Capital, Odiyana Ventures, Triple Gem Capital, Nxgen, X 21, Spicy Capital, Alphabit Fund, FundLand Capital and others.

On March 20, Atticc Labs and its product EarlyFans completed a US$1.5 million seed round of financing from Alliance DAO, SNZ Holding, GSR, Zee Prime Capital, GBV Capital, ProDigital Future Fund, Alchemy Ventures, CyberConnect, Mask Network founder Suji Yan, CyberConnect co-founder Ryan Li and Waterdrop Capital partner Jademont also participated in the investment. Other angel investors include 0x minion, angel, icebergy, naniXBT, toptickcrypto, Zeneca, etc. The funds raised will be used for the launch and promotion of the product EarlyFans.

SAVAGE completes US$1.5 million in seed round financing, led by Faculty Group

On March 22, SAVAGE, a streaming media application based on Polygon, completed a US$1.5 million seed round of financing, led by Faculty Group, with participation from Polygon Ventures, Morningstar Ventures, and Ash Crypto.

On March 21, according to official news, Web3 application user participation incentive protocol Metaverse Headquarters (MVHQ) announced the completion of a US$1.1 million seed round of financing, led by Consensys and Polygon. Through this financing, MVHQ will further simplify and incentivize the development of Web3 applications. User engagement will drive collaboration with Blast, Magic Eden, Flow and Berachain, among others, and protocols and incentives will be introduced through tasks.

On March 19, Blast ecological DeFi project Juice completed US$1 million in new financing, bringing the total financing amount to US$7 million. Arthur Hayes, Delphi Digital, DWF Ventures, Spencer and others participated in the investment.

It is reported that Juice is built by the full chain and Bitcoin DeFi infrastructure OMEGA team based on Blast. Its TVL reaches US$115 million.

On March 20, Berachain ecological transaction aggregation platform Ooga Booga completed US$1 million in financing at a valuation of US$10 million. The investor information and specific financing details have not been disclosed. Currently, Ooga Booga has not yet been launched on the Berachain mainnet.

On March 20, Arbitrum money market and decentralized trading protocol Dolomite announced the completion of strategic financing of US$900,000, with participation from Polygon co-founder Sandeep Nailwal, Polygon Labs CEO Marc Boiron, DCF GOD, DeFi Dad and others.

On March 19, Web3 digital content verification platform Bitbrand announced the completion of US$500,000 in financing. Hustle Fund, Side Door Ventures, GFR Fund, etc. participated in the investment. It is reported that this is the first external financing for the project. Bitbrand mainly uses Web3 technology to verify digital content. Providing practicality to fashion, art and luxury consumers.

On March 19, according to official news, the cross-chain DeFi protocol Entangle announced the completion of a strategic round of financing, with Consensys participating. The specific amount has not yet been disclosed.

Web3 game launch platform HyperPlay receives strategic investment from Square Enix

On March 19, Final Fantasy developer Square Enix announced on Tuesday its investment in Web3 game launch platform HyperPlay and will launch its original Ethereum NFT game Symbiogenesis on the platform. HyperPlay declined to disclose the specific investment amount as part of the platforms strategic financing.

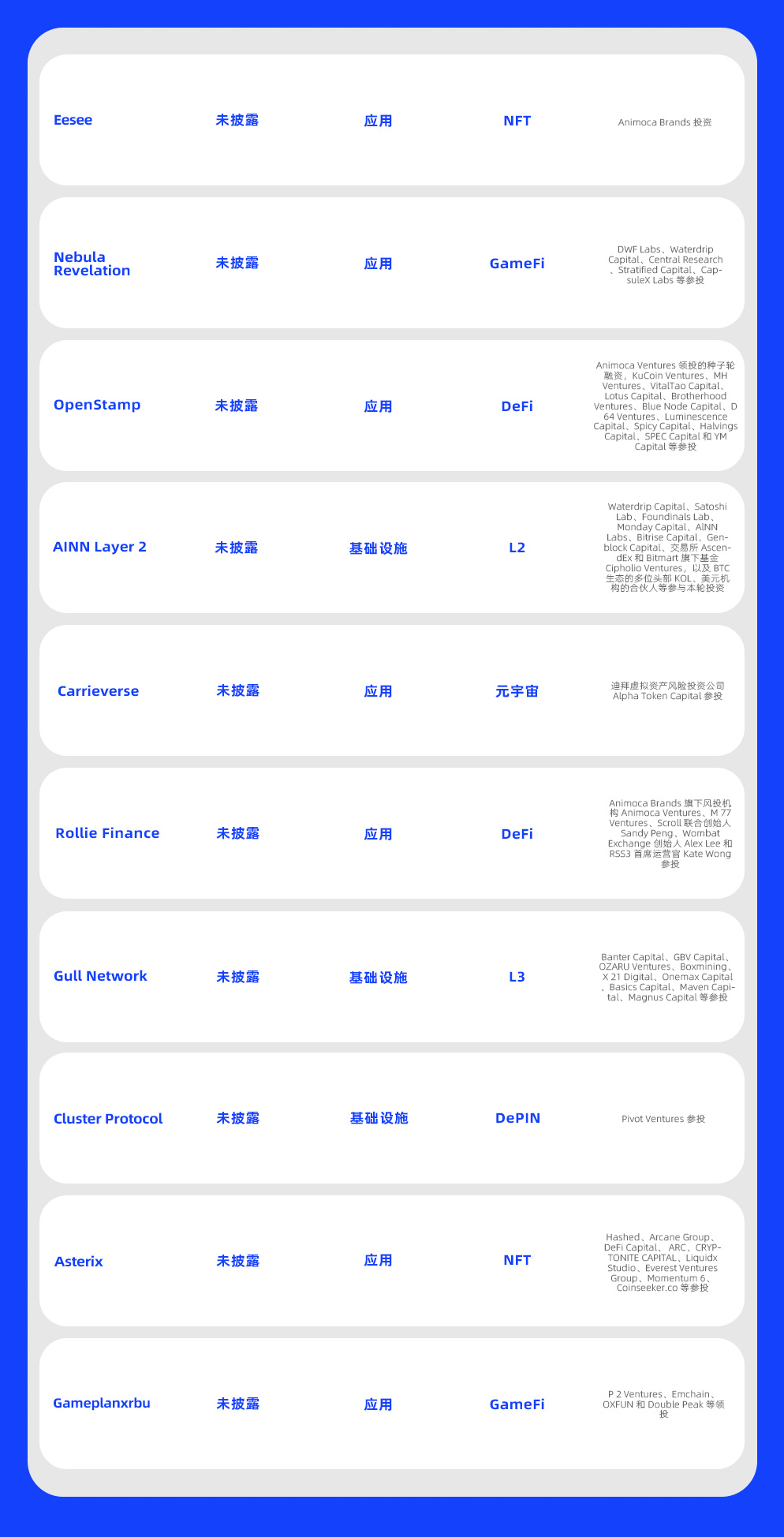

NFT liquidity solution Eesee receives investment from and cooperates with Animoca Brands

On March 20, according to official news, Eesee, the UAE’s NFT liquidity solution and seller gamification marketplace, announced that it had received investment from Animoca Brands and reached a cooperation with it. As part of the partnership, Animoca Brands will provide Eesee with its industry expertise and connections to support Eesees goal of improving the efficiency and experience of digital asset trading in a Web3 environment.

Nebula Revelation completes a new round of financing, with participation from DWF Labs and others

On March 21, Web3 space-themed game Nebula Revelation announced the completion of a new round of financing, with participation from DWF Labs, Waterdrip Capital, Central Research, Stratified Capital, CapsuleX Labs and others.

OpenStamp trading platform receives seed funding led by Animoca Ventures

On March 21, OpenStamp, a comprehensive service platform based on the STAMP protocol, received seed round financing led by Animoca Ventures, KuCoin Ventures, MH Ventures, VitalTao Capital, Lotus Capital, Brotherhood Ventures, Blue Node Capital, D 64 Ventures, Luminescence Capital, Spicy Capital, Halvings Capital, SPEC Capital and YM Capital participated in the investment. OpenStamp offers a variety of products including Mint/Deploy services, SRC-20/SRC-721 marketplace, Indexer, Explorer and Launchpad.

On March 22, according to official news, the BTC second-layer network public chain project AINN Layer 2 announced that it has received strategic investment from a number of well-known institutions in the BTC ecosystem. Waterdrip Capital, Satoshi Lab, Foundinals Lab, Monday Capital, AlNN Labs, Bitrise Capital, Genblock Capital, the exchange AscendEx and Bitmarts fund Cipholio Ventures, as well as many leading KOLs in the BTC ecosystem and partners from US dollar institutions participated in this round invest.

South Korea’s metaverse platform Carrieverse completes strategic round of financing

On March 22, South Korea’s Metaverse platform Carrieverse announced the completion of a strategic round of financing, with Dubai-based virtual asset venture capital firm Alpha Token Capital participating in the investment. The specific financing has not yet been disclosed.

Rollie Finance completed seed round financing, with participation from Animoca Ventures and others

On March 22, Rollie Finance, a one-click artificial intelligence cryptocurrency perpetual trading DEX platform, announced the completion of a seed round of financing. Animoca Brands’ venture capital institutions Animoca Ventures, M 77 Ventures, Scroll co-founder Sandy Peng, and Wombat Exchange founder Alex Lee and RSS3 COO Kate Wong participated in the investment, and the specific amount has not yet been disclosed.

Gull Network completed strategic round of financing and received funding from Manta Network

On March 23, Gull Network, the Manta ecological L3 network, announced the completion of a strategic round of financing, with participation from Banter Capital, GBV Capital, OZARU Ventures, Boxmining, X 21 Digital, Onemax Capital, Basics Capital, Maven Capital, Magnus Capital, etc. Details The amount has not yet been disclosed.

On March 24, according to official news, the DePIN calculation proof protocol Cluster Protocol recently announced the completion of its seed round and strategic financing. Pivot Ventures participated in the investment, and the specific amount has not yet been disclosed. In addition, Cluster Protocol will also join Pivot’s incubation acceleration program.

On March 24, Asterix, a project based on the DN 404 NFT protocol, recently announced the completion of a strategic round of financing, with participation from Hashed, Arcane Group, DeFi Capital, ARC, CRYPTONITE CAPITAL, Liquidx Studio, Everest Ventures Group, Momentum 6, Coinseeker.co, etc. The specific amount has not yet been disclosed.

Gameplan completes seed round financing, led by P2 Ventures and others

On March 24, Gameplanxrbu completed a seed round of financing, led by P2 Ventures, Emchain, OXFUN and Double Peak. The amount of financing was not disclosed.