SignalPlus宏观分析特别版:势不可挡

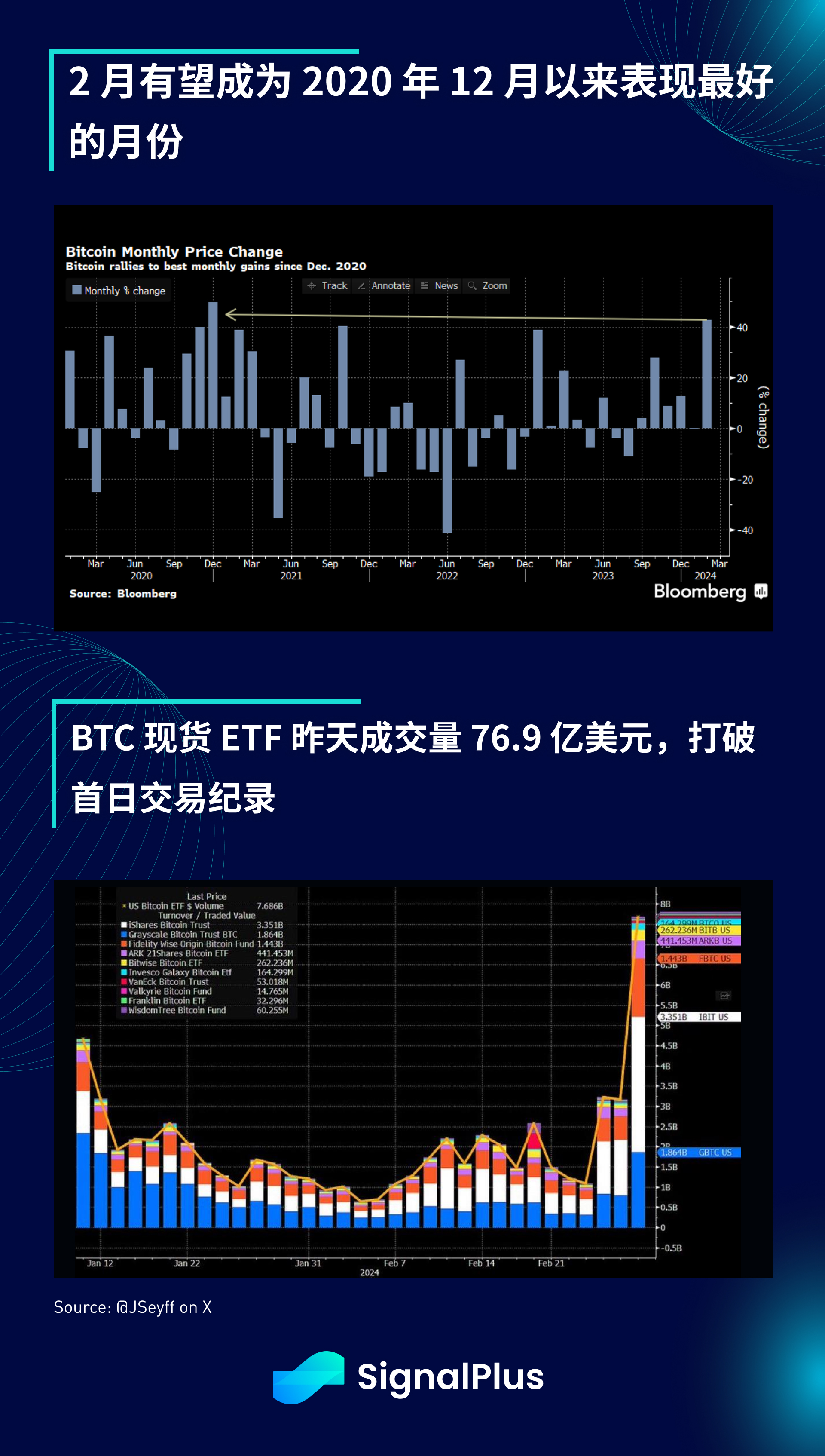

As people start to worry that the current risk rebound may turn into a bubble, Bitcoin has risen sharply from around $57,000 to around $64,000 within 24 hours, making February expected to be the best month for BTC since December 2020 with a gain of over 40%. With the spread of FOMO frenzy, the trading volume of spot ETFs has also surged to $7.69 billion, far exceeding the record of $4.66 billion on the first trading day.

Retail trading activity in the United States is so active that the Coinbase website experienced an outage, showing customer balances as 0, and causing the price to suddenly drop 5%+ from around $64,000 to about $59,000 within a few minutes. Coinbase CEO Brian Armstrong admitted the platform outage on Twitter and reiterated that investor balances are safe, but they were not prepared for a sudden traffic increase of more than 10 times, resulting in a widespread trading disruption.

The parabolic trend of Bitcoin has prompted some macro observers to comment on the current loose financial situation and question the reasoning behind the Federal Reserve's current inclination for looseness. It is worth noting that many other asset classes have also experienced similar historic highs, so the current "wealth effect" is not limited to cryptocurrencies.

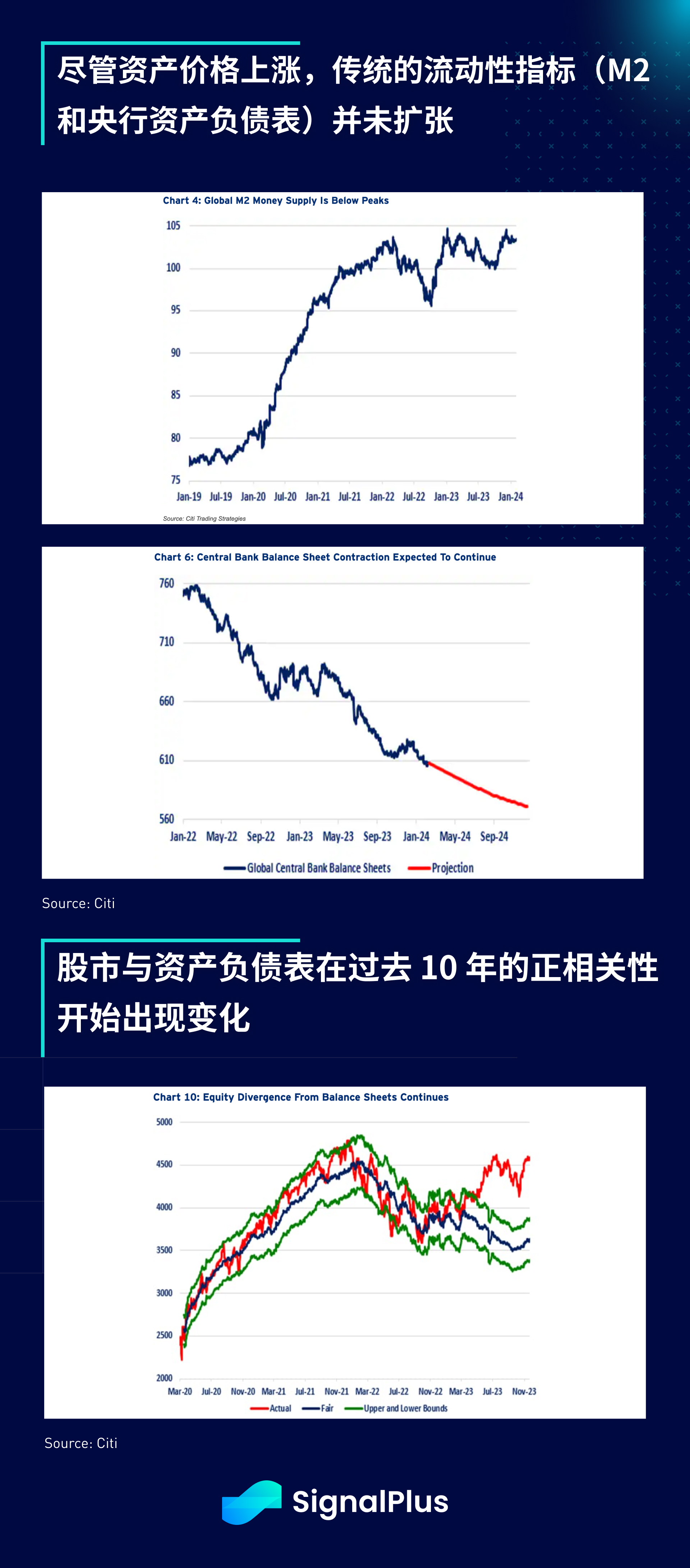

In the midst of market risk appetite, Citigroup poses an interesting question: Where does the "money" come from? Traditional M2 liquidity indicators remain at 2023 levels, while global quantitative tightening (QT) continues unabated. The central bank's balance sheet is projected to shrink from a peak of $760 billion to about $560 billion by the end of the year. Therefore, unlike the era of zero interest rates/quantitative easing in the past decade, the current rise in asset prices is not driven by loose monetary policies of central banks.

Moreover, it is surprising that despite the high market risk sentiment, the amount of cash held in money market accounts has reached a record high of over $6 trillion, and the monthly asset management scale continues to rise. If everything is rising, including stocks, credit, cryptocurrency, and even cash, where is the new money coming from?

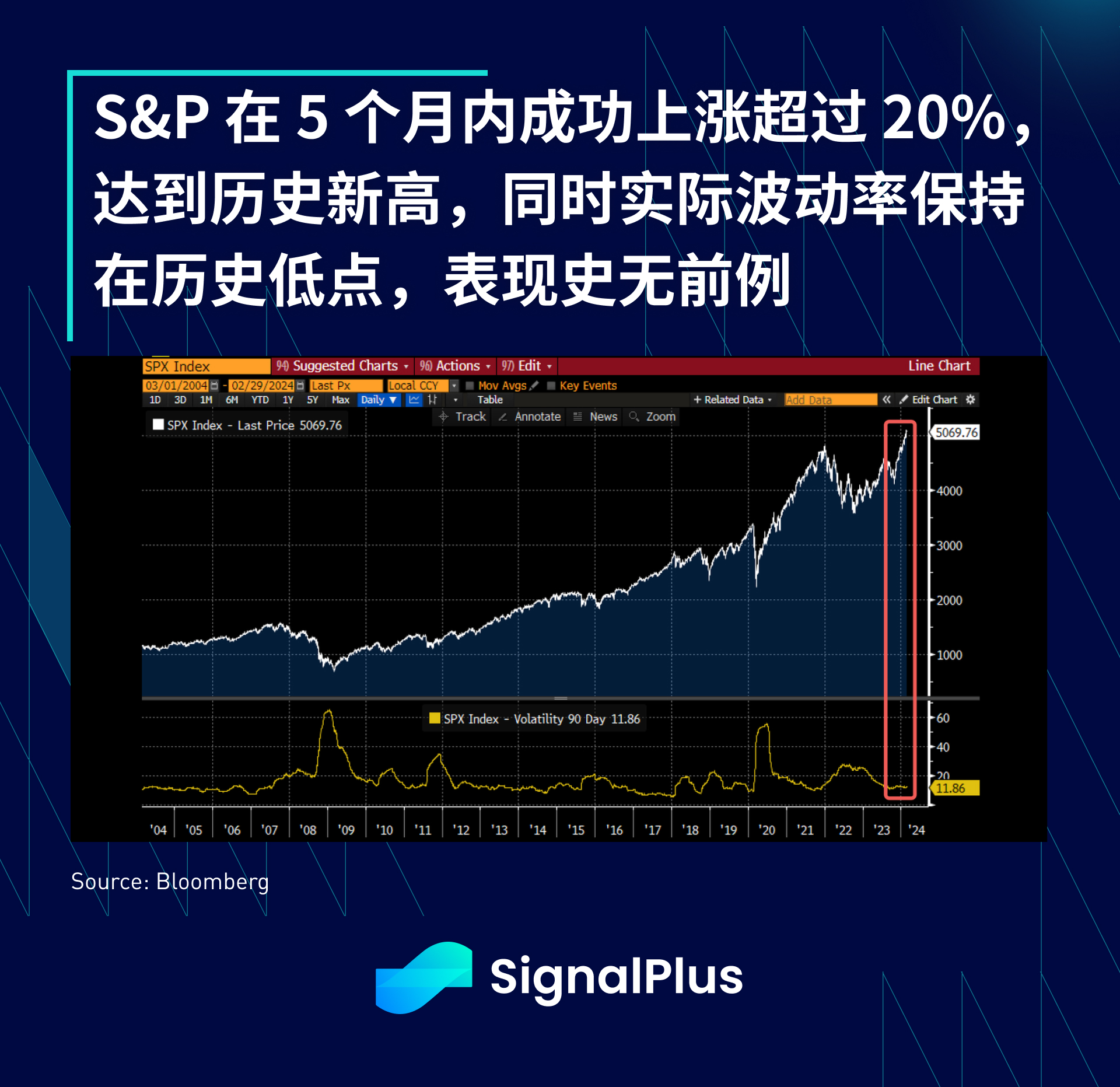

The stock market is not a zero-sum game, and the wealth effect can be created through the expansion of GDP output or technological productivity (AI). However, the rapid and almost non-existent retracement of stock prices remains rare. Since the October low, SPX has risen by over 20% (annualized over 40%!), and the realized volatility (RV) is at historically low levels, which is in stark contrast to the significant increase in volatility when Bitcoin rose from $40,000 to $63,000.

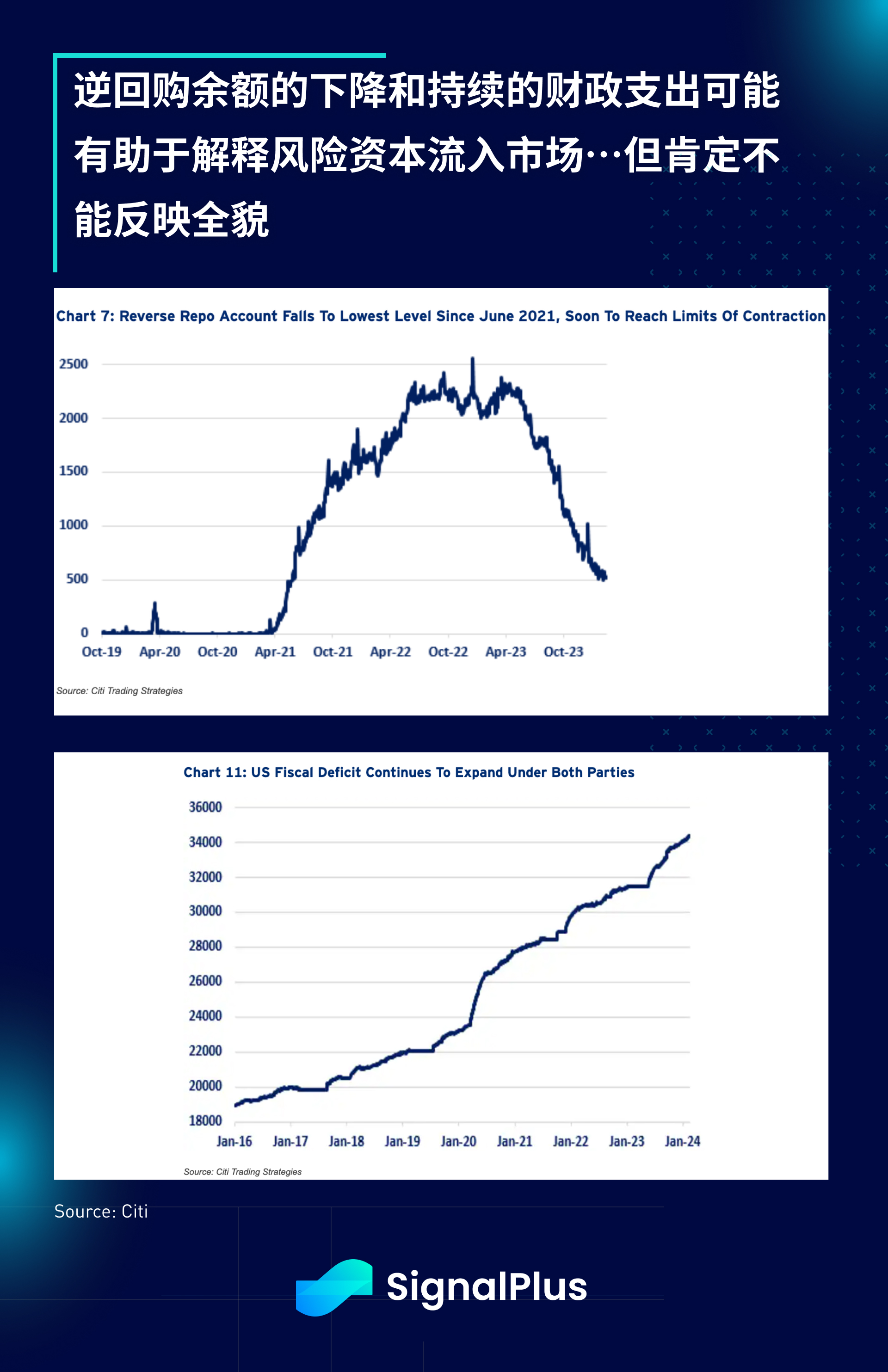

As Citigroup concluded in its report, the only place where liquidity being withdrawn can be seen is the decline in reverse repo balances (leading to the Fed's discussion of a slowdown in quantitative tightening) and the expanding US government fiscal deficit. However, the decline in reverse repo balances ($1.5 trillion) and the rise in the fiscal deficit ($1.8 trillion) still lag far behind the increase in stock market value ($5.5 trillion), not to mention the performance of the credit market and the dramatic growth of the cryptocurrency market (+$0.7 trillion). At present, besides natural growth factors such as EPS/economic outlook/valuation multiple expansions, we do not have a satisfactory answer. Nonetheless, this is indeed a historic rebound worth remembering, so let's enjoy this moment.

You can search for SignalPlus in ChatGPT 4.0's Plugin Store to get real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group, and Discord community to engage in more discussions with friends.

SignalPlus Official Website: https://www.signalplus.com