Crypto whale trading highlights: Insider loses $40 million weekly, followers suffer massive losses.

- 核心观点:加密巨鲸近期交易普遍亏损严重。

- 关键要素:

- 100%胜率巨鲸浮亏近4000万美元。

- 跟单巨鲸24小时亏损超120万美元。

- 40倍杠杆做多BTC巨鲸爆仓630万。

- 市场影响:凸显高杠杆交易风险,引发市场谨慎情绪。

- 时效性标注:短期影响

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

The crypto market has once again entered a period of decline and volatility, and the major crypto whales, known as "trading bellwethers," have once again begun their performance as expected. However, for these well-funded whales, recent trading operations have been far from satisfactory. Some chose to continue adding to their positions after the market rebound, only to suffer paper losses of tens of millions of dollars; others profited from the surge in token prices, but are still far from breaking even; still others chose to sell BTC directly on exchanges to lock in profits. Odaily Planet Daily will analyze the recent operations of these crypto whales in this article for readers' reference.

A whale with a 100% win rate suffered nearly $40 million in unrealized losses in the past week, with its position valued at over $380 million.

As the crypto whale with the highest win rate since the "10.11 crash," revered by the community as the "100% win rate insider whale," its current position is not optimistic.

At the end of October, he opened long positions in BTC and ETH, and made a floating profit of over $10 million in three days ;

On October 27, its unrealized profit once exceeded $20 million ;

On October 28, it opened a long position in SOL and quickly increased its position to over $21 million that day;

On October 29th, he closed his long BTC positions , making a profit of $1.4 million. At that time, he still held long positions in ETH (5x leverage) and SOL (10x leverage), worth $263 million, with a floating loss of $1.3 million. That afternoon, he began to reduce his ETH long positions, first reducing his holdings by 3,400 ETH , making a profit of $186,000; then reducing his holdings by 11,000 ETH , making a profit of $618,000. Finally, that afternoon, he closed his ETH long positions , accumulating a profit of $1.637 million; he only held long positions in SOL, with a position value of $74.21 million and a floating loss of $1.68 million.

On October 30th, he opened a long position in BTC again, and combined with his existing long position in SOL, quickly incurred a total unrealized loss of $3.33 million . Subsequently, after Powell's speech caused the market to fall, he opened another long position in ETH . By noon that day, his unrealized loss had soared to around $6.5 million .

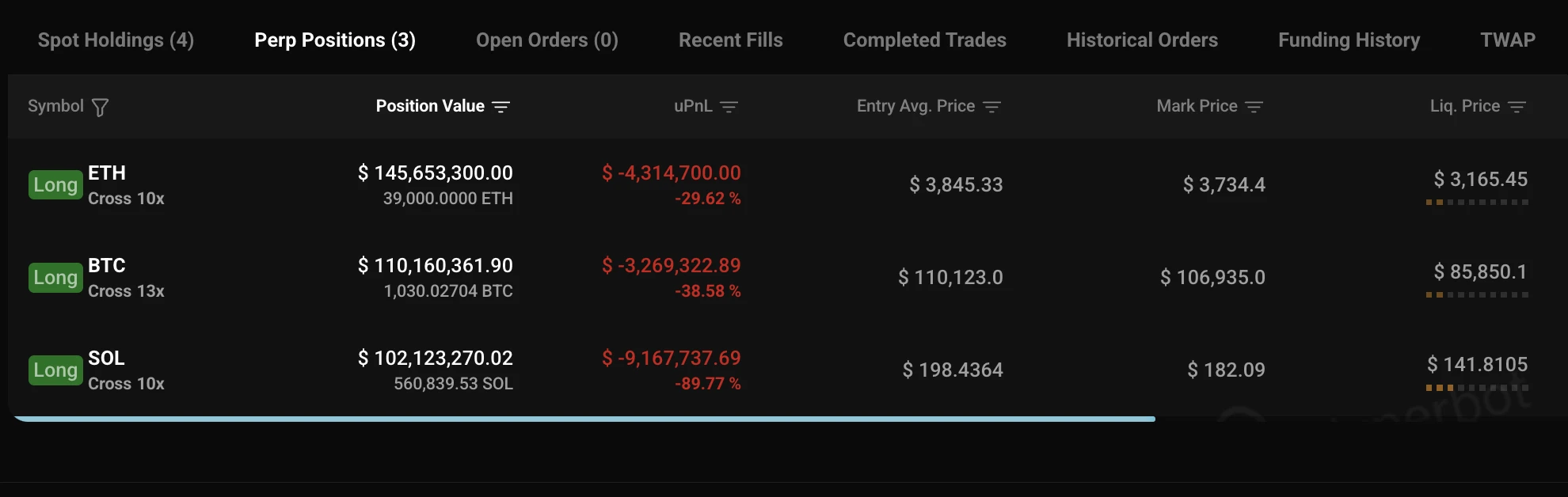

On October 31, the unrealized losses on its long positions increased to over $16 million , including:

- ETH long positions have a floating loss of $4.31 million;

- BTC long positions have a floating loss of $3.27 million;

- The SOL long position has a floating loss of $9.16 million.

The rest is history—

On November 1, the unrealized loss narrowed to around $7 million ;

On November 2, it added to its long position in SOL by 23,871.83 SOL, spending approximately $4.39 million, narrowing its unrealized loss to $6.3 million .

As of writing, the insider whale has given back the profits from its previous contracts at that address; its unrealized losses over the past week have increased to nearly $40 million.

For detailed on-chain information, please see: https://hyperbot.network/trader/0xc2a30212a8DdAc9e123944d6e29FADdCe994E5f2

Even whales that followed insider trading were hit hard by the market, with two whales losing over $1.2 million.

Ironically, perhaps due to the impressive track record of the "100% win rate" insider trading whale, many in the market copied its trades. However, as the market continued to decline, these followers quickly learned their lesson.

Address 0x955...396A8 opened a long position on the morning of October 30th when BTC rebounded, and then panic-closed the position during the rapid pullback at noon, losing approximately $217,000 in just 4 hours;

Address 0x960...0e2Ee went long on BTC and ETH when the price of BTC reached a high of $115,372.8 on October 27, with a total position of $36.87 million. The position was eventually liquidated during the decline, resulting in a loss of approximately $1.061 million in 24 hours.

It's worth noting that the three whales mentioned above are far more than just those who suffered heavy losses by going long on BTC.

A whale who leveraged 40x to go long on BTC suffered a $6.3 million loss in a single day after being liquidated.

On October 30, a whale who had leveraged 40 times to go long on $107 million worth of BTC had its position liquidated as the price plummeted that evening; ultimately, all of its long positions, worth $143 million, were liquidated, resulting in a loss of $6.3 million .

The whale then used the remaining $470,000 after the liquidation to continue its 40x long position in BTC, bringing the total position value to $19 million. The liquidation price was only $1,200 away from the current price.

Currently, this whale address has chosen to go long on ASTER, VIRTUAL, and ZEC at 5x leverage, and is currently experiencing losses.

On-chain information: https://hyperbot.network/trader/0xf35a60331a38326a6af92badd89622555181fb59

Two whales profited over $4 million from going long on ZEC, while one whale lost over $6 million.

On November 1st, according to OnchainLens monitoring , as ZEC's market capitalization surpassed XMR, two whales holding positions on HyperLiquid profited significantly from their long positions. Among them:

The newly created address 0x519c held a 5x long position in ZEC, with a floating profit of approximately $2.2 million at that time; the address has now liquidated its position, with a cumulative profit of over $1.58 million.

On-chain information: https://hyperbot.network/trader/0x519c721de735f7c9e6146d167852e60d60496a47

Address 0x549e also held a 5x long position in ZEC, with a floating profit of approximately $1.8 million at that time; the profit has now retraced to around $1.14 million.

Meanwhile, its HYPE 10x long position, which once had a floating profit of about $2.3 million, has now retreated to a loss.

Currently, the whale's overall account is still in a state of unrealized loss of more than $6 million.

On-chain information:

https://hyperbot.network/trader/0x549e6dd8453ed87fccdcf4f8b37162b10edc0533

Insider whales quietly cashed out their profits, with long-term investors netting over $14.4 million.

Some choose to fight on the battlefield, while others choose to quit while they're ahead.

A long-term whale sold 5,000 ETH, making a profit of $14.43 million.

On October 29, according to The Data Nerd, a whale (0x742...ede) deposited 5,000 ETH into Kraken, worth approximately $19.91 million.

It is reported that this fund was purchased by the whale six months ago at an average price of $1,582. The transaction yielded a profit of approximately $14.43 million, representing a return on investment of 152%. In addition, this address had accumulated 8,240 ETH three years ago at an average price of $1,195, and sold them last year at an average price of $2,954.

Insider information reveals a whale dumping 1200 BTC, worth $132 million.

On November 2, according to on-chain analyst Ai Yi, a whale (1E2...ZRpQ) that made huge profits by shorting before the 1011 flash crash has transferred a total of 1,200 BTC, worth $132 million, to Kraken in the past week.

The most recent transfer involved 500 BTC, and the address has now been liquidated.

https://intel.arkm.com/explorer/address/1E2JG2cZNkVdpdHQJ54MrpgoD28HHnZRpQ