首席叙事官Arthur Hayes项目甄选,Krav能实现病毒式增长吗?

Original | Odaily

Author | Nan Zhi

Last week, Arthur Hayes wrote an article explaining his investment philosophy and that of his investment team - "I would rather invest in a token with a success probability of 0.01% and a narrative in the viral growth stage, than invest in a token with a success probability of 50% and a narrative in the common knowledge stage," and he stated that "technology is not important, the narrative is key."

In this article, Hayes shared several key narratives he believes are important at the moment. Among them, GMX and Pendle have become mainstream narratives that have landed successfully. In this article, Odaily will analyze Krav Trade, a BTC futures exchange based on altcoins, and discuss its narrative and potential for explosive growth.

Krav Trade: A BTC Futures Exchange Based on Altcoins

Narrative

In addition to mainstream coins represented by BTC and ETH, and meme tokens that come and go, there are also altcoins with market values ranging from millions to billions of dollars that have not yet been listed on exchanges. Generally, these tokens have no use case support other than their native protocols, and there is hardly any related lending market or short-selling market. Users profit from buying and selling price spreads, and the capital utilization rate is 100%, meaning that capital utilization cannot be amplified through leverage.

On the other hand, mainstream tokens such as BTC have strong expectations of upward movement in a bull market. However, for altcoins with a capital utilization rate of 100%, one can only choose to invest in either the mainstream tokens or the altcoins.

In response to this, Krav has launched a derivative called Quanto, which allows users to trade BTC and ETH contracts using their altcoins as collateral.

Quanto Derivative

What is Quanto? According to Wikipedia's definition, Quanto is a derivative product where the underlying asset is denominated in one currency, but the derivative itself settles in another currency at a certain exchange rate. This product is highly attractive to speculators and investors who want exposure to foreign assets without assuming the corresponding exchange rate risk.

The above definition can be difficult to understand, so let's use the example of the UNIBOT token pool provided by Krav to explain:

Fixed Exchange Rate: Let's assume the current price of UNIBOT is 50 USDT and the price of BTC is 50,000 USDT, resulting in a ratio of 1:1000;

Depositing Assets: Now, a user owns 1000 UNIBOT tokens and deposits them into Krav;

Establishing Positions: The user can then establish both long and short positions on BTC. Let's say the user creates a long position of 2 BTC, and the exchange rate remains at 1:1000;

Settlement & Exit: Assuming BTC price rises by 10%, the value of the user's position increases to 2.2 BTC, and the user decides to settle;

Based on the previous exchange rate of 1:1000, the user will receive 200 UNIBOT tokens, regardless of the actual exchange rate between UNIBOT and BTC during the opening and settlement period.

In summary, Krav's Quanto is a derivative product that uses altcoins as collateral for long and short BTC/ETH trades, settling at a fixed exchange rate.

Protocol Participants

The participants, methods of participation, and profit mechanisms in the protocol are as follows:

Traders: Profit from trading mainstream coins but need to pay transaction fees;

LP Provider: As the counterparty to the trader, it provides liquidity and profits from transaction fees. If the trader is profitable overall, LP incurs losses (and vice versa). Krav allows anyone to create an LP pool for any token;

Krav Token: Staking it will share 30% of the transaction fees and receive veKRAV and reward multipliers.

Protocol Status

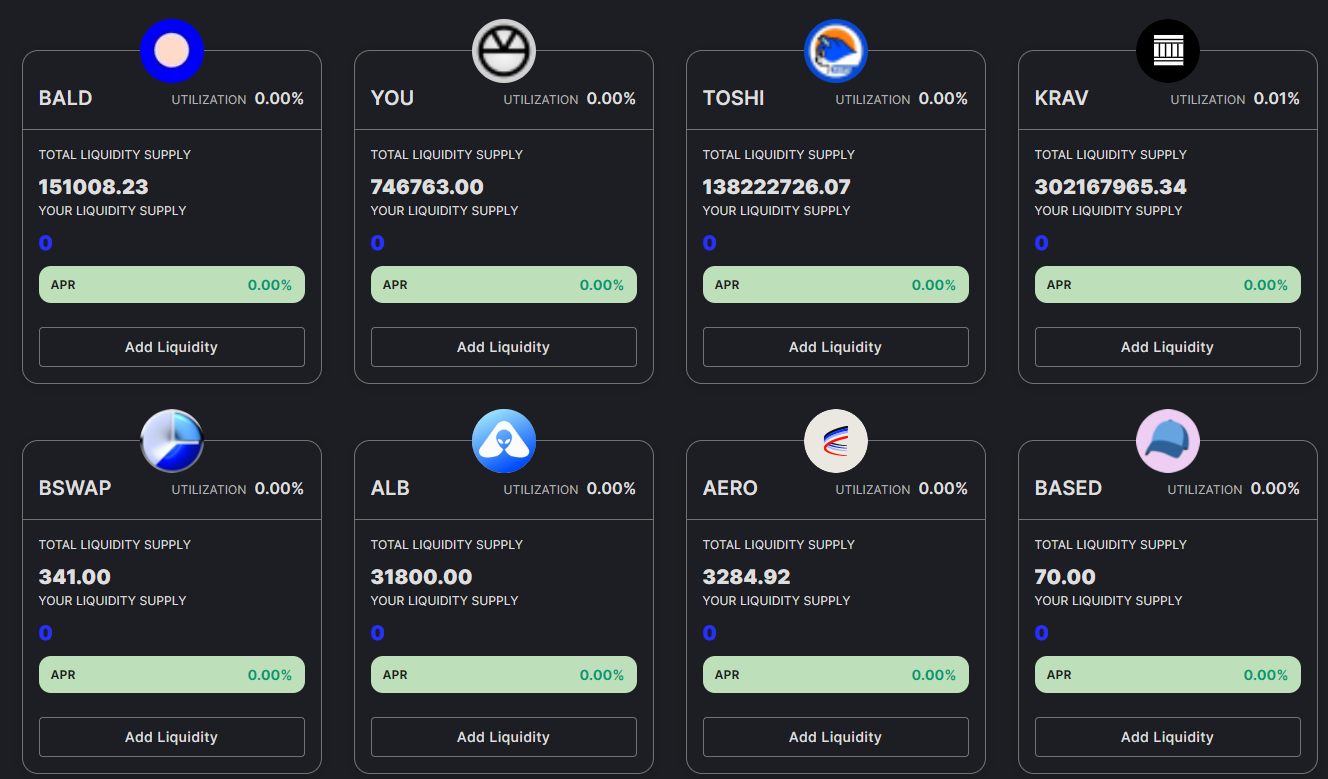

Currently, Krav supports Quanto trading on 7 chains, including Ethereum, Base, Arbitrum, Polygon, etc. Among them, there are token pools such as RLB and UNIBOT built on Ethereum, 9 token pools on Base, and the popular Meme token pogai on Arbitrum last year. According to the official data page, the provided liquidity currently amounts to $1.56 million.

For example, RLB on Ethereum is the token issued by the gambling project Rollbit, with a market cap of up to $476 million, but it is difficult to list on large centralized exchanges due to compliance issues, and there are also few combo protocols. Through Krav's permissionless Quanto trading, users can fully utilize the huge market value of this token for further trading.

CoinGecko data shows that the current market cap of KRAV is $3.82 million, with a growth rate of 63% in the past three months. If narrative growth can be achieved smoothly, there is still considerable room for growth.

Narrative Interpretation

Great Growth Potential

As mentioned earlier, apart from the mainstream tokens listed on exchanges, there are still billions of market value for altcoins that have not been listed on exchanges and have no combo protocols to utilize.

This year, due to factors such as the approval of Bitcoin spot ETFs, expectations of improved macro environment, and Bitcoin halving, the market has high expectations for BTC.

The above two points are respectively the large demand group and solid trading demand, Krav Trade indeed has the ability and space for viral growth.

Challenges and Risks

As a pioneering new protocol, the fundamental challenge is user adoption. Shitcoin investors and mainstream coin traders are usually disconnected, with the former typically focused on on-chain operations and the latter more accustomed to trading on CEX. Krav needs to accurately attract users who are willing to invest in both shitcoins and mainstream coins, and cultivate their habit of holding shitcoin assets and trading BTC/ETH on Krav. Furthermore, each shitcoin has its own community, making the promotional work vast and complex.

In addition, Krav faces underlying asset risks. Shitcoins are highly volatile assets, and when users use them as collateral for trading, there is a chain risk of shitcoin collapsing and liquidation, as well as the risk of collateral liquidation due to Dev Rug and hacker attacks. This greatly limits the scale of user trading.

Conclusion

Krav has significant growth potential, but it requires a very high marketing ability. Whether Chief Storytelling Officer Arthur Hayes' expectation of viral growth can be realized, remains to be seen.