ETF一周回顾:休眠比特币苏醒中,GBTC大量流出

Original|Odaily

Author|jk

In the crypto market last week, the biggest hot spot still revolved around various news about spot Bitcoin ETFs. We are witnessing an interesting mini-cycle of volatility mixed with subtle changes in trader sentiment and market dynamics.

In this article, Odaily will deeply analyze the trading volume of major Bitcoin spot ETFs within a week, including the performance of market leaders GBTC, FBTC, and IBIT, and mine some interesting conclusions based on data.

Spot Bitcoin ETF weekly data summary

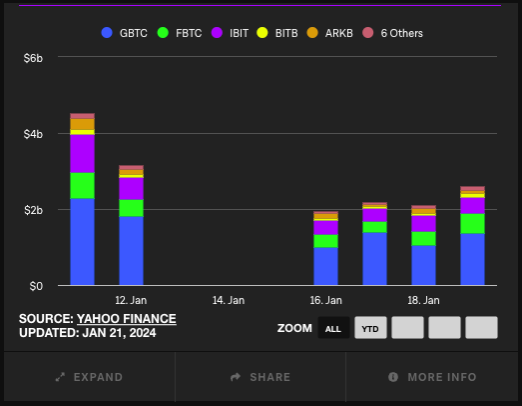

Spot Bitcoin ETF trading volume. Source: The Block, Yahoo Finance

The above chart shows the trading volume trend of Bitcoin spot ETFs within a week, including data for GBTC, FBTC, IBIT, BITB, ARKB and six other ETFs.

As can be seen,On January 12, just released, the total trading volume was close to $600 million, with GBTC having the largest trading volume, followed by Fidelity’s FBTC and BlackRock’s IBIT,Trading volumes for BITB, ARKB, and six other ETFs, on the other hand, are relatively small.

Overall trading volume declined in the following days and after the weekend, but GBTC remained dominant.After January 16, total trading volume stabilized at about $200 million per day, with volume distribution across ETFs similar to January 12.By January 19, total transaction volume had increased slightly. Grayscale’s GBTC accounts for about half of the daily trading volume.

According to Odaily’s previous article in “ETF was approved but BTC fell sharply. Is it because of Grayscale’s market crash? How much selling pressure is still on the way? reported in the article that Grayscales GBTC may be smashed. Investors may sell GBTC shares due to high management fees and the profit motivation of buying at a discount, which will lead to Grayscale selling Bitcoin positions. Therefore, we also need the following inflow and outflow data:

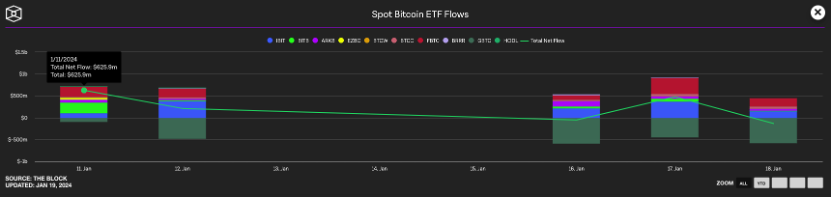

Spot Bitcoin ETF inflows. Source: The Block

can be seen,GBTC has experienced large outflows every day, since the first day, there have been daily outflows of about $500 million. In contrast, the newly launched Bitcoin spot ETF has maintained sizable inflows. According to the green line trend (net inflow) in the figure, the fluctuations are very large. Although there is positive inflow most of the time, the fluctuation trend next week is still difficult to predict.

Bitcoin market data

This week, the price of Bitcoin continued to fall, falling 4% on the 7th and now trading at $40,937. The market fell sharply on January 18, then oscillated back to around $41,500, then maintained it until the 21st, and then oscillated down to where it is today. As can be seen,The outflow of funds from GBTC and the sell the news incident did have a considerable impact on the market.

So has Grayscale crashed the market? According to Arkham data,Grayscale’s sell-off has been ongoing, but it has not been so severe that it would cause the spot price of Bitcoin to become irreversible.Data shows that Grayscale’s current Bitcoin holdings are about 573 K, while the figure on the 13th was 617 K. In more than a week, Grayscale’s holdings have decreased by about 7%, which was originally predicted by someone on Twitter. The scenario of Bitcoin will fall to around $32,000 due to Grayscales crash has not appeared, which is enough to proveGrayscales selling pressure was actually basically absorbed by the inflow of funds from other ETFs and market buying.So there was no waterfall-like decline.

Other market news

Odaily previously reported that BitMEX Research statistics showed that on the fourth day of trading after the U.S. Bitcoin spot ETF was approved, the four largest European Bitcoin ETPs had a single-day outflow of US$30 million, and the total outflow in five days was approximately 106 million. Dollar. There is evidence that investors are switching from high-fee European ETP products to low-fee U.S. ETF products. Over four days (January 11th, 12th, 15th and 16th),The four largest European Bitcoin ETPs saw outflows totaling $75.2 million.This operation is mainly due to fee reasons. Since several U.S. ETFs currently offer low-cost or limited-time zero fee plans, this has resulted in a large amount of cross-border fund buying.

at the same time,The start of trading in ETFs has also led to a large amount of dormant Bitcoin starting to wake up.Days after the spot Bitcoin ETF began trading, $2 billion worth of dormant Bitcoin was moved through multiple linked addresses, according to data monitored by Arkham Intelligence. These BTCs saw one move in 2019, having previously been dormant since 2013. “Historically, these Bitcoins have all moved at the same time and date,” Arkham said. It is reported that these BTC have been merged from 49 addresses to 5 addresses, each address contains 8000 to 12,000 BTC, and a cumulative holding of 49,858 BTC is worth approximately US$2.12 billion.

Overall, the Bitcoin spot ETF market this week showed a differentiated pattern. Although GBTC and FBTC dominated the trading volume as expected, the overall market trading volume and inflows have fluctuated, which may be related to macroeconomic factors and the selling pressure on GBTC.

Tomorrow, we will usher in the second week since the ETF started trading. Odaily will always track and report future transactions.