数据回顾:上所后,铭文和memecoin还有上升空间吗?

Original - Odaily

Author - jk

Since the inscription craze last month, major exchanges have begun to continuously launch new inscriptions, and the trading enthusiasm in the entire inscription market has been unprecedentedly high. Amidst this enthusiasm, two completely different trading concepts have emerged: one is unwilling to miss any new inscriptions, and uses various methods to rub or write scripts in the primary market, and then lists them on the off-site or on the exchange. The other is unwilling to make inscriptions by hand, but prefers to buy from the secondary market after the currency is listed to see if they can reap the growth dividends after the currency is listed on the secondary market.

It should be noted that the price trend of Mingwen trading on various exchanges is not exactly the same as the real-time price, and the memeization of the new generation of Mingwen has also made the rise and fall more difficult to predict. So,What impact will listing on the exchange have on Inscription and memecoin?Is it a signal of a new round of gains or a prelude to massive selling pressure? To put it more specifically for small and medium-sized investors, in addition to making new investments in the primary market, is there still room for growth after the currency is listed?

We sorted out several popular inscriptions and assets in the last round to analyze specifically the impact of listing on their price trends.

Biis

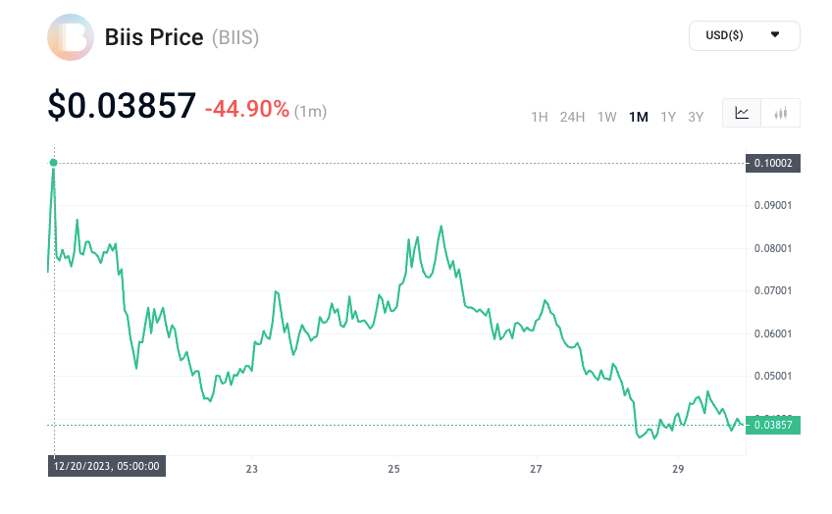

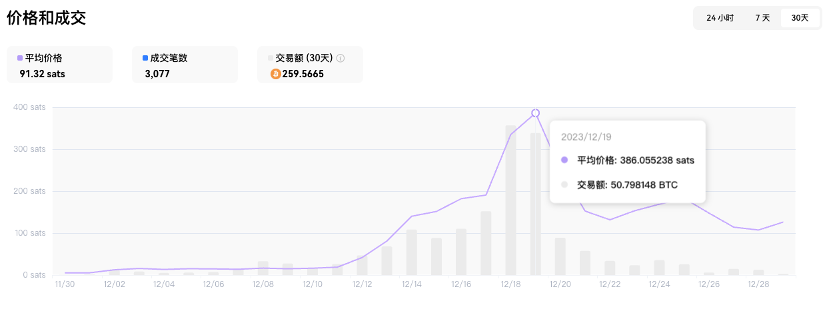

Biis price trend, source: KuCoin

Biis price trend, source: OKX Ordinals

According to data from Coinmarketcap, the current 24-hour trading volume of biis is not too high; ranking first is KuCoin with a trading volume of approximately $430,000, followed by XT.com and OKX. Following this order, the exchange listings with the highest trading volume appear to represent the highest point of the biis.

OKXs listing date is earlier, KuCoins listing date is December 20th (XT.com, which follows closely in terms of trading volume, was listed on the 21st), and the highest price point occurred about 2 hours after the listing. It fell all the way, saw a certain increase on the 25th, and then fell all the way to around $0.038 today.

For Biis, there is very little room for profit from the secondary market. Listing the currency on the exchange with the largest trading volume represents selling pressure. However, if you can buy shares from OKX earlier, there is still room for upside later.

.com

.com quotes, source: MEXC

Judging from the 24-hour trading volume of BRC 20.com, MEXC is the highest, followed by HTX, followed by XT.com and Bitget. MEXC is also the earliest exchange to list the currency. It was launched on .com on December 14th. It has followed the entire cycle from rising to falling. On December 19th, the price reached its highest point of $7.2, and is currently trading at $3.397.

Bitget listed the currency on December 19th, which happened to be the day when the price reached its highest point, and XT.com listed the currency on the 20th. A slower downward trend has followed since then. HTX was listed on the 27th, and the trend has stabilized since the listing.

It can be seen that as far as .com is concerned, if it can keep up with the earliest wave of coin listings, there is still a lot of room for profit; and as major exchanges keep up with the pace, the price has begun to rise from a high point It slipped.

BNSX

BNSX price trend, source: BitMart

In the ranking of BNSX trading volume, Gate.io ranks first, BitMart and AscendEX rank second and third respectively. All three listed their tokens at almost the same time, with Gate and BitMart listing on December 18, and AscendEX later that day. Therefore, the subsequent trend was almost the same: after the currency was listed, the price rose all the way, reaching the highest point of about US$2.49 on the 19th Beijing time, and then fell all the way.

As far as BNSX is concerned, after listing the currency on several major exchanges with large trading volumes, the profit margin is not very large. If you can enter the market on the same day, there is still a certain profit margin. After the 19th, there will be a slight downward trend.

MMSS

MMSS price trend, source: BitMart

MMSS price trend, source: LBank

For Inscription MMSS, the top exchanges by trading volume are: BitMart, LBank, Bitget and Gate.io. The order of listing of these four currencies is: BitMart was the earliest, listing the currency on December 7, LBank on the 19th, and Bitget on the 20th. Gate is the latest to be listed on the 27th. It can be seen that there was a long bonus period after the currency was listed on BitMart. The currency price reached its peak around the 16th, then corrected for a period of time, and reached another small peak on the 27th.

In other words, if you can buy it from the exchange that lists the currency early enough, then there is still a relatively large profit margin from the subsequent currency listing boom brought by other exchanges.

Mice

Mice price trend, source: Bitget

Judging from the selection of a leading token, the impact of listing the currency is still relatively small for the leading inscription. For Mice, the exchanges with the highest trading volume are Gate, OrangeX, Bitget and BitMart, and the order of listing is Gate (16th), Bitget (18th), BitMart (18th), OrangeX (18th). After the listing, there were three peaks, respectively on the 19th, 21st and 25th.

can be seen,For Dragon Head Inscription, a consensus has been formed, and the price trend is more towards the traditional memecoin, rather than a project with only one wave of rise and fall. Therefore, the significance of the currency on the exchange for the price is limited, and there are still several arbitrage opportunities after the currency is listed.

For non-leading tokens, listing them on exchanges does not bring many benefits.From the above examples, we can find that the peak period of currency listing on several exchanges with the largest trading volume is usually the highest point of the currency price, which may only occur within a few hours or a day. You need to have a long-term strategic vision and make early arrangements in exchanges that list coins earlier, or simply create new ones in the primary market; if you pay attention to the inscription relatively late, after most exchanges list the coin, you will buy it in the secondary market. The dividend period is short, and then it basically fluctuates steadily or has a decline.

As for the leading token, it is already a de facto memecoin; the law of rise and fall is more biased towards market consensus and news, and studying the currency itself has limited significance for currency price fluctuations. When facing leading tokens or non-leading tokens, investors should pay more attention to market dynamics, the impact of exchanges, and the overall market consensus. It is necessary to conduct in-depth research and analysis of various factors. At the same time, investors should also be aware that whether it is a leading token or a non-leading token, market uncertainty will always exist, so it is crucial to carefully assess risks and potential rewards.