EMC Labs November Briefing: In response to internal factors and external factors, the fifth round of crypto asset bull market is about to begin.

Original author: 0x Weilan

The market, project, currency and other information, opinions and judgments mentioned in this report are for reference only and do not constitute any investment advice.

macro market

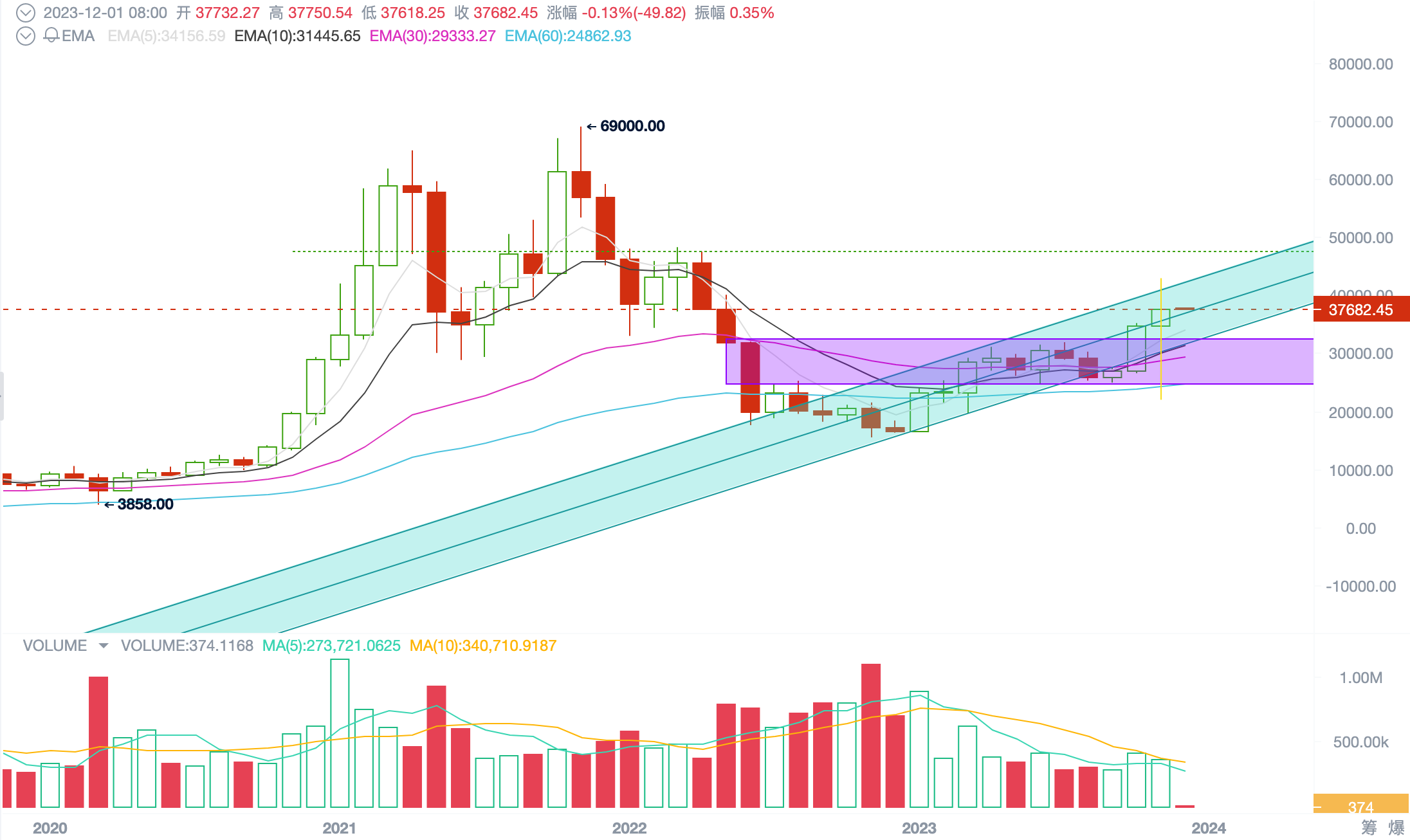

As EMC Labs inOctober BriefingIt is predicted that after achieving the annual breakthrough in October, BTC continued to fluctuate along the upward channel in November, pushing the price to the $38,000 line.

After consecutive gains of 28.54% and 8.88% in October and November, BTC holders’ profitability reached the highest level during the year. Concerns about profit-locking selling and high consolidation have caused BTC to continue to fluctuate near the middle track of the upward channel (approximately $37,000), and its volume has shrunk.

BTC monthly trend

Although there is still one month left in the year, all parties in the market agree that this round of interest rate hikes has ended. Labor employment data has begun to decline, and a mild recession in the U.S. economy has begun. Major investment banks have begun to predict the start time of the interest rate cutting cycle-the summer of 2024 or the second half of the year.

Against this background, the U.S. dollar index recorded a monthly decline of 3%, indicating that easing expectations are getting stronger, and funds began to rush into equity assets with higher risk appetite.

Macro financial markets began to turn higher. The Nasdaq, which has fallen for three straight months, rebounded sharply near its October moving average for a monthly gain of 10.7%.

Nasdaq monthly trend

This month, Binance, the world’s largest centralized exchange that has played a huge role in promoting industrial development and thus posed a challenge to the old system, reached a settlement with the U.S. Department of Justice, paying a huge fine of US$4.3 billion and the founder’s departure. At the cost of becoming CEO, he bid farewell to the barbaric past. The overall attitude of the market is optimistic about this. Although not all black swan level uncertainties have been eliminated, we tend to believe that the encryption industry is bidding farewell to the period of barbaric development, and that compliance development in the traditional world will become mainstream in the next few years.

It is the labor pain of adulthood and the medal that covers the wound. Only in this way can encryption technology penetrate deeply into the western part of human society, and the encryption market may reach 10 trillion US dollars in the next few years, becoming one of the largest equity markets in mankind.

crypto market

In November, BTC opened at US$34,656 and closed at US$37,732, achieving an increase of 8.88% throughout the month, with an amplitude of 12.7%.

The biggest market achievement of BTC this month is to say goodbye to the shackles of the oscillatory box (purple area in the picture below) that has plagued the trend for half a year. The whole month has been running above $34,000, which is the high point after the breakthrough in October. Although the capacity has shrunk, it is still pushing forward amid hesitation and ambiguity.

The middle rail of the ascending channel (the green box in the picture below) has also become the focus of competition between the bulls and the short parties. On November 15/16 and November 20/21, the long and short sides had a hard-fought conflict near the middle rail. The trading volume on the conflict day showed an amplification trend, showing that after the sharp rise, the selling of loose chips and the determination of new funds to enter the market were quite strong.

BTC daily trend

In the end, the multiple forces were superior. Under the suppression of multiple technical indicators, the price of BTC remained strong and hit a new rebound high.

The more positive side is reflected in the L1 sectors overtaking of BTCs monthly growth. ETH rose 13.08% this month, outperforming BTC by 5,500 basis points. L1 Altcoins such as SOL, AVAX, and OSMO have experienced a maximum increase of 3 times since their launch in October. There is a trend of on-site capital inflow from BTC to subdivided sectors.

The continued growth of ETH exceeding that of BTC is one of the symptoms of the start of the bull market and deserves close attention.

capital supply

Through technical analysis, we can know the trend changes in the static market. However, the main driving force of the market since October is the accelerated entry of OTC funds. To study and judge the market outlook, we must conduct in-depth analysis of this main factor.

Following the positive inflow in October, stablecoins continued to have net inflows in November, and the inflow scale expanded to $3.5 billion, 3.5 times the scale in October. EMC Labs’ October briefing “EMC Labs October Briefing: Breakthrough as expected! In the market outlook, BTC is likely to fluctuate upward along the channel pointed out: The outflow trend reversed in October, and stablecoins achieved a single-month net inflow. Stablecoins began to exit the bear market.

In November, this judgment continued to be realized. BTC came out of the bear market at the beginning of the year, stablecoins came out of the bear market in October, and the overall bull market for crypto assets is getting closer!

Stablecoin inflows have accelerated this month, and EMC Labs believes that if stablecoin inflows continue in December, stablecoins will confirm their entry into a bull market. In conjunction with BTC, which has already emerged from the bear market, in the most optimistic estimates, the market will enter the early stage of the fifth crypto asset bull market as soon as January.

Although the overall supply of stablecoins did not turn positive until October this year, the supply of USDT changed from outflow to inflow as early as December 2022, and reached a new historical supply high in October. This early inflow of funds, together with the funds on the market, made the fourth major bottom in the history of Bitcoin, and contributed to the strong 130% rebound achieved by Bitcoin in the first 11 months.

Compared with the overall net inflow in October, the biggest achievement of the stablecoin market this month is that USDC also ended its outflow state and began to achieve net inflow. This means that traders using these two types of stablecoins are beginning to be optimistic about the market outlook and are beginning to increase their positions.

supply trends

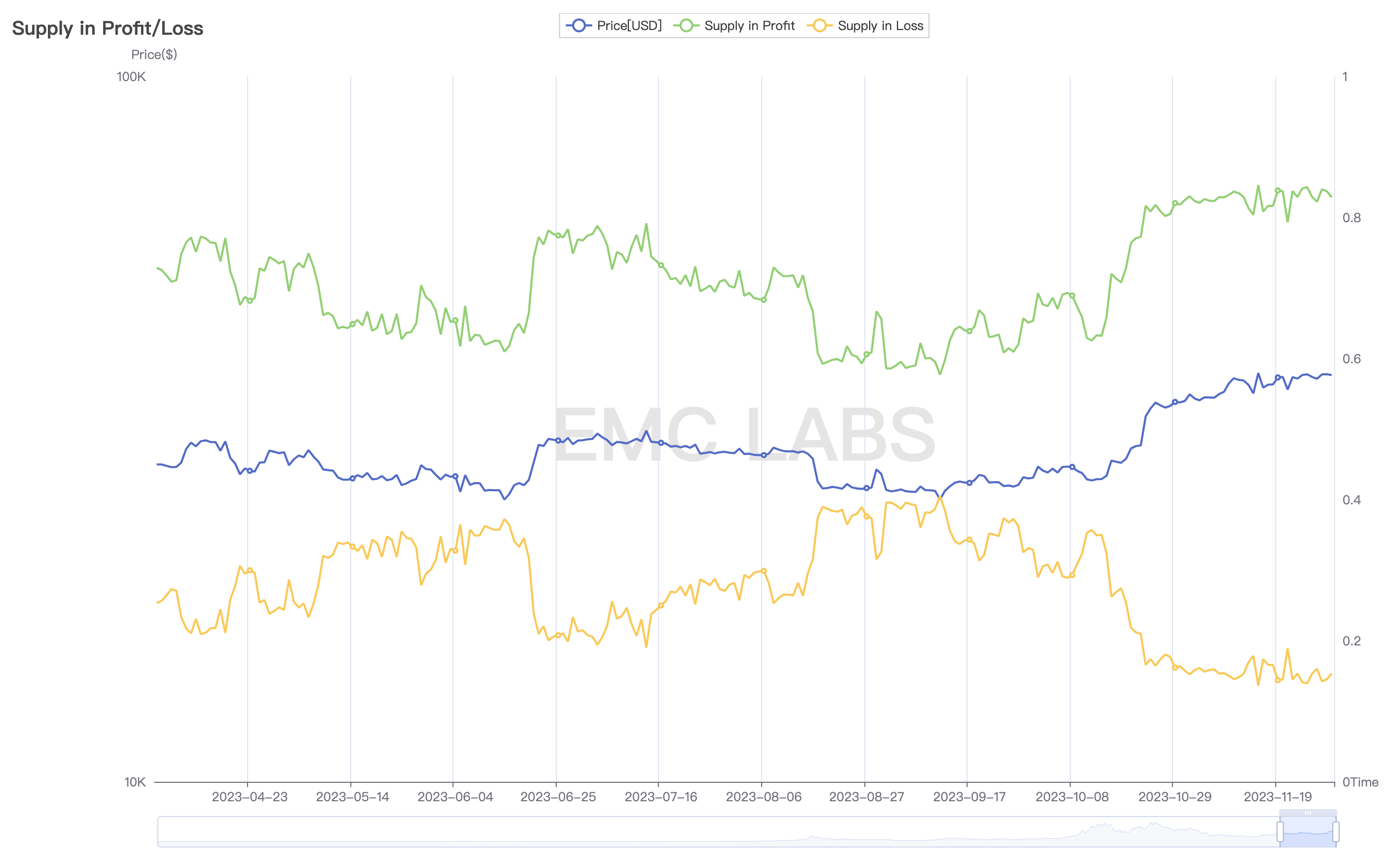

With the continued rise in October and November, the overall supply of Bitcoin is becoming increasingly optimistic. This is an internal factor that we must continue to pay attention to in addition to the net inflow of funds.

As of the end of the month, 87% of the total supply of Bitcoin was in a profitable state. This was due to the rise in BTC prices on the one hand, and the large-scale capitulation and bargain hunting that occurred during the bottom grinding and repair periods on the other.

BTC overall supply profit and loss distribution

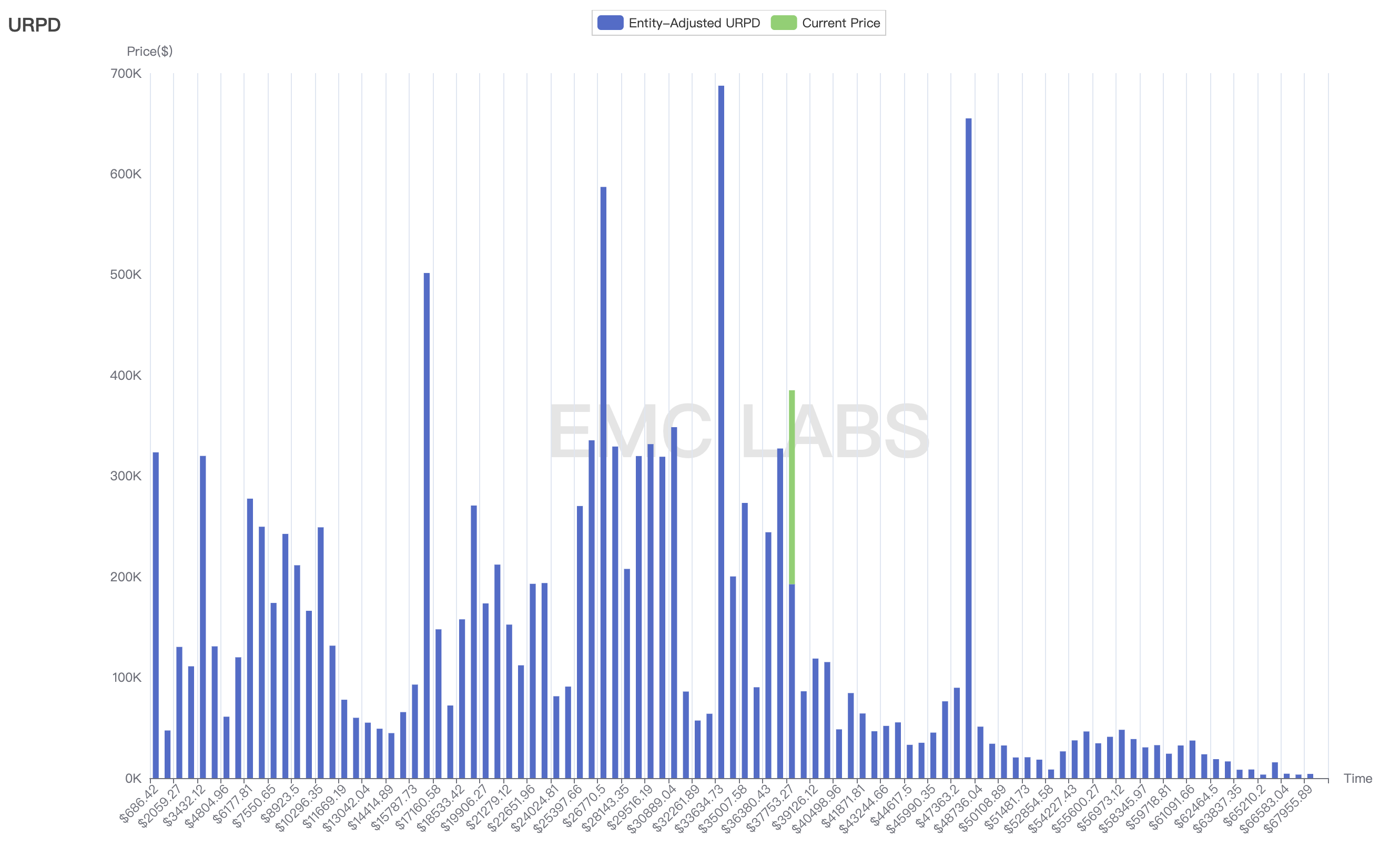

Correspondingly, the cost structure of BTC has also undergone tremendous changes——

BTC overall supply cost distribution

US$33,634 has become the largest accumulation area of chips, and most of these chips were established in October. This is one of the reasons why we judged in our October briefing that the market would not correct in November but would continue to rise.

Above that is $48,000, which is the accumulation area formed in the last bear market decline and is also the high point where we judge the recovery period. This high may be hit in December or January. Its almost pointless to judge the price, but if it comes to fruition, its going to be a double-digit rally in December.

Long and short game

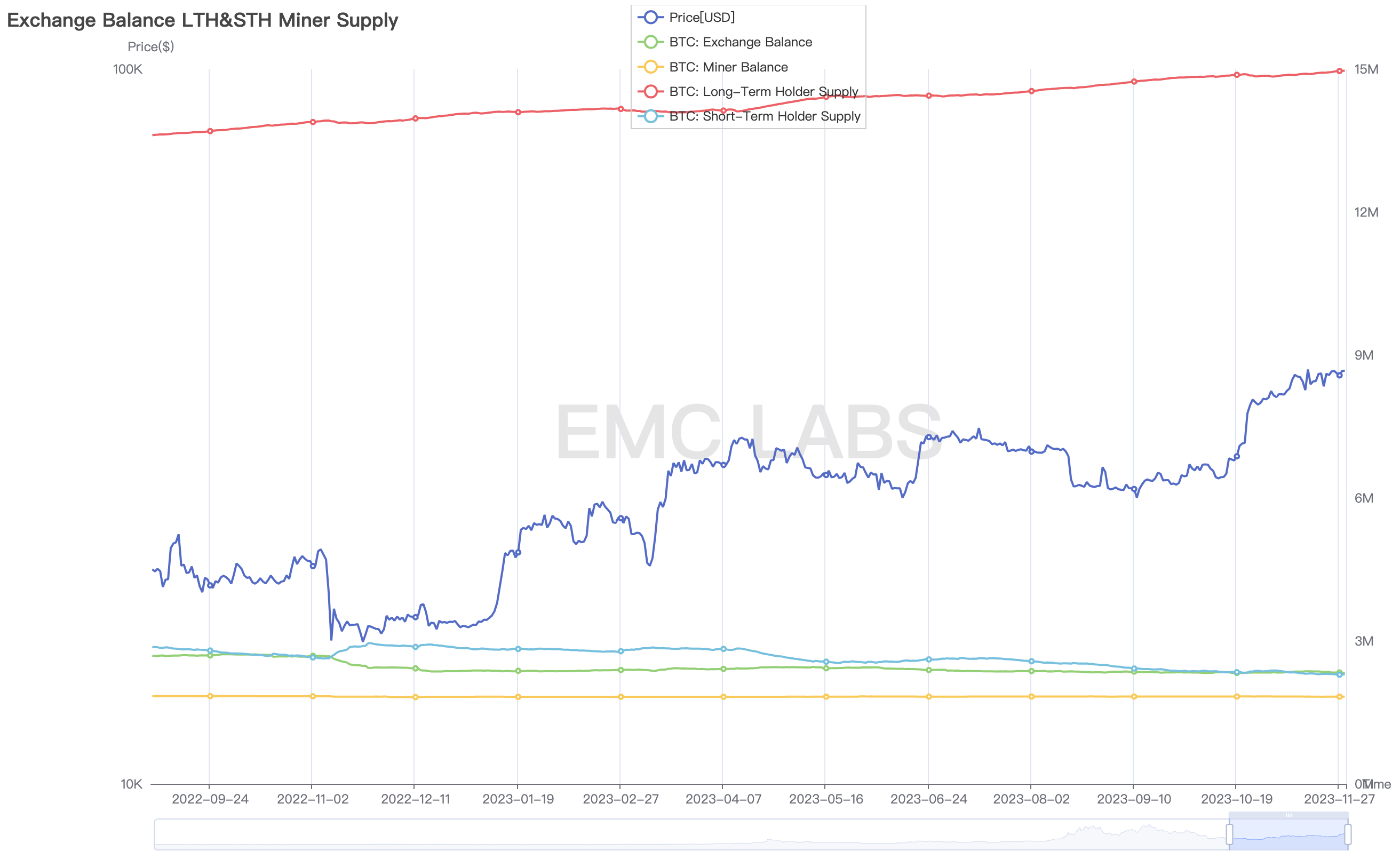

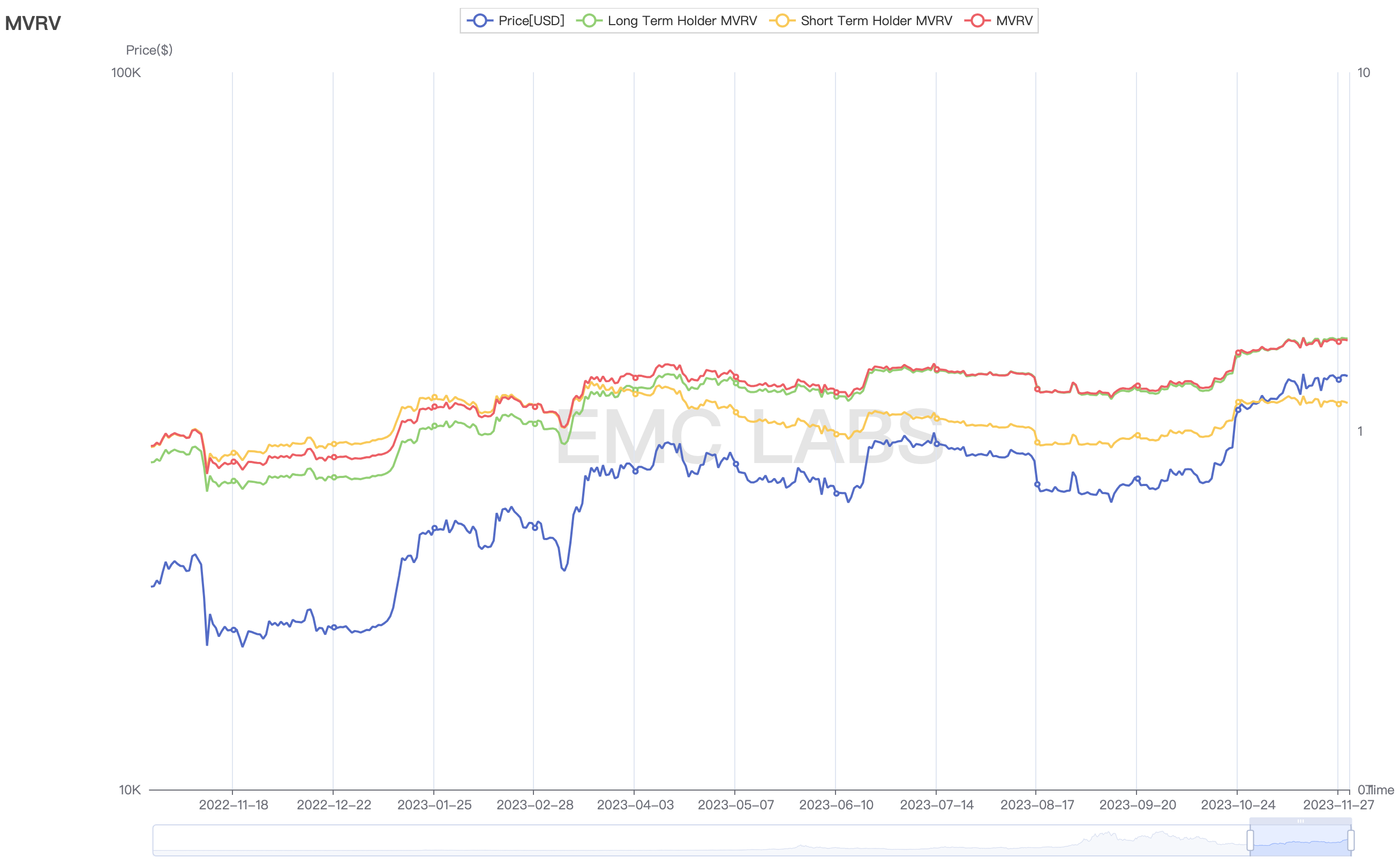

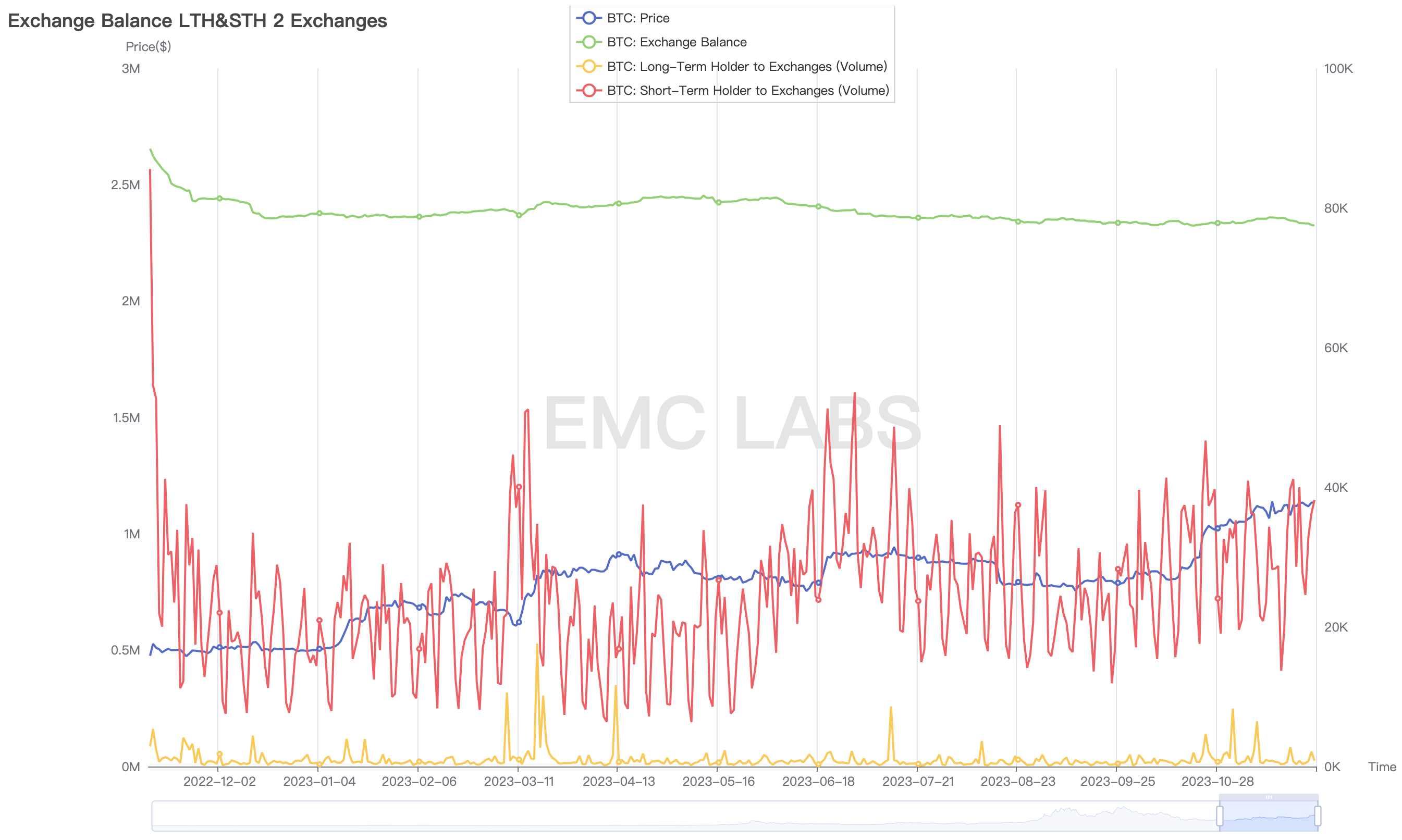

Looking at long and short positions and exchange positions throughout November -

BTC position size of market parties

Long Hand: +110,000 coins to 14.96 million coins;

Short hand: -70,000 coins to 2.29 million coins;

Exchange: -40,000 coins to 2.32 million coins

The long hand is still collecting chips, and the short hand is still handing over chips. This performance is consistent with the convergence trend of continuous loss of liquidity during the repair period. The continuation of this trend makes it difficult for the market to achieve significant declines in the short term.

Let’s look at the floating profit situation of long and short hands. The floating profit of long hands reached 81% and that of short hands reached 21%. Compared with October, long-hand floating profits continued to rise, while short-hand floating profits fell slightly by 1% and remained at a high level of short-hand levels.

Floating profit status of long and short holding positions

During the recovery period, profitability will gradually recover. At the same time, as the recovery period progresses and optimism about future trends gradually increases, the floating profit thresholds of all parties in the market will gradually increase.

Continue to check the profit locking situation: the profit level of selling long positions is between 30 ~ 70%, and the profit level of selling short positions is between 0 ~ 3%.

Judging from the profit level of long hands, those weak hands in long hands are selling (their profit level is lower than the overall profit level of long hands).

Judging from the profit level of short hands, those strong short hands choose to hold the currency and wait for it to rise (the profit level of sellers is far lower than the overall profit level of short hands).

The market is currently at the end of a recovery period. During this period, the profit expectations of long-term investors are getting higher and higher (after entering the rising period, that is, the bull market, their expectations will reach several times), while the profit expectations of short-term investors are also gradually increasing. At the same time, the weak hands in the short hands and the weak hands in the long hands become the final clearance objects. The chips collected by the long hands this month come from this part of the market participants.

Re-examining the selling scale of long and short hands in November——

Longshou experienced large-scale selling on November 2, 10, 21, and 28, with 21,653 pieces sold in four trading days.

Short-term traders experienced large-scale selling on November 7, 21, 22, and 24, with 161,839 pieces sold in four trading days.

This is a selling situation of weak hands in the long and short hand group. Compared with other months of this year, the overall selling level is declining, which also shows that market parties maintain optimistic expectations for the market outlook as a whole.

Long and short selling scale statistics

To sum up, for the most important long-short hand game in the market, EMC Labs maintains its previous judgment: the market is still in the repair period, chips continue to increase from short to long, and liquidity is further lost. Although the floating profit of both long and short-term stocks hit the highest record in the current repair period, the scale of selling did not increase. The market has entered the end of the recovery period, and beyond that is the looming rising period, also known as the bull market.

Data on the chain

On-chain data is the stabilizer of BTC prices. Price increases supported by on-chain data are more sustainable, while upward or downward price trends that deviate from on-chain data are bound to be unsustainable.

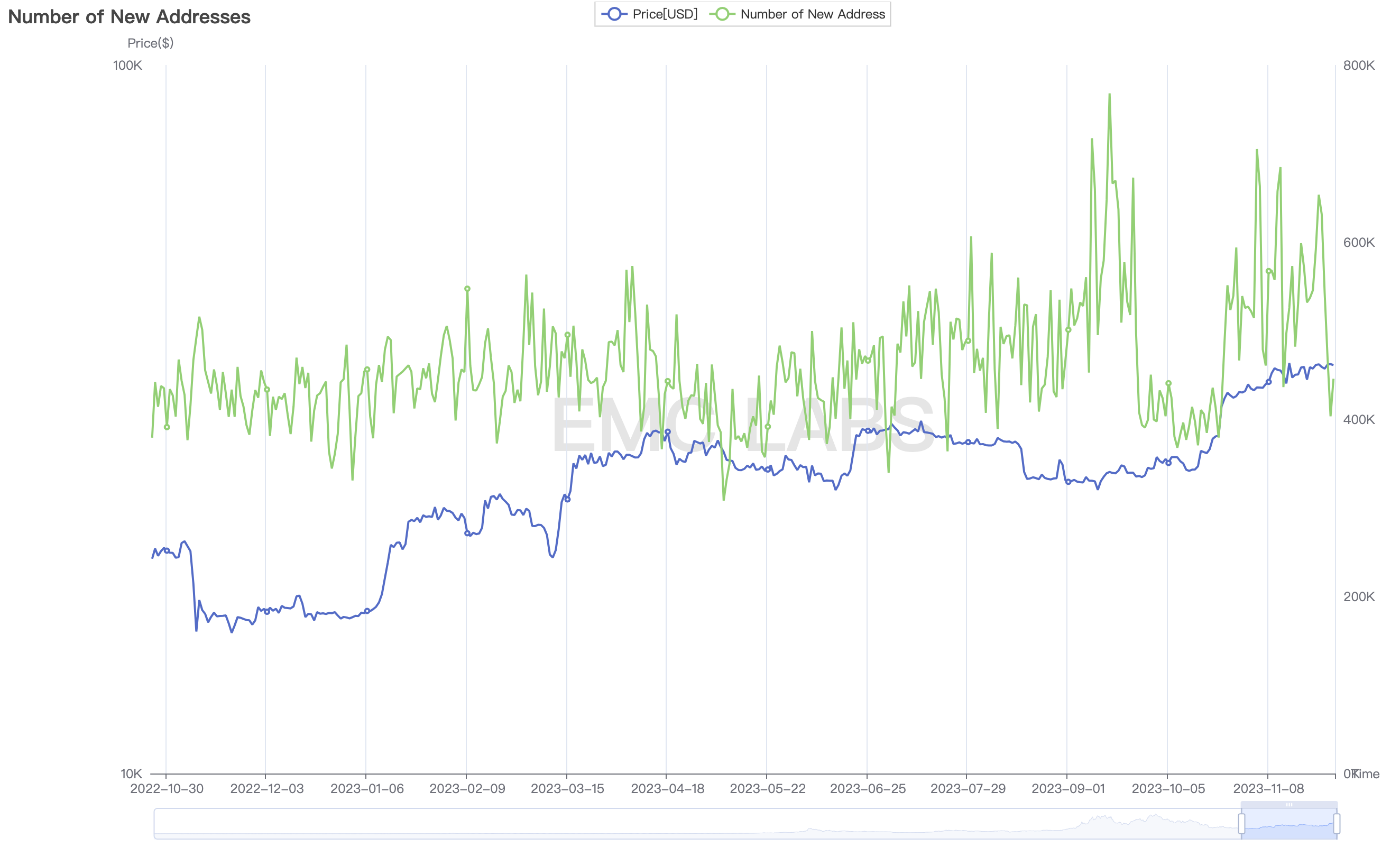

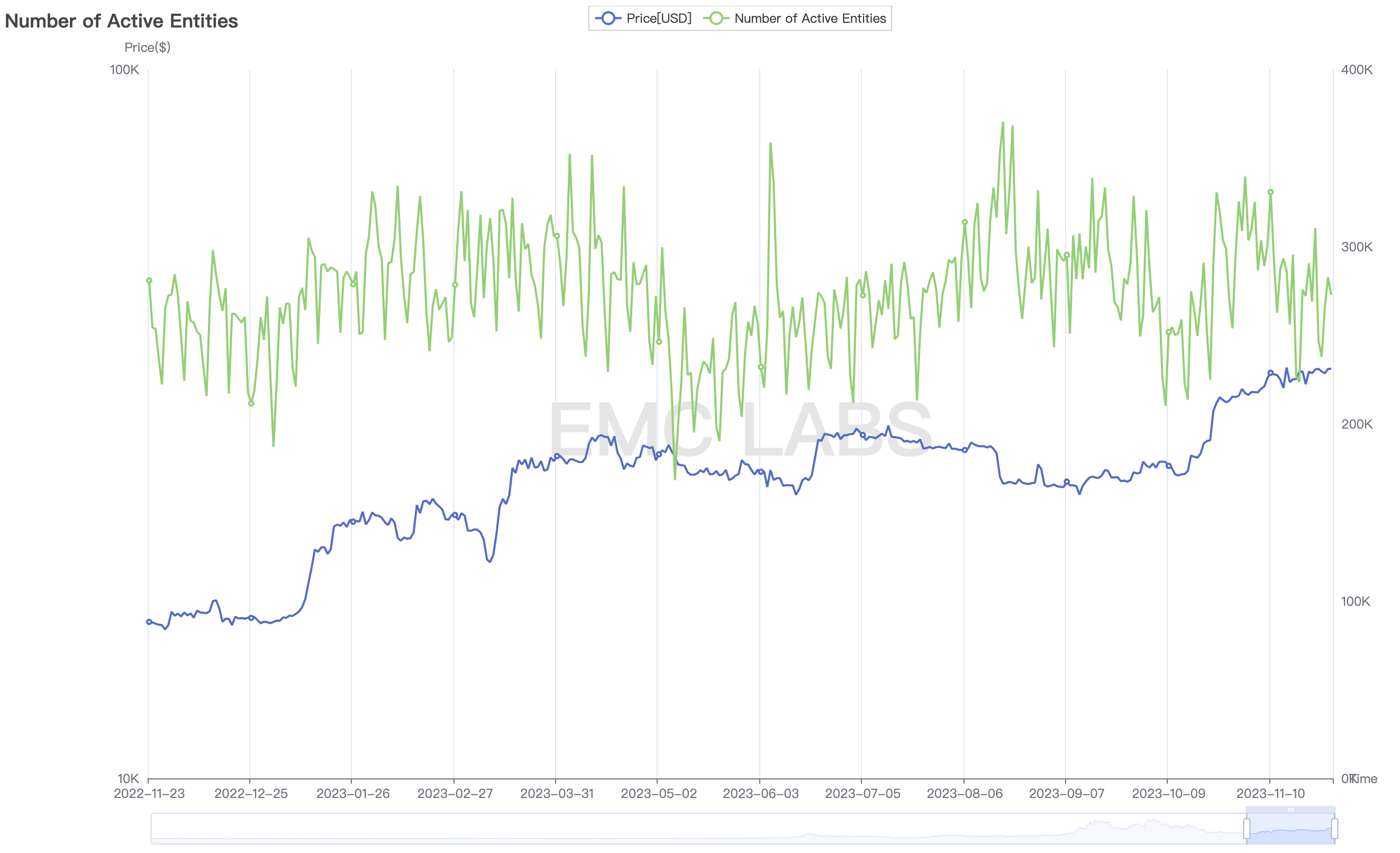

In October, we observed a sharp decline in the number of new addresses, daily active entities, transaction size, and miner revenue. This divergence was effectively fixed in November.

Bit network new address

Bit network active entities

Bit network miner Gas income

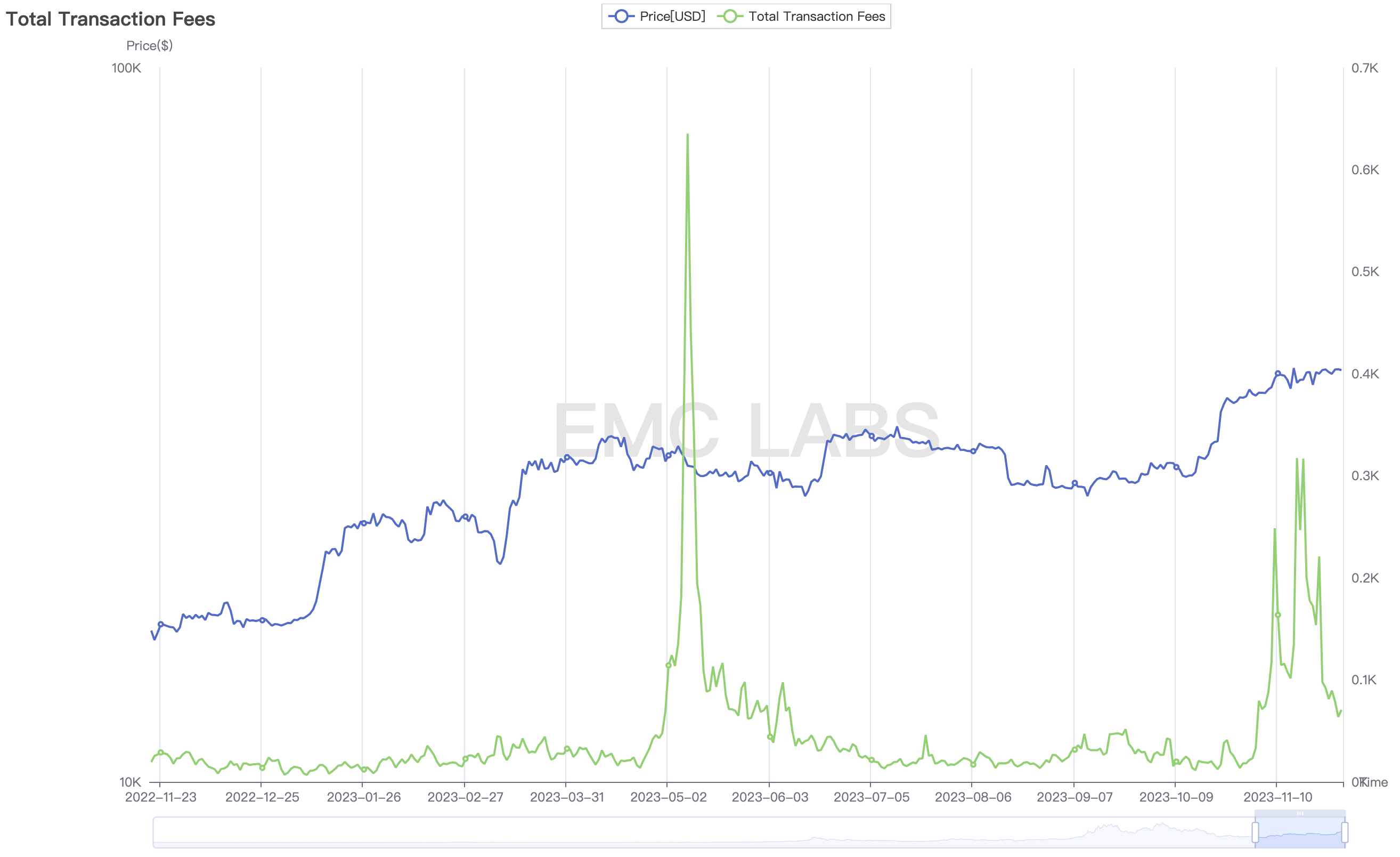

Since the rise of Ordinals assets, especially the BRC-20 MEME token, in April this year, more than 30,000 BTC have entered miners wallets as new consumption type Gas. Whether these tokens will become a new type of asset is still controversial, but the surge in transactions triggered by the two waves of enthusiasm in April and November did pollute the data. Therefore, we should view the on-chain data repair in November objectively.

As the BRC-20 MEME craze cools down quickly, we need to further observe in December the “bullish” trend of on-chain behavior based on accumulation and selling.

About the bull market

According to the Emergence Engine developed by EMC Labs, the current repair period index reaches 100 in nearly a month. Historically, if this time reaches two months, the market will enter a bull market.

The EMC Labs Repair Period Index combines multi-dimensional on-chain data and reflects the internal factors of the market. The external factors, namely capital inflows, are also very optimistic. In October, net inflows were achieved for the first time this year, and the inflow scale in November reached 3.5 times that of October. If the inflow continues to accelerate in December, the inflow time will reach 3 months. Three months is sufficient for judging medium- and long-term trends.

The last month of 2023 is very important, it is a dual focus on the internal and external factors of the crypto asset market. The light blooming from this focus will illuminate the next round of bull market.

This is the conclusion reached by EMC Labs based on objective data from the Specific Heat Network.

The trouble still exists——

For example, the mild recession in the United States has just begun. Is the equity market likely to adjust downward next? It may even affect the inflow of stablecoins?

January 2024 is the last reply time for U.S. BTC ETF applications. If the application is rejected, the crypto market may enter an adjustment.

After Binance, will other exchanges and even public chains and stablecoin issuers be sued and held accountable by the U.S. Department of Justice and SEC?

After the bankruptcy of FTX, asset disposers are selling billions of tokens to the market. Will a large sell-off by a single entity disrupt the rhythm of the market?

In the face of internal and external factors, we should make the most active position preparations; in the face of uncertainty, we should control risks strategically. If so, this uncertainty is no longer important.

We are eagerly looking forward to the arrival of December and are ready to share with you our judgment on the conditions and main track of the bull market in the next monthly newsletter.

Conclusion

November is a big month.

We have benefited from the repair of on-chain data, and are pleased to see the continued upward trend in BTC prices, the small-scale exit of weak-handed groups, and the continuous increase in the floating profit threshold of long- and short-handed groups.

The crypto-asset market ushered in a rock with sky-high fines, USDC ended its divergence, and stablecoin supply inflowed massively throughout the month.

December is an even more important month.

Amid the ambiguity and anxiety, the “internal feelings” and “external responses” of the crypto asset market will approach the point of approximation.

The long recovery period is coming to an end, and the uptrend (bull market) is about to begin!

about Us

EMC Labs (Emergency Lab) was founded in April 2023 by crypto asset investors and data scientists. With Industrial Research and Data Mining as our core competencies, and through an intelligent investment research system, we are committed to becoming the worlds leading crypto asset fund company.

For more information please visit:https://www.emc.fund