10,000-word long article: Crypto-Free Banking in the Bitcoin System

Original author: Eric Yakes

Original compilation: Block unicorn

There are good reasons for Bitcoin-based banks to exist, issuing their own digital cash currencies redeemable for Bitcoin. Bitcoin itself cannot scale to the point where every financial transaction in the world is broadcast to everyone and included in the blockchain. There is a need for a secondary payment system that is lighter and more efficient. Likewise, the time it takes to wait for a Bitcoin transaction to complete is impractical for medium and large purchases.

Bitcoin-based banks will solve these problems. They can function like banks before state-owned monetization. Different banks can have different policies, some more aggressive, some more conservative. Some can be fractional-reserve, while others may be 100% Bitcoin-backed. Interest rates may vary. Cash from some banks may be traded at a discount to cash from other banks. ——Hal Finney

Block unicorn Note: Hal Finney is one of the early supporters and participants of Bitcoin. He is a computer scientist with extensive knowledge and experience in cryptography, cryptocurrency and blockchain technology. Hal Finney was one of Bitcoin’s first transaction recipients and interacted with Bitcoin’s creator, Satoshi Nakamoto. He is very active in the Bitcoin community and has made important contributions to the development and promotion of the technology. Hal Finney passed away in 2014 from ALS (amyotrophic lateral sclerosis). His contributions had a profound impact on the development of Bitcoin and blockchain technology, and his name is often associated with Bitcoin’s early history and development.

The future of Bitcoin is full of uncertainty. We don’t know how well it will scale, how privately it will be used, how it will be stored, or even how it will be used for payments. Beyond the advancement of the protocol and applications, developments in the Bitcoin financial system are likely to have the most significant impact on the value of Bitcoin as an asset, with the range of potential outcomes being very wide. Consider two hypothetical extreme cases: In one scenario, all Bitcoins are held in escrow and receipts are exchanged between users. In another scenario, Bitcoin becomes a self-custodial peer-to-peer asset available to everyone around the world, providing a variety of financial functions.

Both extremes are unrealistic, and when mature, the system will likely end up somewhere in the middle. Many people will pay a custodian to store their Bitcoins, while others will not. Some will use protocols that can be unilaterally exited, while others will trade rights issued by third parties representing the underlying Bitcoin.

What is unique in the emerging Bitcoin financial system is the application of cryptography to basic financial functions. There are novel technologies, being built, and some already theorized, that will enable previously unseen functionality, resilience, and ultimately competition among Bitcoin financial intermediaries. Key to these new technologies are peer-to-peer (P2P) exchange features; Bitcoin financial intermediaries will certainly exist as a business option, but new direct operations and exchanges will also emerge.

I will analyze the possibility of the development of such a system, but will deliberately take a biased view: I assume a basic premise that the greater the possibility of P2P (peer-to-peer), the better. By better I mean I think financial autonomy is a fundamental good worth pursuing; but also better I mean Bitcoin’s overall stability and neutrality. Trustworthy third parties may emerge based on providing convenience, but if they (governments, centralized organizations) dominate P2P opponents, the entire system will be threatened.

This article is an expansion of my previous article Bitcoin Banking, which covered the theory of full backup banking and free banking, and applied these systems to technologies such as the Lightning Network (LN) and federated Chaumian minting. I will extend the analysis above to introduce other emerging technologies and focus on the possible economic characteristics of the mix of outcomes. The best place to start is by discussing trust.

You just have to trust the community

Few species are as cooperative as humans. We work best with our closest relatives because they are most aligned with our genetic interests, which compete to be transmitted to future generations. Evolutionary biologist John Maynard Smith proposed that genes evolve to find a Nash equilibrium when solving strategic problems under competition. This is called an evolutionarily stable strategy, where our genes evolve to influence our behavior, and generally speaking, we favor the most similar copy of our genes.

Within a limited geographical scope, interests among communities tend to be relatively aligned. For example, everyone can agree that they want to be safe. At issue is the approach and at what cost.

Genetic uniformity varies by geographic location, but geographic uniformity, by definition, does not. Across the world, community members have highly aligned interests. Being part of a community brings many benefits.

As individuals gain more from their communities, their risk losses increase. The social risk hypothesis proposes that depression is an adaptive, risk-averse response to the threat of being excluded from social relationships, which will have a critical impact on human survival and reproductive success. Humans are likely hardwired to avoid social rejection.

There is no doubt that people are selfish and their interests are often not aligned with those of the community. No amount of evolutionary theory can stop littering, nor can it stop throwing noisy parties for your own pleasure and disturbing your neighbors’ sleep. However, while these examples may cause some social friction, generally speaking, these things, while causing social discomfort, are not usually considered important enough to risk social ostracism. In contrast, if a community member is caught stealing another persons car, the social consequences can be much more severe.

In the absence of community exclusion costs, moral hazard often arises because the benefits of defecting against a conflict of interest outweigh the benefits of maintaining long-term net positive contributions. Known as the agency problem, conflicts of interest between principles and agents will lead to moral hazard, other things being equal. Community social costs do not solve agency problems, but they do mitigate them.

Additionally, communities have grown with the advent of the Internet. This evolution removes geographic location as a crucial feature of community cohesion while enabling communities with shared interests to form on a global scale. Global online communities are not the result of genetic or geographical uniformity. Rather, they are formed out of shared interests. There is great potential for new technologies and financial arrangements to exist between online communities, which is discussed in detail below.

Where economic agency exists, community trust can mitigate moral hazard. The emergence of the Internet enables new forms of community trust, which in turn can mitigate new economic risks.

community and value

Community trust can be leveraged in a variety of ways. For centuries (perhaps even thousands), informal financial groups have existed as a means of saving and borrowing, whether they were savings and credit societies, village savings and loan societies, savings and credit unions, etc. . Today, informal financial groups are the primary mechanism for saving and borrowing for groups disconnected from formal financial institutions.

Community trust is also leveraged through formal financial institutions. As of 2018, there were 85,000 credit unions with 274 million members worldwide. Before the financial crisis, commercial banks made five times more subprime loans than credit unions, and during the crisis, commercial banks were 2.5 times more likely to fail than credit unions. Their public trust is higher, and small businesses are 80% less dissatisfied with credit unions than big banks.

According to the FDICs 2020 Community Bank Report, community banks are less likely to close, have performed better since the financial crisis, and are the primary source of local businesses, particularly commercial real estate, small business and agricultural lending. Providers of capital, and more prevalent in rural areas, community banks are by their nature local.

With brick-and-mortar banks becoming uneconomical or less accessible in many rural areas, digital solutions are being sought to provide banking services to the unbanked. Bitcoin is an emerging digital currency system with characteristics that can facilitate the establishment and development of informal and formal financial communities. As a monetary asset, Bitcoin is unique in that individuals are able to self-custody, making participation in the banking system an option rather than a necessity.

Furthermore, the fact that Bitcoin is a digitally native currency enables the online-connected global population to voluntarily form financial groups, and Bitcoin’s programmability enables these groups to innovate new trust mechanisms. With the help of this technology, community-based financial groups can be formed without geographical restrictions. By leveraging Bitcoin for transactions and various financial functions, common interests can be realized among geographically dispersed communities.

Bitcoin’s technical properties enable voluntary adoption among geographically widespread communities, and novel organizational forms are emerging with the potential to spawn new financial systems and economic value.

Fedimint is a protocol that integrates four major technologies:

1. Federations: This is a group of individuals with computers who can provide their own storage and processing capabilities to the community. Their computers have the same software, which allows them to transfer information to each other. The federation consists of a group of leaders (called guardians) who generate and control Bitcoins multi-signature addresses and have software capable of communicating with the Fedimint protocol. When users want to join a federation, they leverage the federations storage, processing power, and trustworthiness. This enables them to use any application provided by the guardian. The main application will be Chaumian eCash (defined below), but in theory it could be anything, and probably mainly financial applications. Federation technology has many things to offer users, but its primary value proposition is enabling guardians to faithfully enforce protocols on behalf of users.

2. Multi-sig: Bitcoins are stored in a multi-sig address and are controlled by the federation’s guardians. To send a Bitcoin transaction, the address needs to reach a certain number of signatures. For example, a 3-of-4 multisig has 4 possible keys, but requires at least three keys to send bitcoins.

3. Chaumian eCash: A private representation of value that can be traded as a quasi-bearer note. It utilizes a cryptographic construct called a blind signature: the party issuing eCash (in this case the federation) does not know the identity of the recipient (user) of the eCash, but any third party can identify the signature on the eCash ” from this federation. This enables the federation to issue eCash to users who deposit Bitcoin to the federation’s multi-signature address. Users keep eCash on their device (and back it up to the federation if they lose their device), making it a digital bearer note that relies on trust. The eCash created by the Guardian does not have a public blockchain, it is simply saved in the memory of the users computer, such as a mobile phone, similar to physical cash, and can also be backed up to prevent loss. This eCash scheme provides a payment method that maintains the censorship resistance of underlying Bitcoin while increasing privacy, but it is prone to inflation if an overwhelming majority of Fedimint guardians decide to maliciously and covertly increase the supply.

4. Lightning Network: The Lightning Network (hereinafter referred to as LN) can be ideally used to forward payments between federations through the Lightning Gateway (discussed below). This creates the ability to instantly exchange eCash (cash digital currency) for Bitcoin and has several implications. Importantly, it increases fungibility among various federation-issued eCash, reducing the incentive for many people to join a federation. Increased fungibility among federated eCash and optimization of community trust fundamentally incentivize systemic decentralization.

The combination of these technologies forms a set of rules that users of the Fedimint software must follow, which defines the Fedimint protocol. As an open source protocol that anyone can participate in, the ecosystem includes the following participants:

Users: Individuals with applications capable of running Fedimint, and possibly Bitcoin and the Lightning Network (LN). They send Bitcoin to the federation’s multi-signature address in exchange for eCash. They can send eCash or Lightning between any applications their wallet is connected to, limited only by whether their eCash/Lightning balance is sufficient and whether others accept eCash/Lightning.

Guardians: Individuals selected by the community to build nodes that can communicate with Bitcoin, LN, and Fedimint. They form a federation, manage the hardware, control Bitcoin in multi-signature addresses, and issue eCash. They can also act as a Lightning gateway provider, but this requires specialization (discussed below), so another entity called a Lightning Service Provider (LSP) may perform this function.

Lightning Gateways: Lightning node liquidity provider using Fedimint. Readers can think of this as a Lightning-to-eCash exchange connected to Fedimint, which integrates with Fedimint users as market makers, ready to send Lightning payments and receive Lightning payments for a certain spread. Any federation user can do this, but running well-connected, high-capacity Lightning nodes requires specialization, so this functionality may be provided by extended LSPs. If a user wants to send eCash to another Fedimint user, they send eCash to a gateway, which then forwards the equivalent Lightning Payment to another Fedimint gateway, which then sends the eCash to the recipient. user. eCash cannot leave a Fedimint, it can only be exchanged for Bitcoin or Bitcoin on LN, which can then be received by other Fedimints gateways and converted back to eCash in the new domain. However, users can integrate with multiple federations and exchange eCash among users in those federations.

Modules: Applications within the Fedimint protocol. For users of a specific federation to use a module, that federation needs to support the module. Fedimints will launch three standard modules: Bitcoin, eCash, Lightning Adapter. Examples of potential future modules include smart contract platforms and federated marketplaces. Any federation can choose to support any module. Some federations will have high-performance infrastructure that will support applications that require it (such as exchanges), while other federations will have infrastructure that supports the most basic functionality of sending eCash and Lightning payments. Users can integrate into any number of Fedimints they want to use and select the modules they want.

To summarize, guardians form a federation that users can choose to join by downloading software capable of supporting Bitcoin, Lightning Network, and eCash. The federation a user chooses to integrate with will determine the functionality they have access to. Some federations will be simple community federations with limited default modules to enable payments. Some federations will have high-performance infrastructure that can support more challenging, potentially commercial-scale applications. Users can host funds in their community while connecting to a commercial-scale federation for more business-minded applications. I expect some federations will form within geographic communities, and some commercial-scale federations will form to support large-scale communities across national borders. The system leverages Bitcoin, Lightning Network and eCash technologies to provide a satisfying consumption experience through applications and community hosting.

Fedimint is an innovative solution for basic hosting functions. The traditional banking system has seen little innovation in custodial operations in recent history, at least functionally. As the most basic function of a bank, custody operations have been developed to improve the security measures of digital banking. Federated technology provides a new frontier of innovation for hosting operations. There is significant potential for growth in federal escrow operations to restructure the nature of the organization to better align with stakeholder interests. Centralized financial intermediaries must now compete, not only with self-custody systems, but also with federated systems.

Fedimint combines federated infrastructure with Chaumian eCash, Lightning Network, and potentially further integrated applications to deliver technology that can support a variety of communities, both established and novel.

eCash

Another eCash (which can be understood as electronic cash or digital cash) implementation is the open source project Cashu - a non-federated version of Chaumian eCash. Cashu is similar to fedimint in that it issues eCash (digital cash), but the difference is that it is not a federation of a group of servers, but a single server. While more trust is required without federation, this system does not require a consensus algorithm, resulting in lower transaction latency. Additionally, Cashu only uses LN (Lightning Network) and a federated approach does not yet exist, while fedimint uses both on-chain Bitcoin and LN. Therefore, Cashus use cases and requirements as a protocol may differ from fedimint.

It is worth noting that Calle, the creator of Cashu, proposed a proof-of-debt scheme that is considered likely to be widely implemented in the eCash system. Since ownership of eCash is intentionally blind, auditing the minted eCash supply is inherently challenging. This topic will be discussed in detail later.

Both Fedimint and Cashu are very new, and this discussion is a forward-thinking and theoretical discussion of the potential of this ecosystem. In particular, the integration of LN (Lightning Network) through LSP (Lightning Network Service Provider) may lay the foundation for a native Bitcoin banking system. My first article on this topic covers the academic theory and ends with a practical discussion. The remainder of this article will expand on this perspective by discussing what is possible in this ecosystem.

Cashu is an independent eCash protocol optimized for simplicity and speed. The creators of Cashu have come up with a novel scheme to audit the minted eCash supply while still protecting privacy.

Money role trade-off requires different payment methods

So far we have defined various protocols (such as eCash and LN) that appear to implement different forms of money than Bitcoin. In theory, market participants would converge on a monetary standard. In an ideal world, there would only be one form of currency. However, historically this has never happened, why?

While Im not sure if this is conceptually complementary, in my writings I define three main reasons why multiple forms of currency exist:

1. Information opacity: many different forms of primitive money are used at the same time, because neighboring societies are not economically integrated and know nothing about other forms of money. Awareness is important because it enables individuals to verify the validity of currency. Because people simply don’t understand other societies’ currencies, they can’t verify them and have trouble accepting them for transactions. As society has integrated on a global scale and the Internet has created a global network, the verification problem has been alleviated to a large extent. But its not perfect. Not everyone is connected to the internet. A level of awareness and ease of verification of a form of currency is necessary for widespread adoption.

2. Sovereign Enforcement: Today’s users don’t choose currencies, governments choose them. If currencies were chosen in the market rather than imposed on society for political purposes, the currency chosen would be different from the fiat currencies enforced today. We may well be witnessing the early stages of the decline of this system, but any transition will require an alternative that is practical and decentralized enough to eliminate the possibility of coercion.

3. Trade-offs in the role of money: Different forms of money retain different characteristics that make them more suitable for some forms of trade than others. Therefore, we often see dual currency systems throughout history, such as cattle and salt, or gold and silver. A modern analog could be real estate and the U.S. dollar, where real estate is used to store value and dollars are used for transactions.

As a technological innovation, Bitcoin significantly alleviates these limitations, but some argue that it is not a panacea for all problems. The Bitcoin base layer network alone (before any scaling mechanisms) is capable of storing value very well, but there are two main problems:

1. Transaction throughput: The transaction throughput of the Bitcoin base layer network is not enough to support global payments.

2. Privacy: Bitcoin is not private by default because transactions are recorded on a public ledger. A lot of effort is needed to increase the privacy of Bitcoin transactions.

The Lightning Network was an attempt to solve the problem of transaction throughput, although it brought its own problems. This network is gaining adoption and could become the global payments network needed for Bitcoin payments, or at least be a significant part of such an eventual network. Although sending a transaction with time-locked and fully collateralized Bitcoin over the LN (Lightning Network) is very similar to sending a direct Bitcoin transaction, it does have different characteristics compared to on-chain Bitcoin transactions. Lightning Network is faster but requires channel capacity constraints to receive payments.

It has weaker security since participating in the network requires storing Bitcoins in hot wallets, not to mention that Lightning is newer than Layer 1 Bitcoin and the risk of potentially more complex protocols is unpredictable. To alleviate trust requirements with channel partners, forcing a channel closure delays your ability to receive on-chain Bitcoins. For these reasons alone, one could argue that the economic properties of Lightning payments are fundamentally different from on-chain Bitcoin payments, and if one accepts this argument, one could argue that Lightning is a different monetary medium than Bitcoin.

Although interesting in theory, this may just be a semantic difference. In fact, market participants seem to view Lightning and Bitcoin as interchangeable, which is probably the most important thing.

Likewise, privacy concerns can be addressed in a variety of ways. eCash is one such approach that provides almost perfect privacy but at some cost to auditability. One must trust the issuer of eCash not to spam it (more on this later). However, it does offer the same anonymity and convenience as physical cash, perhaps even to a greater extent because it is in digital form. For similar theoretical reasons, this could also be defined as a different monetary medium - although, again, well see if it has any practical relevance in practice.

It is important to distinguish between medium of exchange and means of payment - as Yang summarizes:

The former (a) refers to a collection of assets (a concept of what) that people regularly use to exchange goods and services in an economy, while the latter (b) is a mechanism that facilitates the transfer of funds from one party to another Method (a concept of how). It suggests that money should be defined solely as a medium of exchange rather than as a means of payment. With this distinction, one can consistently explain why money, demand deposits and smart cards are Money (because they are a medium of exchange), and why checks, money orders, or debit and credit cards are not money (because they are only means of payment and not a medium of exchange).”

Lightning Network and eCash can also be understood as different means of payment rather than different monetary media. One could argue that eCash is a different asset whose value derives from market participants’ demand for its unique characteristics. However, its value is ultimately settled on the Bitcoin blockchain. Whether eCash is considered a separate monetary asset or means of payment will depend on how the system operates as it matures. For example, if it is decentralized reserve, then its value as an asset will depend on the trust in the issuing consortium, whereas if it is a 100% reserve consortium, then its value will depend on the purchasing power of Bitcoin. Similarly, even if the U.S. dollar is partially backed by gold, it is not considered gold, whereas a 100% reserve gold receipt would be considered closely fungible with possession of actual gold (political considerations aside). Since the Lightning Network has a similar economic model to owning Bitcoin, and users and the market seem to view it as such, it can likely be described as a means of payment for Bitcoin.

Theoretical and semantic issues aside, the system described so far would exist at the intersection of three or four protocols: Bitcoin, Lightning Network, Fedimint and/or Cashu. The integration of these protocols allows an economy to have the security of decentralized Bitcoin as a base layer monetary asset, the privacy and transaction throughput of eCash as a medium of exchange, and the unilateral exit of LN (Lightning Network) channels as a means of facilitating this payment Technology.

Various protocols that interact with Bitcoin are forming new means of payment. Whether these protocols eventually become independent media of exchange will become apparent as the systems mature.

Bitcoin native currency market

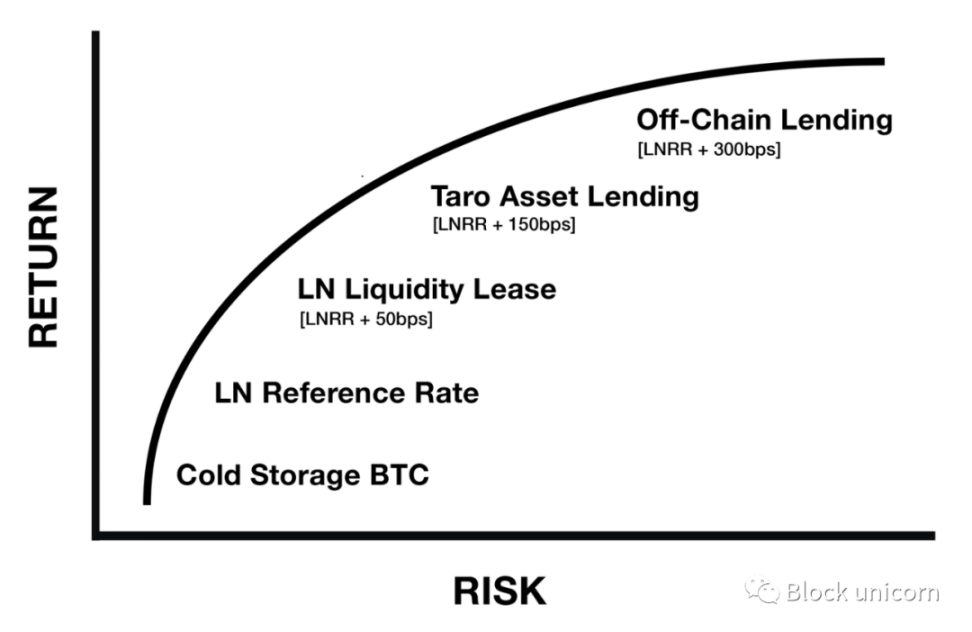

The monetary systems described so far have broad implications for the emergence of digitally native markets. In a previous article, Nik Bhatia argued that the Lightning Network is a Bitcoin-native implementation of risk-free rates. While the base rate is similar to fiat currency systems, the nature of the Lightning Network is fundamentally different in that there is no (economic) counterparty risk in earning yields on Bitcoin through routing fees and liquidity leasing. Bhatia further generalized this theory to the lending risk curve with counterparty risk:

Figure 1 - A new interest rate term structure suitable for the Bitcoin financial system

Through this perspective, we can view the emergence of LN (Lightning Network) node operators as the emergence of decentralized financial service/infrastructure providers native to Bitcoin. This will most likely be a mix of self-hosted and managed services. If the custody provider evolves to offer banking functions, it could be a hybrid of full reserve banking and fractional reserve banking. If LN (Lightning Network) node operators engage in lending business, the market will determine what system ultimately emerges.

What is certain is that a currency market is forming within Bitcoin, in which market participants voluntarily participate to gain economic benefits. In the U.S. financial system, money markets account for approximately one-third of the value of all credit markets.

What is a money market? Broadly speaking, a money market is a market for short-term cash borrowing and lending. Contrast this with capital markets, which are used for long-term lending, equity investments, and derivatives. Both involve contracts, and their contractual nature is what distinguishes them (although again, this distinction is somewhat subjective and we should not get bogged down in semantics). Capital markets include a wider range of assets, across more types of contract terms, and with longer time horizons. Since non-Bitcoin assets have not yet emerged within the Bitcoin ecosystem, capital markets have not yet formed on a large scale. However, through LN (Lightning Network), a currency market is taking shape.

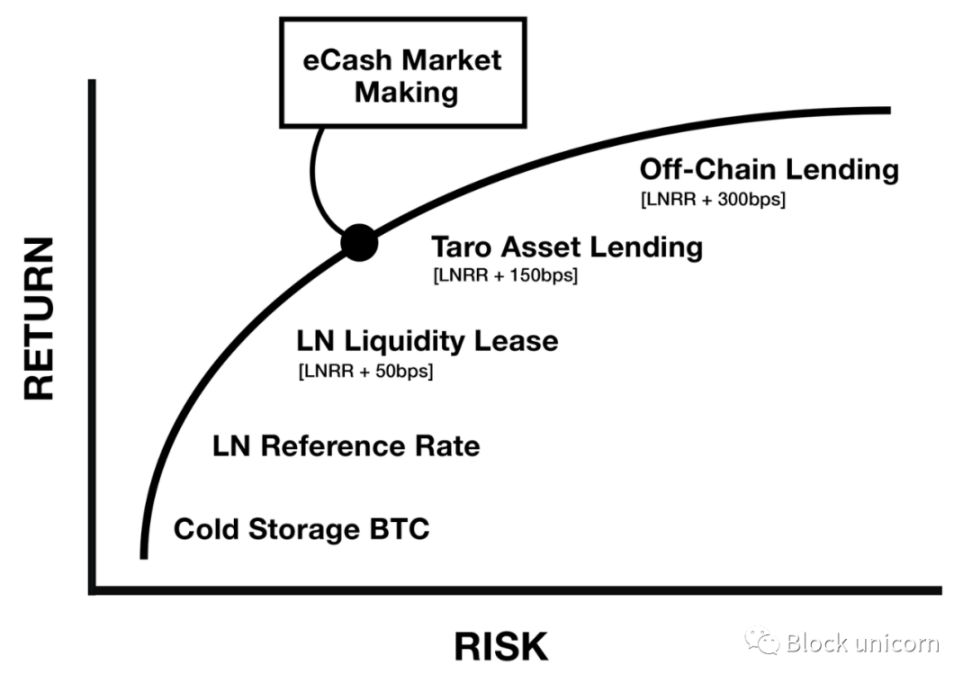

If the consortium to issue eCash emerges at scale, then various markets competing for eCash fungibility with its underlying Bitcoin will also exist. The market will dictate this fungibility, and the main player will be Lightning Gateway. They will be ready to accept eCash and forward a Lightning payment of equal value to the recipient of the transaction. In doing so, they will differentiate between the various eCash issued by the alliance. In return, they will earn the difference on each transaction, forming a currency market. Therefore, the market maker of Lightning to eCash can earn the difference by pricing risk, which we can assume is priced as shown in the risk curve below:

Figure 2 - Market transactions between Lightning Gateway and Federation can be conceived as a new source of economic gain from the term structure of interest rates

In other words, if federated Chaumian eCash finds market fit, the Bitcoin ecosystem will witness the emergence of a new currency market. Markets will be formed for transactions between Bitcoin or the Lightning Network and various forms of eCash issued by the alliance. LSPs (Lightning Service Providers) can act as brokers to earn competitive spreads between eCash and Lightning Market transactions.

Ultimately, the value of these markets will derive from the adoption of the means of exchange they represent. This creates a virtuous cycle of growth. Money markets provide interest rates and attract capital. Investment in these markets increases the utility of the features they support, which should in turn increase adoption of the technology.

Money markets native to Bitcoin are emerging alongside the protocols it supports. Over time, these markets will attract investment and create a virtuous cycle of adoption.

Risks of federated eCash systems

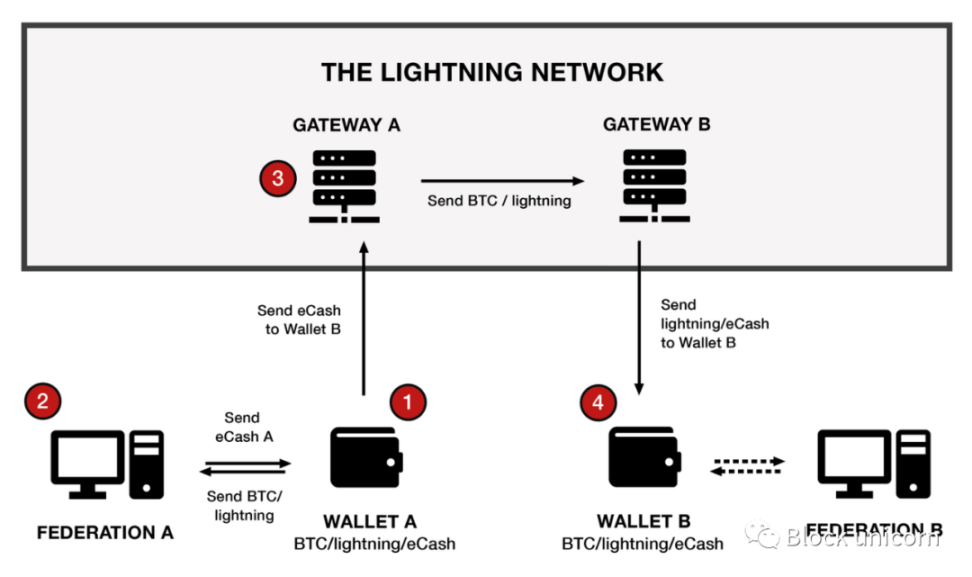

eCash is designed to be exchanged for Lightning or Bitcoin via issuing consortiums, with Lightning gateways being used to forward payments between consortia, theoretically making various forms of eCash interchangeable. The system can be visualized in the following ways:

Figure 3 - Simplified visualization of the interaction between user wallets, federated Chaumian mints, and LN gateways (Chaumian refers to an anonymity and privacy protocol and technology first proposed by David Chaum in 1983 to protect digital transactions privacy.).

1. Wallet A supports Bitcoin, Lightning Network, and Alliance A’s eCash, and it sends Bitcoin to the alliance in its own community.

2. In exchange, the alliance sends eCash to wallet A without knowing the identity of the owner. Any member of Alliance A can easily receive eCash payments from Wallet A. However, if wallet A wants to send a payment to someone in consortium B using eCash, they need to utilize a Lightning gateway.

3. The Lightning Gateway acts as a market maker, ready to send/receive any Bitcoin/Lightning Network/eCash and earn the difference on every transaction. So when Wallet A sends it eCash, the Lightning Gateway will accept it and send the Bitcoin/Lightning to another Lightning Gateway connected to Alliance B where Wallet B is.

4. Wallet B can then accept this amount in Bitcoin or the Lightning Network, or exchange it for Alliance B’s BTC if desired.

Users rely more on professional administrators for their trust needs in the federation to which they belong and are able to conduct private transactions. Self-custody can be complex for the average individual, and since Bitcoin maintains settlement finality, the risk of losing private keys is permanent. Therefore, individuals may translate the risk of trusting a federation of transaction communities into the benefits of reducing the risk of losing Bitcoins and gaining privacy in transactions.

However, users don’t just trust the federation they belong to not to lose or steal Bitcoins. Users also trust the federation not to issue eCash in excess of the Bitcoin they have received. Since there is no cryptographic link between eCash and the Bitcoin received, the federation can unilaterally issue eCash. Privacy benefits also mean that supply is difficult to audit through traditional strategies. This creates a risk of federal devaluation of eCash, so what can prevent this from happening?

If a community trusts the stewards of the federation not to steal their Bitcoin, then they also trust the stewards not to devalue it. Malicious administrators may simply collude to steal Bitcoin rather than devalue eCash. However, managers can also slowly devalue eCash using supposedly trustworthy custody solutions (more on this later). Still, this is a very large cost for a communitys interest, and these incentives do make community hosting a less trustworthy system than third-party hosting.

On the other hand, what if a communitys interest is aligned with devaluing its eCash? In theory, Federation A can convene the community and announce that it will devalue its eCash in exchange for goods and services with Federation B, and distribute the obtained goods equally to community members. The community agrees because they love exchanging something priceless for something valuable. However, if such a system emerges on a large scale, there will likely be some checks and balances in place to reduce such perverse incentives. To understand this, we can look back at history.

There does exist a perverse incentive to devalue eCash (independently), but natural market incentives mitigate this risk.

Bitcoin and Free Banking

Free banking systems, discussed in detail in previous works, can be used as a benchmark for assessing the competitive dynamics of custodial systems. Applying this understanding to a federated eCash system provides a framework for understanding the potential of this technology.

In a free banking system, banks are free to issue banknotes, and the market determines whether those banknotes have value. If a bank issues more banknotes than it reserves, it risks bankruptcy. Applying this risk to a competitive market limits the extent to which banknotes can be issued throughout the system. Through the issuance of banknotes, circulating credit can only expand to a certain extent, otherwise systemic bank runs are inevitable. However, maintaining solvency within the system is not only in the banks’ own interests, but also in the interests of the system’s stakeholders. Rational customers would not use a bank that they suspected was bankrupt because that would effectively mean that as an unsecured creditor to an already bankrupt institution, they would themselves be bankrupt. In practice, however, most customers seem to assume that the bank is solvent, whether this is often or ever accurate.

In free banking systems, information asymmetries are large, which has historically led to bank failures without customers suspecting a problem until it was too late. Therefore, those parties who take the time or naturally gain access to more bank-related information act as gatekeepers of the system. There are three main groups that limit the issuance of banknotes to no more than banks would naturally issue due to their perceived self-interest:

Competitors: Competition among banks limits the amount of banknote expansion that one bank can create over other banks. Through the practice of banknote scrambling, more conservative banks would use their capital to acquire rival banknotes that were suspected of being highly issued and then cash them out in one fell swoop, potentially pushing them into bankruptcy. Competitors can acquire competing institutions at low prices and gain market share through conservative means. This practice was more common in the early days of the banking system and decreased as the system matured and clearing houses (discussed later) emerged.

Brokers: Those groups with access to more bank-specific information will speculate on the banks solvency and profit from arbitrage trades. They would make a profit by purchasing notes that were not widely accepted at a discount and cashing them in at the issuing bank for their full convertible value in gold. They are able to do this because they take the time to obtain specific information about the bank they intend to broker. This practice broadens the acceptance of banknotes, imposes limits on the risks banks can take, and increases information transparency in the system. These broker categories were more common in the early days of the system. Clearinghouses will provide similar functionality once the system reaches maturity.

Clearing Houses: As the system matures, clearing houses emerge to facilitate the functionality of brokers and increase the transparency of information in the system. This constant gross encashment of banknotes is complex and operationally intensive, so banks need a way to net their reimbursements, ultimately easing the system by settling their liabilities in one place (or at least fewer places) operational burden. This led to the establishment of clearing houses, where all banks would settle their liabilities among themselves and only the net balance in their accounts. Centralized settlement of debt places clearing houses at the center of the system, and they often develop additional functions such as: credit monitoring, facilitating protocols for reserve ratios, interest rates, exchange rates and fee schedules, and assisting banks in times of crisis (borrowing or acquisition intermediary). Membership in the clearing house is based on reputation, and only institutions that meet certain criteria can join the club. This is important because trust is inherent in the system and reputation is critical to maintaining trust.

With this in mind, let’s return to the issue raised earlier: federations may have an incentive to devalue their electronic cash and trade it with another federation’s valuable goods and services. In short, this is a classic tragedy of the commons. The commons is trust, that is, whether the electronic cash of one federation is interchangeable with the electronic cash of another federation. On its own, this incentive would appear to be a fatal threat to the success of the system, but when taking into account the emerging parties and the checks and balances they impose on the system, natural market dynamics may exist to mitigate this risk. Several participants in the federal electronic cash system like Fedimint can provide these capabilities:

Federation: Most federations exist just for hosting and payments, but some exist to provide commercial-scale functionality. We can imagine a city where we cant each have our own way. The trusteeship will eventually develop into community streets, city roads and highways. Fedimint (and LN Gateway) provide the architecture and functionality to extend hosting into a set of street and highway networks. Individual federations will compete to build trust in the broader ecosystem. For streets it will be a community level trust, while for highways it will be a more system level trust and the reputation of the large scale federation will be critical to its success.

Lightning Gateway: For a Lightning gateway to integrate and forward payments from a federation, it must hold the federations eCash balance, that is, accept eCash and forward Bitcoin to another federation via Lightning. This will not be an indiscriminate process. The gateway will act as a market maker for each federation only if it trusts and has the possibility to verify the solvency of that federation. If a gateway notices that eCash balances are increasing, while on-chain data shows that Bitcoin balances remain relatively stable, they may become concerned. Terminating their services could be fatal to the federations trading utility. Therefore, the federation will only cooperate with it if the gateway feels comfortable holding eCash, and the lightning gateway will monitor the fungibility between the eCash issued by the various federations in its own interest.

eCash Brokers: There will likely be a class of brokers that function similarly to Lightning Gateways, but instead of forwarding Lightning payments, they will only exchange Federation As eCash with Federation Bs eCash. By acting as a direct market maker, they will replace the Lightning Network with a centralized account-based ledger of transaction throughput. Brokers will constantly monitor and determine which eCash they want to hold balances on, and which they want to avoid or purchase at a discount. This market-making activity would provide another check on the fungibility of eCash and prevent the federation from devaluing its eCash value at will.

Proof of Reserves: Companies building technology that monitors agency reserves could also play a key role, effectively serving as the federal credit regulator. Their presence can provide some form of validation, albeit not a perfect one. They can certainly monitor multi-signature addresses (assets) on the chain, but liabilities will be more challenging. The federation does not know who owns the eCash it issues, but it does know how much it issues. A federation may provide third-party credit regulator access and details of its issuance and redemption history that are sufficient to provide sufficient information to assume full reserves or strong solvency (as discussed below). Therefore, credit regulation and the reputation of large-scale federation are crucial to gain integration throughout the ecosystem. However, this does not eliminate the risk that a federation is issuing out-of-band liabilities, which would require third-party audits. For this reason, reserve certification companies are likely to work with or provide services from audit firms to add assurance against this risk. Web-of-Stakes (33) is an emerging concept of the Civ Kit protocol that can mitigate this risk in specific applications.

Solvency speculators: A class of risk takers similar to hedge funds may emerge who place bets on the solvency of various eCash notes. This would only exist in commercial organizations where funds could perform redemption attacks and hope to make a profit. This would be akin to a note duel between rivals, in which the fund would not benefit from gaining market share of the rival but would instead profit from a short position in the value of the federation. This category is likely to be the last to emerge, as its existence will depend on the establishment of mature liquid capital markets within the system.

Importantly, the digital nature of the system will allow participants to profit from currency devaluation quickly and cheaply. By eliminating the possibility of devaluation as a long-term business model, or even of being unprofitable in the short term, participants in the system are incentivized to behave in a prudent manner. Never in history has there been a financial system with such incentives.

If such a system emerges at scale, we will likely see the integration of these capabilities among various service providers. I foresee that LSPs could not only act as Lightning gateways but also adopt eCash brokerage services and potentially acquire or leverage credential companies and protocols. Just as brokerage and credit monitoring functions were integrated into clearinghouses in traditional free banking systems, I also expect the integration of these functions to occur in community eCash systems. However, all of this assumes that such a system can actually emerge at scale, which will undoubtedly take a long time or not happen at all. Fortunately, technological solutions have the potential to emerge in the short term and mitigate the risk of eCash devaluation.

The incentives of the free market align the interests of agents and consumers where there is already trust. This alignment of interests increases as the system matures, as the value of the system attracts participation from market participants.

eCash Mint’s Proof of Debt Solution

The joint custody system reduces the risk of custodians misappropriating user funds to a certain extent. It also reduces the risk of mints reducing the supply of electronic cash. Free market systems further reduce the incentive to reduce the value of electronic cash, but for a free market system to operate most efficiently, information needs to be as transparent as possible. Methods to improve the transparency of information about outstanding electronic cash minted by electronic cash minting institutions are critical to efficient markets. The more transparent a mints information is, the more auditable it will be. But this also comes with a trade-off, in that greater auditability may reduce the privacy of electronic cash, which is its purpose.

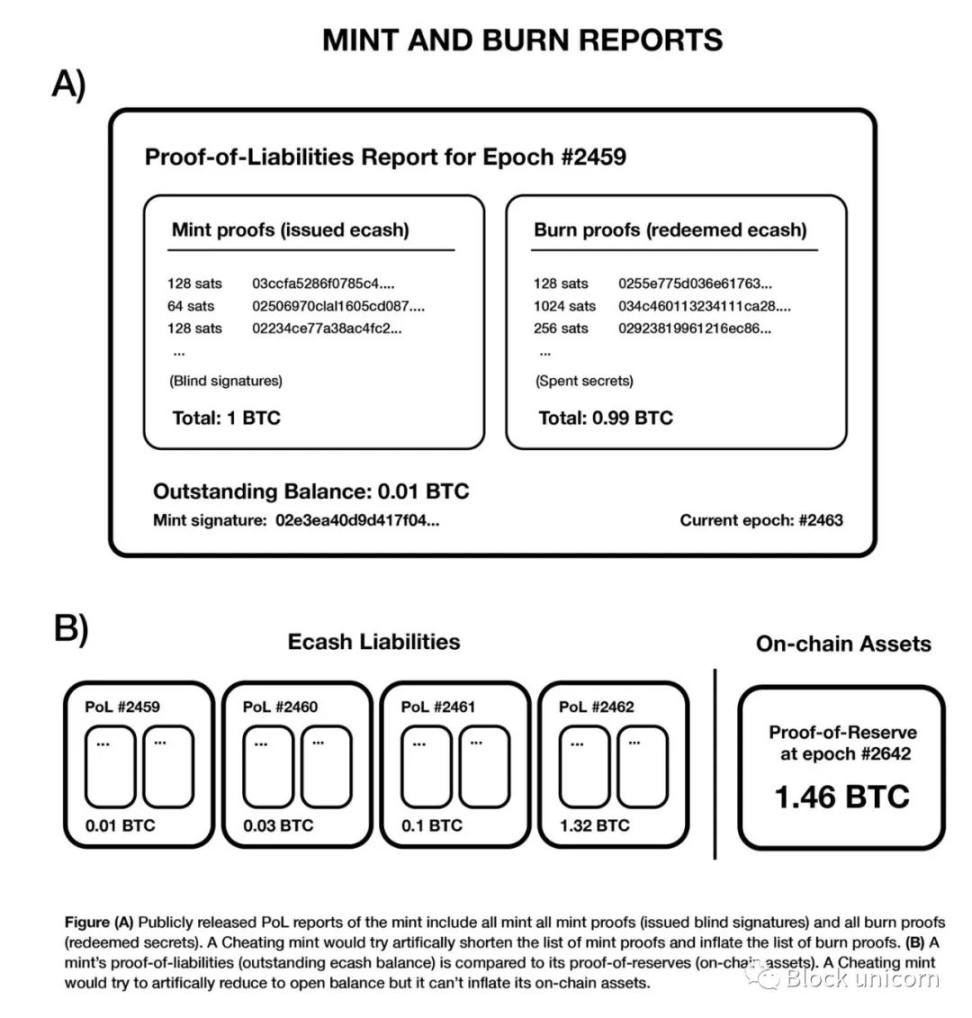

Calle, the developer of the Cashu protocol, has proposed a proof-of-liability (“PoL”) scheme for electronic cash minting institutions that aims to increase the transparency of the issuance of electronic cash supplies without reducing the privacy advantages of electronic cash in most cases. This can be achieved by enabling auditability at the system level while allowing participants to maintain privacy at the individual level. The system requires three main voluntary actions by the Mint:

1. In order to publicly commit to regularly changing its electronic cash private key within a predetermined period of time (a period of time). This allows all electronic cash in circulation to cycle from an old period of time to the current period of time.

2. Generate a publicly auditable list of all issued electronic cash tokens in the form of proofs of mint.

3. Generate a publicly auditable list of all redeemed electronic cash tokens in the form of a certificate of destruction.

The maintenance system of these attributes can enable users of electronic cash issuers to verifiably detect whether the issuer has issued unsupported electronic cash in the past period. This effectively sets an expiration date on the user’s electronic cash, forcing users to refresh their electronic cash to a more recent period. The expiration of e-cash forces users (through automation in their wallet software) to engage in behavior that ultimately forces issuers to report past e-cash issuances and redemptions. This is somewhat similar to simulating the risk of periodic runs on an electronic cash issuer. In Calles words:

“In short, constantly changing periods is like simulating the risk of a periodic run, allowing users to look at previous periods and check whether the issuer has made any tampering in past reports.” (37)

Remember, the goal of this scheme is to best ensure that an issuer’s assets (Bitcoin/LN) are greater than or equal to its liabilities (e-cash). The expiry date of e-cash forces a refresh of all user e-cash in each time period. So if an issuer keeps track of all the e-cash it has issued, all the e-cash that has been destroyed, and is forced to refresh the amount of outstanding e-cash every month, then users can publicly verify the amount of e-cash that existed during that time. Data on the total supply of cash. This scheme can look like this:

Figure 4 - A proof-of-debt scheme used to increase the transparency of eCash issuance without generally reducing the privacy benefits of eCash. Calle

An issuer can attempt two types of spoofing and may be detected in each method:

1. Reduce the total amount of eCash issued by issuing as few blind signatures as possible. Users can detect this when looking at publicly released blind signature reports and find that their own eCash blind signatures are not included. Even a single user can reveal that an issuer is falsely reporting its eCash issuance. However, it is important to note that by revealing the issuing institution, users must give up the privacy guarantees of their eCash. However, LNs privacy is still strong, and even if its not this system, its still far superior to account-based ledger systems.

2. Increase its total redemption amount by creating false proofs of destruction. Issuers can create a wallet, spend unsupported eCash, and then report it. However, if a user can provide a set of tokens whose total value exceeds the reported outstanding balance, they can prove that the issuer is deceiving. This method is not perfect, and the issuer can still escape devaluation in the short term, but in the long term, a deceptive issuer is probability bound to be discovered.

Indeed, as with any eCash devaluation audit, there is no certainty that a fraudulent issuer will be immediately caught. But what is certain is that the probability of catching a fraudulent issuer will increase over time, and this is a major innovation. Rational issuers may avoid devaluation because they know the business model is unsustainable without getting caught and risking a run. Digital bill showdowns (described earlier) will further exacerbate this phenomenon. Simply being aware of this risk may serve as a deterrent mechanism to prevent eCash from devaluing.

However, this system requires voluntary action by issuers and voluntary requests from users for issuers to participate in compliance with these standards. Wallets need to adopt the necessary technology to implement such a best practice. Given the need for users to lower their privacy to reveal fraudulent issuers, I expect the emergence of profit-motivated consumer protection services that build wallets and constantly check issuers for any malicious or negligent behavior and proactively report it. Consumer protection agencies will be able to accept the cost of reduced privacy in order to verify the issuance of eCash by the issuer. Rather than issuer participants leveraging technology to bear the burden of checking for devaluation, a centralized provider can save the financial outlay of this function and provide standard approval of good issuers. For example, reserve proof companies like Hoseki could evolve to provide this functionality. Similarly, if we think of issuing establishments as restaurants, there will be Michelin star reviewers who are constantly eating at these restaurants without knowing it, deciding whether they receive a Michelin star or are complained about poor quality.

Cryptozoology and clever incentive schemes are removing trust from fundamental economic agency problems.

Decentralized systems prevent government intervention

Will such a system eventually be centralized and controlled by the government, like all banking systems throughout history? I think this is unlikely. If a community hosting model emerges, it will likely be highly decentralized at the system level. If there are 1 billion users and an average of 100 members per federation, that would equal 10 million communities distributed around the world. Additionally, commercial-scale federations can also exist, for example, as 70 out of 100 multisigs with signers distributed geographically around the world. Since any participant can join any federation in the world, competition between federations will be fierce among the most trustworthy federations. Not only will there be natural fragmentation for cultural, technological, and geographical reasons, but there will also be fragmentation due to high levels of competition. Still, until a system reaches this scale or this dynamic is established, there is a risk of government regulation.

The political ramifications of clearinghouses and the sustainability of self-custody at scale are critical to a permissionless financial system native to Bitcoin. Being able to actually operate Bitcoin while keeping it self-custody is the main difference between the Bitcoin Standard system and the Gold Standard system. Gold was not a valid means of payment, so custodial services and paper currency became necessary, paving the way for decentralized reserve banking and ultimately political control of reserves and their eventual removal. Bitcoin is different. As more and more tools provide individuals with the opportunity to operate in a self-custodial manner, it will be possible for individuals to conduct economic activities without entrusting their Bitcoin to a custody provider. It seems that this unique property of Bitcoin will ultimately prevent the emergence of similar central bank and fiat currency systems.

Finally, the Fedimint protocol has been designed to accommodate a specific regulatory niche, where guardians oversee assets for the benefit of friends, family, and community, with no profit motive. If a federation meets these characteristics, it is exempt from financial regulations in many modern jurisdictions, but not in all jurisdictions. Of course, regulations can change. In the system described so far, commercial-grade federations may run the risk of regulatory enforcement depending on the jurisdiction. Therefore, where the federation exists and the functions it performs will materially affect the financial applications it provides and the scale at which these applications are provided. One positive aspect of this situation is that regulations are likely to have a decentralizing effect across federations.

Federation is a crypto- and economic-based innovation that fundamentally incentivizes the decentralization of custody, and decentralized systems are critical to preventing political control.

free market potential

The system described so far assumes that in the future, eCash will become sufficiently interchangeable to allow widespread adoption as a monetary asset within the federated system. Why is this happening when Bitcoin and Lightning themselves have solved so many problems? I believe eCash is valuable to the Bitcoin ecosystem for three main reasons:

Privacy: The Lightning Network improves Bitcoin’s privacy, but eCash offers almost optimal privacy. Like todays U.S. dollar cash systems, eCash could provide true digital cash privacy. Of course, physical systems can be exploited by printing the private key on paper and then verifying the amount via a QR code. Opendime is an example of this, it can be traded like cash. In terms of the privacy it actually provides, eCash is arguably superior to this physical system because it maintains the optionality of digital payments.

Settlement finality: eCash is typically stored on the user’s mobile device and can be backed up to the federation via sharding. The process of sharding is to split the eCash mnemonic into fragments and send them to the federations managers for storage, so that in the event of loss, the managers can put the fragments together and return them to the user. However, this may not prevent the thief from stealing the asset if he spent the eCash before performing the backup process with the administrator.

Capacity Limitations: The Lightning Network is limited by capacity requirements, which encourages a certain degree of centralization within the network. eCash does not have this feature. If the Lightning Network continues to suffer from inbound capacity limitations, eCash could become a viable payment alternative.

Are these advantages strong enough to justify the potential risk of inflation, or enough to gain market adoption? Maybe not. An important factor to consider is that this system competes far less with self-hosting than it does with centralized third-party hosting operations and their associated consumer applications, which are generally easier to use. Centralized systems not only present greater moral hazard, but also risk inflation. 2022 is the year when the world realizes that assets that exist on exchanges and are said to be owned by depositors don’t actually exist. This is known as paper Bitcoin and can be understood as these exchanges actually reducing the supply through accounting ledgers that are not fully backed by Bitcoin, as long as these balances are considered real. Regardless, the real Bitcoin supply is not affected. If a centralized ledger is trusted for escrow, there is always a risk of paper Bitcoin and inflation there. So the question is: would you rather have inflationary incentives exist in a relatively more decentralized global community model with strong disincentives, or in major centralized exchanges? Are there strong moral hazard incentives on these exchanges?

Still, will the market voluntarily adopt eCash, or are Bitcoin and Lightning good enough? Again, maybe not. Please consider that LN (Lightning Network) is an essential component of the federated eCash system. Using eCash is optional. In theory, you could host it in a consortium and then only trade on the Lightning Network. A consortium can also be an LSP (Lightning Service Provider), who can issue eCash and immediately convert it to the Lightning Network for users to use, or not issue eCash at all. Protocols like fedimint may be a natural fit for the community-based LSP model. However, this may lead to a more centralized system, as capacity constraints and financial regulations limit the ability of consortiums to grow in smaller communities. If such a system emerges, it could lead to a similar level of centralization as today’s escrow operators. Whats important is that the market interprets all of these considerations (and hopefully more that I dont yet understand).

eCash is more private and unrestricted than Bitcoin and LN (Lightning Network). Additionally, eCash offers stronger collateral protection than third-party escrow providers.

Free Banking vs 100% Reserve System

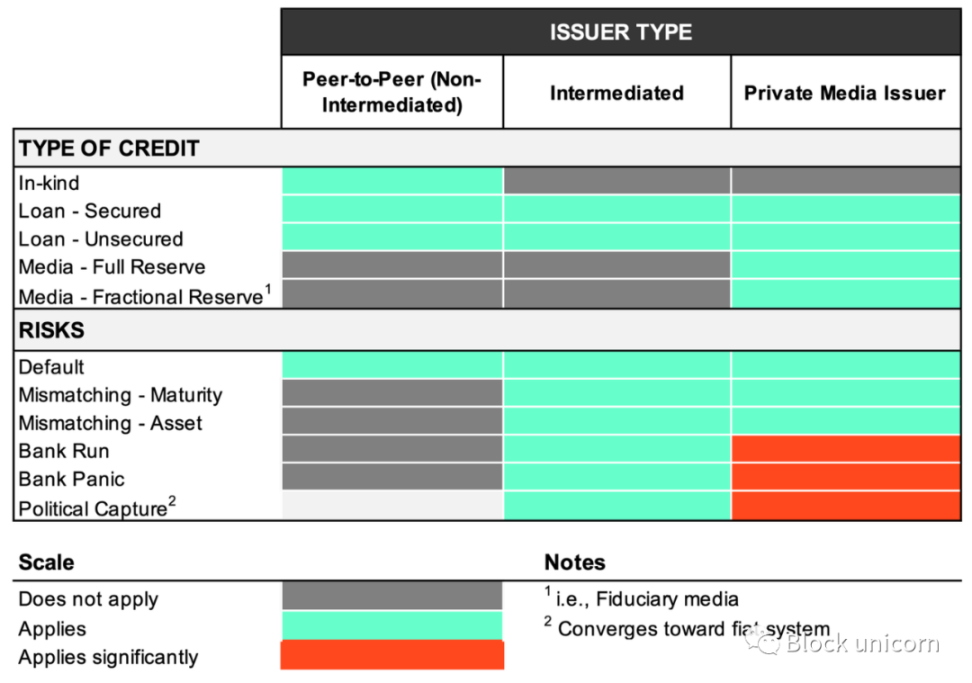

One systemic consideration worth exploring is whether eCash might exist as a fully funded or partially funded system, and what would that look like? Consider the following table, which represents each type of credit and its associated risks:

Illustrative classification descriptions of credit types, major issuers, and associated risks

The vertical columns show the three main categories of credit issuers: peer-to-peer (P2P), intermediaries, and intermediaries that also issue a form of private intermediation. These three types of issuers can also issue various types of credit and, given the type of credit they are issuing, also maintain various risks. We can see that issuer type limits the ability to issue certain types of credit and thus limits the level of risk associated with the issuer:

1. P2P (Peer-to-Peer): Credit issued in the P2P economy is subject to maximum restrictions. Individuals can extend in-kind credit without providing a formal loan—providing a service and deferring payment to a future date. This could be receiving a beer from your local pub and paying for it the next week, or extending the payment term from your accounts receivable contract from 30 days to 60 days. Peer-to-peer loans can also be offered with or without guarantees. While private credit and loan issuance in the P2P economy will certainly exist on a large scale, lending also requires specialization and economicization of intermediaries. Therefore, some form of intermediary will exist to provide loans. In all of these forms of credit, the issuer is exposed to default risk.

2. Intermediary: Credit issued by accepting deposits and making loans. The key difference in this column is that these intermediaries offer loans directly in Bitcoin (or via the Lightning Network) rather than issuing their own media or payment methods (such as eCash). These intermediaries accept deposits in connection with the conditions of their contracts. If these are term deposits, then there is no bank run risk because the depositor cannot withdraw until the contractual term is at least satisfied. However, if they are demand deposits, which can be withdrawn by the depositor at any time, there is a risk that the term of the deposit does not match the term of the loan. Whenever deposit maturities do not match, there is a risk that intermediaries may experience run risk. Even fully prepared institutions without deposit maturity mismatches can go bankrupt due to borrower defaults that result in bad interest rates exceeding total interest rates. Furthermore, intermediary systems are more susceptible to political control because they are institutions subject to the laws of various jurisdictions.

3. Private Media Issuers: If an intermediary issues their own private media (e.g. eCash), then they will offer loans in their own specific form of media, which is backed by Bitcoin. Intermediaries issuing private media run the risk of managing fractional reserves. They can also be a full institution, backing their private medium 1:1 with Bitcoin. If fully funded, the risk of a run risk is similar to that of an intermediary that does not issue media, but if partially funded, the risk of a run is much greater. Furthermore, as history shows us, partially funded institutions are more likely to fail, creating a conducive environment for regulatory encroachment. As the encroachment of regulators increases, there is a greater risk that the entire system will eventually become a fiat currency system.

These systems are all likely to appear in the Bitcoin ecosystem. If we apply this framework directly to the system of joint eCash issuers, we will find that the risk of partial reserve institutions is possible if the scale increases. But this is a much more dangerous situation. The efficiencies created by the digital and encrypted nature of the system will make fractional provision a dangerous and unsustainable business model. Furthermore, the base supply of Bitcoin is not influenced by a central authority, so credit issuance cannot be systematically manipulated. Considering these two characteristics of Bitcoin’s native financial system, the issuance of partially-backed credit will be limited by local practices and can only be sustainable in the short term. The fractional provision system is by no means the only way to achieve credit. For the reasons discussed previously, the technical capabilities provided by Bitcoin, Lightning Network, eCash, and the consortium constitute a powerful toolkit for building systems toward a fully reserve standard, with strong incentives to move toward peer-to-peer credit. Get closer.

However, the emergence of a full reserve standard (100% reserves) is not guaranteed, and certain incentives may lead to the creation of a partial reserve agency: tax power. Defined as the difference between the cost of issuing currency and its market value, tax power creates an incentive mechanism that encourages intermediaries to issue more private media on looser terms to increase their economic profits. Although many aspects of a free banking system limit the extent to which taxing rights can reasonably be withdrawn, it does not eliminate the incentive to at least try to tax them.

However, the credit system can be implemented without a partial provisioning system. The ability to exit the system and conduct peer-to-peer operations on Bitcoin and the Lightning Network will be the main deterrent to an unsustainable fractional reserve regime. As peer-to-peer self-sustaining economies continue to take shape in competition with custodial financial systems, it will become more challenging to operate fractional-reserve institutions under highly competitive conditions. Competition with peer-to-peer systems is just one of the hindering factors, and in addition to the other factors described previously, it remains to be seen which technologies will ultimately best incentivize peer-to-peer or fully prepared systems to become the standard.

Topically, the world witnessed in 2023 how coordinated and rapid withdrawal risks occur in the online economy. Information travels at the speed of light, and consensus can quickly form about an institutions financial health. Mobile banking makes withdrawing money easier and significantly faster. Bitcoin is a permissionless asset that can be transferred instantly via the Lightning Network. The information transparency achieved through the internet, mobile technology, the ability to unilaterally withdraw from an agreement, and Bitcoin may significantly increase the risk of insolvency of a fractional reserve system on such a short time horizon that operating such an institution becomes practically impossible It is impossible to take risks.

Returning to the concept of community trust, the advent of the Internet has redefined communities to exist not just at a geographical or genetic level, but also at a global level defined by shared interests. Bitcoin also enables online communities. Communities are groups of individuals organized around common interests, and for people to organize, they must have the ability to conduct transactions. Bitcoin has enabled online communities to organize, transact, and form communities without permission. We do not yet fully understand the full extent of this organization and potential.

Put aside the Fedimint protocol and consider the technology to be just a federated hosting model in some form. This model requires trust, and the ease of application at the local level increases the potential for the system to remain decentralized. However, it can also create security in a distributed online format. Various communities around the world can use this technology to bypass geographical barriers and form communities in a more secure and less trust-dependent manner.

Incentives arise for the native free banking system in Bitcoin, and technological advances are expected to prevent fractional reserve banking from becoming a sustainable business practice.

Innovative Technology

How to further develop the technology to make this theoretical system possible is discussed. So far, we have discussed technologies such as Lightning Network (LN), federations, and eCash. The combination of these technologies has sufficient characteristics to enable the incubation of a digitally native financial system, but the system is not complete and could benefit from further developed technologies.

One of the technologies, which is still in the theoretical stage, could solve some of the problems in proposed federations, Lightning Network (LN) and eCash systems:

1. Fedimints do not offer unilateral exit options (but Lightning Channels do).

2. The Lightning Network is structurally conducive to centralization.

3. Both the United Mint and the Lightning Network are limited by block space and transaction fees when attracting users to join.

ARK protocol

Ark is an innovative protocol designed to solve some problems. The technical mechanics will not be explained in detail here, but the focus will be on the goals of the project, as the protocol is still in the conceptual stage. Ark is a unique protocol that brings together a variety of other technologies. Similar to CoinJoin, Ark is a coin mixing service. Similar to channel factories, Ark is an onboarding mechanism that reduces the on-chain footprint. Just like LN has Local Service Providers (LSPs), Ark will have Ark Service Providers (ASPs).

Roughly speaking, individuals can connect to the ASP, allowing users to enter the system in batches, thus reducing their on-chain footprint. This is done by locking the Bitcoin to a 2-2 multi-signature address with the ASP, and then receiving a pre-signed transaction from the ASP, providing one of the two signatures required to send the Bitcoin back to the user himself. Through pre-signed transactions called VTXO (Virtual Unspent Transaction Output), users of ASP can exchange these transactions with each other for payment. With this onboarding method, users can hold their Bitcoins within the ASP and maintain a unilateral exit in the event of inadvertent or malicious behavior. This is a solution to the network access problem and also provides a trustless hosting solution. These characteristics make Ark a potential protocol that can further improve the consortium, Lightning Network and eCash systems.

As a practical example, an ASP might be an ideal service provider for purchasing Bitcoin through trustless cost-levelling. Imagine thousands of individuals purchasing Bitcoin simultaneously around the world, on the same schedule, all working together in the same multi-signature transaction.

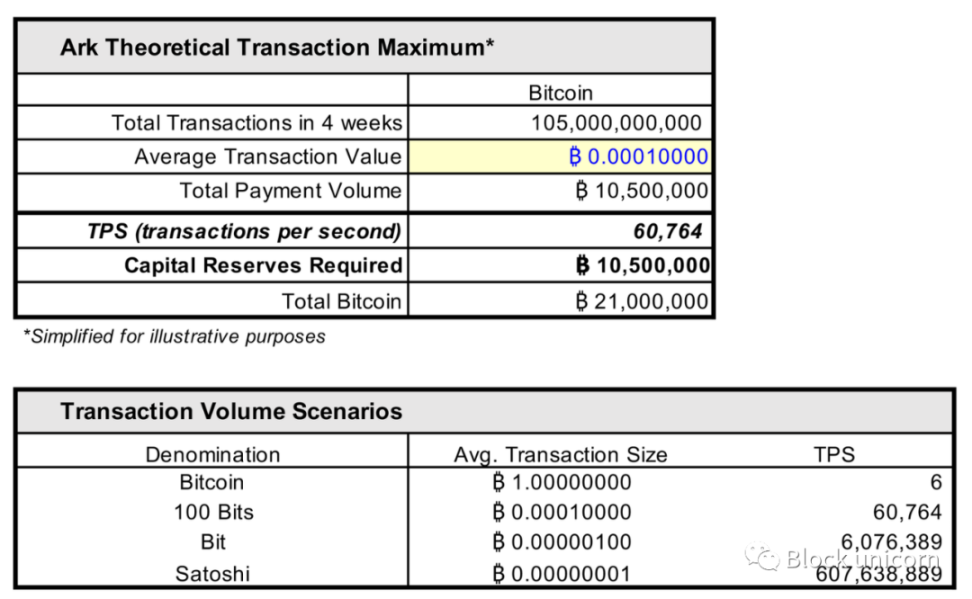

How ASPs will be used for payments is uncertain, as they require large capital reserves to support payments. The maximum amount of potential payments cannot exceed 10.5 million Bitcoins, as all payment volumes through the ASP require an equal amount of reserves within 4 weeks. Since there are only 21 million Bitcoins in total, at most only half of them can be used for payments, as the other half must be kept as reserves to make these payments. It will ultimately be determined by the amount of value represented by 10.5 million Bitcoins to determine the total transaction capacity of the network. The following table expresses the simplified theoretical transaction throughput of the network and various scenarios depending on the average size of transactions:

An exemplary Ark trading (VTXO) economic model. This simplified model does not take into account the total capital reserves within the system and the costs associated with the trading mechanism.

Achieving transactions per second (TPS) comparable to the Visa network (~60,000 transactions per second) is theoretically possible if the average transaction size is 100 bits. However, this may be an inappropriate comparison. If an ASP is primarily used for deposits and custody, similar to a bank, then the appropriate payment network comparison would be to a bank settlement network. From this perspective, ASPs ability to facilitate payments may be far superior to existing banking infrastructure.

Comparisons aside, the most interesting thing about VTXOs as a means of payment is that as Bitcoin continues to increase in value, they become more capital efficient. There is some global average payment size, which is fixed, and the value of Bitcoin is expected to increase significantly (and likely continue to increase in value). As Bitcoin represents more value in the world, VTXO’s potential as a global payments layer will increase. In other words, as the Bitcoin network represents more value globally, the required capital reserve cap (10.5 million Bitcoins) represents more value, while the average transaction size becomes a smaller fraction of it.

Fundamentally, a key point here is that the payments network of tomorrow may not be the payment network of tomorrow. The payment protocols that make the most sense today may not make as much sense as payment costs falling in proportion to the systems capital constraints.

Nonetheless, the reality of this system will be much more complex than this theoretical discussion, with existing protocols offering different and potentially superior payment capabilities. The Lightning Network can provide transaction throughput with lower capital costs. eCash is an ideal medium for low-value high-frequency transactions, but requires trust, while the Lightning Network is equally valuable but less private and subject to liquidity constraints. All these protocols have valuable properties that are reflected in potentially optimized federated service providers using eCash, LN and Ark.

From the perspective discussed so far, Ark cannot be implemented without CTV, TXHASH or elemental opcode soft forks, and the risks of the protocol need to be reviewed. As discussed earlier, the capital efficiency of payments (and therefore the cost of capital) is an important consideration and may be the main driver for the adoption of this protocol. There are other attack vectors to consider, such as Denial of Service (DOS) attacks:

Attacks against users: Exiting ASP is voluntary, but entering ASP is not. While ASPs provide users with a unilateral right to opt out, they also have the right to deny access or ongoing participation to users because they do not have to provide users with access or exchange payments on their behalf. Similar to a bank, users must trust that they will have access. If such a system achieved critical mass, there might be a blacklist for participation. It is important to note that this risk is common to all service providers and the development of P2P systems is the solution. Federated infrastructure could be a potential solution to DOS attacks on users, which is another argument for multi-protocol service provider optimization.

Attacks against ASPs: A DOS attack is possible against an ASP by conducting arbitrary transactions to force the ASP to maintain impossibly high or very expensive reserve balances. However, this attack