Interpretation of PlutusDAO behind the ARB staking proposal: Qiaojin reverses the fundamentals

Original - Odaily

author-Nan Zhi

On the evening of October 30, the proposal put forward by PlutusDAO to launch the Arbitrum governance token ARB staking function began to vote. The proposal set up 100 million ARB incentives, 125 million ARB incentives, 150 million ARB incentives, 1.75 These incentives will be paid by Arbitrum treasury. plsARB, which was once unanchored by more than 60%, gradually recovered. On November 6,"100 million ARB incentive"The vote was passed and the exchange rate rebounded to 0.637.

As the largest LSD protocol on Arbitrum, why did it have such a major unanchoring? Reversing fundamentals at minimal cost, what has PlutusDAO done right recently? Odaily will introduce the business situation of PlutusDAO and its story with ARB liquidity staking in the past six months below.

Project Positioning: A governance rights aggregation protocol designed to maximize user income and liquidity

Official documentation: PlutusDAO is Arbitrum’s native governance aggregator, designed to maximize user liquidity and incentives while aggregating the governance behind the PLS token. Plutus goal is to become the first choice for 2-layer governance black holes and various liquid pledge derivatives for veToken model projects.

Agreement products

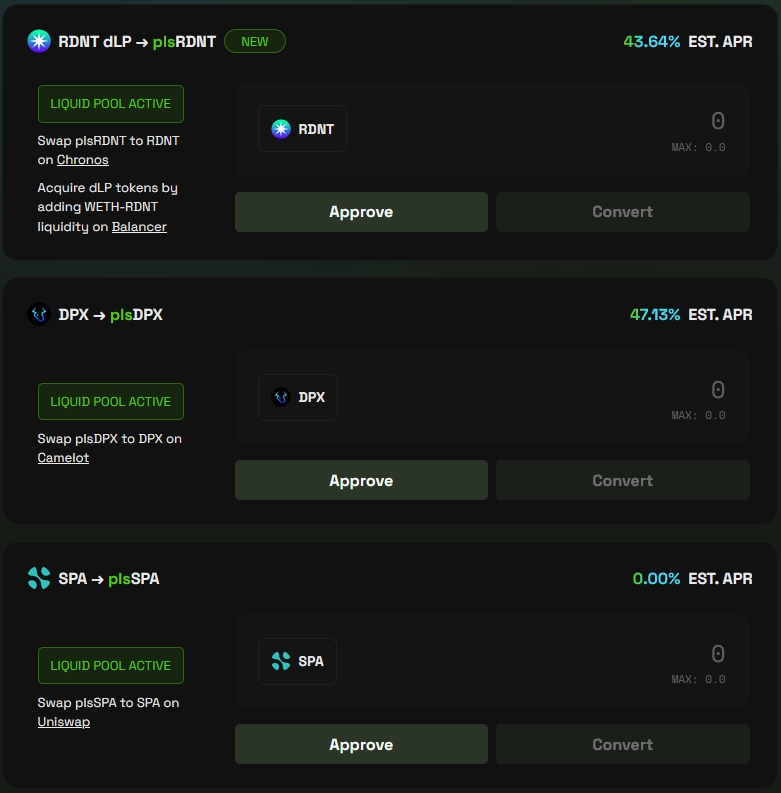

Currently, Plutus has partnered with Dopex, Radiant, GMX, Sperax and Jones to develop various Plutus-related governance products.

In addition to its governance aggregation products, Plutus has a Vaults product line designed to increase yields and create Arbitrum’s native DeFi building blocks. Currently, Plutus has a Vault product created in real time in partnership with GMXs GLP liquidity solution.

Protocol function

plsAssets(LSD):

Users can stake tokens such as Jones, DPX and SPA on Plutus and permanently lock veJONES, veDPX and veSPA, while Plutus will return plsAsset such as plsDPX and plsJONES.

Through plsAsset, users can obtain ve assets without locking up andExit on demand。

By staking plsAsset, users can obtain corresponding platform income, PLS rewards and part of the Plutus income treasury.

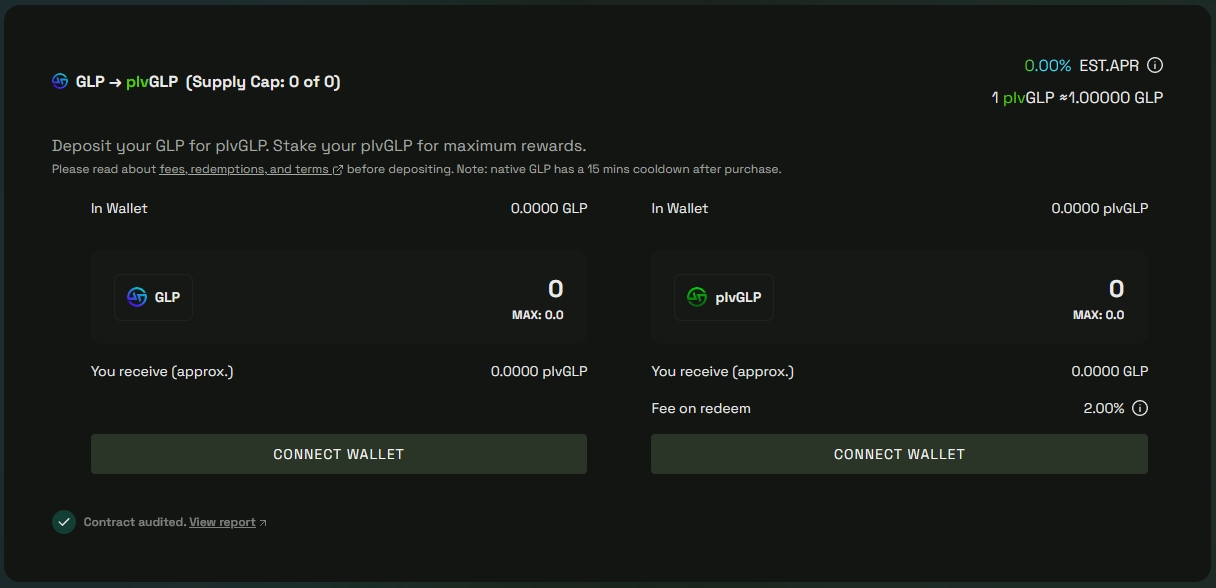

plvAssets(Auto Compounding):

Users can stake GLP on Plutus and obtain plvGLP. Plutus will automatically reinvest the staking income through off-chain robots every 8 hours to increase GLP income.

There is no charge when staking, 2% when withdrawing, and the treasury takes 10% of GLP income.

plvGLP will receive 15% of the total supply of PLS (to be released within two years).

protocol issues

For LSD tokens such as plsDPX, in addition to governance rights, the underlying token also has income rights to the underlying protocol, and naturally has pledge requirements. Therefore, users can obtain liquidity from it, and the protocol can also obtain commissions.

However, for plsARB and plsRDNT, the former only has governance rights, while the latter faces continued selling pressure as a mining currency. In addition to PLS rewards, users have no other staking benefits, and Plutus alsoJust gained the right to govern。

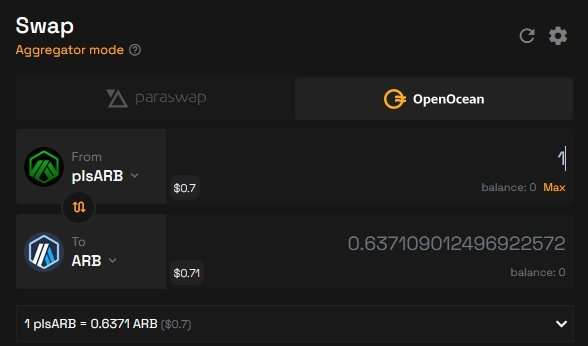

also,Plutus does not open the reverse exchange function to users(plsARB cannot be directly redeemed for ARB), there is only partial liquidity in the secondary market, and with the use of plsARB missing and the future unclear, there has been a serious decoupling in the long term.

As of November 6,A total of 9.536 million ARB are pledged on Plutus, accounting for 0.74% of the float and worth $10.58 million. The plsARB/ARB exchange rate is at 0.637 and is 36.3% off the anchor.

PlutusDAO and plsARB

Publicity Pledge

On March 23, the Arbitrum Foundation granted governance responsibilities in the form of ARB tokens to 625,143 eligible addresses. Due to network stagnation and front-end crashes due to too many claims, various projects in the Arbitrum ecosystem announced that they can assist with claims through their own front-ends, one of which is Plutus.

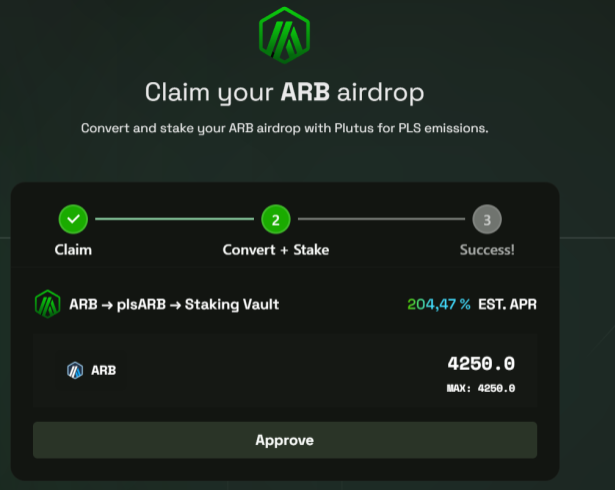

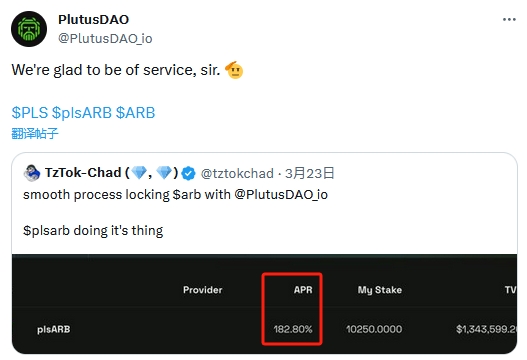

After receiving the ARB on the Plutus front-end, the system will prompt whether to convert the ARB to plsARB. According to screenshots provided by multiple community users, the Plutus official interface shows that the APR is as high as 180 ~ 200%. (The current staking income is only 4%, and it was about 2% before PLS increased)

Dune statistics show thatMost of the staking of plsARB was done in March, as of 0:00 on March 31, one week after the airdrop, the amount of ARB pledged reached 7.86 million.

Dune statistics show thatMost of the staking of plsARB was done in March, as of 0:00 on March 31, one week after the airdrop, the amount of ARB pledged reached 7.86 million.

PlutusDAO received a large airdrop

After the public ARB airdrop, Arbitrum conducted a special airdrop dedicated to specific DAOs in April. Plutus received 2,704,175 ARBs.

according toCastle CapitalA research report written byHow The DAO Uses Its ARB Airdrop”, Plutus allocated 18% of the airdrop to their team vesting contract. The Plutus official team’s response to the purpose of the airdrop ARB is:

“The allocation will be used in a variety of ways to ensure that Plutus is best positioned for future success. In practice, this means we use some for runway, some for the team, product incentives, bPLS incentives, plsARB airdrops, and for plsARB/ARB provides deep liquidity.”

However, half a year has passed,Apart from for the team, no other incentives have been realized.。

Provide a small amount of liquidity and unanchor in the long term

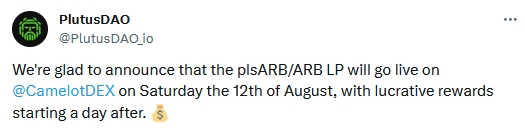

On August 12, officials announced the provision of plsARB/ARB liquidity and the investment of $110,000 worth of LP into the corresponding Camelot pool.

The picture above shows the plsARB/ARB exchange rate since the official addition of liquidity in August. plsARB has been in an unanchored state for a long time. The exchange rate fell to 0.3366 on September 19, and the average ARB price on this day was about 0.84 USDT, that is, one plsARB was only Value 0.28 USDT.

Change fate against fate and start ARB staking proposal

On September 9, Plutus launched on the governance platformThe first version of ARB staking proposal: “We believe the Arbitrum token needs native utility and the Arbitrum DAO has the right to mint 2% of the total ARB supply annually as inflation and use it in any way they see fit. We recommend minting 1.75% of the token supply and distribute within one year.”

Since increasing the total amount of tokens received a lot of opposition from the community, Plutus released an updated version of the proposal on October 20, proposing that the Arbitrum DAO treasury provide pledge rewards, which are 1.75%, 1.5%, 1.25% or 1% of the total amount.

The proposal started temperature check voting on Snapshot on October 30 and ended yesterday. Providing 100 million ARBs finally won, with a support rate of 66.76%, and the other option not providing any ARBs accounted for 33.24%. .

After the temperature check voting is completed, there will be a 3-day preparatory period for the official AIP launch and voting, and a 14-day Tally voting.

Although the process has not yet been completed, plsARB has significantly returned to the anchor. As of the completion of Snapshot voting, the exchange rate reached 0.637, returning to the original high point. Judging from the current overall situation, the probability of subsequent proposals being passed is also relatively high.plsARB is expected to return to its normal ratio of 1:1。

PlutusDAO did not consume funds, time, or operating manpower. It used a proposal to generate others to leverage the process of anchoring, and if the proposal is passed, there is hope to obtain more ARB pledges and commissions.

Taking other LSD protocols (Pirex, Abracadabra, Olive) and plvGLP on Arbitrum as a reference, assuming that Plutus takes 10% of the pledge, and assuming that 20% of the pledge is carried out through Plutus, then Plutus is expected to obtain 1 × 0.1 × 0.2 from the pledge. = Rake of 2 million ARB.

However, re-anchoring itself is actually not difficult. Calculated based on the current plsARB/ARB liquidity in Camelot, to raise the current exchange rate of 0.6 to 1.0 only requires (46.672 × 42.713)^½-42.713 = 19,300 ARB , which can be achieved for less than $20,000. The focus is still on the potential commission income.

However, it is still unclear whether PlutusDAO can obtain enough ARB governance rights to establish ecological barriers due to the combination of the major benefits of the reversal and the unpredictable project operation management.