Comparing Maker and Frax from multiple dimensions: Is Maker still the king of cash?

Original author: Wajahat Mughal

Original compilation: Deep Chao TechFlow

In this article, DeFi researcher Wajahat Mughal compares two DeFi and RWA leaders: Maker and Frax Finance from multiple dimensions, including their main business, rate of return, revenue sources, protocol income, governance tokens, subsequent progress, etc., which Which one would be better?

Maker and Frax are the two leaders in the DeFi field.

Maker provides the over-collateralized decentralized stablecoin DAI, backed by ETH, stablecoins, and RWA (most of which are U.S. Treasury bonds); Frax provides the decentralized stablecoin FRAX and a series of financial products built around it.

DAI’s collateral includes ETH, stablecoins, and RWA—most of which are U.S. Treasuries.

FRAX’s collateral is about to change. Currently moving towards 100% CR and no longer supported by FXS. The recently added sFRAX and the upcoming FXB (bonds) will provide RWA support.

income

The current supply of sDAI is 1.73 billion pieces, with a yield of 5%; the current supply of sFRAX is 41 million pieces, with a yield of more than 6.5%.

It can be seen that DAI has a huge dominance on the supply side, but Frax currently leads the way in yield.

Source of income

The yield on sDAI comes from various RWA T Bill yields, which can be seen from the custodians.

sFRAX earns IORB interest rates from overnight interest accounts, which are held through FinresPBC, which then passes the earnings to sFRAX.

Maker is currently one of the most profitable protocols in DeFi. Over $80 million in revenue. This is because their supply is growing all the time.

FRAX has multiple revenue streams including TBills, AMOs and, of course, ETH LSDs – currently generating $20 million in annual revenue.

MKR and FXS

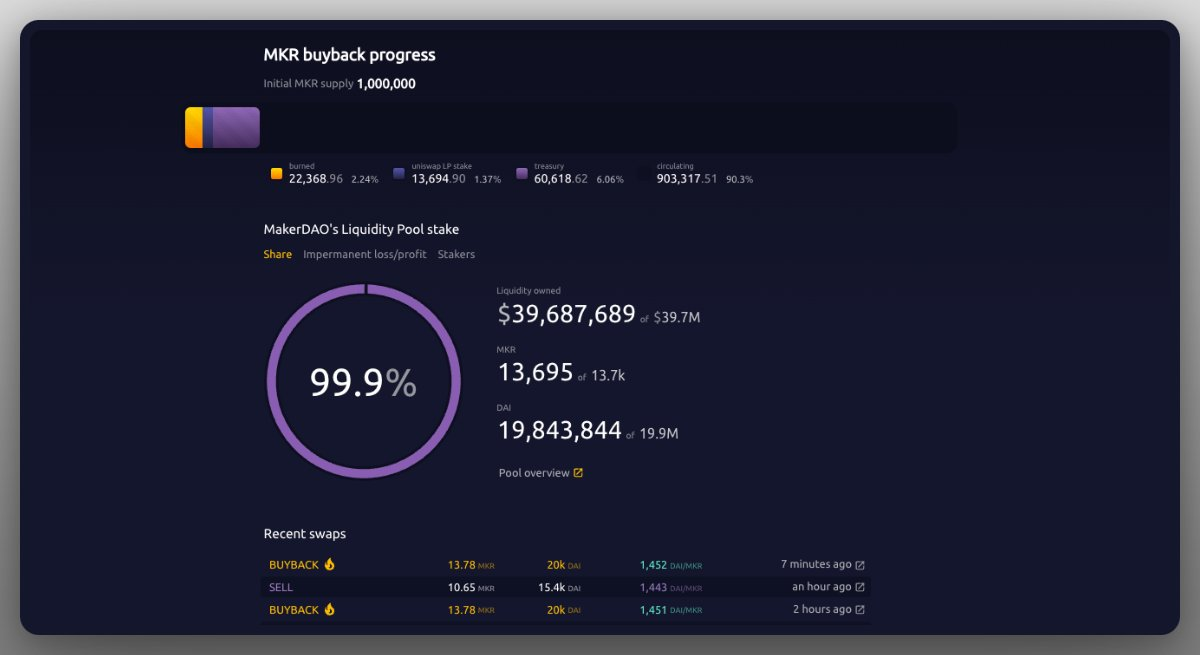

MKR has a market capitalization of $1.3 billion and is used to sustain repurchase agreement revenue.

FXS has a market capitalization of $450 million and earns revenue from the protocol (all efforts are currently aimed at increasing CR to 100%).

future

Both are excellent protocols, with Maker still the king of cash and Frax continuing to add innovative products to its components.

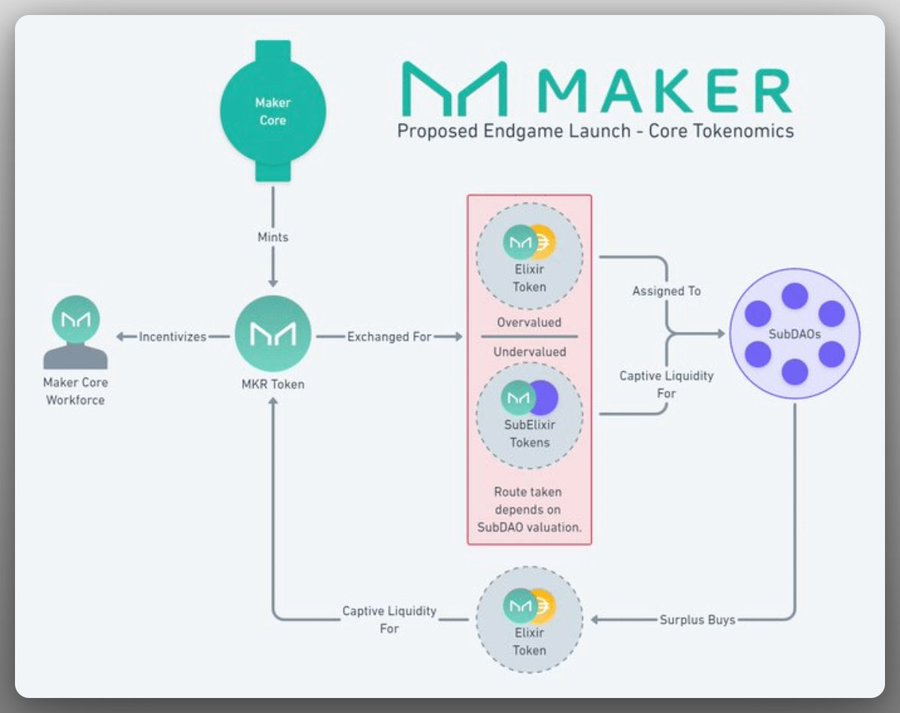

What’s coming next is Maker’s Endgame including token reshaping, decentralized stablecoins, subDAO launch, artificial intelligence integration, and ultimately the Maker Chain; Frax including Frax bonds, frxETH staking product updates, and Ethereum New L2 Frax Chain.

Personally, I prefer Frax and I like the ecosystem they are building.