Original author: Carolina Goldstein, Tiago Fernandes, Three Sigma

Original compilation: Frank, Foresight News

introduce

Tokens play an important role in DeFi systems, but there are some differences in achieving protocol goals, value capture mechanisms, and ecosystem integration. Tokens serve as multifunctional tools, including serving as utility tokens for transactions and access, governance tokens for decision-making, or revenue-sharing tokens for community wealth distribution. These tokens operate in various environments within DeFi, from decentralized exchanges to lending platforms and even the underlying infrastructure that drives the entire system.

In this article, we will delve into the relevant token mechanisms driving DeFi, from liquidity mining, staking, voting custody to revenue sharing models, revealing how these mechanisms shape the current landscape of blockchain protocols and how they are adopted by different protocols .

This study includes tokens from the following protocols: 1inch Network, Aave, Abracadabra, alchemx, Angle, Ankr, ApolloX, Astroport, Balancer, Beethoven X, Benqi, Burrow, Camelot, Chainlink, Cream Finance, Compound, Convex Finance, Curve Finance , DeFi Kingdoms, dForce, dYdX, Ellipsis Finance, Euler Finance, Frax Finance, Gains Network, GMX, Hashflow, Hegic, HMX, Hundred Finance, IPOR, Lido, Liquidity, Lyra, MakerDAO, Mars Protocol, Moneta DAO (DeFi Franc) , MUX Protocol, Notional, Osmosis, Orca, PancakeSwap, Perpetual Protocol, Planet, Platypus Finance, Premia, Prisma Finance, QiDao (Mai Finance), Reflexer, Ribbon Finance, Rocket Pool, Solidly Labs, SpookySwap, StakeDAO, StakeWise, Starlay Finance , SushiSwap, Synapse, Tarot, Tectonic, Thales, Thena, Uniswap, UwU Lend, Velodrome, XDeFi, Yearn Finance, Y 2 K Finance, Yeti Finance.

It is worth noting that this does not include all DeFi protocol tokens, but is only a representative selection, especially focusing on those tokens that introduce innovation or slight changes in the token mechanism.

It is important to note that this is not an exhaustive list of all DeFi tokens, but rather a representative selection focusing on those that introduce innovation or slight changes to the token mechanism.

Research Framework

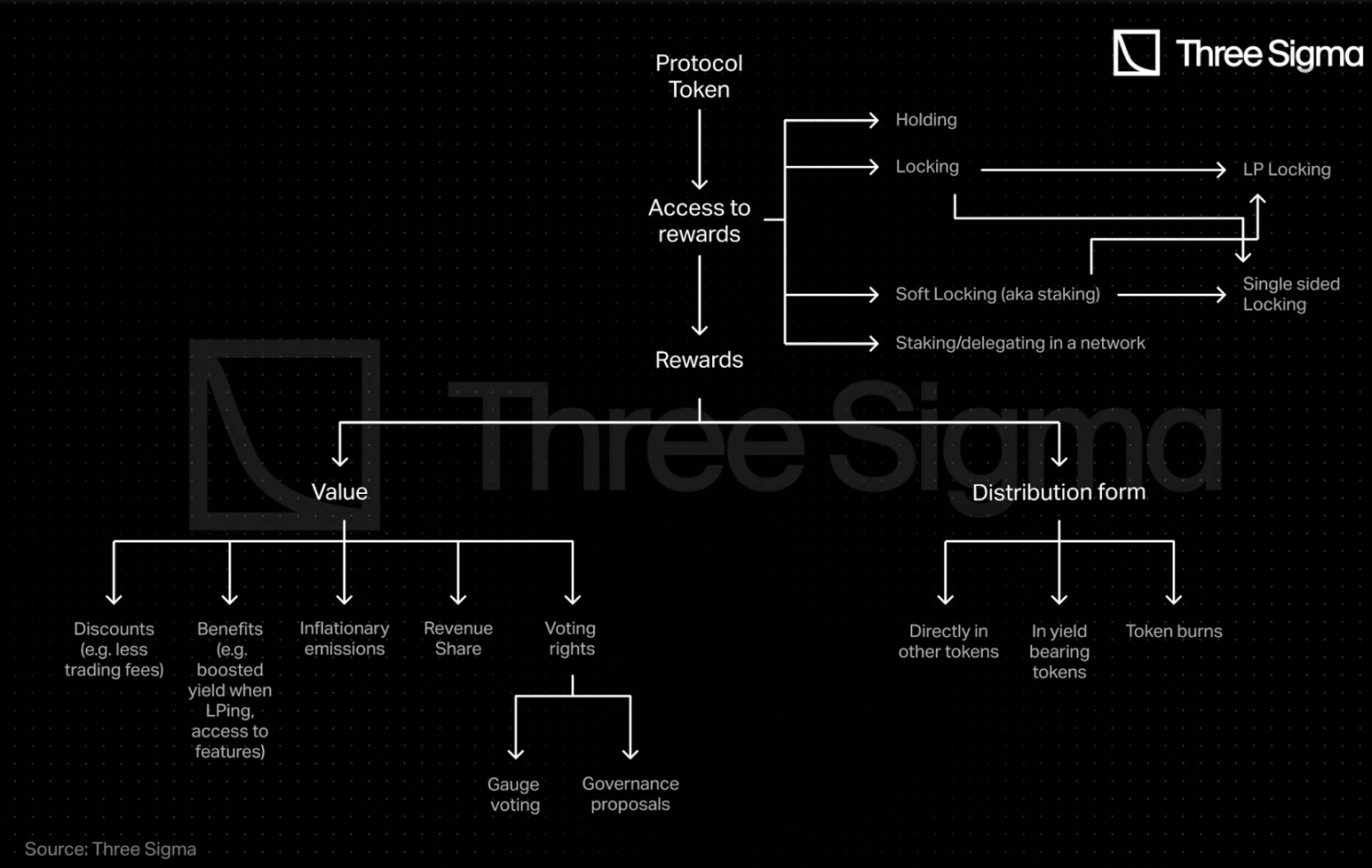

To explore the various roles that tokens play in DeFi, we will take a systematic approach. After examining more than 50 DeFi protocols, one common trend emerged: most protocols provide a way for users to earn rewards with their tokens.

These rewards can range from tangible benefits to more abstract forms of value and may include discounts on protocol functionality, higher returns for liquidity providers, inflation incentives, a share of protocol revenue, or the ability to vote on key decisions. How these rewards are distributed may also differ, with some tokens being directly minted or transferred, while others may involve the destruction of existing tokens or yield-generating assets.

The ways to earn these rewards also vary: users can earn rewards by simply holding tokens, soft locking, locking, or staking/delegating tokens in the network.

These locking mechanisms can vary significantly across different protocols. Therefore, we will focus on three core aspects to give you a comprehensive understanding of the current tokenomics landscape: reward access, value, and distribution. It is important to recognize that while these options provide a way to reward participation, they should be tailored to the design and goals of the individual agreement.

This article does not adopt each protocol’s unique terminology to describe various token strategies and models, but instead uses a standardized approach to ensure clarity and ease of comparison. In this article, the following terms will be used:

Staking: refers to the token pledge within the network (for decentralization);

Locking: Involves locking the tokens for a fixed period, and no withdrawals can be made before the locking period ends, otherwise severe penalties will be imposed.

Soft Locking: The specific locking time of the token is unknown and may be unlocked, sometimes resulting in withdrawal fees or unlocking waiting periods. This is often referred to as staking in typical discussions of token economics;

LP (Soft) Lock: Represents the same concept, but specifically related to locking LP tokens;

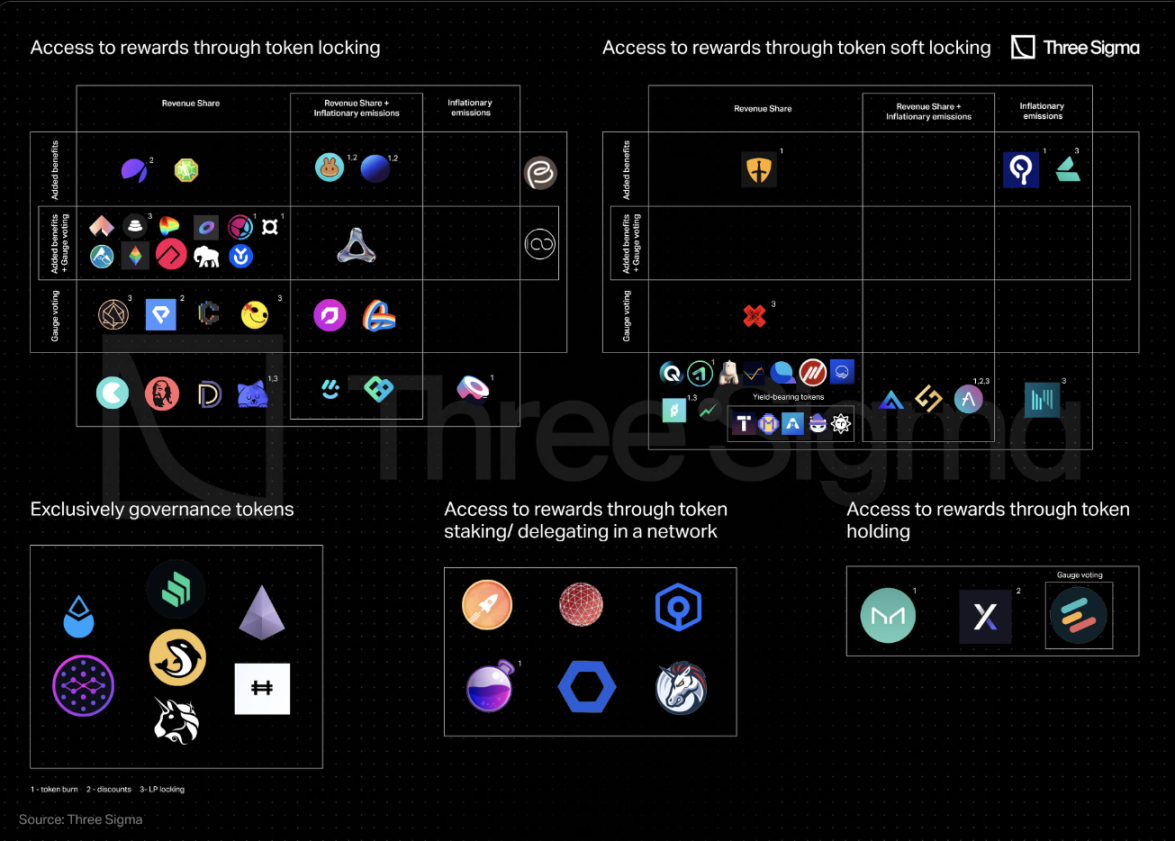

According to our framework, the protocols included in this article are divided into the following categories:

How to get rewards

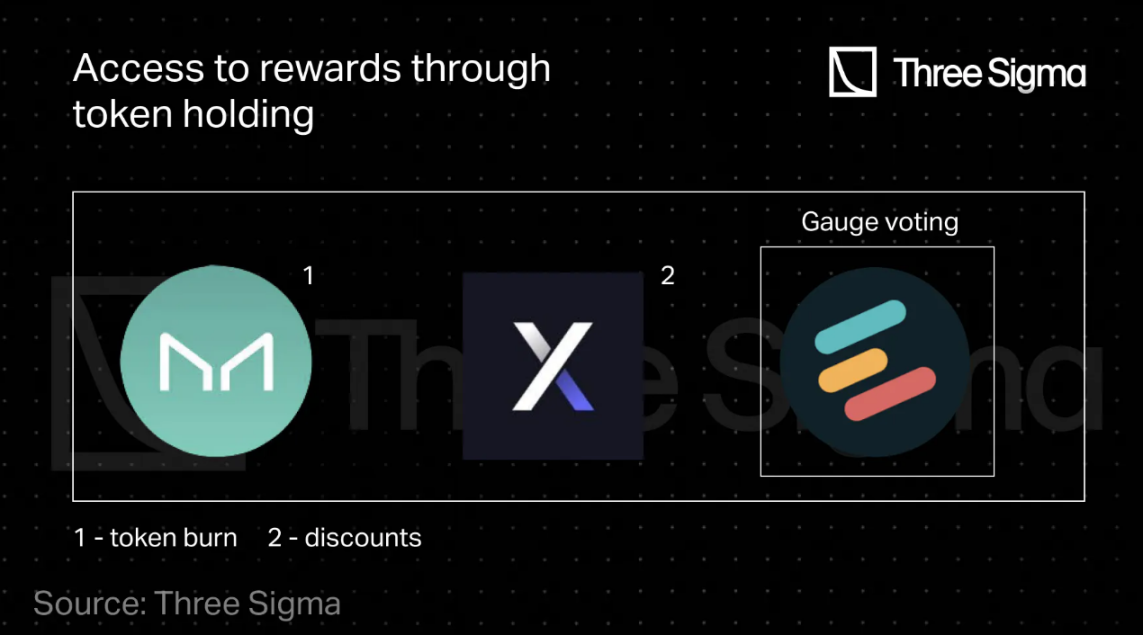

Earn rewards by holding

A handful of platforms, including Euler Finance, MakerDAO and most recently dYdX, reward users for holding tokens.

dYdX is a well-known derivatives exchange in the DeFi field. It has become one of the mainstream choices for active traders by providing lower transaction fees to DYDX holders.

But starting on September 29, 2023, dYdX will begin transitioning to a standard fee structure for all traders. Although DYDX is mainly used as a governance tool for the platform, it is worth mentioning that token holders could also previously transfer their tokens. The pledge is in the security module to enhance the security of the protocol, but the corresponding fund has ceased operations on November 28, 2022.

Euler Finance is an in-project operation of the DeFi lending track. By entrusting the governance token EUL, holders will have the right to influence EUL liquidity incentives and the development direction of the platform. But users must stake their EUL to participate in voting, and if they just hold, they will not actually receive any direct rewards.

MakerDAO’s MKR token serves a dual purpose. First, MKR holders can actively participate in governance decisions and vote on key parameters; secondly, MKR will serve as a protection measure for the protocol when the market fluctuates significantly and the value of collateral is insufficient - in this case, new MKR tokens can be minted And exchange it for DAI.

Although MakerDAO lacks a clear revenue mechanism, MKR holders indirectly benefit from the excess DAI generated through stability fees, as these surplus DAI can be used to buy back and burn MRK tokens, thereby reducing the supply.

With the launch of the recently launched Smart Burn Engine, MKR tokens will accumulate in the form of Uniswap V2 LP tokens instead of being repurchased and burned. Maker will regularly use the DAI in the Surplus Buffer to buy MKR tokens from the DAI/MKR liquidity pool of Uniswap V2, and the purchased MKR tokens will then be combined with additional DAI from the Surplus Buffer. trading pairs and offered to the same market. In return, Maker will receive LP tokens and increase MKR’s on-chain liquidity over time.

Some other protocols also employ buyback and burn mechanisms to indirectly reward users for holding tokens, but since most protocols combine this with other mechanisms, they will be mentioned later in this article.

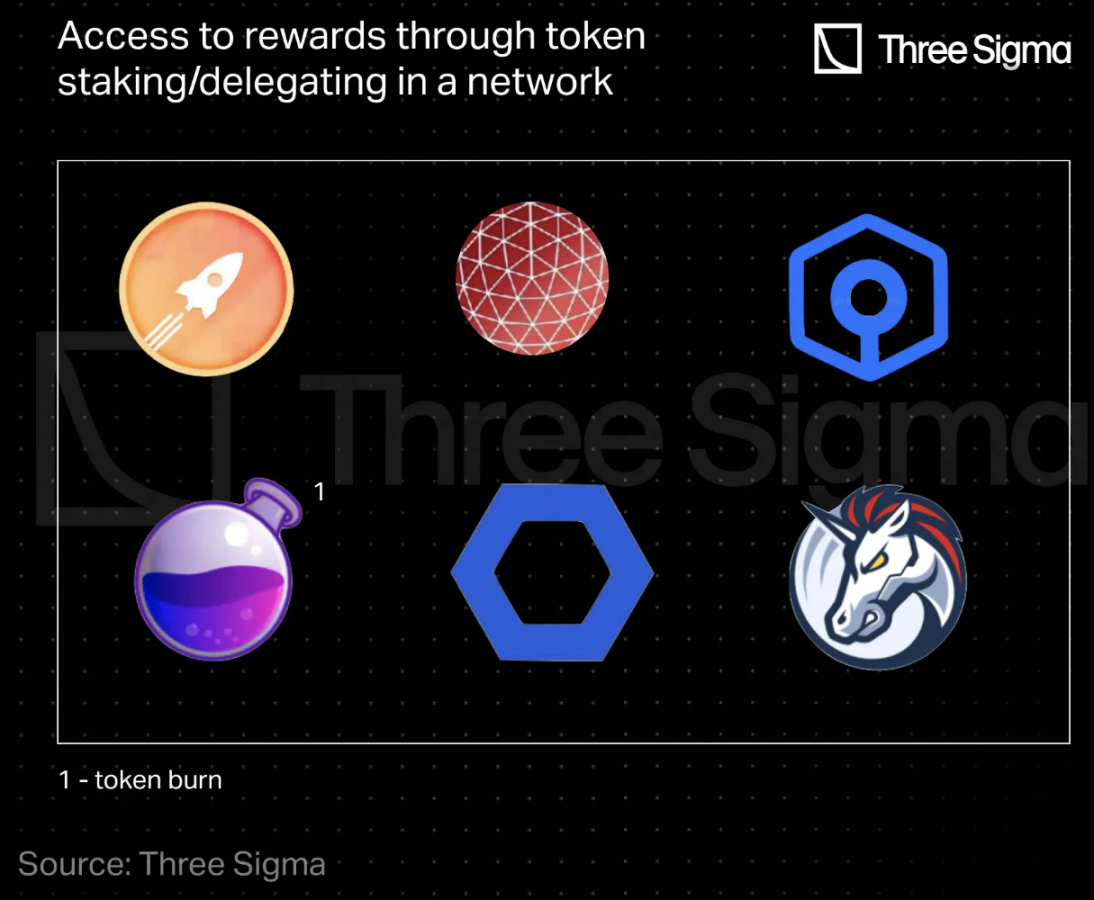

Earn network rewards by staking or delegating

Some protocol tokens are used for staking or delegation to achieve network decentralization and enhance the security of the ecosystem. Among them, staking requires token holders to lock their assets as collateral and actively participate in network operations, verification, transaction verification and maintaining blockchain integrity. This aligns token holders’ interests with network security and reliability and provides potential rewards as well as the risk of losing staked tokens in the event of malicious behavior.

Protocols that employ this staking or delegation mechanism include Mars Protocol, Osmosis, 1inch Network, Ankr, Chainlink, and Rocket Pool.

Osmosis offers multiple staking options for OSMO token holders, including delegating to a validator to ensure network security, with delegators being rewarded with transaction fees based on the amount of OSMO they stake, but with commissions deducted from the selected validator. Stakeholders (including validators and delegators) receive 25% of newly released OSMO tokens when they secure the network.

In addition, Osmosis also provides Superfluid staking, which allows users to stake tokens in the form of OSMO trading pairs to obtain benefits for a fixed period (currently 14 days). These tokens continuously generate Swap fees and liquidity mining incentives, while OSMO tokens also receive staking rewards. In January this year, Osmosis introduced an automated internal liquidity arbitrage mechanism to accumulate profits. The community is currently conducting governance discussions on the potential use of these funds, including the implementation of a destruction mechanism that may deflate OSMO.

The Mars Protocol is also part of the Cosmos ecosystem and operates similarly, with token holders playing an important role in securing the Mars Hub network, managing outpost functionality and setting risk parameters through staking or delegation.

The 1INCH token is the governance token and utility token of the 1inch network. Its main use is in the Fusion mode. The resolver pledges and deposits 1INCH into the feebank contract to enable Swap transactions. Users who entrust 1INCH to support Fusion mode will receive a portion of the revenue generated. Once staked, tokens cannot be withdrawn until the end of the specified lock-up period, otherwise they will be subject to penalties (the default lock-up period is 2 years). In addition, 1INCH holders have voting rights in 1inch’s DAO, allowing them to influence the development direction of the platform. .

Ankrs ANKR token serves a variety of functions, including playing staking, governance, and payment roles in the ecosystem. ANKR staking is unique in that it can be delegated to full nodes rather than just validating nodes, allowing the community to actively select reputable node providers. In return, stakers will share in the node rewards and some slashing risk. Currently, ANKR staking has been expanded to more than 18 blockchains. ANKR tokens also support users to participate in governance, including voting on network proposals. In addition, ANKR tokens can also be used for payments within the network.

Chainlinks native token LINK is the foundation for node operators, enabling individuals to stake LINK and become node operators. Users can also entrust LINK to other node operators to participate in network operations and share fee income. LINK tokens are used for payments within Chainlink’s decentralized oracles to support the operations of the network. In addition, LINK tokens are used to reward node operators for providing basic services, including data retrieval, format conversion, off-chain computing and guaranteed uptime.

Rocket Pool is one of the major players in Liquid Staking Derivatives (LSD). Without the Ethereum PoS participation requirement of 32 ETH, Rocket Pool has introduced RPL tokens to provide insurance for the networks slashing risk and enhance security. Minipools only require 8 or 16 ETH as collateral, and the rest is 24 or 16 ETH borrowed from the pledge pool. RPL acts as collateral as additional insurance to reduce slashing risks. RPL token holders also have governance rights, and RPL tokens are used to pay protocol fees, providing a comprehensive toolkit in the Rocket Pool ecosystem.

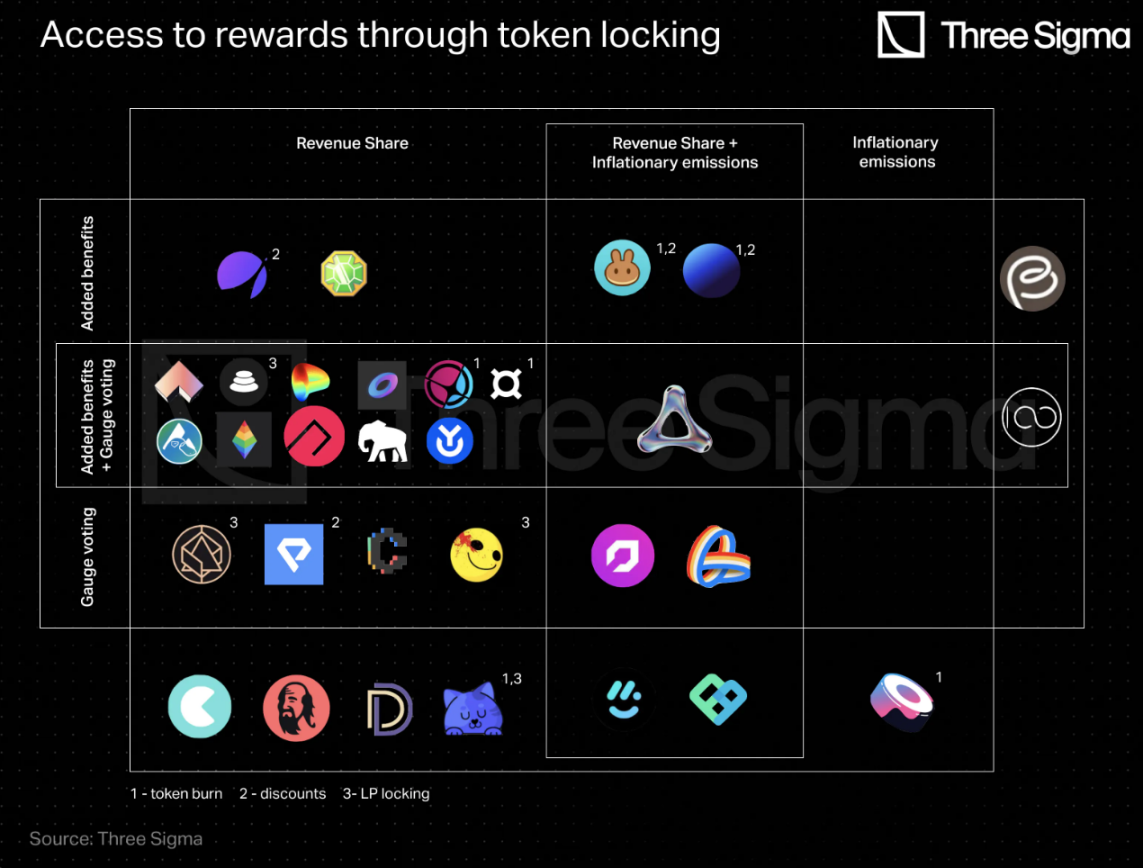

Earn rewards by locking

In the current landscape of DeFi, token locking is the core mechanism for obtaining protocol rewards, including revenue sharing, increasing annual interest rates and inflation emissions, and there are two main forms of locking:

Single-sided locking: users lock native protocol tokens;

LP locking: Users provide liquidity, usually composed of protocol tokens and network native tokens, and then lock LP tokens;

The key to this mechanism is to choose the locking interval within which the user will be bound until its expiration. Some platforms offer extended time options for higher rewards, while others allow early unlocking at a cost The reward costs are high, so this is a strategic decision balancing risk and reward.

However, extending the lock-up period generates more rewards, such as enhanced voting rights and an increased share of the protocol revenue, which is related to commitment and reduced risk factors: a longer lock-up period shows confidence in the protocol, which in turn rewards the protocol with greater In return.

One widely used method of token locking is the Vote Escrow model, pioneered by Curve Finance. When users lock their governance tokens, they receive veTokens, which grant voting rights but are generally not tradable. of. While voting escrow solutions are growing in popularity among DeFi platforms, a number of issues have arisen that limit their effectiveness, including the risk of centralization, where a few large holders gain governance control, as seen with Curve Wars That way.

As a result, more and more platforms and protocols are improving the concept of vote escrow to increase participation and align incentives across the ecosystem. While veTokens are generally non-transferable, some protocols allow tokens to be used for purposes such as unlocking liquidity or earning additional yields, and many DAOs now employ voting escrow solutions to manage user engagement and rewards.

In Curve DAO, users lock their CRV tokens to gain voting rights, and the longer the locking time, the greater the voting rights. veCRV is non-transferable and can only be obtained by locking the CRV for a maximum period of four years. Initially, a four-year lock-in CRV is equal to one veCRV. As the remaining unlock time decreases, the veCRV balance will decrease linearly.

As mentioned before, this model creates a conflict over voting rights, especially regarding liquidity, which Convex leads. To vote on Convex proposals, users must lock their CVX tokens for at least 16 weeks, and here These tokens will not be accessible before.

Ellipsis Finance, the Curve fork project on BNB Chain, also follows this pattern. EPX holders can lock their EPX for 1 to 52 weeks, and the longer the lock, the more vlEPX they receive.

Hundred Finance, which now ceases operations due to a protocol hack, employs a voting escrow model similar to Curve, where locking 1 HND for 4 years generates approximately 1 mveHND, and this balance decreases over time.

The perpetual contract trading platform Perpetual Protocol also adopts this model. Users can increase governance voting rights by up to 4 times by locking PERP to vePERP.

Many DeFi protocols already accept derivatives of voting escrow mechanisms to incentivize user participation. Among them, Burrow adopts a model similar to Curves ve-token, providing BRRR holders with the opportunity to participate in the BRRR locking plan. Starlay Finance on Polkadot and Cream Finance on multiple chains introduced similar concepts, with token holders locking LAY and CREAM to obtain veLAY and iceCREAM tokens respectively. Frax Finance also uses this model, with the veFXS token giving governance voting rights.

Similarly QiDao and Angle have also implemented token locking to gain governance influence. In the options space, Premia and Ribbon Finance offer vxPREMIA and veRBN tokens respectively, and StakeDAO, Yearn Finance, MUX Protocol, ApolloX, PancakeSwap, Planet, SushiSwap, Prisma Finance and DeFi Kingdoms have also integrated variations of the voting escrow mechanism.

These protocols differ in how rewards are distributed and the benefits they offer users, which we will explore further in this article. In addition, Solidly Labs, Velodrome, and Thena are noteworthy decentralized exchanges that evolved from Curve’s voting escrow mechanism and incorporated unique adjustment designs into their incentive structures through the ve(3, 3) mechanism. .

Balancer has introduced an interesting change to the Curve model, which is not to directly lock the protocol’s liquidity mining reward tokens, but to lock LP tokens. Therefore, users do not need to lock BAL, but must lock the liquidity token BPT used to add to the BAL/WETH 80/20 pool to obtain veBAL.

Alchemix also adopts a variation of the LP lock type in the voting escrow model - users mint veALCX by staking 80% ALCX/20% ETH Balancer liquidity pool tokens.

Y 2 K token is a utility token in the Y 2 K Finance ecosystem. It can provide various benefits after being locked into vlY 2 K. It is worth noting that vlY 2 K is locked at Y 2 K/wETH 80/20 BPT. formal representation.

Finally, UwU Lend has launched a new lending network built on its own UWU token - by combining UWU with ETH and providing liquidity on SushiSwap, customers can earn UWU-ETH LP tokens, These tokens can be locked in the DApp for 8 weeks.

In a token lockup, a key feature is the promise of higher rewards, such as voting rights, as the token is locked for longer. This encourages longer lock commitments and greater influence over protocol decisions. The factor that sets the agreements apart is the maximum lock-in period, which ranges from a few months to four years. Managing veTokens also varies; some use a linear decay model that gradually reduces voting power, as seen in Curve, Perpetual Protocol, Cream, Angle, Frax, etc. In contrast, some protocols maintain governance influence even after the lock-up period ends, such as Premia.

Various protocols including SushiSwap, Premia, Ribbon, Yearn, ApolloX, DeFi Kingdoms and Prisma allow early unlocking of their tokens, but with punitive measures such as withholding a portion of earned rewards or introducing hefty fines.

In summary, token locking provides users with greater governance and other benefits, a topic we will explore further in this article.

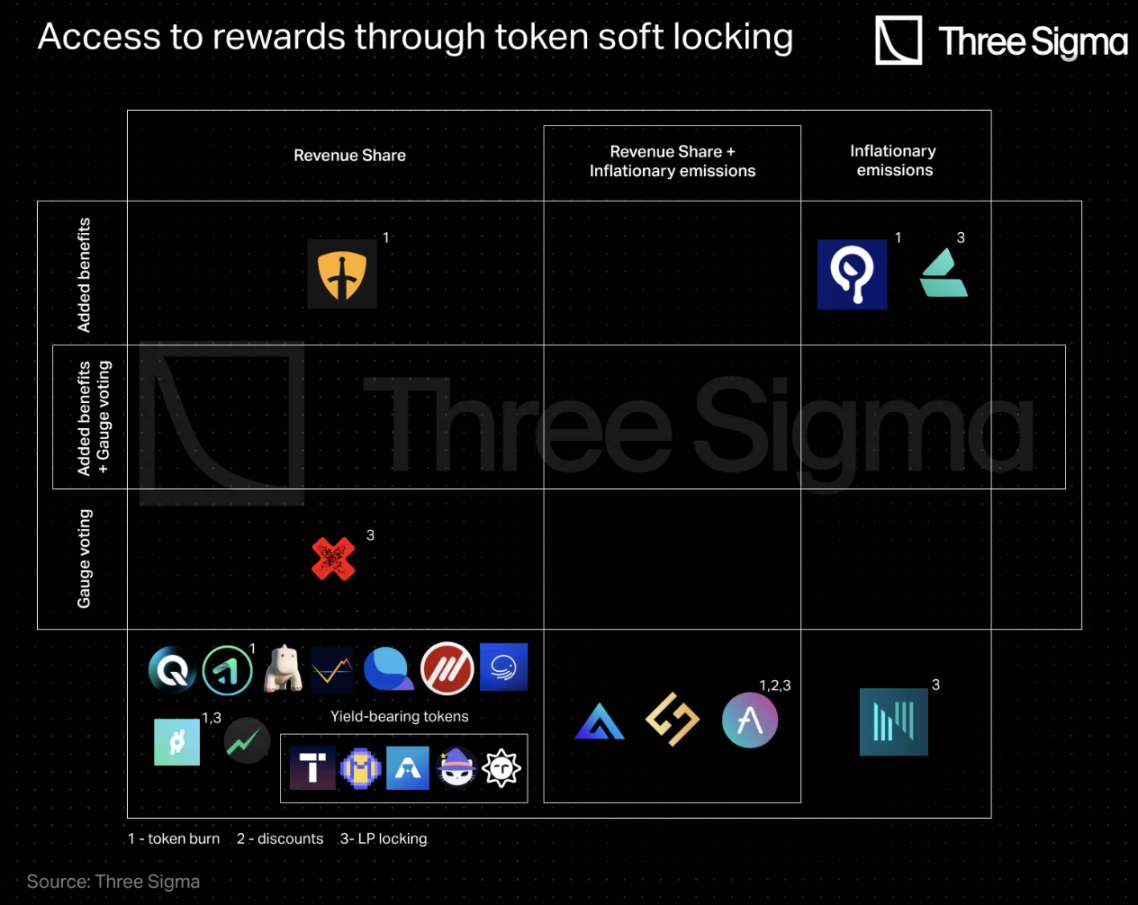

Earn rewards with soft lock

Soft locking, often referred to as staking, introduces a slightly different way of locking a coin. Unlike traditional token locking, users do not have to follow a fixed locking time and they can unlock at any time. Still, to incentivize users to lock up longer, protocols often employ strategies like voting escrow, where rewards increase with the locking period and allow for immediate exit.

Some protocols have waiting periods during the unlocking process, or implement vesting schedules to suppress frequent lock-unlock cycles. In some cases, unlocking fees are introduced to encourage stable and active user participation while providing flexibility.

Benqi Finance, the lending and liquidity staking protocol on Avalanche, follows the voting custody method and distributes QI rewards through liquidity mining, which can then be pledged as veQI. When staking QI, the veQI balance will grow linearly over time, up to 100 times the pledged QI. When unstaking, all accumulated veQI will be lost. Overcollateralized stablecoin protocol Yeti Finance employs a similar system.

Beethoven

The three most popular derivatives exchanges, GMX, HMX and Gains Network, provide token stakers with large rewards to incentivize them to stake tokens, but do not introduce veTokens token economics model.

Other protocols such as Astroport, Abracadabra, Tarot, and SpookySwap allow users to stake tokens in exchange for yield tokens, which capture value over time and can be used to redeem the staked tokens as well as any accumulated rewards.

Camelot tried a different approach with xGRAIL, a non-transferable custodial governance token that can be obtained by soft-locking GRAIL directly, but requires a vesting period before being redeemable for GRAIL.

In addition, protocols such as Liquidity, Thales, XDeFi, IPOR, and Moneta DAO all use unilateral soft locks as a way to obtain protocol rewards.

Like Beethoven X, other protocols also use LP soft locking. Interestingly, many protocols utilize LP staking mechanisms to incentivize liquidity and serve as insurance to protect the protocol from bankruptcy. Aave and Lyra are two protocols that support LP staking and unilateral staking to incentivize liquidity to enter their security modules and prevent fund shortages. Users can deposit AAVE/ETH and WETH/LYRA LP tokens respectively in exchange for protocol rewards from the insurance pool. These tokenized positions can be redeemed at any time, but there is a waiting period. On Notional, users soft-lock NOTE/WETH Balancer LP tokens to receive sNOTE tokens. NOTE Token holders can initiate an on-chain vote to withdraw 50% of the assets stored in the sNOTE pool for system capital replenishment in the event of insufficient collateral.

Likewise, users on the Reflexer protocol are responsible for keeping the protocol capitalized by soft-locking FLX/ETH LP tokens on Uniswap v2.

Hegic uses a StakeCover model where staked HEGIC tokens are used to cover net losses on options/strategies sold by the protocol and earn net profits from all expired options/strategies. It also like Aave and Lyra, staking is used not only to share rewards but also to provide protection. Hegic StakeCover (SC) pool participants will receive 100% of the net royalty income earned (or accrued losses), which is distributed proportionally to all stakers, and users can make withdrawal requests at any time and every 30 days Funds are received at the end of the Epoch.

Finally, a handful of protocols allow users to choose between soft and hard locks.

dForce has introduced a hybrid model with both soft and hard locks, where locking to veDF earns more rewards than soft locking to sDF.

On the Avalanche cross-stable currency exchange Platypus Finance, users can obtain vePTP by staking PTP or locking PTP. For every 1 PTP pledged, users can obtain 0.014 vePTP per hour (linear accumulation). The maximum amount of vePTP that a staker can obtain is the pledged amount. 180 times the amount of PTP, which takes approximately 18 months. And through locking, the total amount of vePTP is determined from the beginning.

Tectonic allows soft locking of TONIC tokens into xTONIC, and the Tectonic protocol has a 10-day waiting period for withdrawals. It is similar to Tarot, but Tectonic allows users to maximize their rewards by locking their xTONIC tokens.

Rewards – incentives and benefits for stakeholders

After exploring ways to earn rewards in DeFi, let’s now delve into the various incentives users receive for actions such as holding, locking, or staking tokens. These include fee discounts, increased yields for liquidity providers, exclusive protocol features, revenue sharing, token issuance and gauge voting.

Agreement fee discount

Many platforms offer discounts to users based on their token holdings and operations. For example, Aave borrowers can reduce interest rates by staking AAVE tokens, while Premia users with more than 2.5 million vxPREMIA tokens can receive a 60% discount on fees. On PancakeSwap, transaction fees can be reduced by 5% when paying with CAKE tokens. Planet offers three tiers of yield-enhancing discounts by staking GAMMA tokens. HEGIC token holders can enjoy a 30% discount on hedging contracts, and staking APX tokens in ApolloX DAO can reduce transaction fees.

revenue sharing

Revenue sharing can be a powerful incentive, and many protocols now distribute a portion of their revenue to users who stake or lock their tokens, aligning their interests with the success of the platform and rewarding contributions to network growth.

Most voting escrow protocols share revenue proportionally with stakeholders, Curve, Convex, Ellipsis, Platypus, PancakeSwap, DeFi Kingdoms, Planet, Prisma, MUX Protocol, Perpetual Protocol, Starlay, Cream, Frax, QiDAO, Angle, ApolloX, UwU Protocols such as Lend, Premia, Ribbon, StakeDAO, Yearn, Balancer, Alchemix, Y 2 K, dForce, Solidly, Velodrome, and Thena all distribute a portion of the protocol revenue. Typically about 50% of fees go to shareholders, but Governance Voting frequently updates these allocations to emphasize the importance of voting rights. Some exceptions to the voting rights lockup group include Hundred, Burrow, and Sushiswap. Typically, agreement fees are divided proportionally among the stakeholders. However, a few protocols (such as Starlay, Solidly, Velodrome, and Thena) distribute revenue based on stakeholder votes for specific gauges.

Regarding soft lock-in agreements, most include revenue sharing. Some protocols that employ voting rights locking systems (such as Beethoven X, Benqi, Yeti, and Platypus) use the locking period and number of tokens as factors in determining stakeholder revenue shares.

In comparison, Aave, GMX, Gains, HMX, IPOR, Astroport, Camelot, Abracadabra, Tectonic, Tarot, SpookySwap, Liquidity, Moneta DAO, Reflexer, XDeFi and Hegic only distribute returns based on the number of staked tokens.

Some protocols like Lyra, Thales, and Notional do not share revenue but reward users for soft locking and securing their platform through inflationary emissions.

Inflation emissions

Regarding inflation emissions, many protocols allocate reserved community governance tokens to liquidity providers and active users to incentivize their participation. While most protocols reserve token emissions for LPs, lenders, and farmers, some use them to reward stakeholders.

As mentioned, Lyra, Thales, and Notional chose inflationary emissions over revenue sharing, and SushiSwap also removed revenue sharing and, in some cases, both revenue sharing and inflation in its January 2023 tokenomics redesign Emissions are allocated to stakeholders, and protocols that implement the ve(3, 3) token economics mechanism (such as Solidly, Velodrome, and Thena) all follow this approach.

Additionally, Aave, Planet, MUX Protocol, PancakeSwap, and Perpetual Protocol offer emission-based rewards alongside revenue sharing.

Protocols such as GMX and HMX also reward stakers with escrow GMX and HMX, and these tokens need to go through a one-year vesting period before they become real GMX or HMX.

metered voting

Voting escrow gives rise to gauge voting, where smart contracts accept deposits and emit tokens to reward depositors. Gauge voting enables stakeholders to influence the distribution of emissions, guiding the distribution of newly minted tokens in the ecosystem. This control of emissions plays a key role in shaping the development and direction of the protocol.

Many protocols using voting escrow support metered voting, including Curve, Convex, Ellipsis, Platypus, Hundred, Starley, Prisma, Frax, Angle, Premia, Ribbon, StakeDAO, Yearn, Balancer, Beethoven X, Alchemix, Y 2 K, Solidly , Velodrome and Thena.

In contrast, protocols such as Perpetual Protocol, Burrow, MUX Protocol, and QiDao do not use metered voting. In addition, Euler Finance allows EUL holders to determine EUL liquidity incentives without locking the tokens in advance, but they need to soft-lock the tokens in gauge to exercise their rights.

additional income

Protocols in DeFi often go beyond direct revenue sharing or token emission to provide additional rewards and benefits to users.

Similar to metered voting, many protocols that follow veToken token economics will increase the number of emissions for users who stake liquidity in the gauge. Noteworthy examples include Curve Finance, Ellipsis, Platypus, Hundred, Prisma, Frax, Angle, Ribbon, StakeDAO, Yearn, Balancer, Solidly and Starley.

Some protocols offer higher yields without metered voting, Burrow increases returns on lending and supply, PancakeSwap enhances liquidity mining returns for LP tokens, Lyra increases LP treasury rewards, and Thales increases active participation To reduce emissions, Planet has increased LP rewards, and ApolloX has increased transaction rewards.

Some agreements take a personalized approach to benefit delivery. Camelot, for example, provides a plug-in system where stakeholders can choose their benefits from options such as shared benefits, increased liquidity of agricultural emissions, or access to the Camelot Launchpad.

DeFi Kingdoms will offer in-game items as a unique advantage, while Osmosis offers Super Fluid Staking (as mentioned above, a method by which LP tokens can be staked in the network to simultaneously secure the ecosystem and provide liquidity sexual rewards).

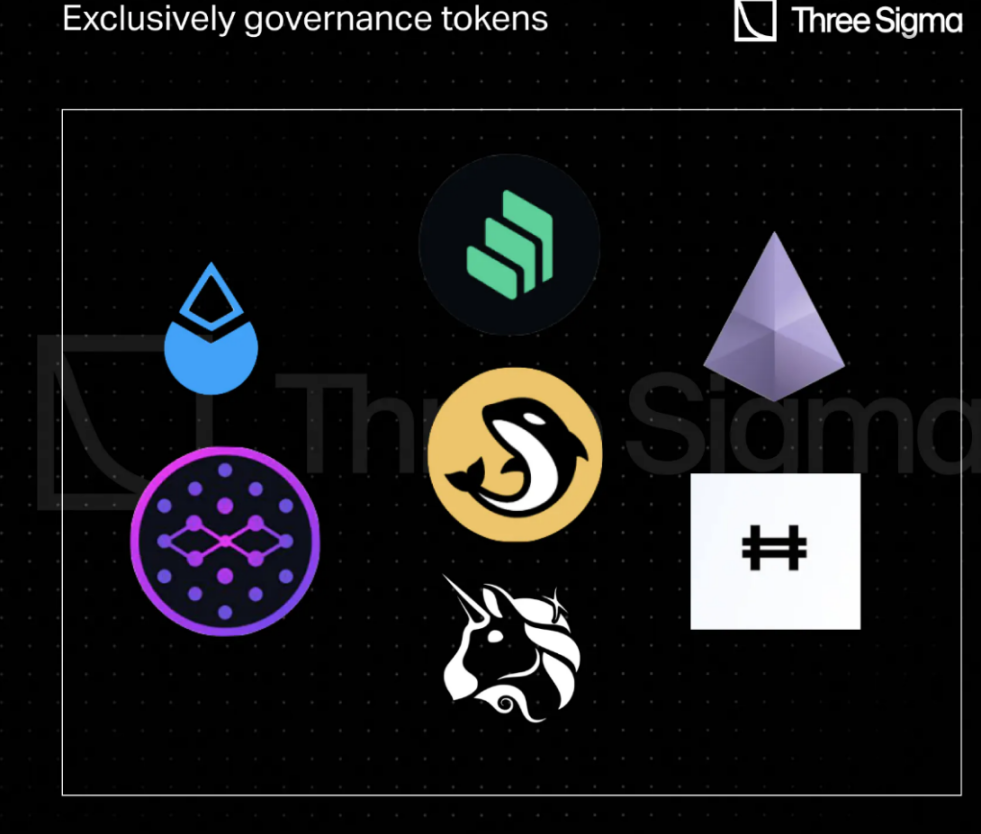

Governance Token

In some DeFi protocols, tokens may lack direct utility such as revenue sharing, but maintain value by participating in governance. Notable examples are COMP and UNI, whose main value lies in governance. These tokens enable users to influence the direction of the protocol, with protocol type seeming to play an interesting role. DEX governance tokens, for example, are often valued higher, even though they have fewer value capture mechanisms, than tokens in other categories. Even better, these tokens account for a smaller proportion of DeFis TVL, and the likelihood of protocol success, token appreciation, and even the promise of future utility are sufficient incentives to hold such governance tokens.

LDO is Lidos governance token, and holders can actively participate in decision-making by voting on key protocol parameters to manage the large Lido DAO treasury. Likewise Compound’s COMP token holders can vote on governance proposals or delegate their tokens to trusted representatives. Uniswaps UNI token is its governance token with a market value of more than $3 billion. UNI holders have the ability to vote, influence governance choices and manage the UNI community treasury, as well as determine protocol fees.

Other protocols that have not created specific reward mechanisms around their tokens include:

Orca, a decentralized exchange on the Solana network;

Synapse (SYN), a cross-chain liquidity network that effectively integrates 18 different blockchain ecosystems;

Hashflow (HFT), a gamified DAO and governance platform that allows participation in cross-chain decentralized exchanges;

StakeWise (SWISE), a liquid staking platform that focuses on decentralized governance and plays an important role in the Ethereum ecosystem;

Reward distribution

Previously, we divided protocol rewards into five broad categories: discounts, perks, voting rights, inflation emissions, and protocol revenue sharing. The first three reward types are firmly tied to their distribution methods, while inflation emissions and revenue sharing can take various forms.

Inflation emission rewards mainly take the form of minted governance tokens, such as AAVE, LYRA, and SUSHI. Some protocols however offer inflation emissions in the form of yield-generating tokens, where the number of original protocol tokens received upon redemption exceeds the number initially minted.

These include Astroport, Abracadabra, Tarot, and SpookySwap, and the appreciation in value of these yield-generating tokens may be due not only to inflation, but also to protocol revenue. Other protocols distribute revenue in raw form, such as fees paid with ETH, or many employ a buyback mechanism to buy back their own tokens from the external market to increase their value and then redistribute them to stakeholders.

Many protocols choose buyback and redistribution mechanisms, such as Curve (CRV), Convex (cvxCRV), Perpetual Protocol (USDC), Cream (ycrvlB), Frax (FXS), QiDAO (QI), Angle (sanUSDC), Premia (USDC) ), Ribbon (ETH), StakeDAO (FRAX 3 CRV), Yearn (YFI), Balancer (bb-a-USD), Beethoven X (BEETS), Gains (DAI), HMX (USDC), IPOR (IPOR), Abracadabra (MIM), DeFi Kingdoms (JEWEL), PancakeSwap (CAKE), Planet (GAMMA).

Other protocols reward stakeholders directly in accumulated tokens, such as GMX, Ellipsis, Platypus, Starlay, Solidly, Velodrome, Thena, and Liquidity.

Additionally, some protocols implement token burning. Instead of redistributing the bought-back protocol tokens, they will burn some of the tokens to reduce the circulating supply, increase scarcity, and hopefully increase the price. By holding tokens, users indirectly earn income from the protocol, as the protocol uses cumulative rewards to remove these tokens from circulation.

Some of the protocols that perform token burning include Aave, Gains, Camelot, Starlay, PancakeSwap, UwU Lend, Planet, MakerDao, Osmosis, SushiSwap, Reflexer, Frax, and Thales.

Conclusion

Although the distribution of protocol categories covered in this article may not fully reflect the current status of the entire DeFi field, some key insights can still be drawn from it.

Specifically, this article mentions 14 lending protocols, 20 DEXs, 5 derivatives protocols, 7 options protocols, 5 liquid pledged derivatives (LSD) protocols, 10 CDP protocols, and 9 other protocols, of course. Protocols with similar characteristics were analyzed but were not explicitly mentioned.

DEXs tend to be locked-in, especially in the context of voting escrow models, while lending and CDP platforms show a preference for soft lock-ups. However, some CDP protocols still use hard locks. The rationale behind this difference may be that DEX has a greater demand for liquidity compared to other protocols. Lending and CDP protocols usually strike a balance between liquidity supply and demand. Because when demand for loans is high, there is usually enough supply to meet the demand as interest rates adjust accordingly. In contrast, the main source of revenue for DEX liquidity providers is transaction fees, and competing with established DEXs can be challenging.

Therefore, DEXs often use inflationary emission incentives and manage token supply through locking mechanisms. Generally speaking, soft locking is the more common method among DeFi protocols, but there are some notable exceptions among the top DEXs. This trend is not only affected by the protocol category, but also by its launch time and reputation. Many of today’s leading DEXs fall into Among the earliest DEXs to launch, the decision to lock up governance tokens in a mature protocol is very different from the decision to lock up tokens in newer, often experimental protocols.

Today, most protocols using locking mechanisms choose to reward users in the form of shared revenue rather than relying on inflationary token emissions. This shift represents a significant improvement over the past few years, allowing the protocol to consistently incentivize users to behave in ways that benefit the community as a whole. This is the clearest way to align incentives, although its long-term feasibility remains uncertain due to regulatory considerations.

Token burning is the most commonly used method when distributing income. From an economic perspective, it seems more logical to buy back tokens on demand and redistribute them, such as to token holders who play a more important role in the protocol. However, from a regulatory perspective, buying back and burning tokens is the simplest way to return protocol revenue to token holders without making it look like a dividend distribution and potentially causing the token to be classified as a security. While this approach has worked for some time, the future of the mechanism remains uncertain. Additionally, some protocols are also heavily influenced by the token economics they endorse at the time of listing or token renewal. The emphasis on actual earnings and revenue sharing is the mainstream narrative in DeFi. This is not only affected by the protocol, but also by broader market conditions. For example, it is difficult to imagine that a token that needs to be locked for four years will have a big impact. Appeal.

The token model of voting escrow has evolved into the most comprehensive approach, including not only token locking but also voting rights, incentive management, and revenue sharing.

Nonetheless, prominent protocols often grant voting rights via tokens without a clearly defined value capture mechanism. While governance powers have significant value, this approach is not feasible for smaller or recently launched protocols, and even if these protocols gain rapid adoption and contribute to the DeFi community, whether they can withstand the test of time remains the biggest challenge.