Weekly Editors Picks (1014-1020)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Is Bitcoin going through a “16-year historical cycle”? How to find cycle tops?

Bitcoins first 3 4-year cycles look very similar to the SP 500s first 3 4-year cycles starting in 1986.

But both Microsoft and the SP 500 are also a true testament to the magnitude of corrections that follow long-term bull markets.

One of the best indicators that Bitcoin traders can use is the Bitcoin funding rate, which basically shows whether the majority of market participants in the derivatives market are long or short Bitcoin. This indicator is very useful for spotting Bitcoin price tops. Another way to look for cycle tops is through timing. When Bitcoin is at the top of the 16-year cycle and we fall below a range, there is a good chance that a cycle top will occur. Only a breakout of that specific range and a move back to this level will invalidate the signal.

Furthermore, a fundamental change in the economy such as the Fed’s withdrawal of funds is likely to have an impact on Bitcoin and how these cycles unfold.

Falcon uses GitHubs six factors as a quantitative standard to measure the team is doing something, including: Star, Fork, Commit, Issues, Pull requests, and Watchers, and found:

With the development of the Crypto market and the prosperity of the industrys developer ecosystem, Github data and currency prices have increasingly shown a strong correlation.

In a bull market, the more active a project on Github is, the higher the price will rise; in a bear market, the more active a project on Github is, the more resilient it will be.

The correlation between Github and currency prices is significantly higher in bull markets than in bear markets.

DeFi

Gryphsis Academy: Improvements and Valuation Outlook of dYdX v4 Economic Model

In 2021, after migrating to Starkware, dYdX solved the TPS and Gas fee problems. The current daily trading volume exceeds 800 million US dollars, occupying the leading position in the perpetual contract market.

dYdX adopts a tiered transaction fee mechanism to convert liquidity by charging lower fees to Makers and users with large transaction volumes, with lower handling fee levels; to encourage the adoption of the new version v4, the agreement will allocate DYDX rewards to early users to further The advantage of handling fees has been expanded.

Features of the new v4 version include: dYdX v4 migrates to an independent chain based on Cosmos SDK; updates the order process, off-chain matching and on-chain consensus; no gas fee is required to submit/cancel orders, only charged when completed; dYdX achieves complete decentralization management. Compared with v3, v4 has made marginal improvements in six aspects: protocol standards, governance functions, discount functions, staking functions, payment of gas fees and fee distribution of tokens, increasing the actual use and value capture capabilities of tokens.

Layer 1 staking and fee distribution increase the actual use and value capture capabilities of tokens, and the introduction of Cosmos’ native stablecoins increases the liquidity of tokens. The three will jointly improve the fundamentals of DYDX and bring continuous benefits to the tokens. . However, the associated risks of reduced security should also be noted.

SocialFi

Recently, Friend.Tech has been caught in a series of SIM swapping attacks. Cryptocurrency investment company Manifold stated that Friend.Tech has potential risks. If one takes into account that one-third of Friend.Techs accounts may be associated with mobile phone numbers, then approximately $20 million may be lost due to user-targeted attacks on the Friend.Tech network. being threatened. Friend.Tech added a new feature on October 5 that allows users to change their login method; Friend.Tech also clarified an issue with Privys two-factor authentication (2FA) password feature not being activated.

The high transaction taxes and robots that many people are complaining about make most retail investors unwilling to participate deeply, and the product features are lacking. But Friend.Tech still holds the top spot in the SocialFi track. Other high-quality imitation disks are also coming. These imitation disks have been optimized and innovated in terms of on-chain selection, economic models, functional design, etc.

The essence of SocialFi is still P2E. Compared with other P2E, users can obtain traffic and influence in addition to token rewards. The more essential thing is that the platform uses the value brought by KOL influence for free. Once the situation is improved, creators can recover the value of their influence.

In addition, for a detailed comparison of the development routes between Stars Arena, Tomo, New Bitcoin City, and Cipher, please see Comparing the development routes of friend.tech’s competing products: Dongfeng Night Blooms Thousands of Flowers》。

Web 3.0

Farcaster is a decentralized social network built in Silicon Valley. At the protocol level: pragmatic decentralization; at the community level: slow and cohesive growth before opening up.

Lens was built by the Aave team and embodies the native culture of Web3 rooted in DeFi. Its protocol: on-chain and asset first; Lens project ecology: trying on-chain media; Lens community: still looking for healthy sources of growth.

Ethereum and Scaling

Interpreting Consensys Research Paper: Is Ethereum Increasingly Centralized?

In terms of the two indicators of stablecoins and pledge pools, Ethereum has a very high degree of centralization. This also seems to correspond to the high shares of USDC and USDT in reality, as well as the leading situation of LDO in the liquidity staking track.

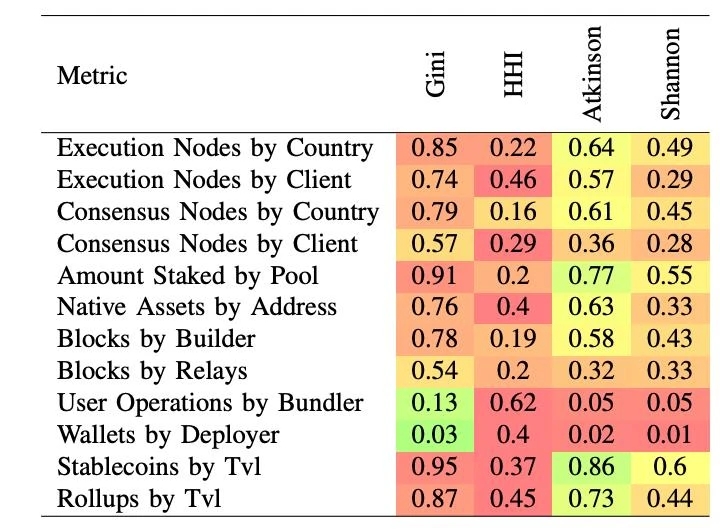

The closer the color is to red, the higher the degree of concentration, and the closer the color is to green, the higher the degree of decentralization.

Ethereum’s degree of decentralization is dynamic. Some segments show a high degree of concentration: for example, in Rollups by TVL, Arbitrum One and Optimism hold the majority of the market share, showing clear concentration.

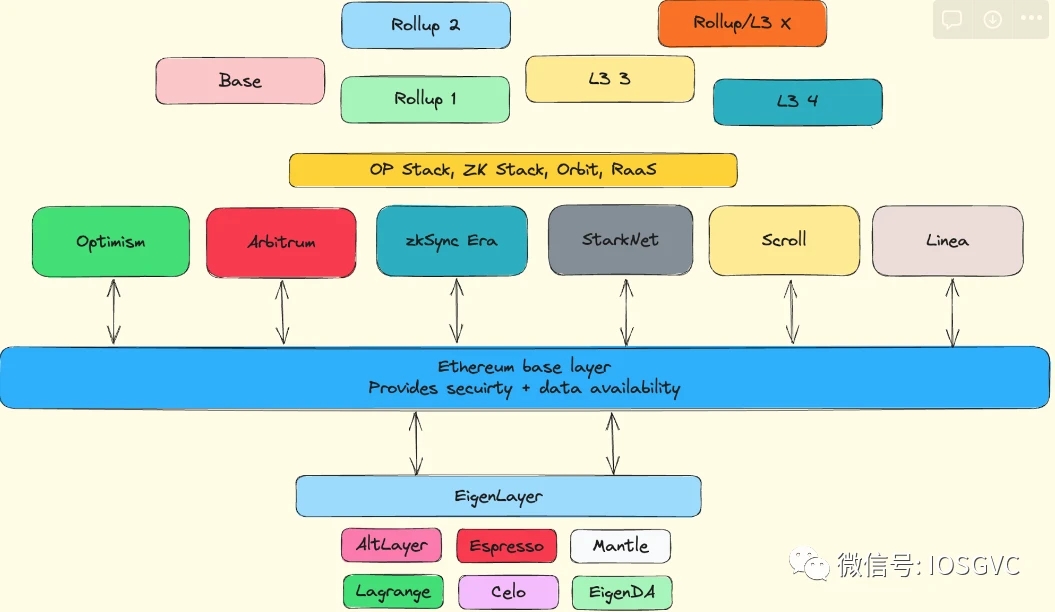

IOSG Ventures: From block transaction life cycle to new trend of rollup-centric

Rollup-centric roadmap

YBB Capital: Modular Blockchain-A New Perspective on Functional Layer Controversy and DA Economics

The architecture of traditional monolithic blockchain usually consists of four functional layers: execution layer, data availability layer, consensus layer, and settlement layer. A design is modular if it breaks the system down into smaller parts that can be swapped or replaced. The core idea is to focus on doing only some things well (the operation of a portion or a single functional layer) rather than trying to do everything. Almost all projects in the modular execution layer are built on Ethereum, because Ethereum has a large amount of resources as a moat and is the most decentralized among options, but its scalability is very poor, so in the functional layer There is great potential for redesign.

Current blockchains can be divided into four categories: single-threaded monolithic blockchains (Ethereum, Polygon, BNB Chain, Avalanche), parallel processing monolithic blockchains (Solana, Monad, Aptos, Sui), single-threaded Modular blockchain (Arbitrum, Optimism, zkSync, Starknet), parallel processing modular blockchain (Eclipse, Fuel). Currently, there are three main DA solutions in the industry: public chain as the settlement layer, Validiums DA model, and modular DA.

Driven by the trend of modularization, dozens of Layer 2 will also fragment liquidity again, and cross-chain communication and security will also be the focus in the future. The modularization of BTC is also a hot trend recently, and there are some slightly feasible solutions, which can also be paid attention to.

new ecology

One week after the launch of the Scroll mainnet, what are the highlights in terms of data?

According to the Blockscout Scroll mainnet Token page, if you refer to the tokens currently holding the largest number of addresses, the projects that are attracting attention include Merkly, Zonic on Scroll, PunkSwap Token, Skydrome, Scroll Name Service, Scroll Doge (zkDoge), Scrollswap Finance Token (SF ), Script (SCRIPT), Scroll Inu. (Sinu).

Hot Topics of the Week

In the past week,Cointelegraph “Bitcoin ETF approved” fake news causes market fluctuations, grayscale:Ready to convert GBTC to ETF upon SEC approval,Informed sources:SEC does not plan to appeal Grayscale ruling, Bloomberg analyst:Even if Grayscale wins the case, the court does not have the authority to require the SEC to approve the conversion of GBTC into an ETF,Cathie Wood:Multiple Bitcoin spot ETFs expected to be approved by the end of this year or early next year,Bitwise CIO:Spot Bitcoin ETF is about to be approved and demand will be 100 times greater than futures ETFs,CryptoQuant:If Bitcoin spot ETF is approved, cryptocurrency market cap could increase by $1 trillion, Chairman of the U.S. SEC:SEC Still Weighing Proposal for Bitcoin Spot ETF,ProShares to launch short Ethereum futures ETF next week;

Stars Arena is back online,Everscale:A large number of EVER tokens have been stolen, and we are working with exchanges to prevent further outflows of tokens.,Some Fantom Foundation wallets were attacked,Aptos network briefly down and transactions affected,Hope Lend hacked,Hope.money:Each agreement exists independently, and the HopeLend incident will not affect other products;

In addition, in terms of policy and macro market,EU formally agrees to new crypto tax data sharing rules,California Governor Signs Cryptocurrency Regulation Bill Set to Take Effect on July 1, 2025,Australia plans to introduce draft legislation in 2024 that will require crypto exchanges to obtain licenses,Korea Financial Supervisory Service to investigate Sui, examine whether it misrepresented the circulation quantity and sold illegally,Israel ordered the freezing of multiple Hamas-related accounts on platforms such as Binance to prevent the flow of funds,SEC drops all charges against Ripple CEO and executive chairman;

In terms of opinions and voices, Cathie Wood:Fed policy actions based on lagging indicators, blockchain and other technologies will exacerbate deflationary pressures,Mysten Labs CEO:Crypto markets will once again attract inflows, but capital deployment will be moreBe strategic and more cautious, Morgan Stanley reports:The crypto bear market may be over, and a bull market may be coming, General Counsel of Delphi Labs:Tokenization of most RWAs is not possible, Sui Foundation denies manipulating token supply:SUI tokens are never liquidated, including staking rewards, Parity Analyst:Polkadot 2.0 is expected to launch the test network by the end of the year and the main network in Q2 next year, slow fog cosine:friend.tech custom tool FrenTechPro is a phishing scam,Be careful when using friend.tech related tools;

In terms of institutions, large companies and leading projects,Tether plans to launch real-world asset platform,Reddit decides to end its nearly three-year-old blockchain-based community points service,Coinbase opens perpetual contract trading to non-U.S. retail investors,Bitmain fired three employees who revealed information about salary arrears,The launch of KYC Hooks in Uniswap V4 directory sparks controversy,Uniswap charges a flat fee of 0.15% for 11 tokens traded through the official frontend,TrueUSD disclosed a third-party breach and some user information was leaked,Celestia Genesis Airdrop Officially Ends,Oracle Pyth Network announces token economics, initial supply accounts for 15%,BarnBridge community votes to authorize founders to comply with SEC order;

In the field of NFT and GameFi, STEPN released a new roadmap:Leaderboards and marathon mode planned to be added in 2024...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~