“The number one whale” Strategy hints at suspending share purchases, is BTC reaching a critical turning point?

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Michael Saylor, CEO of Strategy (formerly MicroStrategy), wrote on Sunday: "Some weeks you just need to HODL." The market interpreted this as a hint to suspend purchases of Bitcoin.

As the listed company with the largest Bitcoin holdings in the world, Michael Saylor's consistent investment philosophy is "Bitcoin first", and investors have become accustomed to him writing "buy" into his DNA. Therefore, every suspension of Strategy will touch the most sensitive nerve of the market, especially in the context of increasing BTC holdings for 13 consecutive weeks.

The Weight of Bitcoin Treasury: How Strategy Influences the Market

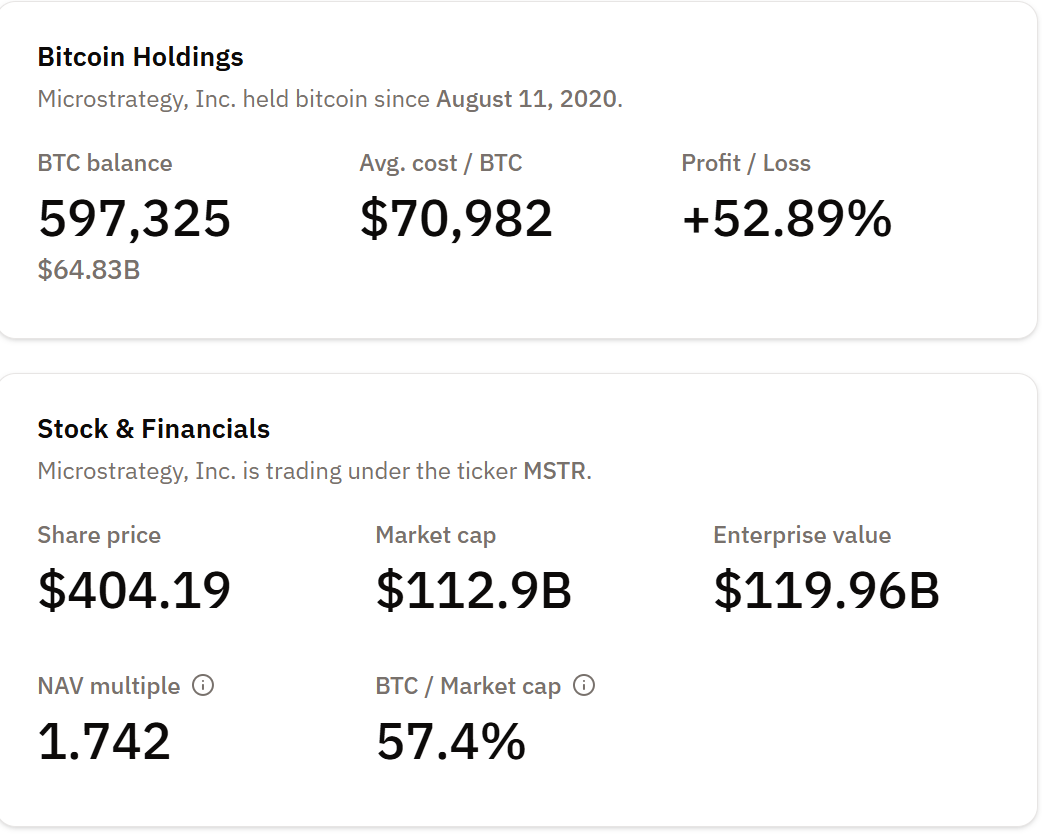

As of July 8, Strategy's total Bitcoin holdings have reached 597,000, accounting for 2.84% of the total supply. Not only is it far ahead of other listed companies, its holdings are even 2.3 times the total of the top 100 listed companies (excluding Strategy).

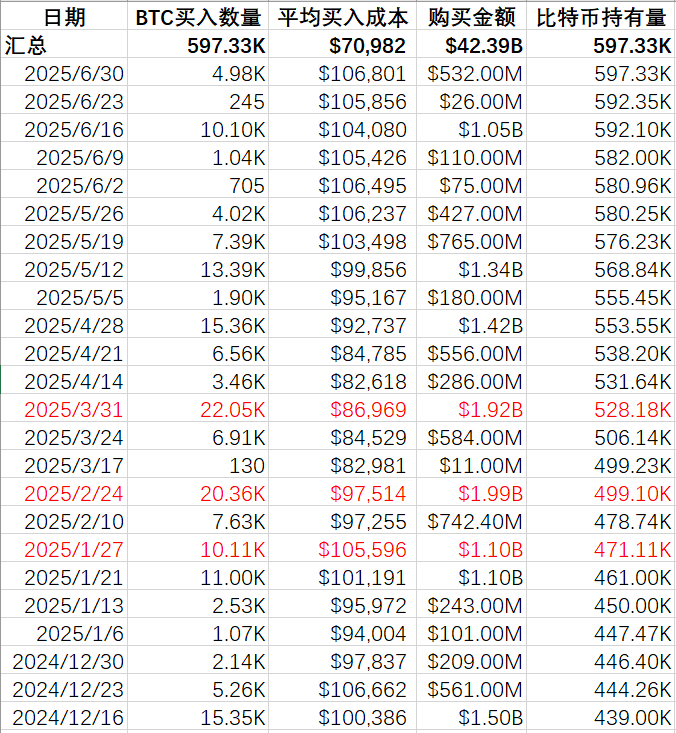

According to the 8-K filing information submitted by Strategy to the US SEC, as of June 30, the value of Strategy's (MSTR.O) digital assets was US$64.36 billion, with an average cost of US$70,982 per coin, of which the total fair value of Bitcoin appreciated by US$14 billion in the second quarter of 2025.

In other words, Strategy is not only a Bitcoin whale, but also a lever of price sentiment in this market. Every move of Strategy will touch the sensitive points of the market. Judging from the several suspensions of purchases since 2025, almost all of them indicate a short-term correction in the market. Will this time be an exception?

Strategy Pause Buying and Bitcoin Trend Correlation

Fundraising Flywheel: Capital Game of Preferred Stocks

Strategy was originally a company that started out as an enterprise analytical software company. Since 2020, its core strategy has shifted to using Bitcoin as the main reserve asset, aiming to hedge against inflation and achieve asset appreciation. Strategy has also become famous for its large-scale investment in Bitcoin.

In order to continue to buy Bitcoin, Strategy needs a lot of capital. Therefore, it chooses to raise funds by issuing preferred stocks. Since February 2025, Strategy has issued three types of preferred stocks, namely STRF, STRK and STRD, corresponding to different income mechanisms and risk priorities:

STRF: 10% cumulative dividends, highest priority. If not paid, dividends will be compounded at an additional 1% per year, up to a maximum of 18%.

STRK: 8% cumulative dividend with convertible option.

STRD: 10% non-cumulative dividend, low priority, more for broad distribution to the market public.

The core design of this structure is to allow Strategy to continuously leverage new capital without seriously diluting the interests of common shareholders, providing ammunition for its continuous purchase of Bitcoin, thereby maintaining the flywheel closed loop of "issuing shares - buying coins - increasing stock prices."

From the perspective of market performance, MicroStrategy (MSTR) is significantly better than Bitcoin itself, especially driven by the recent "crypto US stock" craze. STRK and STRF, as the preferred stocks issued earlier, have also performed very well in the market, and STRD, which was issued later, has also shown good potential. From the perspective of price trends, STRK and STRF have performed particularly well recently, even greatly surpassing the stock performance of MSTR.

It is worth noting that in March, this preferred stock issuance plan attracted internal senior executives to participate in person. According to the disclosure documents of the US Securities and Exchange Commission, several Strategy insiders bought its latest preferred stock, involving the company's CEO, CFO and other senior executives. Among them, CEO Phong Le bought 6,000 shares of preferred stock at a price of US$85, CFO Andrew Kang bought 1,500 shares, and General Counsel Wei-Ming Shao bought 500 shares. This "self-purchase" behavior is both a signal and a release of the company's strong expectations for future returns.

On June 5, Strategy announced a public offering of 11,764,700 10.00% Series A Perpetual Stride Preferred Stock at a price of $85 per share, and completed the delivery on June 10, raising approximately $980 million. Just today, Strategy announced again that it has signed a new sales agreement. According to the agreement, it plans to issue STRD shares to raise $4.2 billion, and it is expected to prepare "on-demand, phased" continuous financing according to the ATM plan. This flywheel is turning faster and faster.

The other side of leverage: a growth engine or also a risk trigger?

According to Strategy 's first quarter 2025 financial report released on May 1 , it has raised nearly $10 billion through ATM issuance of preferred stocks, convertible bonds and common stocks, almost all of which have been invested in Bitcoin. This high-leverage operation has magnified the book gains brought by the rise of Bitcoin, but it has also pushed up the cash flow burden, especially the annualized 8% to 10% interest expenses brought by preferred stocks.

As of now, MSTR's market value is about 112.9 billion US dollars, and the enterprise valuation is about 120 billion US dollars, corresponding to a net asset multiple of 1.7. Although it is still in a reasonable range, the elasticity of this line depends on two fulcrums: one is the continued strength of Bitcoin prices, and the other is the smoothness and stability of the external financing environment.

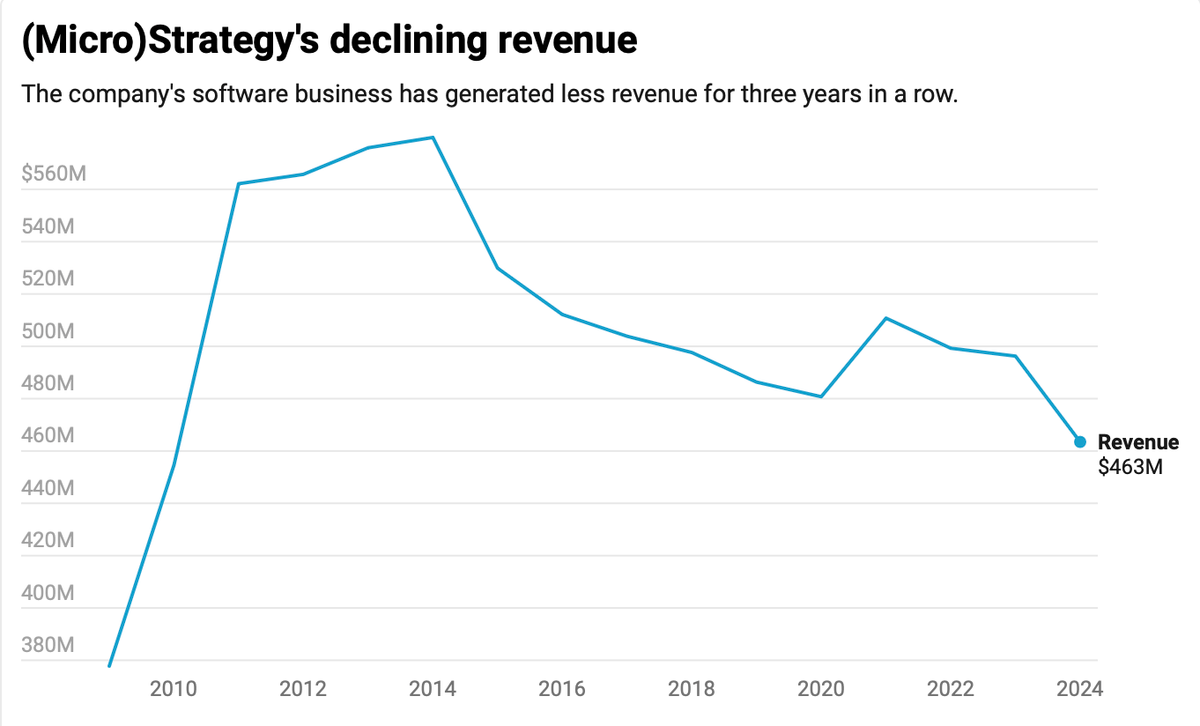

From the revenue perspective, the company's own "blood-making" ability is weak. According to data provided by @0x ChainMind , the company's software business revenue in 2024 was only US$463 million, the lowest record since 2010.

According to the Q1 financial report, the company's main business had a total revenue of US$111.1 million in the first quarter of 2025 , a year-on-year decrease of 3.6% (US$115.2 million in Q1 of 2024). However, subscription service revenue was US$37.1 million, a year-on-year increase of 61.6%, indicating that the transformation of cloud services and subscription models has been successful and is a highlight of revenue. If the old impairment model is still used for calculation, operating expenses and losses are about US$190 million (there is a controversial point here, and Strategy is also facing a class action lawsuit), and cash reserves are US$60.3 million . If this data is extrapolated, operating expenses can only be barely covered. If the company wants to maintain operations and pay 8%-10% annual interest on preferred shares (annual expenditure of up to US$300 million to US$500 million), it must rely on "continuous financing" to maintain the operation of the flywheel.

The "explosion" behind the financial statements: 5.9 billion in floating losses, class action lawsuits on the way

Strategy is facing a class action lawsuit because it adopted the new FASB accounting standard (ASU 2023-08) for the first time in the first quarter of 2025. According to the new rules, companies are required to measure crypto assets at fair value instead of only making impairment provisions when they depreciate. This means that any fluctuations in the price of Bitcoin will be reflected directly in the income statement in real time.

As a result, in Q1 alone, Strategy disclosed unrealized losses of $5.9 billion, which directly caused MSTR's stock price to plummet 8% in that quarter.

Worse still, the company was accused of failing to disclose these floating loss risks in a timely and comprehensive manner. Pomerantz LLP, a well-known New York law firm, immediately filed a class action lawsuit against Strategy in the Eastern District Court of Virginia, accusing it of "false and misleading statements" between April 2024 and April 2025, and suspected of violating federal securities laws. The case is currently underway, and investors can apply to join the class action before July 15. Strategy said it would actively respond, but did not predict the outcome of the case.

This means that the price of Bitcoin not only determines the asset value of Strategy, but also determines its legal risks, financing capabilities and investor confidence.

The voice of the market

Michael Saylor wrote that Strategy has developed a BTC credit model that takes into account loan terms, collateral coverage, BTC price, volatility and annualized return expectations to generate statistical data on Bitcoin risk and credit spreads. Strategy is promoting the digital transformation of the credit market through its STRK, STRF and STRD, which also means that Strategy's path is no longer just about buying Bitcoin, it is more like building a closed loop system around BTC capitalization and financialization.

A report by venture capital firm Breed pointed out that Strategy may become a long-term survivor of the crypto financial model due to its scale, holdings and anti-cyclical capabilities, and there is a 91% probability that it will be included in the S&P 500 index in the second quarter of 2025.

But not everyone is so optimistic. Some analysts pointed out that this flywheel runs smoothly in the bull market, but once it enters a bear market, its debt repayment structure, preferred stock interest and cash flow stability will be severely tested.

On July 1, TD Cowen reiterated its "buy" rating on Strategy in a research report and maintained its target price of $590 per share. It said that despite the risks, it is reasonable for Strategy's share price to be at a premium to the net asset value (NAV) of its Bitcoin (BTC) holdings. The agency said that Strategy's "equity-to-BTC loop" model enables it to use its stock issuance revenue to buy more Bitcoin, thereby driving higher share prices and further Bitcoin purchases, forming a virtuous circle.

Judging from the current data, Strategy's short-term cash flow can still be "barely maintained", and its Bitcoin holdings are the absolute protagonist on the company's balance sheet. But this is also its biggest risk: its prosperity is almost based on the assumption that BTC prices are stable or rising. In a sense, Strategy is no longer a traditional technology company, it is more like a "Bitcoin high-leverage asset management platform" wrapped in a software shell.